Raising capital in today’s regulated markets is increasingly complex, especially for companies entering digital assets. Traditional fundraising involves long approval cycles, strict compliance, and heavy administration that slow growth. As a result, interest in digital securities issuance is rising, offering a more transparent, efficient, and globally accessible approach to managing regulated fundraising for both issuers and investors.

A Security Token Offering (STO) merges blockchain with financial compliance to offer a modern, regulated alternative to capital markets. Smart contracts automate onboarding, KYC/AML, lock-ups, and dividends, while tokenized securities enable secure cross-border ownership. Businesses raise capital efficiently, and investors gain access to assets with real regulatory oversight.

In this guide, we’ll break down how to launch a fully compliant security token offering, how STOs work, and the regulatory requirements you must meet. With experience in building and launching blockchain solutions for numerous industries, IdeaUsher will help you build the entire STO platform with clarity and confidence.

What is a Security Token Offering (STO)?

A Security Token Offering (STO) is a regulated fundraising model where a company issues blockchain-based tokens that represent real financial assets, such as equity, debt, profit rights, or ownership claims. These tokens operate like traditional securities but leverage blockchain for improved efficiency, transparency, and global investor access.

STOs merge the legal safeguards of traditional finance with the automation and programmability of digital assets, giving investors a compliant and trustworthy way to participate in tokenized markets.

- Regulatory compliance: Security tokens must follow established financial regulations, ensuring issuers meet legal standards and investors receive protection similar to traditional securities markets.

- Investor rights: Holders receive clear rights such as ownership, voting, dividends, or profit shares, all encoded transparently within the digital token.

- Legal enforceability: Each token represents a compliant, legally binding claim, meaning investors have enforceable protections backed by real-world contracts and regulatory frameworks.

- Asset-backed value: Security tokens are tied to real assets such as equity, real estate, or debt instruments, giving them intrinsic value rather than speculative utility.

- Transparent ownership records: Blockchain’s immutable ledger provides a clear audit trail of token ownership, reducing disputes, improving trust, and simplifying reporting for issuers and regulators.

How a Compliant STO Works?

Security Token Offerings (STOs) are regulated fundraising methods where companies issue digital tokens for ownership, debt, or revenue rights, complying with securities laws. Unlike unregulated ICOs, STOs follow strict legal rules to protect investors. Here’s the workflow:

1. Business Planning & Securities Structure Design

The issuing company sets fundraising goals, defines what the token represents, and determines offering terms. Legal advisors assess applicable regulations and choose the right exemption or registration path based on jurisdiction and investor type.

Example:

Tech startup “GreenEnergy Inc” plans to raise $10M via STO for solar farm expansion. Legal team structures tokens as equity securities (common stock equivalents) granting ownership + voting rights.

Chooses Reg D 506(c) for accredited U.S. investors, Reg S for international. Issues 10M tokens at $1 each, with quarterly dividends and 12-month lock-up. Legal setup: 6 weeks, $85K fees.

2. Legal Documentation & Regulatory Filings

The company prepares legal documents and files required forms with regulators. Governance structures are implemented, and investor communication protocols are set to meet disclosure requirements.

Example:

GreenEnergy’s legal team prepares an offering memorandum and files Form D with the SEC within 15 days of the first sale, detailing issuer info, offering amount, and exemption claimed.

Registers as Delaware C-Corp, establishes transfer agent relationship with Pacific Stock Transfer, creates investor relations portal for quarterly reporting. Incorporates smart contract audit by CertiK ($45K cost). Total legal documentation: 8 weeks, $120K costs.

3. Smart Contract Deployment

The company selects a blockchain network and develops or licenses security token tech. Smart contracts are programmed with compliance rules and undergo security audits. KYC/AML checks and automated compliance are integrated into the platform.

Example:

GreenEnergy issues ERC-1400 tokens on Ethereum for liquidity. Smart contracts enforce a 12-month transfer lock, KYC-only wallet transfers, 4.9% ownership cap, and quarterly automated dividends.

Integrates Securitize’s compliance platform for KYC/AML ($25K setup + $2K monthly). Contract audited by OpenZeppelin (3-week audit, $60K). Infrastructure deployment: 10 weeks, $145K total costs.

4. Investor Onboarding & KYC/AML Verification

Investors find the offering through compliant channels, register, and complete KYC/AML and accreditation checks. The platform verifies eligibility, and only approved investors can access materials and participate.

Example:

GreenEnergy markets via accredited investor networks and broker-dealers (no social media per Reg D). Investor Sarah registers, verifies identity, and submits a CPA letter confirming her $250K income for accreditation.

Platform uses Onfido for identity verification (completed in 12 minutes), VerifyInvestor for accreditation ($25 per verification, 48-hour turnaround). System checks OFAC sanctions lists automatically. Sarah approved after 3 days, can now access offering memorandum and invest.

5. Token Purchase & Issuance

Approved investors review documents, agree to terms, and submit funds. After confirmation, tokens are minted and distributed to wallets. All issuances are recorded on-chain with compliance data.

Example:

Sarah invests $50,000 (50,000 tokens at $1) via wire transfer. She digitally signs subscription agreement and investor questionnaire. GreenEnergy’s bank confirms payment receipt in 2 business days. Platform records commitment in Carta (cap table software).

At first closing (30 days into offering), $3.2M raised from 127 investors. Smart contract mints 3.2M tokens, distributes to verified wallets within 4 hours. Sarah receives 50,000 tokens in her MetaMask wallet connected to Securitize. Lock-up timer starts automatically, tokens non-transferable for 12 months.

6. Ongoing Compliance & Investor Relations

After issuance, the company maintains compliance, files reports, and manages governance. The platform enforces transfer restrictions, updates registries, and automates payments and communication as required.

Example:

GreenEnergy files Form D amendments when raising additional tranches, provides quarterly financial reports to all 847 token holders via investor portal (SEC requirement for Reg D). After Q1, solar farm generates $420K net profit—smart contract automatically distributes proportional dividends ($0.042 per token). Sarah receives $2,100 in USDC to her wallet.

GreenEnergy files Form D amendments for new fundraising and provides quarterly reports to 847 token holders. After Q1, the solar farm earns $420K net profit; dividends are automatically distributed ($0.042 per token), and Sarah receives $2,100 in USDC.

Company holds annual shareholder vote on board elections via blockchain governance (674 participants, 79% turnout). Transfer agent maintains compliant registry, files required state-level reports. All transfers remain blocked until 12-month lock-up expires.

7. Secondary Market Trading & Liquidity

Once lock-up periods end and if allowed, tokens can trade on regulated exchanges that enforce compliance rules. Liquidity may be limited due to regulations and smaller investor pools.

Example:

After 12-month lock-up, GreenEnergy tokens list on tZERO (regulated ATS) and INX (licensed broker-dealer exchange). Sarah decides to sell 20,000 tokens. Lists at $1.35 per token (35% premium reflecting company growth and dividend history). Buyer completes KYC verification, confirms accredited status.

Smart contract verifies buyer eligibility, executes trade in 45 seconds, updates ownership registry. Sarah receives $27,000 (minus $270 exchange fee, 1% commission). Daily trading volume: $15K-$40K with 8-12% bid-ask spread (lower liquidity than public stocks but meaningful improvement over pre-STO illiquidity).

How a 71% Investor Preference Accelerates STO Adoption in Digital Securities Issuance?

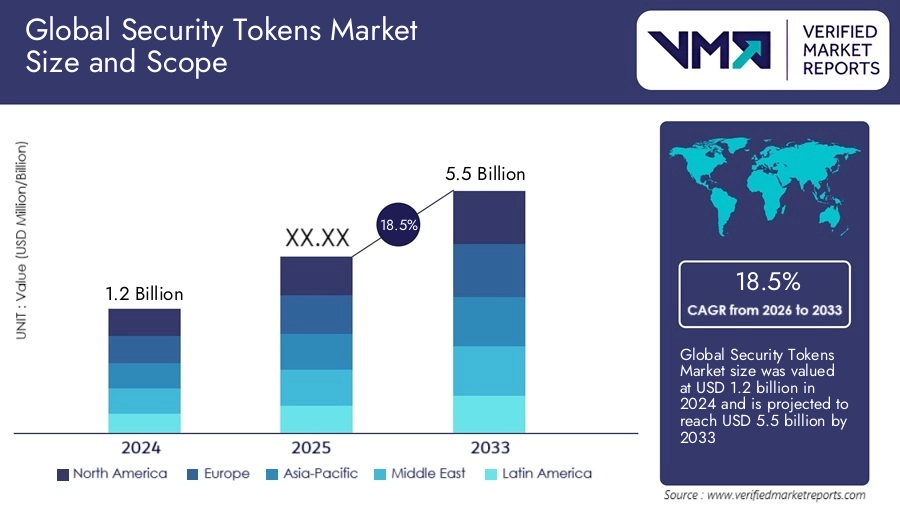

The Security Tokens Market size is expected to reach USD 1.2 billion in 2024 and grow to USD 5.5 billion by 2033, with a CAGR of 18.5% from 2026 to 2033. This growth reflects increasing regulatory clarity and institutional interest in compliant digital securities infrastructure.

According to recent industry surveys, 71% of investors prefer STOs for regulated digital assets, showcasing strong investor confidence in compliant tokenized offerings and signaling growing demand for secure digital securities issuance frameworks.

Why Investor Demand Makes STOs a Smart Choice for Digital Securities Issuance?

Investor behavior is shifting rapidly toward compliant, transparent, and digitally native securities.

- 67% of enterprises have already begun integrating tokenization into their operations, strengthening ecosystem readiness for STOs and increasing potential issuer–investor connectivity.

- A recent RegTech study found issuers adopting STO frameworks experienced up to 40% lower issuance costs than traditional public offerings, driven by reduced intermediary and compliance overhead.

- Tokenized real-estate securities show 63% adoption across major real-estate firms (12% fully implemented, 46% in pilot), demonstrating momentum in one of the largest asset classes.

- Institutional-grade stablecoin infrastructure saw a 90% surge in institutional adoption in Q2 2025, indicating that regulated players are increasingly comfortable with blockchain-based financial instruments.

- Live STO case studies show compliant offerings achieving 100% fundraising success rates from 2018–2019, with examples like tZERO raising USD 134M, NEXO raising USD 52.5M, and Blockchain Capital raising USD 10M in hours, highlighting STOs as a proven vehicle for capital formation.

How STO Technology Enhances Efficiency & Investor Trust?

STOs provide measurable operational advantages across the entire securities lifecycle.

- STOs can reduce offering costs by up to 40%, offering issuers a capital-efficient alternative to IPOs or traditional private placements.

- Blockchain-enabled tokenized securities reduce post-trade operational costs by up to 50%, cutting reconciliation, settlement, confirmation, and reporting overhead.

- Digital securities benefit from near-instant settlement, compared to T+2 or T+3 in traditional markets, accelerating liquidity, capital access, and investor returns.

- Blockchain-based compliance frameworks reduce manual audit workload, with one study reporting a 22% faster regulatory review cycle for tokenized fund structures.

- Smart-contract–driven issuance reduces administrative error rates which contribute to 15–20% of operational breaches in traditional markets, resulting in higher overall system integrity.

Key Features of a Compliant Security Token Offering Platform

A compliant security token offering platform must balance robust investor protections with seamless user experience. By integrating advanced compliance tools and streamlined digital securities issuance, it enables secure, transparent, and regulation-ready tokenized fundraising.

1. Automated KYC and AML Verification System

This module performs identity verification and anti-money laundering checks using automated workflows and secure verification APIs. It ensures only verified, risk-screened participants enter the STO, strengthening regulatory compliance and reducing manual review overhead for issuers and administrators.

2. Investor Accreditation Management

The platform validates and maintains investor accreditation status according to jurisdictional requirements. Through credential proofs and periodic revalidation, it ensures only qualified investors participate in regulated offerings, enabling smooth onboarding for both institutional and high-net-worth participants.

3. Smart Contract-Based Compliance Rules

Compliance logic is embedded directly into smart contracts to enforce automated transfer restrictions aligned with securities regulations. These programmable rules prevent unauthorized transfers, support holding limits, and maintain regulatory integrity throughout the entire lifecycle of the security token.

4. Multi-Jurisdictional Regulatory Framework

The platform includes configurable compliance templates supporting Reg D, Reg S, Reg A+, MiFID II, and other global frameworks. This allows issuers to operate across borders with dynamic jurisdiction routing, reducing legal complexity while maintaining strict alignment with regional securities laws.

5. Allowlisting & Blocklisting Functionality

A robust permission layer controls which investors can buy, sell, or hold the token based on compliance status. Through real-time allowlist and blocklist updates, issuers maintain complete control over eligibility while ensuring every transaction respects regulatory boundaries.

6. Cap Table Management Dashboard

The system provides a unified dashboard to monitor shareholder positions, historical activity, and tokenized equity distribution. This real-time cap table gives issuers instant visibility into ownership changes while providing transparent governance for compliant STO operations.

7. Dividend and Profit Distribution Automation

Automated payout workflows calculate returns and distribute dividends or profit shares to token holders. The platform supports tax-aware distribution logic, ensuring accurate reporting and seamless delivery of financial benefits tied to tokenized securities.

8. Secondary Market Trading Controls

A compliance engine governs resale activities with lock-up periods, transfer restrictions, and regulatory hold features. These controlled secondary market rules ensure token trading respects securities laws while enabling compliant liquidity events for investors.

9. Regulatory Reporting and Audit Trail

The platform generates immutable logs of transactions, approvals, and compliance checks, creating a verifiable audit trail for regulators. This tamper-resistant reporting layer simplifies regulatory reviews and strengthens trust in the STO’s operational integrity.

10. Investor Portal With Document Management

Investors access offering documents, voting rights, statements, and investment records through a secure portal. Integrated document authentication ensures accurate distribution of disclosures, keeping investors informed and giving issuers a centralized communication hub for ongoing engagement.

How to Launch a Security Token Offering (STO) Platform?

Our developers follow a strategic process to ensure smooth platform setup, strong compliance, and seamless user experience. With efficient digital securities issuance, you can launch a secure and scalable STO platform with confidence.

1. Consultation

We begin by analyzing your regulatory obligations, asset structure, investor profile, and fundraising goals. This consultation stage helps us design a compliance-aligned STO framework that matches jurisdictional requirements while preparing the platform for secure, audit-friendly token issuance.

2. Regulatory and Legal Structuring

Our team collaborates with legal experts to define the token’s classification, disclosure requirements, and investor eligibility criteria. This ensures the STO is built on a legally enforceable foundation, reducing future regulatory risks and supporting multi jurisdictional fundraising strategies.

3. Designing the Compliance Architecture

We architect a rules-based compliance system that encodes investor limits, transfer restrictions, and geographic controls. By embedding regulatory logic directly into workflows, we ensure every investor action remains compliant across the entire lifecycle of the security token.

4. Building the KYC, AML, and Accreditation Modules

We integrate automated identity verification, AML screening, and accreditation workflows. These checks establish a verified investor ecosystem where all participants meet the required standards before interacting with the STO or accessing investment opportunities.

5. Smart Contract Development

Our developers create security token smart contracts that include programmable compliance rules, cap table logic, and distribution rights. These contracts maintain trustless enforcement of investor protections, ensuring that every token behaves exactly as the regulatory framework requires.

6. Creating the Issuer and Investor Dashboards

We build intuitive dashboards for issuers and investors to manage offerings, documents, communications, and participation. With secure document handling and clear investment workflows, both sides experience a streamlined and compliant STO environment.

7. Implementing Secondary Trading Compliance Controls

We configure controls for lock-up periods, regulated transfer paths, and eligibility checks for secondary sales. These market-ready compliance safeguards allow tokens to trade while preserving regulatory integrity and preventing unauthorized resale.

8. Adding Reporting and Audit Trail Capabilities

Our team implements immutable logs for transactions, approvals, and compliance events. This tamper-proof audit layer helps issuers demonstrate compliance to regulators and supports transparent monitoring throughout the STO lifecycle.

9. End-to-End Testing and Quality Review

We test every compliance flow, smart contract rule, and investor verification step to ensure seamless operation. This stage guarantees a fully compliant, error-free issuance process that meets both regulatory and investor expectations.

10. Launch and Ongoing Compliance Support

Once everything is validated, we execute the STO launch and monitor its regulatory and operational behavior. Our team provides continuous compliance oversight, ensuring the offering remains aligned with evolving regulations and investor protection standards.

Cost to Launch a Compliant Security Token Offering Platform

The cost to launch a compliant security token offering platform depends on features, regulatory needs, and the complexity of digital securities issuance workflows. A well-planned investment ensures a secure, scalable, and regulation-ready STO ecosystem.

| Development Phase | Description | Estimated Cost |

| Consultation | Defines regulatory goals and fundraising structure to shape your STO blueprint. | $5,000 – $10,000 |

| Regulatory & Legal Structuring | Establishes the legal foundation of the token, disclosures, and investor eligibility rules. | $8,000 – $15,000 |

| Compliance Architecture Design | Designs the system for rules-based compliance, transfer limits, and geographic restrictions. | $10,000 – $18,000 |

| KYC/AML & Accreditation Module | Builds automated workflows for identity checks and investor qualification across jurisdictions. | $8,000 – $14,000 |

| Security Token Smart Contract Development | Creates compliant smart contracts with programmable restrictions and tokenized rights. | $10,000 – $20,000 |

| Issuer & Investor Dashboard | Develops user dashboards for offering management, documents, and investor interactions. | $7,000 – $12,000 |

| Secondary Trading Compliance Controls | Implements lock-up periods and regulatory transfer checks for market-ready compliance. | $6,000 – $10,000 |

| Audit Trail & Reporting System | Adds immutable logs and regulatory reporting for transparent oversight. | $6,000 – $10,000 |

| Testing | Ensures error-free compliance flows and smart contract reliability before launch. | $5,000 – $10,000 |

| Launch & Post Launch Support | Supports rollout, monitoring, and ongoing compliance alignment after deployment. | $5,000 – $13,000 |

Total Estimated Cost:

Note: Actual costs vary by jurisdiction, compliance complexity, onboarding needs, and customization. Additional integrations or advanced reporting may also affect the budget.

Consult IdeaUsher for an STO estimate and roadmap. Our experts help enterprises create compliant STO platforms, ensuring regulatory alignment and a seamless investor experience.

Tech Stacks to Launch a Compliant Security Token Offering

Launching a compliant Security Token Offering (STO) requires a robust tech stack that seamlessly integrates blockchain, security, and regulatory workflows.

1. Blockchain and Smart Contract Layer

Platforms like Ethereum, Polygon, and Avalanche support compliant security token issuance, while OpenZeppelin Contracts provides audited templates to implement secure token standards, permissions, and automated compliance rules.

2. KYC, AML, and Accreditation Layer

Tools such as Trulioo, Sumsub, and Jumio automate identity checks and accreditation, while Chainalysis and Elliptic add on chain AML risk monitoring for secure, compliant investor onboarding.

3. Backend and Compliance Engine

Frameworks like Node.js and Python Django power regulatory workflows, while PostgreSQL and MongoDB store investor data, compliance logs, and audit trails needed for STO governance.

4. Frontend and Investor Interfaces

Technologies like React.js and Next.js create responsive investor dashboards, and Tailwind CSS or Material UI deliver clean, intuitive interfaces for a smooth STO participation experience.

5. Security and Audit Infrastructure

Services such as Quantstamp and CertiK audit token contracts for vulnerabilities, while HashiCorp Vault secures keys and sensitive configuration data across STO operations.

Challenges & Solutions During STO Platform Development

Developing an STO platform involves navigating complex technical, regulatory, and security requirements. Addressing these challenges with the right architecture and compliance strategy ensures a trusted, scalable environment for both issuers and investors.

1. Navigating Complex Global Regulations

Challenge: Complying with multiple regulatory frameworks like Reg D, Reg S, Reg A Plus, and MiFID II is difficult because each jurisdiction imposes different rules and investor requirements.

Solution: We solve this by developing a multi-jurisdictional compliance engine that adapts rules dynamically. Our system adjusts investor eligibility, transfer controls, and reporting workflows to keep the Security Token Offering compliant across regions without manual intervention.

2. Enforcing Transfer Restrictions and Holding Limits

Challenge: Maintaining legally required restrictions on token transfers, lock up periods, and investor limits is difficult without automated safeguards in the token lifecycle.

Solution: We embed programmable compliance rules inside the token smart contracts. These rules control transfer eligibility, lock up enforcement, and holding caps to ensure every movement of the security token remains compliant at all times.

3. Ensuring Scalable and Accurate Investor Management

Challenge: Tracking investor ownership, distributions, and cap table updates becomes complex as participation grows, and any inaccuracy can disrupt compliance.

Solution: We implement a real time cap table system that records ownership changes immutably. This gives issuers transparent oversight of investor activity, dividend distribution, and lifecycle events within the STO ecosystem.

4. Building a Trusted Secondary Trading Environment

Challenge: Enabling compliant secondary trading is difficult because resale rules, investor eligibility, and geographic limitations must be enforced consistently.

Solution: We create regulated secondary trading controls that validate investor status, lock up completion, and jurisdiction constraints before approving transfers. This ensures the STO tokens remain tradable while staying fully compliant.

Top Security Token Offering (STO) Platforms in 2025

Security Token Offerings (STOs) are transforming finance by integrating compliance, transparency, and blockchain efficiency in capital raising. These platforms offer digital securities issuance to tokenized securities, real-world assets, and digital investments.

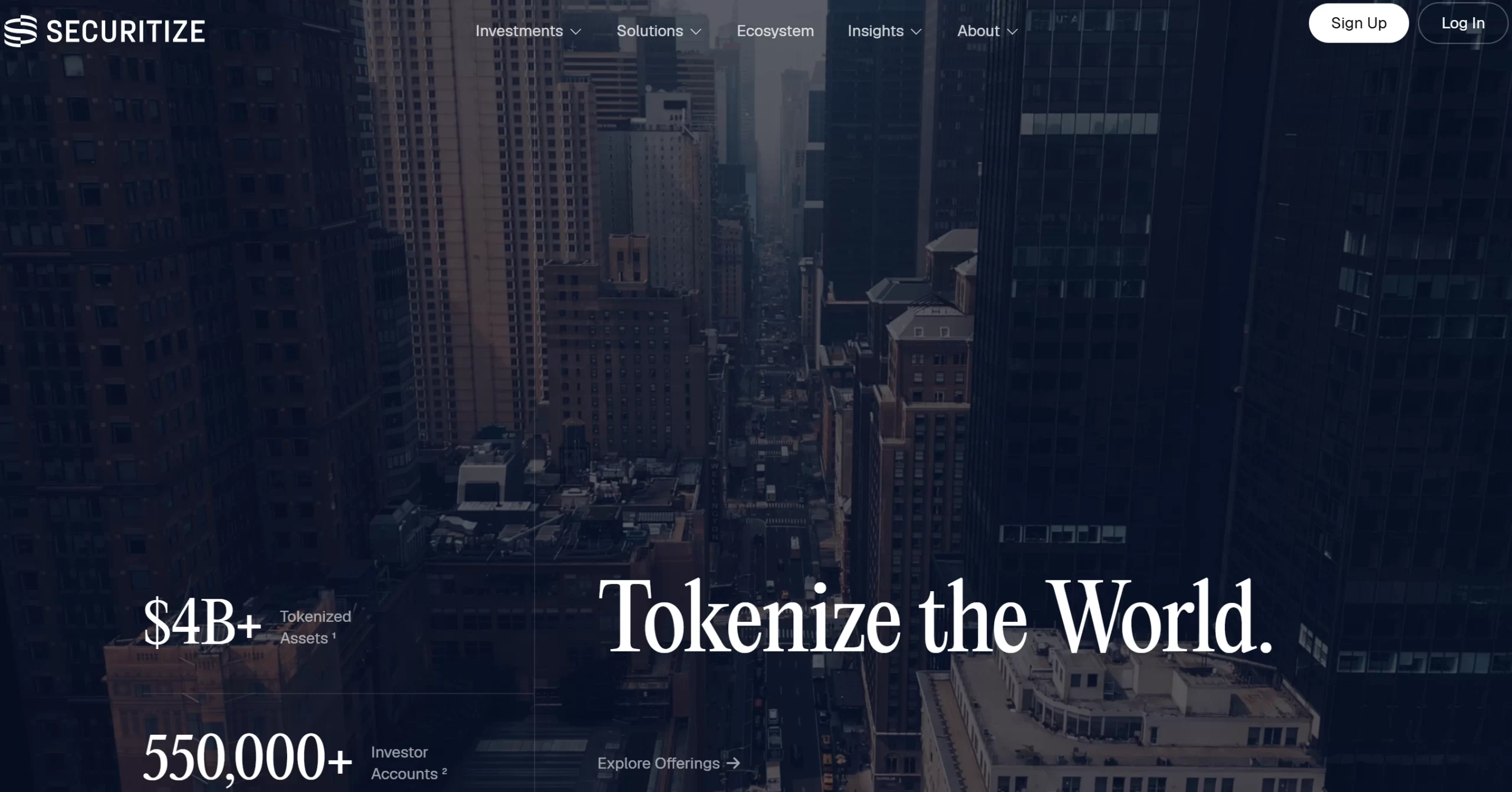

1. Securitize

Securitize is a leading platform for issuing and managing digital securities, offering compliant investor onboarding, token issuance, and lifecycle management. Its regulated broker-dealer and ATS enable secure secondary trading, making it a trusted, end-to-end solution for compliant security-token fundraising.

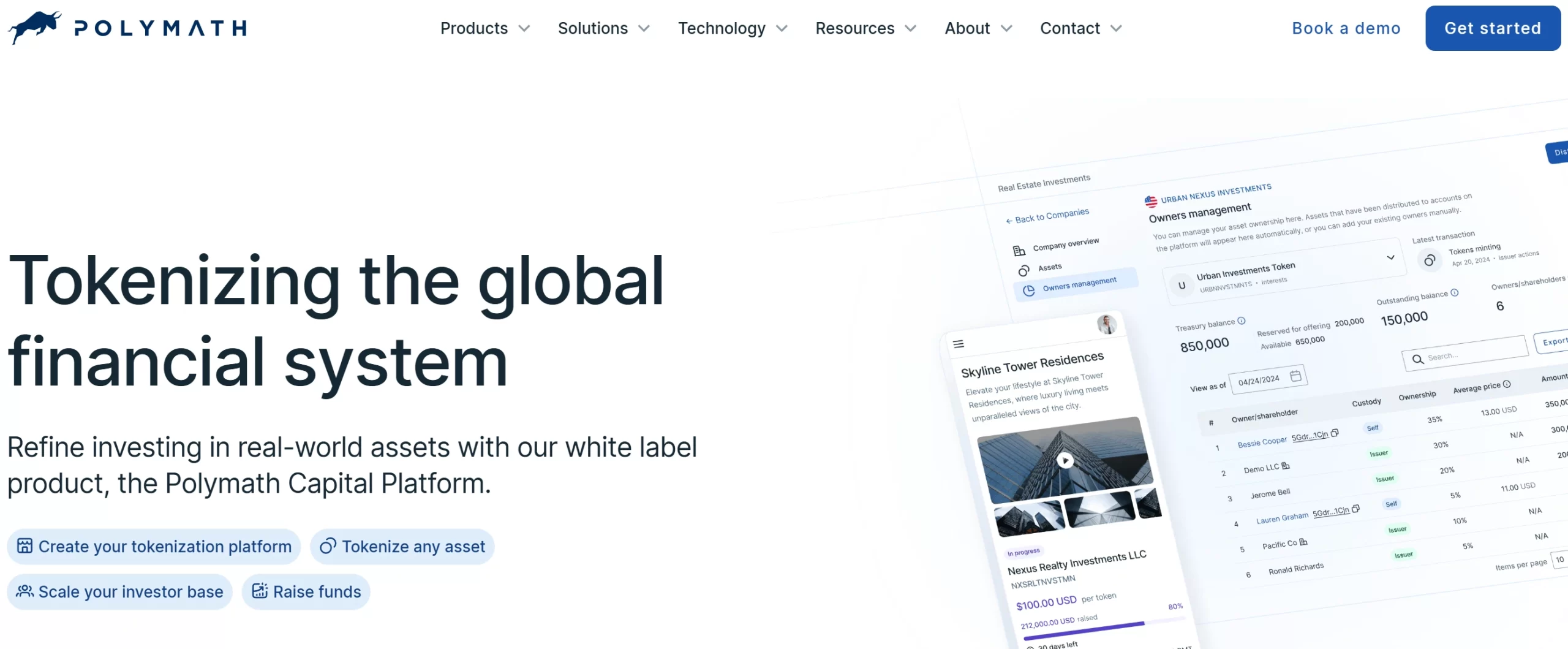

2. Polymath

Polymath provides the technological framework for security-token creation, using its ERC-1400/ST-20 standards to support compliant tokenization of assets. With a strong developer ecosystem and focus on institutional needs, it’s widely used for large-scale, regulatory-focused tokenization of funds, real estate, and equity.

3. tZERO

tZERO is one of the earliest regulated marketplaces for security-token trading, backed by Overstock.com. It offers advanced trading technology and a regulated ATS, delivering essential liquidity solutions and institutional credibility for tokenized securities within the emerging digital-asset ecosystem.

4. INX

INX operates a fully regulated global marketplace for security tokens and digital assets, gaining recognition after its SEC-registered STO raised over $80 million. It offers compliant trading and issuance services, appealing to institutions seeking secure, regulation-driven access to tokenized securities.

5. STOKR

STOKR provides an EU-based marketplace for raising capital through legally compliant security tokens, offering retail-friendly access to tokenized shares and profit rights. Supporting issuance on Ethereum and the Liquid Network, it appeals to startups and SMEs seeking transparent, blockchain-based fundraising.

Conclusion

Launching a compliant STO requires a clear strategy, careful regulatory alignment, and well-structured investor communication. As you work through each stage, it becomes easier to understand how digital securities issuance can create a more transparent and efficient fundraising path. Whether you are tokenizing equity, debt, or asset-backed instruments, the core focus remains investor trust and regulatory clarity. By approaching the process with the right planning, you set a foundation that supports long-term growth and builds confidence in both your offering and your business.

Why Choose IdeaUsher for Your Security Token Offering Development?

IdeaUsher delivers expert solutions for compliant digital securities issuance, helping businesses raise capital while adhering to regulatory frameworks. We combine advanced blockchain technology with robust compliance processes to ensure secure, transparent, and efficient fundraising for issuers and investors alike.

Why Work with Us?

- Regulatory Compliance Expertise: Our team ensures your STO meets jurisdictional requirements for digital securities issuance.

- End-to-End Solutions: From token design to investor onboarding, we provide comprehensive services to launch a fully compliant STO.

- Proven Success: We have helped companies implement secure and transparent blockchain-based fundraising platforms that build investor trust.

- Scalable and Secure: Our platforms are designed for growth, ensuring long-term operational stability and regulatory adherence.

Explore our portfolio to see successful implementations of blockchain fundraising platforms.

Contact us today for a free consultation and launch your compliant security token offering efficiently.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A compliant STO follows regulatory requirements for issuing security tokens that represent real financial assets. It includes investor verification, legal structuring, asset evaluation, and disclosures. Compliance ensures investor trust, reduces legal risks, and strengthens the long-term credibility of the tokenized offering.

Security tokens represent financial assets and fall under strict regulatory oversight. Utility tokens provide platform access and usually face fewer legal rules. STOs require compliance checks, investor rights, and ongoing reporting, while utility tokens focus more on ecosystem participation.

Launching an STO involves legal review, selecting a compliant blockchain, conducting investor verification, structuring token economics, and integrating fundraising mechanisms. Every step must align with regulatory standards to ensure lawful issuance and protect investor interests throughout the offering.

Compliance ensures the STO meets securities laws, protects investors, and avoids penalties or shutdowns. It also improves transparency and makes the offering more credible for global investors. A compliant STO creates long term confidence and supports sustainable digital asset fundraising.