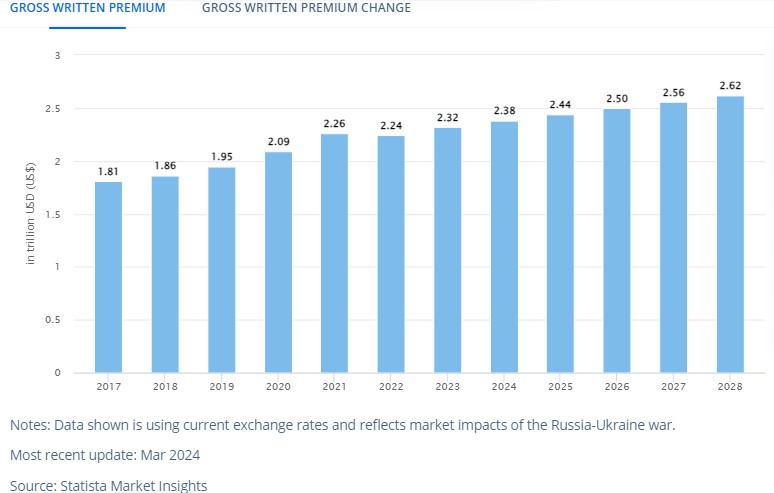

Health insurance apps address concerns like managing complex coverage details, tracking deductibles, and filing claims. They simplify finding providers, comparing costs, and accessing health records, which reduces administrative hassle for users. This is evident from the fact that people love this convenience and are looking for better options to manage their health insurance online. Plus, the fact that the global health insurance market is projected to reach $2.38 trillion by 2024 suggests that there is significant growth in the segment, and so there will be a need for better mobile-friendly solutions.

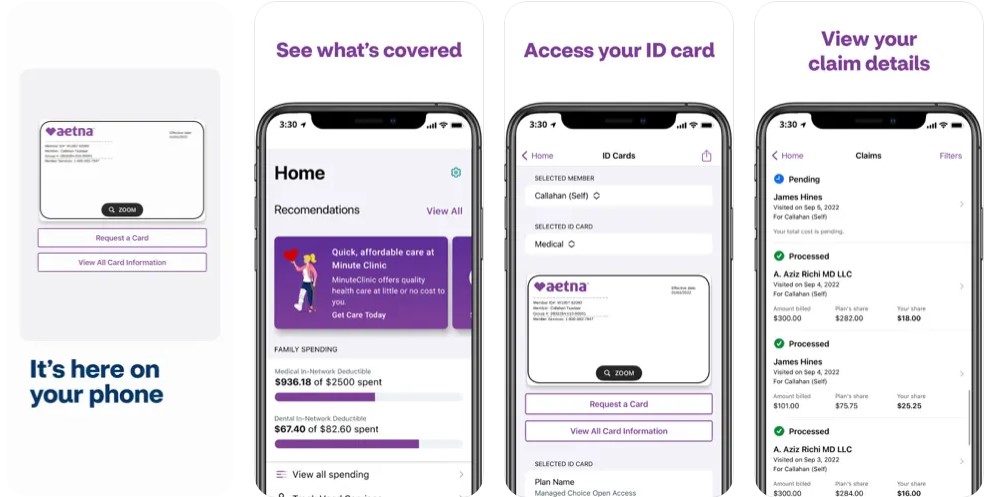

In this context, developing a health insurance app offers a strategic advantage by addressing these needs. Among all the existing solutions, we have benchmarked Aetna due to its comprehensive features, clean design, and integration with healthcare services. So, in this blog, you can expect a thorough guide on developing a health insurance app like Aetna, including insights into essential features, development steps, and strategic advantages to capture the expanding market opportunity.

Aetna: Overview

Aetna Inc. was founded as Aetna Life Insurance Company on May 28, 1853, and is a leading American-managed healthcare organization. It has grown to be a significant player in the US health insurance sector, offering a broad range of insurance products. These include medical, pharmaceutical, dental, behavioral health, long-term care, and disability plans. Aetna distributes these products mainly through employer-sponsored programs and Medicare, addressing diverse healthcare needs.

In 2018, Aetna became a subsidiary of CVS Health. This strategic integration has expanded Aetna’s capabilities, combining health insurance with CVS Health’s pharmacy services for a more comprehensive healthcare approach.

The Aetna Health℠ app simplifies the management of health benefits for Aetna members. It provides an easy way to access insurance details and track expenses. Moreover, users can quickly locate doctors and view their coverage. Additionally, the app offers updates on health plans, making the entire process more manageable. This design aims to improve convenience along with overall user satisfaction.

| Time Period | Key Developments |

| 2010 | Developed and marketed the Aetna Health Insurance app in response to rising smartphone use. |

| Mid-2010s | Used big data and analytics to enhance health record insights and services. |

| 2010s and 2020s | Adopted AI and machine learning for personalized health plans. |

| Pandemic Era | Added virtual healthcare and digital services to improve convenience and access. |

| Post-Pandemic | Focused on user-centric online services, data security, and better customer experiences. |

| Overall Strategy | Strategically advanced and set competitive benchmarks based on market position. |

What Makes The Aetna Unique?

The Aetna Health℠ app is designed to simplify the management of health and insurance benefits. It offers a range of functionalities customized for the user’s efficiency and convenience:

- Digital ID Cards: Users can access their insurance ID cards directly from the app, ensuring they always have proof of coverage when needed.

- Coverage Information: The app provides detailed insights into insurance coverage, allowing users to understand their plan specifics clearly.

- Deductible Tracking: Users can monitor their spending and progress toward meeting their deductible, making it easier to manage out-of-pocket costs.

- Claims Management: The app enables users to review and pay claims for themselves and their family members, simplifying the claims process.

- Provider Locator: Users can search for network providers based on location and specialty, facilitating easy access to quality care.

- Cost Comparison: The app offers tools to compare costs for medical visits and procedures, helping users make informed financial decisions about their care.

- Health Reminders: Personalized tips and reminders are provided to support users in maintaining and improving their health.

- Health Savings Account: Users can check their HSA balance and transaction history, keeping track of their health savings.

- Health Reimbursement Account: The app allows users to manage details of their HRA, ensuring they can efficiently handle health-related expenses.

- Flexible Spending Account: Users can view their FSA balance and track spending, aiding in the management of flexible spending funds.

- Plan Summary: A comprehensive overview of health plans and coverage details is available, offering users a clear summary of their benefits.

- Explanation of Benefits: Detailed explanations of benefits and claims are provided, helping users understand how their claims are processed and what is covered.

Features of Aetna by panels:

| User Panel | Provider Panel | Admin Panel |

| Access ID Cards | Submit Claims | Manage Provider Information |

| View Benefit Details | Get Authorizations and Referrals | Claims Submission |

| Track Deductibles | Check Patient Benefits and Eligibility | Authorizations |

| Manage Claims and Find Providers | Upload Medical Records | Updating Provider Information |

| Compare Costs and Receive Health Reminders | Manage Disputes and Appeals | Administrative Functions (typically managed through the Aetna provider portal) |

| Check HSA, HRA, FSA Balances and EOB | – | – |

| View Plan Summary | – | – |

| Schedule Appointments & Talk with a Doctor by Phone or Video | – | – |

How Does Aetna Work?

The Aetna Health℠ app makes managing your healthcare and benefits straightforward, and here’s how it works:

- Easy Access: Quickly view your ID card, plan details, and coverage information right from the app.

- Track Your Spending: Keep an eye on your spending and progress towards your deductible. You can also check your HSA, HRA, and FSA.

- Handle Claims: View and pay claims for yourself and your family members easily.

- Find Providers: Locate in-network doctors, hospitals, and specialists nearby. The app also helps you find MinuteClinic locations.

- Compare Costs: Get estimates for doctor visits and procedures to make better financial decisions.

- Health Tips: Receive personalized health tips and reminders to stay on track with your health.

- Connect with Care: Schedule appointments at MinuteClinic and talk with doctors via phone or video.

Key Market Takeaways For Health Insurance Apps

The health insurance market is growing quickly, and several key trends are shaping its future:

- Market Growth: The insurance platform market was valued at $81.7 billion in 2023 and is expected to grow to $156 billion by 2028. This growth shows how important it is for insurance companies to adopt new technology and offer digital services.

- Digital Shift: Consumers now expect easy digital interactions with their insurance providers. Health insurance apps are using artificial intelligence (AI) and machine learning to make services more personalized, speed up claims, and improve customer experience. These technologies are crucial for staying competitive.

- Regulatory Compliance: New regulations and compliance rules are pushing insurance companies to use advanced platforms. These tools help insurers follow complex regulations and reduce the risk of non-compliance.

- Health Insurance Market Size: The global health insurance market is projected to reach $2.38 trillion in premiums by 2024. Spending per person is expected to be $306.70. The market will grow at a rate of 2.43% per year, reaching $2.62 trillion by 2028. This growth reflects a rising demand for health insurance and digital services.

- U.S. Market Leader: The United States will lead the market with $1,607 billion in premiums in 2024. This highlights its significant role in the global health insurance industry.

Business And Revenue Model Of Aetna

Aetna has a complex approach to business and making money, which is designed to cover various healthcare needs and generate significant revenue. Here’s a simple breakdown of how Aetna’s model works:

Business Model

| Aspect | Details |

| Insurance Plans | Medical, dental, pharmaceutical, and more. |

| Medicare/Medicaid | Medicare Advantage, Supplement, and Medicaid services. |

| Employer Plans | Health insurance for employees. |

| Extra Services | Medical management and health IT solutions. |

| ACS | IT solutions to improve care and reduce costs. |

1. Comprehensive Health Insurance

Aetna offers a broad range of health insurance plans. These include traditional medical coverage, pharmaceutical benefits, dental and behavioral health services, long-term care, and disability insurance.

2. Government Programs

Aetna provides Medicare Advantage and Medicare Supplement plans, catering to seniors and those needing additional health care coverage. They also manage Medicaid services, supporting individuals with low income.

3. Employer Partnerships

By collaborating with businesses, Aetna delivers customized health insurance solutions to employees, offering plans that meet both company and employee needs.

4. Additional Services

Beyond insurance, Aetna offers additional services like medical management, workers’ compensation administrative services, and health information technology solutions that enhance operational efficiency.

5. Accountable Care Solutions

Aetna provides advanced health information technology products aimed at improving patient outcomes and controlling costs through enhanced care management.

Revenue Model

| Aspect | Details |

| Premiums | Paid by individuals and employers. |

| Service Fees | For plan administration and claims. |

| Government Contracts | Medicare and Medicaid revenue. |

| Pharmacy Services | From prescription plans. |

| Membership Fees | Collected from enrolled individuals. |

1. Premium Revenue

Aetna’s primary income source is premiums collected from individuals and businesses based on their insurance coverage plans.

2. Service Fees

Employers pay Aetna for administrative services, network access, and claims management, adding another revenue stream.

3. Government Contracts

Revenue is also derived from contracts with Medicare and Medicaid programs, reflecting Aetna’s involvement in government-funded health care.

4. Pharmacy Services

Income is generated from providing pharmacy benefits, including prescription drug plans and associated services.

5. Membership Fees

Individuals enrolled in Aetna’s health plans contribute through membership fees, supporting the company’s financial stability.

Aetna’s business model utilizes a variety of insurance products and services to address different market segments, while its revenue model capitalizes on both direct consumer payments and broader contractual agreements.

Features That Make Aetna Popular Among Its Users

Aetna’s Health℠ app stands out for its features, which are designed to simplify healthcare management and enhance user convenience. Here’s an in-depth look at what makes the app so well-regarded:

1. Intuitive Design

The app boasts a user-friendly layout that ensures effortless navigation. Its simple design accommodates users of varying ages and technical expertise, making health management accessible for everyone.

2. Instant Access To ID Cards

Aetna’s app offers easy access to digital ID cards. Users can retrieve their ID cards instantly, a feature that proves invaluable during medical visits and insurance verifications.

3. Detailed Coverage Information

The app provides comprehensive details about health coverage and benefits. Users can easily understand their insurance plans, including what is covered and any limitations, which helps in making informed healthcare decisions.

4. Deductible Tracking

Aetna’s app includes a tool for tracking deductible progress. Users can monitor their spending and see how close they are to meeting their deductibles, aiding in effective financial planning for health care costs.

5. Claims Management

Users can manage their claims directly through the app. The platform allows for viewing, tracking, and paying claims for themselves and family members, simplifying what can be a complicated process.

6. Provider Search Functionality

The app features a search tool for finding in-network doctors, hospitals, and specialists. Users can filter searches by location or specialty, ensuring they receive care from their preferred providers.

7. Cost Estimation Tools

To help in planning and budgeting, the app provides cost estimates for various medical services. Users can get an idea of the costs associated with doctor visits and procedures before making decisions.

8. Personalized Health Reminders

The app delivers personalized health tips and reminders. These notifications help users stay focused on their wellness goals and prompt them to take necessary health actions.

9. Financial Account Management

Users can track balances and transactions for HSA, HRA, and FSA within the app. This feature simplifies the management of health-related finances.

10. Appointment Scheduling And Telehealth

The app includes a scheduling tool for MinuteClinic visits and offers access to telehealth consultations. Users can arrange appointments or speak with doctors via phone or video, enhancing convenience and accessibility.

Innovative Features That Can Enhance An App Like Aetna

To make a health insurance app like Aetna more efficient and user-friendly, incorporating the following advanced features can make a significant difference:

1. Dynamic Plan Comparison

Users can compare multiple health insurance plans side-by-side. This feature lets them evaluate coverage options, deductibles, co-pays, and premiums, helping them select the plan that best fits their needs and preferences.

2. Predictive Analytics For Claims

Using AI and predictive analytics, the app can forecast the likelihood of claim approval based on historical data. It provides actionable insights and suggestions to enhance the chances of a successful claim, streamlining the claims process and reducing the time spent on rejections.

3. Blockchain For Secure Transactions

Blockchain technology ensures secure and transparent transactions and data exchanges. It creates an immutable ledger of transactions, which prevents unauthorized access and fraud. This strengthens trust and safeguards sensitive information, such as personal health records and claim details.

4. Virtual Health Assistant

An AI-powered virtual assistant can provide real-time support to users. It can answer queries about insurance coverage, guide users through complex processes, and offer personalized health advice based on user data and preferences, improving user engagement and satisfaction.

5. Family Health Management

This feature allows users to manage the health and insurance details of all family members from a single account. Users can track individual health records, view coverage details, and handle claims for their entire family, simplifying health management for households.

6. Telehealth Integration

Integrating telehealth services directly into the app enables users to consult with doctors via video calls. This feature facilitates easy access to medical advice, helps in managing minor health issues remotely, and reduces the need for in-person visits, enhancing overall convenience.

7. Integration With Wearables

Syncing with wearable devices like fitness trackers allows the app to collect and analyze health data such as activity levels, heart rate, and sleep patterns. This integration provides users with a comprehensive view of their health metrics, which can be used to customize insurance plans and benefits more effectively.

8. Robotic Process Automation

RPA streamlines repetitive tasks such as processing claims, managing paperwork, and updating records. This automation reduces human error, speeds up workflows, and improves overall operational efficiency. Additionally, RPA aids in detecting fraudulent activities by analyzing patterns and anomalies.

9. Artificial Intelligence And Automation

AI enhances the personalization of insurance plans by analyzing user data to customize recommendations and pricing. Automation complements AI by handling routine tasks efficiently, reducing operational costs, and improving customer service through quicker responses and support.

Development Steps For Health Insurance Apps Like Aetna

Developing a health insurance app that mirrors Aetna’s capabilities involves a detailed approach to both functionality and user experience. To develop an app with similar prowess, follow these steps:

1. Examine Aetna’s Functional Offerings

Start with essential health tools like those offered by Aetna. Include features such as health assessments, wellness plans, and challenges that keep users engaged. Add a telehealth option for virtual doctor visits, including secure video calls and messaging. Also, integrate care management tools for scheduling appointments, sending medication reminders, and creating treatment plans.

2. Target Audience Considerations

Customize the app for different users. For businesses, focus on features like employee benefits management, cost analysis, and compliance tools. For individuals, include health tracking, reminders for preventive care, and clear options for understanding costs and coverage.

3. Reflect Brand Identity

Make sure your app reflects your brand’s identity. Use colors and fonts that match your brand’s style, and make sure the language fits your brand’s tone. This creates a consistent and professional look and feel for users.

4. Address Regional And Local Needs

Adapt the app to fit regional needs and local regulations. This means including health guidelines and insurance rules specific to each area. Offer multiple languages if your audience is diverse to make the app accessible to more users.

5. System Integration And Data Management

Connect your app with existing health insurance systems using APIs. This helps to keep data consistent across platforms. Make sure data is synchronized properly to maintain accurate health records and user information.

6. Utilize Strategic Partnerships

Collaborate with other health and wellness providers. This could include adding features from third-party services like fitness tracking or nutrition advice. Provide extra services that complement your main offerings, such as special wellness content or local health services.

7. Enhance User Experience And Accessibility

Make the app accessible to everyone, including people with disabilities. Include features like voice control and screen reader support. Conduct user testing with individuals who know Aetna’s services to gather feedback and improve the app’s functionality.

Tech Stack For Aetna Clone App Development

Here are some unique considerations and potential tech stack components:

| Component | Technologies | Reasons |

| Backend | – | – |

| Cloud Platform | AWS, GCP, Azure | Scalability, reliability, global reach |

| Serverless Architecture | AWS Lambda, GCP Cloud Functions, Azure Functions | Reduced operational overhead, cost-effective |

| Microservices Architecture | Spring Boot, Node.js, .NET Core | Better maintainability, scalability |

| API Gateway | AWS API Gateway, Google Cloud Endpoints, Azure API Management | API traffic management, security, rate limiting |

| Database | – | – |

| NoSQL | MongoDB, Cassandra, DynamoDB | Flexible schema, high performance |

| Relational | PostgreSQL, MySQL | Structured data, complex queries |

| Graph Database | Neo4j | Managing complex relationships between data entities |

| Frontend | – | – |

| Cross-Platform Framework | React Native, Flutter | Build native-like apps for iOS and Android |

| UI Component Library | Material-UI, Ant Design, Chakra UI | Pre-built UI components |

| State Management | Redux, Zustand | Managing application state and data flow |

| Offline Data Storage | IndexedDB, AsyncStorage | Storing data locally, providing offline functionality |

| Healthcare-Specific Tools | – | – |

| HL7 Integration | FHIR.js, HL7.NET | Interoperability with healthcare systems, data exchange |

| FHIR Support | FHIR.js, FHIR.NET | Data exchange, interoperability |

| EHR Integration | Epic API, Cerner API, Athenahealth API | Integration with popular EHR systems |

| Medical Coding Libraries | RxNorm, SNOMED CT | Accurate coding and billing |

| Security and Compliance | – | – |

| Encryption | OpenSSL, Bouncy Castle | Protecting sensitive data |

| Authentication and Authorization | OAuth, OpenID Connect | Secure user authentication and authorization |

| HIPAA Compliance | HIPAA Toolkit, HIPAA Compliance Manager | Adherence to HIPAA regulations |

| Data Privacy | GDPR Compliance Framework, CCPA Compliance Framework | Data privacy measures, user consents |

| Additional Considerations | – | – |

| Performance Optimization | Webpack, Babel, Lighthouse | App speed and responsiveness |

| Accessibility | Axe-core, Deque a11y | Accessibility for users with disabilities |

| Testing | Jest, Cypress, Selenium | Thorough testing to identify and fix bugs |

Some Revenue Generating Methods For Health Insurance Apps

Finding ways to earn money from health insurance apps can be challenging due to their specific focus and user needs. Here are some straightforward strategies to consider:

1. Specialized Services

Add extra features to your app that offer more than just basic insurance. Create wellness programs that include fitness challenges, diet plans, and mental health tips. These can be offered through subscriptions or premium access. Develop tools to help manage chronic conditions, possibly in partnership with healthcare providers, and include telehealth services for virtual doctor visits. You can charge for these added services or consultations.

2. Data-driven Income (With Privacy In Mind)

Use user data to generate revenue, but make sure to handle it carefully. Collect and anonymize data to provide useful insights to healthcare providers or researchers. Develop tools for assessing health risks and sell this information to insurance companies or businesses. Always prioritize user consent and follow privacy laws.

3. Partnerships

Work with healthcare providers to offer exclusive discounts or rewards to app users. You can earn money through referral fees or commissions from these partnerships. Collaborate with pharmaceutical companies to feature their products or offer special deals. These partnerships can bring in extra revenue while adding value to your app.

4. Subscription Models

Offer premium features or content through a subscription. This could include advanced health tracking, personalized advice, or exclusive content. Consider a tiered subscription model with different levels so users can choose a plan that fits their needs and budget. This provides a steady stream of income and flexibility for users.

5. White-label Solutions

Create a version of your app that other companies can brand as their own. License this white-label app to other health insurance companies or businesses. This can generate revenue through licensing fees and support agreements. Make sure your app has unique features to attract potential partners.

Cost Of Developing A Health Insurance App Like Aetna

Here’s the detailed breakdown of the cost ranges for developing a health insurance app like Aetna:

| Stage | Minimum Cost Range | Maximum Cost Range |

| Research and Planning | $300 | $3,000 |

| Requirement Analysis | $300 | $2,000 |

| Project Scoping | $200 | $2,000 |

| UI/UX Design | $400 | $5,000 |

| Wireframes and Prototypes | $400 | $5,000 |

| Frontend Coding | $1,500 | $18,000 |

| Backend Coding | $2,000 | $22,000 |

| Database Setup | $500 | $5,000 |

| API Integration | $500 | $7,000 |

| User Authentication | $400 | $2,000 |

| Policy Management | $500 | $3,000 |

| Claims Management | $500 | $3,000 |

| Provider Search | $200 | $2,000 |

| Cost Estimator | $300 | $3,000 |

| Health Reminders | $200 | $2,000 |

| Testing | $300 | $4,000 |

| Deployment | $500 | $2,000 |

| Maintenance and Updates | $1,000 | $10,000 |

| Total Cost Range | $10,000 | $100,000 |

Cost-Affecting Factors To Consider For Health Insurance App Development

Developing a health insurance app involves several factors that can significantly influence the overall cost, such as:

- Regulatory Compliance: Building a health insurance app means following strict rules to protect user data, like those set by HIPAA. Meeting these requirements involves extra work and costs for advanced security features and legal checks.

- Integration with Insurance Systems: To provide accurate policy and health record information, the app needs to connect with existing insurance databases and EHR systems. This technical integration adds to the overall development cost.

- Advanced Security Features: Protecting sensitive data requires strong encryption and multi-factor authentication. Implementing these security measures is essential but adds to the development expenses due to their complexity.

- Custom Insurance Management Features: Features for managing claims and policies need to be customized for the app. Developing these specific tools requires additional design and programming, which increases the cost.

- User and Provider Portals: Separate sections for users and healthcare providers are necessary for managing insurance details and claims. Creating and maintaining these portals involves more development work and costs.

- Telehealth Integration: Adding telehealth services like video calls and remote monitoring needs secure communication tools and data sharing. This feature enhances the app but also raises the development cost.

- Personalized Health Insights: Using AI to give personalized health advice and predict future health needs requires extra development. This advanced technology adds to the cost but improves the app’s functionality.

- Scalability and Performance: The app must work well even with many users. Building a system that can handle lots of data and users smoothly adds to development costs.

Conclusion

Developing a health insurance app similar to Aetna offers a promising opportunity to meet modern healthcare needs with advanced technology. Such an app combines a user-friendly design with smart features, making it easier for people to manage their health and insurance. Additionally, incorporating tools like AI and blockchain in these apps can greatly improve the app’s effectiveness. So, if you are looking to provide valuable solutions to your clients and customers, developing an app like this is a great idea. It can boost user satisfaction and keep you ahead in the world of digital health.

Looking To Develop A Health Insurance App?

We have over 10 years of experience and have completed more than 200 projects. With over 50,000 hours of coding behind us, our team is skilled in creating effective and easy-to-use apps. We have developed several similar projects that simplify insurance management, making it easier for users to handle their claims and access important information. So, we strongly recommend you choose Idea Usher to turn your app idea into a practical and efficient solution that meets your needs and exceeds user expectations.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQ

What is an insurance app?

An insurance app is a mobile app that helps users manage their insurance. It allows you to view policy details, file and track claims, pay premiums, and get customer support, making it easier to handle your insurance needs.

What is the BetterHelp algorithm?

The BetterHelp algorithm matches users with therapists based on their specific needs and preferences. It looks at what users are looking for in therapy and connects them with therapists who are best suited to help.

What is the business model of BetterHelp?

BetterHelp uses a subscription model. Users pay a monthly fee to access therapy services. The platform makes money from these subscriptions and offers users regular sessions with licensed therapists.

Who is the target audience for BetterHelp?

BetterHelp targets people who need convenient and affordable mental health support. This includes those who prefer online therapy due to busy schedules, living in remote areas, or wanting privacy. The platform helps those dealing with issues like anxiety, depression, and relationship problems.

How long does it take to create a health app?

Creating a health app generally takes about 3 to 6 months. This timeframe can vary based on the app’s complexity and the development team’s experience. Extra time might be needed to test and make sure the app complies with health regulations.