The global payments industry is changing significantly in 2026. Businesses and consumers want faster, safer, and cheaper ways to make transactions. Traditional payment systems depend on card networks and many middlemen. That’s why many companies have begun using A2A Pay-by-Bank apps. These apps enable easy account-to-account transfers that completely bypass traditional payment systems.

It helps lower operational costs, improves transaction security, and provides the smooth payment experiences that today’s customers want. Companies that invest in these direct banking solutions now can seize new opportunities and gain a strong advantage in a more connected marketplace.

Over the years, we’ve helped several businesses navigate the shift to A2A Pay-by-Bank solutions, offering a streamlined, transparent payment process that reduces dependency on card networks and lowers operational costs. With extensive experience in this space, IdeaUsher understands the challenges and opportunities, which is why we are writing this blog to discuss why A2A pay-by-bank apps are trending in 2026.

Key Market Takeaways for A2A Pay-by-Bank Apps

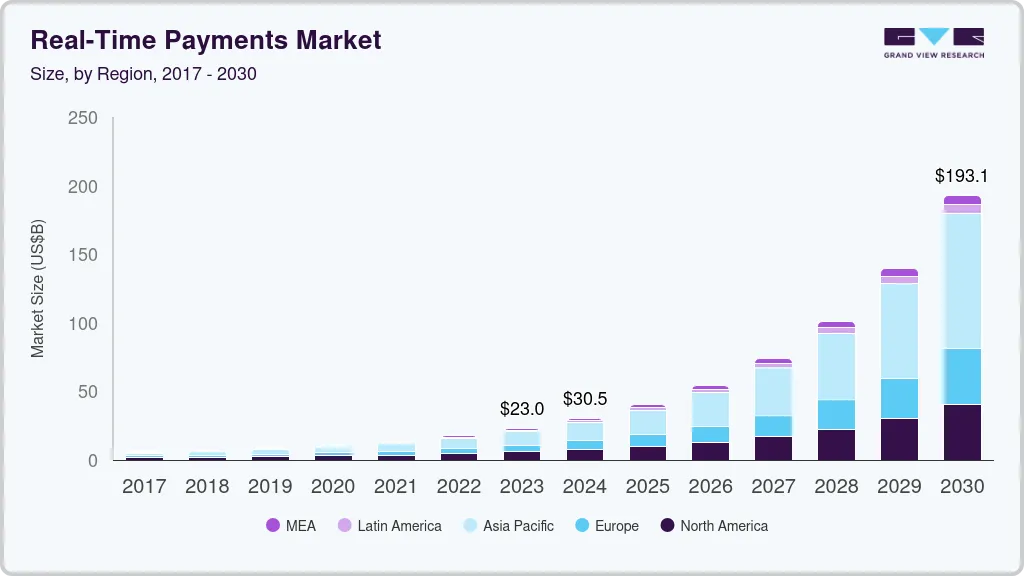

According to GrandViewResearch, the global real-time payments market was valued at USD 17.57 billion in 2022 and is expected to grow to USD 198.08 billion by 2030, with a CAGR of 35.5% from 2023 to 2030. A significant portion of this growth is driven by A2A payments, which are forecasted to reach $195 trillion globally by 2030. This shift is powered by growing demand for faster, more secure payment methods across various industries.

Source: GrandViewResearch

A2A pay-by-bank apps are becoming increasingly popular due to their speed, security, and lower costs compared to card-based payments.

Real-time payment systems like FedNow, UPI, and Pix are helping to accelerate this shift, while open banking initiatives make these payments accessible to millions of users. Merchants are also benefiting from instant settlement and reduced processing fees, making A2A payments an attractive option for businesses.

Key players like Trustly, Orum, Plaid, Stripe, Adyen, and Dwolla are shaping the A2A payment ecosystem. Trustly leads the charge in open banking solutions, while Orum and Plaid focus on providing API-driven A2A solutions. Meanwhile, payment platforms like Stripe and Adyen are expanding their offerings to support direct bank transfers, further boosting the adoption of A2A payments across the globe.

The Old System That Everyone Accepted (Until Now)

For decades, Visa and Mastercard have controlled the payment landscape. Their system, built on the four-party model (customers’ bank, merchants’ bank, card networks, and merchants), made global e-commerce possible. But in 2026, the old model feels outdated. It’s slow, expensive, and clunky for businesses looking for faster, cheaper, and more seamless transactions.

The Hidden Costs of Convenience

Card payments come at a high price for businesses:

- Interchange Fees: Merchants pay hefty fees (up to 3.5%) for every transaction, cutting into profits, especially for high-value items.

- Long Settlement Cycles: Funds from sales may take days to arrive, causing cash flow issues.

- Fraud and Chargebacks: Online fraud leads to chargebacks, with merchants footing the bill for lost revenue and additional fees.

Why Businesses Are Fed Up in 2026?

By 2026, the frustration with the old system has reached a boiling point. Several factors are converging to force change.

Pressure to Scale Globally

Businesses expanding internationally now face a labyrinth of different card rules, fees, and acceptance rates. The promise of universal acceptance no longer holds, especially when regional complexities start to strain the system.

Thinner Margins

In a world of economic pressures and fierce competition, businesses are trimming every fat expense. The high costs of card payments, once an accepted part of doing business, are now a target for optimization.

Customers Expect Instant Gratification

Today’s consumers expect instant transactions. A payment process that involves entering a 16-digit card number, expiry date, and CVV feels outdated, leading to cart abandonment and frustration.

The was no longer sustainable. Businesses are starting to ask the critical question: Why are we still using a financial system built for the past?

What Exactly are A2A Pay-by-Bank Apps?

A2A Pay-by-Bank apps let customers pay directly from their bank account to a business in real-time, skipping the traditional card networks. They use open banking APIs to securely initiate payments within the user’s own banking app. It’s a simple, fast, and secure way to pay without the middlemen.

Why It Feels Different for Businesses?

For businesses, A2A is more than just a technical upgrade, it’s a revolution in how payments are made.

- Immediate Cost Savings: By cutting out card networks, A2A payments drastically reduce transaction fees. A typical $1,000 sale that would incur $30 in card fees now costs only $1 in A2A fees. This difference transforms a business’s bottom line.

- Faster Revenue Access: Built on real-time payment rails like FedNow (U.S.) or SEPA Instant (Europe), A2A payments are nearly instant. The funds arrive in seconds, not days, which boosts cash flow and makes financial management far easier.

- Stronger Fraud Defenses: The “push” model of A2A payments is far more secure than the “pull” model of cards. Instead of a merchant pulling funds from a card, the customer authorizes the payment within their secure banking environment, using multi-factor authentication or biometrics. This eliminates the risk of card details being stolen and greatly reduces chargebacks.

For example, Stripe offers A2A payments, letting customers complete purchases directly from their bank accounts. A buyer selects “Pay by Bank” for a $2,500 sofa, authenticates via fingerprint in their bank app, and the payment is instantly processed. The store skips hefty card fees, saving over $75, and gets the funds immediately.

Why It Feels Different for Customers?

For consumers, A2A payments offer an entirely new experience.

- Seamless, One-Click Checkout: Once linked to their bank account, future payments require just a single click, with no need for entering card details. This makes the process faster and smoother than using a card.

- No Card Details to Enter: Customers don’t need to dig out their wallet or worry about an expired card. The checkout is faster, simpler, and less frustrating.

- Bank-Level Trust: Payments are authenticated in the customer’s trusted bank app, which feels safer than entering card details on a merchant’s website. This reinforces trust and improves security.

For example, Klarna’s “Pay Now” or Trustly’s “Instant Bank Transfer” options let customers pay directly from their bank accounts. A shopper buying $150 of groceries selects “Pay Now,” authenticates with Face ID in their bank app, and the payment completes within seconds. No card is needed, and the process feels fast, simple, and secure.

How Do A2A Pay-by-Bank Apps Work?

In the traditional card model, every payment is a multi-step relay: the user enters card details, the merchant’s bank communicates with the card network, which contacts the user’s bank for approval, and the response travels back the same way. Funds are settled days later, and each player takes a fee.

A2A simplifies this into three players: the user (payer), the payee, and a Payment Initiation Service under Open Banking. There’s no card network tollbooth, funds move securely, directly, and instantly between bank accounts.

Here’s the precise sequence of events when a user uses an A2A Pay-by-Bank app.

Step 1: The Invitation

At online checkout, the user selects the “Pay by Bank” option (or a similar label like “Instant Bank Transfer”). The merchant’s website is integrated with an A2A payment provider such as Stripe, Klarna, or Trustly.

Step 2: The Secure Handoff

The user is seamlessly redirected to a screen hosted by the payment provider to search for and select their bank. This is a secure connection facilitated by Open Banking APIs, regulated standards that ensure safe communication between financial players.

Step 3: Authentication

The user is securely passed to their bank’s authentication environment. This could be a bank mobile app or a secure login portal. Identity verification typically uses biometrics (Face ID, fingerprint) or two-factor authentication. The merchant or A2A provider never sees login credentials, they only receive a secure token confirming successful authentication.

Step 4: Payment Order

Once authenticated, the bank receives a payment instruction from the A2A provider via an API: “Please send $X to Merchant Y’s account.” The user confirms the details and authorizes the transfer. This is a “push” payment, the user actively instructs the bank to send funds, unlike card payments where the merchant “pulls” funds.

Step 5: Instant Settlement

The bank debits the user’s account and sends funds directly to the merchant’s bank via real-time payment rails, such as:

- RTP Network or FedNow (US)

- Faster Payments (UK)

- SEPA Instant Credit Transfer (EU)

Settlement completes within seconds, and the merchant receives immediate confirmation.

Technology Behind the Scenes

Three key technologies enable this “direct tunnel”:

- Open Banking APIs: Secure channels that allow the A2A app to request payment initiation from the user’s bank without needing their password.

- Payment Initiation Services (PIS): Licensed fintech providers authorized to initiate payments on behalf of users.

- Real-Time Payment Rails: The infrastructure banks use to settle funds instantly, 24/7/365, allowing A2A payments to move at high speed.

With this setup, A2A Pay-by-Bank apps deliver instant, low-cost payments while keeping sensitive data private and secure.

Why A2A Pay-by-Bank Apps Are Trending in 2026?

In 2026, A2A pay-by-bank apps are gaining rapid adoption, reshaping payments for businesses and consumers alike. This trend is driven by technology, economic pressure, and changing business priorities. Companies aren’t asking whether to adopt alternative payments; they’re asking which solution gives them a competitive edge. A2A payments are emerging as the clear winner.

1. The Economic Imperative: Cutting Costs

Rising fees and slim margins are pushing businesses to re-evaluate every cost. Traditional card payments, with 2–3% interchange fees, are increasingly seen as wasteful. A2A payments bypass card networks entirely, replacing variable fees with small, fixed charges. For merchants handling large volumes, this can mean thousands in savings monthly.

For instance, Shopify merchants using Stripe’s A2A feature, “Pay by Bank,” avoid card network fees entirely. For a $50,000 monthly seller, this can save over $1,000 compared to standard card processing.

2. The Cash Flow Revolution: Instant Access to Funds

Waiting days for card settlements slows business operations. A2A apps use real-time payment rails like FedNow, Faster Payments, or SEPA Instant, providing instant settlement. This speed turns cash flow from a reactive challenge into a strategic advantage. Businesses can reinvest revenue immediately, pay suppliers faster, and reduce reliance on credit lines.

For example, an online travel agency using Trustly’s Instant Bank Transfer can receive €3,000 for a vacation package within seconds via SEPA Instant, ensuring immediate liquidity for operational needs.

3. Security Awakening: Reducing Fraud Risks

Card-not-present fraud and chargebacks cost businesses billions. A2A payments change the model from “pull” to “push.” Users authorize payments directly from their banks using strong authentication like biometrics. Sensitive card details never leave the bank, drastically reducing fraud and chargeback risk.

For example, Banked’s PIS platform ensures users authenticate directly with their banks. Merchants never see sensitive data, and payments are verified and secure, minimizing fraud exposure.

4. Regulatory Tailwind: Open Banking Goes Mainstream

Open Banking has evolved from a niche compliance requirement to a global standard. Regulations like PSD2 in Europe have forced banks to open secure APIs to licensed providers. This makes A2A payments easier to integrate and safer to use, creating the infrastructure for mass adoption.

Plaid for example, connects users’ bank accounts securely and enables direct payments. Freelancers can pay invoices instantly from their bank account through apps built on Plaid’s regulated platform.

5. Consumer Experience Upgrade: Frictionless Payments

Consumers demand speed and simplicity. Manually entering card details leads to cart abandonment. A2A Pay-by-Bank apps streamline checkout: authentication can happen with a fingerprint scan or Face ID, reducing friction and improving conversion.

Klarna’s “Pay Now” lets users authenticate directly in their bank app at checkout. The process is instant, secure, and familiar, eliminating the friction of card entry while leveraging trust in the user’s own bank.

Use Case: A2A Payments in E-Commerce

One of our clients, a fast-growing e-commerce business in smart home devices, came to us facing a few tough challenges. Their success was being overshadowed by high transaction fees, constant chargebacks, and cash flow delays. These issues were draining profits and holding them back from scaling efficiently.

- Sky-High Card Processing Fees: With a strong average transaction value, the standard 2.9% + $0.30 card fees took a huge chunk out of their revenue. A significant portion of their profits was slipping away into transaction costs—funds that could have been reinvested into growth.

- The Chargeback Battlefield: As a popular online retailer, chargebacks were a constant issue. The time and resources spent disputing these claims were mounting, and the losses were growing, damaging their relationship with payment processors.

- Cash Flow Lag: The traditional 2-3 day settlement cycle from card payments left them in a constant state of cash flow uncertainty. This delayed access to funds made it hard to manage inventory purchases and take advantage of market opportunities. They were successful, but were always waiting for their money.

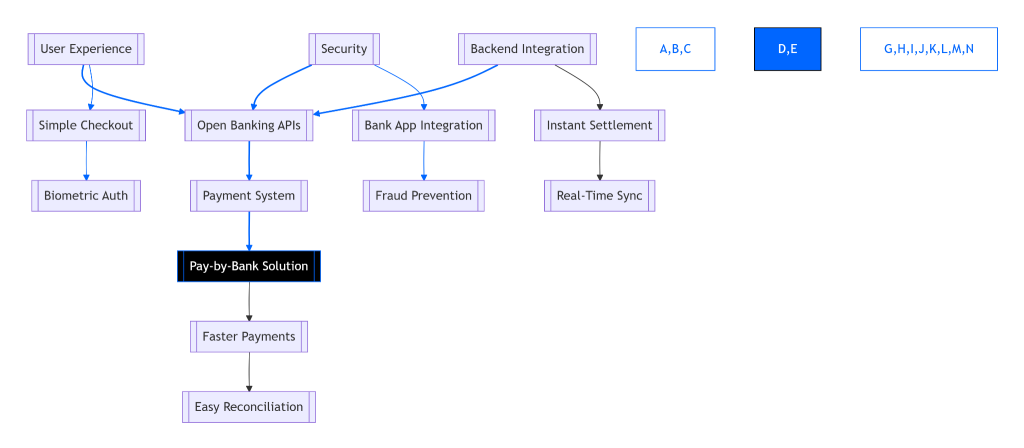

The Solution: Building a Seamless A2A Pathway

Our task wasn’t just to add another payment method; it was to craft a superior financial experience. We created a custom A2A Pay-by-Bank solution that seamlessly integrated into their checkout process.

Here’s how we tackled the challenge:

Frictionless User Experience

We made the checkout process super simple by clearly highlighting the “Pay by Bank” option. Using secure Open Banking APIs, customers were directed to their mobile banking app for easy, biometric authentication. The result was a quick, secure, and modern payment experience that customers loved.

Bank-Level Authentication & Security

We built the solution on top of the customer’s own banking app, which made authentication super secure. By using the same security as logging into a bank, we practically eliminated the risk of card-not-present fraud. It gave both us and the customer peace of mind.

Robust Back-End Integration

We built a robust backend system that routed payments through the fastest channels for instant settlements. This allowed real-time transaction updates and seamless syncing with the client’s order management system. The result? Effortless reconciliation and smooth tracking.

The Results: A Transformation in Efficiency

The impact was immediate:

- 70% Reduction in Payment Processing Costs: With A2A payments, transaction fees dropped significantly. This cut down their operating costs and improved their bottom line.

- Virtual Elimination of Chargebacks: Direct authentication from the customer’s bank made disputes over “unauthorized” transactions nearly impossible, effectively eliminating chargebacks and their associated costs.

- Instant Cash Flow: Payments were settled nearly instantly, improving their financial planning and giving them immediate access to capital. They could now move quickly on inventory and market opportunities, driving agility in a competitive landscape.

For this client, A2A wasn’t just a new feature, it was a strategic upgrade that reinforced and optimized their business model.

Conclusion

2026 is the year A2A payments take center stage, transitioning from a mere experiment to a game-changing revolution. For businesses, it’s all about reducing costs, accelerating cash flow, and enhancing customer satisfaction. It’s a win-win. For platform owners, A2A presents an unparalleled opportunity to unlock fresh revenue streams and stay ahead of the competition. At Idea Usher, we don’t just follow trends, we shape them. Let us help you build a platform that harnesses the power of A2A, driving innovation and growth for your business.

Looking to Develop an A2A Pay-by-Bank App?

The future of payments is direct, seamless, and incredibly cost-effective. At Idea Usher, we help you tap into this potential with a custom A2A Pay-by-Bank App that doesn’t just follow trends but sets them.

We offer more than just code, we bring a mindset shaped by the world’s leading tech companies. With over 500,000 hours of development experience, our team of ex-MAANG/FAANG engineers delivers scalable, secure solutions that go beyond mere promises.

- Built to Scale: Architectures designed to handle millions of transactions.

- Bank-Grade Security: Developed by the same minds behind systems for billions of users.

- Seamless UX: Intuitive flows that increase conversion rates.

Don’t just offer another payment method, launch a strategic advantage. Check out our latest projects to see the exceptional quality we bring.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: A2A payments are more direct, faster, and cheaper than credit cards, as they bypass traditional card networks. This reduces transaction fees and speeds up the payment process, making it a more cost-effective option for both businesses and consumers.

A2: Yes, A2A apps can manage recurring billing through pre-authorized mandates and automated workflows. This allows businesses to easily handle subscriptions and regular payments without requiring constant input from the customer.

A3: Yes, A2A Pay-by-Bank apps are highly secure. They use bank-level multi-factor authentication (MFA) and biometric verification to ensure that only authorized users can complete transactions, providing a safe and reliable payment experience.

A4: A2A apps are ideal for industries like e-commerce, B2B payments, subscriptions, travel, and high-value retail. These sectors benefit from faster, more secure transactions and lower fees, enhancing both customer satisfaction and business efficiency.