Insurance was designed to protect us from uncertainty, but for many people, the process remains slow, confusing, and frustrating. Delayed payouts and long claim assessments often leave people waiting when they need help most. That’s why a parametric insurance platform changes this by offering fast, data-driven coverage that pays out automatically when certain conditions are met, cutting out the usual red tape.

Platforms like Etherisc are demonstrating how technology can make insurance fairer, faster, and much more accessible. By using blockchain, smart contracts, and real-time data, they change how claims are triggered and settled, replacing paperwork with greater accuracy. This approach helps lower costs and fraud, while also rebuilding trust in an industry that needs more transparency.

In this blog, we’ll look at how you can build a parametric insurance platform similar to Etherisc. We’ll cover how it works, the key technologies and features, and the main steps to bring this modern insurance solution to life. As we helped various businesses across industries launch their blockchain & DeFi solutions, IdeaUsher brings expertise in insurance and fintech platforms, delivering secure, scalable, and innovative solutions that streamline risk management and automate payouts.

What is a Parametric Insurance Platform, Etherisc?

Etherisc is a decentralized, blockchain-based parametric insurance platform designed to make insurance products more transparent, efficient, and accessible. Unlike traditional insurance that depends on complex claims verification and human assessment, Etherisc automates the process using smart contracts and predefined parameters (triggers).

The open-source Generic Insurance Framework (GIF) offers standardized blockchain tools for building and managing insurance products. It lets developers create customizable solutions that pay out automatically when oracles verify an event.

This platform automates insurance by connecting real-world events to digital protection, cutting admin work, fraud, and payout delays. Parametric insurance uses real-time data for instant claims, boosting speed, accuracy, and scalability in sectors like agriculture and travel.

- Predefined Triggers: Payouts are activated when specific measurable events (e.g., rainfall below 50mm or wind speed above 120 km/h) occur.

- Data-Driven Models: Real-time data from IoT sensors, satellites, or weather APIs determine when the trigger conditions are met.

- Instant Payouts: Automated smart contracts or digital payment systems release funds quickly after trigger validation.

- Transparency & Trust: All stakeholders clearly understand the payout conditions, eliminating claim disputes.

- Scalable Coverage: Easily adaptable for individuals, communities, or enterprises facing climate and catastrophe risks.

Business Model

Etherisc is a decentralized insurance platform that uses smart contracts and tokenized risk pools to automate and streamline insurance creation and management, making it more accessible and transparent.

- Decentralized Insurance Protocol: Etherisc lets insurers, reinsurers, and developers collaborate to create insurance products, reducing reliance on traditional intermediaries.

- Generic Insurance Framework: GIF is an open-source smart contract system that standardizes and automates insurance product development, underwriting, claims, and payouts.

- Tokenized Risk Pools: Risk Pool Tokens (RPTs) represent shares in insurance pools and can be traded, letting participants invest and earn from insurance products.

Revenue Model

Etherisc generates revenue through platform fees, staking mechanisms, and returns from risk pool investments. Its model aligns incentives for participants while providing a sustainable framework for profit-sharing within the decentralized insurance ecosystem.

- Platform Fees: Etherisc’s open-source protocol is free, but the platform charges participants fees for using services, funding ongoing development and maintenance.

- Staking and Governance: Participants must stake Etherisc’s DIP token to vote on governance decisions and invest in risk pools, creating active involvement and aligning incentives across the ecosystem.

- Risk Pool Investments: Participants invest in risk pools and earn returns tied to insurance product performance. Profits are distributed through RPTs, Etherisc’s risk pool tokens, creating a profit-sharing model.

Parametric Insurance vs Traditional Indemnity Insurance: Key Differences

Insurance has evolved from traditional indemnity-based models to innovative parametric solutions. Understanding the key differences helps businesses and individuals choose the right coverage based on speed, transparency, and risk management needs.

| Feature | Parametric Insurance | Traditional Indemnity-Based Insurance |

| Basis of Payout | Triggered by predefined, measurable events (e.g., rainfall levels, flight delays, temperature thresholds) | Triggered by actual loss or damage experienced by the insured party |

| Claim Process | Automatic or near-instant payouts via smart contracts once trigger conditions are met | Manual claim assessment and verification by insurers; can take days or weeks |

| Payout Speed | Fast, often immediate after event verification | Slower, depends on claim investigation and documentation |

| Data Dependency | Relies on objective, verifiable data from oracles, satellites, sensors, or APIs | Relies on subjective assessment, inspections, and claim documents |

| Basis Risk | Present; payout may differ from actual loss since it is tied to the trigger, not exact damages | Minimal; payout typically matches actual loss after assessment |

| Complexity | Generally simpler to administer due to automated triggers and fewer intermediaries | Can be complex due to manual processes, documentation, and human evaluation |

| Transparency | High; smart contracts and on-chain records make processes auditable | Moderate; relies on insurer reporting and claim evaluation transparency |

| Use Cases | Weather insurance, crop insurance, flight delay coverage, parametric disaster coverage | Home, auto, health, life, liability, and traditional commercial insurance |

| Premium Calculation | Based on statistical probability of the trigger event | Based on historical loss data, risk assessments, and actuarial models |

| Innovation & Technology | Often blockchain-based, integrates AI/ML, oracles, IoT devices | Mostly traditional systems; digital adoption varies by insurer |

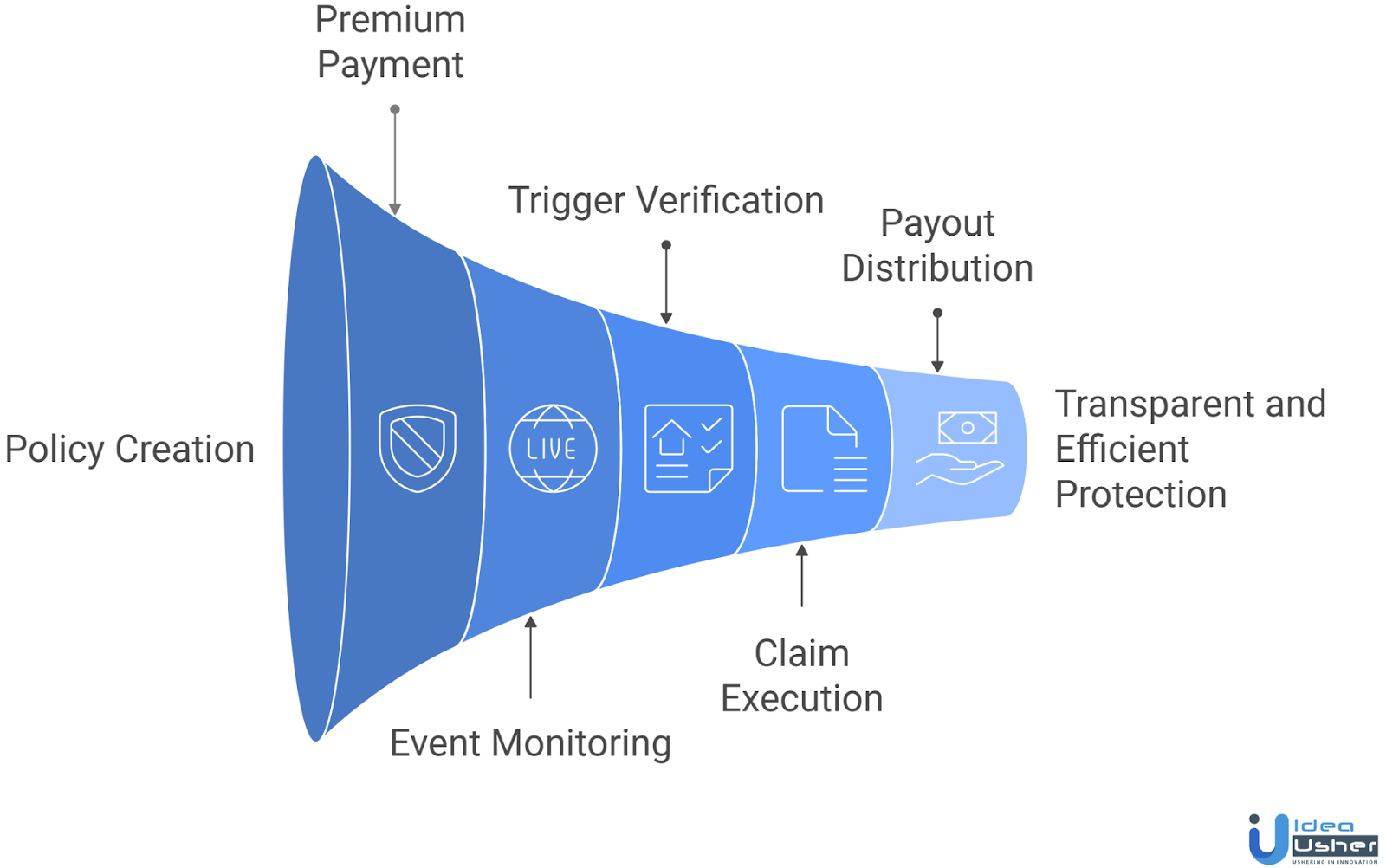

How a Parametric Insurance Platform Works?

Parametric insurance automates coverage and payouts based on predefined triggers rather than actual loss, delivering faster, transparent, and efficient protection. Here’s how the platform works:

1. Policy Creation & Customization

Insurers create policies using a modular framework like the Generic Insurance Framework (GIF). Policies define coverage, triggers, payouts, and premium pricing. Users can select policies tailored to their risks, such as weather-based crop protection or flight delay coverage.

2. Premium Payment & Policy Activation

Once a policy is chosen, the policyholder pays the premium in fiat or cryptocurrency. After payment, the policy is activated and logged on a decentralized ledger, ensuring transparency, traceability, and tamper-proof storage.

3. Real-Time Event Monitoring

The platform monitors relevant events continuously, sourcing data from oracles, satellites, IoT sensors, and APIs. Multi-source validation ensures reliable and accurate event detection.

4. Parametric Trigger Verification

The platform checks if trigger conditions are met when a potential event occurs. Smart contracts validate the event with verified data from oracles or trusted sources, ensuring accurate, quick payouts without manual intervention.

5. Automatic Claim Execution

If the trigger is met, the contract processes the claim right away using the policy’s formula, whether it is linear, step-based, or capped. This automation cuts out delays and extra paperwork, so settlements are handled quickly and fairly.

6. Payout Distribution

After a claim is approved, funds are sent directly to the policyholder’s wallet or bank account. The process is transparent, instant, and auditable, with real-time payout status to enhance trust and satisfaction.

7. Risk Pool & Liquidity Management

Risk pools funded by insurers, liquidity providers, or tokenized capital ensure sufficient coverage for claims. Reinsurance mechanisms may be included to handle large-scale events efficiently.

8. Reporting & Audit

All events, claims, and payouts are logged on-chain. Dashboards provide insights into claim history, fund utilization, and payout accuracy, completing the insurance cycle and supporting future risk assessment.

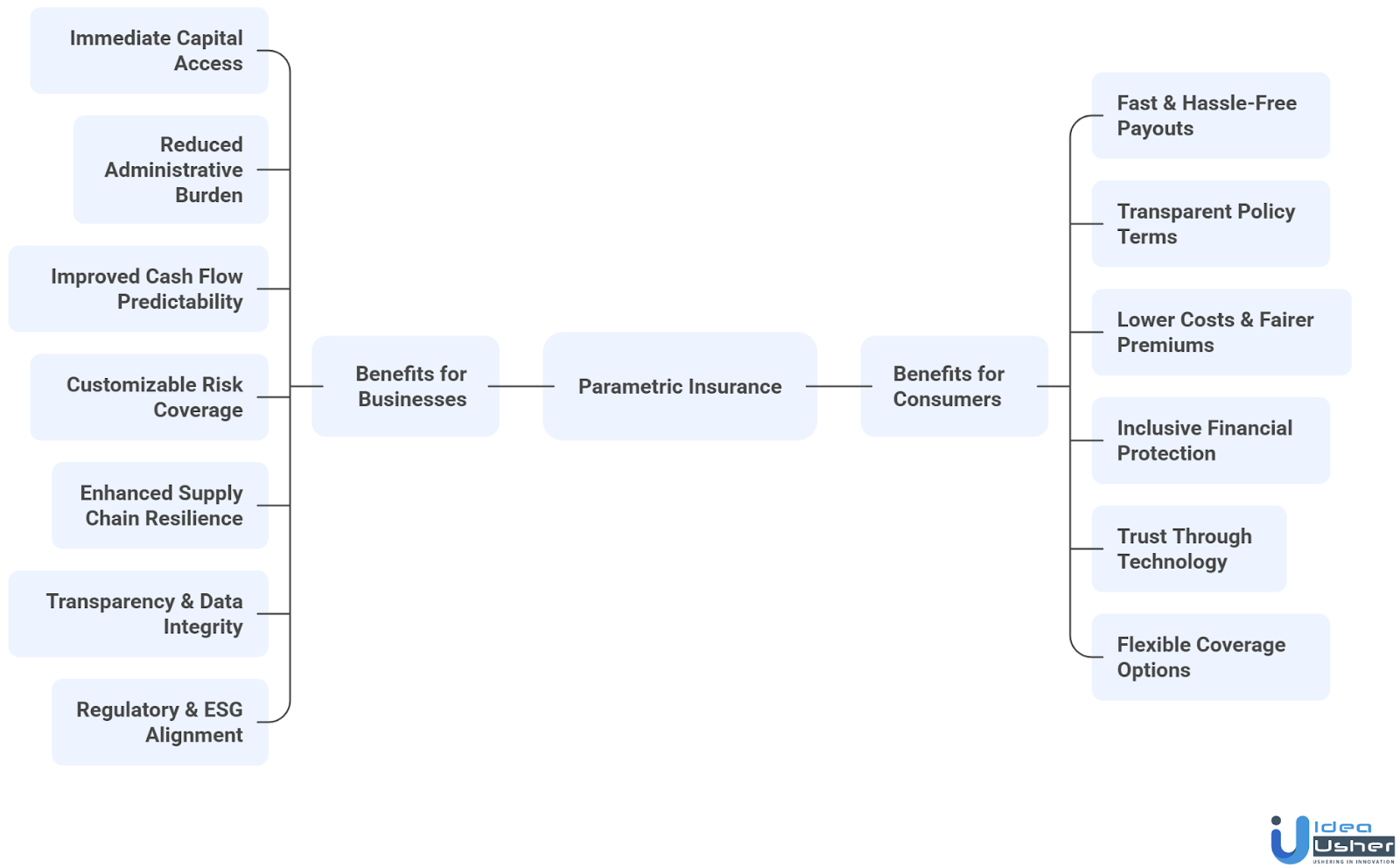

Key Benefits of Parametric Insurance for Businesses and Consumers

Parametric insurance redefines risk management by using objective data triggers for faster payouts, reducing uncertainty, and increasing resilience. It benefits businesses and consumers in interconnected ways.

A. Benefits for Businesses

Parametric insurance offers operational continuity, financial predictability, and risk diversification by transforming traditional coverage into a data-driven, event-triggered model that efficiently manages extreme weather, supply chain disruptions, and other abrupt events.

- Immediate Capital Access: Automated payouts triggered by verified data ensure businesses receive funds quickly, helping them manage liquidity during disruptions or disasters.

- Reduced Administrative Burden: No lengthy documentation or loss verification — smart contracts execute payouts instantly, cutting operational overhead.

- Improved Cash Flow Predictability: Predefined payout conditions allow companies to plan financial responses in advance, ensuring greater stability even during catastrophic events.

- Customizable Risk Coverage: Businesses can create policies that match their specific risks, such as certain rainfall amounts or earthquake sizes, to get protection that fits their needs.

- Enhanced Supply Chain Resilience: Companies operating across multiple geographies can insure specific climate or market risks affecting key suppliers, maintaining continuity during unforeseen events.

- Transparency & Data Integrity: All policy triggers and payouts are governed by blockchain-based smart contracts, ensuring full transparency and auditability.

- Regulatory & ESG Alignment: Parametric models help businesses stay accountable, track their actions, and build resilience. This supports meeting corporate sustainability and ESG reporting requirements.

B. Benefits for Consumers

Parametric insurance simplifies the experience for individuals and small policyholders with clarity, automation, and trust. It removes complex claims and guarantees payouts based on verifiable data, not subjective assessments.

- Fast & Hassle-Free Payouts: Consumers get their funds right away after a trigger event. There is no paperwork, no adjusters, and no waiting.

- Transparent Policy Terms: All triggers (e.g., rainfall level, temperature, or travel delay duration) are defined upfront, ensuring users know exactly when and how payouts occur.

- Lower Costs & Fairer Premiums: Reduced administrative processes and automation lower operational expenses, often translating into more affordable policies.

- Inclusive Financial Protection: Enables microinsurance for farmers, gig workers, and low-income communities who were previously underserved by traditional insurers.

- Trust Through Technology: On-chain data validation and smart contracts help guarantee fair execution, which reduces disputes and builds customer confidence.

- Flexible Coverage Options: Consumers can select coverage for short-term or event-specific risks (e.g., travel delays, power outages, or flood levels) suited to their lifestyle or region.

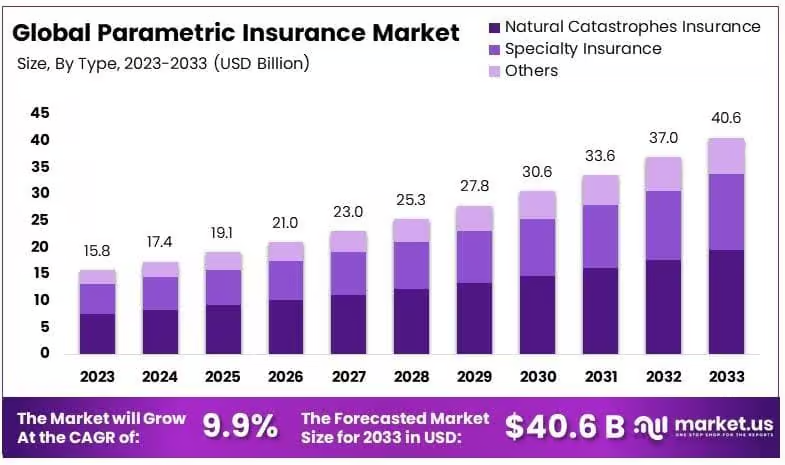

The Reason Behind the Parametric Insurance Platform’s Booming

The Global Parametric Insurance Market is projected to reach USD 40.6 billion by 2033, up from USD 15.8 billion in 2023, with a CAGR of 9.9%. This growth indicates rising demand for quick, automated claim payouts amid increasing climate and catastrophe risks.

Etherisc, the Munich-based blockchain/parametric insurance protocol, has raised approximately US$3.89 million (including a token sale) and a small private seed round to date.

IBISA, a climate‐insurtech focused on parametric cover in emerging markets, closed a US$3 million funding round in June 2024, led by ARAF and others, to scale its offerings in Asia and Africa.

Why Anyone Should Invest in a Parametric Insurance Platform?

Parametric insurance platforms offer a strong investment case: they can scale quickly, target underserved markets, use data triggers for lower costs, and benefit from climate risk and digital tech growth.

- Reduced claims friction & cost: Parametric triggers like rainfall or wind speed speed payouts, reducing manual reviews and increasing cost efficiency.

- Access to emerging markets + underserved segments: For example, Etherisc’s platform has supported smallholder farmers in Kenya, expanding coverage where traditional insurance rarely reaches.

- Technological moat via data + automation: Platforms that integrate IoT, satellites, weather models and blockchain/smart contracts (as many parametric players do) gain competitive advantage.

- Climate risk tailwinds: With climate-related losses rising, demand for parametric solutions is growing as corporates, governments and communities seek new risk-transfer mechanisms.

- Diversification and innovation opportunity: Parametric models enable diversification and innovation across industries like agriculture, travel, weather, renewable energy, and supply-chain risk.

The parametric insurance platform space is shifting from niche to mainstream, driven by market growth, advancing technology, and emerging use-cases, especially in underserved areas. For investors, platforms like Etherisc and IBISA offer exposure to insurance innovation and climate-risk mitigation. For high-growth, high-impact insurtech investments, parametric platforms are worth considering.

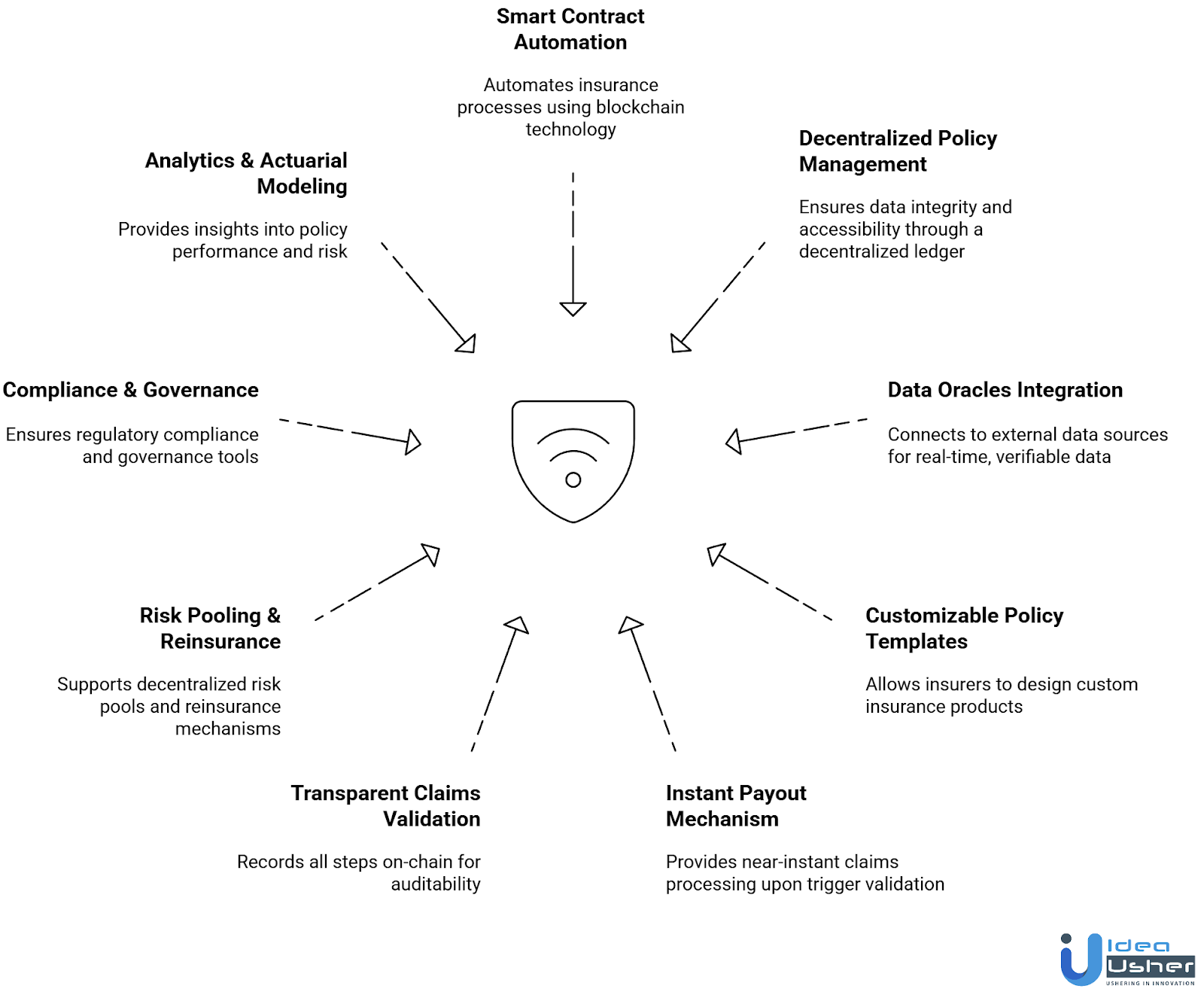

Key Features of a Parametric Insurance Platform like Etherisc

Parametric insurance platforms like Etherisc provide automatic payout coverage when certain conditions are met. Using smart contracts and verifiable data, they offer faster, transparent claims processing than traditional insurance. Here are the main key features of such platforms:

1. Smart Contract Automation

Parametric insurance platform uses blockchain smart contracts via the Generic Insurance Framework (GIF) to automate insurance processes, from policy creation to claims. These contracts define policy details, triggers, and payouts for instant, transparent execution, reducing admin costs and enhancing trust.

2. Decentralized Policy Management

The decentralized ledger stores and executes policies, ensuring data integrity, security, and accessibility. Insurers, reinsurers, and policyholders can interact transparently without a centralized authority controlling the process. GIF modularity allows rapid deployment of new insurance products.

3. Data Oracles Integration & Reliability

The platform connects to external data oracles that fetch real-time, verifiable data from trusted sources like weather APIs, satellite imagery, or IoT sensors. Multi-source validation and oracle reliability mechanisms reduce the risk of false triggers and enhance payout accuracy.

4. Parametric Trigger Catalog

Insurers can design and deploy custom insurance products using modular templates from the GIF. Predefined triggers and payout curves (linear, step, or capped) standardize products for agriculture, flight delay, or climate risk coverage.

5. Instant Payout Mechanism

Automated smart contracts ensure near-instant claims processing once triggers are validated. Basis risk management tools adjust for discrepancies between the trigger and actual losses, protecting both insurers and policyholders.

6. Transparent Claims Validation

Each step, from trigger data to payout confirmation, is recorded on-chain with event logs that can be audited. This allows policyholders to verify outcomes on their own. Data provenance also makes it possible to trace all data sources and changes.

7. Risk Pooling, Reinsurance & Tokenomics

The parametric insurance platform supports decentralized risk pools, reinsurance mechanisms, and tokenized models for capital sharing. This ensures scalable capacity, liquidity, and secure fund allocation across policies.

8. Compliance, Governance & Upgradeability

Built-in regulatory compliance modules (KYC/AML) and governance tools allow protocol parameter changes, product approvals, and dispute resolution. Upgradeable smart contracts enable future enhancements without disrupting existing policies.

9. Analytics & Actuarial Modeling

Real-time dashboards provide insights into policy performance, trigger events, and fund utilization. Embedded actuarial modeling and pricing engines allow insurers to dynamically set premiums, forecast risk, and optimize payouts.

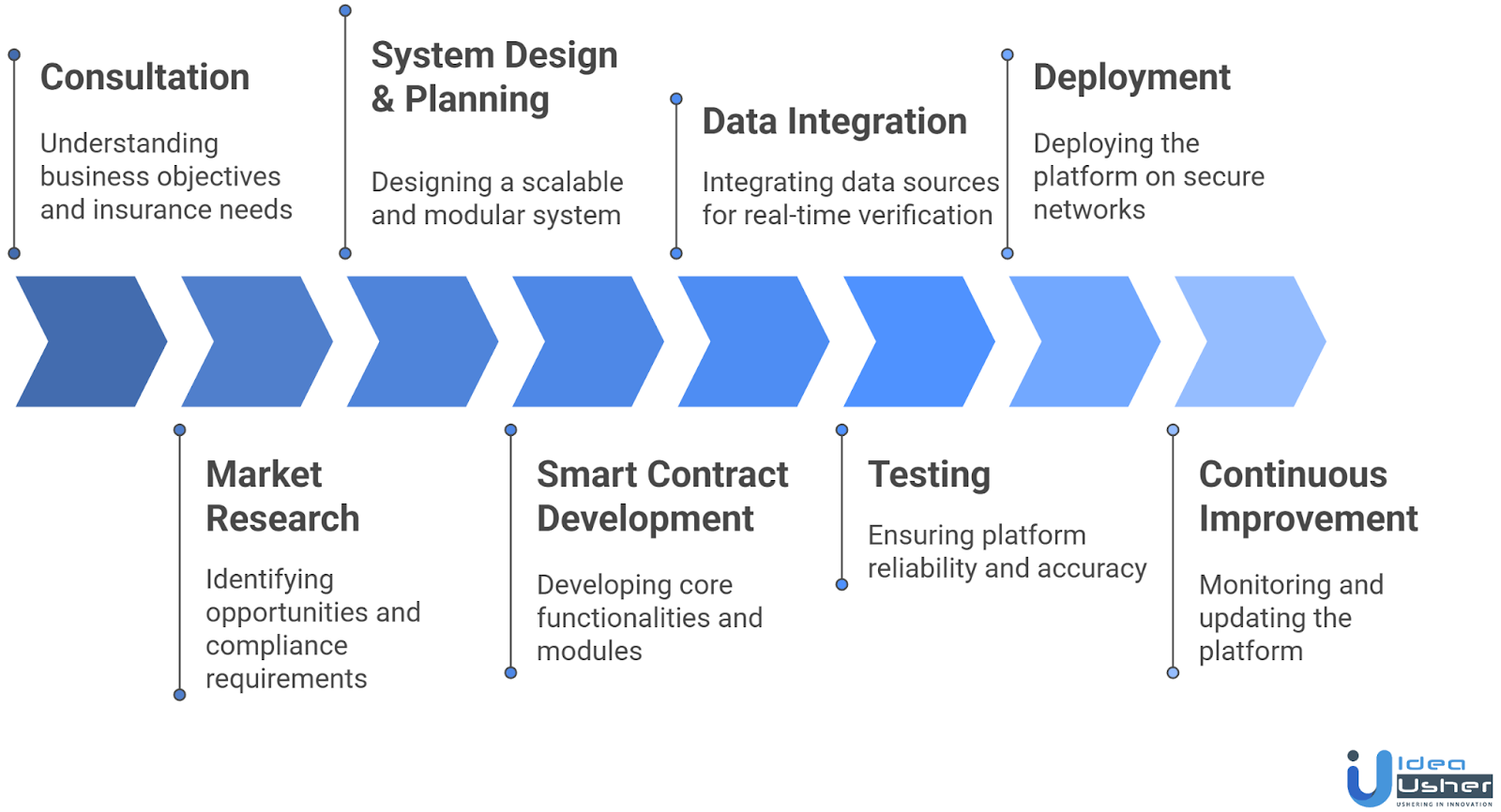

Development Process of a Parametric Insurance Platform

Building a parametric insurance platform like Etherisc requires a structured, end-to-end approach that combines blockchain, data integration, smart contracts, and actuarial modeling. Below is the step-by-step development process:

1. Consultation

We consult with you to understand business objectives, target customer segments, and insurance products. This involves identifying coverage areas, parametric triggers, payout conditions, and compliance requirements, ensuring the platform solves real-world insurance challenges effectively.

2. Market Research

We study competitors, global parametric insurance offerings, and emerging technologies. We analyze regulatory frameworks to ensure KYC/AML compliance, reporting standards, and sandbox requirements. This step identifies gaps, opportunities, and best practices for product design.

3. System Design & Planning

We design scalable, modular architecture capable of handling smart contracts, decentralized ledgers, oracle integrations, and risk pools. The system supports the Generic Insurance Framework (GIF), enabling rapid product configuration, trigger standardization, and modular payouts.

4. Smart Contract & Core Module Development

Core development includes:

- Smart contracts for automated policy execution and payouts

- Parametric trigger modules connected to reliable oracles

- Risk pooling and reinsurance interfaces

- Compliance and governance modules

- Dashboards for policy management and analytics

Smart contracts integrate triggers, payout curves, and basis risk adjustments to ensure secure, transparent, and timely execution.

5. Data Integration

We integrate oracles, IoT sensors, satellite data, and external APIs for real-time trigger verification. Machine learning pipelines are embedded for event detection, anomaly checks, and predictive modeling, enhancing trigger reliability and minimizing false payouts.

6. Testing

Comprehensive testing ensures:

- Correct smart contract execution

- Accurate oracle data ingestion

- Proper risk pool management

- Compliance with regulatory and audit requirements

Simulation of extreme events and basis risk scenarios validates platform reliability and payout accuracy.

7. Deployment

The platform is deployed on secure cloud or blockchain networks, with auto-scaling, monitoring, and backup mechanisms. Multi-region deployment ensures uptime, resilience, and low-latency access for users and insurers.

8. Continuous Improvement

Post-launch, we monitor trigger accuracy, payout performance, and system stability. Updates to smart contracts, oracles, and actuarial models are applied iteratively. Feedback loops and governance protocols allow risk parameters and product templates to evolve with market needs.

Cost to Build a Parametric Insurance Platform like Etherisc

Building a parametric insurance platform involves multiple technical and compliance-focused stages. The cost varies based on automation, data sources, blockchain implementation, and regulatory needs. Below is a clear breakdown to help you plan your investment effectively.

| Development Phase | Description | Estimated Cost |

| Consultation | Requirement understanding, insurance model definition, risk parameters, and business goal alignment. | $5,000 – $8,000 |

| Market Research | Exploring insurance compliance rules, risk modeling research, and global regulatory alignment for automated payouts. | $10,000 – $15,000 |

| System Design & Planning | Designing the blockchain ecosystem, data flow architecture, and smart contract structure for parametric triggers. | $12,000 – $20,000 |

| Smart Contract & Core Module Development | Developing parametric policies, premium handling, payout triggers, and automated claims modules on blockchain. | $18,000 – $32,000 |

| Data Integration | Connecting IoT sensors, satellite data, weather APIs, and real-time oracle feeds for transparent claim automation. | $14,000 – $23,000 |

| Testing | Functional, security, and smart contract audit testing to prevent vulnerabilities and payout errors. | $5,000 – $10,000 |

| Deployment | Blockchain deployment, cloud setup, performance tuning, and policy environment configuration. | $6,000 – $12,000 |

| Continuous Improvement | Regulatory updates, advanced risk analytics, platform scalability, and user-driven feature upgrades. | $6,000 – $11,000 |

Total Estimate Cost: $62,000 – $133,000

Note: This budget ensures a secure, compliant, and fully automated parametric insurance platform with strong data and blockchain infrastructure.

Consult with IdeaUsher to build your insurance ecosystem and launch confidently in the market.

Recommended Tech Stack for Parametric Insurance Platform Development

A parametric insurance platform uses a tech stack for real-time event detection, automatic payouts, and transparent policy execution. Unlike traditional insurance, the platform automatically triggers payouts when events like weather or flight delays occur.

1. Blockchain Layer

These blockchains execute policies and payouts. Ethereum and EVM chains offer strong ecosystems and Solidity support. Polygon lowers gas fees and boosts scalability. Avalanche and Binance Smart Chain enable fast, real-time payouts.

2. Smart Contract Development

Smart contracts automate policy creation and execution. Developers use Solidity for EVM chains, while Vyper offers a secure Python alternative. Parametric contracts enable instant, trigger-based payouts when conditions are met.

3. Oracles and Data Feeds

Oracles send real-world event data to smart contracts. Chainlink offers decentralized data feeds for triggers like weather or flights. Band Protocol delivers scalable, multi-chain data. Reliable oracles are crucial for timely payouts.

4. Backend Infrastructure

The backend manages off-chain logic, event monitoring, and APIs. Node.js and Python handle business logic and data integration. The Graph is used for efficient blockchain data indexing and analytics.

5. Frontend Development

Frontend frameworks power user interfaces for policy management and event tracking. React and Next.js support responsive apps. Web3.js and Ethers.js connect wallets like MetaMask. Users can view policy status and payouts in real time.

6. Security and Auditing Tools

Security tools protect trigger-based payouts. OpenZeppelin provides audited contract libraries. MythX and Slither automate audits and vulnerability checks to prevent manipulation.

Challenges & How to Overcome Those?

Building a parametric insurance platform automates payouts, boosts efficiency, and ensures fair coverage. Yet, integrating data feeds, smart contracts, and regulations presents unique challenges crucial for success.

1. Accurate Trigger Data & Oracle Reliability

Challenge: Parametric insurance platforms rely on accurate trigger data from weather sensors, IoT devices, and satellite feeds. Any inconsistencies or unreliable sources can lead to incorrect or delayed insurance payouts.

Solution: We strengthen data reliability by integrating multiple trusted oracles, implementing redundancy protocols, and cross-verifying all external feeds with intelligent algorithms, ensuring precise and consistent parametric insurance triggers for each policy.

2. Basis Risk Management

Challenge: Basis risk emerges when parametric insurance payouts do not fully reflect the actual loss suffered, potentially causing under-compensation and reduced trust in the platform.

Solution: We minimize basis risk by designing flexible payout curves, fine-tuning thresholds, and using machine learning models to predict events accurately, ensuring parametric insurance payouts are fair and closely aligned with real losses.

3. Smart Contract Vulnerabilities

Challenge: Smart contracts automate parametric insurance payouts, but coding errors or vulnerabilities can result in financial loss and undermine user confidence in the platform.

Solution: Our solution includes extensive testing, third-party security audits, formal verification, and upgradeable smart contracts with governance systems, providing secure and reliable parametric insurance execution without compromising trust.

4. Regulatory Compliance & Legal Constraints

Challenge: Operating a parametric insurance platform across multiple regions requires strict adherence to financial, KYC, and AML regulations, as non-compliance can lead to fines or operational restrictions.

Solution: We embed automated compliance modules, maintain audit-ready transaction logs to meet jurisdictional requirements, ensuring that our parametric insurance platform operates securely and legally.

5. Risk Pool Liquidity & Fund Management

Challenge: Low liquidity in decentralized risk pools can prevent timely parametric insurance payouts during major events, affecting user trust and platform reliability.

Solution: We maintain liquidity through dynamic pool sizing, reinsurance partnerships, and staking incentives for contributors, supported by predictive modeling, ensuring sufficient reserves for consistent parametric insurance payouts at all times.

Conclusion

Building a Parametric Insurance Platform involves combining advanced technology, real-time data monitoring, and automated claim processes to deliver fast, transparent, and reliable insurance solutions. By focusing on precise triggers and seamless user experiences, such platforms empower insurers to reduce operational costs while improving customer satisfaction. Understanding the essential features, regulatory requirements, and integration strategies is key to creating a platform that scales efficiently and adapts to evolving market needs. A well-designed parametric solution ensures trust, transparency, and efficiency for both insurers and policyholders.

Why Choose IdeaUsher for Your Parametric Insurance Platform Development?

At IdeaUsher, we specialize in building robust parametric insurance platforms that leverage blockchain and smart contracts to automate claims and payouts. Our solutions ensure transparency, speed, and reliability for both insurers and policyholders.

Why Work with Us?

- Blockchain & Smart Contract Expertise: We implement secure, automated systems that trigger payments accurately and efficiently.

- Custom Insurance Solutions: From conceptualization to launch, we create platforms tailored to your business model and coverage requirements.

- Proven Experience: We have successfully delivered blockchain-driven solutions across industries.

- Scalable & Secure: Our platforms grow with your business while maintaining operational security and compliance.

Explore our portfolio to see how we have helped companies launch blockchain-based solutions in the market.

Connect with us today for a free consultation and bring your parametric insurance platform to market.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A parametric insurance platform provides automatic payouts based on predefined triggers, such as weather events or flight delays, without requiring traditional claims processes. It reduces processing time, improves transparency, and ensures faster compensation for policyholders.

Key features include smart contract automation, real-time data integration, customizable policy triggers, secure user onboarding, and transparent payout mechanisms. These features ensure reliability, trust, and a seamless experience for both insurers and policyholders.

Blockchain, smart contracts, IoT for data collection, and cloud-based analytics are essential. These technologies enable secure, automated, and transparent operations while providing real-time monitoring, ensuring claims are accurately triggered and processed.

Compliance requires adhering to insurance regulations, data privacy standards, and jurisdiction-specific laws. Incorporating legal audits, regulatory approvals, and transparent reporting ensures the platform operates securely and maintains trust among users and businesses.