The European digital landscape is undergoing a major shift as trust, security, and interoperability become central to how citizens and businesses prove identity online. With the rollout of updated regulations, organizations across sectors now face the challenge of meeting stricter requirements for verification and data handling, which makes building an eIDAS 2.0 compliance app more urgent than ever.

EUDI wallets are designed to answer this need by giving every user a secure, portable, and verifiable digital identity. Powered by blockchain for trust, encryption for security, and seamless cross-border functionality, they allow individuals to control their credentials while helping businesses and governments stay aligned with the evolving rules of eIDAS 2.0.

In this blog, we’ll explore how EUDI wallets support regulatory compliance, the technologies that make them possible, and why they are set to play a central role in Europe’s digital future. As we have helped various businesses capitalize on emerging regulatory frameworks by building compliant solutions that established strong market positions, IdeaUsher has the expertise to develop EUDI wallet applications that meet European standards while maximizing early-market advantages.

What is eIDAS 2.0?

eIDAS 2.0 is the updated version of the EU’s Electronic Identification, Authentication and Trust Services regulation, first introduced in 2014. While the original eIDAS (2014) created a framework for secure electronic identification and trust services across EU member states, eIDAS 2.0 (adopted in 2021 and finalized in 2024) takes it further by introducing the concept of a European Digital Identity Wallet (EUDI Wallet).

The wallet allows EU citizens and businesses to:

- Store and use digital identity credentials (like ID cards, driving licenses, diplomas, or health records) in a secure app

- Access online services across EU borders without repeatedly creating new logins or sharing unnecessary personal data.

- Digitally sign and authenticate transactions in a way that is legally recognized across the EU.

Why Was the Update Needed?

The original eIDAS (2014) was a strong step forward but had limitations that became increasingly clear as digital services expanded:

1. Low Adoption of National eIDs

Only a small number of EU citizens actively used the digital IDs issued under eIDAS 1.0, as many member states implemented different systems that made cross-border interoperability difficult. This limited the effectiveness of the framework and slowed its overall adoption.

2. Fragmentation Across the EU

Each country developed digital identity solutions, but these weren’t always recognized across member states, causing inconsistent user experiences. Lack of interoperability hindered seamless cross-border transaction services.

3. Rising Need for Secure Digital Interactions

The COVID-19 pandemic sped up digital public services, online banking, e-commerce, and eHealth, emphasizing the need for a trusted, EU-wide solution for online authentication without relying on private providers like Google or Facebook.

4. Data Privacy and Control Concerns

Under eIDAS 1.0, users often shared more personal data than needed. eIDAS 2.0 adopts a privacy-by-design approach, allowing users to share only the minimum required, like proving they are over 18 without revealing their exact birthdate.

5. Support for Emerging Technologies

Since 2014, blockchain, mobile wallets, and biometrics have become mainstream, transforming digital transactions and identity verification. This update makes EU regulations future-proof and adaptable to ongoing technological innovations.

Trust, Interoperability, and Cross-Border Digital Identity

The update to eIDAS was driven by a clear set of priorities: to build greater trust in digital interactions, ensure interoperability between member states, and establish a truly cross-border digital identity framework. These goals laid the foundation for the European Digital Identity Wallet (EUDI Wallet), which brings the vision of eIDAS 2.0 to life.

What is EUDI Wallet?

The EU Digital Identity Wallet is a government-approved mobile application that enables European citizens and businesses to securely store, access, and share their official identification data in digital form. It is designed under the EU’s eIDAS 2.0 regulation to provide a single, trusted solution for managing identity documents such as national IDs, driving licenses, health records, and educational or professional certificates directly from a smartphone.

This wallet plays a pivotal role in the European Digital Identity (EUDI) framework by enabling secure, seamless, and privacy-focused identity verification and data sharing across the EU.

- Unified Digital Identity: Provides a single, interoperable digital identity solution for all EU citizens and businesses, reducing the need for multiple authentication systems.

- Cross-Border Authentication: Enables users to securely access services and prove their identity across all EU member states without physical documentation.

- Privacy & User Control: Gives individuals full control over which personal data they share, ensuring compliance with GDPR and building trust in digital services

- Secure Data Sharing: Uses advanced encryption and authentication standards to safeguard sensitive identity information while enabling seamless verification.

- Access to Public and Private Services: Acts as a gateway to online government services, banking, healthcare, education, and e-commerce platforms within the EU.

- Support for EU Digital Single Market: Helps establish a unified digital ecosystem, reducing barriers to digital transactions and fostering economic growth.

How EUDI Wallets Connect Individuals and Public Services?

EUDI Wallets are digital identity tools connecting individuals, businesses, and governments across the EU. They provide a secure, standardized, privacy-focused way to verify identities, easing interactions, lowering barriers, and fostering trust in the digital economy.

- For Individuals: Provides easy and secure access to public and private services without the need for repeated registrations or identity verifications.

- For Businesses: Simplifies customer onboarding, reduces fraud risks, and ensures compliance with identity verification regulations.

- For Governments: Enables secure delivery of e-services, efficient verification of credentials, and streamlined administrative processes.

- For the Entire Digital Ecosystem: Ensures interoperability and legal recognition across the EU, creating a trusted link between citizens, businesses, and governments to foster efficiency and trust.

How does the EU Digital Identity Wallet Work?

The European Digital Identity Wallet (EUDI Wallet) is a secure platform that allows EU citizens, residents, and businesses to store, manage, and share verified digital credentials. It provides a standardized, privacy-focused way to authenticate identity and access services across the EU. Here’s how it works.

1. Credential Issuance

Trusted issuers such as governments, universities, or professional bodies issue digital credentials like ID cards, driving licenses, academic certificates, or health records. These credentials are digitally signed to guarantee authenticity and securely stored in the user’s EUDI Wallet for future use.

2. Secure Storage

Credentials are stored within a mobile app or cloud-based wallet that uses encryption and secure authentication, such as biometrics or PIN codes. This ensures only the wallet owner can access the data, while offering convenient access across devices.

3. Authentication and Verification

The EU wallet sends a request to the user for identity verification to use services. Upon approval, cryptographic proofs verify credentials without sharing unnecessary personal details, ensuring both privacy and trust.

4. Cross-Border Recognition

A key feature of the EUDI Wallet is interoperability across the EU. Credentials issued in one member state are recognized in others without extra verification, thanks to the eIDAS 2.0 framework and strict compliance with EU privacy standards.

5. User Control and Data Minimization

The wallet gives users control over what they share. Individuals can choose the credentials they disclose and limit information to only what’s necessary, for example proving age without revealing the full birthdate, ensuring privacy and transparency.

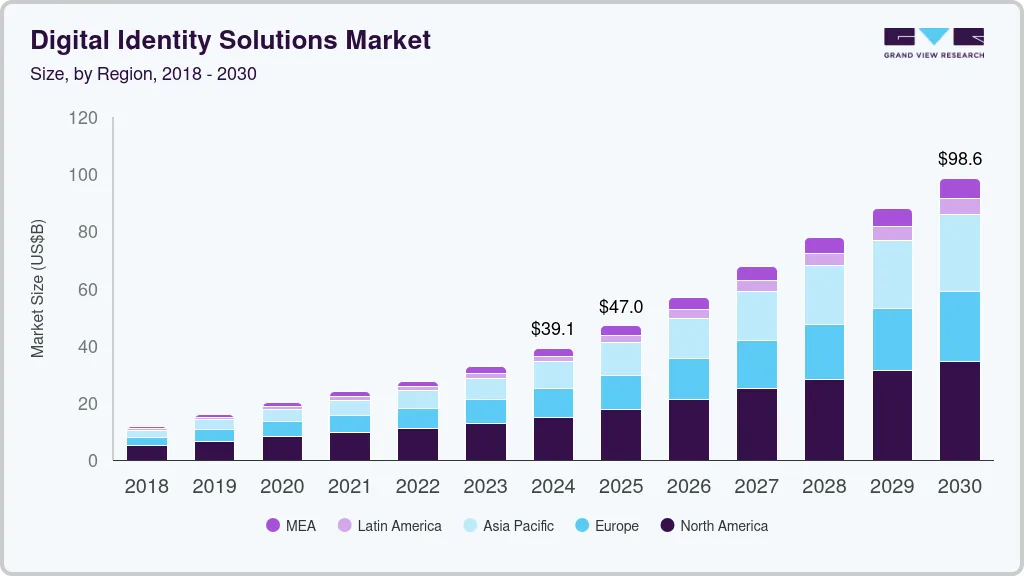

The Reason Behind Global Digital Identity Wallet Adoption

The global digital identity solutions market was valued at USD 39.07 billion in 2024 and is expected to reach USD 98.64 billion by 2030, with a CAGR of 16% from 2025 to 2030. This growth is fueled by rising cybersecurity concerns, the demand for more efficient digital services, and supportive government policies.

In May 2024, the European Union enacted the European Digital Identity Regulation (EU 2024/1183), mandating that all member states provide a certified digital identity wallet to their citizens by November 2026. These wallets aim to offer secure, user-controlled access to personal data, facilitating services like banking, healthcare, and e-government across borders.

The European Commission has allocated substantial funding to support digital identity solutions. The EU Digital Identity Wallet Consortium received co-funding under the Digital Europe Programme, which also issued calls for proposals to promote digital identity wallet technologies.

The EU Digital Identity Wallet market is experiencing rapid growth due to a confluence of regulatory mandates, substantial funding, and a clear demand for secure digital identification solutions. As member states work towards 2026, the market is poised for significant expansion, offering opportunities for innovation and enhanced digital services across Europe.

Why EUDI Wallets Are Central to eIDAS 2.0 Compliance?

The European Digital Identity Wallet (EUDI Wallet) is the practical heart of eIDAS 2.0, turning its regulatory vision into reality. eIDAS 2.0 creates a legal framework for secure electronic identification across the EU, and the EUDI Wallet is the key tool that makes this possible.

1. Strategic Role in EU Digital Identity

The EUDI Wallet is at the heart of eIDAS 2.0 because it transforms the regulation’s goals into tangible tools. By providing a single, standardized platform for digital identities, it ensures the EU can offer a unified identity framework that works seamlessly across member states.

2. Enabling a Unified Digital Framework

eIDAS 2.0 envisions a Europe where identity verification is standardized. EUDI Wallets make this possible by storing credentials in a consistent format, enabling mutual recognition between countries and creating a truly connected digital ecosystem.

3. Strengthening Trust and Security

The wallet builds trust by ensuring strong authentication and secure credential storage. This aligns directly with eIDAS 2.0’s aim to enhance trust in digital interactions, reducing fraud and identity misuse.

4. Bridging Legal Requirements and Real-World Use

While eIDAS 2.0 provides the legal framework, EUDI Wallets translate it into practical application. They bridge regulatory requirements with real-world usability, ensuring that compliance becomes a functional tool rather than a regulatory burden.

5. Catalyzing Digital Integration

By making identity verification reliable and easy, EUDI Wallets drive digital integration across sectors, enabling faster adoption of online services, improving accessibility, and fostering a stronger digital economy.

How EUDI Wallets Support eIDAS 2.0 Regulations?

The EUDI Wallet is the practical implementation of eIDAS 2.0, designed to meet its key regulatory requirements. By combining secure credential storage, user control, and cross-border interoperability, the wallet ensures full compliance while making digital identity verification simple and trustworthy.

1. Compliance Through Standardization

EUDI Wallets meet eIDAS 2.0 requirements by adopting a standardized method for issuing, storing, and verifying identity credentials. This standardization ensures interoperability and legal recognition across the EU.

2. Advanced Authentication Mechanisms

Security is a core requirement of eIDAS 2.0. EUDI Wallets employ multi-factor authentication, including biometrics, PINs, and secure cryptographic methods, ensuring only authorized access to sensitive credentials.

3. Privacy-Centric Identity Management

The wallets implement selective disclosure, allowing users to share only the information necessary for a specific transaction. This ensures compliance with data protection laws and reduces the risk of overexposure of personal information.

4. Cross-Border Legal Validation

EUDI Wallets ensure that identity credentials meet EU-wide legal standards, allowing them to be recognized and trusted in all member states. This is essential for enabling secure cross-border digital transactions.

5. Enabling Regulatory Alignment for Services

By integrating eIDAS 2.0 rules directly into their functionality, EUDI Wallets help service providers comply with identity verification regulations, making them a practical tool for legal and operational alignment.

6. Interoperability Across Systems

EUDI Wallets are designed to work not just across countries, but also across diverse public and private systems. This interoperability ensures consistent identity verification whether accessing government portals, banking platforms, or private digital services.

7. Real-Time Identity Verification

The wallet supports instant authentication, allowing users to verify their identity in real time. This reduces delays in service delivery and enhances the user experience for digital transactions.

8. Integration with Existing National Identity Systems

Rather than replacing national eID systems, EUDI Wallets integrate with them, ensuring compatibility while expanding identity verification capabilities across the EU. They also provide users with a secure, convenient way to access both public and private digital services seamlessly.

9. Auditability and Compliance Monitoring

EUDI Wallets maintain secure logs of identity verification activities. This auditability enables transparency and helps meet compliance reporting requirements, giving both service providers and regulators peace of mind.

Key Benefits of EU Digital ID Wallets

The European Digital Identity Wallet (EUDI Wallet) offers significant advantages for individuals, businesses, and governments, transforming how identity is managed across Europe. By combining security, privacy, and interoperability, it plays a central role in the EU’s digital future.

1. Simplifying Everyday Digital Interactions

EUDI Wallets streamline online interactions by allowing users to access public and private services without repeated identity checks. This convenience encourages greater adoption of digital services.

2. Strengthening Cybersecurity for Users

With strong authentication and encryption, EUDI Wallets protect sensitive data and significantly reduce the risk of identity theft, enhancing confidence in online transactions. They also enable trusted cross-border interactions, supporting a more secure and integrated digital single market.

3. Empowering User Control Over Data

EUDI Wallets follow a privacy-by-design approach, giving users control over what credentials they share. Selective disclosure ensures that only necessary data is revealed, protecting personal information while complying with GDPR.

4. Building Trust Across the Digital Economy

Legal recognition of EUDI Wallet credentials fosters trust between users, businesses, and governments, making digital interactions more reliable and transparent. This legal backing also encourages wider adoption, driving innovation and efficiency across EU digital services.

5. Facilitating Seamless Public and Private Service Access

EUDI Wallets remove barriers by enabling interoperability across borders, allowing citizens to access government services, banking, healthcare, and other platforms seamlessly. This seamless access helps create a truly connected digital ecosystem across the EU.

6. Reducing Administrative Costs

By enabling secure and instant identity verification, EUDI Wallets reduce administrative costs associated with manual identity checks and onboarding processes for both businesses and public services.

7. Promoting Financial Inclusion

EUDI Wallets make identity verification easier for underserved populations, enabling access to essential services such as banking, healthcare, and government assistance, even across borders.

Use Cases of EUDI Wallets Under eIDAS 2.0

The EUDI Wallet under eIDAS 2.0 is a versatile tool transforming digital identity verification across multiple sectors. It enables secure, interoperable, and privacy-preserving identity solutions for individuals, businesses, and governments.

1. Accessing Public Services

EUDI Wallets make it possible for citizens to access public services online without repetitive identity verification. This reduces bureaucracy, speeds up service delivery, and improves the user experience. Citizens can interact with government portals seamlessly using verified credentials stored in the wallet.

Example: In Estonia, the e-Residency platform allows citizens to file taxes, renew documents, and access public services online using a secure digital ID. EUDI Wallets aim to extend similar capabilities across all EU member states under eIDAS 2.0.

2. Cross-Border Healthcare Access

EUDI Wallets enable patients to share verified health credentials securely when accessing healthcare services in another EU country. This improves patient experience, ensures data accuracy, and reduces delays in treatment.

Example: The MyHealth@EU initiative allows sharing of patient health data across EU borders. Integrating it with EUDI Wallets will let patients instantly present verified credentials during cross-border healthcare visits.

3. Secure Online Banking

Banks can leverage EUDI Wallets for Know Your Customer (KYC) processes. This enables instant, secure onboarding and significantly reduces the risk of fraud while lowering operational costs.

Example: BBVA in Spain uses electronic identity verification to onboard customers instantly. Integrating EUDI Wallet credentials would allow BBVA to offer secure, cross-border banking access under eIDAS 2.0.

4. Academic and Professional Credential Verification

EUDI Wallets allow quick verification of academic qualifications and professional licenses, reducing administrative overhead and preventing credential fraud. This benefits universities, employers, and professional bodies.

Example: The European Qualifications Passport for Refugees (EQPR) enables recognition of qualifications across Europe. Integrating EUDI Wallets with platforms like Europass would allow real-time credential verification for EU-wide academic and professional use.

5. Age Verification for Restricted Services

EUDI Wallets support selective disclosure, allowing individuals to prove they meet age requirements without revealing unnecessary personal details. This is especially useful for regulated sectors such as alcohol, gambling, or adult content.

Example: AgeChecked in the UK offers secure age verification for online services. EUDI Wallets could provide similar capabilities EU-wide, ensuring compliance with age-related regulations while protecting privacy.

6. Digital Contract Signing

Integration of EUDI Wallets with electronic signature systems allows secure, legally binding digital contracts. This eliminates the need for physical document exchange and expedites business operations.

Example: Talao’s EUDI Wallet solution integrates with electronic signature platforms, allowing users to sign contracts with verified identity credentials securely and legally, eliminating the need for physical presence.

7. E-Commerce Identity Verification

EUDI Wallets streamline identity verification for online retailers, enabling secure onboarding and reducing fraud during transactions. This creates a better shopping experience while complying with EU regulations.

Example: The NOBID Consortium, involving Nordic, Baltic countries, Italy, and Germany, is piloting integration of the EU Digital Identity Wallet into payment systems. This enables secure, cross-border identity verification for online transactions, enhancing trust and compliance with eIDAS 2.0.

The Future of EUDI Wallets in Europe

The European Digital Identity Wallet (EUDI Wallet) will be key to Europe’s digital infrastructure, mandated by eIDAS 2.0. It aims to give EU citizens a secure, user-controlled way to access services across member states.

1. Full EU-Wide Implementation by 2026

The eIDAS 2.0 regulation, adopted in May 2024, requires all EU member states to make digital identity wallets available to their citizens by 2026. This ambitious timeline underscores the EU’s commitment to creating a unified digital identity framework across the continent.

2. Projected Adoption Rates

According to a forecast by ABI Research, approximately 83 million digital ID wallets are expected to be in circulation by the end of 2025, with that number more than doubling to 169 million in 2026. This rapid adoption is anticipated as EU member states align their technical and commercial approaches to digital identity solutions.

3. Enhanced Interoperability Across Borders

The EUDI Wallet is designed to facilitate seamless cross-border interactions, allowing users to access services in any EU country using their digital identity. This interoperability is a key feature of the eIDAS 2.0 regulation, aiming to eliminate barriers created by fragmented national systems.

4. Privacy and Security Evolution

Future versions of the EUDI Wallet will strengthen privacy protections through features like selective disclosure, allowing users to share only the information necessary for a transaction. Enhanced biometric authentication will ensure greater security for identity verification, aligning with the EU’s stringent data protection standards.

5. Integration with Digital Services

The EUDI Wallet will integrate deeply with public and private sector services. Future functionalities will include secure document sharing, electronic signatures, digital payments, and other identity-dependent processes, offering a unified experience for users.

6. Driving Digital Transformation in Europe

The EUDI Wallet will serve as a key driver for Europe’s digital economy. By simplifying identity verification and fostering trust, it will accelerate digital service adoption, enhance efficiency, and strengthen the EU’s digital infrastructure.

Conclusion

Adopting an eIDAS 2.0 compliance app ensures that organizations meet the latest EU digital identity standards while streamlining secure authentication and data management. By leveraging such a solution, businesses can simplify regulatory adherence, enhance trust with users, and reduce administrative burdens. EUDI wallets supporting eIDAS 2.0 provide a unified, efficient approach to digital identity verification, enabling seamless cross-border interactions. Implementing this technology not only safeguards compliance but also positions organizations to adapt to evolving digital regulations while improving operational efficiency and user confidence.

Why Choose IdeaUsher for Your EUDI Wallet Development?

IdeaUsher brings deep expertise in designing secure, scalable, and compliant digital identity solutions that align with eIDAS 2.0 standards. Our team ensures your EUDI wallet delivers seamless authentication, regulatory compliance, and a user-friendly experience for citizens and organizations.

Why Work with Us?

- Regulatory Expertise: We implement EU-compliant frameworks for identity verification and authentication.

- Custom Solutions: We build tailored EUDI wallets to meet specific government or institutional requirements.

- Proven Track Record: Our experience empowers organizations to manage digital identities efficiently while maintaining trust and security.

- Scalable and Secure: We design wallets that evolve with policy updates and user needs.

Explore our portfolio to see how we have helped businesses launch secure, compliant solutions.

Reach out today to discuss your EUDI wallet development and ensure seamless eIDAS 2.0 compliance.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

An EUDI wallet enables secure and standardized management of digital identities, allowing individuals and organizations to authenticate and verify identities across the EU while adhering to eIDAS 2.0 regulations and maintaining cross-border interoperability.

EUDI wallets streamline adherence to eIDAS 2.0 standards by providing verified digital identity credentials, encrypted data storage, and secure authentication processes, reducing the risk of non-compliance and ensuring reliable cross-border digital transactions.

Yes, by offering secure, government-recognized digital identity verification, EUDI wallets increase confidence in online interactions. Users are assured that their personal information is protected and handled according to strict EU standards.

EUDI wallets reduce administrative overhead for governments and businesses, simplify identity verification, and ensure compliance with EU regulations. This improves operational efficiency, accelerates service delivery, and strengthens trust in digital services.