Gamification in banking isn’t just a buzzword; it’s a game-changer revolutionizing how we engage with finances. From turning mundane transactions into interactive challenges to fostering financial literacy through playful experiences, the fusion of gaming elements with banking services has sparked a financial evolution.

In this comprehensive guide, we’ll explore gamification in banking, understanding how this innovative approach attracts and retains customers, educates, and entertains, all while reshaping the landscape of modern banking.

Discover everything you need to know about this dynamic fusion of finance and fun, unlocking the secrets behind gamification in banking!

What is Gamification in Banking?

Making banking more fun is what gamification does. It’s like turning regular banking things into games. You might earn points or special rewards for saving money or learning about money stuff. This way, it helps you learn and keeps you interested in using your bank. It’s like playing a game while dealing with your money. Gamification makes boring tasks fun and helps you understand money better. It even makes you want to stay with your bank because it feels like you’re part of something cool. So, it changes how people handle their money and makes it more interesting!

But how does gamification in banking work? Let’s find out –

How Does Gamification in Banking Work: Understanding the Principles

Gamification in banking isn’t about turning apps into games but adding challenges that make money matters more interesting. These challenges teach users how to handle taxes or online transactions, giving points redeemable for services like cashback or exclusive offers.

Achieving Goals and Gaining Rewards

The concept relies on achieving targets. Users earn rewards for completing financial tasks, creating a sense of accomplishment. Whether it’s upgrading services or participating in auctions, rewards keep users engaged and motivated.

Creating Competition for Engagement

By introducing competitiveness, banking apps encourage users to stay active. Competition often boosts engagement levels, encouraging users to interact more with their financial tasks.

Interactive and Personalized Experiences

Gamification adds interactivity to otherwise mundane banking tasks. This high level of interaction makes handling finances more enjoyable and understandable. The experience evolves as users progress, making it more personalized and engaging.

Applying Game-Like Principles for Better Banking

It’s not about creating games but using game-like ideas to improve banking apps. Principles like challenges, rewards, and a sense of achievement make fintech applications more captivating and user-friendly.

Gamification in banking isn’t just about making banking more fun; it’s about making financial activities more engaging and rewarding, enhancing the overall banking experience for users.

Gamification in Banking: The Growing Market Insights

The gamification market within banking is on an exponential growth trajectory, projected to surge from USD $9.1 billion in 2020 to a staggering USD $30.7 billion by 2025. This meteoric rise signifies a Compound Annual Growth Rate (CAGR) of 27.4%, showcasing the sector’s rapid evolution and adoption. This substantial expansion underscores the increasing significance and acceptance of gamified experiences within banking services.

As financial institutions embrace this trend, the market’s robust growth reflects the transformative impact and immense potential of integrating game elements into the traditional banking sphere, promising a future where financial engagement intertwines seamlessly with interactive and rewarding experiences.

Benefits of Gamification is Banking: 6 Crucial Advantages

Industry is keen on implementing gamification in banking! But why? What benefits does it provide? Let’s understand!

Attract New Audiences with Engaging Experiences

Gamification taps into the appeal of game-like experiences, attracting users who appreciate interactive and enjoyable banking apps. Leveraging nostalgia for classic games can also draw in a broader audience, making your banking app more appealing.

Cultivate Strong Customer Loyalty

Creating a personalized and educational experience through gamification builds a positive brand image for your banking company. However, it’s essential to balance entertainment with genuine value to avoid seeming gimmicky and maintain customer trust.

Gain Insights Through Customer Research

Analyzing user interactions with gamified features provides valuable insights into their behaviors and preferences. This data becomes a powerful tool to tailor and improve the overall banking app. Incorporating interactive elements like quiz tours educates users about essential app features, potentially leading to increased service usage.

Drive Higher Engagement Levels

Well-designed gamification strategies keep users actively engaged within banking apps. The more time users spend exploring these gamified features, the greater the likelihood of them discovering and utilizing additional banking services.

Encourage Financial Literacy

Gamification can serve as an educational tool, promoting financial literacy among users. Interactive modules and challenges that teach money management skills can empower users to make informed financial decisions.

Boost Customer Retention and Satisfaction

Engaging experiences fostered by gamification contribute to enhanced customer retention. When users find value, entertainment, and ease of use in a banking app, they’re more likely to remain loyal and satisfied, reducing churn rates.

Well, what’s learning without understanding the use cases?

Gamification in Banking: Use Cases

Here, we explore diverse real-world applications showcasing how banks use gamification to attract, retain, and educate customers while gaining valuable insights.

Acquiring Trustworthy Borrowers

Banks employ gamification to entice individuals into opening deposit accounts and using credit cards. For instance, Barclays Ring created a social community of cardholders, encouraging engagement by allowing members to propose credit card features. This approach targets specific client needs, fostering trust and participation.

Enhancing Service Experience

Gamification transforms financial operations into enjoyable experiences. Users engage in games, winning rewards such as higher deposit rates or appliances. This fosters loyalty; when users need a loan, they’re more likely to turn to the bank offering such engaging experiences. Games also aid in managing spending, showcasing patterns, and highlighting savings for financial goals.

Fostering Customer Loyalty

Banks like BBVA leverage gamification to educate users about banking transactions and mobile app functionalities. Clients earn points by completing tasks, redeemable for entertainment or cultural experiences. Such initiatives cultivate loyalty and knowledge among users.

Staying Competitive

Tech-savvy banks like Monobank use innovative techniques and visually appealing mobile apps with hidden mini-games, attracting and retaining customers. These strategies help modern banks stand out in a competitive landscape.

Encouraging Client Loyalty

Standard Chartered’s Twist & Win game offers surprise cashback to users making credit card transactions, driving engagement and loyalty. Similarly, SmartyPig gamifies savings by allowing users to set financial goals and track progress visually.

Extracting Customer Insights

Gamification provides banks with valuable user data on active users, saving methods, and financial goals. Banks like Moven use gamified systems to track bill payments and money shifts, extracting insights to tailor services and strategies.

Edutainment for Financial Literacy

PayPerks uses gamification to educate low- to moderate-income users on financial literacy through rewards and visual effects. Such approaches empower users to make smarter financial decisions, enhancing their financial well-being.

How to Implement Gamification in Banking?

All things said, let’s find out how you can actually implement gamification in banking —

Understanding Your Audience

Before implementing gamification, research and understand your target audience’s preferences, behaviors, and financial needs. Tailor gamified experiences to resonate with their interests and motivations, ensuring maximum engagement.

Embrace Technological Advancements

Leverage cutting-edge technologies to create seamless and immersive gamified experiences. Incorporate AI, AR/VR, or mobile app capabilities to enhance interactivity and user engagement within banking applications.

Define Clear Objectives

Establish specific goals for implementing gamification. Whether it’s boosting customer engagement, increasing product adoption, or educating users, having clear objectives helps in designing effective gamified strategies.

Design User-Centric Experiences

Craft intuitive and user-friendly interfaces for gamified elements within banking apps. Ensure that game mechanics align with financial tasks, making them easy to understand and navigate for users of varying technical abilities.

Gamify Core Banking Functions

Integrate gamification into essential banking functions, such as transactions, savings, or financial planning. Incorporate rewards, challenges, or progress tracking to incentivize desired financial behaviors and habits.

Test and Iterate

Conduct thorough testing and gather user feedback during the gamification implementation phase. Iterate based on insights to refine the gamified features for optimal user engagement and impact.

Compliance and Security Measures

Prioritize security and regulatory compliance while implementing gamification. Ensure that all gamified elements adhere to banking regulations and maintain the security and privacy of user data.

Employee Training and Support

Provide comprehensive training and support for bank staff involved in delivering and promoting gamified services. Ensure they understand the gamified features thoroughly to assist customers effectively.

Measure and Analyze Performance

Implement analytics tools to track the performance of gamified elements. Analyze user engagement, conversion rates, and other key metrics to assess the effectiveness of gamification strategies and make data-driven improvements.

Essential Stack Need for Implementation of Gamification in Banking

Let’s break down the essential technology stack for implementing gamification in banking:

Robust Backend Infrastructure

- Real-time data processing capabilities

- Secure user data storage

- Efficient user management

Data Analytics and AI Tools

- Analyzing user behavior and preferences

- Personalizing user experiences

- Informed decision-making

API Integration

- Seamless connection with third-party services

- Facilitating cross-platform functionality

- Enhancing overall user experience

Mobile App Development Frameworks

- Responsive and feature-rich applications

- Compatibility across various devices

- Streamlined development processes

Gamification Platforms or SDKs

- Ready-to-use components for game mechanics

- Incorporating engagement strategies

- Industry-tailored solutions

Security and Compliance Solutions

- Data encryption and secure authentication

- Regulatory compliance frameworks

- Safeguarding user information

Cloud Services for Scalability

- Flexibility and scalability for increased user engagement

- Efficient resource scaling as user bases grow

- Handling data processing demands

User Interface (UI) and User Experience (UX) Design Tools

- Intuitive and visually appealing interfaces

- Enhancing user engagement and comprehension

Gamification Content Management Systems (CMS)

- Management of game elements, challenges, and rewards

- Easy modification and adjustments

Continuous Integration and Deployment (CI/CD) Pipelines

- Efficient development, testing, and deployment processes

- Ensuring application stability and iterative improvements

Top Examples of Gamification in Banking

Here are some popular examples of gamification in banking —

Chase’s “Sapphire Rewards” program

This program rewards customers with points for using their Chase Sapphire credit card. Points can be redeemed for travel, cash back, and other rewards. The program also has a gamified element, as customers can earn more points by completing certain challenges, such as spending a certain amount of money on travel or dining.

Bank of America’s “Merrill Edge” investment platform

This platform has a number of gamified features, such as a leaderboard that shows how users are performing compared to others. Users can also earn badges for completing certain tasks, such as making a certain number of trades or investing in a certain number of different asset classes.

Citi’s “Financial Goal” tracker

This tool allows users to set financial goals and track their progress towards achieving them. The tracker also has a gamified element, as users can earn points for making progress towards their goals. Points can be redeemed for rewards, such as discounts on Citi products and services.

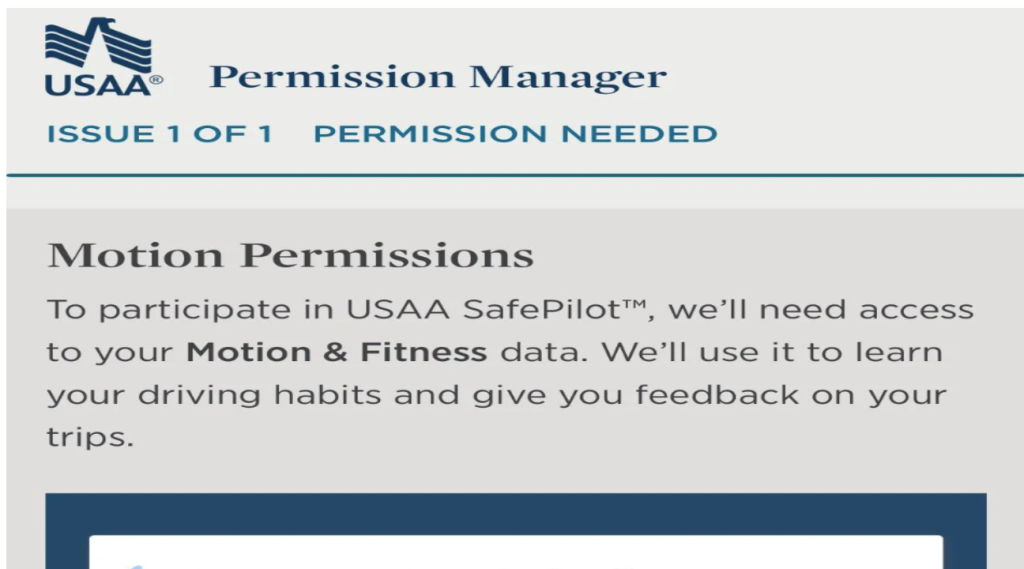

USAA’s “Financial Fitness” app

This app helps users track their spending, savings, and debt. The app also has a gamified element, as users can earn badges for completing certain financial tasks, such as creating a budget or paying off a debt.

PNC’s “Virtual Wallet”

This app allows users to manage their money in one place. The app also has a gamified element, as users can earn points for completing certain financial tasks, such as making a certain number of deposits or bill payments. Points can be redeemed for rewards, such as gift cards and discounts on PNC products and services.

Conclusion

Gamification in banking isn’t just about making money matters entertaining; it’s a strategic tool reshaping the banking landscape. Through challenges, rewards, and user-centric experiences, it enhances engagement, fosters loyalty, and empowers financial literacy. As banks embrace cutting-edge technology and personalized approaches, gamification becomes a catalyst for customer retention and growth. This dynamic blend of finance and gaming elements not only educates and entertains but also drives innovation. Ultimately, it’s transforming traditional banking into an interactive, engaging, and customer-centric realm, promising a future where managing finances feels less like a chore and more like an enjoyable journey toward financial empowerment.

What Idea Usher Can Do For You?

At Idea Usher, we craft tailored solutions to gamify your banking experience. From conceptualizing innovative game mechanics to integrating cutting-edge technology, we reimagine banking interactions. Our expertise lies in creating engaging challenges, personalized rewards, and seamless interfaces, making financial tasks enjoyable. We analyze user behavior and preferences to design captivating experiences that foster customer loyalty and financial literacy. With our collaborative approach, we transform traditional banking into an interactive journey.

Let us unlock the power of gamification, enhancing your banking services, captivating users, and driving lasting engagement for a brighter financial future.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

Frequently Asked Questions

Q. What kind of game elements are used in gamification for banking?

A. Game elements in banking may include challenges, rewards, progress tracking, badges, and personalized experiences. These elements incentivize desired behaviors like saving, promote competitiveness, and create an interactive environment within banking apps.

Q. How does gamification impact banking institutions?

A. For banks, gamification enhances customer retention, drives engagement, and aids in understanding user behavior. It also allows banks to collect valuable data for better-tailored services and strategies, fostering innovation and competitiveness.

Q. Is gamification secure in banking applications?

A. Yes, gamification in banking prioritizes security and compliance. Banks implement robust security measures to safeguard user data, ensuring encryption, authentication protocols, and adherence to industry regulations.