The concept of blockchain in sports ownership is revolutionizing how fans interact with their favorite teams and athletes, creating unprecedented opportunities for direct participation and investment. This innovative approach enables fractional ownership of sports assets, from team shares and player contracts to stadium naming rights and merchandise revenues.

By leveraging smart contracts and transparent ledger systems, blockchain technology democratizes sports ownership, allowing passionate fans to become genuine stakeholders while providing teams with new capital sources and deeper community engagement.

Modern ownership models demand sophisticated platforms that can handle complex regulatory requirements while maintaining user-friendly experiences for diverse investor profiles. These systems must balance transparency with privacy, scalability with security, and innovation with compliance across multiple jurisdictions. As we have guided numerous enterprises through the complete development and deployment of their blockchain-based solutions across various sectors, IdeaUsher possesses the proven expertise to deliver platforms that meet stringent regulatory requirements while achieving substantial market penetration.

What is Blockchain-Based Sports Ownership?

Blockchain-based sports ownership is a digital model where fans and investors acquire verifiable stakes in teams, athletes, or assets using tokenized shares recorded on a blockchain. Unlike traditional ownership, it enables fractional investments, smart contract–driven revenue sharing, and DAO-powered decision-making. This approach eliminates intermediaries, ensures transparent governance, and allows global participation, turning fans into active stakeholders while opening new revenue and engagement opportunities for sports organizations.

Difference Between Blockchain-Based Ownership & Traditional Ownership

Sports ownership was often limited to elites with little transparency and fan involvement. Blockchain changes this by allowing fractional ownership, automated revenue sharing, and direct fan input. The table below compares traditional and blockchain sports ownership.

| Aspect | Blockchain-Based Ownership | Traditional Ownership |

| Accessibility | Open to global fans and investors through fractional tokenized shares. | Limited to wealthy investors, corporate sponsors, or consortiums. |

| Transparency | All transactions and governance activities recorded immutably on blockchain. | Opaque structures, with decisions and finances managed privately by clubs. |

| Fan Participation | Fans gain voting rights via tokens or DAOs, influencing club-level decisions. | Fans remain spectators with little to no decision-making power. |

| Liquidity of Assets | Tokens and NFTs are tradable on secondary marketplaces for instant liquidity. | Stakes are illiquid, often requiring lengthy negotiations or transfers. |

| Revenue Distribution | Automated through smart contracts, enabling instant payouts and royalty splits. | Centralized, dependent on club management and intermediaries. |

| Global Reach | Borderless participation with fiat and crypto support, enabling worldwide ownership. | Geographic and legal restrictions limit investor participation. |

How Blockchain-Based Sports Ownership Works?

Blockchain in sports ownership moves beyond collectibles by enabling secure, transparent, and verifiable participation. It combines tokenized sports assets with smart contracts and global accessibility, creating an ownership model where fans gain both emotional and financial stakes.

1. Asset Identification & Tokenization

Clubs tokenize sports assets such as equity shares, revenue rights, tickets, or player IP, converting them into digital tokens with unique metadata. Each token becomes a verifiable certificate of ownership, ensuring authenticity, provenance, and tradeability across ecosystems.

2. Tokenomics & Distribution

A well-designed tokenomics framework balances scarcity, value, and utility. Tokens may grant access to voting rights, perks, or revenue-sharing. Distribution occurs through IFOs, marketplaces, or club-issued platforms, ensuring fair participation and sustainable fan-driven economies.

3. Smart Contract Integration

Smart contracts ensure automated and transparent execution of rules, handling payouts and transactions instantly. For instance, revenue from merchandise or tickets can be programmatically distributed to clubs, players, and token holders without middlemen, reducing friction and cost.

4. Governance & Fan Participation

Fans holding governance tokens gain real decision-making power within DAO structures. Beyond kit designs, they may influence sponsorships, youth programs, or community projects, embedding fan voices directly into a transparent feedback loop with clubs and leagues.

5. Secondary Market Liquidity

Tokenized assets are tradable on secondary markets, allowing fans to exit or expand stakes. This creates a new asset class in sports, where ownership carries financial upside alongside the traditional emotional value of fandom.

6. Global Access & Compliance

Integration with both crypto and fiat rails ensures borderless participation. Fans worldwide can invest in sports without banking restrictions, while compliance modules enforce securities regulations, making ownership secure and aligned with global legal standards.

Why Traditional Sports Ownership Faces Limitations?

While sports thrive on community and loyalty, traditional ownership remains restrictive and profit-centric. These legacy structures exclude fans from meaningful participation, leaving gaps that blockchain in sports ownership directly addresses.

1. Centralized Club Control

Traditional clubs are controlled by a handful of owners or corporations, where decision-making remains top-down. Fans stay passive consumers instead of active stakeholders, limiting transparency, inclusivity, and long-term loyalty within the sports ecosystem.

2. Capital-Intensive Entry Barriers

Owning even a small stake in a franchise demands millions in upfront capital, restricting opportunities to wealthy investors. Meanwhile, loyal fans funding clubs through tickets and merchandise gain no pathway to equity or shared returns.

3. Fragmented Fan Engagement

Conventional models treat fan involvement as purely transactional activities such as ticket sales or merchandise purchases. With no influence on policies or club directions, engagement stays shallow, preventing emotional and financial bonds from strengthening over time.

4. Lack of Transparency in Revenue Flows

Revenue streams from sponsorships, broadcasting rights, or player transfers involve opaque and complex contracts. This lack of transparency fosters mistrust, while also enabling profit leakage, corruption risks, and inefficient resource distribution within the club ecosystem.

5. Limited Liquidity of Ownership Stakes

When fractional ownership exists, stakes remain illiquid and nearly impossible to trade. Fans and smaller investors lack exit options, discouraging participation and stifling the creation of flexible sports ownership markets.

Why You Should Invest in a Blockchain Sports Ownership Platform?

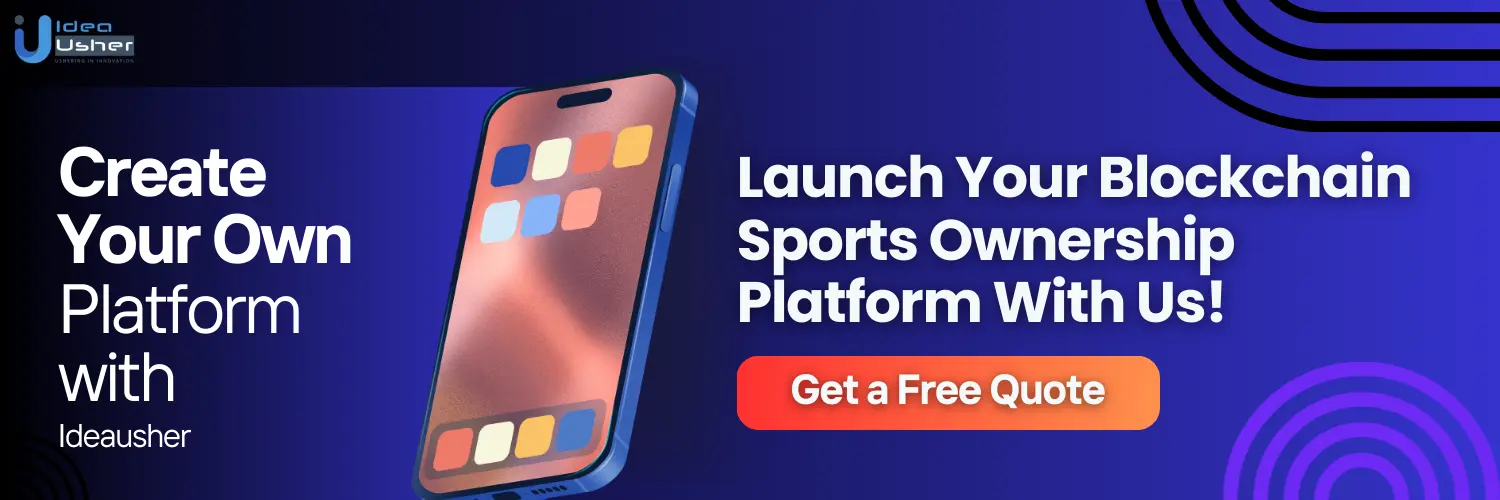

Blockchain in sports is experiencing rapid growth. The market was worth $1.78 billion in 2023 and is projected to hit $10.0 billion by 2035, with a 15.48% compound annual growth rate. This surge is fueled by the increasing use of blockchain in sports for fan engagement, tokenized ownership, and innovative investment models.

Global fantasy football and NFT platform Sorare raised over $680 million, including a $532 million Series B led by SoftBank. The platform allows fans to buy, trade, and play with licensed player cards, showcasing investor confidence in blockchain fan engagement and tokenized sports assets.

Autograph, co-founded by Tom Brady, has raised $170 million to launch a platform for digital collectibles backed by celebrities and athletes. By using blockchain technology, Autograph allows fans to own verified NFTs, showcasing the expanding market for fan-driven sports assets and exclusive collectibles.

Candy Digital, co-founded by Gary Vaynerchuk and Mike Novogratz, raised $100 million in funding, valuing the company at $1.5 billion. The platform specializes in digital collectibles and NFTs for athletes, highlighting the increasing interest in tokenized sports assets and fan engagement.

Fanatics, Inc., a global sports commerce platform, secured $320 million in funding in March 2021 and $325 million in August 2021, achieving an $18 billion valuation. The company’s goal is to transform into a digital sports platform that encompasses NFTs, trading cards, gaming, ticketing, and media, showcasing the potential of blockchain-enabled sports platforms.

Blockchain in sports ownership is transforming fan interaction, opening new investment and engagement avenues. Launching a platform lets stakeholders leverage the merging of sports, blockchain, and fan-driven economies. Early entrants can capitalize on market growth, influence fan experiences, and lead the future of sports ownership.

How Blockchain is Transforming Sports Ownership?

The adoption of blockchain in sports ownership is turning clubs into community-driven ecosystems. By digitizing assets and governance, blockchain introduces transparency, inclusivity, and liquidity, reshaping how fans, investors, and teams connect globally.

1. Tokenization of Ownership Rights

Digital tokens represent fractional ownership stakes, voting rights, or exclusive perks, allowing fans to participate without massive capital. By breaking down high entry barriers, tokenization opens ownership to global supporters and democratizes financial participation in clubs.

2. Smart Contracts for Team Governance

Smart contracts encode rules for voting, revenue sharing, and merchandise royalties, automating decisions with precision. This reduces dependency on intermediaries while ensuring fans influence real outcomes, creating a transparent link between club governance and community-driven engagement.

3. Fraud-Proof Asset Management

Blockchain technology validates tickets, memorabilia, and digital collectibles as NFTs, eliminating counterfeits and guaranteeing provenance. Fans gain confidence knowing their assets are authentic, verifiable, and tradable, while clubs unlock new revenue streams from fraud-proof sports ecosystems.

4. Liquidity Through Secondary Sports Markets

Unlike traditional ownership stakes, blockchain tokens are liquid and tradable on secondary markets. Fans can dynamically adjust holdings, buying or selling ownership rights based on club performance, fan sentiment, or long-term investment perspectives.

5. Driving Borderless Fan Participation

With blockchain platforms, ownership is no longer limited by geography or banking systems. Fans worldwide can buy into European, American, or Asian clubs directly, creating interconnected sports economies that drive inclusion, global reach, and cultural diversity.

Business Benefits of Blockchain Sports Ownership

Blockchain transforms sports ownership into a transparent, liquid, and engaging ecosystem, providing measurable advantages for investors, clubs, and fans.

A. For Investors

Blockchain opens new avenues for sports investors, giving them flexibility, transparency, and access to innovative asset classes previously unavailable in traditional ownership models.

- Liquidity: Tokenized shares and fan tokens enable instant trading in sports investments, giving investors flexibility to adjust portfolios based on club performance and market trends.

- Transparency: Blockchain guarantees that transactions, revenue distributions, and ownership records are immutable and auditable, allowing investors to track fund usage and revenue splits, thereby reducing the risk of fraud and mismanagement.

- Access to New Asset Classes: Investors can now engage in NFTs, fractional ownership of emerging clubs, and dynamic revenue-sharing contracts, creating new opportunities in sports-related digital assets that were previously inaccessible.

B. For Teams and Clubs

Blockchain provides clubs with tools to maximize revenue, reduce costs, and create deeper connections with fans, reshaping how teams operate and monetize their brand.

- Direct-to-Fan Monetization: Selling fan tokens, NFTs, and digital collectibles directly to supporters allows clubs to bypass intermediaries, leading to higher revenue retention and enabling personalized offerings that enhance fan loyalty.

- Reduced Operational Costs: Smart contracts automate processes like ticketing and royalty distribution, reducing administrative workload, minimizing human error, and ensuring instant, transparent revenue flows.

- Fan Loyalty & Engagement: Blockchain gamification, token staking, and exclusive perks turn fans into active stakeholders. Engaged fans are likelier to buy tickets and merchandise, fostering a sustainable revenue and loyalty cycle.

C. For Fans

Fans become active participants rather than passive spectators, gaining ownership, influence, and tangible rewards that deepen engagement and emotional connection to their favorite teams.

- Active Participation: Fans are now active participants. Through DAOs and token voting, they influence decisions on kit designs, community initiatives, and matchday experiences, fostering deeper emotional attachment and loyalty.

- Ownership of Assets: Tickets, fan tokens, and digital collectibles are on the blockchain with verifiable ownership, allowing fans to trade or showcase them as keepsakes and potential investments.

- Rewards and Incentives: Fans are rewarded for engagement with exclusive content, merchandise discounts, staking rewards, and VIP experiences, enhancing interaction and making the experience more meaningful.

Types of Blockchain Applications in Sports Ownership

Blockchain in sports ownership is redefining asset management, governance, and fan engagement. By integrating digital tokens, smart contracts, and decentralized systems, clubs can create transparent, scalable, and interactive ecosystems that benefit both teams and fans.

1. Tokenized Equity and Fan Shares

Clubs can create digital tokens representing fractional ownership or equity, allowing fans to invest directly. This lowers entry barriers, generates capital from supporters, and strengthens emotional and financial engagement while enabling liquidity and tradable ownership rights.

Example: Watford FC became the first major English football club in 2024 to offer fractional digital ownership. Fans could invest in £17.5 million worth of shares through Republic and Seedrs, gaining access to meetings, events, and priority tickets. This model made ownership accessible to global supporters and created liquidity in fan investments, showcasing blockchain-based equity’s potential.

2. NFT-Based Tickets and Memorabilia

Tickets, merchandise, and collectibles minted as NFTs ensure authenticity and traceability. These digital assets are tradable on secondary markets, offering fans both utility like VIP access or event entry and a secure investment opportunity in their favorite teams.

Example: Teams like LA Kings, Miami Heat, and Dallas Mavericks launched NFT-based tickets and collectibles through platforms such as Blockparty and Polygon. These digital assets not only prevented fraud but also offered perks like highlights, loyalty rewards, and VIP access, enhancing fan experience and creating secondary revenue streams.

3. Decentralized Governance via DAOs

Fan participation is enhanced through DAO-based voting, where token holders influence club decisions such as jersey designs, sponsorships, or match-day experiences. This system fosters transparency, strengthens global fan loyalty, and creates a stakeholder-driven sports ecosystem.

Example: Krause House DAO, LinksDAO, and WAGMI United DAO allowed fans to vote on team or league decisions using blockchain tokens. Fans influence operations, budgets, or match strategies, transforming traditional spectators into active stakeholders with a voice, which strengthens engagement and loyalty.

4. Smart Contracts for Revenue and Sponsorship Splits

Automated smart contracts distribute revenues, royalties, and sponsorship funds transparently, eliminating intermediaries. Players, sponsors, and fans receive timely payouts, reducing disputes and creating trust while enabling clubs to implement innovative revenue-sharing models.

Example: Esports leagues and sponsorship platforms implement smart contracts to automate prize and revenue distributions. Payments are triggered by predefined milestones such as performance metrics or appearances, ensuring trustless, transparent, and instant settlements for players, sponsors, and investors alike.

5. Cross-Platform Marketplaces for Fan Tokens

Interoperable marketplaces allow trading of fan tokens across multiple clubs or leagues, giving fans flexibility to manage diversified portfolios. This fosters liquidity, engagement, and investment opportunities while creating a dynamic secondary market for sports assets.

Example: Socios.com and Sorare enable fans to trade tokens and NFTs across multiple teams and leagues, such as Barcelona & PSG, without being limited to one club. Fans gain flexibility in investment, enjoy voting rights, and access exclusive rewards, creating a diversified, global fan economy powered by blockchain.

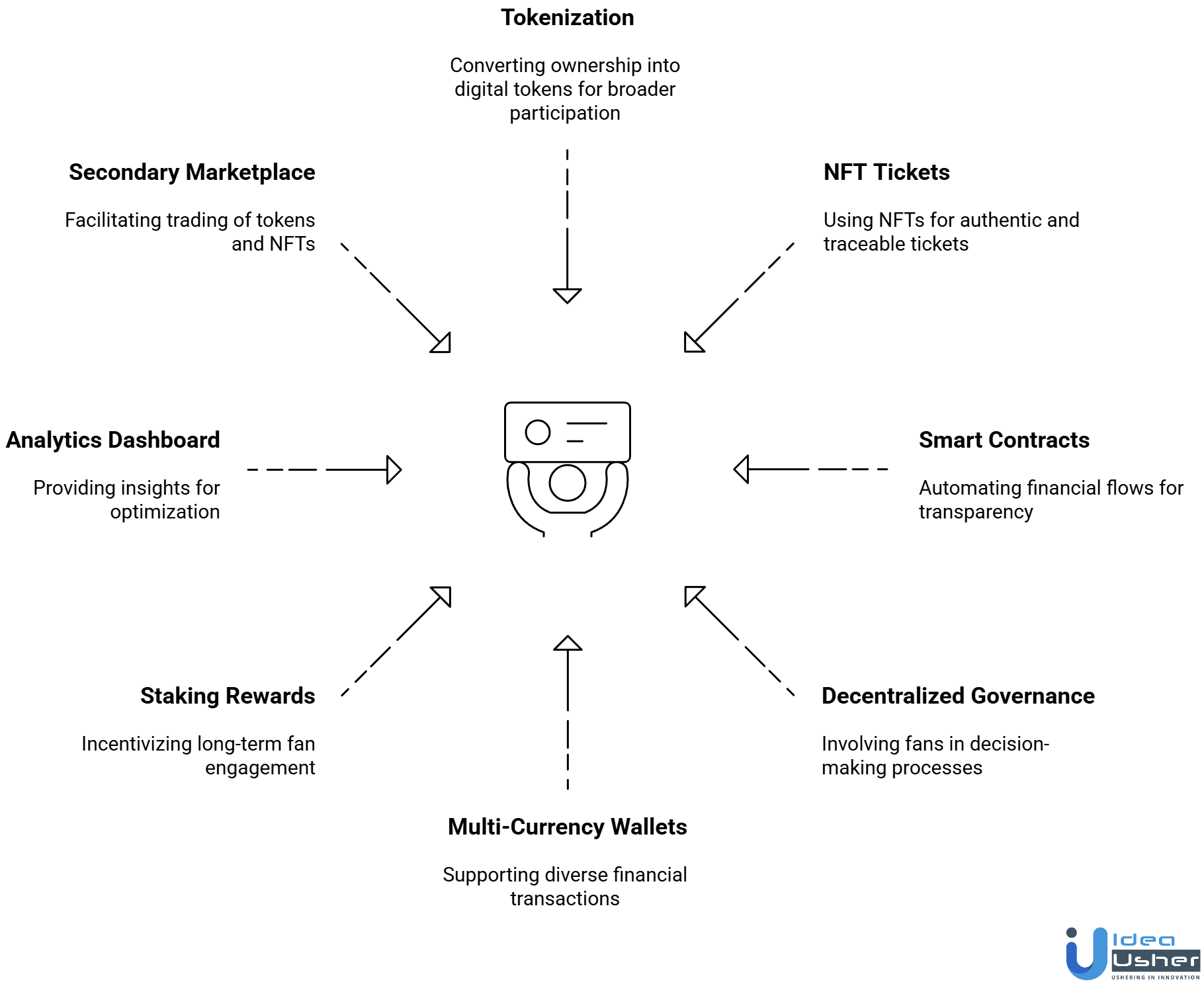

Key Features of a Blockchain Sports Ownership Platform

A blockchain sports ownership platform creates a secure and transparent environment where clubs, investors, and fans interact seamlessly. By combining tokenization, governance, and automated financial flows, these platforms redefine fan engagement and ownership participation.

1. Tokenization of Ownership and Fan Rights

The platform allows clubs to convert equity stakes, fan privileges, or revenue rights into digital tokens. Fractional ownership enables broader participation while ensuring verifiable records of each stakeholder’s rights, creating liquidity and democratizing club investment opportunities.

2. NFT-Based Tickets and Collectibles

Tickets, memorabilia, and merchandise can be minted as NFTs, guaranteeing authenticity and traceability. Fans trade these assets in secondary markets while clubs gain new revenue streams, reduced counterfeiting, and the ability to embed perks like VIP access or exclusive experiences.

3. Smart Contract Automation

Smart contracts automate revenue distribution, royalty payments, and token-based rewards. By removing intermediaries, they ensure accurate, transparent, and tamper-proof financial flows, reducing administrative overhead and enabling creative monetization models such as dynamic NFT royalties or fan incentives.

4. Decentralized Governance (DAOs)

Token-holding fans can participate in decentralized governance, influencing kit designs, sponsorship initiatives, or match-day experiences. This fosters community engagement, emotional attachment, and measurable fan impact, transforming passive supporters into active stakeholders in club decisions.

5. Multi-Currency Wallet Integration

The platform supports both fiat and crypto transactions, allowing global fans to participate in ownership, NFT purchases, or token staking. Multi-currency wallets ensure seamless transactions, borderless participation, and easy management of diverse financial assets.

6. Staking & Rewards Mechanisms

Fans can stake their tokens to earn rewards, unlock exclusive access, or join loyalty programs. This feature encourages long-term engagement, strengthens fan-club relationships, and creates additional monetization opportunities while promoting sustained token holding.

7. Analytics and Insights Dashboard

Real-time dashboards track token circulation, fan engagement, NFT trading, and governance activity. Clubs can use these insights to optimize fan retention, design exclusive offerings, and discover new monetization opportunities while maintaining transparent operations.

8. Secondary Marketplace for Tokens and NFTs

An integrated marketplace enables seamless trading of tokens, NFTs, and ownership stakes. This provides liquidity, encourages active fan participation, and strengthens the platform’s economic ecosystem, creating continuous engagement and revenue potential.

How IdeaUsher Will Develop Your Blockchain Sports Ownership Platform?

Building a blockchain sports ownership platform requires a precise combination of technology, governance, and fan engagement features. At IdeaUsher, we follow a structured, end-to-end approach that ensures scalability, security, and measurable business impact for investors, clubs, and fans.

1. Requirement Analysis & Tokenomics Design

We begin by analyzing your business model, fan base, and monetization goals. This stage defines token types, fractional ownership structures, rewards, and governance rights. By aligning tokenomics with club objectives, we ensure tokens deliver maximum ROI, incentivize fan participation, and establish a sustainable financial ecosystem.

2. Blockchain Selection & Smart Contract Development

We assess blockchains like Ethereum, Polygon, Solana, and Flow to determine which best balances scalability, transaction costs, and security for your platform. Custom smart contracts are developed to automate revenue sharing, staking rewards, NFT issuance, and DAO voting, ensuring transparency and reducing operational overhead. This automation directly impacts profit margins and investor confidence.

3. Core & Advanced Feature Implementation

Our team integrates essential features such as tokenization, NFT-based tickets, and DAO governance, along with advanced modules like staking, secondary marketplaces, and AI-powered fan insights. These features not only enhance user engagement and retention but also open new monetization streams for clubs and sponsors.

4. UI/UX & App Development

We design intuitive web and mobile interfaces that make complex blockchain interactions simple for fans. Personalized dashboards, gamified experiences, and multi-currency wallet support improve user adoption, encourage repeat engagement, and make the platform appealing to global audiences.

5. Security Audits & Compliance Checks

Rigorous audits ensure that smart contracts are error-free, and all blockchain transactions are secure. Compliance with KYC, AML, and regional regulatory requirements reduces risk for investors and establishes trust among users, making the platform more credible and market-ready.

6. Deployment, Maintenance & Scaling

After development, we deploy the platform with robust cloud infrastructure and monitoring systems. Ongoing maintenance, feature updates, and scaling strategies ensure the platform can accommodate growing fan bases, transaction volumes, and global participation, delivering sustained ROI over time.

Cost to Develop a Blockchain Sports Ownership Platform

The cost depends on features, tech stack, security, and scalability. Breaking it down into MVP vs Enterprise-grade solutions helps investors and clubs understand what to expect at each stage.

1. MVP-level Application ( ~ $48,000 – $60,000)

The MVP focuses on essential features to validate your platform idea, engage early users, and test tokenomics. It allows you to enter the market quickly without excessive upfront investment.

Must-Have Key Features:

- Tokenization of Ownership and Fan Rights: Convert club equity or fan privileges into digital tokens, enabling fractional ownership. This ensures transparency, verifiable ownership, and easy trading among early adopters.

- NFT-Based Tickets and Collectibles: Issue tickets, merchandise, or limited-edition digital items as NFTs to prevent counterfeiting and create collectible value for fans.

- Basic Smart Contract Automation: Automate essential functions like revenue distribution from token sales or NFT transactions, reducing administrative overhead and human error.

- Wallet Integration (Crypto + Fiat): Allow fans to buy, store, and trade tokens seamlessly, supporting global participation and ease of use.

- DAO Governance for Fan Voting: Enable fans to vote on decisions like kit designs or matchday experiences, fostering early engagement and emotional investment in the club.

Business Impact: Validates the platform concept, attracts early investors, establishes initial fan engagement, and generates first revenue streams. Provides real-world insights on fan behavior and tokenomics while minimizing financial risk.

2. Enterprise-Grade Solution (~ $70,000 – $134,000)

An enterprise-grade platform is designed for scalability, advanced engagement, and global adoption. It includes comprehensive features that drive monetization, fan retention, and investor confidence.

Must-Have Key Features:

- Advanced Tokenization & Fan Equity Models: Supports complex fractional ownership, fan shares, and multi-tiered token systems with tiered privileges, rewards, and voting rights.

- NFT Marketplaces for Tickets & Collectibles: Full-featured secondary marketplaces for trading tickets, memorabilia, and digital assets, enabling liquidity and additional monetization for clubs and fans.

- Staking & Rewards Mechanisms: Fans can stake tokens to earn rewards, access VIP content, or participate in exclusive experiences, creating long-term engagement loops.

- AI-Powered Fan Insights & Personalization: Tracks fan behavior to deliver personalized content, recommendations, and offers, increasing retention and monetization potential.

- Multi-Chain Support: Ethereum, Polygon, Solana, or Flow integration to optimize transaction speed, reduce gas fees, and enable cross-platform token trading.

- Metaverse & AR/VR Integrations: Virtual stadiums, immersive fan experiences, and digital collectibles enhance engagement and provide unique monetization opportunities.

- Advanced Smart Contract Automation: Fully automated revenue sharing, sponsorship payouts, and NFT royalties to ensure transparency, reduce operational overhead, and increase investor trust.

- Secondary Market Liquidity: Integrated marketplace for buying, selling, or trading fan tokens and NFTs, boosting economic activity and long-term platform sustainability.

Business Impact: Maximizes revenue streams, drives global fan participation, and positions the platform as a leader in blockchain sports ownership. Enables high retention, fan loyalty, and ROI through advanced monetization strategies and immersive experiences.

Conclusion

Blockchain is reshaping sports ownership by introducing transparency, security, and new avenues for fan engagement. Tokenized assets and digital platforms allow fans and stakeholders to participate in ways that were previously impossible, creating stronger connections and measurable value. By combining innovative technology with the passion of sports, these solutions enhance trust, streamline transactions, and open up new revenue opportunities. Platforms that prioritize scalability, reliability, and user engagement are setting the standard for the future, redefining how ownership and participation are experienced across the sports ecosystem.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

Blockchain allows fans to own fractional shares of teams or players through tokenization. This creates interactive experiences, voting rights, and rewards programs, giving fans a tangible stake in sports while enhancing engagement and loyalty across platforms.

Blockchain provides transparency, security, and verifiable records for all transactions. Owners and fans can track investments, verify authenticity, and participate confidently, ensuring that ownership rights and digital assets remain secure and immutable.

Yes, blockchain enables tokenized assets and fan participation programs that open new revenue streams. Platforms can monetize digital collectibles, exclusive access, and loyalty programs, turning fan engagement into measurable financial opportunities for teams and leagues.

Smart contracts automate processes such as ownership transfers, rewards distribution, and voting outcomes. This reduces administrative overhead, ensures trust in transactions, and guarantees that agreements execute exactly as programmed without requiring intermediaries.