Insurance policies have always carried value, but that value has remained locked inside static contracts. Policyholders cannot easily split, transfer, or adapt coverage as circumstances change, leaving a large portion of the insurance value unused. This limitation is one reason insurance tokenization platforms are increasingly adopted, as they can introduce flexibility, automation, and transparency into policy management.

Claims processing may become faster through programmable rules. Risk exposure can be monitored more clearly across pools. Settlement can occur with fewer manual checkpoints. Tokenization reframes insurance from a rigid document into a digital asset that can be structured, divided, and tracked with precision.

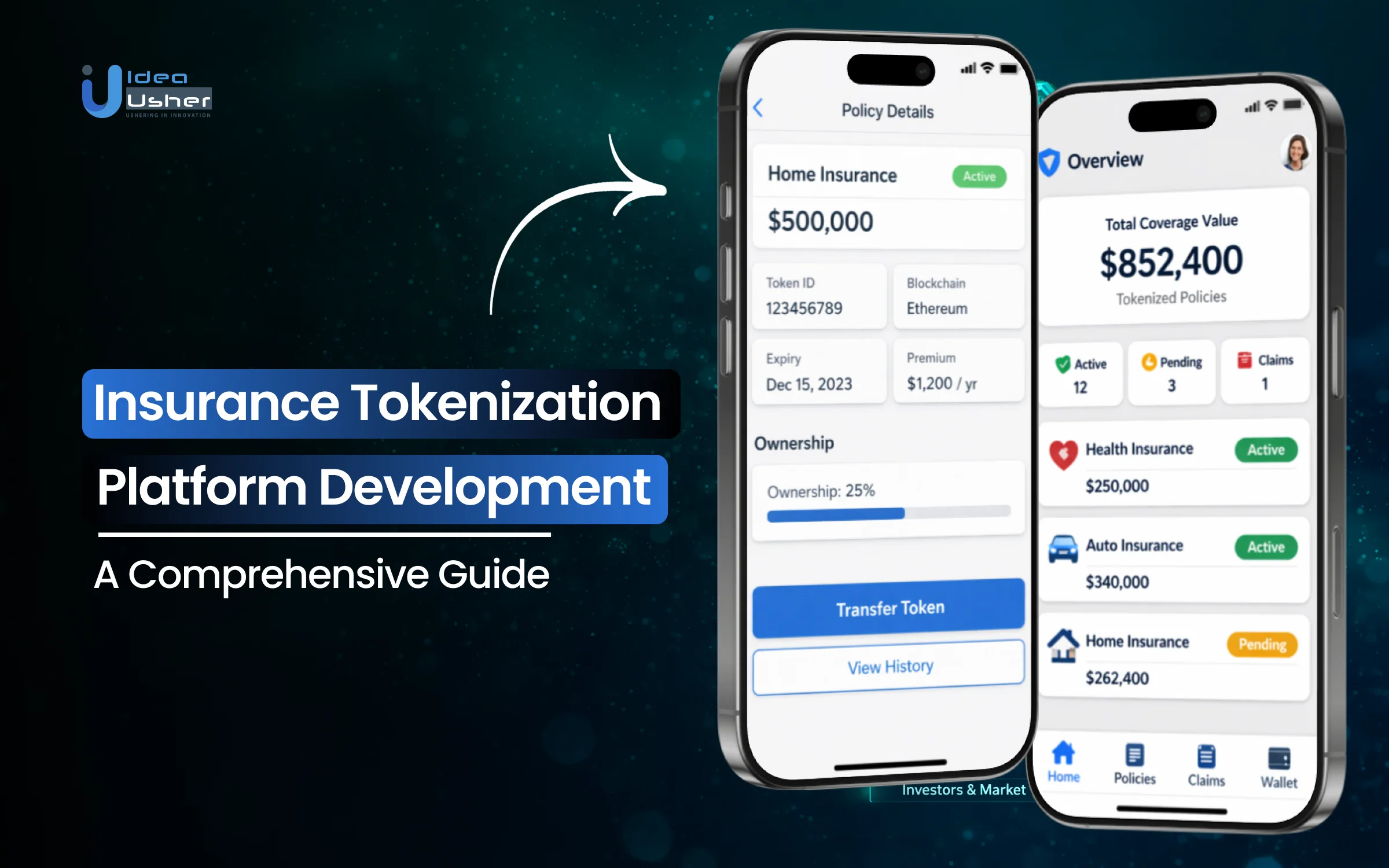

Over the years, we’ve developed several insurance tokenization solutions powered by on-chain policy tokenization frameworks and claims automation layers. Given our expertise in this space, we’re sharing this blog to outline the steps to develop an insurance tokenization platform. Let’s start!

Key Market Takeaways for Insurance Tokenization Platforms

According to Fortune Business Insights, the global tokenization market reached USD 3.95 billion in 2025 and is expected to grow rapidly through 2034, driven by rising adoption across real-world assets. This momentum is now extending into insurance, where tokenization is enabling life, specialty, and parametric policies to move on-chain. Insurers are exploring this shift to unlock new revenue models, improve capital efficiency, and deliver more transparent policy management.

Source: Fortune Business Insights

Insurance tokenization platforms are reshaping how policies are issued, serviced, and transferred. By converting insurance contracts into programmable digital assets, these platforms can support fractional exposure, secondary policy markets, and automated claims processing.

This aligns insurance more closely with the broader RWA tokenization wave, where liquidity and transparency are becoming baseline expectations rather than optional features.

A strong example is Infineo, which has tokenized roughly USD 125 million in life insurance policies within a short timeframe. Built on the Provenance Blockchain, the platform creates verifiable on-chain records while keeping sensitive personal data encrypted off-chain.

By enabling hashed policy fingerprints, automated beneficiary notifications, and future secondary-market layers, the platform demonstrates how insurance can evolve from an illiquid contract into a financeable digital asset class.

What Is an Insurance Tokenization Platform?

An insurance tokenization platform is a digital system that converts insurance policies or coverage components into blockchain-based tokens, making them programmable and traceable. Instead of treating a policy as a static document, the platform represents coverage, premiums, and claims logic as on-chain assets that can automate compliance checks, trigger payouts through smart contracts, and provide real-time visibility into risk and ownership.

Types of Insurance Tokenization Platforms

Insurance tokenization platforms generally focus on different layers of the insurance value chain. Some may tokenize policies or coverage logic, while others may automate payouts or distribute risk on-chain. In more advanced models, reinsurance and claims flows may also be handled through programmable contracts.

1. Policy Tokenization Platforms

These platforms convert full insurance policies or coverage rights into digital tokens. Each token represents ownership or entitlement to a policy, making policies easier to transfer, split, or manage while keeping terms enforced by smart contracts.

Example: Infineo tokenizes existing life insurance policies, turning them into programmable digital assets while keeping sensitive data off-chain and ownership verifiable.

2. Parametric Insurance Tokenization Platforms

These focus on event-driven insurance where payouts are triggered automatically by predefined conditions such as weather data or flight delays. Tokens encode payout rules so claims can settle instantly when trusted data sources confirm the event.

Example: Etherisc builds parametric insurance products where smart contracts release payouts instantly based on oracle-verified data such as flight delays or weather conditions.

3. Fractional Insurance Ownership Platforms

These platforms allow large insurance contracts to be divided into smaller tokenized units. Investors or reinsurers can hold fractional exposure to premiums and risk, thereby improving capital efficiency and secondary-market liquidity.

Example: Nayms allows insurance risk and underwriting positions to be tokenized, letting multiple capital providers hold fractional exposure to premiums and liabilities.

4. Reinsurance Tokenization Platforms

Designed for insurers and reinsurers, these platforms tokenize risk-sharing agreements. Tokens represent portions of reinsured risk, enabling transparent exposure tracking, automated settlements, and faster reconciliation between parties.

Example: Nayms is also used by reinsurers to structure on-chain risk transfer, improving transparency and settlement speed across reinsurance layers.

5. Claims and Payout Automation Platforms

These platforms tokenize claims workflows rather than policies themselves. Smart contracts manage claim validation, approval, and payout distribution, reducing manual intervention and operational delays.

Example: InsurAce automates claim assessment and payouts on-chain, reducing manual processing while keeping rules transparent and enforceable.

Standout Features of an Insurance Tokenization Platform

In the best tokenized insurance platforms, users can actually see and control how coverage behaves instead of trusting hidden systems. You might adjust risk exposure dynamically and track value flows in real time while capital moves transparently across pools.

It should feel like managing a living financial instrument rather than holding a static policy document.

1. The Policy Dashboard NFT

A dynamic, interactive NFT that serves as your live policy document, certificate of insurance, and claims portal all in one visual interface. It updates automatically as policy conditions change, ensuring the user always sees the current coverage status.

How Users Interact With It

Instead of receiving a static PDF, policyholders receive a minted NFT directly in their digital wallet. The NFT visually displays the current policy status, interactive coverage limits, an embedded claim initiation option, and historical performance data for investment-linked policies, all of which update in real time as conditions change.

2. Parametric Trigger Flight Simulator

An interactive simulation tool that lets users model what-if scenarios for parametric coverage before purchase. The simulator reflects real Oracle logic used in live policies rather than hypothetical estimates.

How Users Interact With It:

Before purchasing coverage, users enter location data, adjust trigger thresholds using visual controls, and simulate historical event data to see how different conditions would affect payouts over time, allowing them to fine-tune coverage parameters with confidence.

3. Risk Pool Visualization and Entry Portal

A live, interactive dashboard showing available risk pools where users can deploy capital as micro reinsurers. Each pool reflects real-time underwriting performance rather than static historical summaries.

How Users Interact With It:

Capital providers browse available risk pools using real-time performance metrics, select pools that match their risk preferences, and stake funds directly through an integrated wallet, with their position updating continuously as premiums accrue and claims are settled.

4. Cross-Chain Coverage Bridge

A one-click interface that lets users migrate or duplicate coverage across different blockchain ecosystems. Coverage terms remain cryptographically consistent across chains through standardized policy metadata.

How Users Interact With It:

Users open the bridge module from their dashboard, select a destination blockchain, approve the transaction, and receive an equivalent wrapped policy token on the new network, preserving the original coverage terms and policy logic.

5. Community Governance Dashboard

An integrated voting and proposal system where token holders collectively decide on platform parameters. Governance actions are executed on-chain to ensure decisions directly affect live system behavior.

How Users Interact With It:

Participants submit proposals, vote on platform changes, adjust economic parameters, or delegate voting power to specialists; all governance activity is recorded on-chain and reflected in platform behavior once approved.

Users move from being passive consumers to active stakeholders, aligning platform evolution with real usage and market demand.

6. Real-Time Claims Transparency Map

An anonymized, live global map displaying parametric trigger activations and claims payouts. The map updates directly from Oracle confirmations and settlement smart contracts.

How Users Interact With It:

Users observe live trigger events on a global map, inspect anonymized payout flows, and drill into specific events to view verification data, timestamps, and settlement speed, allowing them to compare real-world events against their own coverage conditions.

This level of visibility builds systemic trust by showing claims execution in real time rather than after the fact.

7. Embedded DeFi Integration Hub

A built-in module that lets users leverage their insurance positions across decentralized finance protocols. Insurance assets retain their protection status even when used within DeFi workflows.

How Users Interact With It:

Within their policy dashboard, users select available DeFi options, approve transactions to use their policy as collateral or to yield-bearing assets, and maintain continuous coverage while unlocking liquidity from previously illiquid insurance positions.

Insurance shifts from a sunk cost into a programmable financial asset that supports liquidity, leverage, and capital efficiency.

How Does an Insurance Tokenization Platform Work?

An insurance tokenization platform converts a policy into a programmable digital asset stored on a blockchain. The policy logic is encoded in smart contracts, which can automatically validate events and execute claims based on verified external data.

1. Policy Creation & Token Minting

The process begins off-chain with familiar steps, including quoting, underwriting, and customer onboarding, with KYC and AML checks. The transformation happens immediately after acceptance.

Smart Contract Authoring

The policy’s core parameters, including premium, coverage terms, payout conditions, and expiration, are encoded into a smart contract. This contract becomes the immutable logic of the agreement.

Token Minting

Once the customer accepts the policy, the platform mints a unique Non-Fungible Token or a fungible token. This token represents the policy itself or a proportional share in a broader risk pool. It acts as a digital deed of ownership and entitlement recorded on the blockchain.

Privacy Layer

Sensitive personally identifiable information is never stored on the public ledger. It remains in encrypted off-chain storage. Only a cryptographic hash or a Zero Knowledge Proof is linked to the token, allowing validity to be verified without exposing private data.

2. The Oracle Layer

A tokenized policy must be able to detect when a real-world, claimable event occurs. This responsibility sits with the oracle layer, which acts as secure middleware between external data sources and the blockchain.

- For a flight delay insurance product, oracles pull data from certified aviation databases.

- For crop insurance, they may aggregate data from weather satellites, government feeds, and on-farm IoT sensors.

A decentralized oracle network relies on multiple independent data sources and consensus mechanisms. This ensures that the data triggering a large payout is accurate, verifiable, and resistant to manipulation.

3. Claims Processing

This layer replaces traditional claims bureaucracy with deterministic execution.

Parametric Triggers

For objective insurance products, the smart contract continuously monitors oracle data. When a predefined condition is met, such as wind speed exceeding a threshold, the claim is automatically validated.

Zero Touch Payout

Once validated, the contract executes the payout logic. Funds in the form of stablecoins or tokenized fiat move instantly from the insurer’s or risk pool’s wallet to the policyholder’s wallet. Settlement happens atomically without paperwork, intermediaries, or waiting periods.

Disputed or Complex Claims

For subjective claims, the platform can integrate a decentralized dispute resolution module. Verified claims assessors or approved jurors review evidence and vote on outcomes. Every decision and data point is immutably recorded on-chain.

4. Capital Management & Secondary Liquidity

This layer transforms insurance from a purely service-based offering into a financial asset class.

Risk Pool Tokenization

An insurer can tokenize an entire portfolio of similar policies, such as regional catastrophe coverage, into a fungible token pool comparable to traditional insurance-linked securities.

Fractional Ownership

The pool can be divided into millions of micro shares and offered to institutional or retail investors through compliant marketplaces. This introduces liquidity and diversified capital into insurance markets that were previously difficult to access.

Collateral Utility

Tokenized risk pools may also be used as collateral in decentralized finance protocols. This unlocks additional financial utility from capital reserves that were historically idle.

5. The Regulatory & Audit Layer

Every action on the platform is recorded as an immutable and timestamped blockchain transaction. This includes policy issuance, premium payments, claim triggers, and secondary token transfers.

The result is a single source of truth shared across insurers, reinsurers, regulators, and policyholders.

Compliance logic is embedded directly into smart contracts. Jurisdictional rules can, by design, restrict token transfers to approved wallets or compliant jurisdictions. Real-time auditing becomes possible, significantly reducing regulatory friction and operational overhead.

How to Develop an Insurance Tokenization Platform?

Developing an insurance tokenization platform starts by modeling real insurance policies into programmable contracts that can reliably execute coverage and payouts. The system should then embed compliance logic and trusted data feeds so claims can be verified and settled accurately.

We have developed multiple insurance tokenization platforms, and this is the structured approach we follow.

1. Policy & Risk Design

We begin by translating insurance policies into structured digital templates. Coverage rules, exclusions, limits, and payout conditions are converted into programmable logic that reflects real underwriting models. Risk parameters are designed to remain flexible, allowing products to evolve without compromising contract integrity.

2. Compliance Architecture

Regulatory requirements are embedded directly into the smart contract layer. We enforce jurisdiction-specific rules, eligibility checks, and reporting logic at the protocol level, ensuring every policy action is compliant by design rather than through manual oversight.

3. Oracle & Data Layer

We connect on-chain insurance logic to real-world events through a secure data layer. Multiple oracle sources, IoT feeds, and trusted APIs are integrated to validate claim triggers. Redundancy and verification logic ensure data accuracy and resilience.

4. Privacy & Identity

Sensitive insurance data is protected using encrypted off-chain storage and controlled on-chain references. We apply selective disclosure and zero-knowledge mechanisms so identity and policy details are shared only with authorized parties while meeting compliance needs.

5. Capital & Liquidity

Tokenized capital pools are structured to support underwriting and reinsurance. Fractionalization allows risk to be shared across participants while smart contracts manage exposure, yield distribution, and loss events. Liquidity logic is designed to remain compatible with compliant secondary markets.

6. Integration & Governance

The platform integrates with existing insurance systems via secure APIs and middleware. Policy systems, CRMs, ERPs, and reporting dashboards remain in sync. Governance frameworks define upgrade processes, parameter controls, and dispute handling to support long-term operation.

What Role Does Reinsurance Play in a Tokenized Insurance Ecosystem?

Reinsurance in a tokenized insurance ecosystem quietly becomes the system that keeps risk flowing and capital responsive. Instead of slow, manual treaties, risk can be split into tokens and shared across global pools, with settlement occurring automatically when triggers are met.

From Bilateral Backstop to Dynamic Risk Marketplace

Traditionally, reinsurance involves one insurer transferring portions of its risk portfolio to a reinsurer through negotiated treaties. This model is essential for risk distribution and capital protection, but it is slow, opaque, and restricted to institutional participants.

Tokenization reshapes this model by turning reinsurance into an open, programmable, and capital market-driven system.

1. The Liquidity Engine

Tokenization enables large, illiquid reinsurance exposures to be broken into fractional risk tokens. Each token represents a defined share of a specific risk pool, such as coastal property exposure or agricultural yield risk.

- New capital enters the market: Hedge funds, family offices, and accredited individual investors can participate directly in reinsurance capital pools that were previously inaccessible.

- Continuous price discovery: Risk tokens can trade on secondary marketplaces, enabling real-time pricing and liquidity for assets that were once locked for years.

A practical illustration of this model is Nexus Mutual. While it is not a traditional reinsurer, its pooled capital structure demonstrates how fractional risk sharing works in practice.

Each underwriting decision distributes exposure across token holders, effectively functioning as a micro reinsurance layer where exposure can be adjusted through token positions.

2. The Automated Backbone

In a tokenized ecosystem, reinsurance agreements are implemented as smart contracts rather than static legal documents.

- Deterministic execution logic: Risk transfer rules, premium flows, and payout conditions are encoded directly into smart contracts. When a predefined parametric trigger is met, settlement executes automatically.

- Near instant settlement: Claims that traditionally require months or years of adjustment and negotiation can be settled in minutes once objective conditions are verified.

The architecture demonstrated by Etherisc illustrates this clearly. Its parametric insurance systems trigger payouts based on verified external data such as satellite or weather feeds.

Applied to reinsurance, this same logic enables automatic cascading payouts from tokenized risk pools to primary insurers without manual intervention.

3. The Capital Efficiency Optimizer

Tokenized reinsurance enables insurers to access capital with greater precision and timing than traditional treaties can.

On-demand risk financing

Instead of locking into annual agreements, insurers can tokenize individual risk portfolios and raise reinsurance capital dynamically as underwriting demand fluctuates.

Composable collateral

Tokenized reinsurance positions can be integrated into decentralized financial systems, enabling capital reuse as programmable collateral and improving overall capital efficiency across the ecosystem.

4. The Data Integrity and Transparency Layer

Every risk transfer, exposure change, and payout is recorded on an immutable ledger, creating a single shared source of truth.

- For regulators: Continuous visibility into aggregate exposure, capital adequacy, and systemic risk concentration.

- For investors: Auditable performance data for each risk pool, enabling better pricing models and more informed allocation decisions.

- For insurers: Elimination of reconciliation friction between multiple counterparties, systems, and reporting formats.

The Reimagined Reinsurance Value Chain

| Traditional Role | Tokenized Ecosystem Role |

| Reinsurer | Risk originator and structurer that packages and tokenizes risk pools |

| Institutional investor | Risk token holder with fractional exposure |

| Broker and intermediary | Smart contract and market protocol |

| Claims adjuster | Decentralized oracle network |

How Ownership Works in a Tokenized Insurance Policy?

In a tokenized insurance policy, ownership works by linking coverage rights to a blockchain token that can be held or custodied. The policyholder may directly control the token and can verifiably trigger claims when conditions are met. In some models, the insurer may hold custody while the policyholder still legally owns coverage and benefits through programmable rules.

1. The Policyholder as Token Holder

In the most common decentralized model, the policyholder is the token’s direct owner. The token is held in their personal digital wallet and grants specific rights encoded in the smart contract.

- The Right to Coverage: The token acts as cryptographic proof of an active insurance policy.

- The Right to Claims: It enables the holder to initiate claims or receive automated parametric payouts.

- Portability and Control: The policyholder truly owns their insurance history. They control access, can prove coverage without intermediaries, and in some models may transfer or sell the policy to another eligible party, subject to regulatory rules embedded in the smart contract.

2. The Insurer as Custodian or Issuer

In a more enterprise-focused adoption model, the insurer may retain custody of the token on behalf of the policyholder.

- Insurer’s Role: Acts as the token issuer and custodian while managing private keys. This provides stronger compliance control and a familiar user experience.

- Policyholder’s Position: The policyholder does not directly hold the token but has a legally enforceable right linked to a sub-token or a permissioned ledger entry.

- Legal Clarity: This structure aligns more closely with existing insurance regulations, which require insurers to maintain records and retain control over the policy lifecycle.

Fractional and Shared Ownership

Tokenization enables shared ownership of a single policy’s economic components, which was not possible in traditional insurance.

Risk vs Benefit Separation

A policy can be structured so that the policyholder holds a Coverage NFT that represents the right to claim, while investors hold Risk Fractionalization Tokens that represent shares of premiums and liabilities.

Reinsurance Reinvented

When insurers tokenize portfolios to transfer risk, ownership of financial liability is distributed across reinsurers or capital market participants. The insurer may still control the client relationship token, while risk tokens are owned by multiple capital providers.

Legal vs On-Chain Ownership

Blockchain tokens represent cryptographic ownership, but their legal enforceability depends on how they map to real-world insurance contracts.

How Platforms Bridge the Gap

- Smart Contracts as Legal Companions: Smart contracts mirror and execute the terms of legally binding agreements stored off-chain. Platforms like Nexus Mutual use a discretionary mutual structure where tokens represent membership and governance rights in a collectively owned risk pool.

- Regulatory Identity Binding: KYC, AML, and decentralized identity mechanisms ensure that only the legally approved policyholder can control the token, aligning legal ownership with on-chain control.

A New Trinity of Ownership

In a mature tokenized insurance ecosystem, ownership is no longer binary. It resolves into three distinct layers.

| Ownership Type | Typically Held By | What It Represents |

| Legal or Contractual Right | Policyholder or Insurer | The enforceable right to coverage under jurisdictional law |

| Cryptographic Asset | Wallet holder or Custodian | The blockchain token that triggers and receives benefits |

| Economic Interest | Policyholder, Insurer, Investors | The financial upside from premiums and downside from risk |

Popular Business Models for Insurance Tokenization Platforms

Popular business models for insurance tokenization platforms usually focus on turning policies and risk pools into programmable digital assets. A platform may quietly earn through licensing, transaction flows, or risk capital participation while insurers and investors interact on the chain.

1. The Platform-as-a-Service

The platform provider offers a modular and configurable suite of smart contracts, oracle integrations, compliance modules, and user interface dashboards. The client, such as a legacy insurer, pays licensing fees, setup costs, and a small transaction fee per policy issued or claim processed.

Revenue Streams and Justification:

- Annual SaaS Licensing Fee: Ranges from $250,000 to $1M or more for enterprise clients, covering access to the core platform and updates.

- Setup and Integration Fee: A one-time implementation cost for customizing products and integrating with the client’s legacy systems.

- Transaction Fee Gas and Service: A percentage between 0.5 percent and 2 percent of the premium or payout value processed through smart contracts.

Example: Evertas

Evertas operates in a similar B2B2C space as a crypto insurance pioneer. They identified a significant coverage gap for digital assets, estimating that institutional cryptocurrency custody would require over $20 billion in insurance. Their business model relies on premium fees and specialized risk assessment services.

2. The Parametric Insurance Marketplace Model

The platform develops or partners with insurers to offer parametric insurance products such as flight delay, earthquake, or drought coverage. These products are sold directly to consumers or small businesses through a decentralized application.

Revenue Streams and Justification:

- Premium Commission: The platform takes a percentage of every premium sold, typically between 10 percent and 25 percent.

- Transaction or Network Fees: A small fixed fee per payout transaction.

Example: Etherisc

Etherisc is a decentralized insurance protocol hosting parametric products such as flight delay and hurricane protection. Premiums typically range from $5 to $30, with payouts between $100 and $500 or more. At a 15 percent commission on a $20 average premium, the platform earns $3 per policy.

3. The Reinsurance and ILS Liquidity Pool Model

The platform collaborates with insurers and reinsurers to securitize risk portfolios, such as catastrophe bonds. These portfolios are tokenized into fungible units and offered to institutional and accredited retail investors.

Revenue Streams and Justification:

- Structuring and Issuance Fees: Typically between 1 percent and 3 percent of total capital raised.

- Annual Platform Management Fee: Between 0.5 percent and 1.5 percent of assets under management.

- Trading Fees: A fee between 0.1 percent and 0.3 percent on secondary market trades.

Example: Solidum

The global insurance-linked securities market exceeded $100 billion in outstanding capital prior to 2023. Platforms like Solidum aim to tokenize this market by partnering with traditional ILS funds.

Capturing just 1 percent of this market or $1 billion in assets under management enables a platform to generate $10 million annually from management fees alone, excluding issuance and trading revenue.

Top 5 Insurance Tokenization Platforms

We studied how insurance value is moving on-chain and reviewed platforms that are building usable tokenization layers. After that research, a few insurance tokenization platforms stood out because of how they handle compliance, asset structure, and lifecycle logic.

1. Securitize

Securitize provides regulated tokenization infrastructure that insurance and financial firms can use to issue compliant digital assets backed by real-world assets. Its strength lies in investor onboarding, transfer agent services, and secondary trading support, which makes it suitable for structured insurance and risk-linked products that must operate within U.S. regulatory frameworks.

2. Infineo

Infineo focuses directly on insurance tokenization by converting life insurance policies into on-chain digital assets. These tokenized policies can be tracked transparently while sensitive data remains off-chain, enabling secondary markets, collateral use, and more flexible ownership of traditionally illiquid insurance instruments.

3. Nexus Mutual

Nexus Mutual is a decentralized insurance protocol that uses tokenized membership and governance to manage shared risk pools. While it is DeFi-native, it demonstrates how insurance coverage, claims assessment, and capital allocation can be handled through tokenized structures that many U.S. users and builders actively participate in.

4. Etherisc

Etherisc operates as a decentralized marketplace where parametric insurance products are issued as smart contracts and funded through tokenized risk pools. Insurance products, such as flight delay or weather coverage, are deployed on-chain, enabling capital providers and users to participate directly in underwriting and payouts.

5. Vertalo

Vertalo provides tokenization and compliance infrastructure to support the issuance of regulated assets, including insurance-adjacent financial products. Handling cap tables, investor records, and transfer controls, it enables insurance tokenization initiatives to remain audit-ready and aligned with U.S. regulatory expectations.

Conclusion

Insurance tokenization platforms are steadily changing how risk capital and trust flow through the insurance stack. For platform owners and enterprises, this may be the moment to move beyond manual processes and build systems that automate underwriting, settlement, and liquidity at scale. With a regulatory-first design and a strong technical foundation, insurance tokenization can become a durable infrastructure rather than a passing experiment.

Looking to Develop an Insurance Tokenization Platform?

IdeaUsher can help design an insurance tokenization platform by structuring policies and cash flows as compliant on-chain assets. Our team may carefully build smart contract logic for issuance servicing and automated payouts.

Our team of ex-MAANG/FAANG developers (with 500,000+ hours of coding experience) builds insurance tokenization platforms that transform static policies into dynamic, programmable assets.

Here’s what we deliver:

- Compliance-by-Design Architecture – Smart contracts built with regulatory frameworks baked in

- Zero-Touch Claims Processing – Oracle-powered parametric triggers for instant payouts

- Cross-Chain Interoperability – Liquidity that moves across blockchain ecosystems

- Privacy-Preserving Tech – Zero-knowledge proofs for GDPR/HIPAA compliance

- Secondary Market Enablement – Fractional ownership and capital mobility built in

Check out our latest projects to witness how we turn insurance innovation into executable code.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Development typically begins by defining which insurance assets or risks will be tokenized and how they will be legally treated. The platform should then be designed with smart contracts that encode policy rules, payouts, and ownership logic. A regulatory first architecture with secure data layers may help ensure the system scales without compliance issues.

A2: An insurance tokenization platform converts insurance policies or risk pools into digital tokens governed by smart contracts. These contracts can automate premium collection, claims validation, and payouts based on predefined conditions. The result is a system that enables faster execution with less manual intervention.

A3: Core features typically include policy issuance modules, smart-contract-based claims processing, and on-chain ownership tracking. Risk pools and liquidity management tools may allow capital to flow efficiently across participants. Strong identity compliance and auditability features are essential for trust.

A4: The cost can vary based on the regulatory scope, technical depth, and integration requirements. A basic platform focused on a single insurance product may require a moderate investment, while an enterprise-grade system can cost significantly more. Factors such as compliance, automation, security audits, and scalability will strongly influence the final budget.