In finance, relying on manual data processing, particularly when dealing with numerical data, increases the risk of human mistake.

Recognizing this vulnerability, financial institutions seek a remedy, and Robotic Process Automation (RPA) emerges as a promising solution. RPA in finance not only enhances operational speed, accuracy, and efficiency but also represents a cost-saving mechanism.

This technology, rapidly evolving, has proven its capability to handle data more effectively than humans, offering a safeguard against the risks associated with manual processing. Financial entities have already embraced RPA for various finance and accounting processes, evolving from basic task automation to comprehensive functions such as report generation, data analysis, and forecasting.

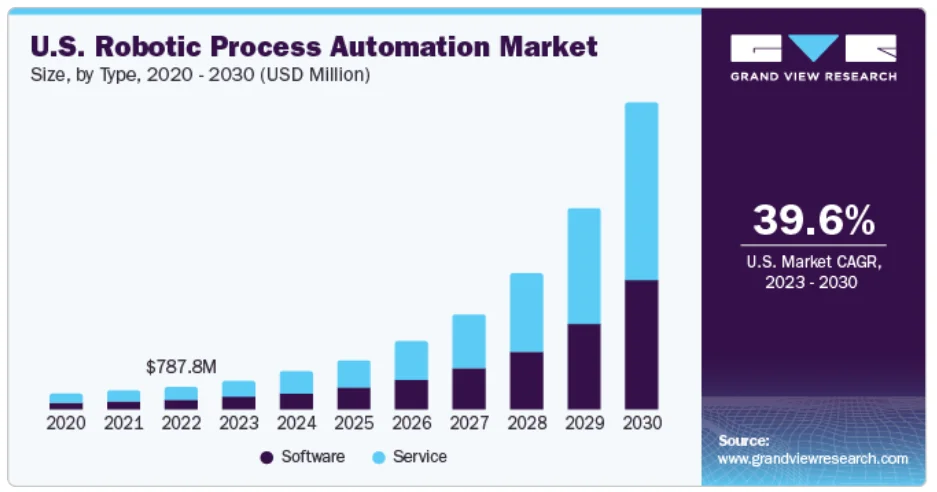

Source: GrandViewResearch

In this blog, explore RPA use cases in finance and accounting, shedding light on the tasks that can be automated to enhance the operational landscape of banking and financial institutions.

What Is RPA In Finance?

Robotic Process Automation (RPA) in finance refers to the use of software robots or “bots” to automate repetitive and rule-based tasks within financial processes. These tasks can include data entry, reconciliation, invoice processing, and other routine activities that are time-consuming for human workers. RPA aims to streamline and enhance operational efficiency by allowing organizations to automate these manual processes, reducing errors and increasing accuracy.

In the finance sector, RPA can be applied to various functions such as accounts payable, accounts receivable, financial reporting, and compliance. Bots can mimic human interactions with software applications, extracting and processing data from multiple sources, and performing calculations to execute financial transactions. This not only accelerates the pace of financial operations but also ensures consistency and compliance with regulations.

One of the key advantages of RPA in finance is its ability to integrate with existing systems without the need for significant changes to infrastructure. This makes it a cost-effective solution for organizations looking to modernize their financial processes. Additionally, RPA allows finance professionals to focus on higher-value tasks that require strategic thinking and decision-making, while routine and repetitive activities are handled efficiently by the automated bots.

While RPA offers several benefits, it’s essential for organizations to carefully plan and monitor the implementation to ensure proper governance, security, and compliance. As technology continues to evolve, RPA in finance is likely to play an increasingly significant role in driving digital transformation within the industry.

Business Benefits Of RPA In Finance

The integration of Robotic Process Automation (RPA) in finance offers numerous business benefits, particularly in areas such as customer experience, productivity, compliance, cost savings, reliability, and accounts receivable management.

1. Amplified Productivity and Efficiency

RPA’s impact on productivity extends beyond task completion; it fosters a culture of continuous improvement. The bots, equipped with learning algorithms, adapt to evolving tasks, constantly refining processes for greater efficiency. Integration with existing frameworks not only minimizes disruption but also enables cross-functional collaboration, ensuring that benefits are realized across departments. RPA’s scalability allows organizations to handle increasing workloads without proportionally increasing human resources, providing a flexible and responsive operational model. Moreover, the reduction in manual errors leads to fewer rework cycles, optimizing overall efficiency.

2. Elevated Customer Interaction

In addition to real-time access to customer information, RPA ensures personalized services through data-driven insights. The bots not only accelerate request solutions but also provide predictive analysis, anticipating customer needs before they arise. The streamlined mobile and online banking processes facilitated by RPA enhance not just speed but also security, incorporating advanced encryption and authentication methods. Furthermore, RPA-driven chatbots offer instant, accurate responses to customer queries, contributing to a seamless and satisfactory customer experience. Through continuous monitoring and analysis, RPA ensures that customer interactions are consistently optimized, leading to high levels of satisfaction and loyalty.

3. Optimized Financial Outcomes

Beyond the initial startup costs, RPA demonstrates its financial benefits by optimizing resource allocation. The technology’s ability to handle repetitive tasks at scale reduces the need for extensive human intervention, leading to substantial labor cost savings. The return on investment is further amplified as organizations leverage RPA analytics to identify additional areas for automation and efficiency gains. The long-term cost savings extend to training programs, as RPA bots adapt quickly to new processes with minimal training requirements. Moreover, the scalability of RPA allows organizations to align costs with business growth, ensuring a flexible and cost-effective operational model.

4. Enhanced Reliability and Precision

RPA’s impact on reliability extends to crisis management, where the bots respond swiftly to system outages, minimizing the impact on operations. The continuous operation of RPA bots ensures an uninterrupted workflow, contributing to business continuity. The accuracy of data entry and processing is heightened by RPA’s ability to cross-verify information across multiple sources, ensuring data integrity. Additionally, the reliability of RPA in handling complex tasks, such as reconciliations and data migrations, instills confidence in the overall operational robustness. The reduction in manual interventions not only enhances accuracy but also frees up human resources for more strategic and analytical roles.

5. Strategic Evolution of Accounts Receivable

RPA’s role in accounts receivable goes beyond automation; it introduces dynamic forecasting capabilities, predicting cash flow trends and helping organizations proactively manage working capital. The automated alerts and reminders sent by RPA bots are not only timely but also personalized, optimizing the chances of prompt payment. RPA’s integration with other financial systems ensures seamless communication, reducing delays associated with manual handovers. Furthermore, the analytics capabilities of RPA contribute to the optimization of credit terms and payment schedules, aligning financial strategies with business objectives. The end-to-end automation of accounts receivable processes transforms it into a strategic asset, contributing directly to the organization’s financial health.

6. Streamlined Compliance, Audit, and Risk Management

In the realm of compliance, RPA serves as a vigilant watchdog, automatically updating processes to align with regulatory changes. The bots not only automate reporting but also conduct real-time audits, providing a proactive approach to compliance management. The reduction in human error significantly lowers the risk of non-compliance, preventing costly fines and legal complications. Additionally, RPA’s ability to generate comprehensive reports from diverse datasets enhances transparency and accountability, aiding in internal and external audits. The automated monitoring of transactions ensures a robust risk management system, reducing exposure to potential financial and reputational risks.

Common Use Cases Of RPA In Finance

Robotic Process Automation (RPA) finds diverse applications within the realm of financial services, offering a multitude of solutions to optimize operational efficiency. The following highlights some key use cases where RPA is proving to be a valuable asset within the finance and accounting sector, presenting compelling reasons for organizations to consider its adoption.

1.Streamlined Payroll Processing for Workforce Satisfaction

Payroll processing stands out as a critical function in ensuring employee satisfaction and business success. RPA brings efficiency to this process by automating tasks such as timesheet validations, deduction calculations, tax calculations, and overtime payouts. With financial institutions often having a global presence, RPA’s ability to capture and process data according to different geographical tax regimes becomes invaluable. The automation of these tedious tasks ensures timely and accurate payroll processing, contributing to a satisfied workforce and streamlined human resource management.

2.Automating Invoice Management

Invoice processing is notorious for its repetitive and time-consuming nature, particularly when dealing with invoices in varied formats. RPA steps in to automate this task, ensuring the accuracy of data and the prompt forwarding of invoices to the relevant approving authorities. The automation of accounts payables and receivables becomes comprehensive with RPA, as it streamlines the entire invoicing process. The elimination of the manual maker and checker process, coupled with the ability to match invoices with corresponding POs, results in a highly efficient and error-free finance and accounting workflow.

3. Enhancing Efficiency in Accounts Reconciliation

Accounts reconciliation is a critical business process that often demands a significant investment of time from the finance team. RPA implementation transforms this task by introducing quick and consistent data auditing and reconciliation. Human intervention is minimized, and RPA bots excel at incorporating essential elements into the reconciliation process. By automating the tedious and error-prone aspects of accounts reconciliation, RPA ensures that financial data is accurate, aligned, and compliant, ultimately enhancing the reliability of financial reports.

4. Optimizing Travel & Expense Management

The finance team’s involvement in raising travel requests and managing expenses is streamlined with RPA. This technology automates the creation of expense reports, ensuring adherence to company policies and speeding up the reimbursement process. RPA bots not only handle the repetitive tasks efficiently but also serve as a watchdog, identifying policy violations and data discrepancies. Automated alerts promptly notify the relevant individuals or departments, allowing for swift resolution and ensuring compliance throughout the travel and expenses process.

5.Streamlining Purchase Order (PO) Processing

In the realm of finance, Purchase Order (PO) processing involves a multitude of steps, from creating orders to obtaining approvals. RPA not only automates the creation of purchase orders but also integrates seamlessly with AI, ensuring accurate data capture and validation. This eliminates the risk of errors associated with manual processing. Additionally, RPA facilitates the establishment of automated approval matrices, allowing for swift and efficient approval workflows without the need for human intervention. The benefits of RPA in PO processing extend beyond efficiency; it provides a transparent and traceable system that enhances compliance and reduces the likelihood of discrepancies.

6. Precision in Tax Calculations Through Automation

RPA’s role in automating tax-related processes goes beyond the use of standard tax processing software. By collating data, creating tax basis, and preparing reports, RPA minimizes the manual effort involved in these critical tasks. The precision offered by RPA bots in handling numerical data to decimal places ensures accuracy in tax calculations, reducing the risk of mismatches during reconciliation and data processing. As businesses strive for efficiency and compliance, RPA emerges as a valuable tool in optimizing the accuracy and reliability of tax-related operations.

7. Streamlining Financial Reporting Processes

Financial reporting in banks and financial institutions involves dealing with extensive data from various sources and formats. RPA proves instrumental in extracting, collating, and analyzing this data, creating a streamlined and efficient reporting process. By automating the tedious manual tasks associated with data extraction, RPA enables financial organizations to generate reports that reflect performance, statistics, and trends accurately. The data-driven insights obtained through RPA enhance decision-making processes, providing a solid foundation for forecasting and planning in the dynamic financial landscape.

8. Efficient KYC Compliance Through Automation

The Know Your Customer (KYC) compliance process in the BFSI sector is not only necessary but also resource-intensive. RPA addresses this challenge by automating KYC processes, significantly reducing costs and improving efficiency. The automation of customer onboarding accelerates the KYC process, allowing financial institutions to meet compliance requirements swiftly. RPA’s contribution to KYC extends beyond mere automation; it enhances the overall customer experience by streamlining onboarding processes, reducing errors, and ensuring that compliance divisions operate more efficiently.

9. Data-Driven Budget Planning & Forecasting

RPA’s impact on budget planning and forecasting is profound, as it facilitates the accurate retrieval of details from diverse reports and systems. The precision with which RPA bots handle data allows for the creation of comprehensive variance reports, offering various perspectives for analyzing data. Drawing comparisons and identifying trends based on historical and current information become more straightforward, empowering businesses with proven strategies for effective budget planning and forecasting. RPA’s ability to automate these processes contributes significantly to optimizing resource allocation and achieving financial goals.

Real-World Examples of RPA In Finance

Robotic Process Automation (RPA) has become a widely adopted technology in the finance sector, offering a solution to automate routine and tedious tasks. Numerous real-world examples highlight the successful integration and impact of RPA within financial services.

1. JP Morgan Chase

JP Morgan Chase, a leading global financial services firm, has incorporated RPA to streamline various aspects of its operations. One notable example is the use of RPA in automating the reconciliation process. In a complex financial environment, reconciling accounts across diverse systems and transactions is time-consuming and prone to errors. RPA bots have been deployed to handle this intricate task, ensuring accurate and efficient reconciliation. The implementation of RPA at JP Morgan Chase illustrates how automation can enhance accuracy, reduce operational risks, and improve overall efficiency in the financial services sector.

2. Societe Generale Bank, Brazil

Societe Generale Bank in Brazil, a leader in financial services, has harnessed the power of RPA to automate tedious and repetitive tasks. The financial industry deals with vast and complex data, and RPA has been instrumental in preparing regular automated reports. These reports not only empower employees with better-informed decision-making capabilities but also contribute to providing excellent customer service. The positive impact on customer experience resulting from RPA implementation has played a significant role in transforming Societe Generale Bank’s business model, emphasizing the strategic value of automation in the financial sector.

3. Radius Financial Group

In the mortgage sector, where extensive paperwork and document verification processes are common, Radius Financial Group has successfully implemented RPA to address time-consuming challenges. The coordination required between mortgage companies and clients for documentation often leads to delays. RPA has played a crucial role in simplifying this complex activity by automating the search and verification of details from various data sources. As a result, processing times have been reduced by a remarkable 80%, allowing Radius Financial Group to maintain business efficiency even during challenging periods like the pandemic. This real-world example showcases the tangible benefits of RPA in optimizing workflows and improving overall productivity.

4. Zurich Insurance

Zurich Insurance, a global insurance giant with a widespread presence, faced the challenge of adhering to geography-specific regulations. The implementation of RPA proved to be a game-changer for Zurich Insurance, enabling the segregation of standard and general policies to meet specific regulatory requirements in different countries. This segregation not only ensured compliance but also led to significant time and cost savings. By leveraging RPA, Zurich Insurance successfully reduced processing costs and time by approximately 50%. This example highlights how RPA can address complex regulatory challenges, optimize processes, and generate substantial efficiencies for globally operating financial institutions.

5. Keybank

Keybank, a prominent commercial bank, has embraced RPA to enhance efficiency in its financial operations. The automation of accounts receivable, a process involving multiple repetitive tasks such as generating invoices and purchase orders, has significantly streamlined the payments process. By implementing RPA, Keybank has not only improved the accuracy of these financial transactions but has also achieved a smoother and error-free flow from the initiation of payments to their final stages. This demonstrates how RPA can be a transformative force in optimizing key financial processes within a leading financial institution.

Challenges And Solutions To Implementing RPA In Finance

Implementing Robotic Process Automation (RPA) in the finance sector brings about numerous benefits, but it’s not without its challenges. Understanding and addressing these hurdles is crucial for successful integration. Here are some prominent challenges associated with RPA in finance:

1. Complexity of Processes

Financial processes often involve intricate workflows, intricate rules, and numerous exceptions. Adapting RPA to handle this complexity requires a detailed understanding of each process and meticulous customization. The time-consuming nature of this analysis can delay the implementation of RPA in finance, demanding a balance between efficiency and customization.

Solution

Conduct a detailed process analysis and break down complex processes into manageable tasks. Prioritize automation for repetitive and rule-based tasks, gradually expanding to more intricate processes.

2. Data Security Concerns

Given the sensitive nature of financial data, maintaining the security and confidentiality of information becomes a critical challenge in RPA implementation. Adhering to data protection regulations, such as GDPR or industry-specific standards, is imperative. Integrating robust security measures within RPA systems to safeguard against potential breaches or unauthorized access is an ongoing concern.

Solution

Implement robust encryption protocols, access controls, and regular security audits. Choose RPA solutions with built-in security features and ensure compliance with data protection regulations.

3. Integration with Legacy Systems

The finance sector often relies on legacy systems that may not be inherently compatible with modern RPA solutions. Bridging the gap between RPA and legacy systems requires careful planning, comprehensive testing, and potentially necessitates updates or modifications to existing infrastructure. Ensuring a smooth integration without disrupting ongoing operations is a key challenge.

Solution

Invest in RPA tools that offer compatibility with legacy systems. Work closely with IT teams to develop a seamless integration plan, considering the need for data migration and system updates.

4. Human Resistance and Skill Gap

Introducing RPA may encounter resistance from employees who fear job displacement or lack familiarity with automation technologies. Addressing this requires effective change management strategies, communication, and investment in employee training programs to bridge the skill gap. Building a positive attitude towards automation is crucial for the successful adoption of RPA in finance.

Solution

Provide comprehensive training programs to employees, emphasizing the benefits of RPA and addressing concerns. Involve employees in the automation process and highlight how RPA can augment their roles rather than replace them.

5. Continuous Monitoring and Maintenance

Maintaining the optimal performance of RPA systems is an ongoing challenge. Regular monitoring is essential to identify and address issues promptly, ensuring that the automation aligns with any changes in regulations or modifications in financial processes. Establishing a robust system for continuous improvement and adaptation is vital for sustained success.

Solution

Establish a proactive monitoring system with alerts for potential issues. Implement regular maintenance schedules and allocate resources for ongoing monitoring and updates to keep the RPA system running smoothly.

6. Costs and ROI Uncertainty

While RPA promises long-term cost savings, the upfront implementation costs can be substantial. Organizations may face challenges in accurately estimating the Return on Investment (ROI) due to uncertainties surrounding factors such as process changes, unexpected challenges, or evolving technology. Managing and justifying these initial expenses is a significant consideration for finance leaders.

Solution

Conduct a thorough cost-benefit analysis before implementation. Clearly communicate the long-term benefits of RPA, including cost savings, improved accuracy, and enhanced efficiency, to justify initial expenses.

How To Implement RPA In Finance and Accounting?

Integrating Robotic Process Automation (RPA) into finance and accounting can revolutionize operational efficiency. This guide outlines key steps for a seamless RPA implementation, empowering organizations to enhance accuracy, reduce costs, and elevate the role of finance professionals in strategic decision-making.

1. Identify Repetitive Tasks

Begin the implementation of RPA in finance and accounting by conducting a thorough analysis of existing processes. Identify tasks that are repetitive, rule-based, and prone to manual errors. Common examples include data entry, invoice processing, reconciliation, routine report generation, and transaction categorization. Delve into the specifics of each task, understanding the nuances and complexities that contribute to their repetitiveness. Consider input from various departments to ensure a comprehensive identification of potential automation opportunities. This detailed analysis sets the stage for a more precise and effective RPA implementation strategy.

2. Assess Compatibility with Legacy Systems

Evaluate the compatibility of RPA technology with the organization’s existing financial systems. Collaborate closely with the IT team to address any integration challenges that may arise during the implementation process. Consider factors such as software versions, data formats, and system architecture. Develop a comprehensive understanding of the intricacies involved in integrating RPA tools with legacy systems, and work collaboratively to create solutions that ensure a seamless transition. This compatibility assessment is crucial for avoiding disruptions and ensuring the continued efficiency of financial operations.

3. Set Clear Objectives and Metrics

Define specific objectives for RPA implementation in finance and accounting. Whether it’s reducing processing time, minimizing errors, improving data accuracy, enhancing employee productivity, or achieving cost savings, having clear goals is essential. Tailor these objectives to align with broader organizational goals and strategic priorities. Establish key performance indicators (KPIs) that are measurable, achievable, and relevant to the identified objectives. This step not only provides a roadmap for assessing the tangible benefits of automation but also serves as a guiding framework for continuous improvement and optimization.

4. Customize RPA Solutions

Select RPA tools that are tailored to the unique requirements of finance and accounting. Consider factors such as scalability, adaptability, and ease of integration. Customize these solutions to handle intricacies such as compliance regulations, security protocols, industry-specific accounting standards, and varied data sources. Engage with RPA vendors to understand the flexibility and customization options available. This customization ensures that the chosen RPA tools align seamlessly with the specific needs and complexities of financial operations, supporting a more effective and sustainable automation strategy.

5. Pilot Testing

Before full-scale implementation, conduct a pilot test on a small scale, focusing on a subset of finance tasks. This allows for a practical evaluation of RPA effectiveness and identifies any potential challenges. Expand the scope of pilot testing to include different business units or regions to assess the scalability of RPA solutions. Gather feedback from end-users, stakeholders, and IT teams to refine the RPA implementation, addressing issues and concerns early in the process. Consider conducting scenario-based simulations to evaluate the RPA bots’ performance under various conditions. The insights gained from pilot testing are invaluable for fine-tuning automation processes and ensuring a successful and sustainable roll-out.

6. Data Security Measures

Implement robust security measures to safeguard sensitive financial data processed by RPA bots. Collaborate with cybersecurity experts to conduct a comprehensive risk assessment and identify potential vulnerabilities. Establish strict access controls, encryption protocols, and secure communication channels for RPA processes. Regularly update and monitor security measures to stay ahead of evolving cyber threats. Develop contingency plans and response protocols to address potential security incidents swiftly and effectively. This proactive approach to data security not only protects the organization from potential risks but also fosters trust among stakeholders and regulatory bodies.

7. Collaborate with Stakeholders

Involve key stakeholders throughout the RPA implementation process. This includes finance professionals, IT personnel, compliance officers, end-users, and representatives from different business units. Create cross-functional teams to facilitate collaboration and ensure diverse perspectives are considered. Conduct comprehensive training sessions to familiarize teams with RPA tools, automation workflows, and the anticipated impact on their daily responsibilities. Establish open communication channels to address concerns, gather feedback, and promote a collaborative culture. Encourage stakeholder engagement through regular workshops, forums, and feedback sessions. This inclusive approach ensures a holistic understanding of the technology, fosters a sense of ownership, and minimizes resistance to change.

8. Scale Gradually

Adopt a phased approach to RPA deployment, starting with a small-scale implementation and gradually scaling up as the organization becomes more comfortable with the technology. Establish clear criteria for scaling, considering factors such as process stability, performance metrics, and user feedback. Monitor the performance of RPA processes closely during this phase, conducting regular reviews and assessments. Leverage lessons learned from the initial phases to inform the scaling strategy, identifying opportunities for automation expansion. Establish communication channels to keep stakeholders informed about the progress of RPA implementation and the benefits realized. This deliberate and incremental approach mitigates risks, allows for continuous optimization, and facilitates a seamless and successful transition to full-scale automation.

9. Continuous Monitoring and Optimization

Implement continuous monitoring mechanisms to track the performance of RPA bots over time. Establish key performance indicators (KPIs) and analytics dashboards to provide real-time insights into the efficiency, accuracy, and compliance of automated processes. Regularly review and analyze data to identify patterns, anomalies, and areas for improvement. Collaborate with data analysts and automation specialists to leverage advanced analytics and machine learning algorithms for predictive maintenance and optimization. Conduct periodic health checks and audits of RPA processes to ensure alignment with evolving business requirements, regulatory changes, and industry best practices. This proactive and data-driven approach to continuous monitoring ensures that RPA continues to deliver maximum efficiency, value, and adaptability in the dynamic landscape of finance and accounting.

10. Document Processes and Compliance

Maintain comprehensive documentation of RPA processes to ensure transparency, traceability, and compliance with regulatory requirements. Create detailed process documentation that includes workflow diagrams, standard operating procedures (SOPs), and a record of key decision points. Implement version control for process documentation to track changes and updates over time. Regularly review and update documentation to reflect any changes in processes, configurations, or regulatory frameworks. Establish a centralized repository for documentation, accessible to relevant stakeholders, auditors, and compliance officers. Conduct regular internal and external audits of RPA processes to verify adherence to financial regulations, data protection laws, and internal policies. This rigorous approach to documentation and compliance ensures accountability, facilitates regulatory audits, and supports ongoing process improvement initiatives.

Conclusion

The implementation of RPA in finance points towards sustained growth as organizations increasingly recognize its pivotal role in financial transformation. The transformative impact is evident in the reduction of operational costs, heightened precision, and accelerated fulfillment of business processes, fundamentally reshaping the day-to-day operations of finance and accounting departments.

Finance professionals can break free of monotonous and repetitive work by using the potential of robotic process automation. This freedom results in a significant change, allowing these experts to reclaim their time on high-value, strategic, and advising tasks. This strategic pivot enables firms to not only remain competitive, but also to cultivate an environment of creativity and happiness.

How Idea Usher Can Help With RPA In Finance?

Idea Usher stands as one of the most rapidly advancing global financial software development companies, distinguished for its outstanding RPA solutions tailored for the finance sector.

Idea Usher, has collaborated with over 500 clients, including Fortune 500 companies such as Gold’s Gym and Honda, as well as indie brands. The company specialises in developing hybrid apps, mobile apps, and custom websites, contributing significantly to the business growth of its clients.

From the initial conceptualization phase through to deployment, our dedicated team remains by your side at every stage, demonstrating unwavering commitment and enthusiasm. Our commitment is to deliver state-of-the-art solutions that not only meet but exceed your expectations.

Here is a case study about how we successully implemented RPA solution to our client’s business.

To revolutionize your business with a robust RPA solution in the finance domain, connect with our proficient tech experts at Idea Usher today!

FAQ

Q. What is RPA in finance?

A. RPA in finance refers to a user-friendly software designed to automate repetitive and monotonous tasks by interacting with user interfaces without disrupting underlying programs.

Q. What advantages come with implementing RPA in the finance industry?

A. The implementation of RPA in the finance industry offers numerous benefits. It efficiently automates repetitive tasks prone to errors and time-consuming manual efforts. This leads to a lean and cost-effective team, ensuring high compliance standards and minimizing human errors. By automating tasks like inventory management, account payables and receivables, record-keeping, payroll processing, and report generation, finance automation allows human resources to focus on strategic planning and client relations.

Q. How does RPA impact finance account payables?

A. RPA has a significant impact on finance account payables, which involves repetitive and error-prone tasks. Integrated with machine learning and artificial intelligence, RPA handles tedious duties such as generating invoices and purchase orders. It ensures real-time tracking and comparison of raised invoices against purchase orders, maintaining audit trails efficiently.

Q. In what ways can RPA be utilized to automate finance tasks?

A. Financial institutions can harness RPA’s capabilities by deploying bots that emulate human interactions in various financial processes. These bots automate mundane tasks like data entry, report generation, invoice processing, and reconciliation with precision and speed. Additionally, RPA bots can seamlessly interact with internal systems such as ERP and CRM, facilitating end-to-end automation and efficient data exchange. By incorporating RPA applications in finance, businesses can streamline operations and focus on value-added tasks while leaving time-consuming activities to RPA bots.

Gaurav Patil