The real estate industry is experiencing a major shift with the rise of real estate tokenization platforms. These innovative solutions are transforming how properties are bought, sold, and invested in by enabling fractional ownership through digital tokens. Powered by blockchain technology, tokenization makes property investment more secure, transparent, and efficient, allowing investors to own portions of properties rather than purchasing them outright.

This approach lowers investment barriers, enhances market liquidity, and opens doors for a broader range of investors. Property owners can now manage and monetize their assets more dynamically, while investors gain greater flexibility in building diversified real estate portfolios.

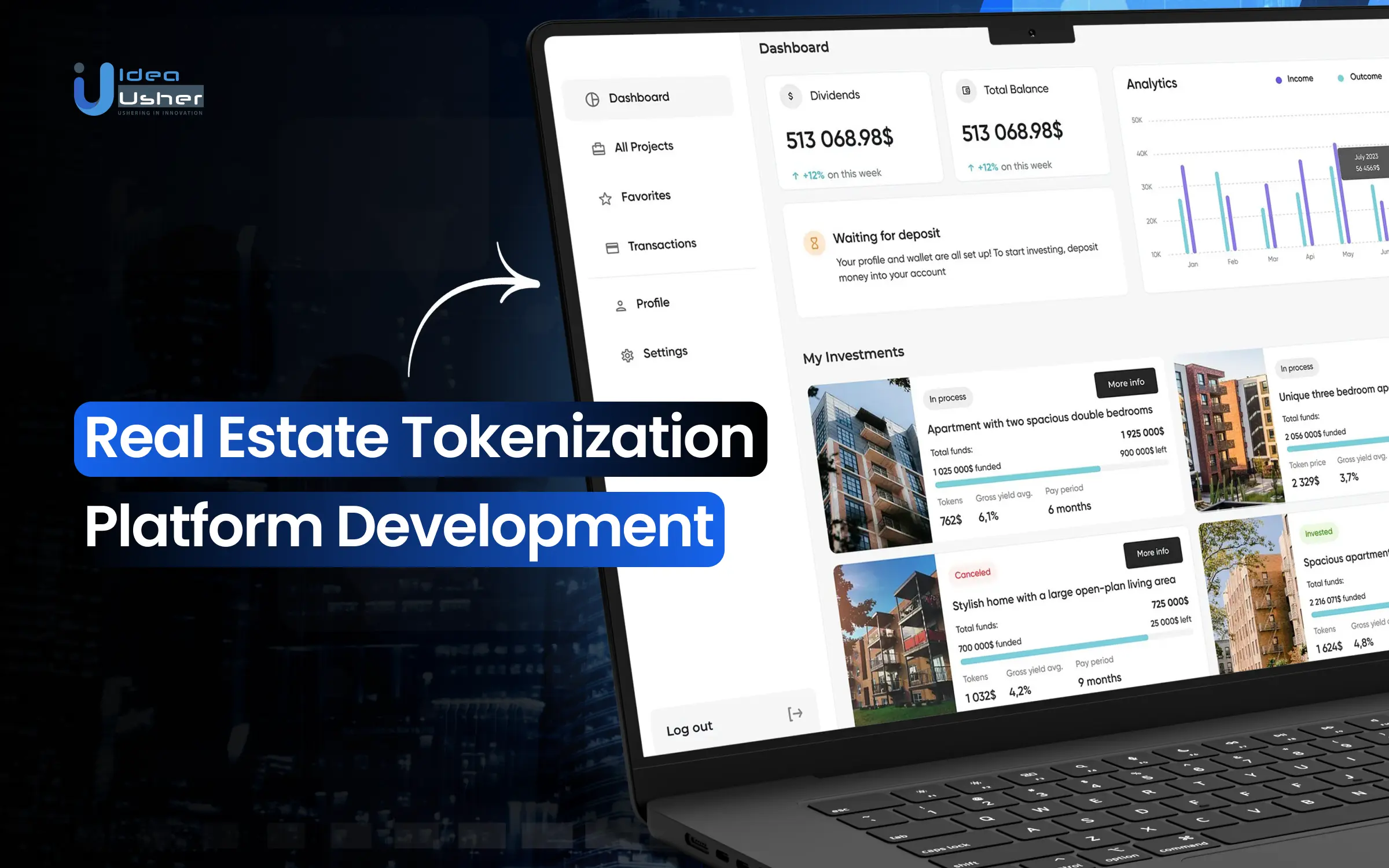

In this blog, we will explore the technology behind real estate tokenization platforms, including key features to consider, factors that affect development costs, and a step-by-step development process. With our extensive experience in delivering cutting-edge blockchain solutions, Idea Usher helps businesses bring their tokenization platforms to market efficiently, aligning with your business goals, user needs, and ensuring a competitive edge.

A Perfect Time To Invest In Real Estate Tokenization

According to a research report published by Spherical Insights & Consulting, the global real estate tokenization market size is expected to grow from USD 2.78 billion in 2023 to USD 16.51 billion by 2033, with a CAGR of 19.50% during the forecast period 2023-2033. This projection highlights the increasing investor interest and technological advancements driving this market expansion.

Dubai-based developer DAMAC Group has partnered with blockchain platform MANTRA to tokenize real estate assets valued at a minimum of $1 billion in the Middle East. This partnership highlights the increasing institutional interest in tokenized real estate.

Elevated Returns pioneered real estate tokenization, notably at the Aspen St. Regis Resort, issuing 18 million tokens at $1 each for an 18.9% stake. They are also working on tokenizing $1 billion of Southeast Asian real estate via Tezos, marking a major digital real estate milestone.

BrickMark, a Zurich-based real estate investment firm, leveraged blockchain technology to acquire a majority stake in Bahnhofstrasse 52, a prestigious luxury shopping property. By issuing BrickMark tokens on the Ethereum blockchain, they completed 20% of the $134 million deal, setting the record for the largest blockchain token-based real estate transaction at that time.

Investing in real estate tokenization platforms provides an opportunity to engage in a growing market. With encouraging projections and successful examples, tokenization enhances liquidity, accessibility, and efficiency in property investments. Early adoption and strategic investments could yield substantial returns.

How is Real Estate Asset Tokenized?

Tokenizing a real estate asset involves converting ownership rights into digital tokens on a blockchain. This enables fractional ownership, allowing multiple investors to hold shares, making it more accessible than traditional investments. Here’s a step-by-step breakdown of how real estate assets are tokenized:

1. Property Selection and Legal Structuring

The first step in tokenizing real estate is selecting the property, which could be residential, commercial, or industrial. The owner or developer sets up a Special Purpose Vehicle (SPV) to hold the property title, with tokens representing shares in the SPV. Legal professionals ensure compliance with local property laws, securities regulations, and AML/KYC requirements, as tokenized assets may be classified as securities.

2. Asset Valuation and Pricing

After setting up the legal structure, the property is appraised to determine its market value. Traditional methods like appraisals or Comparative Market Analysis (CMA), along with automated tools like Automated Valuation Models (AVMs), help determine accurate pricing. The property’s value is then divided into smaller units represented by tokens, allowing fractional ownership by multiple investors.

3. Creation of Security Tokens or NFTs

Once the property is valued, security tokens or NFTs are created to represent ownership on the blockchain. Security tokens comply with securities regulations and offer dividends, rent, or capital appreciation to token holders. NFTs, used for unique properties, represent individual ownership, ensuring that each token is distinct and linked to a specific asset, enhancing asset uniqueness and security.

4. Smart Contract Deployment

Smart contracts automate key property processes, ensuring secure and transparent transactions. These self-executing contracts handle ownership transfers, rent distribution, and token sales. Smart contracts also enable governance and voting for token holders, allowing them to make decisions on property management or investments, providing transparency and eliminating the need for intermediaries during transactions.

5. Token Offering and Listing on Exchange

After token creation, tokens are offered to investors through an Initial Token Offering (ITO) or Security Token Offering (STO). These tokens are then listed on blockchain-based exchanges or proprietary platforms for easy buying and selling. Some platforms also create a secondary market, providing liquidity for tokenized real estate, allowing investors to trade their tokens as they would traditional securities.

6. Ongoing Management and Distribution

With tokens issued, the platform manages rental income, maintenance costs, and operational expenses. Smart contracts handle income distribution to token holders based on their proportional ownership. The platform also manages property performance, paying for utilities, handling maintenance fees, and monitoring tenant relationships, all done transparently and efficiently through blockchain technology.

7. Exit Strategy and Token Liquidity

Tokenizing real estate offers flexible exit strategies. Investors can sell their tokens via the secondary market or transfer ownership through the blockchain. This process eliminates the traditional property sale complexities. If the property value increases, token holders benefit from capital gains when selling their tokens, providing a more liquid and accessible investment opportunity.

How is a Real Estate Asset listed after tokenization?

After tokenizing a real estate asset, the next step is listing it on a platform where investors can buy fractional ownership or trade tokens. This involves technical, legal, and operational steps to ensure proper representation, security, transparency, and regulatory compliance. Here’s a breakdown of the listing process after tokenization.

1. Token Registration and Compliance Verification

The first step in tokenization is ensuring legal compliance. This includes verifying that the tokenized property meets necessary securities regulations, KYC/AML requirements, and tax regulations. Token registration involves ensuring that each token is recorded on the blockchain, tracking ownership and verifying investors’ identities, maintaining transparency and legal compliance in the process.

2. Listing the Tokenized Real Estate on the Platform

Once registered, the property is listed on the tokenization platform. The platform displays detailed property information, such as location, property type, value, ownership structure, and any potential rental income. It also includes token details like total issued tokens, token price, and any associated smart contracts that govern ownership and revenue distribution.

3. Setting Up Secondary Market Access

Providing liquidity is one of the key benefits of tokenizing real estate. The asset is made available on a secondary market for buying, selling, and trading tokens. This could be through a proprietary exchange or integration with blockchain-based DeFi platforms. A liquidity pool may also be set up to facilitate transactions and ensure price discovery.

4. Investor Access and Purchase

Qualified investors can purchase tokens after completing KYC/AML verification to ensure legal compliance. Payment can be made via cryptocurrencies (e.g., Ether, Bitcoin) or fiat currencies (e.g., USD, EUR). Smart contracts securely process these transactions, ensuring transparency and automation. Upon purchase, investors receive tokens representing fractional ownership of the property.

5. Smart Contract Integration and Governance

Smart contracts govern the tokenized real estate assets, automating key functions like revenue distribution and property management. Token holders receive proportional earnings from the property’s income, and they may have voting rights on decisions such as property sales or future investments. Smart contracts enforce these rights automatically, ensuring transparency and fairness.

6. Ongoing Reporting and Updates

The platform provides real-time updates about the property’s performance, including rental income and maintenance status. Investors can track the health and profitability of their investments via a dashboard. Transparency is maintained through the blockchain, where all transactions, payments, and ownership records are publicly verifiable, ensuring a clear view of the property’s financial metrics.

7. Investor Exit and Liquidity Options

The platform offers exit strategies for investors by allowing them to sell tokens on the secondary market or through a buyback program. If desired, developers or property owners may purchase back tokens, offering liquidity and a way for investors to exit the investment without needing to go through public trading, ensuring flexibility and market-driven pricing.

What is Real Estate Tokenization?

Real estate tokenization is the process of converting property ownership into digital tokens that can be bought, sold, or traded on blockchain-based platforms. Each token represents a fractional share of the property, allowing investors to participate in real estate investments without purchasing an entire asset. This approach makes property investing more accessible and enhances market liquidity.

Through tokenization, real estate becomes a digital asset similar to how stocks or bonds are traded making transactions faster, more transparent, and secure with the help of blockchain technology.

At Idea Usher, we specialize in building advanced real estate tokenization solutions that help businesses and investors unlock the true potential of their properties. Our platforms empower clients by increasing liquidity, lowering investment entry barriers, and enabling seamless, secure transactions.

The Technology Behind Real Estate Tokenization Platforms

Real estate tokenization uses technology like blockchain, smart contracts, and decentralized finance to digitize ownership and improve real estate investment. These platforms are changing how properties are bought, sold, and managed. Let’s explore the core technologies and their benefits.

A. Blockchain’s Core Technology in Tokenization

Blockchain is the backbone of real estate tokenization, providing a secure, decentralized ledger for all transactions. When a property is tokenized, its ownership is represented by digital tokens, which are stored on a blockchain. Each token is immutable, meaning once recorded, it cannot be altered, ensuring transparency and trust in property transactions.

- Decentralized Ledger: Blockchain eliminates the need for intermediaries, like banks or lawyers, by allowing all participants to access the same information in real-time. This transparency reduces fraud and enhances security.

- Ownership Records: The blockchain records all property ownership details and transaction history in an immutable way, enabling seamless tracking of fractional ownership across different properties.

B. Role of Smart Contracts in Automating Real Estate Transactions

Smart contracts play a crucial role in automating the process of real estate transactions. These self-executing contracts contain the terms of an agreement directly in the code and execute actions once predefined conditions are met. Smart contracts in tokenized real estate platforms enable the automation of processes like token issuance, payments, and transfer of ownership.

- Automated Transactions: Smart contracts automatically execute actions such as releasing payments when certain conditions are fulfilled, ensuring quicker, more efficient transactions without the need for human intervention.

- Security and Transparency: These contracts are coded and stored on the blockchain, ensuring that every transaction is secure, transparent, and traceable.

C. Tokenization Reduces Transaction Costs

Tokenization significantly reduces the costs traditionally associated with real estate transactions, such as broker fees, legal fees, and administrative expenses. By automating many processes through smart contracts and eliminating intermediaries, tokenization lowers operational costs while improving transaction speed.

- Lower Fees: The need for middlemen like real estate agents, brokers, and notaries is minimized, resulting in reduced service fees and faster transactions.

- Increased Liquidity: Tokenization allows for fractional ownership, meaning investors can buy and sell portions of properties rather than needing to purchase an entire asset. This makes the real estate market more liquid, enabling faster asset turnover and greater market participation.

The Benefits of Real Estate Tokenization

Before diving into the cost of building a tokenization platform, it is essential to understand the key benefits that real estate tokenization offers:

Increased Liquidity

Traditional real estate investments are often illiquid, with transactions taking months or even years to complete. Tokenization enables fractional ownership, allowing investors to buy and sell portions of properties more easily, creating a significantly more liquid market.

Lower Investment Barriers

Tokenization reduces the financial threshold required to invest in real estate. Instead of purchasing an entire property, investors can own smaller fractions, opening opportunities for individuals who previously lacked the capital for real estate investments.

Global Reach

With blockchain technology, real estate tokens can be traded across borders, attracting international investors and diversifying the investor base.

Enhanced Transparency

Blockchain ensures that all transactions and ownership details are securely stored and tamper-proof. This level of transparency is rarely achieved in traditional real estate dealings.

Faster Transactions

Tokenized real estate significantly reduces transaction times. Deals that once took weeks or months can now be completed within minutes or hours.

At Idea Usher, we leverage these benefits to design and develop cutting-edge real estate tokenization platforms. Our solutions help property owners and businesses efficiently tokenize their assets while keeping costs optimized and processes seamless.

Key Features to Include in a Real Estate Tokenization Platform

A real estate tokenization platform needs advanced features for secure, efficient, and transparent transactions. These should serve investors and property owners and ensure regulatory compliance. Key features to include are:

1. Secure Digital Wallet Integration

A secure, integrated digital wallet is crucial for storing and managing tokens on a real estate tokenization platform. Supporting various wallet types, including hot wallets and cold storage, ensures the security of investor assets. By implementing multi-factor authentication (MFA) and encryption, the platform protects tokens and facilitates seamless integration, which is key for user adoption and trust.

2. Token Issuance and Management System

A robust token issuance and management system is vital for a real estate tokenization platform. This system allows for the creation, minting, and transfer of property-backed tokens. It simplifies the process for developers and property owners to issue and manage their assets, including creating different token classes such as security tokens for ownership and utility tokens for governance.

3. Smart Contract Automation

Smart contracts are essential for automating processes on a real estate tokenization platform. They execute actions like token issuance, transactions, payments, and governance based on predefined conditions. This reduces reliance on intermediaries, increases transparency, and automates tasks such as profit-sharing, rent distributions, and contract enforcement, ensuring precise execution and minimizing errors in real estate deals.

4. Investor KYC/AML Compliance Module

A KYC/AML compliance module is crucial on a real estate tokenization platform to verify investor identities before they participate in transactions. This feature ensures the platform complies with international financial regulations, including anti-money laundering (AML) laws. By implementing a solid verification system, the platform builds trust with both investors and authorities, ensuring a secure and legal investment environment.

5. Fractional Ownership and Tokenized Shares

Fractional ownership is a key feature of a real estate tokenization platform. It allows investors to purchase, sell, and trade smaller portions of high-value properties through tokenized shares. This lowers the barriers to entry for real estate investing, enabling a broader audience to diversify their portfolios. It also provides liquidity to traditionally illiquid assets, enhancing the platform’s appeal to a diverse investor base.

6. Secondary Market for Token Trading

A secondary market is an essential component of a real estate tokenization platform. It allows investors to buy, sell, and trade their tokens with other participants in real-time. This marketplace creates the necessary liquidity for tokenized real estate assets, addressing one of the traditional challenges of real estate investing. It enables easy entry and exit for investors, improving market flexibility.

7. Property Valuation and Transparent Reporting

Incorporating real-time property valuation and transparent reporting on a real estate tokenization platform is vital for investor confidence. The platform should track property appreciation, rent payments, maintenance costs, and other financial data. Transparency in property valuation and reporting helps investors make informed decisions and provides them with a clear picture of the asset’s performance over time.

8. Multi-Jurisdictional Regulatory Compliance

A successful real estate tokenization platform must operate across multiple jurisdictions while adhering to local property laws and regulations. This includes securities laws, tax regulations, and cross-border transaction rules. By ensuring compliance with international standards, the platform can scale globally, providing access to a wide range of investors from different regions while minimizing risks associated with regulatory non-compliance.

9. Transparent Voting and Governance Features

Integrating voting rights for token holders is a critical feature on a real estate tokenization platform. Token holders should have the ability to vote on key decisions related to the property, such as maintenance, sales, or property management. This involvement in governance ensures that investors feel more engaged and secure in their investments, making them more likely to support long-term project success.

10. Integrated Payment Gateway

An integrated payment gateway allows investors to make payments for purchasing tokens, receiving rental income, and executing transactions on a real estate tokenization platform. It should support both fiat and cryptocurrency payments, offering flexibility for a global investor base. By providing multiple payment methods and currencies, this feature enhances the accessibility and ease of investment in tokenized properties.

11. Real-Time Asset and Portfolio Tracking

Providing investors with real-time tracking of their portfolio’s performance is essential on a real estate tokenization platform. This includes tracking the current value of tokenized properties, rental income, and overall ROI. Analytics tools should be available for monitoring investment progress, which helps investors make informed decisions and boosts their confidence in the platform’s ability to manage their assets effectively.

12. Enhanced Security Features

Enhanced security features are crucial for protecting investor data and assets on a real estate tokenization platform. The platform should implement end-to-end encryption, multi-factor authentication, cold storage for tokens, and real-time security monitoring. These measures ensure that sensitive information and assets are safeguarded against potential hacks, data breaches, and unauthorized access, providing peace of mind to investors.

13. Mobile and Web Accessibility

Mobile and web accessibility are vital features of a real estate tokenization platform. The platform should be accessible via both mobile applications and web browsers, allowing investors to track and manage their investments at any time and from anywhere. This accessibility enhances user experience and convenience, ensuring that investors can stay updated and make timely decisions on their tokenized real estate assets.

14. Reporting and Taxation Tools

A real estate tokenization platform should include built-in reporting and taxation tools to help investors comply with tax regulations. These tools should generate investment summaries, transaction histories, and capital gains reports. By simplifying tax reporting and providing easily accessible documentation, this feature helps investors stay compliant and reduces the stress of year-end tax filings.

Development Process of Real Estate Tokenization Platform

Building a real estate tokenization platform requires a structured and detailed approach to ensure seamless operations and regulatory compliance. At Ideausher, we guide you through every stage of the process, from conceptualization to launch, ensuring that each step is executed efficiently and aligns with your vision for a successful tokenized real estate platform.

Step 1: Requirement Analysis & Consultation

We begin by understanding the client’s goals, property types, regulatory requirements, and desired platform features. This stage sets the foundation for a compliant and investor-friendly solution.

Step 2: Platform Architecture & Design

Our team creates a secure and scalable architecture while designing a user-friendly interface to facilitate smooth navigation for investors and administrators.

Step 3: Smart Contract Development

Smart contracts are built to automate processes such as token issuance, ownership transfers, and revenue sharing. This ensures transparency and trust in all transactions.

Step 4: Token Creation & Compliance Integration

Tokens representing fractional ownership are created following relevant legal and regulatory frameworks. Compliance measures, such as KYC/AML, are integrated at this stage.

Step 5: Platform Development & Integration

We develop the core platform with features like investor dashboards, transaction tracking, payment gateways, and real-time reporting.

Step 6: Testing & Security Audits

Rigorous testing is conducted to ensure platform reliability, while security audits are performed to safeguard against vulnerabilities.

Step 7: Deployment & Post-Launch Support

Once deployed, we provide continuous monitoring, updates, and support to ensure smooth operations and scalability.

Cost To Develop A Real Estate Tokenization Platform

The cost of developing a real estate tokenization platform varies depending on factors like the complexity of features, the chosen blockchain platform, and the level of regulatory compliance required. Below is a detailed breakdown of the estimated costs associated with each phase of development to give you a clear understanding of the financial commitment involved.

| Development Phase | Description | Estimated Cost |

| Consultation & Feasibility | Initial consultation and market research to define platform requirements, target market, and regulatory compliance needs. | $5,000 – $10,000 |

| Legal & Regulatory Setup | Establishing a legal framework, ensuring compliance with AML, KYC, securities laws, and tax regulations. | $8,000 – $15,000 |

| Blockchain Selection | Selection of the appropriate blockchain (public or private), including infrastructure setup, scalability, and security integration. Custom solutions are more costly. | $20,000 – $45,000 |

| Platform Architecture | Designing the front-end user interface and back-end systems, including APIs for integration and smart contract automation. | $20,000 – $35,000 |

| Property Listing & Valuation | Developing features for listing properties, integration of AVM for real-time property valuation, and secure asset data management. | $15,000 – $25,000 |

| Payment Gateway Integration | Integration of fiat and cryptocurrency payment gateways, ensuring flexibility for global investors and secure transaction processing. | $12,000 – $18,000 |

| Security Features | Implementing end-to-end encryption, cold storage, multi-signature wallets, smart contract audits, and real-time security monitoring. | $15,000 – $30,000 |

| Testing & QA | Thorough testing of the platform, including unit, integration, and user acceptance testing (UAT) to ensure functionality and performance. | $7,000 – $12,000 |

| Platform Launch | Soft launch, beta testing, and full-scale launch preparation, including final marketing and user onboarding support. | $10,000 – $15,000 |

| Ongoing Maintenance & Updates | Regular monitoring, platform updates, security patches, and integration of new features post-launch to keep the platform updated. | $5,000 – $10,000 per month |

According to Ideausher, the estimated total cost to develop a real estate tokenization platform typically ranges from $80,000 to $150,000, depending on the complexity of features, blockchain choice, and security measures required. This includes design, development, legal setup, and post-launch maintenance.

Consult with Ideausher to get a tailored solution for your real estate tokenization platform. Our team will guide you through each phase, ensuring a seamless development process while optimizing costs to meet your specific business needs.

Factors That Influence Real Estate Tokenization Platform Cost

The cost of developing a real estate tokenization platform varies depending on several factors. At Idea Usher, we analyze these elements to provide an accurate and cost-effective estimate for each project.

Platform Complexity

The number of features, user roles, and modules significantly impacts development costs. A basic platform will cost less, while an advanced solution with AI-driven analytics, multiple integrations, and investor dashboards will require a higher investment.

Technology Stack

The choice of blockchain (Ethereum, Polygon, or others), programming languages, and frameworks influences both the cost and scalability of the platform.

Smart Contract Development

Creating secure and compliant smart contracts is a critical part of tokenization. The complexity of these contracts, including revenue-sharing models or profit distribution, affects overall pricing.

Compliance & Legal Requirements

Adhering to KYC, AML, and regional regulations adds to development costs, as it involves integrating compliance frameworks and legal consultation.

Design & User Experience

A highly intuitive and visually appealing UI/UX design may increase upfront costs but ensures better user adoption and retention.

Integration with External Systems

Integrating payment gateways, third-party APIs, or existing property management systems can also influence development costs.

Post-Launch Services

Ongoing support, maintenance, and future updates are essential for long-term success, contributing to the total cost of ownership.

At Idea Usher, we ensure that every cost factor is optimized while maintaining the highest standards of quality, security, and compliance.

Monetization Models To Consider

To ensure your real estate tokenization platform’s success, integrate diverse, sustainable monetization models. Here are key strategies to generate revenue and add value for investors, developers, and users.

1. Transaction Fees

Transaction fees are a simple yet effective monetization method for real estate tokenization platforms. A small fee can be charged for every transaction, such as buying, selling, or trading tokenized assets. Fees can also apply to liquidity events like token staking or secondary market trades, providing a continuous revenue stream.

2. Listing Fees for Property Developers

Listing fees can be charged to property developers or owners who wish to tokenize and list their properties on the platform. The fee can be structured based on property size, value, or a flat rate. This helps offset platform development costs and encourages a range of properties to be tokenized.

3. Management Fees for Ongoing Property Administration

Management fees are charged to developers or property owners for ongoing management of tokenized assets. These fees typically range from 1-3% of the property’s rental income or generated revenue. They provide a steady, recurring revenue stream while incentivizing good property management and ensuring consistent returns for investors.

4. Platform Tokenization and Issuance Fees

Charging platform tokenization fees enables the creation of a native token used for governance or as a utility within the ecosystem. Users purchase tokens to participate in platform governance, transact, or stake. This builds an internal economy while promoting participation and control within the real estate tokenization platform.

Top Leading Real Estate Tokenization Platforms

As the real estate tokenization market grows, key platforms lead with innovative fractional ownership and investment solutions. Here are the top platforms shaping the future, offering new ways for investors and developers to engage with real estate assets.

1. ReaIT

ReaIT is a real estate tokenization platform that offers fractional ownership in real estate properties through blockchain technology. By allowing investors to buy digital tokens representing shares in a property, ReaIT makes it possible for individuals to invest in high-value properties with lower capital requirements, democratizing access to real estate markets.

2. Tokeny

Tokeny provides a blockchain-based platform for tokenizing real-world assets, including real estate. Through its T-REX platform, Tokeny ensures compliance, security, and liquidity for tokenized assets. It allows companies to issue and manage security tokens, enabling fractional ownership and simplifying the management of tokenized securities in real estate investments.

3. Securitize

Securitize is a leading platform for digital securities, specializing in real estate tokenization. The platform enables issuers to create and manage security tokens that represent ownership in physical real estate. With its blockchain-powered infrastructure, Securitize enhances liquidity and provides services like compliance, investor onboarding, and secondary market trading.

4. Propy

Propy is a blockchain-powered real estate platform that facilitates the tokenization of real estate assets. The platform automates processes like title transfers, escrow services, and contract management. By enabling the creation and sale of tokenized ownership, Propy brings global accessibility and transparency to property transactions on a decentralized platform.

5. DIBS Capital

DIBS Capital leverages blockchain technology to tokenize real estate, enabling fractional ownership through security tokens. The platform facilitates compliance and liquidity, allowing both institutional and retail investors to trade tokenized shares of properties. This platform is revolutionizing real estate investment by providing a more efficient and secure way to invest in assets.

Conclusion

Real estate tokenization platforms are paving the way for a more inclusive and efficient investment landscape. By leveraging blockchain technology, these platforms offer increased liquidity, transparency, and accessibility, making it easier for investors to participate in real estate markets. The development of such platforms, while challenging, presents a significant opportunity to revolutionize how properties are managed and traded. As the industry continues to evolve, tokenization will play a crucial role in democratizing real estate investment and offering new avenues for both individual investors and property owners to collaborate in a decentralized and secure environment.

Launch Your Real Estate Tokenization Platform!

At IdeaUsher, we specialize in developing innovative blockchain solutions tailored to your business needs. Our expertise spans various industries, including real estate, where we have successfully implemented blockchain technology to enhance transparency, security, and efficiency.

Partner with IdeaUsher to build a robust, secure, and scalable real estate tokenization platform. Our team of experts will guide you through every step, from concept to deployment, ensuring your platform meets the highest standards.

Contact Us Today for a Free Consultation!

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A real estate tokenization platform is a digital solution that enables the conversion of physical property ownership into digital tokens on a blockchain. These tokens represent fractional ownership of the property, allowing investors to buy, sell, or trade their stakes in a secure and transparent manner.

The platform digitizes a property by creating tokens that represent shares of the asset. Through smart contracts, it automates transactions, ensuring compliance with regulations and facilitating seamless transfers of ownership. Investors can access the platform via a user-friendly interface to manage their investments.

Developing such a platform democratizes access to real estate investments by lowering capital requirements and increasing liquidity. It also enhances transparency, reduces administrative costs, and provides a more efficient way to manage and trade property assets.

Challenges include navigating complex legal and regulatory landscapes, ensuring robust cybersecurity measures, integrating with existing financial systems, and educating users about the new technology. Overcoming these hurdles requires careful planning and collaboration with legal and tech experts.