The online payment industry has seen a significant increase in the volume of transactions and the number of users where online payment has become a primary payment method. Digital or online payments are not restricted to a single app or corporation; millions of apps are available for online transactions, and hundreds of companies build these apps.

According to the reports submitted by McKinsey and Company, digital payment is projected to reach 9.46 trillion dollars by the end of 2023 and is expected to grow at an annual CAGR of 11.8 percent from the year 2023 to 2027 and get 14 trillion dollars by 2027

It may seem like an excellent payment method, where going cashless has become an option in the 21st century.

With a tap of your smartphone, you can go almost everywhere, whether buying groceries or buying stocks online; the possibilities of digital payments are endless.

With so many advantages, there have to be some disadvantages.

The payments performed online are made through an intermediary, or a formal banking system plays as a middleman in the whole transaction, thus making the whole payment system centralized.

Centralized payments restrict the number of users that can access the system of digital payments and the transaction history being stored on the bank’s platform, which can be further misused.

But how to overcome the impact of a centralized payment system and not share any information with any parties involved in the transaction?

This is where the Web3 payment system comes into play: secured, encrypted, and a wise option for a digital transaction or payment; Web 3 is responsible for completely decentralizing the payment industry.

Many companies today are adapting to Web3 payments to give their customers more options to explore while performing a transaction. The two major payment networks in the world, MasterCard and Visa, have been actively exploring integrating the Web3 system into their payment mechanism.

In 2022, MasterCard announced its platform’s first crypto-backed credit card and issued it to potential customers.

After reading all this, you might wonder, can Web3 revolutionize the complete banking/payment system globally?

So without further ado, let’s answer the question.

What is Web3?

Web3 or Web 3.0 is the third form of the world wide Web that most technologists call the new way to surf the Internet without losing anonymity, meaning Web3 is an advanced and secured Internet that is built on a decentralized blockchain or shared ledger system that is used by major cryptos like bitcoin and ethereum.

The founder of the Non-Boring company Packy McCormick is the reason that made everyone question Web3; in his words, Web3 is “the internet owned by the builders and users, orchestrated with tokens.”

Since Web3 uses a shared ledger system and all the information is encrypted on the blockchain, this reduces how significantly giants like Google and Meta store this data in the form of cookies and sell it to the companies will decrease majorly due to the integration of such decisive privacy measures. This can help people regain trust in the Internet and online payment methods and systems.

You might be wondering if Web3 is a legit platform. Yes, and here are some examples of significant companies like Venture Capital investing 27 million dollars in crypto and Web3-related projects. Companies like Twitter and Reddit also invest heavily in Web3-based projects.

And to conclude, Web3’s market value is projected to land at more than 24 billion dollars by the end of 2028.

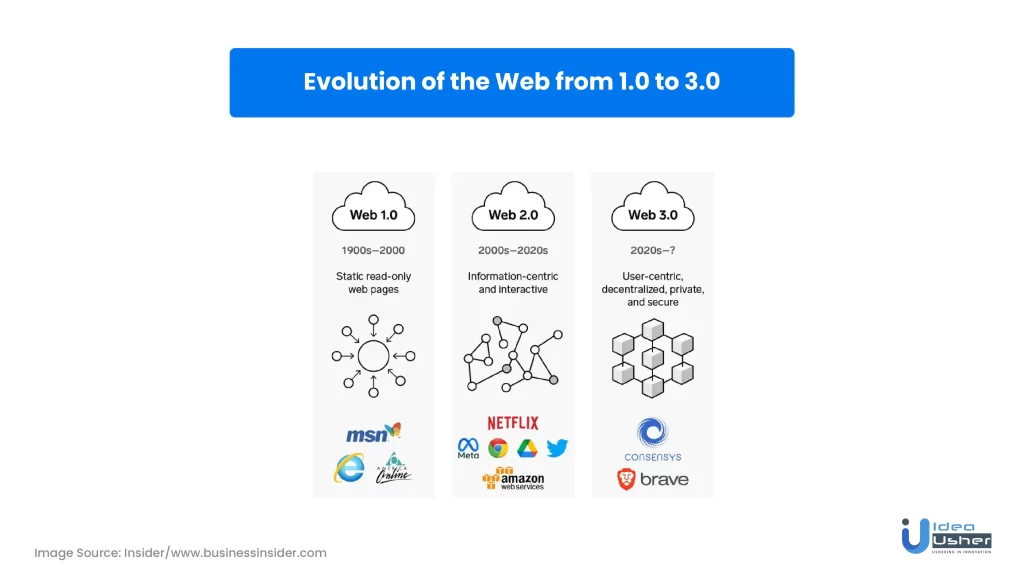

Timeline of Web

To give you a clearer idea of Web3, you must look back at the history of the Web through the past and present years.

Web1

Web1 also called the classic Web, gained popularity when the Internet was first used by people in the year 1994, yet the classic Internet was not much interactive and majorly focused on being the primary source of information to put it into context. Only readable information was available, like a giant newspaper on the screen.

Web2

Web2, or the present Web form, started in 2004 when major companies like youtube, Facebook, and Instagram gained popularity. It was more interactive and vibrant, and the Web was designed to interact with the user. Moreover, it is also the Web where we feed data to the Internet example- by uploading a youtube video where we provide the Internet with data.

What are Web3 Payments?

To protect the privacy and security of the information and avoid leaking of the data, Web3 payments are properly secured and, most importantly, decentralized, allowing a seamless exchange of funds without middlemen or intermediaries like banks or a network. The payment is anonymous and secured.

This also helps avoid red tape since the parties no longer have to register with an organization or grant permission to access personal information such as bank accounts, banking transition statements, and other personal information.

In a nutshell, Web3 payments are the future of online transactions to avoid major online scams.

Can Web3 be the Future of Payments?

Web3 payments are revolutionary advancements that allow seamless and secure online transactions and help place transactions without intermediaries.

Web3 payments can also help to bring more forms of currencies on the Internet as a form of exchange that can help people hold and exchange money, goods, and services with more forms of currencies than the everyday flat financial instruments, Web3 in no time can make cryptocurrencies an acceptable form of payment worldwide, thus opening a new horizon of payments.

One of the advantages of Web3 payment is the settlement of the transaction time, Web2 payments take days to get settled, and blockchain payments, that is, Web3, can be settled in a fraction of a second in real-time, thus making it the future of online transactions.

4 Major Reasons that Make Web3 the Future of Payments.

1. Security

The decentralized payments are secured on the blockchains and backed up on a tamper-free public ledger susceptible to hacking. Data is leaked, which adds a major layer of security to every transaction.

2. Transparency

All blockchain transactions are recorded on a public ledger, allowing for transparency and traceability. It can potentially eliminate fraud and improve trust in the financial system.

3. Autonomy

Every transaction between two parties on Web3 can be directly between those two parties, that is, the payer and the receiver, without a complete need for intermediaries like a bank that allows more autonomy on personal transactions.

4. Lower or No Fees

The transactions on the blockchain require no fees to be intermediate. This is because of the absence of intermediaries on Web3 payments, which in return charges higher fees example- credit card transaction processing fees.

How to Make a Payment in Web3?

The traditional payment method carries some limitations, though with the jor technological advancement, these payments that are being carried out are taking place at a snap of a finger that is no time and within a fraction of a second, yet it must be noticed that Web2 payment structure leads to sharing major data like- Card number, CVV and addresses, to eliminate this here are few methods to carry Web3 payments.

Method 1: Wallets and Web3 SDK for Making Payments

The Web3 wallets can be used to place transactions and engage with dApps and also store digital assets like NFT’s tokens that in major are used for a transaction, and the Web3 browser can support the following blockchain integrations.

- Browser wallets

- Browser wallet extensions

- Mobile Wallets

These different kinds of wallets can be topped up using wallet apps, where the user must make an account on these platforms and set up a confidential and private pin.

Method 2: Using Wallets as a Browser Extension

This is one of the other methods to use for making payments; below are the steps to execute the payments in Web3.

- Downloading and activating the browser add-on.

- Users may upload an existing account or create a new one using its private key.

- Before making a new account, a user can customize the wallet’s password.

- The wallet can transmit data between blockchain networks, such as Mainnet, Testnet, and Devnet.

- The fees that are levied may pop up on the screen.

How to Choose a Financial Software for Making Payments on Web3?

Choosing a financial software for integrating payment on the new form of the Web is dependent on you, just like the payment option in Web2- Apple Pay, Afterpay, and Paypal exists just like that number of software exist for you to use, yet it is essential to consider common factor like- that is secured and backed on blockchain and provides a simple and seamless payment experience.

Here are a few factors to keep in mind:

1. Future Ready Software.

Choose entirely future-ready software that offers decentralized payment solutions and has integrated distributive ledger technology; moreover, choose software that provides after-services and excellent customer service.

2. Compare Prices

While buying software, compare prices of all the top software and check what kinds of packs they offer to business entities and individuals.

Self Sovereign Identity (SSI): New Payment Method

SSI has become one of the most revolutionary concepts in recent years, backed by blockchains, and is a more significant part of Web3. SSI has opened up a new possibility of sharing personal information and data and makes it possible for data to be encrypted and secured, which sometimes seems impossible.

But why is SSI important for you?

Exactly the question that may arise here is why SSI is the new way to store your personal information like name, age, and addresses without ever being disclosed on the Internet that we call the Internet cookies where your data is stored.

Currently, the data stored on the Internet is handled by intermediaries and stored with them, which is sold to companies to generate revenue.

This makes SSI more reliable, where people control how much information they want to share on the Internet.

How can SSI be integrated into the payment system?

The SSI can help us reduce the amount of online financial scams because while making a payment online, we only disclose certain information that the merchant can access. In contrast, on the other hand, Web2 exposes all the information like card number, card expiry, and, most importantly, CVV that can lead to fraud.

Then how the payment will take place, which we will discuss in the next section.

Top Use Cases of SSI.

To understand the usage of SSI and how it is an essential feature of Web3, let us look back at the traditional identification method of verification; the SSI helps the user manage and control the degree of data being shared with external parties.

In a traditional or present setup, when a user opens an account on a social network today, he creates a digital identity comprised of what he uploaded during his first connection – first name, last name, email address – and all the information associated with him as of its use.

But tomorrow, when a user wants to create an account, he can use his wallet without disclosing any personal information or the information he would like to share; only that would be shared.

A major example where we can find that the Internet knows how to read our data is when we log in on social media platforms. Major platforms only allow people above 13 to access social media; how it happens when we enter our date of birth, which gets stored as cookies and shared with companies.

Here are two degrees where the user can disclose their information.

1. Selective Disclosure

It is also called disclosing the most important information, and that is deemed to be required by the Websites for opening or letting access the account; for example, if 13 years are required to open an account, then uploading the picture of a government-issued id without masking the name and age and hiding other information like postal code and address and mobile number is an example of selective disclosure.

2. Zero-Knowledge Proof

As the name suggests, not disclosing a single part of the information or identity is zero disclosure, where the user can transmit data using questions.

This is what revealing identity information in SSI looks like.

Can you Pay without Disclosure of Credit Card Details?: Payment Using SSI.

Here is how payment in the SSI approach looks when the customer pays the merchant; in this scenario, the amount occurs at Walmart’s Website.

- To verify the purchase, the customer submits a proof of payment request to their bank. Walmart wants to validate the customer’s identity and creditworthiness. Therefore the bank issues a Verifiable Credential, including all payment details.

- The customer receives approval in the wallet, and the next step is to approve the payment from the wallet app.

- The purchaser shows his or her ability to pay by giving Walmart proof of payment.

- Amazon will check the customer’s wallet, linked to the distributed ledger, to ensure the proof is correct and certified by the customer’s bank.

Because the transaction was completed without disclosing more information than allowed and, most crucially, without giving credit card information, this SSI mode verification is faster, more secure, and more confidential than the standard payment model.

This is how payment using SSI works.

Conclusion

In conclusion, web3 technology has the potential to revolutionize digital payments. The decentralized nature of Web3 allows for greater transparency, security, and efficiency in transactions, while smart contracts and blockchain technology can automate processes and reduce costs. As Web3 continues to evolve, we can expect to see more innovative payment solutions that provide greater convenience and security for users.

If you are looking to build your Web3 digital payment app, Idea Usher can help. Our experienced team of developers is well-versed in the latest Web3 technologies and can help bring your idea to life. Contact us today to learn more about our Web3 development services and start building your cutting-edge payment app.

FAQ’s

1. What are Web3 payments?

A. Web3 payments refer to online payment solutions based on Web3 technology, a decentralized protocol for the Internet. These payments are typically made using cryptocurrencies or other blockchain-based digital assets, and they offer faster, more secure, and more transparent transactions than traditional payment methods.

2. How do Web3 payments work?

A. Web3 payments use decentralized networks and blockchain technology to process and verify transactions. Instead of relying on a centralized authority, such as a bank, to manage transactions, Web3 payments use a distributed network of nodes to validate and record transactions on a public ledger.

3. Are Web3 payments secure?

A. Web3 payments are generally considered highly secure due to the technology’s decentralized nature. Because there is no single point of failure or control, it is much more difficult for hackers or other malicious actors to compromise the network or steal funds.

4. What are the advantages of using Web3 payments?

A. Some key advantages of using Web3 payments include faster transaction speeds, lower transaction fees, increased privacy and security, and greater transparency and accountability in the payment process.

5. What are some examples of Web3 payment solutions?

A. There are several Web3 payment solutions available today, including cryptocurrencies like Bitcoin and Ethereum, decentralized exchanges like Uniswap and SushiSwap, and payment processors like Coil and Uphold. As the Web3 ecosystem evolves, we expect to see even more innovative payment solutions emerge.