The sports industry is going through a major change as blockchain technology opens up new investment opportunities that were once only available to big sponsors and agents. A tokenized athlete investment app changes how fans and investors can get involved in an athlete’s financial success. It offers fractional ownership in future earnings from sponsorships, media rights, and performance bonuses. This new model connects passionate fans with genuine investment options, allowing supporters to invest in their favorite athletes’ careers.

For businesses, this is a great chance to enter the huge sports investment market. They can create multiple revenue streams through token sales, transaction fees, and strategic partnerships.

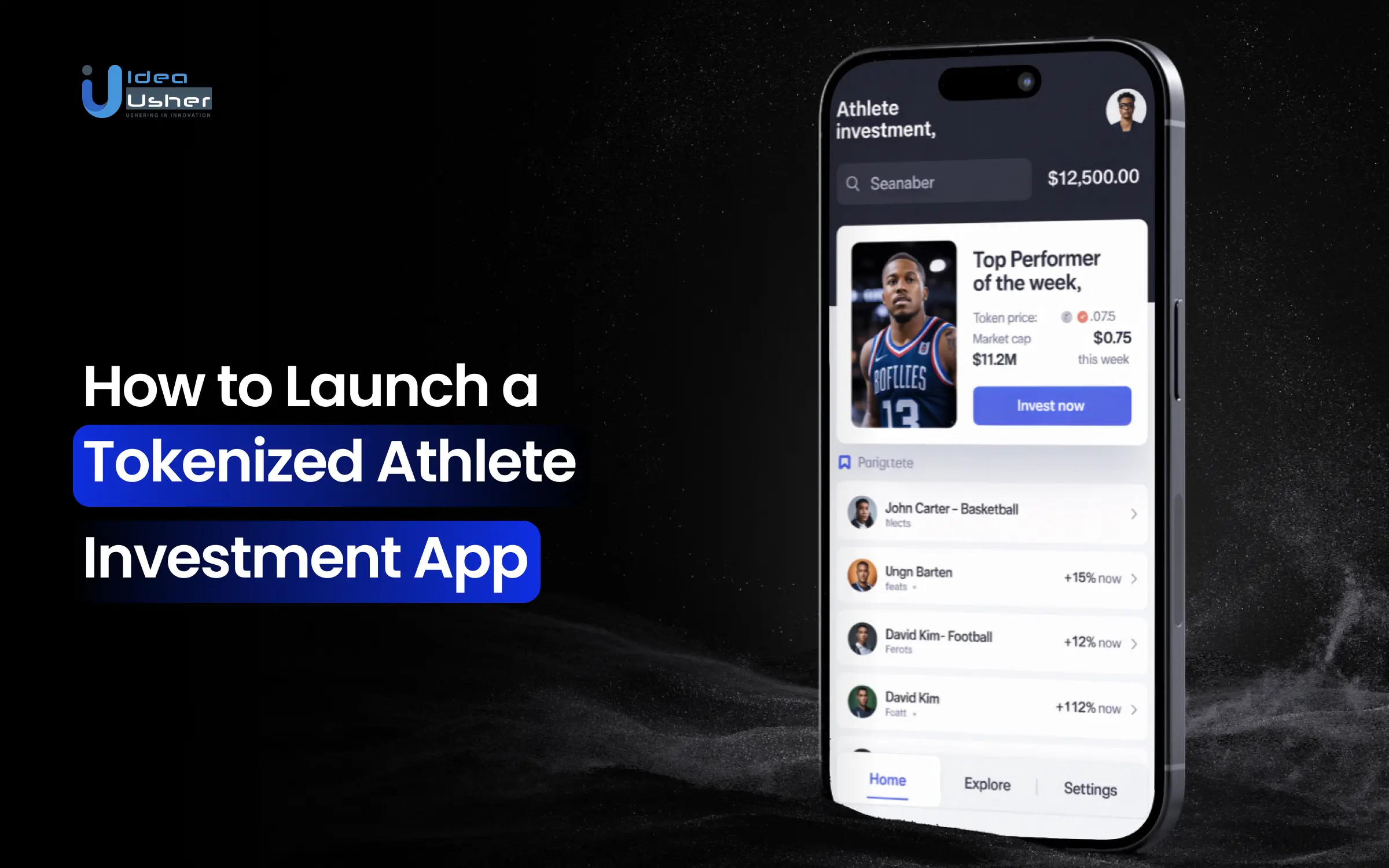

We specialise in building platforms that make it easy for people to invest in athletes. IdeaUsher has created a lot of similar platforms using blockchain, which offers exclusive content and real-time performance analytics to keep investors updated and involved. We’re putting together this blog to share our knowledge on how you can create a similar app, helping you understand how to build an engaging and secure athlete investment platform.

What is a Tokenized Athlete Investment App?

A tokenized athlete investment app lets fans and investors own a piece of an athlete’s future earnings, using blockchain to make it transparent and accessible. By breaking down an athlete’s income, like salary, winnings, and endorsements, into tradable tokens, anyone can invest in their success. It’s a simpler, more democratic way to connect with an athlete’s financial journey, beyond traditional investment models.

Types of Athlete Tokens

Tokenized Athlete Investment Apps typically offer different types of tokens based on the nature of the investment:

| Token Type | Description | Appeals To |

| Performance-Based Tokens | Tied to athlete’s earnings; share of winnings/bonuses goes to holders. | Investors seeking financial returns based on athlete’s performance. |

| Brand/Endorsement Tokens | Linked to athlete’s brand income (endorsements, merch, licensing). | Investors betting on the athlete’s marketability and commercial success. |

| Utility Tokens | Unlocks perks like VIP access, content, and voting rights. | Superfans who value engagement and experiences over financial returns. |

What Makes Tokenized Athlete Investment Apps So Popular?

According to MarketResearchFuture, the tokenized athlete investment market is rapidly growing, with projections to jump from $2.05 billion in 2024 to $10 billion by 2035. This growth is driven by blockchain technology, offering new ways for fans and investors to get involved in sports by investing in athletes’ future earnings. It’s an exciting shift fueled by growing interest from everyday investors and fans who want to connect more deeply with athletes’ financial success.

Source: MarketResearchFuture

Tokenized athlete investment platforms are revolutionizing the way fans interact with their favorite athletes and teams. With their blend of technology and sports culture, these platforms offer a dynamic, engaging, and innovative way to invest, connect, and participate. Here are the key elements that make these platforms so popular:

1. Radical Democratization

Investing in athletes used to be reserved for the ultra-wealthy, agents, venture capitalists, and family offices, who could afford to bankroll an athlete’s career in exchange for a hefty share of future earnings.

With tokenization, anyone can participate.

Athletes’ earnings, from endorsement deals to prize money, can be divided into fractional ownership, allowing a global audience to invest in an athlete’s success. This radical shift in access creates a more inclusive ecosystem, where anyone—from a fan in Tokyo to a retiree in Ohio—can own a piece of that athlete’s future potential.

For example, Rally (now Op3n) took this concept to the next level by allowing fans to buy shares of athletes like skateboarder Nyjah Huston. By tokenizing a portion of Huston’s endorsement earnings, Rally allowed everyday fans to become direct stakeholders in his career, which aligned their financial interests with his success.

2. Unprecedented Liquidity

Traditional private investments are notorious for being illiquid. Investors’ capital is often locked up for years, with no way to exit until a specific event, like a sale or IPO, occurs.

Tokenization introduces liquidity to the equation.

Once the initial offering of athlete tokens is complete, these tokens can be traded on secondary markets, providing instant access to capital. The ability to buy and sell tokens 24/7 reduces investment risk and opens the door to a broader class of investors who may have otherwise avoided illiquid investments.

Socios.com is an excellent example of how tokenization creates liquidity. While focused on fan tokens for sports teams, Chiliz perfected the model by allowing fans to trade tokens like Paris Saint-Germain Fan Tokens or FC Barcelona Fan Tokens on the Socios app.

This secondary market functions 24/7, letting fans buy and sell tokens based on team performance, player trades, or breaking news.

3. Transparency by Default

Investors traditionally rely on periodic reports from a central authority to ensure that their investments are being managed properly. This system relies on trust—something that is often opaque and prone to errors or manipulation.

Tokenization makes trust obsolete by embedding it into the system.

Every transaction, whether minting a token, executing a trade, or distributing earnings, is recorded on an immutable blockchain. This provides a level of transparency and accountability that was previously impossible in traditional investments. Blockchain ensures that every action is verifiable and publicly available, making the entire process trustless and transparent.

4. Utility as a Driver: From Investment to Ecosystem

Traditional investments are purely transactional. They serve one purpose: potential financial return. Once you invest, that’s often where the engagement stops.

In tokenized athlete investment apps, tokens are not just financial instruments, they’re keys to a broader ecosystem.

Beyond financial returns, tokens grant holders access to exclusive experiences, voting rights, and the opportunity to actively participate in the athlete’s journey. This makes the investment experience far richer and more engaging, fostering a loyal and passionate fanbase.

SportsIcon takes fan engagement to the next level with their Golden Tokens, which come with perks like virtual meet-and-greets, behind-the-scenes access, and exclusive digital collectibles.

How the Tokenized Athlete Investment App Works?

A tokenized athlete investment app lets you buy digital tokens that represent a share in an athlete’s future earnings, like prize money or endorsement deals. You can invest as little as $10, and once you own tokens, you’re part of their journey, with payouts when they achieve milestones. Plus, you can trade those tokens anytime on the app’s marketplace, making it a flexible and transparent way to support athletes and potentially earn along the way.

1. The Foundation: Athlete Token Creation

The process starts with the creation of a smart contract—a self-executing agreement that is programmed to automate the terms and conditions of the investment. This contract is deployed on a blockchain (like Ethereum or Solana) and serves as the backbone of the entire system.

The Blueprint: For each athlete, a custom smart contract is created. This contract outlines all the key elements of the investment, including:

- Total Supply: How many tokens will be issued.

- Asset Link: What exactly the tokens represent (e.g., 5% of the athlete’s earnings from prize money between 2024-2026, or 10% of revenue from a specific endorsement deal).

- Distribution Rules: When and how the revenue will be distributed among token holders.

Immutable Launch

Once the contract is reviewed and audited for security, it is deployed to the blockchain. This is a permanent action, meaning the terms cannot be altered later, ensuring transparency and trust. At this point, the tokens are “minted,” ready for investors to purchase.

2. The Investment: Fractional Token Purchases

This is where the app truly democratizes investment, making it possible for fans and small investors to get involved without needing to commit millions of dollars.

Discovery

Users can browse a list of athlete profiles within the app. Each profile highlights the athlete’s career, the terms of the token offering, and potential earnings. Investors can make informed decisions about where to allocate their funds.

Fractional Ownership

Investors don’t have to purchase an entire token. Instead, they can buy fractions of a token for as little as $10 or $20. The app handles the complexity of converting traditional payment methods (like a credit card) into cryptocurrency in the background.

Secure Custody

After purchase, the tokens are instantly transferred to the investor’s digital wallet within the app. The blockchain records every transaction, providing permanent and verifiable proof of ownership.

3. The Reward Cycle

This is where the true power of tokenization shines. The app makes it easy to track, receive payouts, and trade tokens, all in a transparent, efficient, and automated system.

Automatic, Transparent Payouts

- Event Occurrence: When the athlete achieves a specific milestone—say, they win a tournament with a $500,000 prize—a trigger event occurs

- Data Verification: A blockchain oracle, a trusted data service, verifies this milestone and confirms the details (e.g., the prize amount).

- Smart Contract Execution: The verified data is sent to the smart contract, which automatically calculates the share owed to each token holder. For instance, if the athlete’s contract promises 5% of their prize money, that would be $25,000 from a $500,000 prize.

- Instant Distribution: The smart contract automatically executes the distribution, transferring each token holder’s share directly into their digital wallet. This process is immediate, transparent, and eliminates any middlemen or delays.

Liquid Secondary Market

- Marketplace for Trading: Investors don’t have to hold onto their tokens forever. The app includes a built-in secondary market where users can sell their tokens at a price they choose. This creates liquidity, so investors can exit their position whenever they like.

- Dynamic Pricing: Token prices fluctuate based on the athlete’s performance and the demand for their potential. If an athlete performs well, their tokens may rise in value, much like stocks. Conversely, if their performance dips, the token’s price might decrease.

Benefits of Tokenized Athlete Investment Apps

Tokenized athlete investment apps let athletes raise funds directly from fans, reducing financial stress. Fans get to own a share in the athlete’s success, with more transparency and flexibility. Businesses and leagues benefit from stronger fan engagement and new revenue opportunities.

1. For Athletes

Tokenization empowers athletes by changing how they access funding and control their careers.

- Direct Funding & Financial Freedom: Athletes can raise funds directly from fans, allowing them to focus on performance without debt or excessive control from third parties.

- Reduced Dependence on Intermediaries: With less reliance on agents and managers, athletes gain more autonomy and better financial terms.

- Creating a Loyal Economic Base: Fans become active supporters, helping to promote the athlete, buy merchandise, and strengthen the athlete’s brand.

2. For Investors & Fans

Tokenization opens new opportunities for fans and investors alike.

- Fractional Ownership: Fans can invest affordably, owning a piece of their favorite athlete’s future success.

- Unprecedented Liquidity: Tokenized assets can be traded 24/7, offering flexibility and reducing investment risk.

- Radical Transparency & Trust: Blockchain ensures transparency, making every investment and transaction visible and verifiable.

3. For Businesses & Leagues

Sports organizations can leverage tokenization for growth and deeper fan connections.

- Scalability: A global system that can easily onboard athletes without extra administrative costs.

- New Monetization Streams: Platforms and leagues can generate revenue through token sales, transactions, and partnerships with athletes.

- Building a Stronger Fan Community: Fans with a financial stake in athletes are more engaged, increasing viewership, social media activity, and merchandise sales.

How to Develop a Tokenized Athlete Investment App?

We specialize in creating innovative tokenized athlete investment apps. Our process combines advanced blockchain technology with a user-focused approach to empower athletes and investors alike. Here’s how we develop this transformative platform step by step.

1. Define Tokenomics

We begin by structuring the tokenomics, which includes setting payouts, token supply, and the overall revenue model. This ensures a sustainable system where both athletes and investors benefit while maintaining transparency and fairness.

2. Choose Blockchain & Token Standards

We select the ideal blockchain, such as Ethereum, Polygon, or Solana, based on speed, security, and scalability. Depending on the needs of the project, we choose between ERC-20 (fungible tokens) or ERC-721 (non-fungible tokens) to suit the token model.

3. Build Smart Contracts with Oracles

Smart contracts are designed to automate payouts based on performance metrics. We integrate secure oracles to ensure that athlete data is accurately reflected in real-time, ensuring transparency and trust for users.

4. Develop Wallet Architecture

Security is key, so we implement both custodial and non-custodial wallet solutions. We also include multi-sig and recovery features, giving athletes and investors full control while ensuring the safety of their assets.

5. Implement Compliance Framework

We integrate KYC and AML procedures to meet regulatory requirements. This step also involves managing geo-restrictions and automating reporting to ensure your app operates within legal frameworks worldwide.

6. Create Secondary Marketplace

To ensure liquidity, we develop a secondary marketplace where investors can trade tokens. The marketplace is built with a seamless UX and smart contract functionality, giving users a secure and flexible trading experience.

What Story Are You Actually Selling Through Your App?

Before you dive into writing code or selecting a blockchain, there’s a fundamental question you must answer: What story are you selling?

This isn’t just about branding or marketing, it’s about defining the entire structure of your project, from the tokenomics to the legal framework, to how your users will experience the platform. The story you choose will shape everything: the value of your token, how users engage with it, and whether anyone will care.

There are two clear paths you can take, and each leads you in a very different direction. Let’s explore these paths and the potential for blending them into a powerful hybrid model.

Narrative A: “Invest in the Next LeBron” (Financial Product)

This approach treats the token as an investment opportunity. You’re not selling an athlete’s personality or access to their world — you’re selling the potential to profit from their future earnings. The core value proposition here is ROI (Return on Investment), where the token’s value is directly tied to the athlete’s financial performance.

Tokenomics:

- Nature of the Token: The token is a security. Its value fluctuates based on the athlete’s earnings (salary, endorsement deals, etc.).

- Revenue Distribution: A percentage of the athlete’s revenue is distributed to token holders via the smart contract. You may also incorporate staking rewards and burn mechanisms to create scarcity and increase value.

Legal Structure:

Because this is framed as a security, you’ll need to comply with rigorous financial regulations, including accreditation checks for investors, full disclosures, and adherence to SEC (or equivalent) guidelines. This is essentially a brokerage, not just an app.

App Features:

- User Interface: Expect a trading-style platform with price charts, trading volume, dividend history, and other financial data.

- User Experience: Investors are the core user base. They may have little emotional connection to the athlete but are heavily motivated by the potential for financial gain.

Example in Action: David Beckham – DigitalBits ($XDB) Partnership

Beckham’s partnership with DigitalBits is a prime example of this financial product approach. It’s not just about a token for fans, it’s a digital asset tied to the value of Beckham’s brand, with the potential for appreciation based on the global expansion of his commercial endeavors.

The core proposition for holders is financial upside, leveraging blockchain for proof of ownership and potential future utility.

The Risk: This narrative can attract speculative investors who are loyal to profits, not to the athlete. The community built around this token may lack genuine emotional investment in the athlete’s journey, making it a more volatile, profit-driven platform.

Narrative B: “Join LeBron’s Inner Circle” (Utility-Driven)

In this narrative, the token is less about speculation and more about membership and community. The core value proposition is access — to exclusive content, experiences, and a sense of belonging. While there may be financial perks, they’re secondary to the primary promise of community and status.

Tokenomics:

- Nature of the Token: A utility token. Its value is driven by the demand for access to perks and experiences tied to the athlete.

- Revenue Distribution: Tokenomics here are more complex and creative, revolving around governance (voting rights), access rights, and experience redemption.

Legal Structure:

By focusing on utility and avoiding a direct financial investment, you’re positioning your platform outside the regulatory clutches of securities laws. This makes your project easier to build without heavy legal overhead.

App Features:

- User Interface: A hybrid of social platforms like Discord or Patreon, and fantasy sports apps. The key features are community engagement, exclusive content drops, and voting on fan-driven polls.

- User Experience: Fans and superfans are the target users. They’re motivated by emotional investment in the athlete, not just financial returns.

Example in Action: Zora – Athlete NFT Drops

Platforms like Zora, where athletes like WNBA star Kelsey Plum have launched NFT collections, are examples of this utility-driven membership approach. For Kelsey, the NFT didn’t promise financial rewards but served as a key to exclusive access, like training tips, live chats, and real-world experiences.

The Reward: This model attracts a loyal, emotionally invested community. Users are part of something special, gaining not just financial perks but also a deeper connection with the athlete’s journey. They’re not just investors; they’re true fans.

The Winning Narrative: The Hybrid “Golden Circle”

While both of these narratives have their merits, the most powerful model might be a hybrid approach. This blend allows you to offer the best of both worlds — utility and access, combined with shared financial success.

The Primary Narrative: “Join LeBron’s Inner Circle”

The loudest story you lead with is the utility aspect — being part of an exclusive community with access to the athlete, special events, voting rights, and unique experiences. This appeals to fans who want to feel a sense of belonging, not just financial gain.

The Secondary Narrative: “Share in Our Success”

While utility is the core offering, there’s an underlying promise of shared success. You don’t guarantee financial returns, but you highlight the possibility that the athlete’s success could benefit token holders in the form of financial rewards (e.g., a share of earnings from brand partnerships).

Example in Action: Tom Brady’s Autograph Platform & $DRAFT Token

Tom Brady’s platform, Autograph, uses a hybrid approach. Fans can purchase NFTs tied to athletes like Simone Biles and Tony Hawk, granting them exclusive access and experiences, this is the “Inner Circle” aspect.

But the platform also integrates the $DRAFT token, which allows holders to participate in the platform’s financial growth, providing a secondary financial incentive.

Tools & APIs for Tokenized Athlete Investment Apps

Building a robust Tokenized Athlete Investment App requires a thoughtful selection of tools, APIs, and frameworks. Your choices here will play a pivotal role in ensuring your app is secure, scalable, user-friendly, and future-proof. Here’s a detailed guide to the essential components that should form the foundation of your application.

1. Blockchain Platforms

The blockchain forms the backbone of your platform, where transactions and smart contracts are executed. Your decision here revolves around the balance between security, speed, and cost.

| Blockchain | Security | Transaction Speed | Transaction Fees |

| Ethereum | High (most decentralized) | Slower, especially during congestion | High (“gas” fees) |

| Polygon | High (uses Ethereum’s security) | Fast | Low |

| Solana | Moderate (Proof of History) | Extremely fast | Very low |

2. Smart Contract Development

Smart contracts are the heart of your application. These are self-executing contracts with the terms of the agreement directly written into code. The tools and frameworks you choose for writing, testing, and deploying smart contracts are crucial.

Programming Languages:

- Solidity: The go-to language for writing smart contracts on Ethereum and compatible networks (like Polygon). With the largest community and extensive resources, Solidity is ideal for most projects.

- Rust: The primary language for Solana, Rust is known for its exceptional performance and memory safety, making it a great choice for those transitioning from traditional software development.

Development Frameworks:

- Hardhat & Truffle: Industry-standard environments for Ethereum-based smart contract development. These frameworks simplify the processes of compiling, testing, debugging, and deploying smart contracts, helping ensure a smooth and secure development cycle.

3. Oracles

Oracles are essential for connecting the blockchain with real-world data, such as sports statistics or financial market data. They provide the off-chain data needed to execute certain contract conditions.

- Chainlink: The leading decentralized oracle network, offering tamper-proof and highly reliable data feeds. Its decentralized nature ensures that there’s no single point of failure, making it a secure choice for financial contracts and other sensitive applications.

- Band Protocol: Another strong player in the decentralized oracle space, Band Protocol offers similar services to Chainlink but often at lower costs or with data feeds tailored to specific regions or use cases.

4. Wallets & Custody

Wallets are the key to managing users’ digital assets, as they store the private keys that control access. Your decision here impacts both user convenience and security.

MetaMask

The most widely used non-custodial wallet. MetaMask gives users full control over their private keys and is easily integrated into web applications, making it a go-to solution for many blockchain-based apps.

Fireblocks

An enterprise-grade custodial platform designed for businesses that require institutional-grade security for managing digital assets. It’s ideal for treasury management and platforms that need advanced security features like multi-signature approvals and hardware isolation.

Custom Wallet APIs

Many applications build custom wallets directly into their interface. This option allows for a more seamless user experience, especially for those unfamiliar with crypto. It often uses a custodial or hybrid approach, abstracting the complexity of seed phrases but necessitating strong security measures.

5. KYC/AML APIs

Complying with KYC and AML regulations is crucial for maintaining your platform’s trustworthiness and legality. Services like Sumsub, Jumio, and Onfido offer robust API-based identity verification, using AI to validate IDs, perform liveness checks, and screen users against global watchlists. By integrating these, you ensure both regulatory compliance and a smooth, secure onboarding process for users.

6. Backend & Hosting

The backend of your application handles everything that happens off-chain, such as user profiles, marketplace data, and interaction with the blockchain. It’s the unsung hero of your app’s functionality.

- Backend Framework: Node.js is a popular choice for backend development due to its efficiency with asynchronous tasks, like communicating with the blockchain, and its unified JavaScript stack (JavaScript on the frontend, Node.js on the backend).

- Cloud Hosting: Amazon Web Services (AWS) and Google Cloud Platform (GCP) provide scalable, secure, and reliable hosting solutions for your app’s infrastructure. Their global CDNs ensure fast performance across different regions.

- Realtime Databases: Firebase, a Google-backed platform, is an excellent choice for building real-time, scalable apps. It’s ideal for dynamic features like live market prices, real-time notifications, and chat systems.

7. Frontend Frameworks

The frontend of your app is what users interact with. It needs to be intuitive, responsive, and engaging while abstracting away the complexities of the blockchain.

React

The most popular JavaScript library for building modern, interactive user interfaces. Its component-based structure is ideal for maintaining large-scale apps, and it has a vast ecosystem of supporting libraries.

Angular

A fully-fledged frontend framework maintained by Google, Angular is structured and opinionated, making it ideal for large enterprise applications where consistency and scalability are key.

Vue.js

Known for its simplicity and ease of integration, Vue.js offers the flexibility of React combined with the structure of Angular. Its gentle learning curve makes it a great choice for developers of all experience levels.

Use Case: Tokenizing Tennis Tournament Funding

One of our clients, a well-known international tennis organization, came to us facing a major challenge: funding and engaging fans for their essential Challenger-level tournaments. They needed a new model to boost prize pools, improve event production, and attract a global fanbase. They wanted a more reliable financial solution beyond sporadic sponsorships and costly broadcast deals.

Our Solution: A Tokenized Tournament Ecosystem

We didn’t just build a platform; we created a new economy for the organization, reshaping its financial and fan engagement model. Here’s how we made it happen:

The Asset: Tokenizing the Organization’s Future

Instead of focusing on individual players, we tokenized a portion of the organization’s future revenue streams, including tournament sponsorships, broadcast rights, and merchandise sales. By combining these diverse sources, we created a more stable and attractive investment opportunity. This approach offered potential investors a balanced, lower-risk proposition with multiple revenue channels.

Fractional Investment for Global Fans

We introduced the Championship Token ($CT), a digital asset that gave fans and investors a fractional share in the organization’s future revenues. For as little as \$25, anyone could buy \$CT tokens through an easy, compliant process in our custom app. This made tennis fans active participants in the circuit, giving them a real stake in the tournaments’ success.

Transparent Distributions via Smart Contracts

At the platform’s core were smart contracts, which automatically handled everything from revenue collection to earnings distribution for $CT token holders. After each tournament, the contract would calculate and distribute the share, with every transaction recorded on the blockchain for full transparency. Fans could track everything in real-time, without relying on reports or manual tracking.

Multi-Tiered Utility to Drive Fan Engagement

The $CT token was more than just an investment,it was a gateway to exclusive experiences. Fans could vote on key decisions, enjoy behind-the-scenes content, and access virtual AMAs with rising stars. Plus, they earned digital collectibles and discounts on merchandise, making the tokens valuable both financially and in real-world perks.

A Sustainable Revenue Model for the Platform

To ensure long-term sustainability, the platform generates revenue through small, transparent fees. A fee is applied to the initial sale of $CT tokens, and another minimal fee is charged on secondary market trades. This creates a steady income stream that helps maintain and grow the platform while supporting ongoing development.

The Result: A New Era for the Organization

- New Financial Opportunities: Shifted reliance from traditional sponsorships to a global network of engaged fans and investors.

- Active Fan Participation: Fans are no longer passive spectators; they are active participants in the tournament’s growth and success.

- Sustainable Model: Created a transparent, sustainable, and engaging funding model for the organization’s future.

- Stronger Community Connection: Strengthened the bond with a loyal, global community of supporters and investors.

Conclusion

Tokenized athlete investment apps are revolutionizing how sports financing works, providing fans with unprecedented opportunities to invest and engage directly in an athlete’s journey. This shift not only democratizes access to sports-related investments but also opens up new revenue models for businesses and enterprises, creating a dynamic ecosystem of engagement. By partnering with experts like Idea Usher, companies can ensure a seamless development process while staying compliant with regulations, allowing them to fully capitalize on this emerging trend.

Looking to Develop a Tokenized Athlete Investment App?

We don’t just build apps; we create new economic models. Let us help you launch a secure, scalable, and compliant Tokenized Athlete Investment App that transforms fans into active stakeholders and empowers athletes as brands.

Why Partner with Us?

- Proven Technical Expertise: With over 500,000 hours of coding experience, our team of ex-MAANG/FAANG developers handles the toughest technical challenges, whether it’s smart contracts or creating seamless user experiences.

- Beyond Development: We’re not just a development team; we’re your strategic partner. From tokenomics to regulatory compliance, we guide you through the complexities, ensuring long-term success, not just a one-time launch.

Ready to Build the Future of Sports Engagement?

Explore our latest projects to see the powerful, innovative platforms we’ve built for clients just like you.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: A tokenized athlete investment app is a blockchain-based platform that allows fans and investors to buy fractional shares in an athlete’s future earnings or brand value. These tokens represent a stake in the athlete’s career, offering a way for individuals to financially support athletes while gaining exposure to their performance.

A2: Investors can earn money from athlete tokens through revenues tied to the athlete’s performance, such as earnings from endorsements, salaries, or prize money. Additionally, they can trade their tokens on a secondary market, where the value of the tokens can fluctuate based on the athlete’s success and public demand.

A3: Tokenized athlete investments are subject to evolving laws and regulations, which vary by country. To remain compliant, platforms must implement necessary frameworks such as KYC and AML processes, along with adhering to any geo-restrictions and local regulations.

A4: Blockchain enhances security by providing an immutable and transparent record of every transaction, ensuring that all token ownership and earnings distributions are verifiable. Smart contracts automate processes like payments and revenue sharing, reducing human error and increasing trust through decentralized technology.