The way investors manage and grow their money is evolving fast. People now want seamless access, personalization, and faster decision-making without switching apps or manually entering data. Traditional investment apps often cannot support that level of connectivity, so users experience friction, delays, and lower engagement.

Open banking changes this by enabling secure API connections and real-time financial insights. With verified bank data, investment platforms can automate funding, improve portfolio logic, and personalize strategies with confidence. Every data point becomes part of a connected financial view rather than scattered accounts and assumptions.

Over the years, we’ve built many open banking–enabled fintech solutions, powered by open finance API aggregation frameworks and RegTech compliance infrastructure. Thanks to this expertise, we’re sharing this blog to discuss the steps to integrate open banking into investment apps. Let’s start!

Key Market Takeaways for Investment Apps with Open Banking

According to Grandview Research, the open banking market is expanding quickly, valued at about USD 31.6 billion in 2024 and expected to reach roughly USD 135–136 billion by 2030. With a projected growth rate of around 27.6%, the trend reflects how deeply API-driven finance is becoming part of everyday money management. For investment apps, this shift creates an opportunity to build smoother onboarding, smarter recommendations, and faster money movement based on real financial behavior rather than assumptions.

Source: Grandview Research

Open banking also helps remove friction that historically slowed investing. Instead of long forms or delayed transfers, users can verify income, link accounts instantly, and move money in seconds. With access to spending and saving patterns, apps can personalize portfolios, set more realistic goals, and automate deposits, making investing feel less like a chore and more like a natural extension of someone’s financial routine.

Plum and Freetrade offer real examples of how this works in practice. Plum uses transaction data to identify extra cash and move it automatically into savings or investments, helping users build wealth passively.

Freetrade focuses on payment speed and cost, allowing users to fund accounts instantly through open banking rather than relying on slower or more expensive card payments. Together, they show how open banking is reshaping investing into something faster, more intuitive, and tailored to each person’s financial reality.

Understanding Open Banking in Investment Apps

Open Banking in investment apps refers to the regulated, secure sharing of financial data and payment capabilities between banks and fintech platforms via standardized APIs. It allows users to connect their bank accounts directly to investment apps, enabling features such as real-time account information, instant deposits, automated recurring contributions, spending and cash flow analysis, and personalized investment recommendations based on verified financial behavior.

How do Different Regions Implement Open Banking?

The concept is global, but each region approaches regulation differently:

- PSD2 (European Union): Requires banks to open APIs and includes strong customer authentication.

- UK Open Banking: A mature implementation with standardized APIs and an active fintech ecosystem.

- India’s Account Aggregator Framework: A consent-based model enabling secure sharing of financial data across regulated institutions.

- FDX (United States): A voluntary standard gaining adoption as the U.S. moves toward formal Open Banking regulations.

While the frameworks differ, they share the same principle: users own their financial data and must give explicit consent before it is shared.

How Investment Apps Use Open Banking?

Open Banking enables investment platforms to offer smarter, flexible, and more personalized features.

1. Account Information Services

AIS allows apps to retrieve verified financial data from linked accounts. This supports:

- Unified financial dashboards showing checking, savings, credit cards, loans, mortgages, pensions, and investments.

- Spending and cash-flow insights that inform budgeting or investment decisions.

- Income verification for compliance and suitability assessments.

- Better allocation and rebalancing decisions based on a user’s entire financial picture.

2. Payment Initiation Services

PIS improves how money moves between accounts, enabling:

- Instant deposits into investment platforms instead of waiting days for bank transfers.

- Automated recurring investments aligned with savings and investment goals.

- Faster withdrawals back to linked accounts.

- Goal-based transfers that help users stay consistent with investment plans.

3. Risk Profiling and Suitability Intelligence

Open Banking supports more accurate and adaptive investment recommendations through:

- Evidence-based profiling using verified transaction and income data.

- Real-time affordability checks to ensure recommendations align with actual financial capacity.

- Lifecycle adjustments as circumstances or spending patterns change.

- Cross-portfolio risk insights to avoid overexposure across asset classes or sectors.

4. Automated Investing and Recurring Flows

With linked banking data, investment experiences can become proactive rather than reactive:

- Cash detection algorithms that identify idle balances and suggest transfers.

- Round-up investing channels small leftover amounts from everyday spending.

- Salary-triggered investing based on paycheck detection.

- Dynamic contribution adjustments that increase, pause, or reduce investments based on real-time financial health.

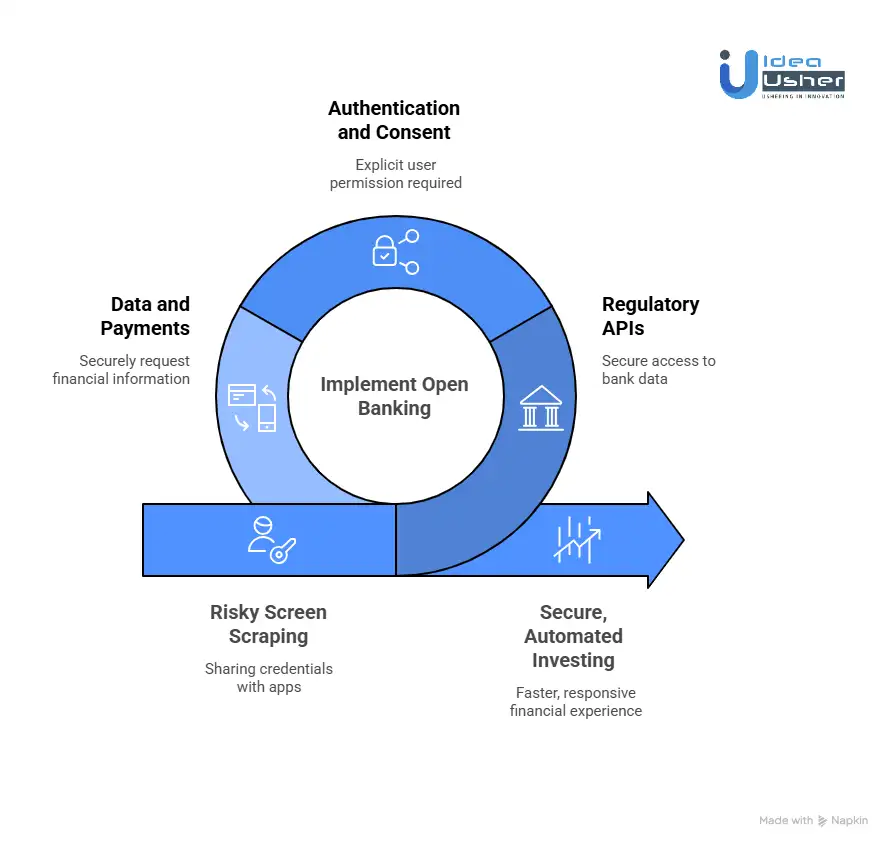

How Open Banking Powers Investment Apps?

Open Banking enables investment apps to access banking data via regulated APIs and token-based authentication securely. This means the app could analyse real spending patterns and initiate deposits without the user having to copy account details or wait days. With this infrastructure, the investing experience feels faster, more automated, and much more responsive to real financial behaviour.

1. Regulatory APIs

In regions like the UK and EU (under PSD2), banks are required to expose secure APIs. These are controlled access points where authorized apps can:

- Pull approved account information (AIS)

- Trigger payments directly (PIS)

No passwords leave the bank. No scraping. No guesswork. Just structured, permission-based access.

2. Authentication and Consent

Every Open Banking connection begins with explicit permission from the user. The process typically follows OAuth2 and OpenID Connect standards:

- The user selects “Connect Your Bank” in the investment app.

- The user is redirected to their bank’s official login page.

- They authenticate using their bank’s security, often biometrics or multi-factor authentication.

- They review and approve exactly what data will be shared and for how long.

- The bank issues a secure, time-restricted token instead of sharing credentials.

That token authorizes future communication with the bank until it expires or the user revokes access.

3. Data and Payments in Motion

After authorization, the investment app can securely request information. Often this happens through an Open Banking aggregator such as Plaid or TrueLayer to simplify connectivity across multiple banks.

When Accessing Financial Data (AIS):

Bank API → Aggregator → Investment App → Categorization and Insights → User Interface

The transaction data is enriched and categorized. The app can identify spending habits, detect salary deposits, and differentiate recurring bills from discretionary spending. This enables features such as:

- Real-time net worth tracking

- Personalized investing guidance

- Adaptive risk profiling

When Initiating Payments (PIS):

User action (“Invest $1,000”) → Payment Initiation API → Bank → Instant Confirmation → Trade Execution

Funds move directly from the user’s bank, usually with immediate confirmation, allowing the platform to begin investing without waiting days for settlement.

The User Experience

Here is how it plays out in real use.

Step 1: Onboarding

Before Open Banking: Users typed in financial information, uploaded statements, and waited for verification.

Now: The user connects their bank once and the app instantly receives verified income and spending data that informs financial suitability and risk modelling.

Step 2: Funding the Account

Before: Users copied routing numbers, logged into a banking portal, and waited several days for funds to settle.

Now: A single confirmation through the connected bank prompts an immediate transfer and the money is ready to invest almost instantly.

Step 3: Automated Investing

With ongoing AIS access (if the user agrees), the app can respond proactively.

For example:

“Your salary has been deposited. You have $450 more than your usual spending buffer. Would you like to put $200 toward your ‘Home Deposit’ investment goal?”

One tap initiates the payment, and the investment is executed automatically.

Step 4: Continuous & Contextual Financial Guidance

If the user later takes out a mortgage or loan with a different institution, the app can detect the new financial obligation and adjust investment recommendations accordingly. This may mean holding more liquid assets or reducing exposure to volatility. Financial advice becomes holistic rather than platform-specific.

Security: Why This Approach Is Safer

Before Open Banking, many financial apps relied on screen scraping. Users handed over their banking usernames and passwords, and the app impersonated them. This method was risky, fragile, and difficult to audit.

Open Banking resolves those issues through:

- Zero credential sharing

- Revocable and scoped access permissions

- Token-based authorization with expiry

- Regulated intermediaries and service providers

- Logged data access events for transparency and compliance

Investment apps participating in Open Banking are required to meet strict regulatory and cybersecurity standards, including GDPR and SOC 2 controls.

How to Integrate Open Banking Into Investment Apps?

Integrating open banking into an investment app starts with defining compliance roles and implementing consent workflows so bank data and payments can be accessed legally and securely.

The next stage focuses on building authentication using OAuth and OpenID Connect, and shaping a unified data model that normalizes financial information for analysis and automation. We have integrated Open Banking into investment apps for many clients, and here is the process we follow.

1. Define Open Banking Roles

We begin by helping clients determine whether their product needs AISP access, PISP services, or both based on business goals and operational regions. During this phase, we also design user consent flows and governance rules to ensure transparency and regulatory alignment.

2. Authentication & Secure Access Workflow

We implement secure authentication flows using standards like OAuth 2.0 and OpenID Connect, tailored to regulatory requirements such as PSD2’s 90-day re-authentication rule. Token handling, generation, refresh, encryption, and revocation are built into the trust infrastructure to maintain airtight security.

3. Real-Time Financial Data Retrieval

Once connections are in place, we normalize fragmented API outputs into a single structured data layer. This unified financial profile becomes the foundation for personalization and investment recommendations.

4. Payment Initiation Services

We enable users to fund investments directly from their bank accounts through secure payment initiation. Asynchronous confirmation handling ensures reliability even when banking networks operate on delayed acknowledgment.

5. Investment Automation Features

With data and payments established, we layer automation into the experience through features like auto-roundups, recurring deposits, and smart scheduling. We connect these triggers to automated trading workflows to allow low-friction investment execution.

6. Certify, and Launch

Before going live, we run performance and security testing to validate readiness in a regulated environment. After launch, we provide monitoring and consent lifecycle management to help ensure compliance and platform stability over time.

Most Successful Business Models for Investment Apps with Open Banking

Open Banking has become a turning point for investment apps. With secure access to banking data and real-time payment initiation, newer investment products can operate with far greater automation, personalization, and efficiency than legacy brokerages. As a result, several repeatable revenue models have emerged and matured across the industry. The four below represent the most commercially successful blueprints.

1. Automated Micro-Investing

This approach relies on Open Banking’s transaction feeds and account aggregation to automatically invest incrementally, eliminating the need for manual deposits. One of the best-known implementations is the purchase round-up system that invests leftover change from everyday spending.

How Revenue Is Generated:

Most platforms using this model charge:

- A monthly platform fee (typically $1 to $5)

- An asset-based fee between 0.25% and 0.50% annually

The model scales exceptionally well because users make consistent, small deposits without friction. The more banking behavior the system can track, the faster assets under management (AUM) compound.

Example: Acorns

- Monthly subscription: $3 to $5 for individuals, $5 to $9 for family accounts

- AUM fee: 0.25% for balances over $1 million

Estimated performance: 4.6 million active users and roughly $6.2 billion in AUM by 2023 - Annual revenue (2022): ~$128 million, increasing about 30% year over year

- Partner cashback feature added an estimated $15 million in revenue by linking spending data to merchant reward triggers

2. Comprehensive Wealth Platforms

Platforms in this category use Open Banking to pull income, spending, debt, insurance, and investment data into a single financial dashboard. The platform then delivers personalized recommendations based on the full financial profile rather than incomplete self-reported information.

Revenue Mechanics:

Fees typically fall into the 0.50% to 1.25% AUM range for full wealth management. Higher tiers (usually $200 to $500 per month) may include:

- Human advisor access

- Automated tax-loss harvesting

- Estate and retirement planning tools

- Personalized liquidity and risk reporting

Users pay a premium because the advice is based on complete financial context rather than isolated accounts.

Example: Betterment

- Digital plan: 0.25% annually

- Premium plan: 0.40% to 0.50% annually with higher balance thresholds

Betterment manages over $36 billion in AUM and generated more than $250 million in revenue in 2023. Open Banking-powered features such as cash-flow optimization significantly improved premium tier adoption, which grew 45% year over year.

Research across the sector shows platforms offering a consolidated financial overview via Open Banking experience three times higher user engagement and roughly 25% lower churn.

3. Monetized Financial Data

This model attracts users with zero-fee trading, then monetizes through premium analytics, order routing economics, and anonymized behavioral insights. Open Banking improves data precision by showing how investment decisions relate to income cycles, savings levels, and spending behavior.

Revenue Streams Include:

- Licensing aggregated and de-identified spending trends to institutions

- Premium research subscriptions priced between $10 and $50 per month

- Payment for order flow (PFOF)

- Margin lending and securities lending

Data products are increasingly important as regulators scrutinize PFOF revenue.

Example: Robinhood

- Gold subscription: $5 per month and growing in adoption

- PFOF revenue (peak years before regulatory shifts): Around $700 million annually

- Data monetization: Estimated $50 to $100 million in emerging annual revenue

In 2023, subscription revenue reached $124 million and increased at a double-digit rate as the company emphasized advanced analytics and research tools tied to Open Banking.

Why Investors 2X Their Investments in Fintech Apps with Open Banking?

Investors are doubling down on fintech apps using Open Banking because the model feels safer, more scalable, and more data-driven. In countries that adopted Open Banking policies, investors doubled their investments in fintech startups compared to before, and that signals a clear shift in confidence.

If a platform can prove secure access to verified financial data and demonstrate faster onboarding with stronger unit economics, then investors will very likely see it as a smarter bet for long-term growth.

1. Clear Regulation Reduces Perceived Risk

Open Banking brings structure to what was once a gray area. Frameworks like PSD2 and the UK Open Banking Standard create defined rules for how financial data can be accessed, stored, and used. This regulatory clarity simplifies compliance work, reduces legal ambiguity, and gives investors confidence that the business model is permitted, scalable, and defensible.

Investor mindset: “We are not waiting to see if regulators approve this category. They already have. Now we are evaluating which team can execute best.”

2. Lower Customer Acquisition Costs

For years, onboarding in financial products was slow, frustrating, and expensive. Users uploaded bank statements, waited for background checks, and abandoned sign-up flows in large numbers.

Open Banking changes that equation. Connecting a bank account now takes seconds. Verification becomes automated, not manual. The result is a dramatic improvement in activation and conversion.

The economic investors focus on:

| Metric | Legacy Model | Open Banking Model |

| Onboarding time | 5–7 days | ~90 seconds |

| Drop-off rate | 40–60% | Under 15% |

| CAC | $100–150 | $30–50 |

These improvements create stronger unit economics from the start. That matters during valuation.

3. Real-Time Financial Data

Access to verified, permissioned financial data is no longer a luxury. It is now a foundational asset.

Traditional fintech apps rely on assumptions, surveys, and incomplete signals. Open Banking platforms operate on truth. They see spending behavior, recurring obligations, income patterns, and financial resilience in real time.

This difference drives better decisioning, deeper personalization, and higher engagement.

Observed outcomes:

- Three to five times more daily active users

- Meaningfully higher product stickiness

- Up to 40 percent reduction in churn

For investors, that translates into reduced lifetime value volatility and more predictable revenue.

4. Scalable Expansion Through API Infrastructure

Before Open Banking, expanding a fintech product into multiple markets required negotiating individual technical agreements with each bank. That process was costly, slow, and often impossible for early-stage teams.

Open Banking providers now act as abstraction layers. One integration can unlock connectivity to hundreds or thousands of financial institutions. Scaling becomes a product decision, not a legal or engineering battle.

The scaling shift looks like this:

| Scenario | Before Open Banking | After Open Banking |

| Adding 10 banks | 10 unique integrations | Configuration and test cycles |

| Time required | 6–12 months | 2–4 weeks |

| Technical debt | High | Low and predictable |

Faster expansion means capital can be deployed toward growth, not infrastructure.

5. More Revenue Streams

Open Banking is not just a cost-saver. It opens new income pathways.

With accurate data and consent-based access, fintech apps can move beyond transactional models and build deeper financial relationships.

Examples of monetization paths:

- Personalized lending or investment recommendations

- Premium analytics tiers for power users

- Risk-based pricing models using verified financial data

- B2B licensing or analytics for banks, lenders, and insurers

- Automated financial actions such as payments or budgeting services

This diversification appeals to investors because it strengthens resilience, improves margins, and increases lifetime value.

Challenges to Integrate Open Banking Into Investment Apps

Integrating Open Banking into an investment product is more than connecting bank data to an app. It requires regulatory alignment, reliable data flows, secure authentication, and infrastructure that scales across markets and banking institutions. Based on our experience building financial platforms across multiple regions, these are the most common challenges teams face and how we approach solving them.

1. API Fragmentation & Lack of Standardization

Every bank exposes data differently. Authentication workflows, payload formats, error handling, and API maturity vary widely across regions and institutions. This creates inconsistent behavior, slows development, and makes scaling a repetitive integration task.

How We Solve It:

We build a unified abstraction layer that standardizes communication across providers. Schema mapping, version handling, and fallback logic ensure your application receives structured and predictable data regardless of the bank. This approach reduces complexity and makes adding new banks significantly faster.

2. Authentication Fatigue and User Drop-Off

Regulations like PSD2 require users to reconnect their banking access periodically, often every 90 days. If the reconnection experience feels confusing or disruptive, users abandon the process and core financial features stop functioning.

How We Solve It:

We design authentication flows that prioritize user experience. Using OAuth 2.0 refresh strategies, in-app prompts, and guided reconnection screens, the process becomes smooth and predictable. Background token monitoring ensures users are notified at the right time and never during sensitive actions such as funding a portfolio.

3. Regulatory Differences Across Regions

Open Banking regulations vary across the UK, EU, US (FDX), Australia (CDR), and emerging markets. Differences affect consent handling, data access rights, reporting obligations, and feature availability. A single rigid implementation cannot serve global use cases.

How We Solve It:

We build with compliance-by-design. Modular regulatory layers adapt based on the jurisdiction, allowing you to launch in new markets without rewriting core logic. Our team continuously monitors evolving frameworks, including PSD2, GDPR, FDX, and CDR to ensure long-term compliance readiness.

4. API Downtime & Reliability Issues

Bank APIs are not always stable. Maintenance windows, throttling, outages, and latency issues can interrupt real-time features such as funding, balance visibility, or transaction categorization. When this happens, user trust can quickly erode.

How We Solve It:

We architect for resilience. Retry engines, cached fallback data, graceful degradation, and meaningful user messaging keep the platform functional during outages. Real-time monitoring alerts our engineering team so issues are addressed before users experience failure.

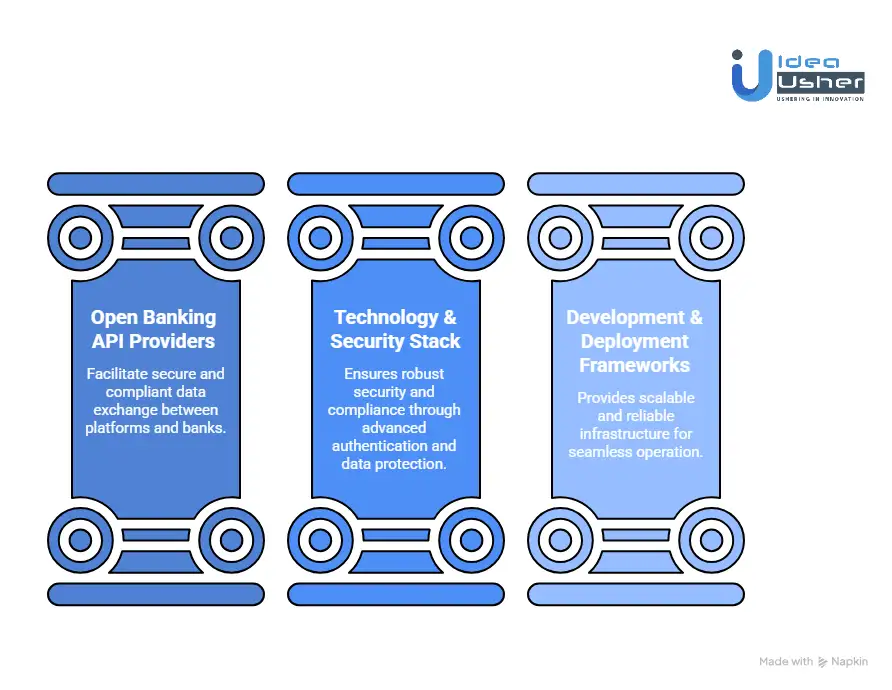

Tools & APIs for Integrating Open Banking Into Investment Apps

Building an investment platform with Open Banking capabilities requires a technology stack designed for compliance, reliability, and secure data exchange. The following breakdown covers the key components to consider when architecting your solution.

1. Open Banking API Providers

Your API provider acts as the primary bridge between your platform and financial institutions. The goal is to avoid managing multiple bank connections individually while ensuring regulatory compliance.

| Provider | Summary |

| Plaid | A leading provider in the U.S. and Canada with extensive bank coverage and strong developer support. Ideal for North American investment products. |

| TrueLayer | A strong option for Europe with full PSD2 compliance, real-time payment initiation, and high-quality data enrichment. |

| Tink | Known for one of the widest banking networks in Europe. Now part of Visa, and offers normalized financial data and reliable aggregation. |

| Belvo | Designed for the Latin American market with expanding support in Europe. Useful for transaction categorization and income verification. |

| Yapily | Focused on enterprise-grade integrations with deep compliance support and strong European market coverage. |

| FDX-based APIs (U.S.) | An emerging standardized model is improving interoperability as the U.S. Open Banking ecosystem continues to evolve. |

Selection guidance: Evaluate based on regional coverage, the need for Account Information Services (AIS), Payment Initiation Services (PIS), data enrichment expectations, and long-term operational requirements.

2. Technology & Security Stack

Security is foundational to Open Banking and influences authentication, regulatory posture, and data management.

- OAuth 2.0 & OpenID Connect: These standards power authorization and identity management. OAuth enables secure delegated access without exposing credentials, and OpenID Connect adds standardized identity verification.

- Webhook-based event processing: Webhooks provide real-time updates such as transaction confirmations or account changes without relying on continuous polling.

- ISO 20022 data formatting: A global messaging standard that streamlines interoperability and future-proofs financial data structures.

- Compliance frameworks including PCI DSS and SOC 2: While credentials often remain with the Open Banking provider, your platform still requires compliance to demonstrate secure operational handling of financial data.

Security note: Tokenize access credentials and sensitive user profile data throughout the system.

3. Development & Deployment Frameworks

The underlying infrastructure must support scale, reliability, and strong operational controls.

- Cloud platforms, including AWS, Google Cloud, or Azure: Each offers compliance-aligned environments, regional hosting, and dedicated financial services tooling.

- Docker and Kubernetes: Containerization and orchestration support consistent environments, automated scaling, and modular microservice deployments.

- Cryptography tools: Use proven libraries such as libsodium, OpenSSL, or cloud-based key management services to protect data in transit and at rest beyond standard TLS.

Architecture recommendation: Create a dedicated Open Banking gateway microservice. This isolates external integrations, simplifies maintenance, and makes switching providers or adding new ones significantly easier.

Top 5 Investment Apps with Open Banking

We spent some time digging into the market, and we found a handful of investment apps in the US that do a surprisingly good job with open banking style connectivity. These apps make funding, tracking, and automation feel smoother because the link between banking and investing is almost seamless.

1. Robinhood

Robinhood lets users link their bank accounts so they can move money in or out with ease, and once connected, the app allows instant deposits that make funding trades feel fast and seamless. It is widely used because it keeps the investing experience simple, especially for first-time investors.

2. M1 Finance

M1 Finance supports automated investing and gives users a way to move money straight from their connected bank account into custom investment portfolios. The platform feels integrated because banking, automation, and investing run together with very little manual effort.

3. Acorns

Acorns links to a user’s bank account so it can automatically round up purchases and invest the spare change, and it also allows scheduled transfers for people who want consistent saving habits. It is built for users who want an investing system that feels passive and almost invisible.

4. Webull

Webull allows users to connect their bank accounts and quickly transfer funds to begin trading stocks, ETFs, and crypto. It suits people who want a more advanced trading interface while still having a smooth and fast way to fund trades.

5. Wealthfront

Wealthfront connects directly to bank accounts and powers automated deposits that feed long-term investing portfolios with minimal user input. It works well for people who prefer automation and want an investing app that quietly manages risk, rebalancing, and cash flow.

Conclusion

Open banking is already reshaping investment platforms, turning them into smarter and more automated wealth systems that react to real user data. If you adopt it early, you position your product for the broader move toward open finance, where banking, lending, insurance, and investing data can work together securely and predictably. The upside is meaningful. You could see faster onboarding, higher deposits, stronger engagement, and revenue models that scale with user activity rather than manual operations.

Looking to Develop an Investment App with Open Banking?

Idea Usher can guide you through the full development cycle and help you build an investment app that integrates Open Banking with secure payments and seamless data access. Our team can handle architecture, compliance, smart automation, and user flows so the platform feels fast and reliable. If you want support from experts who understand both fintech and regulation, we can work with you to deploy a scalable product.

Why Partner with Us?

- 500,000+ Hours of Mastery: Our team of ex-MAANG/FAANG developers brings battle-tested expertise to your most complex technical challenges.

- Beyond Hype, Into Compliance: We focus on the hard parts: programmable compliance (KYC/AML on-chain), legal-smart contract bridges, and tamper-proof royalty oracles, so your platform is built for institutional trust, not just buzz.

- End-to-End Builders: From smart contract architecture to investor dashboards, we deliver full-stack, scalable solutions.

Check out our latest projects to see the sophisticated work we can do for you.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Open Banking is not mandatory for most investment apps, but it is becoming a smart and sometimes expected choice, especially if the platform needs real-time bank connectivity or frictionless onboarding. Many teams adopt it so they can reduce manual verification steps and improve payment accuracy without relying on outdated rails that are slow or error-prone. For regulated environments, it will often align with compliance best practices, which makes scaling easier.

A2: Integration time can vary depending on the API provider and how complex your internal architecture is, but many teams complete a basic build in a few weeks. A fully polished rollout with payment flows, reconciliation logic, and automated onboarding may take longer because it needs careful testing across banks and authentication paths. If your engineering team is already familiar with OAuth flows and financial data models, the process usually runs more smoothly.

A3: Open Banking is designed with strong layered security, so it can handle high-value transactions as long as the app follows required compliance practices and implements proper encryption and authentication. Sensitive user data is never shared without explicit consent, and payments run through regulated infrastructure rather than older systems that store credentials. When built correctly, it can sometimes be more secure than traditional card-based transactions.

A4: Open Banking can absolutely support automated investing workflows because it gives reliable access to verified financial data and allows secure account-to-account transfers. With the right implementation, recurring deposits, balance checks, portfolio rules, and triggers can run with minimal user intervention. This kind of automation helps reduce operational overhead and improve accuracy across settlement and reporting flows.