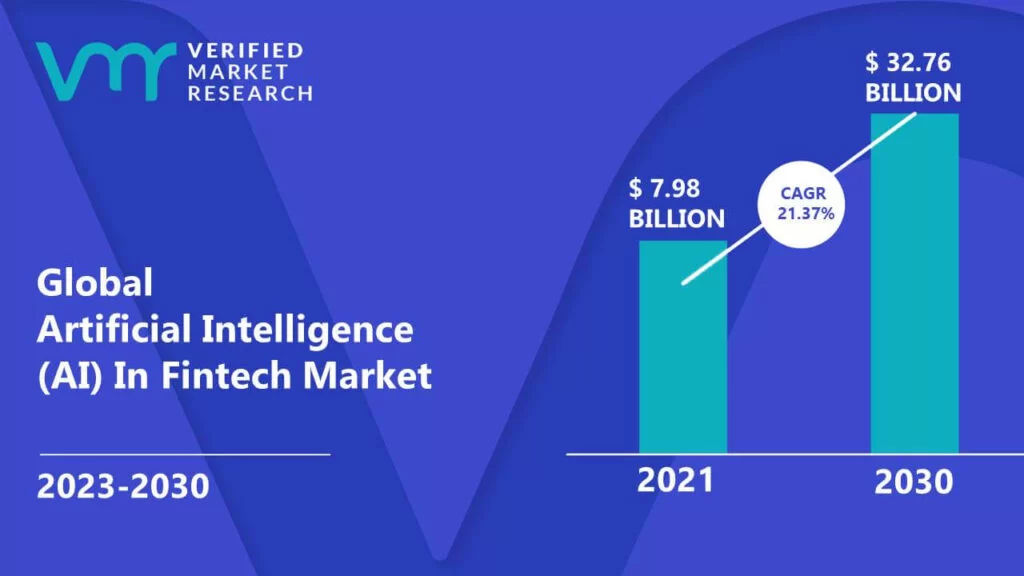

From automated trading algorithms to virtual assistants and chatbots. The fintech industry has seen a tremendous surge in AI-powered applications.

AI-powered fintech apps can analyze massive amounts of financial data and provide real-time insight to help financial institution improve their decision-making process.

Moreover, AI can help fintech users with automated financial planning to detect and prevent fraudulent activities. As the fintech industry grows continuously, financial institutions, businesses, and start-ups must keep up with the latest trends and technologies to remain competitive.

Incorporating AI into fintech applications is becoming crucial for businesses to provide cutting-edge financial experiences to their customers.

Explore the ways and means to integrate AI in fintech apps and how to build AI-powered fintech apps starting from scratch.

Let’s start first by knowing the benefits of AI in fintech apps.

Advantages Of Artificial Intelligence In Fintech Apps

AI has many advantages in Fintech apps, which are discussed below.

1. Reduce Operational Costs

Businesses can offer the benefits of innovation to customers only if they can manage their operational costs. Compared to traditional financial services, fintech apps offer high accessibility of services to their customers.

Intelligent automation driven by AI in fintech companies helped them reduce operational costs at various stages.

Additionally, assessment algorithms help companies build better financial products and predictive analytics help fintech businesses offer their customers the right products and services.

2. Automate Customer Support

Automated customer support is another key feature where AI is revolutionizing fintech apps. Chatbot is the best example of where the fintech businesses leverage them to manage basic customer queries and similar requests.

This helps Fintech businesses to free up their customer service representative from basic queries and focus on addressing complex questions of their customers.

Moreover, customers need instant responses that only AI-powered chatbots can handle. Also, many chatbots support multiple languages helping fintech businesses manage their global customers’ queries regarding the languages they understand.

3. AI-Powered Financial Advisor

Likewise, chatbots, AI-powered digital assistants, help fintech apps to offer financial advice and personal management services to their customers by utilizing NLP capabilities.

AI-powered financial advisers use machine learning algorithms to identify the patterns of their users’ transactions and spending habits and offer them better advice regarding managing their finances.

4. AI Stock Trading

Robo advisers use AI algorithms to analyze data sets and execute trades at optimal prices.

Users can also automate their trading strategy using AI in stock trading based on trading indicators’ crossover, candlestick patterns, etc. Moreover, trading bots comprise no human emotions, helping customers automate their strategies more easily.

5. More Accurate Fraud Detection

Banks and other financial services operate under strict regulations to focus on data security, fraud detection, etc. Fintech companies are not left behind when complying with the same regulation.

By leveraging artificial intelligence, companies can scan their transaction to detect and avoid fraud with the help of various pattern-matching techniques.

MasterCard is one of the best examples where they improved fraud detection techniques by developing its “Design Intelligence Platform” that only allows valid transactions.

What Are The Challenges Of AI In Financial Services?

The development of fintech apps using AI technology comprises the following challenges.

1. Scalability And Data Sensitivity

Managing a complex data set are one of the most significant challenges to scaling AI technology for the financial industry.

To overcome the scalability challenges, financial institutions may need to invest in comprehensive AI-based security systems, including advanced authentication methods, encryption technologies, and fraud detection software.

Moreover, engineers must implement machine learning techniques such as supervised, unsupervised and reinforced learning.

2. Compliance And Security

Every business must comply with a strict set of compliance standards in the financial industry. The company may face significant penalties if they fail to comply with the standards set of compliances.

Data security is another major concern that financial institutes must address by ensuring the company has developed a secure and reliable system to protect their data against potential attackers.

3. AI Talent Shortage

There is a global shortage of AI developers due to extreme competition from large tech companies with more resources and a need for more professionals and graduates with capable AI skill sets.

It would be best to outsource your fintech project to a reliable AI development company.

4. Transparency And Trust

AI algorithms need customer data to help them enhance better platform experience. However, accessing customer data creates trust issues among businesses.

Therefore, clarifying your decision to access customer data is crucial to maintain their trust in your fintech-based platform.

How To Integrate Artificial Intelligence In Fintech Apps?

The process of integrating AI in Fintech apps or building AI-powered Fintech apps starting from scratch is mentioned as follows.

1. Find What You Will Automate

It is worth noting that AI differs greatly from rule-based automation. Programming is involved in rule-based automation, whereas AI involves machine learning.

ML learns from experience and performs tasks better in an automated manner. Therefore, it becomes crucial for you to identify what business operations need to automate with the help of artificial intelligence in your Fintech business.

Many things can be automated in the fintech business, such as customer support with chatbots, identifying fraud detections, leveraging business operations, etc.

In this stage, you will need a software architect and project manager to identify better automation opportunities with artificial intelligence.

2. Plan The Data Sets For Your AI Solution

Data is the foundation of artificial intelligence and machine learning. You must carefully plan data models to train your AI/ML algorithms and help them deliver optimal value.

Employing a suitable AI development company can help you identify and prepare data sets based on your project needs.

After preparing the data sets, you can feed them to your AI/ML algorithms to train and automate your selected business operations.

3. Identify The AI Capabilities You Need

AI brings tremendous potential to fintech business with its wide range of capabilities. Fintech businesses can empower themselves by leveraging the following capabilities of AI.

This includes machine learning which includes useful capabilities, including a learning supervised algorithm and an unsupervised algorithm.

On the other hand, natural language processing (NLP) helps fintech businesses with text generation, machine translation, and answering questions.

Computer vision is another subfield of artificial intelligence that includes useful capabilities such as image recognition and machine vision. Speech is another valuable artificial intelligence subdomain that includes speech-to-text and text-to-speech capabilities.

4. Hiring An AI Development Company

You must identify and hire the best AI development company for your fintech project. You can go through the following screening guide to hire the best company.

- Accessing their AI development portfolios, particularly for the fintech industry

- Their proficiency in working with various AI-based algorithms, such as supervised, unsupervised, and reinforcement learning

- Take feedback from past clients.

Here is a detailed guide to hiring AI developers for your project.

5. Deploying And Maintaining AI-based Solutions

Regularly upgrading your AI-based platform with new features is a way to ensure its success in the long run.

Partnering with the right AI development company can help you add new features and functionality to your AI-based fintech platform to let it stay competitive.

Tech Stack To Develop AI-Powered Fintech Apps

The recommended tools to build your AI-powered fintech app is as follows:

| Application and data | Firebase, Swift, Kotlin Cloudinary, Realm |

| Utilities | Google Analytics, XCTest |

| DevOps | Crashlytics GitHub, Xcode, Fabric by Twitter. |

| Business tools | Sketch, Gmail, Sumerian, Invision, SwiftLint. |

| Neural Networks | CNN, RNN, Representation learning, Manifold learning, Variational autoencoders, Bayesian networks, Autoregressive networks |

| Algorithms | Supervised/unsupervised learning, Clustering (density-based Hierarchical, partitioning), Metric learning,Few-shot learning |

| Libraries | OpenNN, Neuroph, Sonnet, Tensorlfow, Tensor2Tensor, tf-slim |

| Modules/Toolkit | Microsoft Cognitive Toolkit, Core ML, Kurento’s computer vision module |

| DL Frameworks | PyTorch ,MXNet, Nvidia Caffe,Caffe2, Chainer, Theano |

Top 5 AI Fintech Startups For 2023

Explore the best AI startup in the fintech industry to get exposure to ideas regarding your business

1. Axyon AI

An Italian company that offers an investment management platform. They provide services related to hedge funds and commodity traders and assist managers with worldwide brands, including Microsoft, NVIDIA, and IBM.

| Founded in | 2016 |

| Available on | Web |

| Headquarters | Modena, Italy |

| Founders | Daniele Grassi, Giacomo Barigazzi, Jacopo Credi |

| Funding | $1.77M |

2. Forwardlane

A company that offers financial analytics systems with the integration of CRM technology. Their platform is powered by a natural language processing algorithm primarily targeting brokers and asset management firms.

Moreover, the company has partnered with global leaders such as Microsoft Dynamics, Thomson Reuters, Salesforce, etc.

| Founded in | 2015 |

| Available on | Web |

| Headquarters | New York, US |

| Founders | Nathan Stevenson |

| Funding | $8.2M |

3. Token Metrics

Token Matrix has its series of financial TV shows and proudly tagged itself as “Bloomberg for crypto”. However, the AI-powered analytics platform is their primary offering for the cryptocurrency market.

| Founded in | 2018 |

| Available on | Web |

| Headquarters | Washington, US |

| Founders | Ian Balina |

| Funding | $4.5M |

4. AiDA

A Singapore-based fintech company focusing primarily on insurance, fraud claim prevention, and helping underwriters. The company provides artificial intelligence and machine learning solutions for the financial industry.

| Founded in | 2016 |

| Available on | N/A |

| Headquarters | Singapore |

| Founders | Andrew Ang |

| Funding | N/A |

5. Active.Ai.

This company is specialized in creating advanced chatbots for the financial industry. Their powerful artificial intelligence engine “Trinity” creates meaningful engagement for the end users.

Visa, Axis Bank, and Kotak Mahindra Bank are some major brands partnered with Active.AI to deliver the best experience to their end users.

| Founded in | 2016 |

| Available on | Web, Mobile & Desktop |

| Headquarters | Singapore |

| Founders | Ravi Shankar, Parikshit Paspulati, Shankar Narayanan |

| Funding | $4.5M |

Conclusion

There are numerous benefits to the financial industry of integrating AI in Fintech apps. The AI-powered apps can process vast amounts of data and provide real-time insight.

Moreover, AI helps financial institutions to make more informed decisions and minimize fraud-related risks. Additionally, Fintech apps can empower them by leveraging the power of AI to improve their financial processes and increase efficiency.

The best way to build your AI-powered fintech app is to outsource your project to a reliable AI development company like Idea Usher.

The company has knowledge of the fintech industry and can provide end services from ideation to launch and maintenance for your AI-powered fintech app.

Their professional developers are experts in developing and implementing all the required features and APIs and integrating technologies such as AI, AR/VR, Blockchain, etc.

Contact us today to understand how we can help to develop your AI-powered fintech app. Know more about our AI development services.

Contact Idea Usher

Build Better Solutions With Idea Usher

Professionals

Projects

Email:

Phone:

FAQ

Q. How AI will impact the fintech industry?

A. AI-based products and services, including trading algorithms, financial advice, and automated customer service, will become major trend in the fintech industry and will improve financial services along with offering more control to users over their money in the coming years.

Q. How ML and AI have helped fintech companies?

A. Machine learning and algorithms have helped fintech industries with multiple use cases, including security and fraud detection assessment management, customer support, insurance, loans, personalizations, forecast, and improved financial decision-making.

Q. What are the key technologies that make fintech successful?

A. Blockchain, Artificial Intelligence (AI), Security, Internet of Things (IoT), and Cloud are key technologies that make fintech successful.