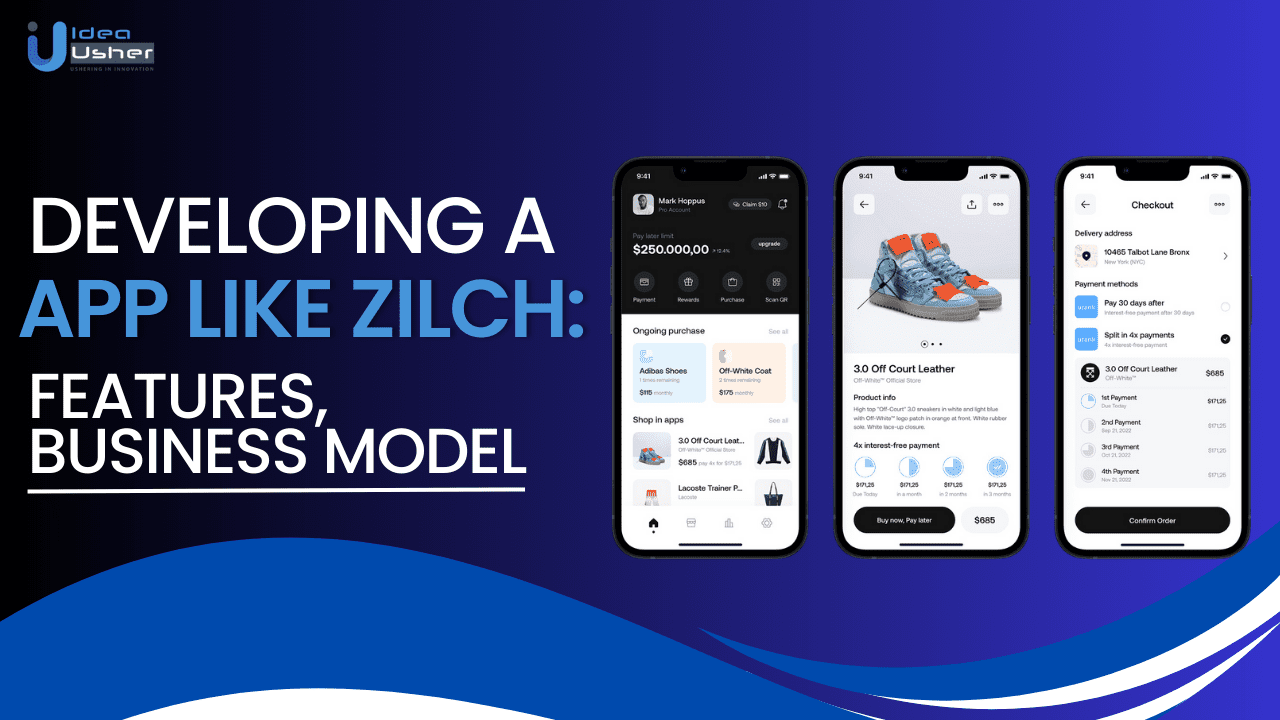

Buy Now, Pay Later services are changing the way we shop, offering a convenient alternative to traditional credit. One of the frontrunners in this sector is Zilch, a BNPL provider known for its innovative features and customer-friendly approach.

We’ll explore Zilch’s unique features, such as its virtual card and mobile app integration, pay-anywhere capability, rewards program, and “no interest, no late fees” policy.

Additionally, we’ll examine Zilch’s business model, including revenue streams like interchange fees, affiliate marketing, and optional customer fees. Finally, we’ll provide development tips for building a successful BNPL app.

What Is Zilch?

Zilch, launched in 2018, has quickly risen to prominence in the BNPL market. Its innovative approach to deferred payments, coupled with a focus on customer satisfaction and transparency, has set it apart from competitors. Zilch’s journey from inception to its current status as a market leader offers valuable lessons for aspiring BNPL app developers. It stands out in the BNPL landscape by offering a unique card-linked approach. Rather than integrating directly with merchants, Zilch provides users with a virtual card that can be used anywhere Mastercard is accepted. This broadens the scope of purchases and simplifies the user experience.

Key Market Takeaways Regarding BNPL Apps Like Zilch

Here are some key market takeaways regarding BNPL apps like Zilch, backed by statistics and references:

- Explosive Growth: The BNPL market is experiencing rapid expansion. According to a report by Worldpay from FIS, BNPL transactions are projected to quadruple globally by 2024, reaching $680 billion. (Source: FIS Global Payments Report)

- Millennial and Gen Z Appeal: Younger generations are driving the adoption of BNPL services. A study by Ascent found that 44% of millennials and 36% of Gen Z consumers have used BNPL. (Source: The Ascent BNPL Study)

- Expansion Beyond Retail: While BNPL initially gained popularity in the retail sector, it’s now branching into other areas like travel, healthcare, and even home improvement. Zilch’s card-linked model is a testament to this trend, allowing users to pay for various services in installments.

- Competitive Landscape: The BNPL market is becoming increasingly crowded. Major players like Klarna, Afterpay, Affirm, and PayPal are competing with newer entrants like Zilch. This competition is driving innovation and better terms for consumers.

- Regulatory Scrutiny: As BNPL grows, regulators are paying closer attention to ensure consumer protection and responsible lending practices. This could lead to stricter rules in the future, impacting the way BNPL providers operate.

- The Zilch Advantage: Zilch’s unique card-linked approach gives it an edge by offering wider acceptance and a simplified user experience. This model could inspire other BNPL providers to adopt similar strategies.

Unique Features of Zilch

Zilch sets itself apart with several unique features that make it a favorite among users. Here’s a closer look at what makes Zilch stand out:

1. Over-the-Top (OTT) BNPL

Unlike traditional BNPL services that require merchants to integrate with the provider, Zilch operates through a virtual card and mobile app. This over-the-top approach allows users to shop anywhere online or in-store using their Zilch card, providing unparalleled flexibility.

2. Pay Anywhere Capability

Zilch’s virtual card is accepted at millions of locations worldwide. This means users can make purchases at their favorite retailers without worrying about whether the store has a direct partnership with Zilch.

3. Robust Rewards Program

Zilch offers a generous rewards program where users earn cashback on their purchases. These rewards can be redeemed for discounts or used to offset future payments, adding significant value for the consumer.

4. No Interest or Late Fees

One of the most attractive features of Zilch is its “no interest, no late fees” policy. This approach makes Zilch an appealing option for consumers who want to avoid the additional charges often associated with other BNPL services.

Zilch’s Business Model

To replicate Zilch’s success, it’s crucial to understand its business model. Here are the primary revenue streams:

1. Interchange Fees

Whenever a Zilch card is used for a transaction, Zilch earns revenue from interchange fees charged to merchants. This fee is a small percentage of the transaction amount and is a common revenue source for payment processors.

2. Affiliate Marketing

Zilch partners with retailers and earns a commission on sales generated through its app or website. This affiliate marketing strategy not only boosts Zilch’s revenue but also enhances its value proposition to consumers by offering special deals and discounts.

3. Optional Customer Fees

In certain cases, Zilch charges customers a small, upfront fee for transactions where the retailer’s commission is insufficient to cover costs. This fee is transparent and typically minimal, ensuring it doesn’t deter users.

Development Steps for a Successful BNPL App

Here are the development steps to create a successful BNPL app like Zilch –

1. Market Research and Analysis:

- Competitor Analysis: Study existing BNPL apps like Zilch, Klarna, Afterpay, and Affirm. Identify their strengths, weaknesses, unique features, and target audience.

- Target Audience Identification: Define your ideal user demographics, preferences, spending habits, and financial needs. Tailor your app to meet their specific requirements.

- Regulatory Landscape: Research the legal and regulatory frameworks governing BNPL services in your target markets. Ensure compliance with all applicable laws.

2. Conceptualization and Planning:

- Define App Features: Decide on core functionalities like user onboarding, virtual/physical card issuance, payment plans, credit assessment, merchant partnerships (if applicable), and security measures.

- Choose a Business Model: Determine your revenue sources (merchant fees, late fees, interest charges, premium subscriptions).

- Create a Technology Stack: Select the programming languages, frameworks, databases, and cloud infrastructure that will power your app. Prioritize scalability and security.

- Develop a Roadmap: Outline a detailed project plan with timelines, milestones, and resource allocation.

3. Design and User Experience (UX):

- Wireframing and Prototyping: Create wireframes to visualize the app’s structure and flow. Develop interactive prototypes to test user interactions and gather feedback.

- UI Design: Craft a visually appealing and user-friendly interface. Ensure intuitive navigation, clear information hierarchy, and consistent branding.

- User Testing: Conduct thorough user testing to identify usability issues and refine the design before development.

4. Development Process:

- Backend Development: Build the server-side infrastructure to handle user data, payment processing, credit assessments, transaction history, and security.

- Frontend Development: Create the user interface (UI) using the chosen technology stack. Implement the design elements and user flows from the previous stage.

- API Integration: Integrate with payment gateways, card networks (Visa, Mastercard), credit bureaus, and any other third-party services required for your app’s functionality.

- Security Implementation: Implement robust security measures such as data encryption, multi-factor authentication, fraud detection algorithms, and regular security audits.

5. Testing and Quality Assurance (QA):

- Functional Testing: Thoroughly test all app features to ensure they work as expected.

- Performance Testing: Evaluate the app’s speed, responsiveness, and stability under different loads.

- Security Testing: Conduct penetration testing and vulnerability assessments to identify and fix security loopholes.

- User Acceptance Testing (UAT): Get feedback from real users to identify any issues or areas for improvement.

6. Launch and Deployment:

- Submit to App Stores: Prepare your app for release on the Apple App Store and Google Play Store, adhering to their guidelines.

- Marketing and Promotion: Launch a marketing campaign to create awareness and drive user acquisition. Utilize social media, content marketing, influencer partnerships, and PR.

7. Post-launch Optimization:

- Monitor and Analyze: Track key metrics like user engagement, retention, conversion rates, and revenue. Use analytics to identify areas for improvement.

- Gather User Feedback: Collect feedback through surveys, reviews, and support channels. Use this feedback to iterate and enhance the app’s features and user experience.

- Regular Updates: Continuously update your app with new features, bug fixes, and performance improvements. Stay ahead of the competition by adapting to user needs and market trends.

Key Features of a Successful BNPL App

Creating a successful BNPL app requires incorporating several critical features that enhance user experience and build trust. Here are the essential elements:

User-friendly Interface

An intuitive, easy-to-navigate interface is crucial for retaining users. This involves clean design, straightforward navigation, and a seamless purchasing process.

Security Features

Given the financial nature of BNPL apps, robust security measures are non-negotiable. Implementing strong encryption, secure transactions, and fraud detection systems are vital to protect user data and build trust.

Instant Approval

To ensure a smooth user experience, the app should offer instant credit approvals. This requires efficient backend systems capable of performing quick credit checks without compromising accuracy.

Integration with Merchants

Successful BNPL apps need to integrate seamlessly with a wide range of merchants. Developing flexible APIs and maintaining strong merchant relationships are key to offering users a diverse range of shopping options.

User Education and Transparency

Clear communication about terms, fees, and repayment schedules helps users make informed decisions. Providing educational resources and maintaining transparency fosters trust and encourages responsible borrowing.

Essential Tech Stack To Keep In Mind

Creating a successful BNPL app like Zilch requires a robust and flexible technical stack that can support all necessary features while ensuring scalability, security, and ease of use. Below is a comprehensive tech stack that includes recommendations for frontend development, backend development, databases, and other essential tools and technologies.

Frontend Development

The frontend of your BNPL app is what users interact with directly, so it needs to be both aesthetically pleasing and highly functional. Here are some key technologies for frontend development:

- React.js: A powerful JavaScript library for building user interfaces, React.js is known for its efficiency and flexibility. It allows developers to create dynamic and responsive user interfaces.

- Vue.js: Another popular JavaScript framework, Vue.js is lightweight and easy to integrate. It is excellent for building single-page applications and provides a straightforward way to manage the app’s state.

- HTML5 and CSS3: The backbone of web development, HTML5 provides the structure of your app, while CSS3 handles the styling. Together, they ensure your app is responsive and visually appealing.

- Bootstrap: A CSS framework that helps in designing responsive and mobile-first websites quickly. It includes pre-designed components and layouts, speeding up the development process.

Backend Development

The backend of your BNPL app handles all server-side logic, database interactions, and integration with external services. Here are some recommended technologies for backend development:

- Node.js: A JavaScript runtime built on Chrome’s V8 engine, Node.js is ideal for building scalable network applications. It is known for its performance and efficiency in handling concurrent requests.

- Express.js: A minimal and flexible Node.js web application framework, Express.js provides a robust set of features for web and mobile applications, making it easier to build APIs.

- Django: A high-level Python web framework that encourages rapid development and clean, pragmatic design. Django is excellent for building secure and maintainable web applications.

- Spring Boot: A Java-based framework used to create stand-alone, production-grade Spring-based applications. Spring Boot simplifies the development of Java applications by providing a convention-over-configuration approach.

Database Management

Choosing the right database is crucial for storing and managing user data, transactions, and other critical information. Here are some database technologies to consider:

- PostgreSQL: An open-source relational database management system known for its robustness, scalability, and support for advanced data types.

- MongoDB: A NoSQL database that provides high performance, high availability, and easy scalability. MongoDB is ideal for handling large volumes of unstructured data.

- MySQL: A widely-used open-source relational database management system that is reliable and easy to use. MySQL is a good choice for applications requiring complex queries and transactions.

- Redis: An in-memory data structure store used as a database, cache, and message broker. Redis is excellent for improving the performance of your app by caching frequently accessed data.

API Development and Integration

For integrating with merchants, payment gateways, and other external services, you’ll need robust API development tools:

- GraphQL: A query language for your API that allows clients to request exactly the data they need. GraphQL makes APIs fast, flexible, and developer-friendly.

- RESTful APIs: Representational State Transfer (REST) is an architectural style for designing networked applications. RESTful APIs are easy to use and integrate with various services.

Security Measures

Implementing strong security measures is essential for protecting user data and transactions. Here are some security technologies and practices to consider:

- JWT (JSON Web Tokens): A compact, URL-safe means of representing claims to be transferred between two parties. JWT is commonly used for authentication and information exchange.

- OAuth 2.0: An authorization framework that enables applications to obtain limited access to user accounts on an HTTP service. OAuth 2.0 is used for securing APIs.

- SSL/TLS: Secure Sockets Layer (SSL) and Transport Layer Security (TLS) are protocols for establishing authenticated and encrypted links between networked computers.

DevOps and Continuous Integration/Continuous Deployment (CI/CD)

For efficient development and deployment, consider using DevOps tools and CI/CD pipelines:

- Docker: A platform for developing, shipping, and running applications in containers. Docker enables developers to package applications with all dependencies into a standardized unit.

- Kubernetes: An open-source system for automating the deployment, scaling, and management of containerized applications. Kubernetes is ideal for managing large-scale applications.

- Jenkins: An open-source automation server that supports building, deploying, and automating any project. Jenkins integrates with many tools and is highly customizable.

Monitoring and Analytics

Monitoring your app’s performance and analyzing user behavior is crucial for continuous improvement:

- New Relic: A software analytics and performance monitoring tool that helps developers and operations teams understand and improve their applications.

- Google Analytics: A web analytics service that tracks and reports website traffic. Google Analytics is useful for understanding user behavior and improving the user experience.

- Datadog: A monitoring and analytics platform for cloud applications. Datadog provides visibility into the performance of your app and infrastructure.

Compliance and Legal Considerations

Navigating the regulatory landscape is crucial for the success of a BNPL app:

- Regulatory Requirements: Complying with financial regulations, such as those related to consumer protection and data privacy, is essential to avoid legal issues.

- Data Protection: Implementing robust data protection measures ensures user data is secure and complies with relevant privacy laws.

- Consumer Rights: Ensuring your app respects consumer rights and provides clear terms and conditions can help build trust and avoid disputes.

Conclusion

Creating a BNPL app like Zilch involves understanding its unique features, business model, and the essential steps to develop a user-friendly and secure platform. By focusing on these aspects, you can build a successful BNPL app that offers consumers flexibility, rewards, and a seamless shopping experience. Ready to revolutionize the BNPL market? Start planning your app today!

Our seasoned team navigates the intricacies of the BNPL landscape, ensuring your app development process complies with all regulatory standards while meeting the distinct preferences of American consumers. Whether you seek to empower businesses with BNPL solutions or simplify the purchasing journey for individual shoppers, Idea Usher delivers tailored strategies that align seamlessly with your goals.

Contact us today for a free consultation and discover how we can help you tap into the immense potential of the BNPL market!

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

Faq‘s

What technologies are used in BNPL platform development?

BNPL platforms often utilize technologies such as secure payment gateways, data encryption for security, API integrations with e-commerce systems, machine learning for credit risk assessment, and responsive web/mobile interfaces for user accessibility.

How long does it take to develop a BNPL platform?

The development timeline can vary based on project complexity and specific requirements. Typically, it involves initial planning, design, development, testing, and deployment phases. Idea Usher works closely with clients to streamline the process and deliver solutions efficiently.

How do you ensure compliance with regulatory requirements?

Idea Usher has a deep understanding of the regulatory landscape in the US BNPL market. We ensure compliance with consumer protection laws, data security standards (such as PCI DSS), and financial regulations (like the Truth in Lending Act), integrating these requirements into the platform development from the outset.

Can a BNPL platform be customized to fit my business needs?

Yes, Idea Usher offers customizable solutions tailored to your specific business requirements. Whether you operate a retail store or e-commerce platform or offer services online, we adapt the BNPL platform to align with your branding, customer experience goals, and operational workflows.

How can I get started with Idea Usher for developing a BNPL platform?

Contact Idea Usher today for a free consultation. Our team will discuss your project requirements, provide insights into BNPL platform development, and offer tailored solutions to help you leverage the growth opportunities in the BNPL market.