Fintech is a term used to describe technology in the financial sector. It’s not just about new technologies like blockchain and cryptocurrencies but also technologies already in place and being used in novel ways. This blog explores how to build a fintech app that enhances your business.

Fintech apps have been around for years, and they’ve come a long way since their inception. From Venmo to Square Cash, these apps have helped revolutionize how we live our lives.

Fintech apps are changing the way we do business as well as how we interact with each other. They’re also changing how we think about money, which has resulted in some pretty innovative apps that help us manage our finances better.

If you’re searching for how to build a FinTech app, it will help to know what it takes. And we’re seeing a huge increase in activity on this front. Over 65.3% of people in US using at least one fintech app by 2022. Additionally, 90% of the Gen X population uses mobile banking and fintech apps.

These facts make now a great time for anyone wanting to enter this growing field. But if you want to break into FinTech or just need some inspiration for your app idea, here are some of the essential details you should know before you jump in.

What are the Types of Fintech Apps?

Fintech apps are growing in popularity, and for a good reason. They provide users with the tools they need to manage their finances and can be used on many devices.

Fintech apps are often tailored to specific needs or areas of interest. Here are some of the most common types of fintech apps:

1. Digital Payments

These apps make it easy for people to pay for goods and services using their phones or other devices. The most popular example is PayPal, which allows you to complete transactions using your phone number or email address. Other examples include Venmo, Apple Pay, and Zelle.

2. Digital Banking

Digital banking is a fintech app that allows users to manage their accounts from their phone or computer easily. This includes checking your balance to pay bills and transferring funds between accounts. This type of app has been around for years but has recently become more popular due to recent technological advances and increased internet access worldwide.

3. Digital Lending

These apps let you borrow money from investors who buy into your loan. They’re often used for emergency funds, but some people use them to fund home improvements or other big expenses. The interest rates are often higher than traditional loans, but they can be a good option if you don’t qualify for traditional financing or don’t want to pay high fees to borrow from a bank or credit union.

4. Digital Investment

These apps allow you to manage your investments online and make trades on your phone or tablet. They also provide a way to store your financial information online so that you don’t have to worry about losing it if your phone breaks down or gets lost. Some examples include Wealthfront, Acorns, and Robinhood.

5. Insurtech

The insurance industry has been slowly adopting technology, but it’s finally felt the pressure to catch up with other industries using technology for years (think banking and finance). Insurtech is the term used to describe apps that help insurance companies improve their business processes. The most common use case for insurance is predictive modeling, which can be used for underwriting, claims processing, and risk management.

6. Regtech

It is a type of technology that helps businesses comply with regulations. Regtech applications are used by businesses to manage compliance requirements, including Know-Your-Customer (KYC) checks, anti-money laundering (AML) checks, and other regulatory requirements. Regulators also use Regtech to understand the financial industry and its activities better. Regtech solutions can automate manual processes such as data analysis, management, and reporting.

7. Consumer Finance

The consumer finance app is the most popular type of fintech app. It offers financial services to consumers like credit cards, loans, and mortgages. The consumer finance app helps people manage their finances by providing various services, including budgeting, investing, and debts.

Why Should Your Business Develop a Fintech App?

The advent of fintech apps has changed the way people do business. As a result, businesses can now reach out to a broader audience and offer them high-quality services.

The use of fintech apps is not only convenient but also easy, especially when it comes to making payments. For example, if you have an e-wallet account, you can pay for goods and services using your mobile phone.

You must understand how fintech apps can benefit your business as a business owner. Here are some reasons why:

1. Convenient for customers

The most obvious reason fintech apps are so popular is that they’re convenient for customers. They can make an appointment, pay their bills, or order products with just one tap on their mobile device. It’s also easier for businesses to store customer data on their servers instead of relying on paper records that could get lost or damaged easily.

2. Enhance Revenue

Increases revenue streams from mobile banking services such as bill pay and mobile deposits. Banks that offer these types of services through an app have seen great success in increasing revenue due to increased usage rates compared with those who only use traditional ATM/branch services for these activities.

3. Provides better customer service

Fintech apps help businesses provide better customer service by allowing them to deliver customized content at the right time. Whether it’s a push notification or text message, these mobile tools help companies keep their customers engaged and informed, leading to increased sales.

4. Creates an edge over the competition

If you want to stay ahead of the curve and gain an advantage over your competition, creating a fintech app is a must. It provides your customers with more convenient ways to interact with your brand and makes it easier for them to access your services 24/7 from anywhere in the world.

5. Increases brand loyalty

When customers can easily access their accounts from anywhere in the world, they become more loyal because they see how easy it is for them to do business with you. This increases their trust in your company and makes them more likely to continue doing business with you.

What are the Features of Fintech Apps?

Fintech apps are a great way for your small business to save money, increase efficiency and grow. The features of fintech apps include:

1. Scheduling and Planning

The most popular kind of fintech app is scheduling and planning software. This software allows users to schedule employees’ shifts, track attendance, and other time-related data, create reports on time use, and more. Any employee, including managers or freelancers working with multiple clients, can use this software.

2. Reporting Tools

Reporting tools are the most important feature of any fintech application. The data has to be organized and presented in an easy-to-understand format. This will enable you to make informed decisions about investing your money.

3. Virtual Assistants (VAs) and Virtual Private Assistants (VPAs)

Virtual assistants (VAs) and virtual private assistants (VPAs) are mobile apps that help you manage your finances remotely. They can perform a variety of tasks for you, including:

- Calculate your net worth

- Manage your budget

- Set up recurring payments to pay bills automatically

- Track your spending

- Keep track of your credit score

4. Personal Finance Management (PFM)

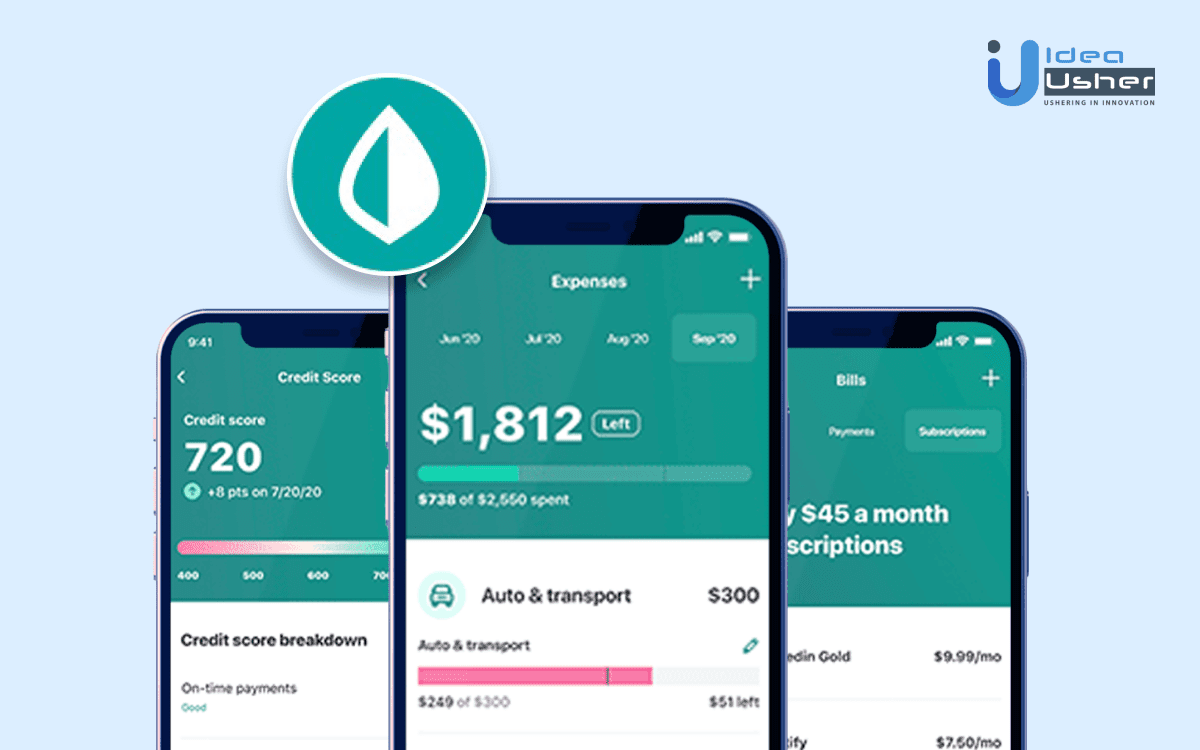

Personal finance management is a category of apps that help you manage your money, track your spending and saving habits, and plan for long-term financial goals.

These apps will help you track your budget, set savings goals, and save money. They’ll also make it easier to pay bills from your phone. Some apps will also help you invest or find new ways to earn more money through side hustles.

5. Expense Tracking

Expense tracking is a feature that allows users to keep track of their finances and expenses. This can be done by exporting data from your bank account, credit card, or any other financial account. It can also be used with other features such as bill reminders or bank alerts.

6. Payroll Services

Payroll services on a fintech app can save you time and money. They allow you to manage your payroll more efficiently, which means you can pay your employees on time and avoid hefty fines from the IRS. The best payroll services also offer benefits such as direct deposit options.

7. Bookkeeping Software

Bookkeeping software is essential to any business, whether you run it yourself or have employees do the work for you. It allows you to keep track of all your finances in one place and helps you generate reports that show how well your business is doing over time.

8. Credit Score and Monitoring Service

This service calculates your credit score, monitors it for changes, and sends alerts about any changes. It also helps you keep track of your spending and offers better tips on managing your finances.

9. Money Transfer Services

Transferring money to other countries is one of the most popular features of fintech apps. It allows people to send and receive money from anywhere in the world. They can do so using their smartphone or computer, which makes it easy to send money to family and friends abroad.

10. Online Bill Payments

One of the main features of these apps is the ability to make payments online. This allows you to save time and money since you do not have to go out and physically pay bills in person. You simply enter the amount that needs to be paid and submit it online. The money will be transferred directly from your account into theirs, so there is no need for any physical exchange!

11. Investment Portfolio Management

Professionals usually manage investment portfolios, but these apps allow users to manage their portfolios easily. The app lets users create an investment plan based on their needs and risk tolerance levels. They can then monitor their portfolio’s performance over time and adjust as needed.

12. Mobile Banking

Fintech apps have made it much easier for people to manage their bank accounts on the go. You can check your balance, deposit checks and pay bills wherever you are as long as you have access to the Internet. This is helpful if you’re traveling abroad or don’t have time for a trip to the bank because of work commitments or family obligations.

13. Real-time Updates

Fintech apps provide real-time information so that you can keep track of your finances in real-time. This is especially useful if you’re on a budget and need to track how much money you have left for the month or just want to know what’s happening with all your assets at any given moment.

14. Security Features

Regarding security, Fintech apps offer many options that can help protect your data from hackers or other malicious attacks. These include two-factor authentication (2FA), which requires users to enter a code before accessing their accounts, and biometric identification like fingerprint scanning or facial recognition software.

15. Bill Reminders

Bill reminders are one of the most basic features in all finance apps. They allow you to set up reminders for upcoming bills such as rent or car payments. You can also set up recurring bills such as student loan payments and subscriptions. Some bill reminder apps even allow you to set up payment plans with your creditors, which is great if you’re on a tight budget!

How to Build a Fintech App?

You must be on your toes if you’re in the financial sector. Competition is fierce, and new technology is constantly emerging. That’s why it’s time to stop thinking that your business is complete and consider mobile apps to enhance your customer experience and boost sales.

So how can you build a fintech app? What are the steps involved in creating this type of product? Let’s take a look at the process:

1. Market Research

The first step in building a fintech app is researching the fintech market. This will give you an idea of what’s out there, what needs to be improved, and what your competitors are doing. You need to know exactly how much people are paying for their banking services, how much they spend on loans, and how many new accounts are opened each year.

You should also look at trends in the industry, such as mobile-first design, open banking and automated account management. These trends will help you decide which features to include in your product and how you can improve them.

2. Defining MVP Scope

The goal of an MVP is not to create a finished product but to find out if there is a need for your product and, if so, how people use it. For example: If you want to create an app that helps people save money by monitoring their spending habits, you would want to do more than just design an interface that lets users enter their expenses and savings goals––you would also want to test what happens when users use it.

3. Selecting Technology Stack

Selecting the technology stack for your fintech app is one of the most important steps in the development process. This will determine how easy it is to scale your app, what kind of features you can build, and how much time it will take to do so.

You’ll need to decide whether to build your app with a front-end or back-end framework. Front-end frameworks are typically used for building user interfaces (UI), and back-end frameworks are used for building APIs and server logic.

4. Building APIs

The main reason to build APIs for your fintech app is that they are the basis of building any other functionality. If you want to add new features or improve existing ones, you need to have good API documentation as a foundation for integrating with other systems.

5. Designing UI/UX

The next step in building any app is designing the user interface (UI). The UI lets users interact with an application by providing them with buttons and menus with which they can perform actions such as logging into their accounts or making payments.

The design must be attractive so people will want to use it regularly. This step aims to ensure that users find it easy to navigate through the app and access all the features they need. It also needs to be simple so that even first-time users can easily navigate it without problems.

6. Test Launch

Before launching your app, it is important to test it thoroughly to become bug-free and error-free. Once you have tested it properly, you can easily launch it on any device or platform.

Compliance Policies While Developing Fintech Apps

Compliance is one of the most important aspects of developing a fintech app. The financial industry is highly regulated, and any breach can lead to serious consequences.

Here we discuss some of the best compliance practices while developing fintech apps.

1. AML Compliance

Anti-Money Laundering (AML) refers to policies that protect financial institutions from being used for money laundering activities such as terrorism financing or drug trafficking. It ensures that financial institutions follow strict rules regarding identifying customers and monitoring their transactions. These rules include:

2. Payment Card Industry Data Security Standard

The Payment Card Industry Data Security Standard is a set of security standards for payment card systems. It was developed to ensure that member organizations can protect customer account data and comply with the laws and regulations related to data security. The PCI DSS is issued by the Payment Card Industry Security Standards Council (PCI SSC).

3. KYC Compliance

Know Your Customer (KYC) refers to laws and regulations requiring businesses to identify their customers before establishing a business relationship. KYC policies prevent fraudulent activity and money laundering by ensuring that only legitimate transactions occur.

4. Digital Signature Certificate

Digital signatures are a secure way of signing documents and messages online without needing a pen, paper, or fax machine. They are commonly used on websites as proof that you’ve agreed to something or sent a message from your account. They’re also used by software developers when creating applications to ensure that no one else can use their work without permission.

What are the Technology Trends in Fintech App?

To stay ahead of the competition, fintech companies are adopting these new technologies to develop innovative products and services that would appeal to customers. This has led to a rise in demand for developers with the skills to build fintech apps.

Here are some of the emerging technologies being used by fintech companies:

1. Blockchain

Companies like Ripple and Ethereum have used blockchain to create their cryptocurrencies (RippleNet and Ether). These cryptocurrencies can make payments between two parties without third-party intervention.

Blockchain technology will help Fintech companies reduce costs associated with maintaining multiple ledgers while providing better security than other traditional methods of financial transactions. The banking industry can benefit by saving $27 billion annually by 2030 by using blockchain to restrict leakages.

2. Artificial Intelligence

Artificial intelligence is one of the most interesting and talked-about topics in fintech. AI is the technology that allows machines to perform tasks that would normally require human intelligence. It’s no surprise that it hugely impacts the financial industry, which relies heavily on data analysis, predictive models, and automation.

Artificial intelligence in fintech has grown rapidly over recent years, thanks to advancements in technology and the availability of big data. AI can be used to understand customer behavior better, predict customer needs and automate processes such as fraud detection or compliance checks – all of which will make your business more efficient and profitable.

3. Big Data

Fintech apps have benefited greatly from the introduction of big data analytics. Companies can use this technology to analyze customer trends and apply those findings to improve their services or create new products. For example, if a company notices that many people are using their app on Sundays, they may decide to increase staffing for these days or offer discounts for services on Sundays. The possibilities are endless regarding big data analysis in fintech apps!

4. Cybersecurity

The security of your data is paramount for any application. Fintech apps have become increasingly popular because they are easy to use, making them an attractive target for hackers. A good example is banks’ online banking portals, which cybercriminals have attacked recently.

The best way to protect your data is to use encryption technology that encrypts all sensitive information before it leaves your device, so even if hackers manage to steal it from your server, they will not be able to read it without the right key or password.

5. Microservices

Microservices are software development techniques that allow developers to build small, separate applications that can be integrated into larger systems. They help reduce costs and improve flexibility. Microservices can make it easier for developers to work on multiple projects simultaneously.

Wrapping Up

Idea Usher can help you build the perfect Fintech app for your business.

Idea Usher is a platform where you can find and develop the best financial technology for your business. Whether you want to increase revenue, reduce costs, or improve customer experience, we have an innovative FinTech solution.

Our team of experts will work closely with you to understand your business goals and requirements. We’ll then design, develop and deploy an app tailored to your needs.

Build Better Solutions With Idea Usher

Professionals

Projects

Our core focus is on FinTech applications, and we have extensive experience building these types of software. Our developers are experts in building mobile apps for iOS and Android and desktop apps for Windows and macOS.

We will work closely with you to discover your needs and help you shape what your finished product should be like. We’ll make sure that it’s easy to use from day one so that you can immediately get started on the right track.

Contact us to explore how we can help you develop the perfect fintech product for your business.

E-mail: [email protected]

Phone Numbers : (+91) 946 340 7140, (+91) 859 140 7140 and (+1) 732 962 4560

FAQs

Q. How does a Fintech application work?

A. The Fintech application is a software application that helps you manage your finances. It’s an electronic wallet that allows you to store your money in one place and easily manage it.

Fintech apps make things easy for the end user by doing all the hard work. They can also help cut fees and save time and effort when managing your money.

Q. How much does it cost to build a fintech app?

A. The cost of building an app largely depends on the complexity of your idea, industry, and target audience.

Q. How long does it take to create a fintech product?

A. Creating a fintech product can vary greatly depending on the product type, your company’s structure, and the available time.