Managing loan pipelines, tracking borrower touchpoints, and coordinating with loan officers becomes increasingly complex as lending teams scale. Relying on spreadsheets or disjointed tools often results in delays, errors, and missed follow-ups. That’s where loan CRM platforms like Jungo make a difference, bringing sales, communication, and document workflows under one roof to streamline operations and improve borrower experiences.

We’ve worked with numerous businesses to build CRMs specifically tailored to the fintech industry, designed to streamline their lending processes and enhance team collaboration, thereby reducing friction. IdeaUsher has the expertise to develop a loan CRM platform like Jungo, covering everything from core features and integrations to automation, compliance, and scalable system design.

What is Loan CRM Platform: Jungo?

Jungo is a loan CRM platform built specifically for mortgage and real estate professionals. It streamlines loan origination by integrating LOS (Loan Origination System) data, automating marketing, and managing borrower-realtor communication in one place. Built on Salesforce, this platform offers deep customization, lead tracking, and compliance tools tailored to mortgage workflows. It helps lenders improve conversion rates and client retention by centralizing all customer and partner interactions across the loan lifecycle.

Business Model

Jungo is a subscription CRM on Salesforce for loan officers, brokers, and real estate pros. It centralizes workflows, marketing, referrals, and compliance, using Salesforce’s ecosystem for integrations with LOS, email, and marketing apps. It creates a hub for lead generation, client communication, and onboarding.

Revenue Model

Jungo follows a SaaS-based recurring revenue model tailored for the mortgage and real estate industry. Its pricing strategy is structured around user-based subscriptions with tiered plans that unlock more features as businesses scale.

- Tiered Subscription Plans: Offers multiple pricing tiers based on feature sets, starting from ~$96/user/month for basic tools to ~$149/user/month for bundled solutions.

- Add-on Services: Advanced features like LOS sync, SMS integration, and custom workflows are available in higher tiers.

- One-Time Setup Fee: Charges a setup fee of around $249–$299 per account for onboarding and customization.

- Annual Billing Model: Most plans follow a yearly billing cycle, improving cash flow and customer retention.

- Custom Enterprise Plans: For large teams, custom pricing is available with access to enhanced support, API access, and security controls.

Why Is Jungo So Popular?

Jungo has become popular by directly addressing mortgage professionals’ operational pain points with a purpose-built CRM on Salesforce. Its integrations with LOS, automated marketing, and borrower workflows reduce manual tasks, speeding up loan closing. Unlike generic CRMs, it is pre-configured for mortgage workflows, enabling quicker onboarding, compliance, and scalable pipeline management.

How Jungo Streamlines Mortgage and Loan Workflows?

Modern mortgage teams need more than basic CRM to handle complex loans. Jungo, a specialized loan CRM platform, automates tough tasks and integrates with lending tools to improve speed, accuracy, and borrower experience.

1. End-to-End CRM Automation

The loan CRM platform like Jungo connects lead capture, marketing, processing, and client servicing into a unified workflow. It automates follow-ups, notifications, and status updates, ensuring every borrower interaction is tracked and acted upon without missing key touchpoints.

2. Pre-Built Mortgage Workflows & Templates

Unlike generic CRM systems, Jungo offers pre-configured workflows tailored for mortgage CRM platforms. These include onboarding steps, document reminders, pre-approval processes, and closing follow-ups, all designed to reduce delays and eliminate repetitive manual coordination from loan officers’ daily tasks.

3. LOS Integrations with Encompass & Calyx

Jungo’s direct integration with top loan origination systems, such as Encompass and Calyx, ensures that mortgage CRM platforms like Jungo automatically sync loan stages, borrower data, and milestones, eliminating duplicate entries and aligning teams on real-time updates.

4. Real-Time Borrower Engagement

This loan CRM platform uses built-in messaging, email campaigns, and milestone notifications to keep borrowers informed and engaged. Timely communication helps reduce drop-offs, encourages faster document turnaround, and improves borrower satisfaction throughout the loan journey.

5. Referral & Partner Management Tools

Jungo supports co-branded marketing, lead sharing, and performance tracking for realtors and partners. These capabilities enable loan officers using a mortgage CRM platform like Jungo to scale their referral network and improve relationship visibility with minimal manual overhead.

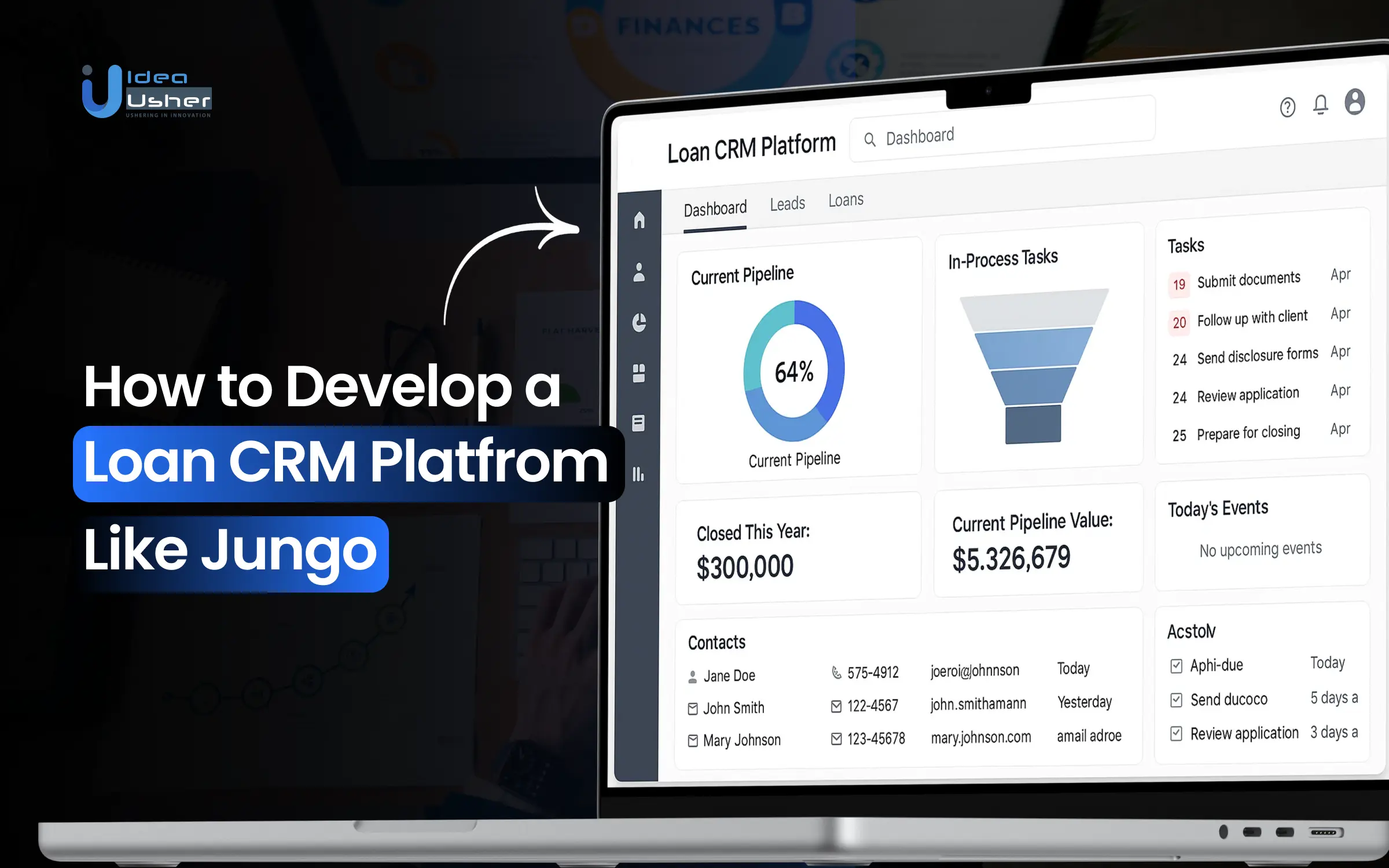

6. Dashboards & Analytics for Loan Officers

With built-in dashboards and analytics, this loan CRM platform gives visibility into performance KPIs like conversion rates, loan pipeline stages, and referral activity. This helps lending teams identify inefficiencies and make data-backed decisions to optimize workflows.

Why You Should Invest in Launching a Loan CRM Platform?

The mortgage CRM software market is growing, valued at USD 9.16 billion in 2024 and projected to reach USD 12.18 billion by 2031, with a CAGR of 4.00% from 2024 to 2031. Growth is driven by digitization and demand for automation in lending and client management.

nCino, a loan CRM platform provider, raised over $170M across its Series A to D rounds before going public in 2020 with an IPO that netted $268.4M. Its Salesforce-native architecture and tailored mortgage workflows made it a preferred choice for banks and lenders seeking scalable CRM solutions.

FinMkt, a consumer financing infrastructure company, raised $14.5M+ to expand its lending and loan servicing tech. It has since become a trusted CRM component in embedded finance and retail credit ecosystems, supporting end-to-end loan lifecycle management.

The steady funding for mortgage CRM platforms shows strong institutional interest in digital lending. With banks, brokers, and fintechs seeking vertical-specific CRMs, launching a platform can generate SaaS revenue, licensing, and partnerships. Now is an ideal time to invest.

How a Loan CRM Platform Drives Business Growth?

A loan CRM platform like Jungo isn’t just a digital organizer. It plays a direct role in business expansion by aligning operations, streamlining processes, and giving lenders the tools they need to manage leads, loans, and customer relationships efficiently.

1. Specialized for Lending Operations

A loan CRM platform is for lending teams, not adapted from generic sales tools. It supports mortgage workflows, credit checks, document tracking, and underwriting integrations, resulting in fewer errors, faster processing times, and a smoother borrower experience from start to close.

2. Unified View of the Borrower Journey

Platforms like Jungo CRM integrate with LOS and stay compliant with TRID and RESPA, providing loan officers with a centralized dashboard. This enables them to handle everything from lead capture to loan disbursement through a single, seamless interface without switching tools.

3. Operational Efficiency Becomes a Growth Engine

With repetitive admin work handled by automation, loan CRM platforms free loan officers to focus on relationships and deal closures. This shift not only reduces software clutter but also builds a more scalable, performance-driven operational model for lenders.

4. Data-Driven Optimization

Built-in analytics within mortgage CRM platforms allow teams to analyze lead behavior, drop-off stages, and conversion performance. These insights can then be used to refine the sales funnel, improve lead quality, and optimize every stage of the loan pipeline.

5. Personalized Engagement at Scale

Smart segmentation and borrower tracking let lenders personalize follow-ups and prioritize leads. A mortgage CRM platform improves client communication, boosts retention, and enhances borrower lifetime value, making personalization a direct lever for growth.

Must-Have Features in a Loan CRM Like Jungo

To develop a high-performing loan CRM like Jungo, your software needs intelligent automation, real-time syncing, and borrower-friendly workflows. These features should mirror modern mortgage and loan teams that are fast, compliant, and conversion-focused.

Below are the core modules that turn a generic CRM into a robust mortgage CRM platform tailored to the loan lifecycle.

A. Lead Management & Tracking

Managing leads effectively is critical for loan officers. Your CRM must be capable of capturing leads from various channels, scoring them accurately, and routing them in real time to avoid delays in response.

1. Multi-Source Lead Capture

Your loan CRM platform should automatically collect leads from digital ads, landing pages, web forms, and third-party portals. By integrating API or webhook-based ingestion, the CRM eliminates manual entry and ensures all leads flow into a unified pipeline.

2. Automated Lead Scoring

Assigning weighted scores based on source, borrower profile, credit indicators, or campaign interaction helps prioritize leads efficiently. Your platform should allow custom scoring rules that match your lending strategy and borrower persona.

3. AI-Based Lead Prioritization

AI models should analyze borrower behavior, such as click patterns or credit score triggers, to surface high-intent leads. The CRM must also auto-alert or route these leads to experienced loan officers for rapid follow-up and better conversion rates.

B. Workflow Automation for Loan Lifecycle

A successful mortgage CRM platform simplifies the loan lifecycle with automation. From pre-qualification to closing, every manual task should be streamlined through automated workflows built around lending milestones.

1. Automated Email/Text Sequences

Trigger borrower communication through intelligent email or SMS campaigns based on loan status or borrower action. These sequences can remind borrowers about missing documents or provide personalized loan guidance without overwhelming the sales team.

2. Task Generation and Reminders

Automatically assign tasks to processors and underwriters when a borrower reaches the next stage or misses an input. The system should set deadlines, track dependencies, and escalate when needed to ensure continuous momentum.

3. Pre-Configured Mortgage Pipelines

Offer workflows specific to FHA, VA, or conventional loans that come with built-in logic, task templates, and compliance checks. Users should be able to customize pipelines for different branches, products, or jurisdictions.

C. LOS & Third-Party Integrations

Integrating with external platforms is crucial for operational efficiency. Your loan CRM platform should support seamless syncing with Loan Origination Systems and document verification APIs to keep borrower records accurate and up to date.

1. Encompass, Calyx, LendingPad, Blend, etc.

Integrate with top LOS systems to sync borrower data, loan milestones, and disclosures in real time. Support for two-way syncing and event-based triggers helps avoid data duplication or version conflicts.

2. Document Collection and Verification Tools

Utilize APIs from Plaid, Finicity, or Truework to automate income, employment, and asset verification. This eliminates back-and-forth paperwork and speeds up loan approval while enhancing the borrower experience.

D. Communication & Client Engagement

Modern borrowers expect instant updates and secure communication. Your mortgage CRM platform like Jungo must offer omni-channel support and secure document handling to meet those expectations while staying compliant.

1. Omni-Channel Messaging (Email, SMS, In-App)

Ensure all communication is synchronized across channels and logged inside the CRM. Loan officers should be able to pick up any conversation mid-stream, regardless of the communication method used.

2. Secure Document Sharing

Enable borrowers to upload sensitive documents securely via portals with encryption, time-stamped access logs, and multi-factor authentication. Built-in e-signature support ensures legal compliance while speeding up the process.

3. Custom Templates

Provide branded templates for pre-approvals, milestone updates, or disclosures that auto-fill borrower-specific data. These templates help save time while ensuring consistency and compliance in every client interaction.

E. Reporting & Compliance Monitoring

Compliance and performance tracking are essential in lending. A robust loan CRM platform must provide real-time dashboards, audit trails, and automate compliance rules to mitigate risk and enhance team performance.

1. Audit Trails

Track every action taken by users or borrowers, including data changes and communication logs. Timestamped entries with user attribution ensure complete traceability for internal audits or external reviews.

2. Compliance Rule Enforcement

Embed rules that enforce disclosure timelines and prevent premature communications. Your CRM should monitor actions against TRID, RESPA, and other lending compliance frameworks to reduce regulatory exposure.

3. Activity Logs and Call Reports

Log all calls, emails, and meetings to provide full visibility into each loan file. Managers should be able to filter by team member, time range, or loan stage to evaluate process gaps or training needs.

Steps to Build a Loan CRM Platform like Jungo

To build a loan CRM platform like Jungo, we focus on user-specific workflows, automation depth, and integrations that align with how mortgage and loan businesses actually operate. Below are the practical development steps we take to build such a platform with precision and scalability.

1. Consultation

First, we will consult with you to identify challenges and gaps that mortgage brokers, loan officers, and lending teams face. We map each mortgage cycle stage like lead capture, document handling, underwriting, and closing against user personas. This helps us create workflow blueprints that ensure the loan CRM platform is tailored for residential, commercial, or refinance lending.

2. Architect a Modular CRM Backbone

We build a microservices-based CRM architecture that supports modular plug-ins like lead tracking, compliance, communication, and document handling. This enables your platform to evolve with new lending products like FHA or USDA loans without code duplication or systemic disruption across your infrastructure.

3. Build Advanced Lead & Contact Management Engine

Our team develops a smart lead ingestion and enrichment engine that uses role-based dashboards and AI to route, score, and cluster leads. We integrate borrower demographics and credit insights to drive precision targeting, while providing loan officers with a comprehensive view of every lead’s stage and interaction history.

4. Workflow Automation Engine for Loan Pipelines

We implement a visual workflow engine with drag-and-drop tools for task assignments, alerts, and email/SMS triggers. Admins can set rules like missing document flags or SLA countdowns. We also build reusable pipeline templates tailored to refinance, purchase, or construction loans across different regions or teams.

5. Integrate with LOS and Financial Tools

We handle secure, bi-directional API integrations with LOS platforms like Encompass, LendingPad, and Calyx. Our devs sync borrower records, loan status, credit data, and document logs while adding middleware layers that let you switch LOS systems or integrate additional tools like fraud checks without backend rewrites.

6. Embed Client Engagement and Communication Tools

We build an in-app engagement suite with email, SMS, secure portals, and AI-based content triggers. Borrowers receive auto-reminders, disclosures, and custom messages. We also embed sentiment analysis to help lenders prioritize clients who show signs of hesitation, frustration, or who need additional support during the process.

7. Design Compliance-First Reporting Framework

Our system includes immutable audit trails, activity logs, and compliance automation that meet standards like RESPA, GLBA, and TILA. We configure rules that flag risk in real-time and generate performance reports for branches and loan officers. Our explainable AI flags why loans fail compliance or slow down in the pipeline.

8. Build Role-Based Dashboards and Analytics

We build custom dashboards for each role like admins, managers, or loan officers, featuring relevant KPIs like time-to-close, pipeline stages, fallout rates, and conversion. Visual tools like heatmaps help identify bottlenecks and monitor client drop-offs, enabling data-driven decisions to boost team output and loan success across departments.

9. Deployment

Our developers deploy the CRM in cloud-native environments with Docker/Kubernetes for scalability and bank-grade security. We implement tenant isolation, role-based access, and white-labeling support. Clients can self-configure roles, workflows, and integrations via a low-code admin panel without needing developer assistance for everyday operations.

Cost to Develop a Mortgage CRM Platform

Building a full-featured mortgage CRM platform like Jungo requires a structured investment that aligns with workflow automation, LOS integrations, and financial compliance. Below is a detailed breakdown to help estimate costs based on each core development phase.

| Development Phase | Estimated Cost | Description |

| Consultation | $8,000 – $12,000 | Interviews, competitor research, and mapping core workflows |

| UI/UX Design | $10,000 – $15,000 | Designing user-friendly dashboards, mobile views, and responsive components for loan officers, underwriters, and borrowers. |

| CRM Backend Architecture & Database Design | $15,000 – $32,000 | Building a modular architecture for scalability, microservices, and database schema optimized for mortgage CRM platform operations. |

| Lead & Contact Management Engine | $12,000 – $18,000 | Lead ingestion pipelines, scoring algorithms, and dashboards |

| Workflow Automation Module | $14,000 – $28,000 | Visual pipeline builders with task automation, SLA alerts, and communication triggers for each loan type. |

| LOS & Third-party Integration Layer | $15,000 – $29,000 | Secure APIs to sync with LOS platforms, credit bureaus, e-signature tools, and income verification services |

| Client Communication & Document Tools | $10,000 – $16,000 | Secure messaging, templated email/SMS, and document sharing portals |

| Compliance & Reporting System | $10,000 – $18,000 | Real-time compliance checks, audit trails, and performance dashboards |

| Admin Panel & Analytics Dashboards | $12,000 – $17,000 | Custom dashboards for managers and branch admins with pipeline heatmaps and actionable KPI reports. |

| Deployment | $10,000 – $14,000 | Bank-grade encryption, containerized deployment, cloud hosting setup, and role-based access systems. |

Total Estimated Cost: $65,000 – $125,000

Note: These estimates are based on mid-tier agency rates. Costs may vary depending on the team’s location, regulatory needs, or infrastructure requirements. Consult with our development team to determine the exact budget of your loan CRM platform like Jungo.

Technologies Recommendation to Build a Loan CRM Platform

A robust mortgage CRM relies on a modern tech stack for seamless loan origination, borrower communication, and pipeline management. Its combination of frontend, backend, AI, and integration technologies ensures scalability and compliance.

1. Frontend Technologies

The frontend is the face of the CRM platform where users interact with borrower dashboards, lead pipelines, tasks, and communications. It needs to be fast, intuitive, and responsive to support real-time lending operations.

- React: Widely used for its flexibility and fast rendering, making it ideal for building responsive dashboards, loan tracking pages, and activity feeds.

- Angular: Suitable for larger, enterprise-grade mortgage CRM platforms that require strict component structure, routing, and state management.

- Vue: Lightweight and easy to maintain, Vue works well for platforms that prioritize quick setup and user-friendly interfaces with minimal complexity.

2. Backend Technologies

The backend powers the business logic, user management, document flows, and integration with external APIs. It serves as the brain of the loan CRM platform.

- Node.js: Efficient for handling real-time tasks like loan updates, status notifications, or borrower chat support due to its non-blocking architecture.

- Python (Django): Good for rapid development cycles and well-suited for CRMs that include AI components like lead prioritization or report generation.

- Java Spring: Used in systems that require high security, robust architecture, and scalability, often preferred in mortgage CRMs built for banks or large institutions.

3. Databases

Databases store critical information such as borrower records, task logs, application histories, and compliance data. They must offer speed, security, and scalability.

- PostgreSQL: A highly reliable SQL database for structured data like borrower profiles, loan progress, and audit logs critical for regulatory compliance.

- MongoDB: Handles semi-structured or dynamic data formats such as document metadata, form responses, and third-party API data in a flexible way.

4. CRM Engine

The CRM engine orchestrates lead management, borrower interactions, and task automation. It serves as the functional core of the platform.

- Salesforce SDK: Ideal for teams that want to build quickly on top of Salesforce’s proven CRM capabilities and benefit from its existing modules and integrations.

- Custom Microservices: Enables highly tailored CRM logic, such as configurable workflows, automated lead routing, partner portals, and custom notification systems.

5. AI/ML Capabilities

AI capabilities are increasingly integrated into mortgage CRM platforms to automate insights and assist in decision-making across the loan lifecycle.

- Lead Scoring: Uses borrower behavior, credit data, and response history to rank leads by conversion probability, helping loan officers focus on high-value prospects.

- Churn Prediction: Detects disengagement patterns and flags borrowers at risk of dropping off, allowing timely follow-up and re-engagement.

- Underwriting Models: Analyze financial, behavioral, and credit data to support pre-underwriting risk assessments and streamline approvals.

6. Security Protocols

Security in loan CRM platforms is essential for maintaining borrower trust, meeting regulatory standards, and protecting sensitive financial information.

- OAuth 2.0: Provides secure authentication and access delegation, allowing safe sign-ins via platforms like Google or Microsoft accounts.

- AES-256 Encryption: Protects sensitive borrower data both in transit and at rest, meeting industry standards for secure data handling.

- Role-Based Access Control: Ensures different user roles such as agents, underwriters, and admins, have appropriate levels of access and visibility.

7. Integrations

A loan CRM platform must seamlessly connect with multiple third-party tools and services used across the lending ecosystem for smooth operations.

- REST APIs: Used to connect the CRM with services like credit bureaus, KYC tools and loan origination systems for real-time data exchange.

- Zapier: Helps automate repetitive tasks like creating follow-ups, calendar invites, or syncing contact data with email tools.

- LOS APIs: Enable bi-directional sync with loan origination systems such as Encompass, making it easier to manage applications and updates in one place.

- DocuSign: Enables borrowers to securely sign loan documents directly within the CRM platform, streamlining the application process.

- Twilio: Powers multi-channel communication like SMS, voice calls, and WhatsApp, for instant notifications, appointment reminders, or borrower support

Challenges in Building a Loan CRM and How to Overcome Them

While building a mortgage CRM platform, businesses often face a blend of regulatory, technical, and user-focused challenges. Addressing these properly is key to ensuring long-term performance, usability, and trust within a high-stakes lending environment.

1. Compliance Complexity

Challenge: Handling borrower data and automating lending workflows under strict financial regulations is complex. Mortgage CRM platforms must comply with laws like GLBA, HMDA, GDPR, and manage audit trails, permissioned access, and encrypted docs securely.

Solution: We implement role-based access control, bank-grade encryption, and real-time audit logs while embedding regulatory logic into workflows. Our team aligns CRM processes with U.S. and global compliance standards, ensuring your loan CRM platform stays audit-ready without slowing operations.

2. Real-Time Data Syncing with LOS Platforms

Challenge: Loan origination systems often use legacy architectures with inconsistent APIs. Synchronizing borrower data, document statuses, and underwriting stages between CRM and LOS without data loss or delays is a major integration challenge for mortgage CRM systems.

Solution: We build custom connectors using middleware and event-driven sync models that bridge legacy LOS systems with your loan CRM platform. This ensures accurate two-way updates in real time, keeping all teams aligned and reducing manual reconciliation risks.

3. High User-Experience Expectations

Challenge: Loan officers and brokers want fast, clutter-free dashboards, while borrowers need intuitive application flows. Creating a CRM that works well for agents and users on mobile and desktop is a key UX challenge.

Solution: We design modular dashboards for different user roles, implement mobile-first UIs, and use frameworks like React to keep performance high. We also conduct role-specific UX testing, so the platform feels frictionless whether you’re a lender or a borrower.

4. Maintaining Lender-Borrower Trust

Challenge: Loan CRMs handle sensitive financial information and customer touchpoints. Any lapse in messaging, delayed updates, or security issues can quickly erode borrower confidence, impacting both conversion rates and customer retention for mortgage businesses.

Solution: We build real-time notifications, secured document uploads, and transparent borrower portals into the CRM. By integrating tools like Twilio, DocuSign, and AES-256 encryption, we ensure trust is maintained through consistent, secure, and timely borrower communication.

Monetization Models for Loan CRM Platforms

A well-structured pricing model sustains product viability and aligns with lending teams’ usage patterns. Below are modern loan CRM monetization strategies that generate recurring revenue and scalable value.

1. Subscription SaaS

A loan CRM platform can follow a SaaS pricing model by charging a monthly subscription fee or per active user. This ensures predictable revenue streams while giving clients flexibility in scaling access as their lending operations expand across geographies or branches.

2. Tiered Plans with Workflow

CRM providers often roll out tiered pricing plans where advanced workflow features, automation modules, or integrations are unlocked at higher levels. This encourages upgrades and aligns platform value with business growth, especially for enterprise-level mortgage CRM use cases.

3. Integration and Setup Fees

For platforms offering custom integrations with LOS systems, onboarding workflows, or third-party tools like DocuSign and Twilio, charging one-time setup fees is a common model. This covers development effort while ensuring clients receive tailored functionality from day one.

4. White-Labeled Solutions for Enterprise Clients

A white-labeled loan CRM platform can be monetized by offering branded versions to lending institutions. Enterprises often pay a premium for exclusive design, infrastructure scaling, and API controls, making this a high-value offering for CRM vendors targeting financial enterprises.

Conclusion

Building a loan CRM platform like Jungo requires a clear understanding of lending workflows, strong data integration capabilities, and user-centric design. By combining CRM functionalities with mortgage-specific tools, the platform can streamline communication, automate routine tasks, and enhance overall loan management efficiency. A well-designed system not only improves operational transparency but also helps teams close loans faster while delivering a better borrower experience. With the right development approach, you can create a robust platform tailored to meet the unique demands of modern lending environments and drive long-term value for your organization.

Why Choose IdeaUsher to Build Your Loan CRM Platform?

At IdeaUsher, we specialize in building high-performance CRM platforms tailored for the lending industry. Our team understands the unique workflow needs of loan officers, brokers, and financial institutions, and delivers solutions that streamline lead management, automate documentation, and improve borrower experiences.

Why Partner With Us?

- Industry-Aligned CRM Expertise: We design CRM platforms with built-in mortgage, loan origination, and financial workflows to help your teams operate more efficiently.

- Seamless Integrations: From LOS platforms to marketing tools, we ensure your CRM connects with every system in your stack.

- Customization First: Every feature is tailored to your lending process, ensuring your CRM works the way your team does.

- Proven Results: Our custom CRM solutions have helped financial platforms reduce loan processing time and improve client satisfaction significantly.

Explore our portfolio to see how we’ve helped lending companies modernize their CRM infrastructure and improve operational efficiency.

Get in touch for a consultation and start building a smarter loan CRM solution today.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A loan CRM platform should offer lead management, document automation, borrower communication tools, pipeline tracking, and integrations with LOS and compliance systems to streamline every stage of the mortgage or lending process efficiently.

Automation reduces manual tasks like follow-ups, email responses, and document collection. It helps loan officers stay organized, minimizes human errors, and speeds up the loan approval process while keeping client interactions personalized.

LOS integration allows seamless data sharing between systems, helping loan officers avoid duplication, ensure compliance, and manage loan files efficiently from application to closing without switching platforms.

A CRM can track communication history, maintain audit trails, and automate document collection to meet regulatory standards. It ensures every interaction and document is recorded properly, helping lenders stay compliant with minimal effort.