BNPL apps like Uplift have become very important for common people to manage their finances. Because of these apps, people can now spread out payments for their purchases over time without incurring traditional credit card interest rates. Using these tools, it has become a lot easier for ordinary people to manage their budgets.

By developing a similar app, businesses can cater to this growing requirement in the market and attract a huge user base across the globe who are looking for flexible payment options.

What is the Uplift App? And What Makes it Unique

Developed by Uplift Inc. in 2021, the Uplift BNPL app empowers users to manage their finances with smarter shopping. This budgeting app allows users to split purchases at partnered travel brands and stores into bite-sized monthly installments. Uplift displays their spending power upfront and offers flexible payment plans to suit their needs. Unlike traditional credit cards, Uplift boasts interest-free financing options on qualifying purchases, making it a transparent and potentially cost-effective way to pay. The Uplift app currently holds a strong rating of 4.8 stars on the Google Play Store, with over 3,000 reviews praising its user-friendly interface and budgeting tools.

The Uplift app cuts through the noise with its commitment to transparency and user control. Unlike competitors who might hide fees in complex terms, Uplift prioritizes a “no surprises” experience. The “My Uplift” section within the app clearly displays the total loan amount and repayment schedule for each purchase. This upfront information empowers users to make informed decisions without fearing unexpected costs.

This focus on clarity builds trust and allows users to manage their budgets while making purchases confidently. Furthermore, Uplift’s strength lies in its adaptability. The app’s “Purchase Power” feature shows users their spending limit upfront, and the “Plan Selector” offers a variety of repayment options, including interest-free financing on qualifying purchases. This caters to a wider range of financial situations, giving users the freedom to choose a repayment structure that best suits their needs through the “AutoPay” feature, which can simplify the process by automatically handling monthly installments.

How Does the Uplift App Generate Revenue?

Uplift focuses on generating revenue through merchant fees rather than charging users directly. Here’s how it works:

- Merchant Fees: Uplift charges merchants a percentage of the total purchase financed using their platform. This incentivizes travel companies to offer Uplift as a payment option, potentially increasing sales and attracting customers who prefer flexible payment plans.

- Interest on Loans: While Uplift doesn’t impose subscription or late fees, users may incur interest depending on their purchase and credit history. Interest rates range from 0% to 36%, with an average of 15% APR. Uplift partners like Allegiant and Carnival can even offer special 0% interest promotions. It’s important to note that Uplift utilizes a simple interest structure, meaning interest is not compounded.

To utilize Uplift for travel financing, users must meet three basic requirements: a credit score above 550, a US-originating trip (for airfare financing), and personally participating in the financed trip.

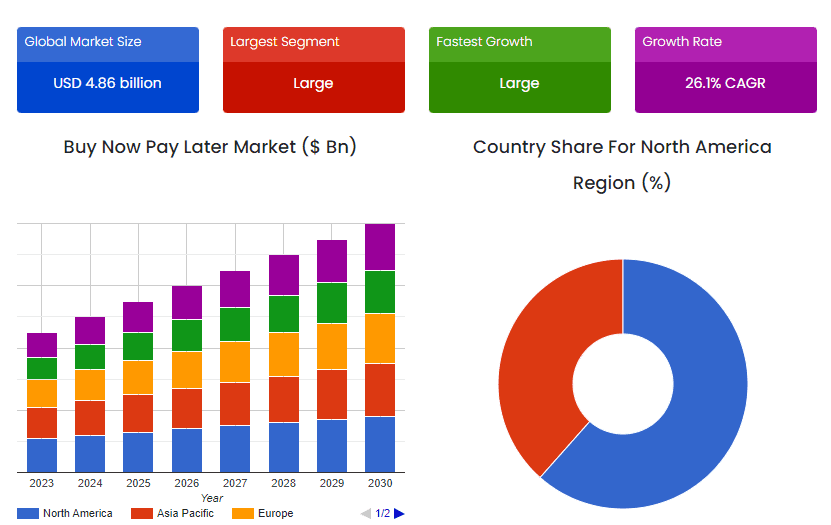

Key Market Takeaways for BNPL Apps

Source: Skyquestt

One key driver is the seamless integration of BNPL services into existing payment gateways. For instance, PayPal recently announced deeper partnerships with major retailers, making BNPL an even more convenient option at checkout. This ease of use translates to increased sales for businesses and a smoother buying experience for customers, who can split their purchases into manageable installments.The BNPL market is expanding beyond traditional retail, with travel companies embracing this payment method.

Airlines and travel agents now offer “Buy Now, Pay Later” options, making travel more accessible. This trend is exemplified by recent collaborations like Flipkart Wholesale partnering with Rupifi to offer BNPL options to small and medium businesses in the travel industry. This empowers travelers to spread the cost of their trip over time, giving them more control over their finances. Furthermore, BNPL services typically don’t require credit checks, which is advantageous for businesses seeking to reach a wider audience, especially younger consumers who may not have established credit yet.

What Features Make Uplift BNPL App So Popular Among Its Users?

Uplift’s BNPL app has gained significant traction among users due to several key features that cater to the evolving financial needs of today’s consumers. Here are some interesting features within the Uplift app that likely contribute to its popularity:

1. Transparent and Flexible Payment Options

Uplift goes beyond the typical single payment offered by credit cards. It breaks down purchases into smaller, manageable installments through its program called “Split Pay.” This program often comes with clear interest rates and fees displayed upfront as “APR” and “processing fees.” This transparency allows users to budget effectively and avoid accruing unexpected charges. Additionally, Uplift offers users the option to choose their repayment terms through a feature like “Flex Plans,” providing flexibility to align payments with their income cycle.

2. Fast and Convenient Application Process

Uplift streamlines the BNPL application process with its “Instant Approval” system. This eliminates the lengthy procedures often associated with traditional credit card applications. A faster approval process can be particularly appealing to those who need financing for an immediate purchase.

3. Improved Budgeting and Credit Building

Uplift can be a valuable tool for budgeting and credit building. By dividing purchases into installments, users can spread out the financial impact with “Split Pay,” potentially allowing for better control over their spending through features like “Budget Trackers.” Uplift also reports repayments to credit bureaus, helping users establish a positive credit history if they manage their “Uplift Advantage” (loyalty program) responsibly.

4. Rewards and Loyalty Programs

Uplift incentivizes users through its loyalty program, “Uplift Advantage.” This program can gamify the BNPL experience, encouraging users to make repeat purchases through the platform and earn points redeemable for rewards. This can be a win-win situation, as users get rewarded for their purchases, and Uplift benefits from increased customer engagement.

5. Seamless Integration with Online Merchants

Uplift likely partners with various online retailers, allowing users to utilize the BNPL option directly at checkout through a feature like “Uplift at Checkout.” This seamless integration eliminates friction from the purchase process, simplifying the selection of Uplift’s BNPL service for online shopping.

How to Develop a BNPL App Like Uplift?

Developing a BNPL app like Uplift requires a comprehensive approach that combines market insights, advanced technology, and regulatory adherence. Businesses aiming to create a successful BNPL platform must follow a structured process to ensure all critical aspects are addressed.

1. Market Research & Niche Selection

Understanding the market landscape is the initial step in creating a BNPL app. Businesses must analyze existing BNPL providers and pinpoint a specific market segment that aligns with their objectives. For example, Uplift focuses on the travel sector, offering tailored BNPL solutions for travelers. Conducting thorough market research helps identify target audiences, understand their needs, and uncover potential pain points related to BNPL options.

2. Feature Planning & Prioritization

Defining the core functionalities of the BNPL app is crucial for its success. Key features should include account creation, purchase splitting, installment management, and secure payments. Based on market research and competitor analysis, businesses can prioritize these features and consider unique elements that differentiate their app. For instance, Uplift’s focus on travel includes dynamic payment splitting and customized payment plans for different travel-related expenses.

3. Regulatory Compliance & Licensing

Navigating regulatory requirements is essential for any BNPL platform. Companies must understand the regulations governing BNPL services in their target markets and obtain the necessary licenses. Compliance with consumer protection laws, data security regulations, and financial oversight is non-negotiable. Ensuring regulatory adherence not only builds trust with users but also mitigates legal risks. Establishing a dedicated compliance team or consulting with legal experts can facilitate this process and ensure all regulatory obligations are met.

4. Technology Stack Selection

Choosing the right technology stack is critical for building a secure and scalable BNPL app. Companies should select technologies that support both backend and frontend development. For backend development, cloud platforms and robust databases are essential for handling transactions and storing sensitive data. Frontend development should focus on creating a user-friendly interface using programming languages and frameworks that ensure responsiveness and ease of use.

5. Payment Processing Integration

Seamless payment processing is a cornerstone of any BNPL app. Partnering with secure payment processors such as Stripe, Adyen, or PayPal ensures smooth transaction handling and enhances user trust. These processors offer features like multi-currency support, fraud detection, and compliance with global payment regulations. Integrating reliable payment processing systems ensures that users can make payments securely and conveniently, which is essential for the app’s credibility and success.

6. Risk Management & Credit Assessment

Effective risk management and credit assessment are crucial for determining user eligibility for BNPL plans. Developing a robust credit assessment system helps evaluate users’ creditworthiness and manage financial risk. This system can incorporate traditional credit checks or alternative scoring methods tailored to specific markets. For example, Uplift may consider travel-specific factors when assessing credit risk. Implementing a thorough risk management strategy protects the platform from potential losses and ensures responsible lending practices.

7. Integration with Partners

Forming strategic partnerships enhances the functionality and reach of the BNPL app. Seamless booking integration, as seen with Uplift, allows for a one-click BNPL option directly within partner websites or apps. This integration streamlines the user experience and simplifies the checkout process. Additionally, dynamic payment splitting enables users to divide their total expenses into separate BNPL plans, with varying interest rates or terms based on the specific purchase. These integrations add value to the platform and attract more users.

8. Testing & Deployment

Thorough testing is essential before launching the BNPL app. This includes testing the app’s functionalities, security measures, and performance under different conditions. Conducting extensive testing helps identify and resolve issues, ensuring a smooth user experience. Once testing is complete, businesses should develop a strategic deployment plan. This plan includes deploying the app on relevant app stores (iOS, Android) and implementing marketing strategies to promote the launch.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

What is the Cost of Developing a BNPL App Like Uplift?

| Phase | Cost Range | Details |

| 1. Research & Planning | $5,000 – $20,000 | |

| Market Research | $5,000 – $10,000 | Cost depends on the scope and depth of analysis. |

| Business Plan Development | $5,000 – $15,000 | Based on the complexity and level of detail required. |

| Technical Feasibility Study | $5,000 – $10,000 | Depending on the chosen development approach and features. |

| 2. Front-End Development | $20,000 – $150,000 | |

| UI Design | ||

| Basic Design | $10,000 – $20,000 | Simple UI design. |

| Highly Customized Design | $30,000 – $50,000 | Complex animations and detailed customizations. |

| App Development | ||

| Native Development (Android & iOS) | ||

| Junior Developers | $40,000 – $60,000 per platform | Basic development by less experienced developers. |

| Mid-Level Developers | $50,000 – $75,000 per platform | Standard development by moderately experienced developers. |

| Senior Developers | $70,000 – $100,000+ per platform | Advanced development by highly experienced developers. |

| Cross-Platform Development | $20,000 – $40,000 for the entire app | Cost-effective development for both platforms using frameworks like Flutter or React Native. |

| 3. Back-End Development | $30,000 – $180,000 | |

| Server-Side Development | ||

| Basic Functionalities | $30,000 – $50,000 | Basic server-side logic and operations. |

| Complex Functionalities | $50,000 – $100,000+ | Advanced features include fraud detection and credit checks. |

| Payment Gateway Integration | $5,000 – $15,000 | Depending on the chosen provider and transaction volume. |

| API Development | $10,000 – $30,000 | Based on the number and complexity of APIs. |

| 4. App Features | Highly Variable | |

| Basic Features | Included in Base Development | Consider these as baseline costs. |

| Advanced Features | ||

| Creditworthiness Checks | $15,000 – $25,000 | |

| Budgeting Tools & Financial Insights | $10,000 – $20,000 | |

| Loyalty Programs & Rewards | $20,000 – $30,000 | Including backend integration. |

| In-App Messaging & Support | $10,000 – $15,000 | |

| Integration with Partner Stores | Cost varies | Additional fees may be required from the partner. |

| 5. Testing & Quality Assurance (QA) | $15,000 – $30,000 | The cost can vary depending on the testing scope and chosen automation tools. |

| 6. UI/UX Design | $10,000 – $20,000 | This cost might be included in Front-End Development or treated separately. |

Total Cost Range – $115,000 – $430,000+

Apart from the core cost mentioned above, businesses also need to understand the variable costs associated with developing a BNPL app like Uplift. These expenses can fluctuate depending on several factors, impacting the overall budget and timeline.

1. Advanced Budgeting and Financial Tools

Uplift goes beyond simple split payments. They might offer features like budgeting tools, financial insights, or educational resources to help users manage their finances responsibly. Developing these features requires additional expertise in financial modeling, user interface design, and data visualization, potentially increasing development costs compared to a basic BNPL app.

2. Loyalty Programs and Rewards Integration

Uplift might incentivize users with loyalty programs or rewards for using their BNPL service. Integrating with loyalty program platforms or developing a custom system can be complex and add to the development cost. Additionally, there might be ongoing fees associated with loyalty program management.

3. Creditworthiness Assessments (if applicable)

Unlike some basic BNPL apps focused on smaller purchases, Uplift offers financing for larger transactions. This might necessitate creditworthiness checks to assess user eligibility and manage risk. Integrating with credit bureaus or developing custom risk assessment models can be a significant cost factor compared to a BNPL app that doesn’t require such checks.

4. Scalability and Performance for High Transaction Volumes

Uplift caters to potentially large transactions, especially in the travel sector. The app’s infrastructure needs to be robust and scalable to handle high transaction volumes without compromising performance. This might involve investing in cloud-based solutions, load-balancing technologies, and performance optimization strategies, which can add to the development cost compared to a BNPL app with lower transaction volume expectations.

Tech Stacks Required to Develop a BNPL App Like Uplift

Building a BNPL app like Uplift involves leveraging a diverse range of technologies to ensure a seamless user experience, robust backend operations, and innovative features. For businesses entering this space, selecting the right tech stacks is crucial for developing a competitive and reliable BNPL platform.

Here are some essential tech stacks required to develop a BNPL app, focusing on front-end and back-end development, AI integration, dynamic interest rates, and more.

1. Front-end Development

The user experience (UX) and visual appeal (UI) of a BNPL app are pivotal in attracting and retaining users. Popular choices for front-end development include React.js and Flutter. React.js, a JavaScript library, is known for building dynamic and interactive interfaces, offering a seamless user experience. Flutter, an open-source framework from Google, enables the creation of beautiful apps that work effortlessly on both iOS and Android devices.

2. Back-end Development

Backend development is where the server-side operations and application logic are handled. Technologies such as Node.js and Python with frameworks like Django or Flask are commonly used. Node.js, a JavaScript runtime environment, allows developers to build scalable and efficient server-side applications. Python, along with frameworks like Django or Flask, provides a robust foundation for creating the core functionality of a BNPL app.

3. AI-powered Purchase Recommendations

Leveraging artificial intelligence (AI) to analyze user data and recommend relevant BNPL financing options can significantly enhance the user experience. By incorporating machine learning algorithms, the app can offer personalized suggestions for travel upgrades or financing plans, potentially increasing conversion rates. AI-powered recommendations make the app more intuitive and user-centric, helping businesses cater to individual user preferences and needs effectively.

4. Dynamic Interest Rate Engine

Implementing a dynamic interest rate engine allows the app to adjust interest rates on BNPL plans in real time based on various factors. This system can use real-time data on travel trends, competitor pricing, and customer profiles to offer competitive financing while maintaining profitability. Dynamic interest rates provide flexibility and responsiveness to market conditions, making the app more attractive to users by offering tailored financial solutions.

5. Custom Fraud Detection

Standard fraud prevention measures might not be sufficient for a BNPL app, especially in the travel sector. Developing or integrating specialized fraud detection systems designed for travel BNPL transactions is essential. Advanced anomaly detection techniques can identify fraudulent activities specific to travel bookings. By employing machine learning models and data analytics, businesses can create robust fraud prevention systems that protect both the platform and its users from potential threats.

6. Cloud-based Scalability

Scalability is a critical aspect of any BNPL app, particularly when handling fluctuating demands. Optimizing cloud infrastructure ensures the app can handle surges in transaction volume during peak travel seasons without service disruptions. Cloud platforms such as AWS, Google Cloud, or Microsoft Azure provide scalable resources and infrastructure management, ensuring the app remains responsive and reliable even during high user activity periods.

7. Analytics & Business Intelligence Tools

To understand how users interact with your BNPL app and identify areas for improvement, consider incorporating analytics tools. Free options like Google Analytics provide basic user behavior insights, while Mixpanel, a product analytics platform, offers more in-depth analysis to help you optimize your app’s features and user experience.

8. Security and Compliance

It is essential for any “Buy Now, Pay Later” platform to prioritize strong security measures and compliance with regulations. Implementing industry-standard security protocols, such as encryption at rest and in transit, and adhering to regulations like PCI DSS for data security are essential. Regular security audits, vulnerability assessments, and compliance checks help maintain a high level of security, protecting user data and ensuring regulatory adherence. Businesses must stay vigilant and continuously update their security measures to address emerging threats.

Conclusion

These days, consumers want flexible payment options when making purchases. That’s why we are seeing a high demand for innovative BNPL apps in the current market. This is the perfect time for fintech businesses to enter the race by developing their own BNPL apps. By investing today, businesses can also attract a niche audience for their application and create a loyal brand following!

Looking to Develop a BNPL app like Uplift?

Revolutionize financial flexibility with Idea Usher! We leverage our 500,000 hours of fintech development to build a secure, scalable BNPL app like Uplift. Our team crafts robust backend systems and user-friendly interfaces, ensuring seamless integration with merchants and fostering responsible credit behavior through AI-powered risk assessment. Partner with Idea Usher and turn your BNPL vision into reality.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

Q1: How much does it cost to develop a BNPL app?

A1: The cost of developing a BNPL app varies depending on several key factors. Simpler versions with core functionalities can be built for less, while feature-rich apps with complex integrations will naturally cost more. The location of development teams, platform choices (native or cross-platform), and the extent of desired features all play a role in the final price tag. Partnering with an experienced fintech development company can not only optimize costs but also ensure a secure and scalable BNPL solution tailored to your specific needs.

Q2: How do you develop a buy now, pay later app?

A2: Developing a BNPL app requires a multi-step approach. First, delve into market research and competitor analysis to understand the landscape. Then, design a user-centric app with a secure backend and integrate payment gateways. Developing features like credit checks, fraud prevention, and transparent billing is crucial. Rigorous testing and regulatory compliance ensure a smooth launch. Finally, prioritize user education and responsible lending practices to foster a sustainable BNPL ecosystem.

Q3: What is the architecture of BNPL technology?

A3: BNPL platforms often rely on modern, scalable architectures. Microservices, modular components that handle specific tasks, enable flexibility and rapid development. Event-driven architecture ensures smooth communication between services, triggering actions based on events like a purchase or on-time payment. APIs facilitate seamless integration with merchants and credit bureaus while robust security measures safeguard user data and financial transactions.

Q4: How do BNPL platforms make money?

A4: BNPL platforms generate revenue by playing middleman. They typically charge merchants a fee, often a percentage of the transaction value plus a fixed sum, for offering BNPL as a payment option. This incentivizes merchants as it can boost sales by increasing customer purchasing power. Late fees from users who miss payments can also be a source of income, though responsible BNPL providers prioritize on-time payments through rigorous credit checks and clear communication.