Fintech refers to innovation and technology that seeks to compete with financial institutions to provide better business operations for clients in the banking and adjacent industries. You could need help from fintech app development companies if you are a business that deals with banking, asset and wealth management, mortgages, insurance, or investment. To help you choose the finest company to create your app, we have compiled a list of experienced businesses.

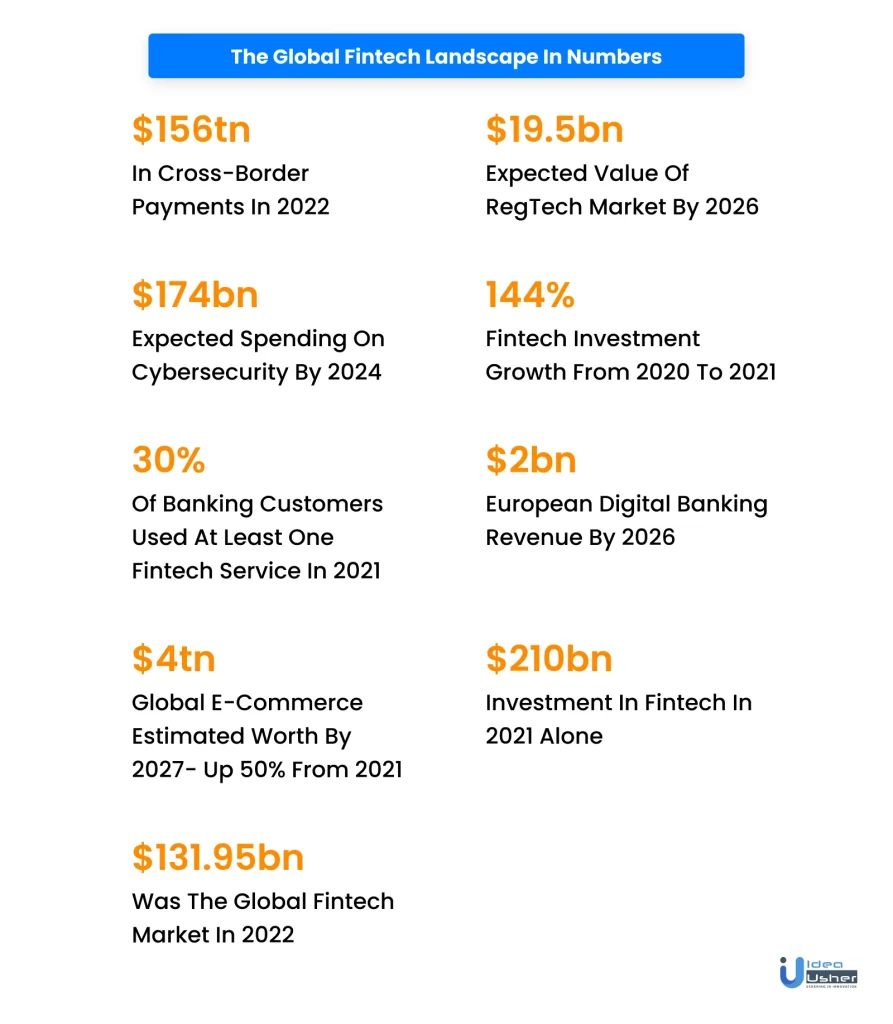

| Fintech Industry Highlights: |

| – An estimated $131.95 billion will be spent on the worldwide fintech business. |

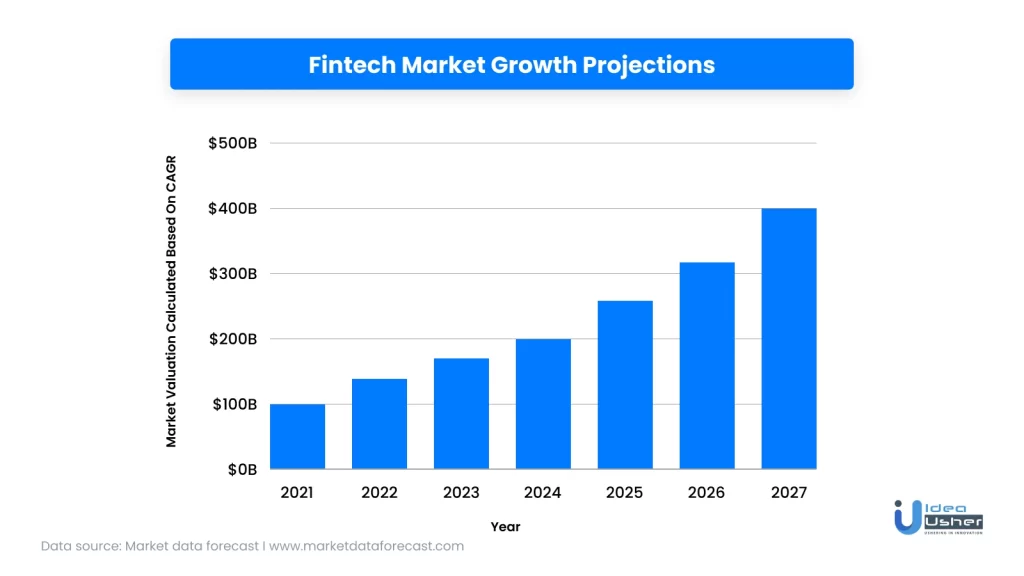

| – By 2027, the fintech industry is anticipated to reach $400 billion. |

| – The CAGR for the fintech market is 25.12%. |

| – Last year, almost 26,000 financial firms were established. |

| – In 2022, it is anticipated that digital payments will total $8.49 trillion globally in 2027 when it increases at a 12.31% CAGR. |

| – From 61.3% in 2018 to 65.3% in 2022, the US usage of digital banking has increased substantially year over year. |

Why does the world need fintech app development companies?

Your corporation may require a reputable software service provider to execute advancements in financial organizations. The development of next-generation financial services and the commercial success of the customer are particularly dependent on fintech application firms. The software partner determines whether or not the product actually meets the demands of the target market and how it seems and feels to the user. Experienced fintech app development companies may serve in a consulting capacity and offer insightful guidance on entering the market and navigating the competition. Therefore, selecting a reliable technology partner is of utmost importance for the project.

Tech stack preferred by fintech startups

Here are a few trending fintech apps/services and their tech stack:

| Klarna | – Cloud services: AWS. – DevOps solutions: New Relic, Docker. – Frameworks: PowerShell. – Programming languages: JavaScript, Python, Java, PHP, C, C#, TypeScript, Objective-C, Ruby, Scala, Kotlin, Rust, Elixir, CoffeeScript, Perl, Erlang, ActionScript. – Extras: SendGrid, Nginx, Apex |

| Venmo | – Cloud services: AWS. – DevOps solutions: CMake, Docker. – Frameworks: PowerShell, Backbone.js. – Programming languages: PHP, JavaScript, Java, Python, C#, TypeScript, Ruby, Go, Objective-C, Swift, C++, Perl, C, Lua. – Extras: Nginx, Braintree, Amplitude. |

| Chime | – Cloud services: AWS. – Databases and stores: Kafka, Citus, Snowflake. – DevOps solutions: Kubernetes, Visual Studio, GitHub, CircleCI. – Frameworks: Ruby on Rails, React Native – Programming languages: Elixir, Ruby, JavaScript – Extras: Looker, Optimizely, Plaid, Segment. |

| Revolut | – Cloud services: Google Cloud. – Databases and stores: PostgreSQL. – DevOps solutions: Visual Studio, Git, Bitbucket, Docker. – Frameworks: Gatsby, Node.js – Programming languages: Java, JavaScript, Kotlin, Python, Scala, Swift, TypeScript. – Extras: Nginx. |

| N26 | – Cloud services: AWS. – Databases and stores: Redis, PostgreSQL, Kafka, Realm. – DevOps solutions: GitHub, Docker, Visual Studio, Selenium, Gradle. – Frameworks: Node.js, Vapor. – Programming languages: Python, Java, Kotlin, TypeScript, Swift, Julia. – Extras: Ubuntu, Nginx, Debian, Postman. |

This brings us to the following, mostly approximative, tech stack for web and mobile:

| Programming languages (web and mobile for iOS and Android) | Python, JavaScript, Java, C/C++, Ruby, Kotlin, Objective-C, Swift, Go, Scala, Rust, Elixir, Lua, TypeScript |

| Frameworks (backend, frontend, cross-platform) | React, React Native, Node.js, Django, Ruby on Rails, Spring, Xamarin, Ionic, Angular, Vue |

| Databases | PostgreSQL, MySQL, MongoDB, Redis, Kafka, Citus, Snowflake, Realm |

Top 10 Best fintech app development companies

here are some of the top fintech app development companies in the USA

1. Idea Usher

One of the best financial app development companies in the USA. They provide affordable fintech apps integrated with technologies like blockchain, AI, Ml, etc., and help businesses turn their concept into reality. The firm offers full-cycle blockchain products to startups, medium-sized businesses, and large corporations to integrate blockchain into business operations. They are knowledgeable in cutting-edge technology, such as the cloud, chatbots, blockchain, the Internet of Things, artificial intelligence (AI), augmented reality (AR), virtual reality (VR), and others.

- Founded: 2014

- Location: USA

2. GBKSOFT

It is a mobile and web development company building customized IT services for startups and big enterprises. They power up businesses via digital solutions and focus on building long-term and trusting relations with their clients. They assist businesses in determining specifications and planning and delivering solutions as per clients’ expectations.

- Founded 2011

- Location: Ukraine

3. Miquido

It is a google certified agency dedicated to solving fintech challenges with innovative solutions. They have delivered 150+ solutions for renowned brands like Skyscanner, Nestle, BNP Paribas, HelloFresh, etc. Miquido offers solutions that include web and mobile app development, AI and Ml integration, product strategy, design, and development.

- Founded: 2011

- Location: Germany, UK, Switzerland, Poland

4. Qulix Systems

It is an international firm that provides IT consulting, quality control, and software development (it is a part of Qulix Group). The headquarters of Qulix are in Burton, Cheshire, while the development facility is in Wroclaw, Poland.

- Founded: 2000

- Location: Poland

5. DECODE

It is a software company with expertise in full-service enterprise mobile and application solutions. They have extensive domain expertise in fintech, social media, telecom, etc. Decode services include product identification and design to development and quality assurance. They develop apps for native and cross-platform using Reach native and Flutter. Their web app development process includes reach.js for the frontend and node.js for the backend.

- Founded: 2011

- Location: Croatia

6. UppLabs LLC

They are creating secure and compliant software for the financial technology, healthcare, and real estate sectors and excel at keeping to schedules and priorities. As a team, UppLabs routinely produces high-quality work on schedule. UppLabs have managed to score more than 1000+ successful deployments of web and mobile app solutions, 150+ deployed projects, and 50+ successful setups of dedicated development teams projects. They are a FinTech solution and software development provider company with ten years of reliable experience in the global market.

- Founded: 2014

- Location: USA, Ukraine

7. Clarion

They provide IT services to SMEs and startups to build software products and solutions by assembling a world-class, devoted global team of Virtual Employees. Clarion Technologies have managed to bag project execution for over 1100+ SMB clients over the previous 20+ years. This firm excels at working with AI, machine learning, big data, and more advanced technologies. Apart from this, their fintech project team collaborates with other departments to outline the business’s requirements with new financial and banking industry updates.

- Founded: 2000

- Location: India

8. Praxent

They specialize in developing financial software and have concluded that the key to raising conversion rates, customer engagement, and product usage is to provide a customized and seamless user experience since businesses demand fintech app development companies who put their clients first, which is why Praxent’s developers create engaging financial user experiences to get a competitive edge and user satisfaction.

- Founded: 2000

- Location: Texas

9. EffectiveSoft

The fintech industry must comply with complex and exacting criteria for software usability, sophisticated security, scalability, and effective performance while working with massive data. EffectiveSoft has strong connections with many financial institutions and has considerable knowledge of the market to safeguard against any possible failures. By offering financial software development services, they help financial firms create safe and reliable IT environments.

- Founded: 2000

- Location: USA

10. Inoxoft

It is a fintech app development firm that assists companies with automation issues, improving trade performance and digitizing financial services. Inoxoft helps businesses make wise investments in the development of fintech solutions. They provide digital alternatives for clients to implement advanced innovations in the Fintech industry.

- Founded: 2014

- Location: Ukraine

Technologies that will shape the future of financial technology

Technologies that will impact the competitive landscape of finance and fintech development, as per the McKinsey analysis, are as follows:

1. Blockchain

- Distributed Ledger Technology (DLT) uses blockchains and will support finance by allowing the storage of financial transactions in multiple places at once.

- Cross-chain technology will facilitate blockchain interoperability.

- Smart contracts, zero-knowledge proof, and distributed data storage and exchange will continue to play a prominent role in fintech innovations (digital wallets, digital assets, DeFi, and NFT)

2. Artificial intelligence

- In banking, AI may improvise financial modeling across the sector by identifying the elements that enhance performance.

- AI can assist in identifying patterns across financial networks, building associations, and drawing on a wide range of data sources.

- Analytics can encourage using limited and pertinent data while developing financial models. These include decentralized machine learning that, rather than providing processing capacity to the data, solves the privacy issue associated with centralizing datasets.

- Advanced encryption, secure multi-party computing, zero-knowledge proofs, and other privacy-aware data analysis techniques will drive a new frontier in consumer protection.

- AI assists financial institutes in attaining an advantage from previously under-used customer behavior data collected via conventional operations.

- AI can increase operational efficiency by completely automating manual processes and replacing or enhancing human judgment with sophisticated diagnostics.

3. Cloud computing

- By 2030, cloud technology will account for earnings before interest, tax, depreciation, and amortization of over $1 trillion across the world’s top 500 companies – McKinsey.

- Cloud can improve platform integrity through automated and embedded security processes and controls.

- The cloud is creating new forms like open banking and banking-as-a-service while upending the traditional relationship between consumers and financial service providers.

- Cloud technology possesses agile capabilities and flexible scalability that assists financial institutions with responsiveness to customers and the market.

- Banks may profit from cloud-based microservice design, in which APIs open up machine-to-machine communication and enable services to expand independently without increasing the entire product’s coding base.

4. SaaS and serverless architecture

- It allows companies to use the software as needed without owning or maintaining it themselves.

- Serverless architecture removes the need for firms to run their servers, freeing up time and resources for customers and operations while reducing costs.

5. IoT

- IoT determines risk and simplifies the underwriting and claims process.

- The IOT technology offers new services based on the accumulated data from customers.

- IoT can deliver benefits in managing customer relationships, allowing insurers to establish more intensive and targeted customer contact.

- IoT is also bringing banks closer to their consumers by integrating financial services into wearables, such as digital payments.

How to Select the Right Fintech App Developer

Developing a successful fintech application can be a daunting task. However, with the right fintech app developer, you can make the process much smoother and ensure that your app is developed to the highest standards. In this article, we’ll take a closer look at some key factors that you should consider when selecting the right fintech app developer for your business.

1. Technical Expertise

First and foremost, it is crucial to find a developer with the necessary technical expertise to create a high-quality fintech app. This means looking for a developer with a deep understanding of fintech and financial systems. The developer should also have experience in developing similar apps to the one you are looking to create. This ensures that they have a good understanding of the technical requirements and can anticipate potential problems that may arise during the development process.

2. Innovative Solutions

The fintech industry is constantly evolving, which means that your app needs to be innovative and offer unique solutions to problems. Therefore, it’s important to look for a developer that can come up with innovative solutions for fintech problems. A developer that is creative and can think outside the box can help you create a unique app that stands out in the marketplace.

3. Experience in Working with Financial Institutions

Fintech is heavily regulated, and working with financial institutions can be challenging. Therefore, it’s important to find a developer with experience working with financial institutions and a good understanding of the regulatory environment. A developer that has worked with financial institutions before will be familiar with the regulations and can help ensure that your app is compliant.

4. Strong Project Management

Developing a fintech app is a complex project that requires strong project management skills. Therefore, it’s important to find a developer with a track record of delivering projects on time and on budget. A developer that can manage the project effectively and keep you updated throughout the development process can help ensure that the project is completed successfully.

5. Good Communication and Customer Service

Developing a fintech app is a collaborative process, and it’s important to find a developer that is responsive and easy to work with. Look for a developer that values good communication and customer service, as you will be working closely with them throughout the app development process. This will ensure that you are kept up-to-date with the progress of the project and can make any necessary adjustments along the way.

6. Cost

Developing a fintech app can be expensive, so it’s important to have a clear understanding of the costs involved. Find a developer that is transparent about their pricing and the breakdown of costs. A good developer should be able to provide you with a detailed estimate of the costs involved, including any potential additional costs that may arise during the development process.

7. Check References and Previous Work

Finally, it’s important to check references and look at the developer’s previous work. This will give you a sense of the quality of their work and their ability to deliver apps that meet their clients’ needs. Ask for references and look at their portfolio to get a sense of their experience and the quality of their work.

Get a fintech app developed by Idea Usher

Businesses should consider a number of considerations while outsourcing the development of fintech apps to one of the best companies. The continuous, alluring, and dependable app development services the aforementioned businesses provide will be advantageous to clients worldwide. With a list of the top firms creating fintech mobile apps, we hope you can identify the top financial app developers, such as Idea Usher, for your innovative fintech applications that meet user demands. At Idea Usher, you can get the expertise you need for your finance app and the scheduled delivery of desired products and services.

Get in touch now!

Build Better Solutions With Idea Usher

Professionals

Projects

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQ

Q. What should I look for in a software development team?

A. A qualified team of experts must manage the development process with ease. So, when selecting a development team, take into account the following considerations.

- Knowledge of business concerns

- Engagement in the project

- Technical proficiency

- Domain expertise

- Excellent team cohesion

- Dependable teammates

- An efficient exchange of ideas

- Experience and understanding of the subject

Q. What is the importance of financial software development?

A. Financial software allows you to conduct business securely and transparently, irrespective of location and time. Some benefits of using fintech applications are listed below:

- Adaptation of adequate market conditions

- Improves the quality of sales and services

- Offer a personalized experience

- It provides protection and freedom

- Reduces expenses and time.

Q. What are the basic checkpoints to consider when choosing the best financial software development company?

A. Before choosing an outsourcing partner, you must check a few essentials, including:

- Their background in the creation of financial software

- References provided by clients

- Regulations and compliance obligations

- If they have a simple module to comprehend their development cycle

- Delivery etiquette

- The approach that will be applied to complete your project

- Business capacity

- Knowledge level of the financial solution provider.

Q. Why should you outsource fintech software development?

A. Fintech development outsourcing is a sensible choice for several reasons. Because of the knowledge and experience that an outsourcing business like Idea Usher brings to the table, it is more affordable, dependable, and quick. You may concentrate on company growth and other key aspects of your organization while the outsourced partner handles the development.

Q. How do l create a FinTech app?

A. Prior to selecting a development firm to assist you in defining the key aspects of your app, identify the market niche, protect your system with various regulatory acts (PC-DSS, PSD2), and consider the design. The release of the MVP will be fantastic for gauging user response to your offering.