Sometimes, managing our finances can feel like a roller coaster ride! You make a budget, but then surprise expenses pop up, leaving you scrambling. You know you want to save for that dream vacation, but tracking every penny feels like a chore. This is where budgeting apps like Simplifi come in, making things easier for you.

Boasting over a million users and consistently receiving positive reviews, Simplifi simplifies budgeting through features like automatic transaction categorization, personalized spending insights, and goal tracking. By utilizing these tools, individuals can take charge of their finances, make well-informed decisions about their spending, and ultimately reach their financial objectives. This creates a promising opportunity for companies to venture into the personal finance app sector by creating a similar app.

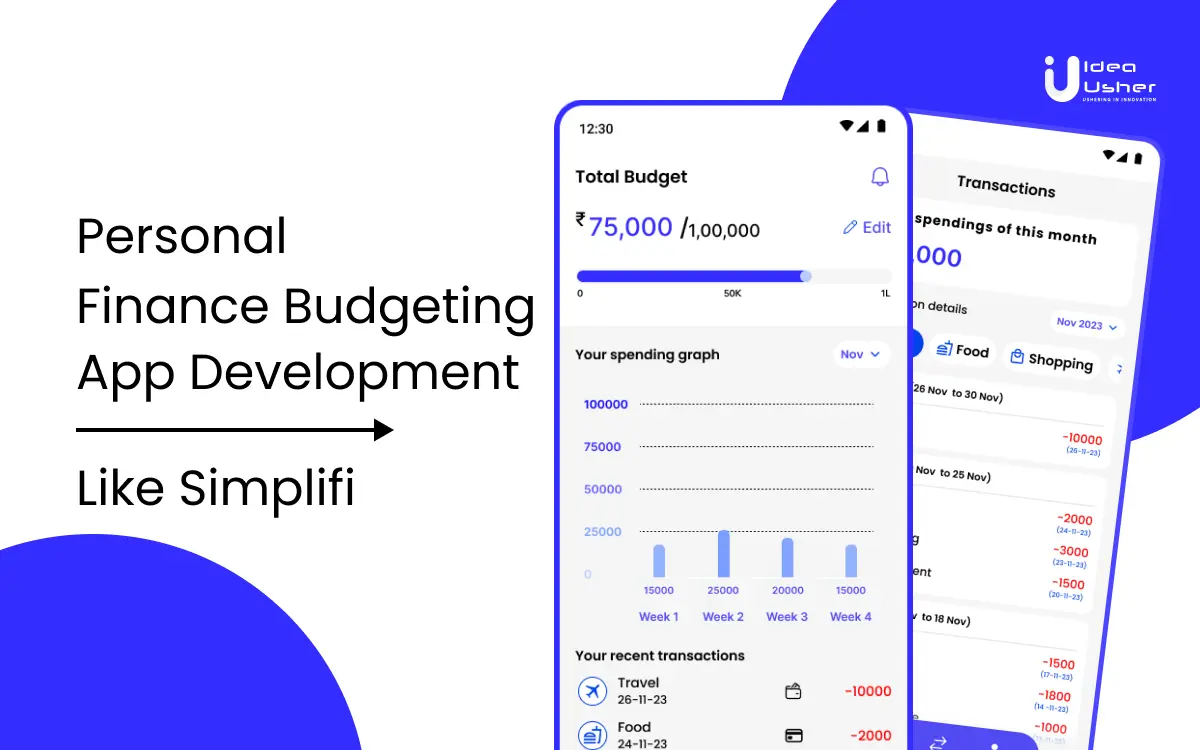

In this blog post, we’ll explore the intricacies of developing a robust and user-friendly personal finance budgeting app, equipping businesses with the knowledge to navigate this promising market.

What is the Simplifi App?

Owned by financial software giant Quicken, Simplifi is a personal finance app that helps in money management through user-friendly features. It automatically categorizes transactions, offers personalized insights into spending habits, and tracks progress toward financial goals. By providing a clear picture of your finances, Simplifi empowers users to make informed spending decisions and achieve financial wellness. The app was launched in 2020, and it quickly gained traction, attracting over a million users within a few years.

What Makes the Simplifi App Stand Out?

Simplifi cuts through the clutter with its user-centric design and focus on practical financial guidance. Unlike some competitors that overwhelm users with intricate features, Simplifi prioritizes intuitive navigation and clear data visualization.

Simplifi’s “Auto-Categorization” feature automatically sorts transactions into spending categories like groceries, dining, or entertainment. This eliminates the need for manual data entry, saving users valuable time and ensuring accurate budgeting. Furthermore, the app’s “Goals” functionality empowers users to set specific savings targets, like a dream vacation or a down payment on a house. Simplifi then tracks progress towards these goals through a user-friendly interface, providing regular updates and motivation to stay on track.

Additionally, the app’s “Spending Trends” breakdown helps app users identify areas where they can potentially make some savings. This empowers them to optimize their budgets and reach their financial goals faster.

Key Market Takeaways for Personal Finance Mobile App

According to FactMR, the personal finance mobile app market is experiencing explosive growth, driven by a surge in smartphone usage and a growing desire for financial control. With over 70% of smartphone users turning to finance apps, this trend is expected to continue through 2031. This widespread adoption presents a significant opportunity for businesses.

Source: FactMR

The high penetration of personal finance apps, with an average of 2.5 per smartphone, allows for the collection of valuable user data. This data includes bank account details, spending patterns, and other financial insights. By analyzing this data, businesses can gain a deeper understanding of consumer behavior and archetypes.

Furthermore, the rise of AI is transforming the personal finance app landscape. Recognizing the potential of AI to provide better money management tools, many app developers and established financial institutions are putting their money into this technology. For example, Chime recently secured $750 million in funding to enhance its AI capabilities and become a market leader. Similarly, U.S. fintech startup Albert raised $100 million to develop its AI-powered financial management platform further.

Why Are Personal Finance Budgeting Apps a Lucrative Investment?

These days, consumers actively seek user-friendly tools to manage their finances and make informed decisions. This presents a compelling opportunity for companies to invest in personal finance budgeting app development.

1. Soaring Demand and Shifting Preferences

The demand for personal finance management tools is skyrocketing. A report indicates that mobile finance apps surpassed 573 million downloads in the US alone in 2021, reflecting a 19% increase from the previous year. This trend is fueled by the widespread use of smartphones and digital gadgets. More and more consumers are turning to mobile apps for financial management, looking for easy methods to monitor their spending and maintain their budgets.

2. Recurring Revenue Potential

Beyond the initial app download, personal finance budgeting apps offer the potential for ongoing revenue generation. Many successful apps implement a freemium model, providing basic features for free while offering premium features through subscriptions or in-app purchases.

For instance, Mint, a popular budgeting app owned by Intuit, boasts a freemium model with paid tiers offering additional features like credit monitoring and bill pay. Additionally, in-app advertising can be another revenue stream, allowing businesses to partner with relevant financial institutions or service providers. This strategy can generate a reliable and consistent revenue stream for businesses, making personal finance budgeting app development a financially attractive proposition.

3. Room for Innovation in a Growing Market

While the personal finance app market is experiencing significant growth, there’s still room for innovative concepts. While established players like Mint and YNAB hold a significant market share, there’s a gap for apps catering to specific demographics or offering unique features. For example, an app focused on helping millennials manage student loan debt or one designed specifically for freelancers could attract a dedicated user base. By identifying these untapped market segments and developing creative, user-friendly solutions, businesses can carve a niche for themselves and stand out from the competition.

What are the Must-Have Features for Personal Finance Budgeting App?

Personal finance budgeting apps have become essential tools for individuals and businesses looking to manage their finances effectively. Let’s explore the must-have features that can make a personal finance budgeting app truly unique.

1. User Registration/Login

A seamless user signup and login process is crucial for any personal finance app. The registration should be straightforward, asking only for essential information such as name, email, and password. Clear labeling for input fields and data verification ensures accuracy. Upon successful registration, a confirmation email should be sent to the user. Additionally, providing feedback for user errors helps improve the overall experience.

2. Payment Service Integration

Integrating payment services enhances the user experience by facilitating convenient financial transactions. A user-friendly interface for payment integration allows app users to link their personal bank accounts, debit cards, and other payment methods effortlessly. This feature is essential for smooth and efficient money management.

3. Engagement Through Gamification

Gamification features in personal finance apps significantly boost user engagement and retention. By offering rewards, bonuses, and gifts for achieving specific financial tasks, these apps encourage users to stay on track with their financial goals. Gamification not only makes financial management fun but also motivates users to improve their financial habits.

6. Investment Monitoring

Investment tracking is a vital feature for those looking to grow their wealth. Personal finance apps should include tools to track expenses and manage investment plans. Notifications for overspending help users stay within their budget, while an investment tracker keeps them informed about market trends and their portfolio’s performance, including mutual funds and real estate investments.

7. Budgeting & Expense Management

Effective budgeting and expense management are the core functions of any personal finance app. Offering various budgeting options—weekly, monthly, and yearly—helps users plan their finances according to their needs. These apps should provide tools to track spending, categorize expenses, and generate detailed reports, enabling users to manage their finances more effectively.

8. Enhanced Security Measures

Security is a top priority for personal finance apps. High-end encryption and secure cloud infrastructure are essential to protect user data from breaches, bot attacks, and hacking. Robust security measures ensure that users can access their financial accounts safely, fostering trust and confidence in the app.

9. Reminders and Notifications

Timely alerts and notifications keep users informed about important financial activities. These include reminders for bill payments, deadlines, and milestones. By keeping users updated, these features help prevent missed payments and ensure that users stay on track with their financial goals.

10. Data Representation

Data visualization tools, such as infographics and interactive charts, make financial information easy to understand. An interactive dashboard allows users to manage their finances more effectively by providing a clear and concise overview of their financial status. These visual tools are essential for making informed financial decisions.

11. AI-driven Assistance

AI-powered assistance sets modern personal finance apps apart from their competitors. Using advanced algorithms, these apps provide actionable insights that help users achieve their financial goals. AI can analyze spending patterns, suggest budgeting tips, and offer personalized financial advice, making financial management more efficient and effective.

12. User-Friendly Interface

It is crucial to have a user-friendly interface to ensure a positive user experience. An intuitive design and seamless navigation make it easy for app users to access various features and manage their finances without any hassle. A well-designed interface enhances user satisfaction and encourages regular use of the app.

13. Customer Support

Having reliable customer support is also quite important for addressing user queries and resolving issues promptly. When there are multiple support channels available, such as chat, email, and phone, users can get the help they need. Responsive customer support can help in enhancing user trust and loyalty.

14. Customization and Personalization

Personal finance apps should offer customization and personalization options to cater to individual user preferences. Tailored financial solutions, such as personalized budgets and investment plans, enhance the app’s relevance and usefulness. Allowing users to customize settings and preferences ensures a more personalized financial management experience.

15. Cross-Platform Compatibility

Cross-platform compatibility is essential for accessibility and convenience. Personal finance apps should be accessible across various devices, including smartphones, tablets, and desktops. Syncing data in real-time ensures that users can seamlessly manage their finances, regardless of the device they are using.

How to Develop Budget Apps like Simplifi?

Budgeting apps like Simplifi offer a seamless way for people to track their spending, save money, and achieve financial goals. The development of such apps requires a structured approach to ensure they meet users’ needs and stand out in a competitive market. Here’s the step-by-step process to create a budget app,

1. Market Research

Before diving into app development, conducting thorough market research is essential. Understanding the competitive landscape helps identify opportunities and gaps in existing budget apps. Analyzing user reviews and feedback on popular apps provides insights into what app users like and dislike, guiding the development of a superior product.

2. Defining App Goals & Objectives

It is important to clearly define the goals and objectives of the app as this sets the foundation for its success. Whether the purpose is to help users save more effectively, provide detailed spending reports, or integrate with various financial institutions, having a clear and specific purpose drives the development process.

Identifying the target audience is crucial for the app’s design and functionality. Understanding who will use the app helps tailor its features to meet their specific needs, ensuring higher user satisfaction and engagement.

3. Developing User Personas

Creating detailed user personas helps businesses understand the app’s potential users better. These personas include information like age, occupation, financial habits, and pain points, guiding the design and functionality to cater to these users effectively.

4. Establishing Core Features

Determining the core features of the app is a critical step. Essential features for a budgeting app might include expense tracking, budget creation, goal setting, and financial insights. These features should align with the app’s goals and user needs.

5. UI/UX Designing

A well-designed UI and UX are paramount for the success of a budgeting app. The design should be intuitive, making it very easy for app users to navigate and perform tasks efficiently.

6. Creating Wireframe and Prototype

Creating wireframes and prototypes allows developers to visualize the app’s layout and flow. These tools can help in identifying some potential issues early in the development process and provide a tangible representation of the app’s design.

7. Visual Design Alignment

Ensuring the visual design aligns with the app’s purpose and target audience is crucial. The design should be appealing yet functional, providing a pleasant user experience without compromising on usability.

8. Usability Testing

Conducting usability tests with real users helps identify design flaws and usability issues. Feedback from these tests can be used to make necessary adjustments, ensuring that the app is user-friendly and meets user expectations.

9. Incorporating Essential Features

Incorporating essential features is vital for the app’s functionality. Features like transaction categorization, budget creation, expense tracking, and financial insights are fundamental to a budgeting app’s success.

10. Cost Considerations for Basic vs. Advanced Features

Balancing the cost of development with the app’s features is a key consideration. Basic features are essential, but advanced features like AI-driven insights or real-time financial tracking can enhance user experience and differentiate the app from competitors.

11. Choosing Tech Stack

To make sure everything works smoothly within the app, you also have to choose a proper tech stack,

Hybrid: React Native, Flutter

Choosing a hybrid tech stack like React Native or Flutter allows for cross-platform development, reducing time and cost. These frameworks enable developers to write code just once and deploy it on both iOS as well as on Android platforms.

Frontend: Angular, React JS

For the frontend, frameworks like Angular and React JS offer robust solutions. They provide the tools needed to create a responsive and dynamic user interface, which is essential for a budgeting app.

Native: Objective C, Swift, Kotlin

For a more tailored user experience, developing natively using languages like Objective C and Swift for iOS or Kotlin for Android can be beneficial. Native development often results in better performance and a more seamless user experience.

Backend: .NET, Python, Java, Node JS, PHP, TypeScript

The backend of the app handles data processing and storage. Choosing a robust backend tech stack like .NET, Python, Java, Node JS, PHP, or TypeScript ensures the app can handle user data securely and efficiently.

12. Development Process

The development process involves building the front end and back end simultaneously. This ensures that the app’s interface and functionality are developed cohesively, resulting in a seamless user experience.

13. Ensuring Scalability and Security

Scalability and security are crucial in app development. The app must handle a growing number of users and transactions while safeguarding user data from breaches and unauthorized access.

14. Integration with Financial Institutions

Integrating the app with financial institutions enables app users to connect their personal bank accounts, debit cards, and even financial accounts. This provides a comprehensive view of their finances and enhances the app’s functionality.

15. Manual and Automated Testing

Testing is also a crucial phase in app development. Both manual and automated testing should be conducted to figure out and rectify any bugs or issues. This ensures that the app is dependable and performs well under various conditions.

16. Deployment Strategy for App Stores

A properly planned deployment strategy is essential for a successful app launch. Submitting the app to app stores, optimizing the app listing, and planning marketing efforts are key steps in this phase.

17. Post-Launch Monitoring

After the app is launched, continuous monitoring is necessary to ensure it performs well. Gathering user feedback, tracking app performance, and making necessary updates keep the app relevant and functional.

Cost of Developing a Personal Finance Budgeting App like Simplifi

| Stage | Cost Range | Description |

| Research & Planning | ~$5,000 – $15,000 | Market research, feature scoping, UI/UX design wireframes and prototypes. |

| – Market Research: ~$2,000 – $5,000 | ||

| – Feature Scoping: ~$1,000 – $3,000 | ||

| – UI/UX Design: ~$2,000 – $7,000 | ||

| Development | ~$75,000 – $300,000+ | Frontend, backend, mobile app development, API integrations. |

| – Frontend Development: ~$20,000 – $75,000 | ||

| – Basic Interface: ~$20,000 – $35,000 | ||

| – Advanced Interface: ~$50,000 – $75,000 | ||

| – Backend Development: ~$40,000 – $100,000+ | ||

| – Core Functionality: ~$40,000 – $60,000 | ||

| – Complex Integrations & Security: ~$60,000 – $100,000+ | ||

| – Mobile App Development: ~$20,000 – $100,000+ | ||

| – Basic Mobile App: ~$20,000 – $40,000 | ||

| – Full-Featured Mobile App: ~$50,000 – $100,000+ | ||

| – API Integrations: ~$5,000 – $20,000 | ||

| App Features | Variable Cost | Basic budgeting, tracking, advanced features. |

| – Basic Budgeting & Tracking: ~$5,000 – $15,000 | ||

| – Advanced Features (per feature): ~$10,000 – $50,000+ | ||

| – Automated Goal Tracking: ~$10,000 – $15,000 | ||

| – Debt Payoff Calculators: ~$15,000 – $20,000 | ||

| – Investment Tracking: ~$25,000 – $50,000+ | ||

| Testing & Deployment | ~$5,000 – $15,000 | Unit testing, integration testing, usability testing, deployment. |

| – Unit Testing: ~$1,000 – $3,000 | ||

| – Integration Testing: ~$1,000 – $2,000 | ||

| – Usability Testing: ~$2,000 – $5,000 | ||

| – Deployment: ~$1,000 – $5,000 | ||

| UI/UX Design | ~$5,000 – $20,000 | Visual design, usability testing, refining UI/UX. |

| – Visual Design: ~$3,000 – $10,000 | ||

| – Usability Testing: ~$2,000 – $10,000 | ||

| Total Cost Range | ~$125,000 – $400,000+ | Overall cost range depending on features, team location, and project scope. |

Apart from the core cost mentioned in the above table, here are some variable costs that can affect the overall development cost,

1. Financial Institution Integrations

Securely connecting with banks and financial institutions through APIs requires specialized development practices and can be a significant cost factor depending on the complexity of the data retrieved.

2. Data Visualization Prowess

Simplifying complex financial data is key for user engagement. Interactive charts, graphs, and customizable dashboards showcasing spending trends and progress toward goals require specialized data visualization libraries and development expertise, adding to the cost.

3. Real-Time Updates

Features like instant balance updates and low-balance alerts necessitate real-time communication between the app and user devices. Implementing WebSockets or server-sent events for efficient two-way data flow adds complexity and cost to the backend development.

4. Account Aggregation Complexity

The ability to connect to various financial institutions seamlessly is a major convenience for users. However, integrating with different banks and credit unions’ APIs can be a challenge. The complexity of data retrieved (transactions, account balances) and the number of institutions supported all influence development costs.

Tech Stacks Required to Develop a Budgeting App

Developing a budgeting app like Simplifi requires a well-rounded tech stack. Here’s what you need to get started,

1. Frontend Development

First comes the front end, which deals with everything the app user sees and interacts with,

Languages and Frameworks

HTML, CSS, and JavaScript serve as foundational languages for developing the user interface (UI). These are often augmented with frontend frameworks like React, Angular, or Vue.js, which facilitate the creation of responsive and interactive UI components crucial for user engagement.

Third-Party Libraries

The utilization of libraries such as Chart.js, D3.js, or Highcharts enhances the app’s capability to display dynamic charts, graphs, and other UI elements. These libraries improve the user experience by presenting financial data in a visually appealing format.

2. Backend Infrastructure

Next, work on the backend, which makes sure that everything on the app works smoothly,

Programming Languages

Python, Java, or Node.js are preferred languages for backend development due to their scalability and compatibility with various frameworks and libraries.

Frameworks

Frameworks such as Django (Python), Spring (Java), or Express.js (Node.js) provide robust tools and libraries that streamline backend development. These frameworks offer ready-made modules for authentication, data handling, and API integration, accelerating the app development process.

3. Relational Databases

MySQL, PostgreSQL, or SQLite are optimal choices for storing financial data such as transactions, budgets, and financial goals. These relational databases offer strong querying capabilities and ensure data integrity, which is essential for maintaining accurate financial records.

4. Cloud-Based Storage

Implementing cloud storage solutions like Amazon S3 or Google Cloud Storage ensures scalable and secure storage for user documents and non-relational data. Cloud storage enhances accessibility and reliability, which is crucial for managing user data across different devices and locations.

5. Deployment and Scalability

Deploying the app on cloud platforms such as AWS (Amazon Web Services), Azure, or Google Cloud Platform provides scalability, reliability, and seamless integration with other cloud services. Cloud deployment enables the app to handle varying loads and ensures high availability, which is essential for delivering a consistent user experience.

6. Authentication and Authorization

Integrating proper authentication mechanisms, such as OAuth or JWT (JSON Web Tokens), ensures secure user login and access control. Authorization frameworks like RBAC (Role-Based Access Control) manage user permissions effectively, safeguarding sensitive financial information from unauthorized access.

7. Data Encryption

Utilizing industry-standard encryption protocols (e.g., AES-256) ensures data security both at rest and in transit. Encryption protects sensitive financial data from potential threats and breaches, maintaining user trust and compliance with data protection regulations.

8. Machine Learning Applications

Integrating machine learning algorithms enables automated transaction categorization, personalized budget recommendations, and fraud detection. These AI-driven features enhance user experience by providing tailored financial insights and proactive security measures.

9. Data Analysis Algorithms

Deploying algorithms for analyzing spending patterns, calculating net worth, and projecting future balances based on historical data empowers users to make informed financial decisions. Advanced data analytics capabilities offer valuable insights into financial behaviors and trends, supporting effective budget management and goal achievement.

10. Time-Series Databases

Implementing time-series databases like InfluxDB or MongoDB Time Series facilitates efficient storage and retrieval of time-sensitive financial data. These databases optimize data handling for real-time analytics and reporting, which is critical for tracking and analyzing financial transactions over time.

11. Financial Institution APIs

Securely integrating with bank APIs (e.g., Plaid, Yodlee) enables real-time fetching of account data, including balances and transactions. API integrations provide users with up-to-date financial information, enhancing the accuracy and relevance of budgeting insights and recommendations.

12. Libraries for Visualization

Utilizing visualization libraries such as D3.js, Chart.js, or Tableau enables the creation of interactive charts, graphs, and dashboards. These visual tools empower users to visualize spending patterns, monitor goal progress, and gain actionable insights from financial data, promoting transparency and engagement.

13. Data Warehousing

Implementing a data warehouse (e.g., Amazon Redshift, Google BigQuery) consolidates and organizes data from multiple sources. Data warehousing supports complex reporting, ad-hoc querying, and trend analysis, facilitating comprehensive financial reporting and strategic decision-making.

14. Goal Tracking and Scenario Modeling

Enabling features for goal tracking and scenario modeling enables users to set financial goals, track progress in real-time, and simulate different financial scenarios (e.g., debt payoff strategies). These tools empower users to make informed financial decisions and visualize the impact of their actions on future financial outcomes.

How to Leverage ML for Personalized Budgeting & Anomaly Detection Within the App?

Integrating ML into a personal finance app unlocks a new level of sophistication. Personalized budgeting recommendations are a prime example. Here, supervised learning algorithms like decision trees or random forests can be trained on vast datasets of user spending habits. These models analyze a user’s transaction history, income sources, and financial goals to identify patterns and predict future spending behavior. The app can then leverage these insights to recommend personalized budgeting strategies, suggest areas for optimization, or even automatically adjust spending categories based on learned patterns. This empowers users to make data-driven financial decisions and fosters long-term engagement with the app.

Security is another area where ML shines. Businesses can utilize anomaly detection algorithms to create a robust defense against fraud. One approach involves training unsupervised learning models, like k-means clustering or autoencoders, on historical datasets containing fraudulent transactions.

These models learn the “normal” behavior of user spending patterns. Real-time transactions are then compared against the established patterns, and any significant deviations can be flagged as potential fraud. This proactive approach helps identify suspicious activity before financial damage occurs. However, implementing ML effectively requires careful consideration of factors like model complexity, training data requirements, and computational resources.

How Can Apps Like Simplifi Generate Revenue?

Simplifi uses a freemium model to monetize its personal finance app across mobile and web platforms. Users can access core features like transaction categorization and budgeting tools at no cost.

However, to unlock premium functionalities like bill pay, custom spending categories, and investment tracking, users can subscribe to a paid tier. Simplifi offers two subscription options: a monthly plan at $3.99 and an annual plan at $2.00 per month (billed annually), providing a 50% discount for users who commit to a yearly subscription. This pricing strategy incentivizes long-term engagement and potentially reduces churn.

It’s important to note that Simplifi operates within the broader Quicken ecosystem, which includes the legacy desktop software “Quicken Classic.” Quicken Classic offers its own subscription tiers, with pricing starting at $5.99 per month. While Simplifi caters to a mobile-first audience, users might consider upgrading to Quicken Classic for more advanced features tailored for desktop use.

The freemium model, with its free basic tier and premium features behind a paywall, is a popular strategy for personal finance budgeting apps. However, for businesses looking to build a sustainable and scalable app, exploring additional revenue streams is crucial. Here’s how some popular apps are thinking outside the box:

1. Targeted In-App Advertising

While in-app advertising can be a turn-off for users, Mint, a leading budgeting app owned by Intuit, demonstrates how to do it effectively. Mint integrates non-intrusive, targeted ads that align with users’ financial goals and spending habits. For example, a user who frequently uses the “groceries” category might see ads for local grocery stores offering coupons or discounts. This targeted approach provides value to users while generating revenue for Mint through partnerships with relevant businesses.

2. Data Monetization

Providing budgeting and financial advice often requires a deep understanding of user behavior. With user consent, apps like YNAB anonymize and aggregate financial data to generate valuable market research. This anonymized data can be sold to financial institutions or research firms, helping them develop new products and services tailored to specific consumer demographics. YNAB emphasizes user privacy and clearly outlines its data practices, building trust and ensuring users feel comfortable sharing their anonymized financial information.

3. Strategic Partnerships

Partnerships with financial institutions can unlock new revenue streams. For example, Qapital, a budgeting app geared towards millennials, partnered with Mastercard to offer a co-branded debit card. The card integrates seamlessly with the Qapital app, allowing users to manage their spending and potentially earn rewards for using the card. This partnership benefits both parties: Qapital gains a new user acquisition channel, while Mastercard reaches a target demographic of young, tech-savvy consumers.

4. Subscription Plus Model

The subscription plus model goes beyond basic premium features. For example, Digit, a savings app known for its automated savings features, offers a premium tier with additional benefits. Premium subscribers not only get access to advanced savings goals and investment options but also receive a free credit monitoring service from a trusted partner. This creates a more compelling value proposition for the premium tier, justifying the higher subscription fee and potentially increasing user adoption.

5. In-App Purchases for Specialized Features

Some apps offer a freemium model with the option for in-app purchases to unlock specific features. For instance, a budgeting app might offer a free tier with basic budgeting tools and transaction categorization. However, users might need to make an in-app purchase to access features like custom budgeting categories, in-depth spending reports, or advanced analytics. This approach allows users to choose the features they need without having to commit to a full subscription, potentially increasing overall revenue for the app.

Conclusion

These days, feeling in control of your finances can be a distant dream. Bills pile up, unexpected expenses arise, and the path to financial security can seem shrouded in mist. But what if there was a tool, a digital companion, that could empower you to take charge? Personal finance budgeting apps like Simplifi are more than just number-crunching machines; they’re beacons of hope, guiding users toward a brighter financial future.

For businesses, the opportunity to develop such an app isn’t just about profit margins. It’s about fostering a community of financially empowered individuals. By understanding the cost factors involved, businesses can create budgeting apps that are accessible and effective, placing the power of financial well-being directly in users’ hands. This investment in user success fosters not only brand loyalty but also a sense of trust and partnership.

Looking to Develop a Finance Budgeting App Development like Simplifi?

Idea Usher is your one-stop shop. With over 500,000 hours of development experience in fintech apps, our team of experts can craft a secure, scalable budgeting app. We’ll leverage cutting-edge technologies for data encryption, API integrations, and real-time updates, empowering your users to take control of their finances with confidence. Let’s discuss how Idea Usher can turn your vision into a reality.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

Q1: How to develop a personal finance tracking app?

A1: Building a personal finance tracking app involves several steps: First, define core features like recording transactions, categorizing spending, and setting budgets. Next, decide on development – will you code it yourself or partner with a development team? Security is essential, so prioritize data encryption and secure login options. Finally, focus on user experience by creating a user-friendly interface and clear data visualizations to keep users engaged and ensure your app’s success.

Q2: Who regulates financial apps?

A2: The regulatory landscape for financial apps can vary depending on the app’s functionalities and the specific country of operation. However, some common regulatory bodies play a key role. National banks, authorities like the Consumer Financial Protection Bureau (US), or securities commissions often oversee financial apps. These entities ensure apps comply with data security regulations, consumer protection laws, and relevant financial service licenses depending on the features offered (payments, investments, etc.). Understanding these regulations is crucial for businesses developing financial apps.

Q3: How do you automate personal finances?

A3: Automating personal finances is about leveraging technology to streamline money management. Many budgeting apps offer features like automatic transaction categorization, which sorts your spending into categories. You can also set up automatic transfers to move money between accounts, ensuring consistent savings or bill payments. Some apps even allow automated goal tracking so you can see your progress toward financial objectives without manual calculations.

Q4: How much does it cost to develop a budgeting app?

A4: The cost of building a budgeting app depends heavily on the features you choose and the complexity of its development. Basic functionalities like budgeting and tracking are less expensive to create, while features requiring advanced algorithms or integrations with financial institutions will significantly increase the overall cost. However, by carefully selecting features and partnering with experienced developers, businesses can optimize the development process for a cost-effective and successful budgeting app.