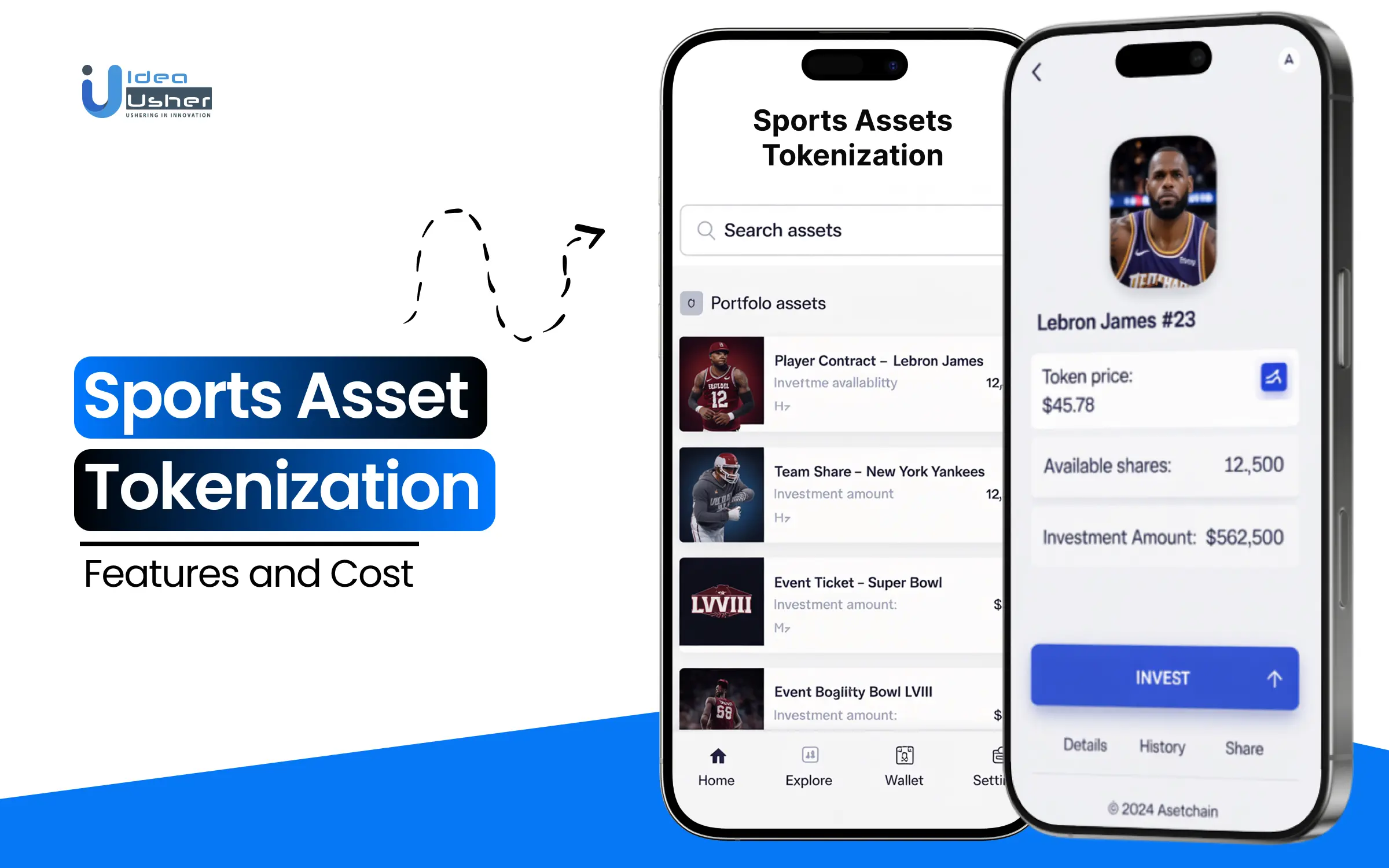

The sports industry is going through a digital shift that is changing how fans connect with their favorite teams. Sports asset tokenization turns traditional memorabilia, experiences, and ownership options into digital assets on the blockchain. This lets fans own fractions of everything from game-worn jerseys to exclusive stadium experiences.

This technology fills the gap between being a fan and actual ownership. It turns dedicated supporters into real stakeholders and creates new revenue sources for sports organizations.

As digital-savvy audiences seek more interactive experiences, tokenization provides teams with the ideal way to strengthen fan relationships and discover new ways to make money. IdeaUsher understands the intricacies of this process and has been instrumental in helping numerous sports businesses transform their assets through tokenization. We’re writing this blog to guide you on how to start tokenizing your sports assets and turn your fans into active stakeholders.

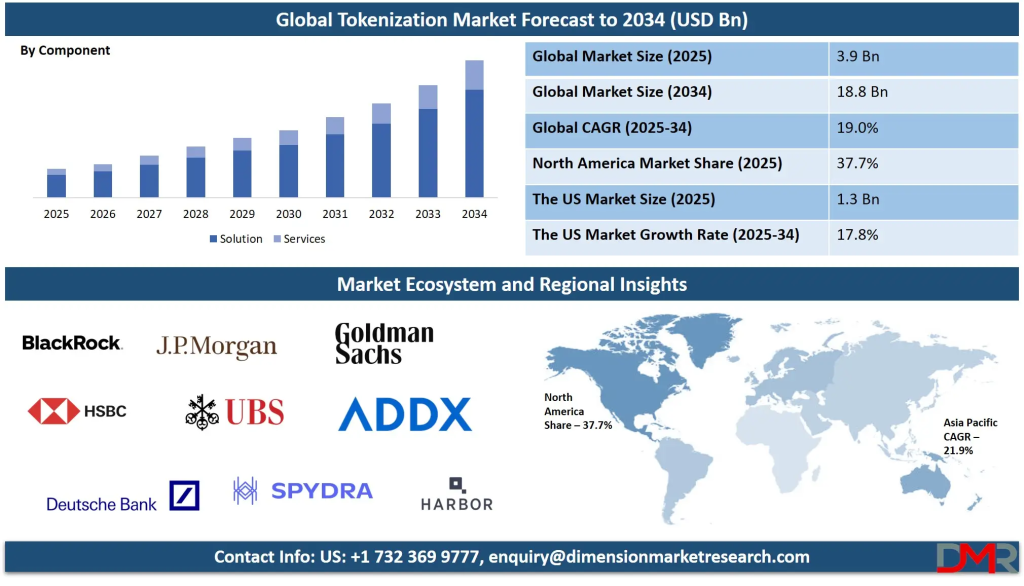

Key Market Takeaways for Sports Asset Tokenization

According to DimensionMarketResearch, the sports asset tokenization market is poised for substantial growth, with expectations to reach USD 3.9 billion by 2025 and an impressive USD 18.8 billion by 2034, expanding at a 19.0% annual growth rate. This surge is driven by the growing adoption of blockchain technology, which is transforming how sports assets are bought, sold, and owned. As more organizations explore tokenization, the sports industry is unlocking new opportunities for both investment and fan engagement.

Source: DimensionMarketResearch

Football is leading the charge, with major clubs taking advantage of tokenization to make ownership more accessible. By turning assets like teams, stadiums, and player contracts into digital tokens, clubs can attract smaller investors and global participants.

This shift offers a new form of investment, giving fans and investors the chance to own a piece of their favorite teams, all while participating in the excitement of the sport.

Pioneering examples of tokenization, such as Spencer Dinwiddie’s tokenized contract and Vasco da Gama’s FIFA solidarity mechanism rights, are setting the stage for broader adoption. Clubs like FC Barcelona, Paris Saint-Germain, and Manchester City are launching fan tokens, allowing supporters to engage in team decisions and enjoy exclusive perks. This trend is reshaping the future of sports ownership and fan interaction in ways that were once unimaginable.

What is Sports Asset Tokenization?

Sports asset tokenization is the process of converting sports-related assets, both tangible and intangible, into digital tokens stored on a blockchain. These tokens represent value and ownership in a secure and easily transferable way. Just like a stock certificate, but with far greater flexibility, these digital tokens can be divided, traded, and programmed with functionalities like revenue sharing, voting rights, and exclusive experiences.

By tokenizing sports assets, you can enable fans to become stakeholders in the future of their favorite teams or athletes, allowing them to engage in ways beyond simply watching games or buying merchandise.

Key Concepts in Sports Asset Tokenization

Democratization:

- Fractional Ownership: Tokenization allows fans to own a share of their favorite team’s revenue or an athlete’s contract for a much lower cost.

- Global Accessibility: This process makes sports investment available to anyone, breaking down traditional financial barriers.

Liquidity:

- 24/7 Trading: Tokenized sports assets can be traded like stocks, anytime, providing greater flexibility.

- Real-Time Value: Tokenization enables assets to be bought and sold quickly, reflecting their actual value in real-time.

Sports Asset Tokens Vs. Other Asset Tokens

While the underlying blockchain technology is similar across various asset types (e.g., real estate, art, commodities), sports tokenization is distinct due to the influence of fandom.

| Aspect | Sports Asset Tokens | Real Estate, Art, and Commodities Tokens |

| Value Drivers | A mix of financial performance and emotional connection with teams or athletes. | Primarily driven by economic factors like rental income, value appreciation, and market supply/demand. |

| Fan Influence | Fans’ emotional investment significantly influences value (e.g., holding onto tokens during tough seasons). | Fans or investors may not have emotional attachment; decisions are mostly economic. |

| Market Behavior | Emotional ties can lead fans to retain tokens despite market downturns. | Investors may sell at the first sign of market decline, driven purely by financial performance. |

| Investment Focus | Tokenization offers both financial returns and fan engagement. | Investment is usually for financial returns (e.g., rent, appreciation). |

This unique combination of financial and emotional investment makes sports asset tokenization a powerful tool for building community, fostering engagement, and transforming fans into active participants in their teams’ successes.

Important Features of Tokenized Sports Assets

Tokenized sports assets offer fan perks like voting and exclusive content, while allowing fans to earn tokens through engagement. They link token value to team performance and create a global investment opportunity. Additionally, they enable a market for trading iconic moments.

1. Fan Utility and Perks

Sports tokens go beyond basic governance rights by offering continuous, interactive utility. Fans can engage in activities like voting on team decisions, accessing exclusive behind-the-scenes content, receiving ticket discounts, or even meeting players, enhancing their connection to the team.

2. Play-to-Earn Model

By gamifying the experience, sports tokenization allows fans to earn tokens through actions like watching games, predicting outcomes, or participating in polls. These tokens can unlock rewards or be traded, creating a dynamic loop of fan engagement and added value.

3. Link to Performance and Events

The value of sports tokens is closely tied to real-world events. A fan’s token might increase in value based on a team’s performance or the occurrence of memorable moments like a game-winning goal or championship victory, offering a unique connection between fan engagement and on-field success.

4. Marketing and Sponsorship Tool

Tokens act as powerful marketing assets, attracting global audiences and creating fresh sponsorship opportunities. Brands can offer exclusive discounts or access to token holders, while sports organizations gain valuable, verifiable data to present to potential sponsors.

5. Monetizing Intangibles

Tokenization can extend beyond tangible assets like stadiums, allowing organizations to monetize intangible assets like a player’s future earnings, team brand value, or historic moments as NFTs, turning otherwise unquantifiable items into valuable tokens.

6. Global Investor Pool

Sports tokenization taps into a vast, passionate global fanbase, enabling teams and athletes to raise capital from micro-investors who are already emotionally connected to the asset. This broadens investment opportunities far beyond traditional funding sources.

7. Liquid Secondary Market

Sports NFTs have created a thriving secondary market for emotionally charged moments, such as iconic game clips or rare memorabilia. These unique items can be bought, sold, or traded, creating a new way for fans to invest in and monetize significant sports moments.

8. New Funding for Athletes and Teams

Tokenization provides an alternative fundraising model where athletes or teams can directly raise capital from their fanbase. This bypasses traditional investment channels, offering a more democratic and direct method of securing financial support for growth and development.

Why Businesses Are Investing in Sports Asset Tokenization?

Businesses are investing in sports asset tokenization because it unlocks new revenue streams and strengthens fan loyalty. It allows them to raise capital directly from their global fanbase and create unique, ongoing engagement opportunities. Tokenization also expands sponsorship potential and offers global market access, driving long-term growth.

1. New Revenue Models

Tokenization opens up new revenue streams tied to fan engagement. By tokenizing assets like future revenue or equity, teams can raise capital directly from their fanbase. Transaction royalties from secondary market trading create a continuous revenue flow, making each token an appreciating asset.

2. Active Fan Engagement

Tokenization turns fans into active stakeholders with a financial and emotional investment. Fans holding tokens have access to exclusive perks like voting rights and VIP experiences. This creates deeper loyalty and stronger connections with the team, building long-term relationships.

3. Global Accessibility

Tokenization removes geographical barriers, allowing global fans to invest in teams. Blockchain enables anyone, anywhere, to buy tokens, and tokenized assets can be traded 24/7 on exchanges. This creates liquidity and connects teams with a worldwide fanbase, growing their global presence.

4. Marketing & Sponsorship Growth

Tokenized assets enhance sponsorship opportunities by offering brands direct access to engaged fans. Sponsors can offer exclusive, token-gated promotions, adding value beyond traditional logo placement. Co-branded NFT campaigns also create new, innovative ways for teams and brands to engage fans.

How to Tokenize Sports Assets?

We help sports organizations unlock the power of their assets through tokenization, turning them into tradable digital assets. From selecting the right asset to handling legal, technical, and regulatory aspects, we guide you every step of the way. Whether it’s for capital raising or fan engagement, we make the process simple, secure, and tailored to your needs.

Phase 1: Strategic Ideation and Asset Selection

The first step is all about strategy, not just technology. We work closely with our clients to determine what to tokenize and why it matters. The purpose of tokenization generally falls into two categories:

- Capital Raising: We help you raise funds by offering fractional ownership of assets (through Security Tokens).

- Fan Engagement: We facilitate the creation of fan tokens that allow you to engage with your community in new, innovative ways (Utility/Fan Tokens).

What can we tokenize for you? The possibilities are vast:

| Asset Type | Description |

| Equity | A fractional share of your team or franchise. |

| Revenue Streams | A portion of future broadcast rights, ticket sales, merchandise royalties, or stadium naming rights. |

| Athlete Assets | A percentage of a player’s future contract earnings or endorsement income. |

| Collectibles & Moments | Unique digital memorabilia like NFTs of iconic plays, jerseys, or championship rings. |

| Fan Access | Tokens that grant voting rights, VIP experiences, or exclusive content to your fans. |

Phase 2: The Legal Foundation

Legal expertise is crucial to the success of any tokenization project. We help our clients navigate the complex legal landscape, ensuring that the project is structured properly and compliant with all relevant regulations.

Legal Wrappers and SPVs

To ensure everything is above board, we set up a Special Purpose Vehicle or LLC to legally hold the underlying asset. The tokens then represent fractional ownership of this entity, forming the legal backbone of your project.

Regulatory Compliance

We assess whether your token is a security (an investment contract regulated by the SEC) or a utility (for ecosystem access). For security tokens, compliance with regulations like KYC/AML is non-negotiable, and we integrate these requirements directly into the token.

Third-Party Audits

To provide credibility and trust, we engage independent auditors to verify the asset’s ownership and valuation, giving investors and fans confidence in the project’s legitimacy.

Phase 3: Technical Development and Token Design

With the legal framework in place, we move to the technical phase, where the tokenization truly comes to life. Here’s how we handle it:

Smart Contract Development

We craft the self-executing code (smart contracts) that governs the entire token. These contracts are deployed on the blockchain and automate everything—from distributing revenue to granting fan votes and enforcing transfer restrictions for compliance.

Fungible vs. Non-Fungible Tokens

Depending on your needs, we’ll create either fungible tokens (identical shares, typically using ERC-20) or non-fungible tokens (NFTs) (unique assets like iconic memorabilia, using ERC-721).

Blockchain Selection

We choose the best blockchain for your specific needs—whether it’s Ethereum for its reliability or a faster, more scalable solution like Polygon or Solana for lower fees and faster transactions.

User Experience

We design seamless platforms (web and mobile) that make it easy for users to buy, hold, and trade tokens without needing to understand blockchain technology.

Phase 4: Token Issuance & Distribution

Tokenizing your asset is just the beginning. Here’s how we ensure long-term success:

- Minting: We deploy the smart contract to officially mint the tokens.

- Primary Sale/Distribution: Tokens are distributed to investors and fans through private sales, public offerings, or even an airdrop to loyal fans.

- Secondary Trading: We help list your tokens on exchanges or marketplaces, creating liquidity and allowing your fans and investors to trade them, establishing a market price.

- Ongoing Management: Tokenization is not a one-time event. We continue to actively manage the community, run voting events, distribute rewards, and ensure the technical platform runs smoothly.

What is the Cost Required for Sports Asset Tokenization?

We follow a cost-effective approach to sports asset tokenization, ensuring that our clients achieve maximum value without compromising on quality. We focus on delivering secure, scalable solutions while keeping costs manageable throughout each phase of the project.

| Phase | Cost Range | Description |

| Phase 1: Planning and Legal Due Diligence |

| Legal and Regulatory Compliance | $15,000 – $200,000+ | Engaging legal experts to navigate complex securities laws, intellectual property rights, and KYC/AML regulations. Cost increases with global offerings. |

| Asset Valuation and Due Diligence | $5,000 – $100,000 | Professional valuation of the asset and ownership verification, especially for illiquid assets like a stadium or future earnings. |

| Phase 2: Technical Development |

| Smart Contract Development & Audit | $15,000 – $80,000 | Development of the smart contract (e.g., ERC-20, ERC-721) and third-party security audit to ensure safe and secure code. |

| Platform Development (Frontend & Backend) | $30,000 – $250,000+ | Development of the user interface, experience, and backend systems for account management, wallets, and asset data. Cost depends on the platform’s complexity. |

| Blockchain Integration | $10,000 – $50,000 | Connecting the platform to a blockchain network (e.g., Ethereum, Solana, Polygon) and managing related network costs like gas fees. |

| Phase 3: Launch and Ongoing Operations |

| Marketing and Promotion | $5,000 – $100,000+ | Branding, digital marketing campaigns, PR, and community building efforts to drive token sales and platform adoption. |

| Ongoing Platform Maintenance & Security | $5,000 – $75,000 annually | Continuous upkeep, security monitoring, regular audits, bug fixes, and infrastructure costs for the platform’s long-term operation. |

| Ongoing Compliance and Management | $5,000 – $50,000 annually | Maintaining legal compliance with KYC/AML policies, legal monitoring, and ensuring the platform meets evolving regulations and managing investor relations. |

The costs outlined above are estimates, and the total cost for sports asset tokenization typically ranges from $50,000 to $200,000 USD, depending on the complexity of the project. For a more accurate quote tailored to your specific needs, feel free to reach out to us for a free consultation. We’re here to help guide you through the process and ensure a successful launch.

Cost-Affecting Factors for Sports Asset Tokenization

When budgeting for a sports tokenization project, it’s easy to focus on obvious expenses like smart contract development or UI design. However, the true cost of a successful project lies in a series of crucial behind-the-scenes decisions. Understanding these factors is vital for building a sustainable fan economy, rather than running into costly problems down the road.

1. The Blockchain Choice Is a Financial Decision

The choice of blockchain will determine both your upfront development costs and your users’ experience. Here’s a breakdown of some popular blockchain options:

| Blockchain Option | Security | Cost to Interact | Hidden/Development Costs |

| Ethereum (The “Gold Standard”) | Most secure and decentralized. | $5 – $50+ per transaction. | High fees can lead to user abandonment for small transactions. |

| Layer-2 Solutions (Polygon, Arbitrum) | Inherits security from Ethereum. | $0.001 – $0.10 per transaction. | Adds $5,000 – $15,000 for integration but improves long-term user engagement. |

| Alternative Layer-1s (Solana) | Fast but less decentralized. | $0.00001 – $0.00025 per transaction. | Higher developer costs, with 15-25% premium for talent. |

The “cheapest” chain to build on initially might be the most expensive long-term. Choosing Ethereum for a fan app could add up to a $5 million+ “engagement tax” over time, compared to using Layer-2 solutions.

2. The Oracle Problem

Smart contracts need an oracle, a secure bridge to bring off-chain data to the blockchain.

Cheap and Risky: A custom-built centralized oracle.

- Setup Cost: $5,000 – $10,000.

- Real Cost: A major risk. A compromised server could trigger incorrect $1M reward distributions, causing financial and reputational damage.

Robust and Professional: A decentralized oracle network like Chainlink.

- Development Integration Cost: $10,000 – $25,000+ for secure integration.

- Ongoing Operational Cost: Data requests cost $0.25 – $2.50+ per call.

For example, distributing rewards to 100,000 fans for a playoff win could cost $25,000 – $250,000 in Oracle fees.

The cost of a professional oracle is an essential insurance policy. Skipping it could expose your project to millions in risk.

3. The Scalability Tax

Designing for scalability is expensive but essential.

MVP Architecture: A simple, centralized backend.

- Setup Cost: Saves $20,000 – $40,000 initially.

- Real Cost: The “Scalability Breakpoint.” Hosting and database costs can spike from $500/month to $10,000+/month during traffic surges, likely causing platform crashes and damaging your brand’s reputation.

Enterprise-Grade Architecture: Built for scale from the start.

- Upfront Development Cost: Adds $30,000 – $75,000 for advanced features like load-balanced, auto-scaling cloud infrastructure, and optimized databases.

- Ongoing Cost: ~$2,000 – $5,000/month for robust hosting, but it scales smoothly under heavy traffic, ensuring a positive user experience.

You can pay for scalability upfront in development costs, or face much higher costs later, emergency developer sprints ($150+/hour), skyrocketing cloud bills, and irreparable brand damage.

Tools & APIs Needed for Sports Asset Tokenization

Building a successful tokenized sports asset is like constructing a championship-winning team: you need the right players in the right positions. The technology stack you choose forms the backbone of your project, determining its security, scalability, compliance, and user experience.

Here’s a breakdown of the essential tools, APIs, and frameworks required to bring a sports tokenization project to life.

1. Smart Contract Frameworks: The Rulebook

Smart contracts are the self-executing code that defines the logic of your tokens—how they are created, transferred, and what utilities they provide. The programming language you choose is often dictated by your chosen blockchain.

| Programming Language | Description | Primary Use Case |

| Solidity | Widely used for Ethereum and EVM-compatible chains. Robust but can be expensive. | Ethereum, Polygon, Avalanche, EVM-compatible blockchains. |

| Rust | Known for speed and safety, ideal for high-volume, low-cost transactions. | Solana, Polkadot, parachains. |

| Move | Designed for Aptos and Sui, defines assets as programmable objects for security. | Aptos, Sui blockchains, tokenized assets, NFTs. |

2. Blockchain Platforms: The Stadium

This is the foundational layer where everything operates. The choice of blockchain is a strategic decision balancing security, cost, speed, and environmental impact.

Ethereum

The industry leader, offering the highest level of security, decentralization, and a massive ecosystem. The main drawback is high transaction fees during congestion, which can make small fan interactions expensive.

Polygon (PoS)

A Layer-2 scaling solution for Ethereum. It provides Ethereum-compatible security and connectivity but with lower fees and faster transaction times. It’s an ideal choice for consumer-facing dApps and NFT projects, offering an excellent balance of security and affordability.

Solana

Designed for speed and scale, capable of processing thousands of transactions per second at a fraction of the cost. Solana is perfect for applications requiring high-frequency, low-value interactions (e.g., voting, rewards, micro-transactions), though its network stability has been a concern.

3. Compliance APIs: The Security Check

When dealing with valuable assets or security tokens, regulatory compliance is non-negotiable. KYC/AML tools like Jumio, Onfido, and Veriff help verify user identities and screen against watchlists during sign-up or token purchases. This step is crucial for ensuring your platform meets global financial regulations and keeps transactions secure.

4. Oracle Services: The News Feed

Blockchains are sealed environments and cannot access external data on their own. Oracles bridge the gap between off-chain real-world data and on-chain smart contracts.

Chainlink / Band Protocol: These decentralized oracle networks are crucial for sports tokenization, enabling:

- Triggering Payouts: Automatically distributing rewards based on real-world events, like a team making the playoffs or a player scoring.

- Verifying Outcomes: Settling prediction markets or fantasy sports leagues based on official game results.

- Pricing Assets: Feeding real-time data, such as the price of sports assets or NFT collectibles.

5. Wallets & Custody: The Digital Vault

This is how users interact with and secure their tokens.

User Wallets (Metamask, Phantom): Browser and mobile extension wallets that allow end-users to store their tokens and interact with your dApp. Metamask is popular for EVM chains, while Phantom is the go-to for Solana.

Enterprise Custody (Fireblocks, Gnosis Safe): For the project treasury and funds requiring top-tier security, institutional-grade custody solutions are a must.

- Fireblocks provides insured, multi-layer secure storage and a robust policy engine for managing transactions.

- Gnosis Safe is a popular multi-signature wallet for EVM chains, requiring multiple approvals for transactions, which is essential for decentralized governance.

6. Analytics & Monitoring Tools

You can’t improve what you don’t track. Tools like Dune Analytics let you build custom dashboards to monitor everything from user activity to token performance. The Graph, on the other hand, helps you efficiently pull specific blockchain data, like balances or transaction history, without the need to scan the entire network.

Use Case: Boosting Fan Engagement

One of our clients, a professional basketball league, came to us looking to boost global fan engagement and create a new revenue stream. While their fanbase was large and passionate, the engagement was passive, limited to watching games and buying merchandise. They needed a way to transform their international audience into an active, engaged community that went beyond geographical limits.

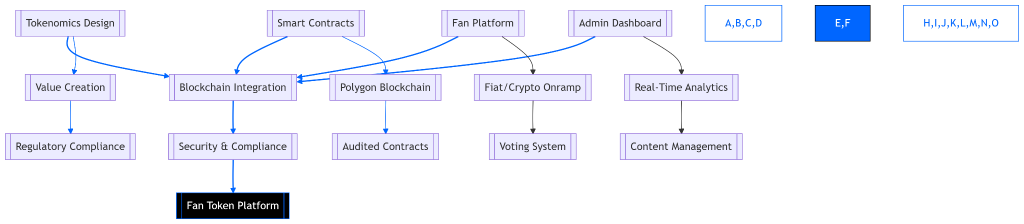

The Solution: A Custom Fan Token Ecosystem

IdeaUsher was approached to build a fan token platform that would offer the league a unique way to engage with its fans while generating a new revenue stream. We provided a comprehensive solution, focusing on strategy, legal compliance, technical development, and delivering an exceptional user experience.

Strategic Tokenomics Design:

We worked closely with the league to create a token model that offered real value and exclusive access for fans. The goal was to make it easy for fans to adopt while ensuring everything met global regulatory standards. This approach ensured the token system was both appealing and compliant.

Secure Smart Contract Development:

Our team of experienced engineers built secure, audited smart contracts on a fast, low-cost blockchain like Polygon. These contracts handled everything from token minting and distribution to setting up a tamper-proof voting system. We also implemented token-gating, giving fans access to exclusive content and perks.

Intuitive Fan-Facing Platform

We designed a smooth, easy-to-navigate web app where fans could quickly purchase tokens using credit cards or crypto. The app also allowed them to participate in polls and vote on important league decisions. Plus, fans could unlock exclusive content and explore a marketplace full of exciting perks.

Robust Administrative Dashboard

We built a robust admin panel for the league, allowing them to quickly launch new voting initiatives. It also gave them control over managing and releasing exclusive content to token holders. The panel provided real-time insights into key metrics like token ownership, voting participation, and revenue.

The Result: A Slam Dunk

- Capital Raised: The initial token sale generated $5 million, providing the league with significant funding for future initiatives.

- Global Engagement Soared: The league experienced a 40% increase in global fan engagement, with token holders showing 3x higher retention and spending compared to non-holders.

- A New Community Paradigm: The launch successfully created a global “Fan Nation,” enabling the league to foster a direct, meaningful connection with fans around the world—breaking down geographical barriers and setting a new standard for fan loyalty and engagement.

Conclusion

Sports asset tokenization is revolutionizing the way sports organizations operate, offering a powerful mix of financial and emotional value for fans. By acting now, businesses can unlock fresh revenue streams and foster deeper loyalty within their communities. Idea Usher is here to be the trusted partner, helping build scalable, compliant, and fan-first platforms that set the stage for long-term success in this rapidly evolving space.

Looking to Tokenize Sports Assets?

At Idea Usher, we offer the expertise to turn your sports assets, whether it’s team equity, player contracts, memorabilia, or exclusive fan experiences, into secure, scalable, and cutting-edge digital tokens.

Why Partner with Idea Usher?

- Elite Technical Expertise: With over 500,000 hours of coding experience, our team, composed of ex-MAANG/FAANG developers, brings deep technical know-how to design blockchain solutions that are not just secure but also scalable. We build with precision, ensuring every project is engineered for excellence.

- End-to-End Solutions: From strategic planning and legal structuring to smart contract development, UI/UX design, and secure deployment, we guide you at every step. We turn your vision into a fully-functional, market-ready product.

- A Proven Track Record: Don’t just take our word for it, our portfolio of successful projects speaks for itself. We’ve consistently delivered innovative, high-quality solutions for clients across various industries.

Stop watching the future of sports unfold, let’s build it together.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Sports assets that can be tokenized include contracts, tickets, stadium naming rights, merchandise, memorabilia, and digital content. Essentially, any valuable asset tied to a team or event can be transformed into a digital token for easier management and trading.

A2: Developing a sports tokenization platform typically takes 4 to 9 months, depending on the complexity of the project. Factors like the type of assets being tokenized, legal requirements, and the desired features will influence the timeline.

A3: Yes, sports tokenization is legal, but the specifics depend on the jurisdiction and the type of token being issued. Security tokens, for example, must comply with securities regulations, while utility tokens often have fewer legal hurdles but still require proper compliance.

A4: Fans benefit by gaining exclusive perks like voting rights on team decisions, access to VIP experiences, and digital collectibles. Additionally, sports tokens can provide potential financial returns through participation in revenue-sharing or asset appreciation.