Banking today is undergoing a major transformation due to the power of artificial intelligence (AI). AI is like a digital wizard that’s helping banks and financial institutions work smarter. It’s all about AI’s knack for handling massive amounts of data, spotting hidden patterns, and making smart decisions, which is changing the game for the industry. So, how exactly is AI shaking up the world of banking and finance? What are the use cases?

Well, there are plenty of exciting possibilities. It’s improving customer experiences, streamlining behind-the-scenes tasks, catching sneaky fraudsters, managing risks, and ensuring everyone plays by the rules. Plus, AI is the magic behind automating boring, repetitive jobs, making things super accurate and lightning-fast, all while saving banks big bucks. And don’t forget those AI-powered chatbots and virtual helpers, which are always there to assist customers, no matter the hour.

According to the experts, almost 80% of banks are jumping on the AI bandwagon because they see the huge benefits. This tells us that the world of banking is changing fast, and AI is the key to making things work better, smarter, and more efficiently. In this article, we’ll dive deep into all the cool ways AI is transforming banking and finance, showing you the perks and what’s coming next in this exciting journey.

Role Of AI In Banking And Finance

Let’s understand the role of AI in banking and finance and delve into the multifaceted aspects that make AI a game-changer in the banking and finance industry.

1. Value Creation

AI technologies have the potential to unlock substantial value in the banking and finance industry, with estimates reaching up to $1 trillion annually. This value creation is driven by AI’s ability to personalize services for customers, resulting in increased revenues. Moreover, AI-driven automation reduces operational costs, minimizes error rates, and optimizes resource utilization, further contributing to value generation.

2. Customer Experience

Enhancing customer experience is at the forefront of AI’s impact in banking and finance. AI-powered systems are adept at tailoring recommendations, content, and services to individual customer preferences, providing a level of personalization that was previously unimaginable. This not only elevates customer satisfaction but also introduces innovative value propositions.

A prime example of AI enhancing customer experience is Erica, the virtual assistant introduced by the Bank of America. Erica specializes in efficiently managing credit card debt reduction and card security updates, handling over 50 million client requests in a single year. Such AI-driven interactions redefine customer engagement.

3. Risk Management

While AI offers significant advantages, it also introduces novel risks. Financial institutions embracing AI must navigate existing regulatory frameworks to effectively manage these risks. Adapting risk management strategies becomes crucial in this AI-driven landscape, ensuring that AI-related risks are identified and mitigated.

4. Regulation

The integration of AI into financial services requires meticulous consideration of regulatory compliance. Although there are no specific restrictions on AI usage, financial firms must align their AI-driven processes with existing regulatory frameworks. For instance, firms offering investment advice must ensure AI-informed advice remains suitable for customers, adhering to regulatory requirements.

5. Automation and Efficiency

AI’s impact on automation and efficiency is paramount. It surpasses human decision-making in terms of speed and accuracy, resulting in streamlined operations and cost reduction. This technological prowess empowers banks to efficiently manage risk and meet regulatory needs while simultaneously fostering growth and differentiation.

Robotic Process Automation (RPA) exemplifies the potential of AI in automation. JPMorgan Chase’s CoiN technology, powered by RPA, outpaces human capabilities in document review and data extraction. This heightened efficiency is emblematic of AI’s transformative role in banking and finance.

6. Cybersecurity and Fraud Detection

In an era where digital transactions are rampant, AI stands as the guardian of cybersecurity and fraud detection. AI-powered systems continuously monitor transactions, identifying unusual patterns and potential threats. A prime example is Danske Bank, which increased its fraud detection capability by 50% and reduced false positives by 60% using AI. This technology automates crucial decisions while routing cases to human analysts when needed.

7. Loan and Credit Decisions

AI-based systems are revolutionizing loan and credit decisions. Traditional reliance on credit history, scores, and references is being complemented by AI’s ability to analyze customer behavior and transaction patterns. These systems can even proactively warn banks about risky behaviors that might lead to loan defaults, changing the landscape of consumer lending.

8. Tracking Market Trends

AI and Machine Learning (ML) process vast data volumes to predict market trends, evaluate sentiments, and suggest investment opportunities. AI solutions guide banks on the best times to invest in stocks and warn of potential risks. This high-speed data processing expedites decision-making and enhances convenience for both banks and clients.

8. Data Collection and Analysis

The sheer volume of financial transactions necessitates innovative AI solutions for efficient data collection and analysis. AI streamlines this process, improving the overall user experience. This data is not only valuable for customer service but also for fraud detection and credit decisions.

Market Insight For AI In Banking And Finance

Artificial Intelligence (AI) is transforming the banking and finance industry, and its potential for value creation is significant. Here are some key insights:

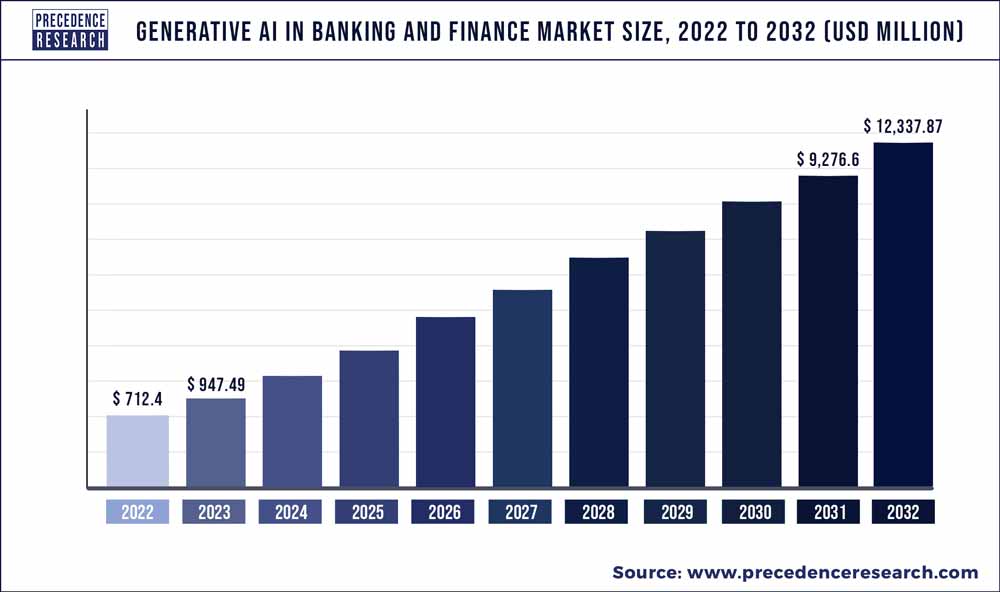

The global market for generative AI in banking and finance was approximately valued at $712.4 million in 2022, and it is anticipated to reach about $12,337.87 million by 2032, with a steady growth rate of 33% expected during the forecast period from 2023 to 2032. Moreover, as per another report, the AI in Banking Market, valued at $5.13 billion in 2021, is projected to ascend to $64.03 billion by 2030, with a consistent growth rate of 32.36% anticipated from 2023 to 2030.

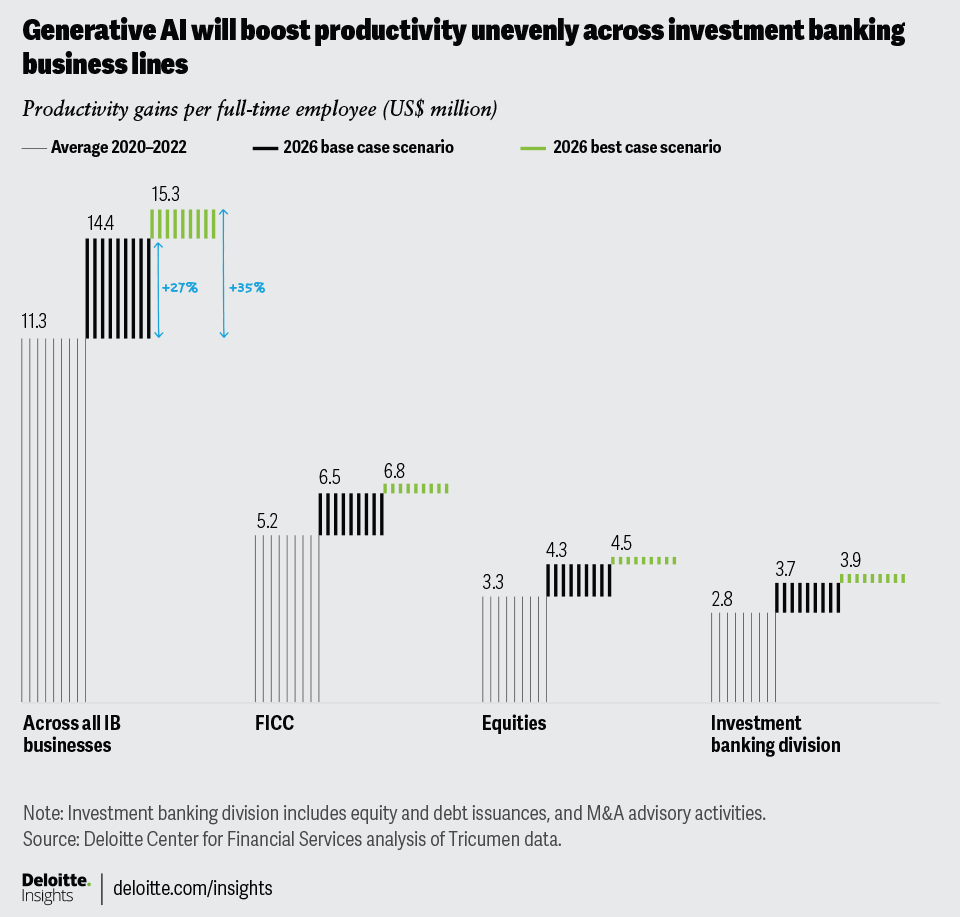

According to McKinsey’s estimations, the adoption of AI technologies in the global banking sector has the potential to add an extra $1 trillion in value each year. Furthermore, Deloitte predicts that the leading 14 global investment banks can substantially enhance front-office productivity, potentially achieving a productivity increase of 27% to 35% through the utilization of generative AI. This could translate to an additional revenue of approximately $3.5 million per front-office employee by the year 2026.

Note: Challenges in the banking industry stem from the difficulty of transitioning from isolated AI experiments to widespread adoption. This struggle is exacerbated by the absence of a cohesive AI strategy, limited investment in core technology, disjointed data resources, and outdated operational models that hinder collaboration between business and technology units. Looking ahead, the industry is witnessing a surge in proof-of-concept (POCs) and experimental endeavors, exemplified by JPMorgan Chase’s trademark application for “IndexGPT,” a product designed to provide investment advice to customers.

These future trends suggest a growing recognition of AI’s potential and the need for a more concerted effort to overcome the existing challenges and fully embrace the transformative power of AI in banking.

Benefits From AI Integration To Banks And Consumers

Here’s a comprehensive exploration of the benefits that AI integration offers to both banks and consumers:

1. Benefits for Banks

1.1. Enhanced Cost Efficiency

The integration of AI technology significantly reduces operational costs by automating labor-intensive tasks such as customer service, fraud detection, and risk assessment. This efficiency allows banks to allocate resources more strategically, resulting in substantial savings over time.

1.2. Streamlined Operations

AI-powered systems streamline internal processes, enabling banks to operate more smoothly and effectively. By automating routine tasks, employees can focus on high-value and strategic activities, leading to improved operational effectiveness.

1.3. Improved Risk Management

AI empowers banks with advanced data analysis capabilities to assess risks more accurately. By considering a broader spectrum of data points and employing predictive models, AI enhances risk management strategies, ultimately minimizing potential financial losses.

1.4. Revenue Growth

AI-driven insights enable banks to identify untapped customer segments and develop tailored products and services. By offering personalized financial solutions, banks can attract new customers and increase profitability. Additionally, AI aids in optimizing pricing strategies, contributing to revenue growth.

1.5. Enhanced Customer Experience

AI technologies like chatbots and recommendation engines provide customers with personalized and responsive services. Chatbots offer 24/7 assistance, resolving queries efficiently, and recommendation engines suggest products and services that align with individual customer needs, resulting in an improved overall customer experience.

2. Benefits for Consumers

2.1. Convenience and Accessibility

AI integration enhances the convenience and accessibility of banking services. Mobile banking apps powered by AI allow customers to deposit checks, transfer funds, and pay bills without visiting a physical branch. This accessibility simplifies banking tasks and fits seamlessly into customers’ busy lives.

2.2. Personalized Financial Guidance

AI-powered financial planning tools offer consumers personalized and tailored financial advice. These tools assist customers in setting and achieving their financial goals, providing them with valuable insights and guidance for their financial journey.

2.3. Enhanced Security and Fraud Protection

AI plays a pivotal role in strengthening security measures and detecting fraud effectively. AI-powered fraud detection systems continuously monitor transactions, swiftly identifying suspicious activity patterns in real-time. This proactive approach safeguards consumers’ financial information and protects them from potential threats.

Use Case And Real-World Examples Of AI In Banking

AI is reshaping the banking industry by revolutionizing various aspects of its operations, from customer support to fraud protection and lending risk management.

1. AI in Banking Customer Support

AI-driven chatbots and virtual assistants are providing 24/7 customer support, enhancing accessibility and convenience for banking customers.

- Companies like Ally Financial and Capital One employ AI to offer personalized assistance through mobile platforms.

- Kasisto’s KAI platform enables banks to create their chatbots for sophisticated financial queries.

- Affectiva’s humanoid robot, Pepper, interacts with customers, offering guidance, information, and humor.

- HooYu combines biometrics and AI to improve security and convenience, allowing remote account opening with facial recognition.

2. AI in Fraud Protection

AI is playing a pivotal role in detecting and preventing fraud within the banking sector.

- Socure’s ID+ Platform employs machine learning to verify identities by analyzing various data points.

- Vectra AI’s cyber-threat detection platform automates threat detection and accelerates investigations.

- FIS utilizes AI in compliance and credit analysis to enhance Anti-Money Laundering (AML) and KYC processes.

- Symphony Ayasdi AI addresses the complexity of anti-money laundering (AML) with AI-powered AML solutions.

- DataVisor counters application and transaction fraud in real-time using machine learning and clustering algorithms.

- Jumio’s KYX platform uses facial recognition and AI to validate customer identities and continuously assess risk, enhancing online trust.

- F5 provides cybersecurity solutions that help financial services safeguard data, detect fraud, and enhance security and resilience.

- Darktrace employs AI and machine learning to detect suspicious activity in network data, protecting financial firms from cyber threats.

3. AI in Lending and Risk Management

AI is transforming lending and risk management in banking, promising more equitable credit underwriting and improved risk assessment.

- Kensho Technologies provides machine intelligence and data analytics to financial institutions for quick answers to complex financial questions.

- The PNC Financial Services Group employs AI to predict a company’s financial future, aiding decision-making.

- ZestFinance’s AI-based software aims to reduce bias in credit models, promoting fairer credit underwriting.

- Feedzai uses machine learning to monitor transactions and enhance speed and security in an era of instant payments.

4. AI in Financial Credit Decisions

- Enova employs AI and machine learning in its lending platform to provide advanced financial analytics and credit assessment.

- Ocrolus offers document processing software that combines machine learning with human verification to analyze financial documents efficiently, aiding loan eligibility assessment and credit scoring.

- DataRobot provides machine learning software for predictive modeling, assisting financial institutions in making accurate underwriting decisions and detecting fraudulent credit card transactions.

- Scienaptic AI provides a credit underwriting platform that utilizes non-traditional data sources and adaptive AI models to offer transparency and reduce losses in credit decisions.

- Zest AI’s AI-powered underwriting platform assesses borrowers with limited credit history, using thousands of data points to help lenders better evaluate traditionally considered “at-risk” populations.

5. AI in Financial Risk Management

- Kensho provides machine learning training and data analytics software to assess extensive datasets and documents, aiding in risk identification and management.

- Simudyne’s platform allows financial institutions to conduct stress tests and analyze market contagion on a large scale, improving risk management.

- Symphony Ayasdi AI creates cloud-based machine intelligence solutions to aid fintech businesses in understanding and managing risk, as well as fraud detection.

- Range offers money management services to millennials, combining traditional wealth management with DIY tools powered by machine learning.

6. AI in Quantitative Trading

- Canoe ensures efficient collection and extraction of alternate investment data, using AI and natural language processing to categorize customer documentation.

- Entera is an AI-powered investment platform for real estate investors, providing market insights and matching properties with investor preferences.

- AlphaSense is an AI-powered search engine for the finance industry that analyzes keyword searches within financial documents to identify market trends.

- Kavout employs machine learning to analyze vast amounts of data and ranks stocks using its AI-powered K Score, aiding in stock selection.

- Alpaca uses deep learning technology and high-speed data storage for its yield farming platform, allowing users to lend assets in the cryptocurrency market.

7. AI in Personalized Banking

- Kasisto’s conversational AI platform, KAI, improves customer experiences by providing self-service options, recommendations, and personalized financial advice.

- Abe AI offers a virtual financial assistant that integrates with various platforms, providing customers with convenient and personalized banking services.

- Trim is a money-saving assistant that connects to user accounts, analyzes spending, cancels subscriptions, and negotiates bills to save users money.

8. AI in Blockchain Banking

- TQ Tezos leverages blockchain technology to create tools for public use, spanning industries like fintech and healthcare.

- WealthBlock.AI streamlines the process of finding investors using blockchain, automating marketing, and investor referral checks.

- ShapeShift is a decentralized crypto wallet and marketplace that supports a wide range of cryptocurrencies, providing users with access to multiple blockchains.

- Figure uses blockchain and AI to streamline the home loan process, offering home equity lines of credit and other consumer credit products.

Challenges In Adopting AI & ML In Banking

1. Data Quality Concerns

Inaccurate or incomplete data can hinder AI and ML models, making it crucial for banks to ensure data accuracy and completeness for reliable insights.

2. Navigating Regulatory Requirements

Compliance with ever-evolving banking regulations is a complex task when integrating AI and ML, demanding careful navigation of legal frameworks.

3. Model Explainability

In the banking sector, understanding the inner workings of AI and ML models is challenging, raising concerns about transparency and accountability in decision-making processes.

4. Bias and Fairness

Biases in AI models can result in discriminatory outcomes in lending and other services, posing ethical and regulatory challenges that banks must actively address.

5. Model Governance and Management

The complexity of AI/ML models demands rigorous governance and ongoing management to ensure they align with evolving business goals and compliance requirements.

6. Employee Reluctance

Employee resistance to AI adoption, often due to job security fears or a lack of understanding, necessitates comprehensive training and change management strategies.

7. Integration Challenges

Integrating AI/ML models seamlessly into existing banking systems requires meticulous planning to avoid disruptions and optimize their functionality.

8. Maintenance of Models

The longevity of AI/ML models relies on continuous maintenance to preserve their accuracy and relevance in an ever-changing financial landscape.

9. Loss of Emotional “Human Touch”

As automation increases, maintaining a personalized touch in customer interactions remains vital to fostering trust and strong customer relationships.

10. Privacy Breaches

With AI/ML handling sensitive customer data, banks must prioritize data security to prevent breaches, which could lead to significant reputational and legal consequences.

Why Should The Banking Sector Embrace An AI-Centric Approach?

The AI-first approach in the banking sector refers to adopting AI technologies as the foundation for new value propositions and distinctive customer experiences.

Why AI-First?

Banks have consistently embraced innovative technology to reshape customer interactions. We’re presently in the era of AI-driven digitalization, made possible by reduced data storage costs, improved accessibility and connectivity, and rapid AI advancements. These innovations can increase automation and, when used cautiously after managing risks, frequently enhance decision-making in speed and precision compared to humans.

The banking sector must embrace an AI-first approach for several reasons:

1. Competitive Edge

Traditional banks must transition into “AI-centric” establishments to effectively compete and thrive. Implementing AI technologies can confer a competitive advantage, enabling banks to maintain leadership positions.

2. Value Generation

AI technologies hold the potential to unlock approximately $1 trillion in additional value annually. They can augment revenue streams by enhancing service personalization, reducing costs through automation-driven efficiencies, minimizing error rates, and optimizing resource allocation.

3. Enhanced Decision-Making

AI technologies, when employed prudently to manage associated risks, often outperform human decision-making in terms of both speed and precision.

4. Elevated Customer Experience

The infusion of AI into banking applications and services has reshaped the sector, making it more customer-centric and technologically current. AI-driven systems enhance bank productivity, enable data-informed decision-making beyond human capacity, and reduce operational costs.

5. Swift Fraud Detection

Intelligent algorithms swiftly identify fraudulent activities within seconds, a paramount security feature in the banking industry.

6. Adapting to the Digital Era

We find ourselves in an AI-powered digital era facilitated by declining data storage and processing costs, increased accessibility and connectivity, and rapid AI advancements. Banks must adapt to this digital transformation to cater to the evolving demands of their clientele.

AI-First Strategy

Highly effective AI strategies rest upon four pillars: enhancing data assets, expanding infrastructure to facilitate broad experimentation, involving employees in the quest for new AI applications, and utilizing AI to address customer needs beyond conventional banking services.

Key Considerations To Become AI-First Bank

Becoming a bank that prioritizes AI involves several important factors:

1. Enhance Data Assets

AI models in banking are relatively easy to create or obtain. What truly makes them valuable is having accessible, well-prepared data for AI algorithms. Banks often struggle with organizing their data.

2. Implement AI Widely

To be effective as an AI-driven bank, you must implement AI models extensively. This means expanding your infrastructure to allow for widespread experimentation.

3. Incorporate AI into the Company Culture

It’s crucial to engage your employees in searching for new ways to use AI. This involves fostering a culture that embraces AI and encourages employees to think about its applications in their daily work.

4. Offer AI Services Beyond Banking

Explore how AI can solve customer problems beyond traditional banking services. This might include collaborating with other companies to offer additional services or using AI to develop new products that go beyond conventional banking.

5. Establish a Clear AI Strategy

Banks need a well-defined AI strategy to succeed in this transformation. Without one, other banks proficient in AI will provide customers with more personalized services at lower costs.

These considerations can guide banks in making a successful shift toward an AI-centric approach.

Steps To Become An AI-First Bank

Step 1: Craft a Robust AI Vision

The journey to becoming an AI-first bank begins with a well-defined AI vision. This vision should seamlessly align with the bank’s core objectives and values while also taking into account industry standards and regulatory compliance. Conduct thorough internal market research to identify areas where AI can bridge existing gaps, ensuring a strategy that is both visionary and pragmatic. Remember, your AI strategy should be a guiding star for the entire transformation process.

Step 2: Identify High-Impact Use Cases

To harness the full potential of AI, identify high-impact use cases that resonate with your bank’s strategic direction. These use cases could span across customer service, risk management, fraud detection, and beyond. Evaluate the extent to which AI solutions can integrate into your existing processes or if any modifications are necessary.

Consider the example of a bank implementing AI in customer service to enhance chatbot capabilities, providing customers with instant, personalized support. This proactive approach not only improves customer satisfaction but also reduces operational costs.

Step 3: Develop, Test, and Deploy

Once you’ve pinpointed your use cases, it’s time to roll up your sleeves and dive into development. Start by building prototypes to understand AI technology’s strengths and limitations. Rigorously test these prototypes using relevant data to ensure accuracy and iterate as necessary.

Consider a situation where your bank is developing an AI-based credit risk assessment model. By training the model on historical data, you can predict potential loan defaults with higher precision, leading to better risk management decisions.

Step 4: Continuous Operations and Vigilant Monitoring

Transforming into an AI-first bank isn’t a one-time event; it’s an ongoing commitment. Establish a robust monitoring and evaluation cycle to continuously assess the AI model’s performance. This not only aids in managing cybersecurity threats but also ensures the smooth execution of operations.

Consider an AI-driven fraud detection system that constantly monitors transactions for unusual patterns. Regular monitoring allows your bank to stay ahead of evolving fraud tactics, protecting both the institution and its customers.

Step 5: Optimize Data Assets

In the AI-driven banking landscape, data is the key to success. To unlock the full potential of AI, prioritize the ease of access, preparation, and utilization of data. Efficient data handling and management are what transform ordinary AI models into invaluable assets.

Suppose your bank has a data lake that seamlessly integrates structured and unstructured data from various sources. This collection of data enables AI algorithms to provide deep insights into customer behaviors, preferences, and financial needs.

Step 6: Scale Infrastructure for AI

Scaling infrastructure is essential for an AI-first bank. To accommodate widespread experimentation and innovation, invest in a robust and scalable AI infrastructure. This empowers your bank to explore new AI use cases, adapt to market changes swiftly, and meet growing customer demands.

Step 7: Cultivate an AI-Driven Culture

Engaging employees in your AI journey is vital. Foster a culture that encourages staff to actively seek out new AI use cases in their daily tasks. By doing so, you tap into a valuable resource – the creativity and expertise of your workforce.

For instance, your bank employees are encouraged to propose AI-driven solutions for streamlining internal processes. This not only improves operational efficiency but also empowers staff to contribute to the bank’s AI transformation.

Step 8: Extend AI Services Beyond Banking

Think beyond traditional banking services. Explore opportunities to leverage AI in addressing customer needs beyond the realm of banking. Partner with other companies to offer complimentary services or create entirely new AI-powered products.

For instance, your bank could collaborate with fintech startups to provide AI-based financial planning tools, extending your services to help customers manage their investments and financial goals more effectively.

Technology Stack For A Bank Looking To Become AI-First

| Layer | Technology Stack | Purpose |

| Data Ingestion | Apache Kafka, AWS Kinesis, RabbitMQ | Real-time data streaming and ingestion |

| Data Storage | Hadoop HDFS, AWS S3, Google Cloud Storage | Scalable storage for structured and unstructured data |

| Data Processing | Apache Spark, TensorFlow, PyTorch | Data preprocessing, feature engineering, and model training |

| AI Modeling | Scikit-learn, Keras, XGBoost, H2O.ai | Building and fine-tuning AI models |

| Model Deployment | Docker, Kubernetes, AWS SageMaker | Deploying models to production environments |

| Monitoring & Logging | ELK Stack, Prometheus, Grafana | Real-time monitoring, error tracking, and logging |

| Automation | Apache Airflow, Jenkins, GitLab CI/CD | Automated workflows, model retraining, and deployment |

| Data Visualization | Tableau, Power BI, D3.js, Matplotlib | Creating interactive dashboards and reports |

| Security & Compliance | HashiCorp Vault, AWS IAM, OAuth2 | Ensuring data and model security, regulatory compliance |

| Customer Engagement | Chatbots, Natural Language Processing | Enhancing customer service and interactions |

| Cloud Infrastructure | AWS, Azure, Google Cloud Platform | Scalable and cost-effective cloud hosting |

Additionally, banks looking to embrace an AI-first approach often adopt a technology framework known as the integrated capability stack, which encompasses four fundamental layers:

1. Engagement Layer

This tier encompasses the various touchpoints where customers interact with the bank. It encompasses platforms such as mobile applications, websites, automated teller machines (ATMs), and more.

2. AI-Enhanced Decision-Making Layer

At the core of this layer are AI technologies that facilitate informed decision-making. This includes the deployment of machine learning models, natural language processing algorithms, and other AI-driven solutions.

3. Foundational Technology and Data Layer

This layer serves as the infrastructure backbone and data foundation for the bank. It comprises databases, cloud services, application programming interfaces (APIs), and other essential components.

4. Operational Framework

This layer encompasses the operational processes, governance frameworks, and human roles required to sustain an AI-first strategy effectively.

Future Of AI In Banking And Finance

The future of AI in the banking and finance industry is nothing short of revolutionary. Here’s an in-depth exploration of the trends and predictions that are set to redefine the financial landscape:

1. Quantum Leap with Generative AI

Banks are increasingly embracing Generative AI, characterized by powerful large language models (LLMs). These LLMs, empowered by natural language processing and AI machine learning, possess the remarkable ability to comprehend and generate human-like responses to user queries. Their impact is poised to be as transformative as the advent of the internet itself. The potential applications span from streamlined customer interactions to supercharged data analysis.

2. Hyper-Personalized Financial Guidance

AI’s future in finance extends to delivering highly tailored financial advice. It’s not merely about recommending products; AI will assist banks in identifying new revenue streams. Consider a financial advisor who intimately comprehends your unique financial situation, goals, and risk tolerance, providing precise insights that enhance customer experience and encourage unwavering loyalty.

3. Automation: Efficiency Redefined

Automation, powered by AI, plays a pivotal role in cost reduction. From automating customer service interactions to streamlining intricate back-office tasks, AI-driven automation stands as a critical driver of operational efficiency. Banks will allocate resources more judiciously, optimizing productivity and enhancing their competitive edge.

4. Risk Management Reinvented

AI’s expertise in risk management continues to evolve. It empowers banks with a deep understanding of potential risks, enabling informed decision-making and proactive risk mitigation. The future holds the promise of even more sophisticated risk assessment, ensuring resilience in a rapidly changing financial landscape.

5. Financial Inclusion for All

AI is a powerful driver of innovation and financial accessibility. Banks harness their capabilities to offer improved services, reduce risks, and extend financial accessibility to underserved populations. Financial inclusion isn’t just a goal; it’s an imperative that AI is propelling forward.

6. Disruptive Dynamics

The financial sector is experiencing swift changes, as seen in the asset management industry. Here, passive fund managers, empowered by AI and algorithms, are challenging the conventional active fund managers. This transformation vividly illustrates AI’s capacity to swiftly reshape industry dynamics.

How Idea Usher Can Help Your Business?

The integration of Artificial Intelligence (AI) into the banking and finance industry represents not just a fleeting trend but a significant shift towards enhanced efficiency, customer-centricity, and innovation. Leading the charge in this transformative journey are companies like Idea Usher, specializing in AI-related projects and offering invaluable support for harnessing AI’s potential to drive business growth.

At Idea Usher, our core expertise lies in aligning AI technologies with specific business objectives and crafting tailored AI solutions that cater to unique needs. This encompasses streamlining operations, elevating customer experiences, and automating tasks efficiently. Importantly, we provide cost-effective AI development services, ensuring a substantial return on investment.

Our solutions prioritize user experiences with responsive design, ensuring seamless functionality across various devices and platforms. Real-time capabilities are at the forefront of our AI applications, facilitating data-driven decisions on the go. In an increasingly mobile-centric world, our mobile optimization ensures that AI solutions are not only accessible but also user-friendly on smartphones and tablets.

By collaborating with us, your business can transform your AI ideas into high-performing applications, driving sustainable growth. Furthermore, we offer a diverse range of services, each tailored to specific needs, making us an ideal partner for AI development.

The future of banking and finance is AI-first, and with the right partner, businesses can convert their vision into a high-performing app. The journey towards becoming an AI-first bank is complex but achievable with the right strategy and partnership. So, contact us right away and get started with AI solutions for your business.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

Contact Idea Usher at [email protected]

FAQ

Q. How is AI improving customer experiences in banking?

AI is enhancing customer experiences by providing 24/7 support through chatbots and virtual assistants, offering quick responses and personalized solutions.

Q. What does it mean to become an AI-first bank?

Becoming an AI-first bank means prioritizing the integration of artificial intelligence throughout all aspects of banking operations to enhance efficiency and customer service.

Q. What is an AI-first bank, and how does it differ from traditional banks?

An AI-first bank is a financial institution that prioritizes artificial intelligence in its operations, leveraging AI for customer service, fraud detection, and personalized financial recommendations, setting it apart from traditional banks.

Q. What benefits can customers expect from an AI-first bank?

Customers of AI-first banks can expect faster, more personalized services, efficient issue resolution, and access to advanced financial tools and insights, all driven by cutting-edge AI technology.

Q. What are the key steps for a traditional bank to transition into an AI-first bank?

Transitioning into an AI-first bank involves investing in AI technologies, data analytics, training staff, and implementing AI-driven strategies to transform banking services and customer experiences.