Gold-backed digital assets are often positioned as a bridge between the stability of physical gold and the efficiency of blockchain systems. Behind that promise, however, lie practical challenges around custody verification, ownership mapping, redemption guarantees, and regulatory alignment. These realities define gold-backed token development, where maintaining trust depends on how closely technical design reflects real-world constraints.

At the system level, delivering stability depends on a tightly coupled infrastructure that links physical reserves with on-chain logic. This includes vault integrations, proof of reserves, smart contracts that govern issuance and transfers, and controls for audits and redemptions. Security, transparency, and compliance are not optional layers, but foundational elements that determine how reliably the asset functions under market conditions.

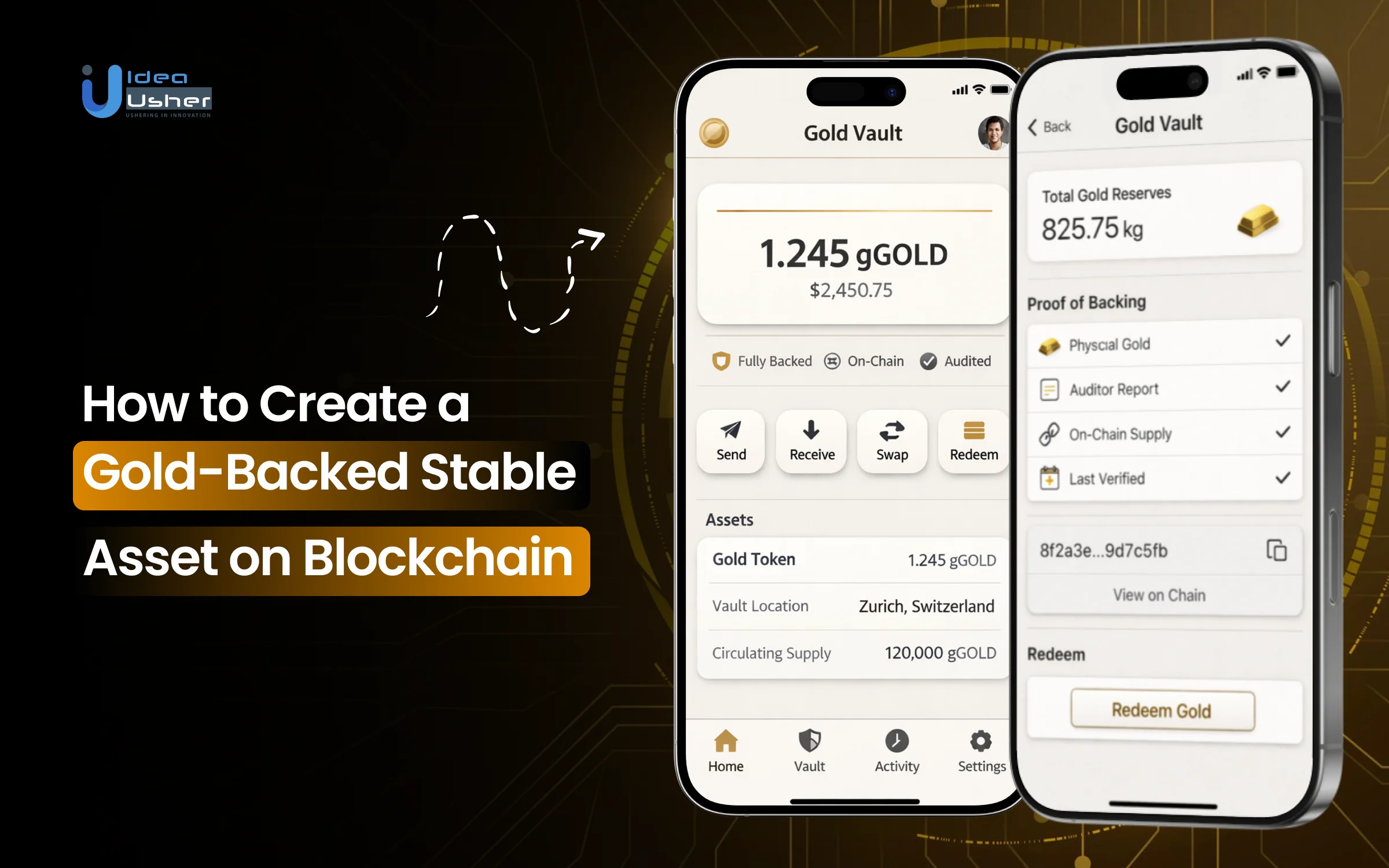

In this blog, we explain how to create a gold-backed stable asset on blockchain by breaking down the key components, technical workflows, and operational considerations involved in building a stable and trustworthy digital representation of physical gold.

What Is a Gold-Backed Asset Tokenization Platform?

A gold-backed asset tokenization platform is a digital system that creates blockchain assets tied to physical gold. It links verified gold reserves stored securely to digital tokens representing ownership or value, each corresponding to a specific gold amount, ensuring stability with the real commodity.

The platform manages the entire lifecycle of the gold-backed asset, including gold verification, custody, token issuance, ownership, redemption, and audits. Blockchain guarantees transparency and traceability, with governance and compliance controls ensuring asset integrity and reliability.

- Asset-backed token issuance framework that enforces one-to-one alignment between token supply and physical gold reserves

- Custody-integrated reserve management system that synchronizes vault holdings with on-chain records

- Smart contract–driven issuance and redemption logic that automates supply controls and asset settlement

- On-chain ownership and transaction traceability layer that enables continuous verification of token circulation

- Audit and reconciliation infrastructure that supports reserve validation and supply transparency

- Governance and compliance orchestration layer that manages operational controls and policy enforcement

Core Components of a Gold-Backed Tokenization Platform

A gold-backed tokenization platform relies on secure custody, smart contracts, compliance frameworks, and transparent audits to connect physical gold with digital tokens, showcasing the essential structure behind reliable asset-backed systems.

| Platform Component | Primary Function | Why It Matters |

| Physical gold verification layer | Confirms gold purity, weight, and authenticity before token issuance. | Ensures that every issued token is backed by real and qualified gold. |

| Secure custody and vault integration | Stores verified gold in insured and regulated vaults. | Protects physical reserves and maintains asset backing integrity. |

| Reserve-to-token mapping system | Links each digital token to a defined quantity of stored gold. | Maintains one-to-one alignment between token supply and physical reserves. |

| Blockchain issuance infrastructure | Issues and manages gold-backed tokens on a blockchain network. | Enables transparent ownership tracking and secure asset transfers. |

| Smart contract control layer | Automates issuance, transfers, and redemption logic. | Enforces asset rules consistently and reduces operational risk. |

| Redemption and settlement framework | Enables conversion of digital tokens into physical gold. | Reinforces credibility and long-term trust in the asset. |

| Audit and reconciliation mechanism | Verifies alignment between circulating tokens and gold reserves. | Supports accountability, transparency, and compliance readiness. |

How a Gold-Based Asset Tokenization Platform Works?

A gold-based asset tokenization platform converts physical gold into blockchain-backed digital tokens, enabling fractional ownership, transparency, and secure trading. This overview outlines the core operational framework.

1. Physical Gold Qualification and Custody Acceptance

The platform begins by qualifying physical gold through purity certification, weight validation, and ownership verification. Only custody-approved gold enters the system, with each batch assigned a unique reserve reference tied to vault records.

2. Reserve Registration and Issuance Control Setup

Verified reserves are registered within the platform’s internal reserve ledger. Issuance controls define exact reserve-to-token conversion logic, enforce supply ceilings, and lock issuance permissions until custody confirmation remains continuously valid.

3. Controlled Token Issuance and Circulation Tracking

The platform issues tokens strictly against registered reserves and tracks real-time token circulation, ownership changes, and supply state on-chain. Circulation remains constrained by issuance rules linked to physical reserve availability.

4. Redemption Validation and Physical Gold Release

When redemption requests occur, the platform validates token ownership, eligibility conditions, and settlement thresholds. Approved requests trigger coordinated physical gold release while simultaneously reducing on-chain token supply.

5. Post-Settlement Reserve Reconciliation

After physical settlement, the platform performs reserve-to-supply reconciliation to confirm that remaining gold holdings accurately match circulating tokens. Only after validation does the system allow further issuance or redemption activity.

How Does a Gold-Backed Stable Asset Maintain Price Stability?

A gold-backed stable asset maintains price stability via physical gold reserves and strict issuance, redemption, and verification. Stability depends on real assets and controls, not just market algorithms, ensuring digital supply matches physical value.

1. Physical Gold as the Value Anchor

The asset derives stability from physical gold reserves held in secure custody. Each unit of the digital asset represents a defined quantity of gold, which anchors price behavior to established gold market valuations rather than speculative demand.

2. Controlled Token Issuance

The platform enforces strict issuance limits tied to verified gold reserves. Tokens enter circulation only after custody confirmation, which prevents oversupply and protects the asset from dilution-driven price fluctuations.

3. Redemption-Based Price Correction

Redemption mechanisms allow holders to exchange digital assets for physical gold. This redemption linkage creates a natural price correction mechanism by discouraging excessive deviation from the underlying gold value.

4. Continuous Reserve Reconciliation

Ongoing reconciliation ensures the circulating supply always reflects available reserves. Reserve-to-supply validation reduces uncertainty and reinforces market confidence, which contributes directly to price stability.

5. Transparent Supply and Ownership Visibility

Blockchain-based records provide real-time visibility into token supply and circulation. Transparent data allows markets to assess backing accuracy, reducing speculation-driven volatility.

6. Governance Over Supply Adjustments

Defined operational rules govern when issuance pauses, resumes, or adjusts. Supply discipline frameworks prevent reactive or arbitrary changes that could destabilize asset pricing.

Why Is Tokenized Gold Trading Growing 6x Faster Than Traditional Gold?

The tokenization market was valued at USD 2.03 billion in 2021 and is expected to grow to USD 13.53 billion by 2030, with a CAGR of 24.09%. This surge is fueled by investors embracing enterprise blockchain-based gold trading platforms that leverage gold’s stability alongside the liquidity of digital tokens.

Tokenized gold trading has rapidly grown, surpassing $1 billion in market cap for assets like PAX Gold (PAXG) and Tether Gold (XAUT) as of October 2025, doubling from under $500 million the previous year.

This indicates a 6x growth rate, significantly surpassing the expansion of traditional gold ETFs such as SPDR Gold Shares (GLD) or iShares Gold Trust (IAU).

Investors are attracted to fractional ownership, which involves trading tokens that represent less than a gram of gold. This, combined with around-the-clock global trading, has transformed how both retail and institutional investors perceive gold as an asset.

A. Structural Advantages Over Traditional Gold Markets

Tokenized gold platforms redesign market structure to suit modern trading behavior and digital finance ecosystems.

- Always-on market access: Tokenized gold trades continuously without reliance on limited exchange hours or physical market schedules, increasing participation frequency and volume.

- Lower entry and transaction friction: Digital ownership eliminates physical handling, transport, and storage coordination, reducing time and cost barriers associated with traditional gold trading.

- Faster settlement cycles: Blockchain-based settlement completes ownership transfers quickly, replacing multi-day clearing processes common in conventional gold markets.

- Fractional trading capability: Market participants trade smaller gold units efficiently, expanding demand beyond institutional buyers.

B. Alignment With Digital Asset and Capital Market Trends

Tokenized gold integrates naturally into evolving digital finance and investment environments.

- Compatibility with digital asset platforms: Tokenized gold operates within blockchain ecosystems already used for trading, custody, and portfolio management, increasing visibility and liquidity.

- Improved capital efficiency: Digital gold assets move easily across platforms, enabling faster redeployment of capital compared to physical gold holdings.

- Transparent supply and ownership data: On-chain visibility reduces information gaps, which supports confident trading decisions and higher transaction velocity.

- Global participation without physical constraints: Tokenized gold enables cross-border trading without logistics delays, expanding market reach and accelerating adoption.

Gold asset tokenization grows faster than traditional gold because it aligns gold ownership with modern market expectations. Continuous access, faster settlement, and transparent supply transform gold from a static asset into an actively traded digital instrument.

The Role of Blockchain in a Gold Tokenization Platform

Blockchain is the core layer linking physical gold reserves with digital systems. It ensures accurate ownership records, controlled issuance, transparent verification, and efficient settlement, reducing reliance on manual coordination and centralized records.

1. Immutable Ownership and Transaction Records

Blockchain maintains tamper-resistant ownership records that log every token issuance, transfer, and redemption. This immutability prevents unauthorized changes and ensures historical traceability across the full lifecycle of the gold-backed digital asset.

2. Enforced Reserve-to-Token Integrity

Blockchain systems support rule-based issuance controls that restrict token creation to verified reserve conditions. These controls help maintain strict alignment between circulating digital assets and physical gold held in custody.

3. Transparent Supply and Circulation Visibility

On-chain data provides real-time visibility into token supply and movement. This transparency allows operators, auditors, and participants to independently verify circulation status without relying on delayed or manually prepared reports.

4. Automated Execution of Asset Workflows

Blockchain enables automated execution of issuance, transfer, and redemption logic through predefined operational rules. Automation reduces human error and ensures consistent enforcement of platform policies throughout asset operations.

5. Faster Settlement Without Physical Movement

By recording ownership changes directly on-chain, blockchain allows digital settlement within minutes. Physical gold remains securely stored while the platform completes asset transfers efficiently and reliably.

6. Foundation for Audit and Proof-of-Reserve Processes

Blockchain records support continuous reconciliation and audit processes by providing a single source of verifiable transaction data. This foundation simplifies reserve validation and strengthens long-term operational accountability.

Key Features of Gold-Backed Asset Tokenization Platform

A gold-backed asset tokenization platform integrates secure custody, smart contracts, and transparent audits. These elements support effective gold-backed token development, showcasing how physical gold is represented within blockchain systems.

1. Verified Gold Reserve Management

The platform must manage verified physical gold reserves with clear records for purity, weight, and storage location. This feature establishes asset authenticity and creates a reliable foundation for issuing blockchain-based gold-backed assets.

2. One-to-One Token Backing Enforcement

A robust control mechanism must enforce one-to-one reserve alignment between issued tokens and stored gold. This enforcement prevents over-issuance and preserves price stability across the digital asset lifecycle.

3. Secure Custody Integration

The platform should integrate directly with regulated vault and custody providers. This integration enables accurate reserve monitoring, inventory reconciliation, and secure coordination between physical gold holdings and digital token supply.

4. Smart Contract-Based Token Issuance

Smart contracts must govern token issuance and redemption logic through predefined rules. Automated execution reduces operational risk and ensures consistent enforcement of supply constraints and settlement conditions.

5. On-Chain Ownership and Supply Transparency

Blockchain infrastructure should provide transparent ownership tracking and real-time supply visibility. This feature allows stakeholders to verify token circulation and strengthens confidence through immutable transaction records.

6. Redemption and Physical Settlement Support

The platform must support defined redemption workflows that allow conversion of digital tokens into physical gold. Clear settlement procedures reinforce asset backing and long-term credibility of the gold-backed stable asset.

7. Audit and Proof-of-Reserve Capability

Built-in audit support enables proof-of-reserve validation through regular reconciliation of token supply and gold reserves. This capability strengthens accountability and supports regulatory and operational reviews.

8. Governance and Access Control Framework

A structured governance layer manages role-based permissions and operational controls. This framework ensures responsible platform management, policy enforcement, and controlled execution of critical system actions.

9. Compliance and Reporting Readiness

The platform should include compliance-ready reporting tools that support audits, disclosures, and regulatory assessments. Accurate reporting improves transparency and prepares the platform for market and jurisdictional requirements.

10. Secure Wallet and Asset Management Support

Integration with secure digital wallets enables safe storage and transfer of gold-backed tokens. Strong key management and access controls protect ownership credentials and support daily asset operations.

How to Create a Gold-Backed Stable Asset on Blockchain?

Creating a gold-backed stable asset on blockchain requires secure custody, compliant token design, and transparent issuance models. Our developers follow structured gold-backed token development practices, showcasing a reliable approach to asset-backed blockchain implementation.

1. Consultation

We begin the development process with strategic consultation to understand business objectives, asset scope, and market positioning. Our team evaluates use cases, stability goals, and operational expectations to define a clear foundation for building a gold-backed stable asset platform.

2. Asset and Reserve Structuring

Our developers work with you to design a gold reserve structure that defines asset backing rules, token representation, and reserve allocation logic. This step ensures clarity around ownership, valuation alignment, and long-term stability of the gold-backed asset.

3. Custody and Operational Model Design

We design a custody and operational framework that aligns physical gold storage with digital asset issuance. Our approach focuses on secure reserve handling, inventory synchronization, and controlled access across custody, issuance, and redemption workflows.

4. Proof-of-Reserve and Transparency Framework

Our developers create a proof-of-reserve and transparency framework for continuous verification of gold reserves against tokens. It sets audit frequency, disclosure methods, and reconciliation to maintain trust and credibility of the gold-backed asset.

5. Token Economics and Stability Design

Our team defines token economics and stability mechanisms that maintain consistent value linkage to physical gold. We establish issuance limits, divisibility rules, and circulation controls to support predictable supply behavior and market confidence.

6. Smart Logic and Workflow Definition

We design automated operational workflows that govern issuance, transfers, and redemption. This step focuses on defining system logic, permissions, and validation rules that reduce manual intervention and ensure consistent execution across the platform lifecycle.

7. Governance and Compliance Alignment

Our developers incorporate governance and compliance considerations into the platform design. We define control structures, approval processes, and reporting requirements to support responsible operations and regulatory readiness from launch onward.

8. Testing, Validation, and Launch Preparation

We conduct comprehensive testing and validation to ensure reserve alignment, operational accuracy, and system reliability. Our team prepares the platform for launch by validating workflows, access controls, and asset lifecycle processes before market release.

Cost to Build a Gold Asset Tokenization Platform

The cost of gold-backed token development depends on technology scope, compliance needs, and custody integration. These factors directly influence gold-backed token development, showcasing how requirements shape overall investment planning.

| Development Phase | Description | Estimated Cost |

| Consultation and requirement analysis | Business assessment, asset structure planning, platform scope definition, and initial regulatory review. | $5,000 – $10,000 |

| Platform architecture and system design | Technical architecture, workflow design, reserve logic planning, and governance structure setup. | $10,000 – $20,000 |

| Gold reserve and custody integration | Reserve tracking design, custody coordination workflows, and physical to digital asset alignment. | $15,000 – $30,000 |

| Token issuance and asset logic development | Issuance controls, supply management, redemption logic, and asset lifecycle workflows. | $25,000 – $50,000 |

| Governance and compliance frameworks | Access controls, compliance workflows, audit readiness, and reporting structures. | $15,000 – $30,000 |

| Proof-of-reserve and transparency mechanisms | Reserve reconciliation logic, disclosure workflows, and audit support systems. | $10,000 – $20,000 |

| Wallet integration and asset management | Secure storage, asset transfers, and ownership management features. | $15,000 – $25,000 |

| Testing and launch | Functional testing, reserve validation, workflow verification, and launch readiness checks. | $10,000 – $20,000 |

Total Estimated Cost: $65,000 – $120,000+

Note: The cost to build a gold asset tokenization platform varies based on complexity, custody, compliance, audits, customization, integrations, regulations, and upgrades.

Consult with IdeaUsher for a cost estimate and development plan for a secure, compliant gold asset tokenization platform aligned with your goals.

Cost-Affecting Factors to Consider During Development

Several key factors influence gold-backed token development costs for gold-backed tokenization platforms, including technology, compliance, security, and operational scalability, impacting overall project budgeting and efficiency.

1. Regulatory and Compliance Scope

Expanding compliance requirements across jurisdictions increases legal reviews, documentation, reporting workflows, and validation processes, which directly impacts development timelines and overall platform build costs.

2. Custody Model Complexity

Choosing between single-custodian or multi-custodian setups affects integration effort, reconciliation logic, and operational controls, increasing development cost as custody relationships and workflows become more complex.

3. Proof-of-Reserve and Audit Frequency

Higher audit frequency and advanced proof-of-reserve mechanisms require additional development for reconciliation logic, reporting layers, and data validation, raising both initial build and ongoing maintenance expenses.

4. Platform Scalability Requirements

Designing the platform to handle higher transaction volumes and future expansion increases architectural planning, performance optimization, and testing effort, which adds to overall development cost.

5. Custom Governance and Access Controls

Tailored governance structures with role-based permissions and approval workflows increase design and implementation complexity, leading to higher development and testing costs.

Challenges and How Our Developers Solve Them?

Gold-backed token development presents challenges around custody verification, compliance, and system transparency. Our developers address these through structured architecture and validated workflows, showcasing practical solutions for building reliable gold-backed blockchain platforms.

1. Aligning On-Chain Supply With Physical Gold Reserves

Challenge: Token circulation can drift from physical gold reserves due to delayed custody updates, reconciliation gaps, and manual issuance controls during active platform operations.

Solution: We design reserve-linked issuance controls that connect token minting directly with verified custody data, supported by automated reconciliation checks that continuously validate supply alignment before and after transactions.

2. Designing Reliable Proof-of-Reserve Mechanisms

Challenge: Many platforms struggle to present reserve data that auditors and users can verify without exposing sensitive custody or operational information.

Solution: Our developers implement structured proof-of-reserve frameworks that map vault records to on-chain data using controlled disclosures, enabling repeatable audits and transparent reserve validation without compromising security.

3. Managing Redemption Without Operational Bottlenecks

Challenge: Physical gold redemption introduces delays due to manual approvals, logistics coordination, and inconsistent settlement rules across different redemption requests.

Solution: We build clearly defined redemption workflows with automated validation, approval checkpoints, and settlement tracking that streamline physical delivery while preserving operational oversight and asset protection.

4. Ensuring Regulatory Readiness Across Jurisdictions

Challenge: Compliance requirements vary by region, creating uncertainty during platform development and increasing the risk of post-launch regulatory changes.

Solution: Our developers design configurable compliance and reporting layers that adapt to jurisdiction-specific rules without altering core platform logic, supporting scalable and compliant market expansion.

Regulatory and Compliance Considerations for Gold-Backed Stable Assets

Regulatory and compliance frameworks are critical for gold-backed token development, ensuring investor protection, legal adherence, and transparent operations across jurisdictions. This section highlights key considerations shaping secure and compliant tokenization.

| Regulatory Area | What It Involves | Why It Matters |

| Asset classification | Determining whether the gold-backed asset qualifies as a commodity-backed token, security, or payment instrument. | Classification affects licensing requirements, disclosure obligations, and permissible distribution models. |

| Gold custody regulation | Compliance with laws governing physical gold storage, vault licensing, and third-party custodianship. | Ensures lawful storage of reserves and protects the legal validity of asset backing. |

| Proof-of-reserve disclosures | Regular reporting and validation of gold reserves against issued tokens. | Maintains transparency and prevents regulatory scrutiny related to reserve misrepresentation. |

| Anti-money laundering requirements | Implementation of transaction monitoring, reporting, and risk controls. | Reduces financial crime exposure and supports lawful platform operations. |

| Know your customer obligations | Identity verification processes for platform users and participants. | Ensures compliance with financial regulations and limits misuse of the asset. |

| Cross-border regulatory compliance | Adherence to differing rules across jurisdictions where the asset is issued or accessed. | Supports lawful market expansion and avoids enforcement actions in foreign regions. |

| Audit and reporting standards | Periodic audits of reserves, issuance logic, and operational controls. | Strengthens accountability and demonstrates responsible asset management. |

| Consumer protection rules | Clear disclosures related to redemption terms, risks, and asset rights. | Protects users and reduces legal exposure related to miscommunication or disputes. |

Top Gold-Backed Asset Tokenization Platforms

Top gold-backed asset tokenization platforms digitize physical gold into blockchain tokens, enabling secure ownership, liquidity, and transparency across global markets. Below is an overview of leading real-world implementations.

1. PAX Gold (PAXG)

PAX Gold is a regulated ERC-20 token where each unit is backed 1:1 by an LBMA-certified London Good Delivery gold bar stored in secure vaults, offering high liquidity, monthly audits, and direct redemption options.

2. Tether Gold (XAUT)

Tether Gold tokens represent one troy ounce of physical gold stored in Swiss vaults and trade across major exchanges with multi-chain support (Ethereum & TRON), combining gold’s stability with digital transferability.

3. GoldeFi

GoldeFi (GOLD) is a blockchain-based platform that issues digital tokens backed by real, ethically sourced physical gold. Each token represents a fractional share of physical gold stored in secure, audited vaults. The platform focuses on making gold investment accessible to everyone through micro-fractionalisation and transparency in sourcing.

4. AurusGOLD (AWG)

AurusGOLD tokens are backed 1:1 by LBMA-certified gold from global refineries, with a decentralized minting network that supports liquidity and interoperability across DeFi platforms.

5. Perth Mint Gold Token (PMGT)

PMGT was a government-guaranteed gold token backed by physical gold stored at the Perth Mint, designed to blend sovereign trust with blockchain efficiency. It allowed secure, tradable digital ownership directly linked to audited gold reserves.

Conclusion

Creating a gold-backed stable asset on blockchain is as much about trust as it is about technology. Clear asset custody, transparent auditing, and compliant smart contracts shape confidence for both issuers and users. When these elements align, blockchain becomes a reliable bridge between physical gold and digital value. Approaching gold-backed token development with a focus on governance, security, and accountability helps reduce risk while preserving price stability. The result is a digital asset that reflects gold’s credibility while operating within a modern, decentralized financial framework for institutions and individual participants.

Why Choose IdeaUsher to Build a Gold Asset?

IdeaUsher brings deep experience in creating asset-backed digital instruments that prioritize stability, trust, and transparency. We work closely with issuers and asset managers to design gold-backed stable assets supported by secure custody, auditable reserves, and robust on-chain governance models. Our approach focuses on building confidence for users while meeting operational and regulatory expectations.

Why Partner With Us?

- Gold-Backed Token Design: We structure stable assets with disciplined issuance and redemption mechanisms.

- Smart Contract Reliability: Our contracts are built for accuracy, security, and long-term maintainability.

- Regulatory-Aware Development: We help align your stable asset framework with applicable financial and commodity regulations.

- Market-Ready Platforms: Our solutions are designed for institutional and retail participation alike.

Take a look at our portfolio to see how we’ve assisted companies in launching secure and compliant blockchain solutions across various industries.

Contact us to explore supporting your gold-backed stable asset platform with transparent reserves and strong blockchain infrastructure.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A.1. Stability in gold-backed token development comes from full physical gold backing, disciplined token issuance, transparent audits, and controlled minting and burning mechanisms, ensuring alignment with gold rather than market speculation.

A.2. Physical gold is stored with regulated custodians while blockchain tokens represent legal ownership or claims. Smart contracts track supply, issuance, and redemption, creating a verifiable bridge between off-chain assets and on-chain records.

A.3. Essential features include controlled minting, burn functions for redemption, audit-friendly transparency, upgrade governance, and security safeguards. These functions ensure the token supply matches gold reserves and reduces operational and financial risks.

A.4. Issuers often face regulatory clarity issues, user trust building, custody verification, and liquidity development. Addressing these challenges early through transparent disclosures and strong infrastructure improves adoption and long-term asset credibility.