There’s something timeless about assets like fine art or rare wine because they represent history, scarcity, and cultural value. For decades, these markets felt distant and restricted since only a few could access them. Now, businesses are beginning to explore how to tokenize specialized asset classes using blockchain-driven frameworks and secure digital infrastructure.

With modern custody models and verification systems, ownership can finally move with both efficiency and trust. Fractional participation may allow more people to invest without compromising the asset’s integrity or provenance. The process is still technical and layered, yet it is becoming significantly more accessible as the ecosystem matures.

Over the years, we’ve worked with several fintech startups and NFT marketplaces, helping them tokenize a wide range of asset classes using digital asset management frameworks and regulated Web3 infrastructure. With that experience, we’re sharing this blog to walk you through the steps required to tokenize specialized asset classes such as art or wine. Let’s get started.

Key Market Tokenize Specialized Asset Classes

According to MordorIntelligence, the asset tokenization market is valued at USD 2.08 trillion in 2025 and is forecast to climb to USD 13.55 trillion by 2030 at a 45.46% CAGR, underscoring how digital representations of real-world assets are reshaping global capital formation. This explosive growth fuels rising interest in tokenizing specialized asset classes like art and wine, which traditionally suffered from illiquidity, high entry barriers, and provenance issues. Blockchain enables fractional ownership, secondary trading, and verifiable authenticity, drawing institutional investors and broadening access beyond elite collectors.

Source: MordorIntelligence

Masterworks stands out as a major platform tokenizing fine art, allowing investors to buy shares in high-value pieces like those by Picasso or Warhol, with tokens traded on secondary markets for enhanced liquidity.

Similarly, BlockBar leads in wine tokenization by issuing NFTs that represent ownership of specific bottles stored securely, enabling fractional purchases and peer-to-peer trading while combating counterfeits. These platforms exemplify how tokenization democratizes access to illiquid assets valued in the billions globally.

Notable partnerships amplify this trend, such as WineFi’s collaboration with Lympid to offer fractionalized fine wine investments via blockchain, providing instant liquidity and lower entry points for diversified portfolios. Hydra X’s alliance with ArtWise further advances tokenized art, combining compliant infrastructure with secondary markets to make fine art accessible worldwide.

What Does It Mean to Tokenize Specialized Asset Classes?

Tokenizing high-value assets, such as fine art or rare wine, means converting physical, scarce, and traditionally illiquid assets into a digital form that can be owned, divided, and traded using blockchain technology.

This is not the same as making a digital duplicate. Instead, the process attaches a secure blockchain token to the real asset using legal frameworks and verification systems. That token serves as a cryptographic proof of ownership, supported by documentation, authentication, and custody.

Digital Tokens vs. Physical Ownership

This shift raises one of the most important questions for collectors: what does ownership mean when the physical piece remains in a secure facility?

Traditional Physical Ownership

- One individual or entity controls the entire item

- Proof relies on paper certificates, expert validation, and physical possession

- Access often requires transportation, insurance, and logistical coordination

- Selling usually demands a single buyer capable of purchasing the full asset

Tokenized Ownership

- Multiple verified investors may own fractional interests

- Proof of ownership is verified cryptographically on the blockchain

- Transfers can happen globally within minutes

- Individual fractions can be traded independently, creating market liquidity

A legal structure ensures the system remains enforceable. Most commonly, a Special Purpose Vehicle holds legal title to the physical asset. The token represents ownership in that SPV. This framework connects the digital record to real-world legal rights instead of relying on symbolic or informal representation.

Security Tokens and Collectible NFTs

Not all tokenized assets are treated the same from a regulatory perspective. In the luxury and investment space, the distinction between a security token and a collectible NFT is essential because it determines how the asset must be governed, sold, transferred, and disclosed.

Security Tokens: Investment-Backed Ownership

Security tokens represent real economic rights linked to a physical asset. Investors typically purchase these tokens because they expect a financial return, either through appreciation or eventual sale.

Key characteristics include:

- Investment purpose tied to future profit

- Classification as a regulated financial security

- Compliance with frameworks such as SEC Regulation D or EU MiCA

- Requirements for KYC, AML screening, and sometimes investor accreditation

- Technical structure is often built on regulated token standards such as ERC-1400 or ERC-3643

Example: A group of 100 investors collectively owns a Basquiat painting through fractional digital shares, expecting a profit when the artwork is sold or revalued.

Collectible NFTs: Ownership as Experience or Identity

Collectible NFTs do not promise financial return. Instead, they represent digital uniqueness or access. These are more commonly tied to art experiences, digital displays, membership perks, or cultural participation rather than regulated investment rights.

Key characteristics include:

- Designed for collecting, sentimental value, identity, or exclusivity

- Usually treated as digital collectibles rather than regulated securities

- Built using standards like ERC-721

- Minimal compliance requirements beyond platform terms

Example: A limited edition animated NFT of a wine bottle created for display in a virtual collection.

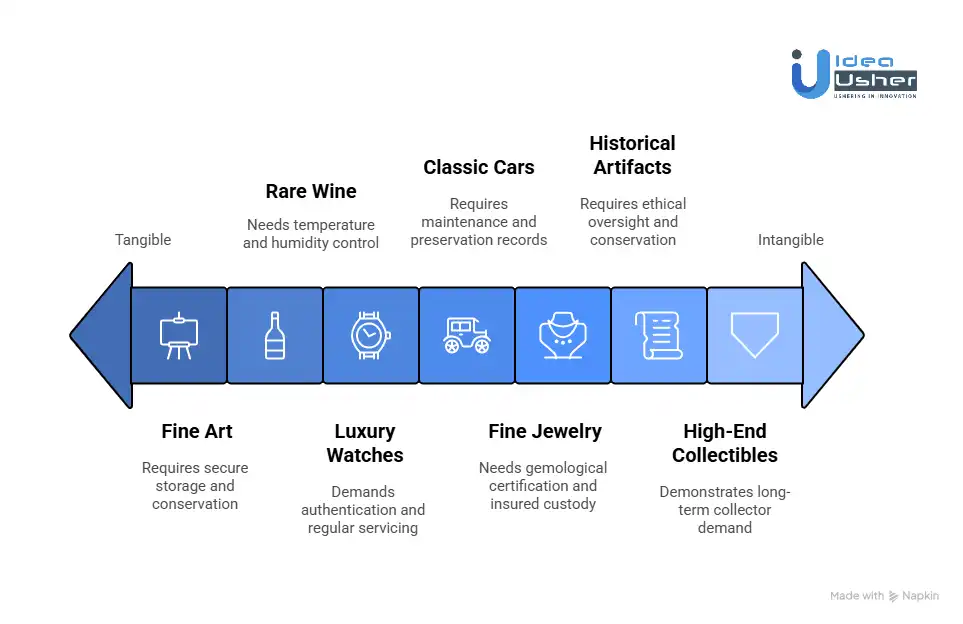

Types of Specialized Asset Classes That Can Be Tokenized

Tokenization is expanding beyond digital-native assets and entering markets traditionally dominated by private collectors, auction houses, and institutional investors. These physical assets can now be shared, traded, and owned fractionally through blockchain technology, while remaining securely stored in professional custody environments.

1. Fine Art

Fine art remains the most established category in the tokenized asset landscape. Paintings, sculptures, photography, and mixed media pieces can be fractionalized and exchanged like shares.

Example: A fractionalized offering of a Pablo Picasso painting was launched through several regulated platforms, allowing investors to purchase verified digital shares rather than the entire asset.

Key considerations:

- Provenance and authentication

- Museum-grade storage and conservation

- Insurance aligned with fluctuating valuations

- Agreements defining display or exhibition rights

2. Rare Wine and Premium Spirits

Investment-grade wine is gaining momentum in tokenized markets because supply is finite and condition directly impacts value.

Example: Tokens representing bottles of Château Margaux 2009 were issued and traded on a tokenization platform, offering investors fractional exposure to a highly sought-after vintage.

Operational requirements include:

- Constant temperature and humidity control

- Certificate verification to prevent counterfeits

- Maturity timeline and consumption rights

- Clear rules for redemption or delivery

3. Luxury Watches

Rare timepieces with historic significance or limited production runs are increasingly treated as investment assets.

Example: A limited-edition Patek Philippe Nautilus was fractionalized, enabling multiple investors to own regulated digital shares while the watch remains preserved in a secured vault.

Challenges:

- Authentication of original components

- Regular servicing and documentation

- Secure storage with appropriate insurance

- Clear rules around physical handling

4. Classic and Collector Automobiles

Vintage racing cars, hypercars, and historically significant models are now entering the tokenization space due to their appreciation potential and devoted collector base.

Example: Tokens tied to ownership of a Ferrari F40 were offered to investors, turning one of the most recognizable collectible cars into a fractional investment asset.

Considerations:

- Maintenance and expert servicing

- Preservation records and restoration history

- Unique transport and insurance requirements

- Governance around usage or exhibition

5. Fine Jewelry and Precious Gemstones

Signed high jewelry and rare gemstones carry significant long-term value and have strong demand from collectors.

Example: A high-value Cartier diamond necklace was tokenized, allowing multiple investors to purchase equity-backed digital shares tied to the physical piece.

Important requirements:

- Gemological certification

- Secure insured custody

- Import/export compliance

- Limited and controlled physical handling

6. Historical, Literary, and Cultural Artifacts

Rare manuscripts, documents, first editions, or culturally important items are increasingly tokenized, though they often require ethical oversight.

Example: A verified first-edition copy of Shakespeare’s works was structured as a fractional asset, offering cultural engagement alongside investment rights.

Primary considerations:

- Ethical and regulatory permissions

- Conservation requirements

- Public display governance

- Clear cultural stewardship policies

7. High-End Collectibles and Emerging Markets

This category includes rare sports cards, musical instruments, luxury fashion archives, and authenticated memorabilia that demonstrate long-term collector demand.

Example: A 1952 Mickey Mantle baseball card was tokenized and offered to investors, turning one of the most valuable pieces of sports memorabilia into a tradable digital asset.

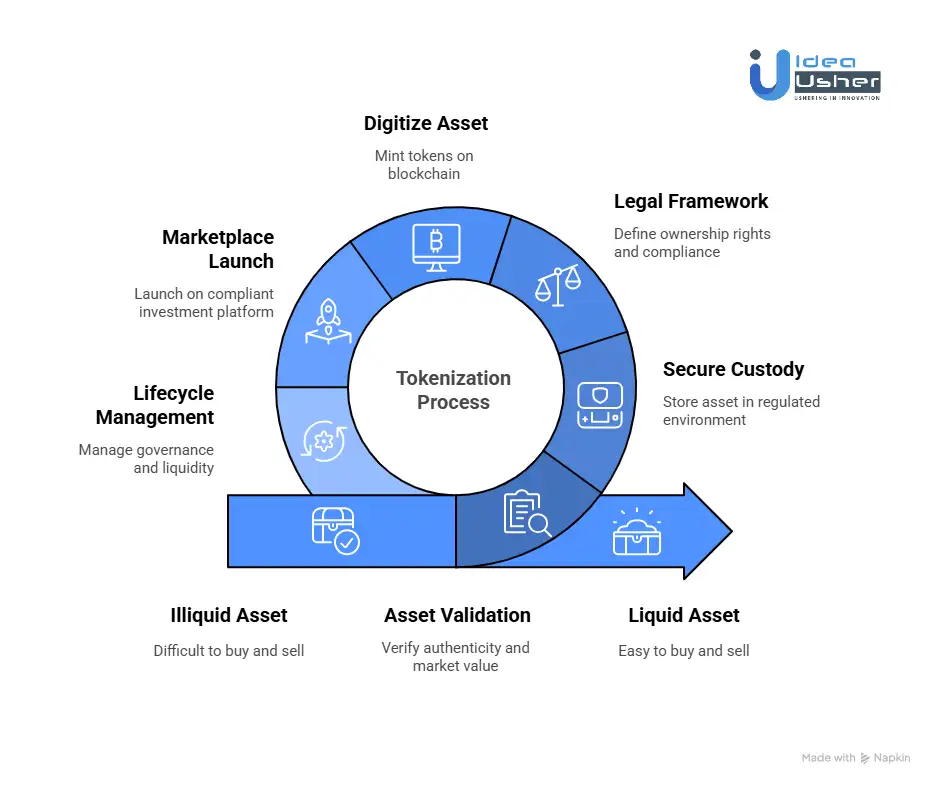

How to Tokenize Specialized Asset Classes?

Tokenizing fine art or rare wine starts with proving authenticity and securing legal ownership, because the asset must be verified and stored correctly before anything becomes investable. Next, the process involves building a compliant token model and encoding ownership rights into smart contracts so transfers and governance remain transparent and enforceable.

Over the years, we have helped many clients tokenize their assets, and if you are considering it, we can guide you through every technical and regulatory step.

1. Identify and Validate the Asset

We begin by validating the asset through certified authentication, provenance verification, legal due diligence, and expert valuation to confirm legitimacy and market value. For wine assets, we also review condition reports, storage history, origin documentation, and producer credibility to ensure suitability for tokenization.

2. Custody, Storage & Insurance Setup

Once the asset is verified, it is placed in a secure and regulated custody environment where a tamper-proof digital identifier is assigned. Full replacement-value insurance is arranged and detailed custody records are maintained to support transparency, auditability, and long-term trust.

3. Create the Legal and Regulatory Framework

We establish a compliant legal structure that defines ownership rights, investor protections, and the appropriate token classification. This includes forming the correct legal vehicle such as an SPV or trust and ensuring alignment with KYC, AML, securities law, and international compliance requirements.

4. Digitize and Tokenize the Asset

With legal and custodial frameworks in place, the asset is digitized and minted on blockchain using standards such as ERC-721, ERC-1155, ERC-3643, or ERC-1400. Smart contracts automate governance, compliance controls, transfers, and payouts while all provenance and valuation data is recorded on-chain.

5. Launch on a Marketplace or Platform

The tokenized asset is then launched on a compliant marketplace or investment platform where approved investors can participate. Trading, pricing mechanisms, and investor access are managed securely and transparently, with dashboards offering real-time insights into valuation, custody, and ownership status.

6. Manage Lifecycle and Exit Strategy

After launch, we manage ongoing governance, inspections, conservation work when needed, and periodic revaluations to protect asset quality and investor confidence. Liquidity options such as secondary trading, redemption programs, or full asset sale events are provided based on the selected model.

Monetary Benefits of Tokenizing Specialized Asset Classes

Tokenization is reshaping the economics of high-value collectible and alternative assets. By converting traditionally illiquid assets such as fine art, wine collections, and luxury real estate into fractionalized digital securities, markets gain liquidity, lower transaction friction, and unlock new monetization mechanisms.

1. Extracting Liquidity Premium

Fine art and collectible markets are notorious for slow sales cycles and failed transactions. High-value pieces often require 6–18 months to sell, and roughly 40% of potential deals never reach completion. The challenge is not valuation; it is market structure.

How Tokenization Changes the Market

By enabling fractional ownership and establishing accessible secondary markets, tokenization shortens sale timelines and encourages ongoing trading.

Example Scenario:

| Metric | Traditional Sale | Tokenized Offering |

| Asset Value | $5.6M | $5.6M |

| Time to Market | ~9 months | 4 weeks |

| Transaction Cost | 15% ($840k) | 5% ($280k) |

| Structure | One buyer | 10,000 tokens @ $560/token |

Within 90 days, 35% of tokens had traded at an average 22% premium, creating near instant liquidity and additional upside for the issuer.

Liquidity Discount Recovery Model:

- Liquidity Cost = Asset Value × Opportunity Cost × Time Held

- Opportunity Cost (Alt Investment): 8%

- Time (years): 0.75

Cost = $5,600,000 × 0.08 × 0.75 = $336,000

Tokenization removes this waiting period cost, creating a direct monetary benefit.

2. Reducing Friction and Costs

Conventional sale processes for luxury assets involve costly intermediaries such as brokers, auction houses, insurers, and legal specialists. Tokenization significantly reduces these fees by automating and sharing infrastructure.

Traditional Cost Layers in the Art Market

- Auction commissions: 10–25%

- Insurance: ~1.5%

- Logistics: 0.5–1%

- Legal and diligence: 2–3%

Total cost: 14–30% of asset value lost to process

Tokenized Cost Framework

- Smart contract deployment: 0.1–0.3% (one time)

- Legal and compliance: 1–2%

- Platform fee: 2–5%

- Custody: 0.5–1% annually

Total upfront cost: 3.6–8.3% plus recurring custody fees

3. Value Lift From Transparency

Collectors and investors pay more when authenticity, ownership, and provenance are indisputable. Blockchain recordkeeping addresses opacity and reduces perceived risk.

Comparable Market Evidence

Tokenized real estate (RealT dataset) has shown capitalization rates 15–25% higher than those of similar non-tokenized assets, due to improved transparency and reduced uncertainty.

Transparency Driven Repricing Model

Base Value: $1,000,000

- Traditional Market Value = $1,000,000 × 0.80 = $800,000 (opacity penalty)

- Tokenized Value = $1,000,000 × 1.10 = $1,100,000 (transparency premium)

Net Valuation Gain = $1,100,000 – $800,000 = $300,000 (≈37.5% uplift)

4. Creating New Revenue Infrastructure

Tokenization enables income models linked directly to the productive performance of real assets.

For example, in the case of a Burgundy Premier Cru vineyard valued at €8M and divided into 80,000 tokens priced at €100 each, investors receive smart-contract-controlled payouts representing 70% of the vineyard’s annual profits. At the same time, ongoing secondary trading activity generates recurring marketplace fees, creating both passive yield for holders and sustainable revenue streams for the platform.

Platform Economics

| Category | Amount |

| Initial offering fee (2%) | €160,000 |

| Secondary market turnover (2× annual volume @ 0.25% fee) | €40,000/year |

| Total Year 1 revenue | €200,000 |

Replacing Debt Financing

Token sales can substitute expensive art-backed borrowing.

- Traditional loan: $10M asset → $4M loan @ 10% annual interest = $400,000 cost

- Token sale: Sell 40% ownership and retain 60% upside with zero interest expense

Savings: $400,000 annually

5. Portfolio Optimization and Risk Benefits

Tokenized luxury assets behave differently from stocks, bonds, and crypto. Their historically low correlation makes them strong diversification instruments that improve portfolio resilience and performance.

| Asset Pair | Historical Correlation |

| Art vs S&P 500 | 0.15–0.25 |

| Wine vs Bonds | 0.05–0.15 |

| Tokenized Assets vs Crypto | 0.30–0.45 |

Allocating 10% of a diversified portfolio to tokenized assets can:

- Increase Sharpe ratio by 15–25%

- Reduce volatility by 8–12%

For a $10M portfolio:

Volatility Reduction Value = $10M × 10% × 10% = $100,000/year

Additional Alpha (2%) = $200,000 added annual return

The 308% Growth in Tokenized RWAs Fuels Specialized Asset Classes

You might look at specialized assets like art or wine and wonder whether they truly fit in this ecosystem, yet the pace of adoption suggests their tokenization could soon feel standard. If this trajectory holds, then access, verification, and trading might become far more efficient and far less restricted than the traditional models investors rely on today.

1. Regulation Strengthened by Large-Scale Adoption

This market didn’t expand in a legal vacuum. Every asset put on-chain contributed to clearer rules and enforceable precedents.

What’s emerged is a repeatable compliance template built on:

- Regulatory Precedent: Tokenized funds, property, and treasuries paved the way for luxury collectables to be legally tokenized with less ambiguity.

- Institutional-Grade Compliance: KYC and AML frameworks, transfer-agent workflows, and disclosure standards now exist and are interoperable across blockchain ecosystems.

- Credibility Through Institutional Entry: When players like BlackRock, Franklin Templeton, and JPMorgan tokenize assets, regulators gain confidence instead of hesitation.

Luxury assets now benefit from the regulatory scaffolding that mainstream RWAs have already established.

2. Enterprise-Ready Infrastructure

The capital flowing into tokenized mainstream assets funded the technology, and specialized assets now get to inherit.

This includes:

- Mature Oracle Systems: Tools for proof-of-reserves and real-time data validation, originally built for financial markets, now support provenance tracking and asset authentication.

- Cross-Chain Financial Interoperability: Settlement networks originally designed for bonds and real estate now allow seamless movement of tokenized art, wine, and collectible shares.

- Secure Custody at Scale: Infrastructure hardening that came from securing billions in financial instruments now protects priceless cultural and luxury assets.

Specialized asset tokenization is stepping onto a platform already engineered, tested, and adopted.

3. A New Generation of Blockchain-Native Investors

Just a few years ago, tokenization required explaining blockchain fundamentals. That era is over.

Investors now understand concepts such as:

- Fractional ownership

- On-chain identity

- Automated compliance

- Digital provenance

- Programmable economic rights

They understand these not because they were theorized but because they are already used in tokenized financial markets.

The psychological barrier was higher than the technical one.

That barrier is gone.

Why Luxury Assets Are Becoming the Next Wave

The infrastructure exists. The regulatory pathway is defined. The market has matured.

So why art, wine, and collectibles?

Richer Metadata Creates Higher Value

Tokenized financial assets track ownership and yield, while tokenized cultural assets record provenance, conservation data, exhibition or publication history, and scarcity metrics. These added layers transform the asset into something with traceable identity and context, giving it narrative, emotional, and cultural resonance that traditional financial instruments simply cannot replicate.

Liquidity That Never Existed Before

Historically, assets like fine art trade only when a collector decides to sell and that may take decades.

Tokenization transforms static ownership into dynamic markets.

- Traditional art turnover: ~28 years

- Tokenized art turnover: ~18 months

Liquidity creates velocity. Velocity attracts capital.

Democratized Access Without Losing Exclusivity

A Warhol, a Rothschild vintage, or a Patek Philippe no longer needs to be transferred as one indivisible asset, because tokenization supports fractional access, legal compliance, investment grade custody, and transparent pricing that makes participation feasible for a wider range of investors without compromising the integrity or security of the underlying asset.

Today, the average entry point for tokenized art is $4,200, compared to multimillion-dollar physical ownership requirements.

The Adoption Timeline

| Phase | Market Focus | Core Outcome | Impact on Luxury Assets |

| 2022–2023 | Tokenized treasuries, cash equivalents | Regulatory clarity and compliance frameworks | The legal blueprint emerges |

| 2024 | Real estate, private equity, institutional pilots | Secondary markets mature | Investor education consolidates and custody scales |

| 2025–Present | Luxury assets, IP, collectibles | Specialized platforms emerge | Tokenization shifts from infrastructure to experience |

We have now entered Phase 3: Specialization.

The Data Signals the Opportunity

- Tokenized assets trade at 15–30% higher valuations due to liquidity premiums.

- Family offices are now allocating 5–7% to tokenized luxury assets.

- Retail access remains largely unrealized despite demand growth.

Yet adoption is still early:

- Only 12% of galleries have tokenization plans

- Only 8% of fine wine funds offer digital equivalents

- Institutional participation dominates the market

This disconnect between readiness and utilization is where the opportunity lies.

Challenges to Tokenize Specialized Asset Classes Like Art or Wine

Tokenizing physical luxury assets sounds simple on paper. You verify ownership, fractionalize it, mint tokens, and unlock global liquidity. In reality, the gap between the physical world and blockchain infrastructure is huge, and the challenges show up in places most newcomers don’t expect.

1. The Regulatory Uncertainty Problem

The classification of tokenized assets is still shifting, and a token can fall under multiple regulatory categories depending on its structure. Misalignment increases compliance risk, and current legal frameworks are not built for fractional digital ownership. This uncertainty often slows interest from legal teams, investors, and institutional partners.

What works:

The most reliable approach is to assume the asset will be treated as a regulated financial instrument. Starting with a compliant structure avoids expensive retroactive fixes.

Our implementations typically include:

- Security-focused token standards such as ERC-1400 or ERC-3643

- On-chain compliance enforcement, including KYC and AML-gated transfers

- Legal wrappers like SPVs that mirror on-chain ownership logic

- Region-specific compliance module,s including Reg D, Reg S, and MiCA frameworks

Why it matters: Platforms that embrace regulation early build trust and longevity. Platforms that avoid it usually hit barriers when they attempt to scale.

2. Custody and Risk of the Physical Asset

A digital token has value only if the physical asset behind it is verified, protected, and accessible. Damage, mishandling, or poor custody practice can destroy millions in value and investor confidence.

Many blockchain teams underestimate the operational complexity of storing wine, fine art, or similar luxury assets.

How we solve it:

We work only with custodians who specialize in handling rare physical assets. A typical setup includes:

- Climate-controlled bonded wine cellars and museum-grade art vaults

- Insurance from reputable underwriters with full risk coverage

- Legal isolation through SPVs to separate the asset from the platform’s corporate risk

- Chain-of-custody tracking that ties the physical item to a tamper-proof digital record

3. The Trust and Verification Barrier

Periodic audits and paper certificates are not enough once ownership becomes fractional and globally distributed.

The solution:

Transparency must be continuous rather than occasional. Our verification frameworks often include:

- IoT sensors tracking temperature, humidity, position, and access

- Blockchain oracle feeds using solutions like Chainlink or API3

- Tamper-resistant tags and verifiable provenance systems

- Randomized audit requests initiated by smart contracts with penalties for non-compliance

Every environmental event, movement, or inspection becomes part of the asset’s immutable on-chain history.

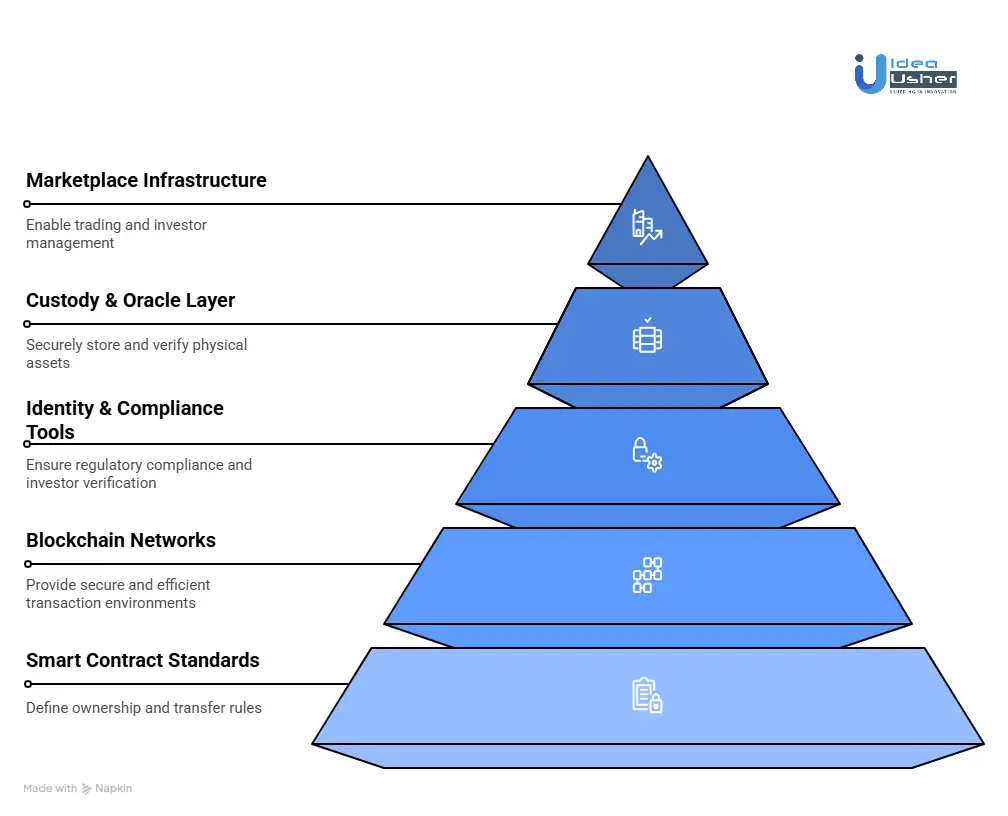

Tools & APIs to Tokenize Specialized Asset Classes Like Art or Wine

Tokenizing real-world assets such as fine art, rare wine, collectibles, or heritage pieces requires a carefully assembled technology stack. Unlike standard NFT projects, these asset classes demand regulatory compliance, secure custody infrastructure, data integrity, and long-term provenance protection. Below is a breakdown of the core technology layers used when building platforms for tokenized luxury assets.

1. Smart Contract Standards

The smart contract layer defines how ownership is represented, transferred, and enforced. Different standards apply depending on whether the asset is fractionalized, tradeable as a security, or represented as a collectible.

- ERC-721: Ideal for one-of-a-kind collectibles and non-fungible assets such as a single artwork, bottle, or vintage case.

- ERC-20: Used for fungible fractional ownership models. Each token represents a share rather than a unique item.

- ERC-1400 and ERC-3643: Designed for regulated tokens that must comply with securities rules. These standards allow permissions, restrictions, and compliance logic to be embedded directly into the token.

Choosing the correct standard depends on whether the project is creating a collectible, a tradable investment product, or a hybrid model.

2. Blockchain Networks

Different blockchain environments serve different needs depending on cost, speed, accessibility, and regulatory sensitivity.

- Ethereum: The primary network for high-value assets where trust, security, and strong institutional adoption are important.

- Polygon: Useful for lower fees and smooth secondary trading while still benefiting from Ethereum security.

- Avalanche: Known for efficiency and scalability, especially for platforms expecting high transaction throughput.

- Hyperledger Besu: Best suited for enterprise or private tokenization environments where consortium governance or permissioned access is required.

The right choice typically depends on the balance between cost, compliance, and the expected trading environment.

3. Identity and Compliance Tools

Since tokenized fine assets often fall under investment regulations, compliance must be automated and reliable.

- KYC and KYB APIs: Verify individual investors and legal entities before they can participate.

- AML Screening Systems: Detect sanctioned or high-risk participants and maintain regulatory records.

- On-chain Digital Identity Frameworks: Allow identity verification to remain verifiable on-chain without exposing private personal information.

A compliant tokenization platform ensures only eligible participants can trade, hold, or redeem real-world-backed tokens.

4. Custody and Oracle Layer

For physical assets, digital ownership only works if the real-world item is securely stored, traceable, and verifiable.

- Chainlink or API3 Oracles: Bring off-chain custody, audit, insurance, and condition reporting on-chain.

- IoT Temperature or Condition Telemetry: Useful for wine, collectibles, and sensitive materials that require environmental stability.

- Vaulting and Escrow Platforms: Professional storage partners create trust that the underlying asset is safeguarded, insured, and monitored.

This layer connects the digital token to the physical asset’s real status in real time.

5. Marketplace and Tokenization Infrastructure

This layer enables minting, investor onboarding, secondary trading, and compliance automation.

- Fireblocks: Provides secure wallet infrastructure, transaction governance, and safe platform operations.

- Tokeny and Securitize APIs: Support on-chain compliance, token issuance, transfer controls, and investor lifecycle management.

- Polygon RWA Toolkit: Offers ready-made components tailored specifically for real world asset tokenization on the Polygon network.

These platforms accelerate development and reduce the risk of building compliance features from scratch.

Top 5 Examples of Tokenized Specialized Assets

We have spent time researching how tokenization is moving into specialized asset classes, and it is clear that this shift is becoming a serious part of alternative investment frameworks. You will notice that these examples are not theoretical because each represents a real asset converted into tradable digital ownership that may improve liquidity while maintaining custody security.

1. Tokenized Pablo Picasso Painting

Fine art tokenization allows high-value artworks to be divided into fractional ownership shares, making historically exclusive markets accessible to wider investors. A notable example is the fractionalized offering of a Pablo Picasso painting, where verified digital shares were issued through regulated platforms.

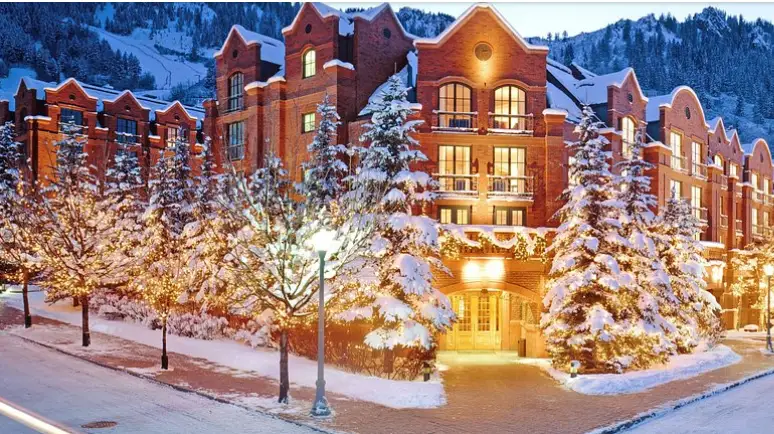

2. St. Regis Aspen Resort

The St. Regis Aspen Resort became one of the earliest large-scale commercial properties to be tokenized, offering fractional ownership through blockchain. The equity was issued as security tokens on tZERO, enabling investors to purchase a stake in the luxury hotel without traditional barriers to entry.

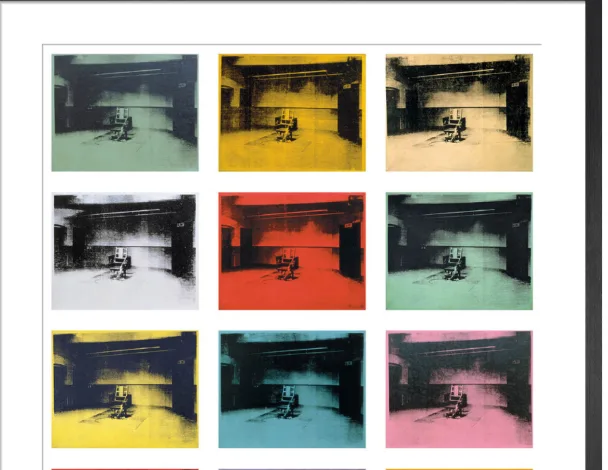

3. Andy Warhol’s 14 Small Electric Chairs

This famous Andy Warhol artwork was partially tokenized by Maecenas, allowing investors to buy digital shares representing ownership in the piece. By tokenizing a high-value artwork, the project demonstrated how blockchain can open fine art investment to a broader audience rather than restricting it to wealthy collectors. Nearly half of the artwork’s value was fractionalized and sold during the offering.

4. WeWork Zurich Location

Sygnum Bank partnered with WeWork to tokenize ownership shares in a Zurich office building. Investors were able to purchase blockchain-based tokens linked to equity in the commercial property. This tokenization model improved liquidity and accessibility for institutional and retail investors seeking exposure to income-generating commercial real estate.

5. Rare Scotch Whisky Barrels

Platforms like CaskX tokenize ownership of rare and aging Scotch whisky barrels, providing investors access to a traditionally niche asset class. As whisky matures, the value of the physical barrels typically increases, and tokenization makes it easier to buy, sell, or transfer ownership. This model highlights how blockchain enables fractional investment in specialized luxury and collectible assets.

Conclusion

Tokenizing assets like fine art and rare wine is quickly becoming a serious investment frontier because it makes ownership more liquid, accessible, and globally tradable. With the right legal setup, token standards, and automated compliance, the model becomes secure and scalable, rather than experimental. If you choose to build with Idea Usher, you get full-stack development, token architecture, marketplace tooling, and institutional-grade implementation so you can deploy confidently in the growing RWA space.

Looking to Tokenize Specialized Asset Classes Like Art or Wine?

IdeaUsher can help you tokenize assets like art or wine by building a secure platform with compliance, smart contracts, and marketplace features. With over 500,000 hours of coding experience and a team of ex-MAANG/FAANG developers, the process becomes faster and technically sound. If you want to launch confidently, the team can support architecture, integrations, and long-term scaling.

What we deliver:

- Fractional Ownership Models that open investment to a global audience.

- Regulatory-by-Design Architecture ensuring full compliance across jurisdictions.

- Real-World Asset Bridging linking physical custody to on-chain authenticity.

- Liquidity Engine Integration with DeFi protocols for 24/7 trading.

- Immutable Provenance Tracking from creation to every future sale.

We’ve delivered cutting-edge blockchain solutions for forward-thinking enterprises. Check out our latest projects to see how we turn complex asset classes into tomorrow’s digital assets.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Ownership is legally enforced through a structure like an SPV or a trust that holds the physical asset, while the token represents equity in that entity. So even though ownership is recorded on the blockchain, the legal rights are backed by a traditional framework recognized by courts and regulators. This setup ensures that every token holder has a verifiable claim in the event of ownership challenges or transfers.

A2: Fractional owners can redeem the full physical asset, but it usually happens through a governed process rather than one person acting alone. Most platforms use voting or DAO logic to decide when redemption is allowed, and the rules are set before the tokens are issued. Once approved, the platform either transfers the asset to a single holder or liquidates it and distributes its value to all participants.

A3: Ethereum, Polygon, Avalanche, and permissioned chains like Hyperledger are commonly used for tokenizing collectible assets because they support smart contracts and interoperability. You might choose Ethereum for liquidity or ecosystem maturity, while Polygon or Avalanche could help with lower transaction costs. Enterprise chains are useful when compliance, privacy, and controlled access matter more than public trading.

A4: In most jurisdictions, tokenized art or wine is considered a security because fractional ownership gives holders an expectation of value or profit. That means the offering must follow STO regulations, automated KYC, AML checks, and compliance workflows. Treating the token as a regulated financial product protects both the issuer and investors while giving the platform long-term viability.