Fintech, short for financial technology, is revolutionizing the way we handle money. From mobile banking to investment apps, fintech apps have made financial services more accessible, efficient, and user-friendly. But what exactly goes into developing a successful fintech app?

Fintech apps come with a variety of features designed to make financial transactions seamless and secure. These include user authentication, secure transactions, real-time notifications, and integration with various financial institutions.

This guide will take you through every step of fintech app development, from the initial planning stages to post-launch maintenance.

What is Fintech?

Fintech, short for financial technology, refers to the innovative use of technology to provide and enhance financial services. It encompasses a broad range of applications, from mobile banking and online payment systems to investment platforms and blockchain-based solutions. Fintech aims to make financial services more accessible, efficient, and user-friendly by leveraging advancements in software, data analytics, and the internet. Key areas of fintech include:

- Mobile Banking: Apps that allow users to manage their bank accounts, transfer money, and pay bills from their smartphones.

- Online Payments: Platforms like PayPal, Stripe, and Square that facilitate seamless online transactions.

- Investment Services: Robo-advisors and trading apps that help users manage their investments with minimal human intervention.

- Lending Platforms: Peer-to-peer lending services that connect borrowers with lenders directly, bypassing traditional banks.

- InsurTech: Technologies that streamline the insurance process, from underwriting to claims management.

- Cryptocurrency and Blockchain: Digital currencies and decentralized technologies that offer new ways of handling transactions and data security.

Why There is a Rise Of Fintech Apps –

Here is a detailed explanation –

Accessibility and Convenience

Fintech apps have made financial services more accessible to a broader audience. Traditional banking often requires physical visits to bank branches, which can be time-consuming and inconvenient. Fintech apps, on the other hand, enable users to conduct financial transactions from anywhere at any time, providing unprecedented convenience. This is particularly beneficial for people in remote areas or those with limited access to physical banking infrastructure.

Enhanced Efficiency

Fintech apps streamline various financial processes, reducing the time and effort required to perform tasks like transferring money, applying for loans, or investing in the stock market. Automation and digital workflows minimize paperwork and manual processing, leading to faster and more efficient service delivery. For businesses, this translates to lower operational costs and improved customer satisfaction.

Improved Financial Inclusion

One of the most significant impacts of fintech is its role in promoting financial inclusion. Many people around the world remain unbanked or underbanked, lacking access to essential financial services. Fintech apps bridge this gap by offering affordable and user-friendly solutions that cater to these populations. Mobile wallets, for instance, provide a secure and convenient way for people to save money, make payments, and receive remittances without needing a traditional bank account.

Innovative Financial Products

Fintech has spurred the development of innovative financial products tailored to meet the specific needs of different user segments. From micro-loans and pay-as-you-go insurance policies to investment platforms that use AI to offer personalized advice, fintech apps offer diverse solutions that traditional financial institutions may not provide. These innovations help users manage their finances better and achieve their financial goals more effectively.

Enhanced Security

Security is a critical concern in financial transactions, and fintech apps have made significant strides in enhancing the security of financial services. Advanced technologies like encryption, biometric authentication, and blockchain provide robust security measures that protect user data and prevent fraud. As a result, users can trust fintech apps with their sensitive financial information and conduct transactions with confidence.

Data-Driven Insights

Fintech apps leverage big data and analytics to offer users valuable insights into their financial behaviors and trends. By analyzing spending patterns, investment performance, and other financial activities, these apps can provide personalized recommendations and alerts. This helps users make informed decisions, optimize their financial strategies, and improve their overall financial health.

Cost-Effective Solutions

Compared to traditional financial services, fintech apps often offer more cost-effective solutions. Lower overhead costs and the use of automation allow fintech companies to provide competitive pricing on services such as money transfers, loans, and investment management. This makes financial services more affordable and accessible to a wider range of users.

Continuous Innovation

The fintech industry is characterized by continuous innovation. Companies are constantly developing new technologies and improving existing ones to serve their users better. This dynamic environment drives the financial industry forward, leading to the creation of more efficient, user-friendly, and secure financial products and services.

Build Better Solutions With Idea Usher

Professionals

Projects

Key trends in the fintech ecosystem

The fintech ecosystem is rapidly evolving, driven by technological advancements and changing consumer behaviors. Here are some key trends shaping the future of fintech:

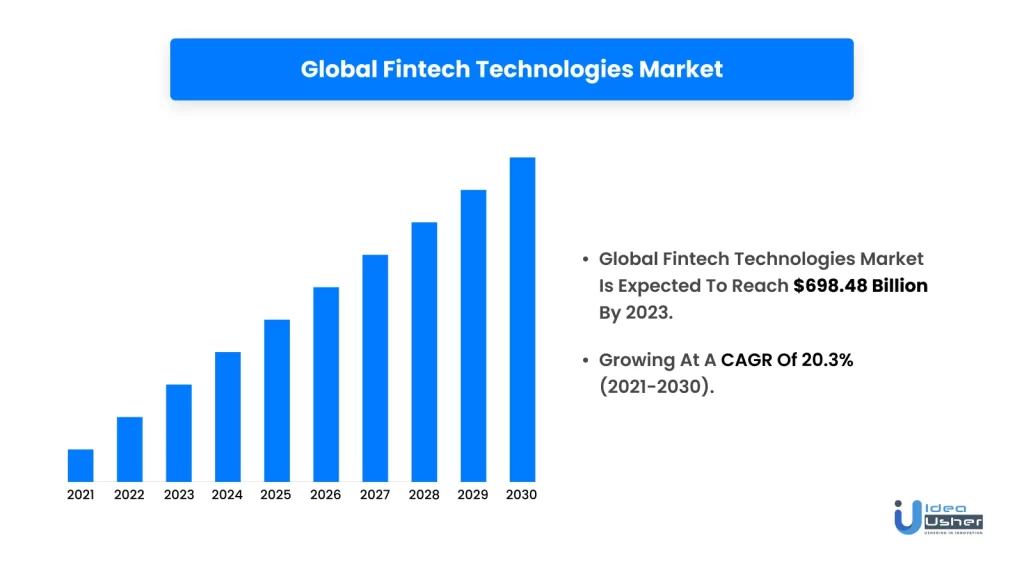

Fintech has impacted the financial industry by offering online operations and transactions. Furthermore, businesses have adopted technologies like AI and data science along with fintech apps to streamline their operations. The Fintech industry is about to see a growth in billions in the coming year, and it offers numerous benefits to users.

How To Develop a Fintech Application?

Before you dive into development, it’s crucial to define the primary purpose of your app. Are you looking to create a mobile banking solution, a payment processing app, or something else? This will guide all subsequent decisions.

Step 1. Determine your niche and comply with the law

- Finding your specialty is important before starting the development process.

- You should decide what sort of fintech app you want to create and what sector of fintech you want to concentrate on.

- You must identify your target audience.

- Identify the features you want in your app.

- Make sure your application complies with all applicable laws in the regions where your app will be used.

Step 2. Set features and cost expectations

- Choose the features of your financial app.

- Make sure to include the components that your customers might want. Avoid too many unnecessary features that can complicate your financial app.

- Assess your budget before starting the development process to avoid budgetary restrictions in the later stages of development.

- Having your requirements and projected budget ready on paper often helps when creating project scope documents.

Step 3. Hire a team

- You need team technical experts across a variety of industries to design a fintech software, including:

- UI designers

- Android/iOS and web developers

- Project managers

- Business analysts and quality assurance specialists

- Frontend and backend developers, etc.

- Employing a skilled fintech app development team is always beneficial for companies as it saves resources in the long run.

- The size of your project will determine how many people will be on your development team.

- You may also employ individual fintech developers based on the skill sets you require.

Step 4. Designing UI/UX

- For finance applications, effective UI/UX design is crucial as it is the component that the user engages with the most.

- It is better to develop several prototypes as they can help determine which UI/UX design best matches your app.

- Some UI/UX design best practices include:

- Simple to use features.

- Avoid over-stuffing the program with functionality.

- Easy navigation

- Easy to understand.

- The colors shouldn’t be overly muted or vibrant.

Step 5. Create an MVP

- Testing your concept before starting the protracted development process is a crucial resource-saving step.

- The term “Minimum Viable Product” refers to a proof of concept with only enough functionalities to allow for testing.

- With an MVP, you get feedback for your application. As a result, you can improvise your app against risk factors.

- MVP makes sure that the fintech application is efficient and beneficial to users.

Step 6. Development

At this stage, you need to work on basic elements like:

- Authentication and user management using a tool like Firebase. It helps in the development of applications and provides management, crash reporting, and secure user authentication.

- You must get secure hosting like Cloud Firestore, which is an encrypted cloud-hosted database solution. It is a Firebase product that works seamlessly with all other Firebase products to facilitate user experience and development. It streamlines the process of developing apps, is capable of high performance, and offers automated scalability.

- You can integrate a tool like Experian to check credit scores. Tools like this provide a consumer-facing API that retrieves credit records and ratings. Apart from Experian, there are other tools available, like ACS (American Credit Systems) or the Universal Credit Services API, that produce credit reports. These APIs can provide access to the following data:

- Pre-Employment Credit Reports

- Decision-only Credit Reports

- SSA89

- 4506T IRS Tax Transcripts

- Criminal Searches

- Social Security Number Verifications

- Motor Vehicle Records

- Eviction Searches

- You may incorporate a solution that links your app to bank accounts, such as Yodlee or Plaid. However, Plaid is a significant API in the fintech sector. It is agile, consolidates the financial data of your users onto a single platform, reduces risk, and expedites development.

- You can include a payment gateway like Stripe in your app after back account linkage. Global payment processor Stripe unites a variety of payment service providers into a single offering.

- You may automate your customer support by using a Chatbot API. You may develop open-source tools like Python Scikit to tackle more difficult jobs like processing tenant pre-approvals because this is powered by machine learning.

Most importantly, you must consider legal obligations for your app, which include the following:

- Recognize the legal agreements related to utilizing these APIs to access consumers’ financial data.

- Make a policy for the handling and privacy of data.

- Get insurance so that you are protected in the event of a breach.

- Create a plan for business continuity and catastrophe recovery.

Step 7. App maintenance

- Your application’s development cycle does not end with the development and deployment phases.

- Every fintech app should be frequently updated and upgraded once it has been created to make sure it is operating properly.

- Legal compliance can also occasionally be upgraded with new features.

Tech stack for fintech app development

| Native app development | – iOS based: Objective, CSwift, Apple XCode, iOS SDK – Android-based: Java, Kotlin, Android studio, Android SDK |

| Cross-platform app development | React Native, C# |

| Hybrid app development | HTML 5, PhoneGap |

| Other effective technologies | Node.js, C++ |

Features of the fintech app

here are a few features to have in a fintech app –

User Authentication and Authorization

Security is paramount in fintech apps. Implement robust user authentication methods like biometric verification and multi-factor authentication to protect user data.

Secure Transactions

Ensure all transactions are encrypted and secure. Use technologies like SSL/TLS to encrypt data in transit and secure user information.

Real-time Notifications

Keep users informed with real-time notifications for transactions, account updates, and other important activities.

Integration with Financial Institutions

Integrate your app with various banks and financial institutions to provide a seamless user experience.

Ease of navigation

The app’s user interface has to be simple and easy to use. A voice search, a written query feature, shortcut features, etc., can be included in the app for a seamless experience.

Personalized experience

You can target the younger demographic through this feature. In-app virtual assistants and personalized insights, depending on the user behavior, can be used to attract the attention of your audience.

Customer service

Excellent customer assistance is available through self-help, live chat, or other channels in the banking applications. Clients can easily get in touch with businesses for their inquiries. You can offer assistance to the user through a chatbot or by other means to contact customer service agents.

Notifications

These are essential for promoting products/services and retaining the user’s interest in the brand. Although too many notifications may annoy your user. Therefore, there must be a feature that allows users to select the type and frequency of notifications.

Secure sign-in

Security is the most crucial quality, given the rise in data breaches and cybercrime. Technology, such as biometrics, multi-factor authentication with secure sign-in options, etc., makes it simpler to sign in and secure data.

Digital payments

Every mobile banking app should have easy access to various digital payment options, mobile wallets, UPI, etc, in order to facilitate frictionless transactions. It makes it simple for users to manage their accounts, schedule recurring payments, and pay bills. Additionally, a FinTech app that offers digital payment options enables users to conduct transactions and view account information whenever it’s convenient.

Peer-to-peer payments

Sometimes referred to as P2P payments, they give customers more convenience by ensuring that money is transferred quickly and securely. P2P payments made using mobile banking applications are cheaper, safer, and more reliable than payments made by third parties.

Build Better Solutions With Idea Usher

Professionals

Projects

Types of fintech app

Here Are a Few Types Of Fintech Apps –

1. Digital Banking

Banks are creating fintech applications for their customers as a result of improved technology and the preference for digital banking. Digital banking has evolved into a highly practical method for customers to manage their bank accounts and for bank staff to handle client data conveniently. Users may manage their bank accounts online with the use of fintech applications for digital banking, avoiding occasional bank visits.

2. Digital Payments

Digital payments relate to transactions that are fast, cashless, and secure. This model is facilitated by fintech apps with online payment systems, digital currencies, and e-wallets. Digital payment is often regarded as one of the most well-known market segments of the fintech sector. By 2021, Statista predicts that the value of worldwide digital payments will be USD 6,685,102 Million.

3. Digital Investment

Digital investment applications serve as a platform to enable investments. It provides users with pertinent and informative data they can use to make knowledgeable decisions about their investment goals. Investors may explore and invest in various financial assets and stock markets using digital investment fintech applications.

4. Digital Lending

This type of fintech application is used by financial organizations like banks and private lenders to streamline and effectively manage loan processes. Lending software and loan apps fall under digital lending fintech applications since they simplify transactions and communication between borrowers and lenders.

5. Consumer Finance

Fintech consumer finance applications support their users in managing their personal finances. Users may manage their finances effectively, create budgets, and engage in intelligent spending with the help of these applications, which offer essential tools and capabilities.

Future Trends in Fintech App Development

here are some future trends to keep an eye on –

AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are at the forefront of fintech innovation. These technologies are transforming financial services by automating processes, providing insights through data analytics, and enhancing customer experiences.

Blockchain Technology

Blockchain technology is renowned for its security and transparency, making it a promising technology for fintech apps. It provides a decentralized ledger that records transactions across multiple computers, ensuring that the data cannot be altered retroactively without altering all subsequent blocks. This makes blockchain inherently secure and resistant to fraud.

Personalized Financial Services

Personalization is becoming increasingly important in the competitive fintech market. By leveraging data analytics, fintech apps can offer services tailored to individual user needs and preferences. This involves analyzing user data to gain insights into their financial behavior, spending habits, and goals.

Case Studies of Successful Fintech Apps –

Fintech apps have revolutionized the financial landscape, offering convenience, accessibility, and innovative features. Let’s delve into three industry leaders – PayPal, Robinhood, and Revolut – to understand the key ingredients of their success:

1. PayPal: The Pioneer of Digital Payments

- Focus on User Experience: PayPal’s simple and intuitive interface makes sending and receiving money effortless. Integration with various online platforms further streamlines the user experience.

- Robust Security Measures: PayPal prioritizes user security through multi-factor authentication and encryption technologies, fostering trust and confidence among users.

- Continuous Innovation: PayPal constantly adapts, expanding its services beyond online payments to include features like invoicing, bill pay, and even cryptocurrency.

Key Takeaways: Simplicity, user-centric design, and robust security are fundamental for building a successful fintech app.

2. Robinhood: Democratizing Stock Investing

- Breaking Down Barriers: Robinhood’s commission-free trading platform made investing in stocks more accessible to a wider audience, particularly millennials.

- Engaging Interface: A user-friendly and mobile-first approach makes investing feel approachable and engaging, even for beginners.

- Innovation Through Gamification: Robinhood incorporates features like fractional shares, allowing users to invest smaller amounts, further democratizing the investment landscape.

Key Takeaways: Identifying underserved markets and offering innovative solutions that lower barriers to entry can be a recipe for success.

3. Revolut: The All-in-One Financial App

- Consolidation for Convenience: Revolut combines multiple financial services like currency exchange, international transfers, budgeting tools, and even crypto trading within a single app.

- Global Reach: Revolut caters to a global audience by offering multi-currency accounts and seamless international transactions.

- Focus on Transparency: Revolut provides clear fee structures and real-time exchange rates, fostering trust and empowering users to make informed financial decisions.

Key Takeaways: Addressing the need for integrated financial solutions and prioritizing transparency builds user loyalty and trust.

Successful FinTech apps prioritize user experience, robust security, and continuous innovation. By identifying unmet needs and offering convenient, secure, and user-friendly solutions, these apps have transformed the way we manage our finances.

Get a fintech app developed by Idea Usher.

Are you looking to revolutionize the financial industry with a cutting-edge fintech application? Partner with Idea Usher, a leading technology solutions provider, to turn your innovative ideas into reality. At Idea Usher, we specialize in creating robust and secure fintech applications tailored to your business needs. Our team of experts has extensive experience in developing apps for various financial services

Contact our fintech app development experts to discuss your needs and have a fintech app developed.

Get in touch now!

Build Better Solutions With Idea Usher

Professionals

Projects

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQ

Q. Which is better for developing finance apps: native or cross-platform?

A. Native programs demand less work for security upgrades and completely support all platform hardware. Therefore, we advise natives.

Q. How do fintech applications generate revenue?

A. The most typical and important way for Fintech applications to make money is by displaying adverts within the app. In addition to receiving payment for airing advertisements, third-party ad networks also compensate app owners when users click on their adverts.