As the financial industry is growing exponentially due to disruptive technology, financial institutions can provide their clients with fresh, creative services that turn the financial services sector into a multibillion-dollar business.

Creating a fintech application is an exciting peek into the financial services industry’s future. Fintech apps have completely changed how people and organizations deal with money and provide them with a great level of accessibility, efficiency, and ease.

The Fintech industry has a lot of room for more innovation as long as technology keeps improving. Thus, this is the perfect time for you to design a FinTech app for your company. This blog covers everything from development steps to factors that decide the costs of developing a FinTech app.

- Fintech Industry Market Stats

- What Is The Revolut app?

- What Makes Revolut App So Popular?

- How Does Revolut App Work?

- Must-Have Features For An App Like Revolut

- How To Develop A Fintech App Like Revolut?

- Fintech Platforms Use Cases

- How To Monetize An App Like Revolut?

- Cost Affecting Factors To Develop An App Like Revolut

- Top 5 Fintech Platforms Like Revolut

- Tech Stack To Consider For Developing An App Like Revolut

- Conclusion

- FAQ

Fintech Industry Market Stats

Source: Statista

- It is expected that the number of people utilizing digital banking will rise from $197 million in 2021 to $217 million in 2025, while the FinTech sector will grow to a size of $699.50 billion by 2030.

- Digital Investment will be the largest market in 2023, with an AUM (Assets Under Management) of $51.04 billion.

- In 2023, the average AUM per user in the digital investment industry will be US$916.70.

- In 2024, the digital assets market is estimated to increase at a 34.5% CAGR.

- The number of users in the digital payments industry is estimated to reach 320.20 million by 2027.

- The total AUM in the digital investment market is expected to reach $51.04 billion in 2023.

What Is The Revolut app?

Revolut, a financial technology platform, provides several financial services. Since its establishment in 2015, it has grown in recognition for its cutting-edge approach to international currency exchange and banking.

The app allows users to hold and manage multiple currencies within a single account. This feature is useful for individuals who frequently travel or make international transactions.

Also, users can exchange currencies at competitive rates directly within the app, avoiding traditional banking fees and often getting better rates than traditional banks. The app enables users to send money internationally with low or no fees, using real exchange rates.

Moreover, Revolut issues a physical or virtual debit card that users can use for everyday transactions where the card is often linked to a multi-currency account, allowing users to spend in different currencies without incurring additional fees.

Users can manage their finances more effectively using the app budgeting tools and spending analytics. Also, users can buy, sell, and hold various cryptocurrencies directly within the app.

What Makes Revolut App So Popular?

Revolut app has simplified the financial experiences of their customers in many ways. Revolut allows users to hold multiple currencies within a single account, enabling international transactions without traditional currency exchange fees. Also, users can convert currencies at no markup fee with real-time interbank exchange rates, which is beneficial for frequent currency converters and travelers abroad.

Moreover, the app includes budgeting tools that help users categorize and track their spending, where the app’s real-time notifications and spending insights contribute to better financial awareness.

Also, with features like card freezing, location-based security, and biometric identification (facial recognition, fingerprint), Revolut strongly emphasizes security, making it a most desirable fintech platform among customers.

How Does Revolut App Work?

From allowing users to create their accounts to making international payments, here are the overall working of the Revolut app:

1. Account Setup:

To ensure security, Revolut takes users through a thorough account setup process. This typically includes providing personal information like name, address, and identification verification. Users might need to submit photos of their ID and a selfie for verification purposes. Once verified, the account is activated, granting access to the app’s features.

2. Multi-Currency Accounts:

Upon account creation, users can set up a multi-currency account. This feature allows them to hold, exchange, and transfer funds in multiple currencies within the same account. It simplifies international transactions and eliminates the need for separate accounts for different currencies.

3. Currency Exchange:

Revolut offers users the ability to exchange currencies at interbank rates or real-time rates. This feature benefits travelers or individuals dealing with international transactions by providing competitive exchange rates within the app, often without additional fees.

4. Debit Card:

Connected to the Revolut account, users can access both virtual and physical debit cards. These cards enable transactions in local and foreign currencies. The virtual card can be used for online purchases, while the physical card allows users to make purchases at brick-and-mortar stores or withdraw cash from ATMs globally.

5. International Transfers:

Revolut’s platform facilitates international money transfers at lower costs compared to traditional banks. Users can send money in various currencies directly to recipients’ bank accounts, often with faster processing times.

6. Budgeting and Analytics:

The app provides tools for financial management, including spending analysis, transaction categorization, and budgeting features. Users can set spending limits, track expenses, and receive insights into their financial habits to help manage their money more effectively.

7. Cryptocurrency Support:

Revolut offers cryptocurrency services, allowing users to buy, sell, and store various cryptocurrencies within the app. This integration enables users to manage both traditional and digital assets from a single interface.

8. Security Features:

To ensure the safety of users’ accounts and transactions, Revolut implements robust security measures. This includes transaction alerts for any activity on the account, two-factor authentication to prevent unauthorized access, and the ability to instantly freeze and unfreeze debit cards via the app in case of theft or loss.

Must-Have Features For An App Like Revolut

To ensure a flawless user experience, developing an app similar to Revolut requires careful consideration of several elements. The following essential features for a Fintech app such as Revolut are as follows:

1. Multi-Currency Management

Managing diverse currencies within a single account simplifies global transactions. Users can effortlessly convert currencies and make purchases worldwide. This functionality is particularly beneficial for frequent travelers or individuals engaging in international business, eliminating the hassle of multiple accounts.

2. Competitive Currency Exchange

Providing real-time or interbank rates ensures users get the best deals when converting currencies. This feature not only saves costs but also guarantees transparency and fairness in exchange rates, outperforming traditional banks’ offerings.

3. Comprehensive Debit Card Integration

The provision of both physical and virtual debit cards linked to a multi-currency account allows users to conduct transactions seamlessly across different currencies. The added security of virtual cards for online purchases enhances user trust and safeguards against potential fraud.

4. Affordable International Transfers

Enabling low-fee transfers at actual exchange rates for international transactions brings considerable savings compared to conventional bank charges. This feature promotes hassle-free global money transfers, benefiting both local and cross-border users.

5. Financial Management Tools

The app’s robust financial tools give users real-time insights into spending patterns and personalized budgeting options. Categorizing expenses and setting limits for various spending categories empowers users to manage their finances efficiently and achieve their financial objectives.

6. Cryptocurrency Support and Wallet

Offering a secure platform for buying, selling, and storing cryptocurrencies alongside traditional currencies allows users to diversify their holdings within a single app. The provision of a digital wallet ensures the safety of their digital assets.

7. Savings Goal Tools

The feature allowing users to create dedicated savings Vaults or Pots helps in achieving specific financial goals. Users can track progress and allocate resources efficiently by segregating funds for distinct purposes, enhancing their saving and budgeting strategies.

8. Premium Membership with Enhanced Benefits

The premium subscription plan, packed with exclusive benefits like expanded trading limits and travel insurance, incentivizes users to upgrade for an elevated financial experience. This tiered offering caters to diverse user needs and preferences.

9. Robust Security Measures

Incorporating advanced security measures such as transaction alerts, two-factor authentication, and instant debit card control reinforces user confidence. These measures safeguard against potential threats, providing users with peace of mind while conducting financial transactions.

How To Develop A Fintech App Like Revolut?

Developing a fintech app involves several critical steps, and while there are generic steps common to app development, the fintech domain has specific considerations. Here are some steps tailored to developing a fintech app, taking into account the unique challenges and requirements of the financial technology sector:

1. Selecting a Fintech Niche

Selecting a fintech field is deciding where to concentrate your efforts within the larger financial technology industry. For your fintech firm to succeed, choosing the appropriate niche is essential since it enables you to customize your offerings to fit the specific requirements of a certain market group.

The fintech industry comprises popular niches such as digital payments, neobanks, robo-advisors, blockchain and cryptocurrency, insurtech, lending platforms, and personal finance management. We discussed each niche and use cases in detail.

2. Decide Fintech monetization model

Avoid including as many monetization mechanisms as possible in the MVP version. Select the best fit for the pilot project, and when you identify additional prospects and income sources, add more later on. Select the option requiring the least amount of work to execute, and makes the most sense.

Fixed commissions, In-app advertising and referrals, business collaboration, business API, and tools are some monetization methods of popular fintech platforms like Revolut.

3. Understand compliance

Compliance in developing mobile applications for finance goes beyond just complying with Google Play and Apple App Store publication rules.

You must do compliance research to find any legal roadblocks and limits based on your target market. Once compliance has been determined, modify your development process to make room for it. Additionally, stricter quality assurance procedures emphasizing security and penetration testing may be necessary.

To avoid negative repercussions, the technology must employ, the company plan, the software, and many other factors all adhere to Fintech regulations, such as

I. Fintech Regulations in the US

- Bank Secrecy Act (BSA)

- USA PATRIOT Act

- Anti Money Laundering Act (AMLA)

- Electronic Fund Transfer Act (EFTA)

- Red Flag Rule

- Fair Credit Reporting Act (FCRA)

II. Fintech Regulations in the UK

- Financial Services and Markets Act 2000 (FSMA)

- Proceeds of Crime Act 2002 (POCA)

- Final Guidance on Cryptoassets

III. Fintech Regulations in the EU

- EU Anti Money Laundering Directives (AMLDs)

- General Data Protection Regulation (GDPR)

- Revised Payment Services Directive (PSD2)

4. Agree on MVP features

It’s critical to concentrate on essential functionality that meets the main demands of your target audience while creating the features for the Minimum Viable Product (MVP), as careful thought and execution are crucial to consider for developing an app like Revolut.

User registration and onboarding, multi-currency accounts, money transfers, budgeting and expense tracking, security features, settings and preferences, and basic reporting are some basic MVP features for the FinTech app.

5. Partner with a vendor

If you don’t have an internal app development team capable of delivering the fintech product or some parts, partnering up with a reliable fintech software development company is a good idea. They can help develop your product based on your business goals and requirements with their app development services.

Here is the list of specialists, usually as a part of the Fintech platform development team.

- Front end developer

- Back end developer

- Business analyst

- Designer

- Project Manager

- QA Specialist

6. Fintech Platform Development

Developing software takes a lot of time and resources; it cannot be completed in a single day. Thus, the first things a business should think about are a concept and a niche. We have included the four main processes below to help make the entire Fintech software development process a little more straightforward and efficient:

I. Gather Project Requirements

Selecting the future application and monetization approach requires performing a market study. Pay special attention to the project evaluation before setting the budget and schedule.

II. Create a Design

The system for fintech software should be easy to use. Therefore, a smooth user experience is another most important factor. Make a list of your preferences and references, then collaborate with a UI/UX team to develop a design.

III. Start Building App Features

Specify the features and parameters of the project for your Fintech software. Describe the problems that the product fixes for people and how they would use it. Consider developing a minimal viable product (MVP), which is a basic software version that has all of its necessary functionalities.

IV. Test and Improve

Carefully inspect and test the financial application software. You may inspect every aspect of the product’s operation and find any issues to avoid in the future by doing a test run.

7. Launch, get feedback, and improve

Creating insurance apps, budgeting apps, creative payment apps, or any other financial software will not likely be completed flawlessly on the first attempt. Because software product development is quite iterative, be prepared to revise the development process to give enhancements and optimizations.

Fintech Platforms Use Cases

The fintech platform offers a wide range of services within the industry, each serving certain requirements. These are some noteworthy fintech areas that you can consider for entering the profitable market of the fintech industry:

1. Digital Payments

Centred on enabling digital transactions, such as online purchases, mobile payments, and peer-to-peer payments. Digital payment platforms leverage digital technologies to provide convenient and secure alternatives to traditional forms of payment, such as cash or checks, and have become popular due to their efficiency, speed, and accessibility.

Examples: PayPal, Square, Venmo, Cash App.

2. Neobanks

Banks that are exclusively digital and provide financial services without physical locations frequently highlight user-friendly interfaces and improved client experiences. Neobanks are financial institutions that operate exclusively online or through mobile apps, without traditional physical branches. These banks leverage technology to provide various financial services, offering a digital alternative to traditional banking.

Examples: Chime, N26, Revolut.

3. Robo-Advisors

Automated investing platforms that manage investment portfolios, offer financial advice using algorithms and provide investment management services with minimal human intervention.

These digital platforms use algorithms and computer programs to create and manage investment portfolios for users based on their financial goals, time horizon & risk tolerance. Robo-advisors typically follow a passive or index-based investment approach, aiming to optimize returns through a diversified portfolio while minimizing fees.

Examples: Wealthfront, Betterment, Robinhood.

4. Blockchain and Cryptocurrency

Using blockchain technology, a fintech platform can offer diverse financial applications, including decentralized finance (DeFi) systems, wallets, and cryptocurrency exchanges. Fintech platforms can leverage distributed ledger technology to facilitate secure, transparent, and decentralized financial transactions.

Examples: Coinbase, Binance, Uniswap.

5. Insurtech

Technological innovations in the insurance industry offer customized coverage, expedite procedures, and enhance risk assessment.

Insurtech is a use of technology innovations to enhance and optimize the insurance industry where companies leverage digital platforms, data analytics, artificial intelligence, and other technologies to streamline processes, improve customer experiences, and create innovative insurance products. Insurtech aims to bring efficiency, transparency, and cost-effectiveness to various aspects of the insurance value chain.

Examples: Lemonade, Root Insurance, Oscar Health.

6. Lending Platforms

Websites that provide loans, such as alternative financing options, small company loans, and peer-to-peer loans. Lending platforms, also known as online lending platforms or peer-to-peer lending platforms, connect borrowers with lenders, facilitating the borrowing and lending of money without the involvement of financial institutions like banks.

Lending platforms streamline the lending process, making it more efficient, transparent, and often more accessible to a broader range of individuals and businesses.

Examples: LendingClub, Funding Circle, SoFi.

7. Personal Finance Management

Apps and tools are made to assist users with budgeting, tracking spending, and managing their personal money. Personal finance management apps typically offer features that enable users to link bank accounts, credit cards, and other financial accounts to provide a detailed view of their financial situation.

Examples: Mint, YNAB (You Need A Budget), PocketGuard.

How To Monetize An App Like Revolut?

There are several ways to monetize an app like Revolut. The popular monetization models are as follows:

1. Fixed commissions

When using the Revolut app as an example, the first business model to consider is that one. The primary benefit of this model is that it encourages consumer choice. Users can select appropriate price plans as long as the team provides various options. In addition, a lot of teams launch a free plan.

Although it has certain drawbacks, it facilitates consumer engagement. You may also target several user groups and even narrow them down by category simultaneously. Revolut, for example, has separated its plans into two categories: personal and commercial.

2. Operation fees

That’s a simple way to make money from apps like Revolut. Users will only be charged under this model if they utilize a service or complete a transaction. Depending on the kind of financial activity, recipient nation, volume of transactions, etc., the team must establish the charge rates. Teams may also think about charging flat fees or using a percentage basis. When users exceed their plan limits and wish to conduct more transactions, Revolut uses this mechanism.

3. In-app advertising and referrals

Apps similar to Revolut can also be monetized using the most often-used business model. Those won’t be the standard ads we see in other applications. By drawing consumers’ attention with native ads such as referral schemes or suggestions, digital financial services may make the most of their offerings.

Promotions are frequently paid for by businesses, but remember that reward systems may also attract many new clients, boosting sales. Revolut, for instance, provides a $50 welcome gift to users who register using a coupon or link from associated partners.

4. Business collaboration

In order to provide digital financial services, the company has to work with several partners. It incorporates nearby suppliers as well as conventional financial institutions. The team can offer a greater choice of services and an expanded user experience when they collaborate well. Revolut has launched several services, including airport lounge passes, online shopping incentives, and app connections.

As a result, if the group can turn a partnership notion into something that benefits both the company and the people, then there are no restrictions.

5. Business API and tools

Revolut is a very successful market player, and it’s important to note that it went far beyond serving other companies. They provide other teams with business APIs to facilitate payments and transactions.

Additionally, Revolut offers various solutions to meet a range of purposes, including payroll, invoicing, and spending management. It implies that the group’s initial idea will never fully reveal its potential. Revolut’s continuous development has enabled it to evolve from a financial app to a digital financial services market aggregator.

Cost Affecting Factors To Develop An App Like Revolut

The cost of developing an app like Revolut can depend on several factors, including the features & functionalities you want to incorporate, the complexity of the app, the technology stack, and the development team’s location and expertise. Some key factors can influence the cost:

1. Scope and Features

The cost of development increases with the number of features you want to integrate. Features like support for cryptocurrencies, currency conversion, international transfers, multi-currency accounts, and budgeting tools influence the total cost.

Core features of a FinTech app may include user authentication, account management, transactions, and notifications. Additional features like budgeting tools, investment management, financial analytics, or integration with third-party services (e.g., payment gateways and APIs for banking data) can increase costs.

2. Platform (iOS, Android, Cross-Platform)

Developing for both iOS and Android raises expenses in most cases. If you wish to target two platforms at once, cross-platform frameworks like Flutter or React Native can be a more affordable choice.

3. Design Complexity

An attractive and easy-to-use design is essential for a financial application. Complex designs might cost more overall since they need more time and resources. Using pre-built, standard UI components may be less expensive. However, creating custom-designed UI components tailored to specific requirements can increase costs.

4. Security Requirements

As fintech applications handle sensitive financial data, it’s critical to have strong security measures in place. Enhanced security features might raise the price of development. Fintech apps are often subject to strict regulations, such as GDPR, PCI DSS, and others, depending on the region and the type of financial services provided. Ensuring compliance with these regulations adds complexity to the development process.

5. Integration with Financial Institutions

Integrating with banks and financial institutions involves additional complexity and can contribute to development costs. The level of integration with financial institutions will influence costs. Direct integration with banks, payment processors, and other financial systems may require additional resources and expertise.

6. Regulatory Compliance

Financial rules may be needed to add extra functionality, documentation, and testing. Regulatory compliance is essential and might drive up development expenses. Adhering to industry standards and best practices, like the Payment Card Industry Data Security Standard (PCI DSS) for payment processing, can impact the development cost.

7. Technology Stack

Costs can be impacted by the programming languages, frameworks, and technology selection. Some technologies could need specialized knowledge or come with licensing costs.

Depending on your preferences and requirements, you might use languages like JavaScript (React or Angular for web, React Native or Flutter for mobile), Swift for iOS, or Kotlin for Android. For UI/UX design, costs can vary based on the complexity of the app and the level of customization required.

8. Geographic Location of Development Team

The location of the development team might affect the cost of development. Developer rates could vary depending on the location. It’s important to note that these are generalizations, and rates can vary within each region based on factors such as the specific country, city, and the level of expertise required.

Top 5 Fintech Platforms Like Revolut

In this section, we have discussed the top five Fintech platforms Alternate to Revolut that can help you gain more ideas about the fintech industry regarding features and business models:

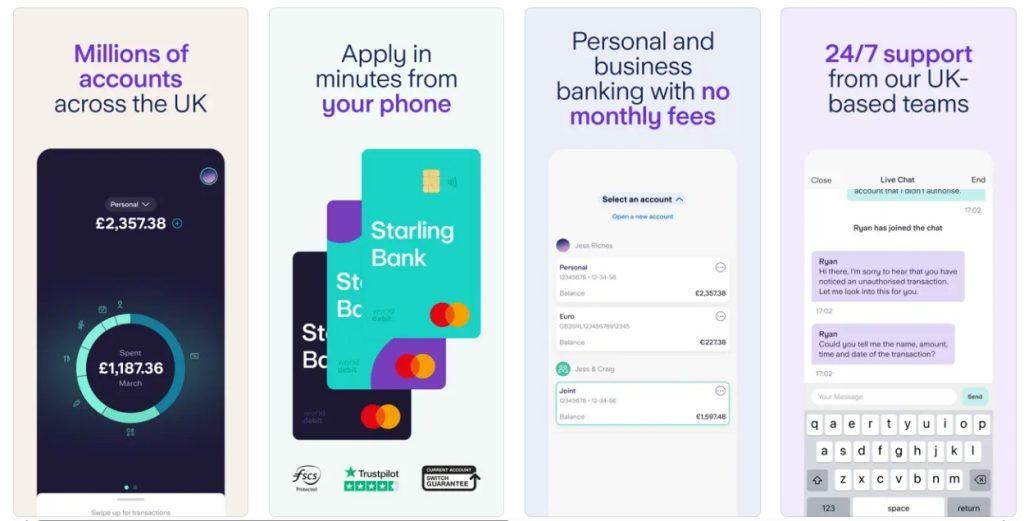

1. Starling

Starling’s personal current account is free to create and administer, and it can be managed using a mobile app, just as Revolut’s Standard account. Notifications about payments entering or leaving your account will be sent to users who can look into their expenditures to help with budgeting.

Additionally, users may create “goals” to assist them in setting away funds for particular purposes. If users meet the requirements, they can also use an overdraft facility.

| Launched in | 2014 |

| Founded by | Anne Boden |

| Available on | Web, Android & iOS |

| App Downloads | 1M |

| App Ratings | 4.5 |

| Headquarters | London, UK |

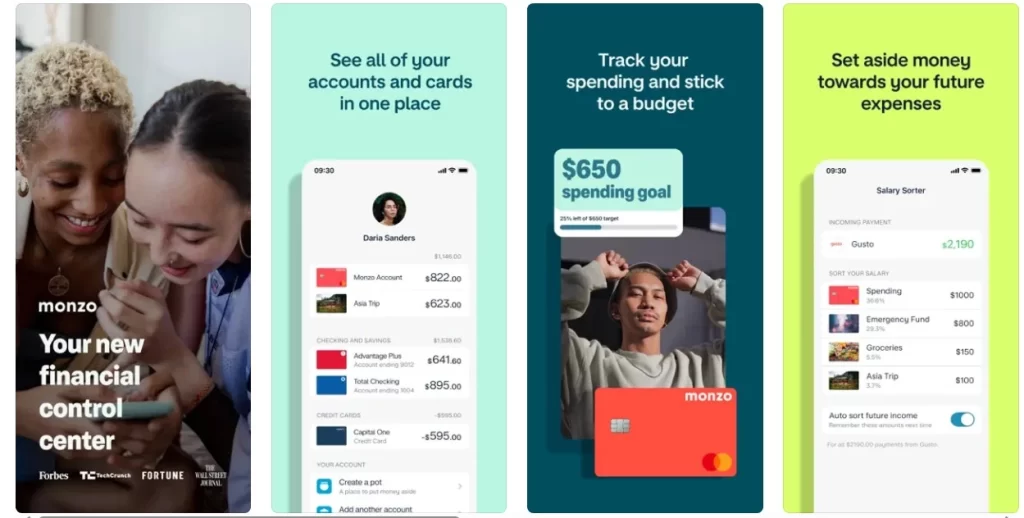

2. Monzo

Users can establish savings “pots” and decide whether to “round up” their spare change to save into one of those pots using Monzo’s free version of its app-based current account.

Users can also set budgets and classify their spending. To keep their finances separate, they may create a bills pot and opt to have bills and direct debits paid from it where they will also receive fast alerts of transactions.

Upon applying for a credit card, users will receive the well-known Monzo card—a contactless Mastercard which is free to use for both domestic and international transactions, although the amount of free cash withdrawals in the UK and throughout Europe is just £250 every 30 days (a 3% fee applies when users go beyond that).

| Launched in | 2015 |

| Founded by | Tom Blomfield, Jason Bates, Paul Rippon, Gary Dolman, and Jonas Huckestein |

| Available on | Web, Android & iOS |

| App Downloads | 5M |

| App Ratings | 4.5 |

| Headquarters | London, UK |

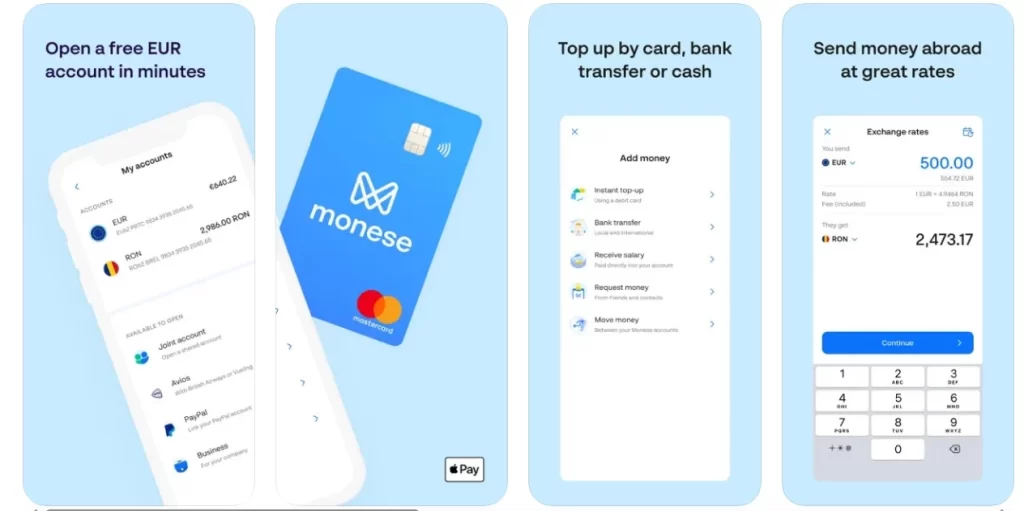

3. Monese

While Monese isn’t as well-known as Revolut, Monzo, or Starling, it also provides a free e-money account only for digital transactions. Furthermore, users don’t need proof of address to establish an account—just their ID.

Additionally, Monese accounts in many currencies are supported, and money transfers between them are free of charge. The free Monese account offers a less favorable exchange rate for other foreign transfers than its paid-for equivalents.

In addition, the free account offers real-time alerts for every purchase, a monthly and weekly budgeting tool, and a spending analysis tool. Users can set up savings buckets and a rule to round up their purchases, much as with some of the other challenger accounts, to help them put money aside.

| Launched in | 2015 |

| Founded by | Norris Koppel |

| Available on | Web, Android & iOS |

| App Downloads | 1M |

| App Ratings | 4.2 |

| Headquarters | London, UK |

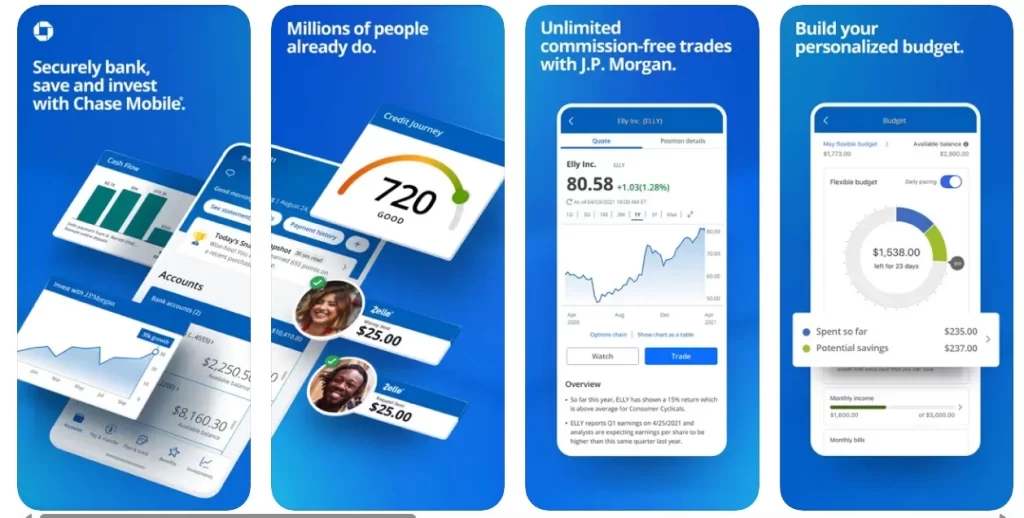

4. Chase

Given that Chase does not support international payments, Revolut is the greatest option for anyone who wish to send money overseas. Revolut offers the ability to trade shares and purchase cryptocurrencies, and their interface is likewise more sophisticated than Chase’s.

Though Revolut has monthly restrictions, both accounts provide fee-free international transactions as well as a round-ups function that rounds up users’ transactions and transfers the difference to a savings account. However, Revolut does not pay interest on this money, but Chase does. In addition, Chase provides interest on in-credit balances and, for the first year, rewards on users’ purchases. Lastly, Revolut lacks FSCS protection whereas Chase does.

| Launched in | 1955 |

| Founded by | John Thompson |

| Available on | Web, Android & iOS |

| App Downloads | 10M |

| App Ratings | 4.4 |

| Headquarters | New York, USA |

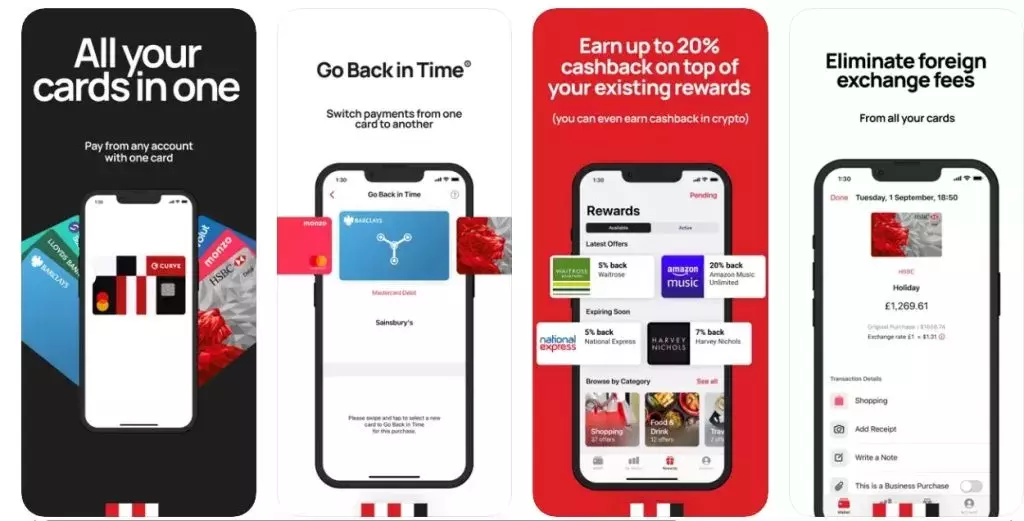

5. Curve

Curve serves as the hub for all of users’ payment accounts, giving customers the ability to manage and spend their money regardless of the bank or credit account it is kept in.

Any account that is linked to the Curve app may be used to make purchases using a Curve debit card. To put it another way, users can load all of their credit and debit cards from Visa and Mastercard onto the app and use the Curve card to make purchases with any of them.

Curve also functions as a virtual accountant by linking all of the accounts. So, instead of having to go through an endless number of receipts or tabs of online bills, Curve maintains track of spending and provides users with information about it.

| Launched in | 2015 |

| Founded by | Shachar Bialick |

| Available on | Web, Android & iOS |

| App Downloads | 1M |

| App Ratings | 3.4 |

| Headquarters | London, UK |

Tech Stack To Consider For Developing An App Like Revolut

Developing a fintech app requires a combination of tools and technologies to handle various aspects such as development, testing, security, and more. Here are tech stack for developing a fintech app:

1. Integrated Development Environments (IDEs)

- Android Studio: For Android app development

- Xcode: For iOS app development

2. Cross-Platform Development

- React Native

- Flutter

3. Backend Development

- Node.js

- Django

- Flask

- Ruby on Rails

- Express

4. Database Management

- MongoDB

- PostgreSQL

- MySQL

5. Encryption

- OpenSSL

- Bcrypt

6. Code Analysis

- Veracode

- Checkmarx

7. Payment Integration

- Stripe

- PayPal

- Braintree

8. Testing Frameworks

- JUnit

- XCTest

9. Automated Testing

- Appium

- Selenium

10. Collaboration and Project Management

- Jira

- Trello

- Asana

11. Version Control

- Git

- Mercurial

12. Continuous Integration/Continuous Deployment (CI/CD):

- Jenkins

- Travis CI

13. Customer Support

- Zendesk

- Freshdesk

14. Analytics and Monitoring

- Google Analytics

- New Relic

- AppDynamics

15. Design Tools

- Sketch

- Adobe XD

- Figma

16. Cloud Services

- Amazon Web Services (AWS)

- Google Cloud Platform (GCP)

- Microsoft Azure

14. Blockchain Integration (if applicable)

- Web3.js

- Ethers.js

15. Cross-Browser Testing

- BrowserStack

- Sauce Labs

Conclusion

Overcoming the popularity of already-presented products such as Revolut may appear difficult. It’s not easy to start an app development business. Every team knows how critical it is to provide a worthwhile product to the market and appeal to consumers. Furthermore, there are situations when other teams may encounter challenges due to the existence of identical apps.

On the other hand, many businesses frequently find that open competition motivates them. They can produce effective items by adding original aims and adhering to best practices.

Thus, developing an app similar to Revolut may appeal to many companies. They possess all the resources and technology required to raise consumer expectations and keep launching cutting-edge financial goods and services. In addition, there are no obstacles to market entry because the group is meticulously planning to progress the digital.

Working with a reliable fintech app development company can be the best move to take your business ahead of your competitors by strategically utilizing their development and business consultation services.

Utilize our app development services to develop your fintech app and your products while working with us. As an app development firm, we help our clients achieve their long- and short-term business objectives and ambitions by suggesting and creating a milestone-based approach to technology.

Our team will carefully examine your company’s requirements before recommending and developing an app like Revolut.

Get in touch with us right now to find out more about how our development services may assist you in starting and growing your company.

FAQ

Q. What fintech apps are like Revolut?

A. N26, Monzo, Payoneer, Bunq, Chime, and MoneyLion are fintech apps like Revolut.

Q. What is Revolut, and why is this app so popular?

A. A fintech app that offers a variety of digital financial services globally. The app became popular as it offers features including payments, money transfers, currency exchange, savings vaults, investments, etc. In addition, they continue to develop novel financial services and establish industry standards within the fintech sector.

Q. What are the must-have features of apps like Revolut?

A. Registration, Accounts and cards management, Payment system integration, P2P payments, and Smart budgeting are some of the must-have features for apps like Revolut.

Q. How to build an app like Revolut?

A. An app like Revolut can be developed by following the given steps: selecting a fintech niche, deciding on a fintech monetization model, understanding compliance, agreeing on MVP features, partnering with a vendor, and starting fintech platform Development, launch, get feedback, and improve.

Gaurav Patil