- What is metaverse real estate?

- How to build real estate in the metaverse?

- Benefits of developing virtual real estate

- Virtual real estate market Overview

- Metaverse Real Estate Marketplace

- Investment avenues in virtual real estate

- Opportunities and threats of investing in metaverse

- Get your virtual real estate developed by Idea Usher

- FAQ

The real estate industry has seen significant technological changes during the past few years. As a result of developments in technology, such as the meteoric rise of online real estate purchases and the metaverse, the real-estate industry is experiencing a radical upheaval. A lot of people are thinking about the metaverse now. Although the idea has been around for some time, the stakes are high for those who choose to engage in it because of how novel it is. If you’re not familiar with the concept of metaverse real estate development, you may have some questions, and this article is outlined to answer them.

| Market Size in 2020 | USD 821.9 Million |

| Market Size Expected in 2028 | USD 5953.6 Million |

| Metaverse Real-Estate Companies | Axie Infinity, Crypto Voxels, Decentraland Foundation, Linden Lab, ShibaLand LLC, Somnium Space LTD., SuperWorld Inc., TandB Media Global Thailand Co. LTD., The Sandbox, The Voxel Agents, Tokens.com, Uplandme Inc. |

- What is metaverse real estate?

- How to build real estate in the metaverse?

- Benefits of developing virtual real estate

- Virtual real estate market Overview

- Metaverse Real Estate Marketplace

- Investment avenues in virtual real estate

- Opportunities and threats of investing in metaverse

- Get your virtual real estate developed by Idea Usher

- FAQ

What is metaverse real estate?

It refers to a virtual realm where people may explore 3D environments. It’s a virtual land and buildings which could be the property for residential and commercial developments. Property of any sort, including billboards for advertising, commercial areas, and genuine company headquarters, may be developed there.

Those properties are mostly the virtual squares on a computer screen. However, several platforms have been created to be programmable spaces. Those are the spaces where users may connect socially, exchange NFTs, play games, market their services, and attend meetings using 3D avatars.

Real estate in the metaverse is offered in the form of NFT, which may be traded for cryptocurrency or fiat money. Due to its decentralized nature, the metaverse allows landowners to retain their property rights. However, this is only one of many benefits of using the metaverse in the property industry.

The growth of the metaverse will boost the value of digital property. As per the estimation, the value of virtual real estate will expand at a compound annual growth rate of 45.2% between 2020 and 2025.

How to build real estate in the metaverse?

You must follow a strategic approach for the development of real estate in the metaverse.

1. Choose a platform

In order to build property in the metaverse, you need a diverse set of skills. You can develop a virtual real estate on different platforms. It is important to consider all of your options before making a final decision.

- All the major blockchain systems, including Ethereum, Algorand, Solana, and Polygon, gives the skeleton for constructing a decentralized and community-driven simulated environment.

- The capacity of a smart contract—which stipulates specific behavior in response to certain events—provides the backbone for a metaverse built on a blockchain.

- Having decentralized money, cryptocurrency and NFTs available is needed for optimal performance. Selecting such platforms allows you to set up real-estate properties within preexisting blockchain metaverse platforms like Sandbox, Decentraland, Crypto Voxels, etc.

Existing metaverse platforms are still in their infancy. Thus it is advisable to process the development of real estate in the metaverse from scratch. It is the best way since you can add the features and capabilities you like. This way, you can make a larger and more specialized platform. Additionally you can process metaverse ecosystem development while adding real estate properties as you go.

2. Create a metaverse smart contract

There has to be a development of blockchain-based smart contracts. An immutable collection of “rules” that trigger predetermined actions when certain criteria are met makes up a metaverse smart contract. When a buyer and a seller both click “Agree,” the smart contract begins processing the transaction between them.

Leasing agreements between two parties may be outlined and carried out with the use of smart contracts. Additionally, this also includes canceling the agreement if the renter breaks regulations. A virtual real estate ecosystem’s benefits can be completely tapped into with the help of smart contracts. Using an NFT smart contract, you may tokenize real estate assets into non-fungible entities.

3. Implementation of IPFS storage system

Decentralized IPFS storage systems are installed and processed to store massive amounts of data. The cryptographically hashed information is stored in a system that was set up according to the operating system’s specifications.

4. Create a database for information

The next step is to create a database where user can store the important data of the virtual world. Those data includes user identities and associated information, transaction records, and other data, stored using a variety of safeguards.

5. Include AI and VR features

The bulk of work in creating a virtual real estate marketplace goes into this. By incorporating AI and VR capabilities, the metaverse platform may generate digital avatars, VR settings, etc. It facilitate user engagement with the system. Including these features will provide a digital representation of a physical process.

6. Design your metaspace

Metaspace may be anything from an app to a virtual meeting room to a virtual home theater. It is a virtual world that a person equipped with a virtual reality headset may access. Once the platform is done, then the conceptualizing of the virtual real estate property may begin. The process of designing a metaspace includes designing the building’s overall structure.

A metaspace’s size can range from that of a single room to that of an entire city. With the help of a metaverse development company, you can create 3D designs and VR applications that are in accordance with the goals of a blockchain-enabled platform with relative ease.

7. Creating an interaction layer

At this stage, you will develop the application logic that will enable characters and assets to interact with the digital real estate. This layer regulates things like accessibility, navigation, communication protocols, and user controls. One simple example is when a patron uses a pass to enter a building, such as a convention center.

At this level, it’s important to define how your system will work with third-party apps. Zoom, smart glasses, VR goggles, headsets, haptic gloves, sensors, etc., are all examples of technologies that may be used for video chatting. In the interaction layer, the development of bridge between the real world and the metaverse takes place.

8. Develop an interoperability layer

Interoperability expands the scope of the metaverse and encourages more people to participate in it. For instance, a resident of one metaverse may wish to visit a venue located in another and buy tickets to the event. The users may accomplish the same by ensuring interoperability across various blockchain technologies.

To make a completely working virtual world, it is essential to facilitate cross-environment transactions. Therefore, go for a blockchain that can provide the swift and secure processing of payments through a gateway.

An experienced firm in metaverse real estate development, such as Idea Usher, can always simplify this process for you.

Benefits of developing virtual real estate

The metaverse is the next generation of the internet, and digital real estate is a novel approach to virtual land ownership. Some of the advantages of virtual real estate to users and platform owners are as follow:

- The first benefit is that users may acquire virtual real-estate through the metaverse.

- Users can profit from cryptocurrency or fiat cash holdings by renting or selling their land to other entities.

- Landowners in the virtual world might sigh relief when it comes to the regular inflow of additional cash and benefits they receive.

- In the metaverse, client may use land virtually for any purpose with little to no outlay of resources.

- Metaverse land ownership idea attracts tenants, which can boost revenue.

Virtual real estate market Overview

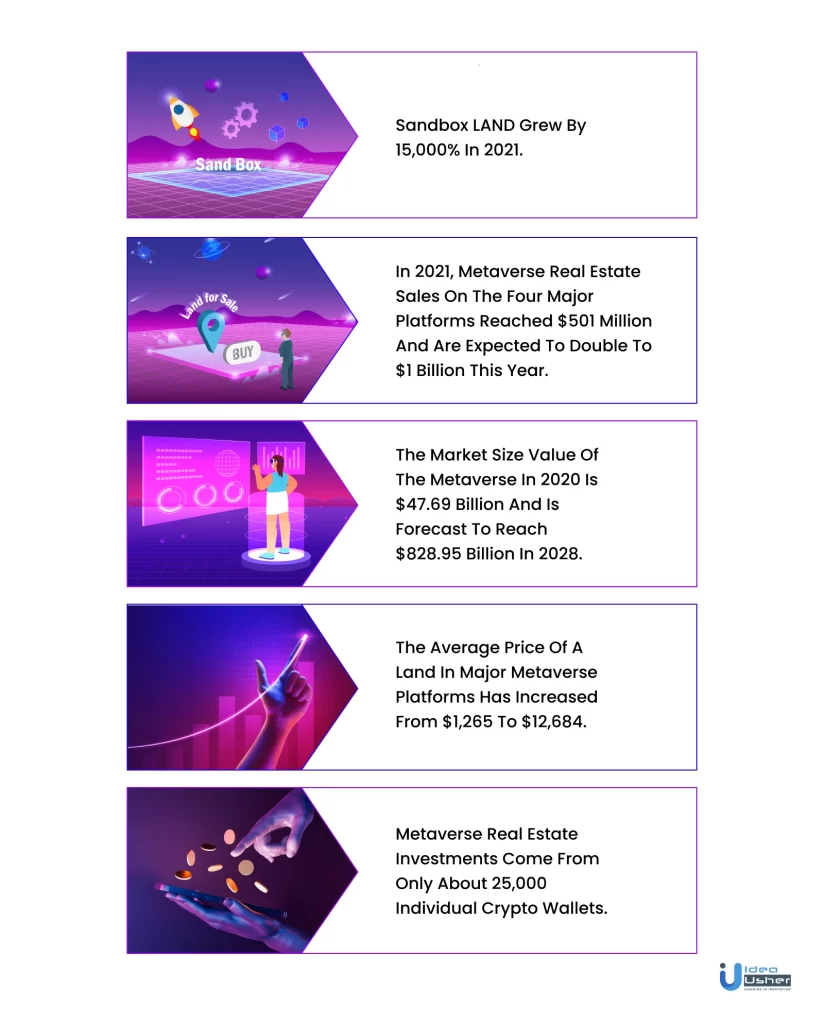

Here is the most up-to-date information on the market to assist you in making a data-driven choice regarding your potential investment in metaverse assets. Consider these figures as you weigh the pros and cons of virtual real estate.

As reported by CFTE, the growth of Sandbox LAND in 2021 was 15,100%. In the same year, its virtual land purchases topped all others, totaling $350 million for 65,000 transactions in virtual land.

Real estate sales in the metaverse on the four most popular platforms hit $501 million in 2021 and are projected to quadruple to $1 billion by the end of 2022, according to MetaMetric Solutions.

A market assessment by Emergen Research estimated the market size value of the metaverse at $47.69 billion in 2020 and $63.00 billion in 2021, and predicted the same sector would generate $828.95 billion in revenue by 2028. According to the prediction, it may register a revenue CAGR of 43.2% during the forecast period.

According to Brand Essence Market Research, the virtual real estate market is most likely to grow at a compound annual rate of 31% a year from 2022 to 2028.

Across the board, according to TRT World, the average cost of land in the most popular metaverse environments has risen from $1,265 to $12,684. Apart from this, they reported roughly 25,000 crypto wallets to make up the investor base for metaverse property.

There appears to be mostly good data on metaverse property. They show that early “settlers” on digital platforms make enormous profits. You must remember, though, that these universes are fresh and untested. You may need to explore deeper than the stats suggest.

There are big risks, but potentially big rewards.

Janine Yorio, CEO of Republic Realm.

Metaverse Real Estate Marketplace

Deceltraland, CryptoVoxels (now renamed as Voxels), the Worldwide Webb, Treeverse, and The Sandbox are some of the most prominent marketplaces currently accessible. However, there are other sites where users may purchase plots. As more people become aware of the benefits of investing in the metaverse, even more of them will emerge.

Currently, most real estate is traded on the secondary market or through third-party platforms. That makes it more convenient for potential buyers to use Ethereum to make purchases. It’s common for certain markets to accept their coin as payment. The Sandbox (SAND) and Decentraland use MANA – which are two examples that use their coins for purchases, and switching between them is simple.

Suppose you want to purchase real estate in the metaverse. In that case, the process of comparing pricing, information, and the precise location of the plot will be identical to that of using a city map or a real estate broker’s website. The same comparable data for each plot is provided on real estate platforms, allowing you to make wise purchases.

Investment avenues in virtual real estate

1. Gaming platforms

Investors are pouring millions into video games to capitalize on the growing digital real estate interest among conventional and online gamers. Electronic games and investor enthusiasm around cryptocurrencies have boosted this market. Many believe that NFT-enabled games will benefit the gaming business, which is worth billions of dollars.

In games like Fortnite, World of Warcraft, and Minecraft, gamers have spent years on in-game assets such as weapons, armor, or tools to strengthen their character. Now, the NFT-enabled games allow players to trade game assets for cryptocurrency or let them sell them for a game coin that can be transformed into dollars.

In certain games, users may buy virtual land in the form of NFT to rent out. The players can charge for access to their virtual land, or sell on the in-game market or external market like OpenSea. The players can use in-game coins for transactions and may trade it for Ethereum and USD.

SBC (HSBA.L) entered the Metaverse on March 17, 2022, by buying virtual real estate in The Sandbox, an online gaming arena.

2. Virtual event

In recent years, many virtual events have taken place in “metaverse” spaces. Several famous musicians are investing substantially in this technology, and some are even performing live concerts. For example,

- In November 2021, Justin Bieber performed at the live metaverse concert.

- On March 27, 2022, Daler Mehndi purchased the virtual property (Balle Balle Land) in the Indian metaverse, the PartyNite.

- Bandwagon, a Singaporean indie band, performed its first virtual reality performance in March 2022 as part of the Pixel Party.

As time passes, demand for property in the metaverse rises for several reasons. This is also why there is a constant modification in venues in the metaverse to serve the purpose of celebrations, concerts, and other events. Virtual real estate has become one of the industry’s most fashionable features. Its popularity soars among customers and market players.

3. Digital land

Even though most people can’t afford to, corporations spend billions on fictitious land.

- CNBC said that since Facebook made its first meta move, the price of a digital plot had increased by 500%.

- Reportedly, one corporation paid over $2.5 million to buy property in Descentraland, a cryptocurrency-based metaverse in which all in-game material belongs solely to its participants.

- Another company bought land in Atari’s The Sandbox Metaverse for almost $4.3 million.

- About 16,000 individuals have purchased virtual plots in the new blockchain-linked video game, according to Sandbox co-founder and COO Sebastian Borget’s interview with Al Arabiya English.

- Like Fortnite concerts, celebrity appearances and events are on the rise. Stars like Snoop Dogg and Paris Hilton have assets in the virtual world, which is surely driving up the price of digital real estate.

- Companies are investing in virtual stores in the metaspace to provide customers with an immersive experience.

The trend toward moving into digital space is now the new standard. It is also the source of the market’s largest profit.

Opportunities and threats of investing in metaverse

Even though the prediction says that metaverse will expand rapidly in the next few years, it is still a young and unsteady sector.

- If a metaverse site ever goes away for good, everything you own there disappears along with it.

- There’s also the problem of determining a fair price. It’s never clear how to put a price on land if its scarcity is fictitious and its potential worth is impossible to predict.

- Real estate in the metaverse is vulnerable to market fluctuations since its value depends on cryptocurrencies that are notoriously unstable.

- Metaverse property investments are more speculative than prospective due to the great degree of uncertainty they entail. In other words, the “potential risks are significant” would be an understatement.

- A moment of carelessness in the virtual world can wipe out all of your savings.

- On the other hand, investments in virtual real estate may reap large profits. It is due to the rapid move to full digitization in virtually all businesses.

With more sophisticated technology and massive investments in the metaverse, real estate will result in auspicious growth for the market during the forecast period.

– Analyst Comment

Understand the metaverse well before making any financial commitments. Think through the potential drawbacks and obstacles, then measure them against the advantages. You shouldn’t make a call until you’ve carefully weighed all the benefits and downsides.

Get your virtual real estate developed by Idea Usher

When it comes to developing the metaverse, Idea Usher provides services that are practical and customized. If you’re willing to start a metaverse real estate business, we can help you with the development process. The development will center on tailoring solutions to your specific requirements, and the result will be profitable. In collaboration with your business, we will develop the most functional and user-friendly virtual real estate platform possible, so you can begin making deals immediately.

Get in touch today!

Build Better Solutions With Idea Usher

Professionals

Projects

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQ

Q. Who are the top players in the global virtual real estate market?

A. Some of the key players in the virtual real estate market across the world are:

Axie Infinity, Cryptovoxels, Decentraland Foundation, Linden Lab, ShibaLand LLC, Somnium Space LTD., SuperWorld Inc., TandB Media Global Thailand Co. LTD., The Sandbox, The Voxel Agents, Tokens.com, Uplandme Inc.

Q. How is a land in the metaverse useful?

A. Owners of land in the metaverse can construct a wide range of virtual structures and games. The landowner may also construct billboards on the site for commercial purposes or a gallery to display all the NFTs they have acquired. People who own land in the metaverse can let others use it for various purposes, including hosting games, events, and social interactions.

Q. Does the metaverse’s virtual real estate come with any risks?

A. There may be risks with virtual real estate as there are with conventional real estate. Think about the consequences if the platform you are investing in suddenly disappears–all of your property and investments will no longer exist. There’s also the difficulty of determining the value of the virtual property. The land value in the metaverse depends on the price of bitcoin, which is unstable. Hence, there are risks for sure, but the metaverse guarantees profit at some point. However, it is advisable to go through extensive research before investing.

Q. What impact will the metaverse have on real estate markets?

A. Since metaverse VR/AR tech greatly extends the buyer pool, real estate agents also makes profit. There are already VR property showcases in action. Virtual reality (VR) choices allow prospective homeowners to take tours of properties without ever leaving the comfort, using VR headgear and compatible device.

Q. Who owns metaverse land?

A. The big four control most of the property in the metaverse (Somnium Space, Sandbox, Cryptovoxels, and Decentraland). There are around 268,645 plots — some of the most expensive on the market, are owned by these platforms.

Q. How to earn from metaverse land?

A. Starting-off financially in the metaverse can be done in a number of different ways, such as trading digital assets, creating virtual environments, playing play-for-pay games, trading tokens, and holding virtual events.

Related posts:

- Web3 in Real Estate: A Complete Guide

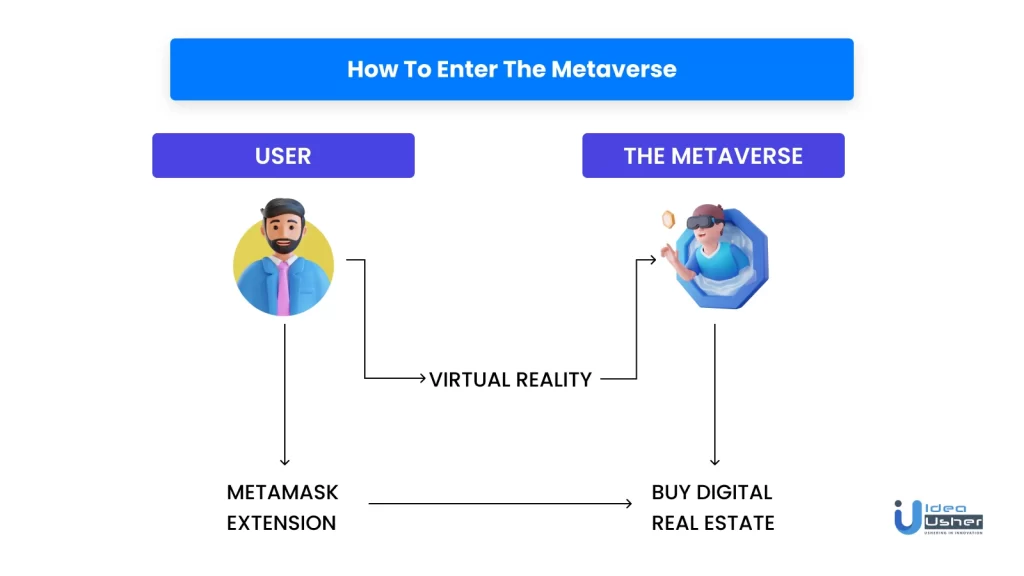

- How To Enter The Metaverse And Make Profit

- Mobile App Development for Digital Real Estate: Trading Strategies

- A guide to metaverse enterprise solutions.

- Real Estate App Development in 2021

- Metaverse Virtual City Development: A Complete Guide

Powered by YARPP.

Rebecca is a multi-disciplinary professional, proficient in the fields of engineering, literature, and art, through which she articulates her thoughts and ideas. Her intellectual curiosity is captivated by the realms of psychology, technology, and mythology, as she strives to unveil the boundless potential for knowledge acquisition. Her unwavering dedication lies in facilitating readers' access to her extensive repertoire of information, ensuring the utmost ease and simplicity in their quest for enlightenment.

Hire the best developers

100% developer skill guarantee or your money back. Trusted by 500+ brands

Contact Us

- SCF 98, Phase 11, Sector-67 Mohali, 160062

- 651 B Broad St, Middletown, 19709, county New Castle Delaware, USA

- [email protected]

- (+1) 628 432 4305

HR contact details

Follow us on

Idea Usher is a pioneering IT company with a definite set of services and solutions. We aim at providing impeccable services to our clients and establishing a reliable relationship.

Our Partners

Contact Us

- SCF 98, Phase 11, Sector-67 Mohali, 160062

- 651 B Broad St, Middletown, 19709, county New Castle Delaware, USA

Follow us on

Idea Usher is a pioneering IT company with a definite set of services and solutions. We aim at providing impeccable services to our clients and establishing a reliable relationship.

Rebecca Lal