For most listeners, supporting an artist still means streaming music or buying tickets, while ownership and long-term value remain concentrated elsewhere. At the same time, independent musicians rely on funding models that often require giving up rights early. This mismatch between modern fan engagement and traditional ownership structures is where a fractional music ownership platform begins to make sense.

These platforms reframe music as a shared asset. Instead of relying only on labels or advances, artists can divide specific rights or revenue streams into smaller shares and offer them directly to supporters. Making this model work depends on systems that handle rights attribution, royalty tracking, secure transactions, and compliant payouts.

In this blog, we break down how to create a fractional music ownership platform by focusing on core features, development cost, and the operational realities involved in building something that works in the real world.

What Is a Fractional Music Ownership Platform?

A fractional music ownership platform is a digital ecosystem that allows music assets to be divided into smaller ownership units and shared among multiple investors. Instead of a single entity holding full rights, ownership is distributed transparently through blockchain-backed records.

These platforms enable artists and rights holders to unlock capital by offering portions of their music catalog while retaining creative control. For investors, fractional ownership provides access to music royalties as an alternative asset class with measurable performance data.

- Built on decentralized ownership models that record music rights transparently and prevent unauthorized ownership changes

- Uses smart contracts to manage fractional ownership rules, royalty splits, and automated revenue distribution

- Each fraction represents a verifiable share of future music earnings, permanently recorded on an immutable ledger

- Ensures trust, traceability, and fair revenue participation for artists, rights holders, and investors

- Combines music rights management with blockchain infrastructure to create a liquid and transparent marketplace for monetizing music intellectual property

How Fractional Music Ownership Works?

Fractional music ownership works by dividing music rights into smaller shares, allowing multiple investors to earn revenue based on their ownership percentage through transparent and legally structured systems.

1. Music Asset Submission and Verification

The platform allows artists or rights holders to submit music assets for fractionalization. Before listing, ownership rights, revenue splits, and licensing terms are reviewed to ensure the asset is legally eligible for shared digital ownership.

2. Fraction Creation and Ownership Structuring

Once approved, the music asset is divided into defined ownership fractions. Each fraction represents a proportional claim on future royalties, allowing the platform to offer structured investment opportunities with clearly defined ownership and earnings participation.

3. Investor Onboarding and Fraction Purchase

Investors register on the platform, complete identity verification, and explore available music assets. They can purchase fractions based on interest, budget, and risk preference, with ownership records updated to reflect their participation accurately.

4. Revenue Generation and Royalty Distribution

As the music generates income from streaming, licensing, or other channels, the platform collects earnings and distributes royalties proportionally to fraction holders based on their ownership share.

5. Performance Tracking and Ownership Transfers

Investors can track asset performance, earnings history, and ownership value through the platform dashboard. Where enabled, fractions can be transferred or resold under platform-defined rules to support liquidity.

How Music Rights Are Divided and Shared Digitally?

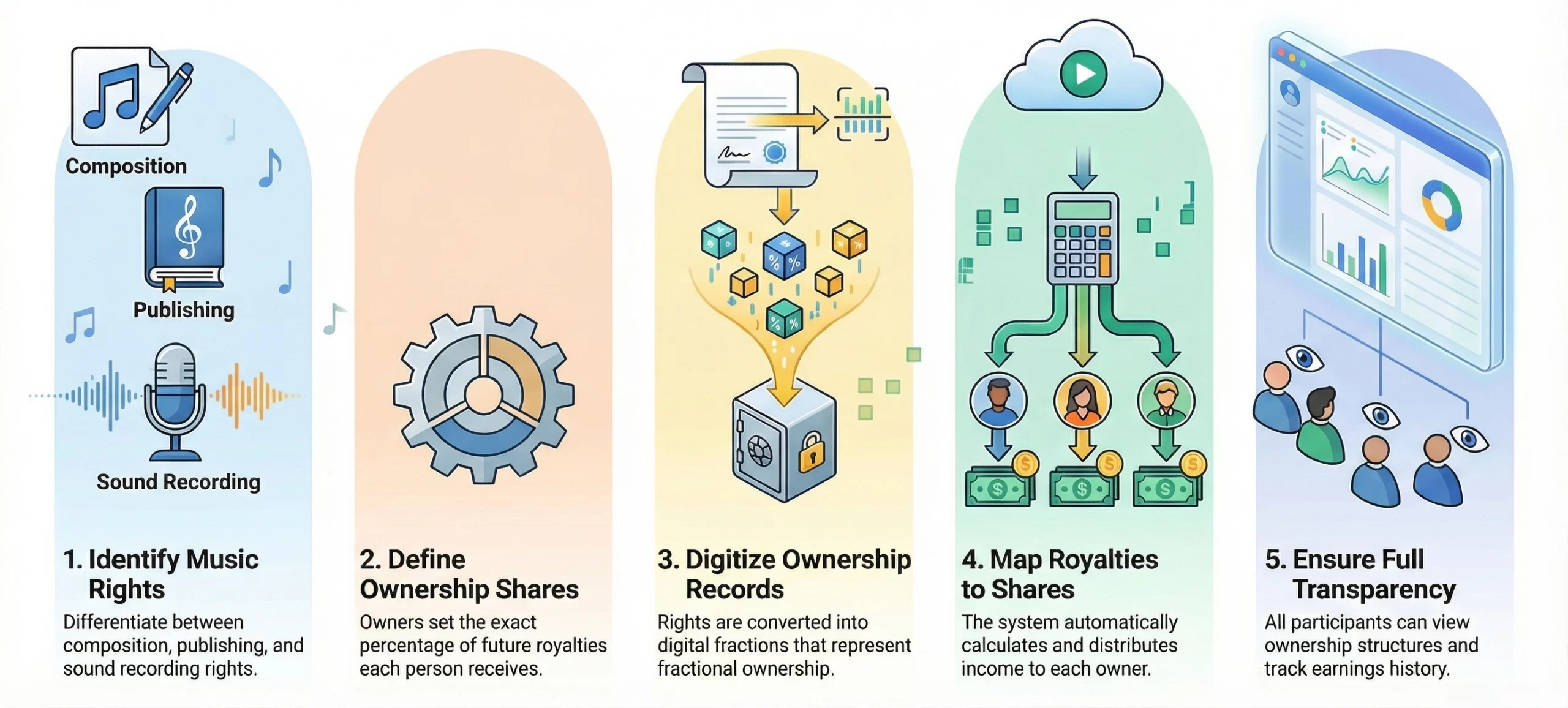

Digital music rights are divided into defined ownership shares using structured agreements and technology-driven records. This approach enables transparent sharing of royalties and responsibilities across multiple stakeholders within a controlled digital framework.

1. Understanding Different Music Rights

Music ownership consists of multiple rights, including composition, publishing, and sound recording rights. Each right carries its own revenue streams and ownership rules, making clear classification essential before any digital sharing or fractionalization occurs.

Example: A songwriter may own publishing rights while a label controls the sound recording, meaning each party earns from different revenue sources tied to the same track.

2. Defining Ownership & Revenue Shares

Before rights are shared digitally, ownership percentages are clearly defined. These percentages determine how future royalties are allocated, ensuring each participant receives earnings proportional to their ownership without impacting creative control.

Example: An artist may choose to offer 15 percent of future streaming royalties to investors while retaining full ownership of the remaining rights.

3. Digitizing Music Ownership Records

Once ownership terms are defined, music rights are converted into digital records that represent fractional ownership. These records act as a single source of truth, capturing ownership shares, revenue entitlements, and transaction history transparently.

Example: A single track can be divided into 1,000 digital fractions, each representing a fixed share of royalty earnings linked to ownership records.

4. Mapping Royalties to Ownership Shares

Each digital ownership unit is directly linked to royalty distribution logic. As the music generates income, the platform uses these ownership mappings to calculate and distribute earnings accurately to all rights holders and investors.

Example: If a track earns monthly streaming revenue, payouts are automatically calculated so each fraction holder receives income based on their ownership percentage.

5. Transparency & Long-Term Rights Management

Digital ownership records allow all participants to view the rights structure and earnings clearly. This transparency reduces disputes, simplifies audits, and supports long-term management of music rights across the platform lifecycle.

Example: Investors and artists can review historical ownership changes and royalty payouts at any time through the platform dashboard.

How a 40% Independent Artist Revenue Share Reshapes Fractional Music Ownership?

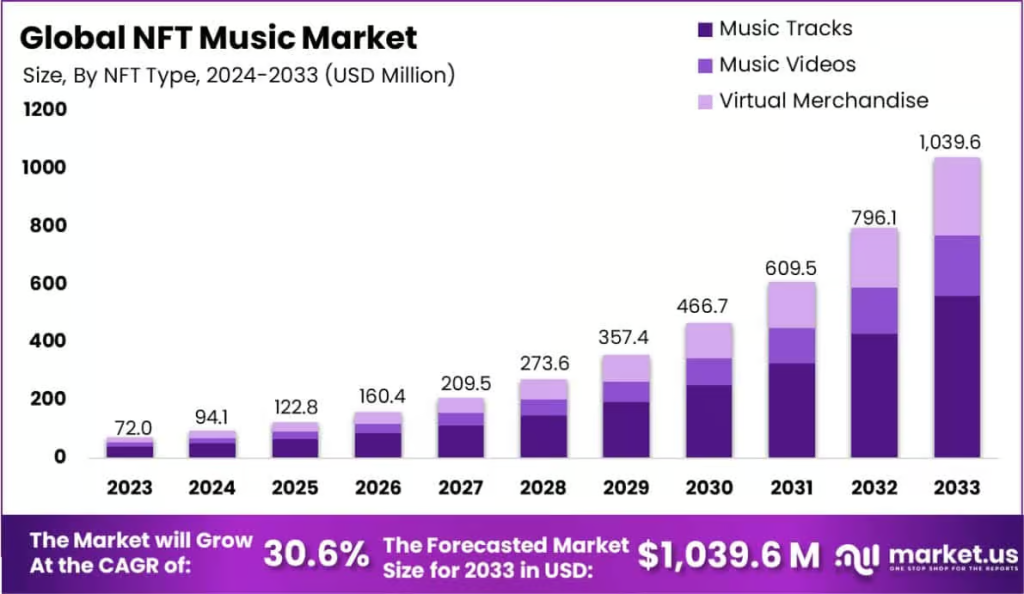

The global NFT music market is projected to reach USD 1,039.6 million by 2033, up from USD 72.02 million in 2023, growing at a 30.6% CAGR from 2024 to 2033. This growth reflects rising adoption of digital ownership and direct monetization models across the music industry.

Independent artists now generate up to 40% of global music revenue through direct channels, while the traditional label-driven model has declined from its earlier 65–70% dominance, signaling a shift toward artist-led platforms.

Why Independent Artist Revenue Share Is a Foundation for Fractional Ownership

This shift changes who controls music assets and how value is unlocked. Independent artists are structurally better positioned to adopt fractional ownership because they control rights, distribution, and fan relationships directly.

- Direct control over rights and revenue: Independent artists retain ownership, making it easier to define, split, and share revenue participation without complex label negotiations.

- Stronger direct-to-fan relationships: Artists with loyal fanbases can activate fractional ownership models where fans invest in music they already support emotionally.

- Faster adoption of digital ownership models: Without legacy constraints, independent artists can experiment with fractional ownership and tokenized participation more quickly.

- Alignment with digital-first monetization: The rise of NFT music markets complements fractional ownership by normalizing digital assets and transparent revenue participation.

What This Means for Fractional Music Ownership Platforms?

This data explains why fractional music ownership platforms are gaining relevance now. The market conditions favor platforms that empower independent artists and structure fan participation around ownership and revenue sharing.

- Larger addressable supply of eligible music assets: Independent artists contribute to expanding rights-ready catalogs, simplifying the onboarding process for fractional music ownership platforms by reducing third-party ownership complexities.

- Higher platform adoption potential: Artists seeking alternatives to labels are more open to platforms offering capital access without ownership loss.

- Stronger investor and fan confidence: Transparent ownership and direct artist involvement improve trust and participation in fractional music investments.

- Clear long-term platform opportunity: As digital ownership adoption grows alongside independent revenue share, fractional platforms become a natural bridge between artists, fans, and capital.

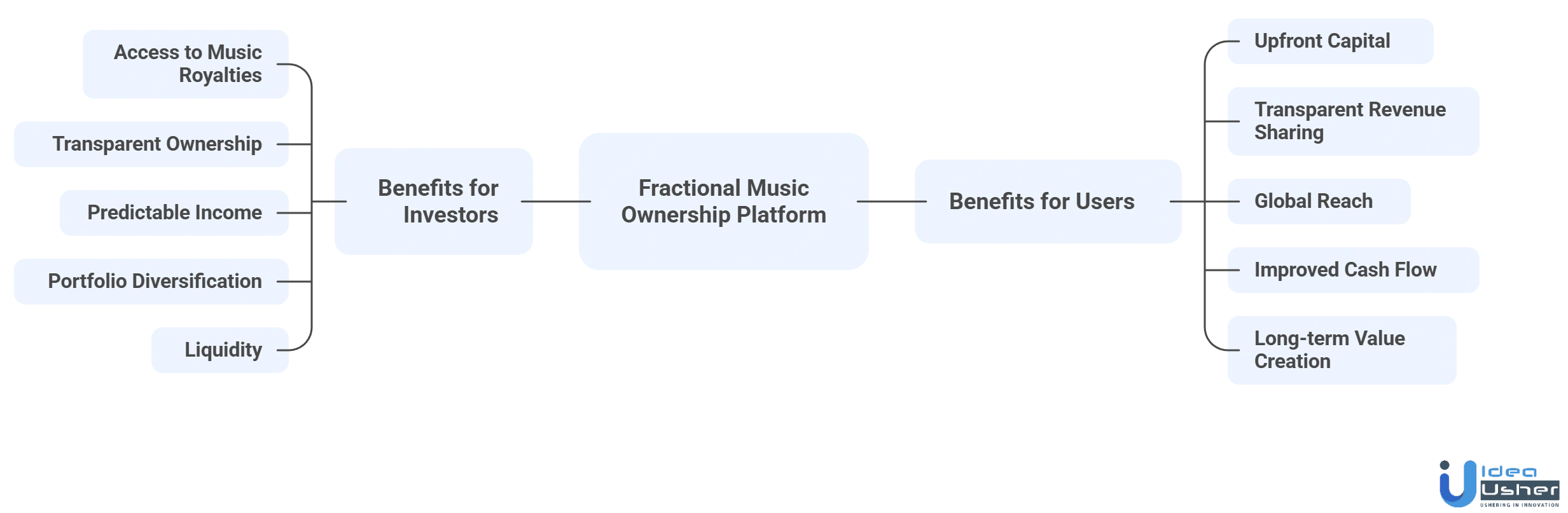

Benefits of Building a Fractional Music Ownership Platform

Building a fractional music ownership platform creates new revenue opportunities while increasing access to music investments. It supports artists, investors, and platforms through transparent ownership models and scalable digital infrastructure.

A. Benefits for Investors

Fractional music ownership opens access to a traditionally closed asset class. Investors gain exposure to music royalties with transparent ownership, measurable performance, and flexible participation, making it suitable for both retail and sophisticated investors.

- Access to music royalties as an alternative asset: Investors can participate in revenue-generating music assets without purchasing full rights, lowering entry barriers while diversifying investment portfolios.

- Transparent and trackable ownership: Digital ownership records allow investors to clearly see what they own, how royalties are calculated, and how earnings are distributed over time.

- Predictable income potential: Music catalogs generate recurring revenue from streaming, licensing, and synchronization, offering investors the opportunity for ongoing royalty-based returns.

- Portfolio diversification: Music royalties often behave differently from traditional financial assets, helping investors spread risk across non-correlated investment opportunities.

- Liquidity through fractional resale: Fractional ownership enables partial exits through secondary trading, offering more flexibility compared to traditional long-term music rights investments.

B. Benefits for Users (Artists & Rights Holders)

For artists and rights holders, fractional ownership platforms unlock new monetization paths while preserving creative control. These platforms transform music rights into flexible financial assets without compromising artistic independence.

- Access to upfront capital without selling full rights: Artists can monetize a portion of future royalties while retaining long-term ownership and decision-making authority over their music.

- Transparent revenue sharing: Clear ownership structures and digital records help artists understand exactly how earnings are split, reducing disputes and administrative complexity.

- Global reach to investors and fans: Fractional platforms connect artists with a broader audience, including fans who want to invest directly in the music they support.

- Improved cash flow management: By unlocking capital earlier, artists can reinvest in production, marketing, and growth without relying solely on traditional label advances.

- Long-term value creation: Fractional ownership allows rights holders to strategically manage catalogs over time while benefiting from ongoing royalty streams and asset appreciation.

Key Features of a Fractional Music Ownership Platform

A fractional music ownership platform relies on carefully designed features that enable secure ownership sharing, transparent revenue distribution, and legal compliance. These features form the foundation for building a reliable and scalable music investment ecosystem.

1. User Registration & Identity Verification

A strong registration system builds platform trust by integrating KYC and AML workflows that securely link verified users to blockchain wallets. This ensures compliance, prevents fraud, and supports on-chain ownership, payments, and royalties across jurisdictions.

2. Artist & Rights Holder Onboarding

The onboarding process lets artists, labels, and rights holders submit music assets with proof of ownership. Rights validation includes copyright, publishing splits, and licensing, ensuring only legally cleared music IP is recorded on the blockchain.

3. Music Asset Tokenization

Tokenization turns music rights into digital units on a blockchain, each with permanent ownership, revenue details, and metadata. Smart contracts set rules for supply, value, and sharing, enabling transparent fractional ownership without centralized records.

4. Music Catalog & Asset Marketplace

The platform hosts a decentralized marketplace for tokenized music assets, showing ownership, royalties, smart contract terms, and performance. Blockchain transparency enables investors to assess assets with verifiable data instead of speculation.

5. Fraction Purchase & Investment Management

Investors buy music fractions via integrated wallets and gateways and transactions settle on-chain instantly, transferring ownership. The platform syncs blockchain records with user portfolios for accurate tracking, transaction history, and real-time asset visibility.

6. Smart Contract Ownership Management

Smart contracts automate ownership rules, revenue splits, and transfer permissions, executing deterministically after deployment. They ensure trustless agreement enforcement, reduce administrative effort, and protect artists and investors with immutable ownership logic.

7. Royalty Tracking & Automated Revenue Distribution

Royalty data from streaming platforms, licensing partners and distributors is processed off-chain and reconciled with on-chain ownership. Smart contracts calculate fractional entitlements and automate payouts, delivering transparent, auditable, and timely distribution aligned with blockchain ownership percentages.

8. Secondary Marketplace

A secondary marketplace lets investors resell music fractions under governance rules. Blockchain validates ownership, prevents double-spending, and ensures authenticity. This adds liquidity while maintaining compliance, transparency, and controlled circulation.

9. Digital Wallet & Payment Integration

Each user has a secure digital wallet for ownership tokens and earnings. The platform supports fiat and crypto payments for easy investments and withdrawals. Wallets ensure secure key management and interactions with smart contracts.

10. Ownership Dashboard & Portfolio Analytics

The ownership dashboard consolidates blockchain data and financial metrics. Users track token holdings, royalty income, asset performance, and transactions. Combining on-chain transparency with analytical insights supports informed investment and asset management decisions.

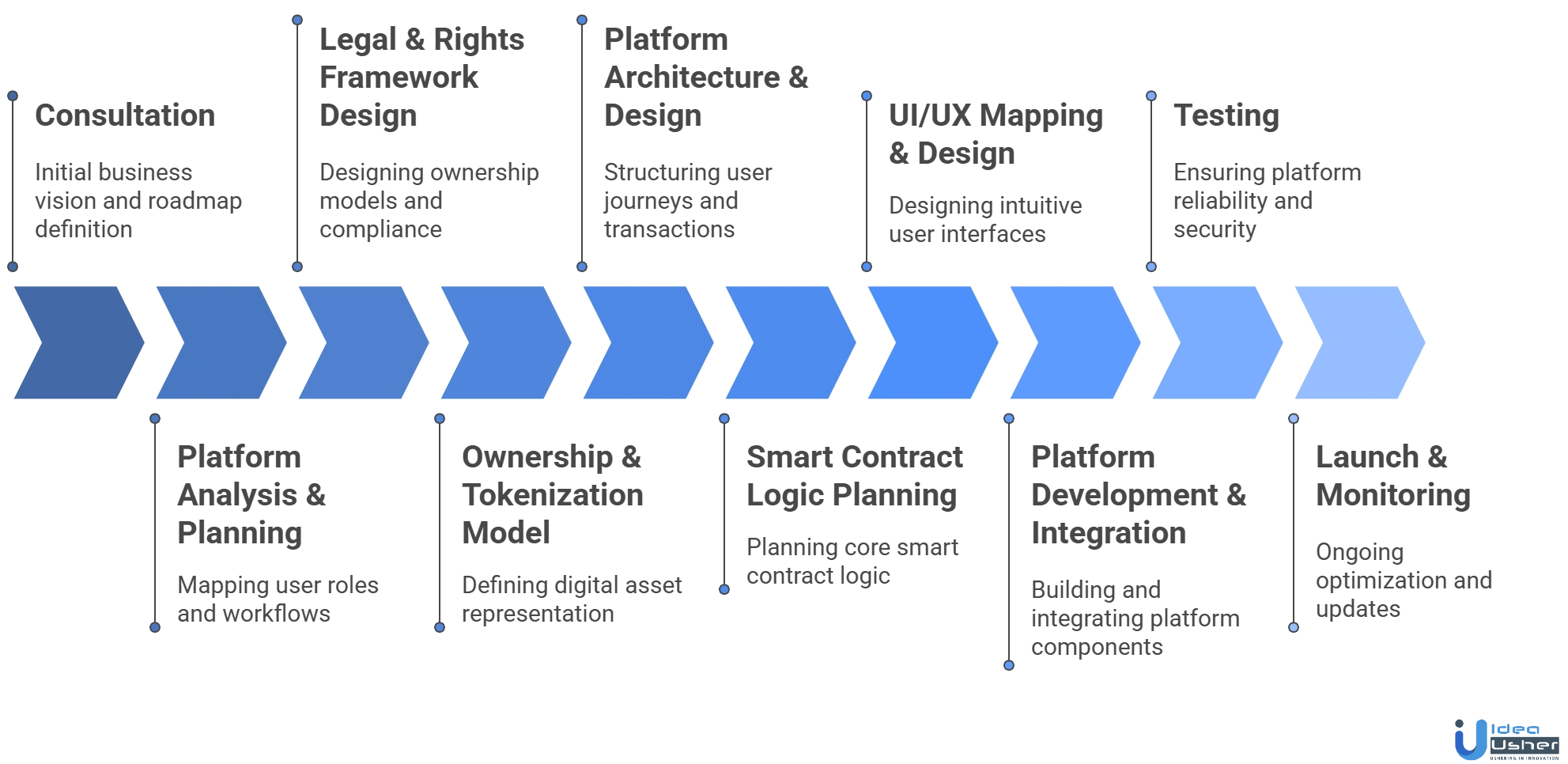

How to Create a Fractional Music Ownership Platform?

A fractional music ownership platform development involves combining technology, music rights management, and regulatory compliance into a single system. Our developers follow a structured development process to transform shared ownership concepts into reliable, market-ready solutions.

1. Consultation

We begin with a deep consultation to understand your business vision, target audience, and revenue model. Our team evaluates music rights structures, ownership goals, compliance requirements, and blockchain feasibility to define a clear, scalable platform roadmap.

2. Requirement Analysis & Platform Planning

Our developers analyze functional requirements, ownership workflows, and monetization logic. We map user roles, asset lifecycles, and transaction flows to ensure aligned platform architecture, regulatory readiness, and long-term scalability from day one.

3. Legal & Rights Framework Design

We collaborate closely with legal stakeholders to design ownership models, royalty distribution rules, and compliance boundaries. This step ensures music rights, fractional ownership terms, and revenue participation logic are accurately reflected in platform governance.

4. Ownership & Tokenization Model Definition

We define how music assets will be fractionalized, valued, and represented digitally. Our approach ensures clear ownership logic, transparent supply control, and enforceable revenue entitlements that can be reliably managed through decentralized ownership records.

5. Platform Architecture & Workflow Design

Our team designs the end-to-end platform structure, including user journeys, asset management flows, and transaction handling. This phase ensures smooth interaction between on-chain ownership data and off-chain operational processes.

6. Smart Contract Logic Planning

We plan the core smart contract logic that governs ownership rules, royalty splits, and transfer permissions. Our developers focus on deterministic execution, auditability, and long-term upgrade considerations to reduce operational risk.

7. UI/UX Mapping & Design

We design intuitive interfaces for artists, investors, and administrators. User experience flows are crafted to simplify complex blockchain interactions while maintaining transparency, trust, and usability across all platform functions.

8. Platform Development & Integration

Our developers build and integrate all platform components, including ownership management, marketplaces, wallets, and dashboards. We ensure consistent data synchronization, secure transaction handling, and seamless interaction across the entire ecosystem.

9. Testing, Security Review & Validation

We conduct rigorous functional testing, security reviews, and ownership validation checks. This phase ensures smart contract reliability, data integrity, and platform resilience before any public release or asset onboarding.

10. Launch, Monitoring & Continuous Improvement

After launch, we monitor platform performance, transaction flows, and user behavior. Our team provides ongoing optimization, updates, and feature enhancements to ensure platform stability, compliance alignment, and sustainable growth.

Cost to Build a Fractional Music Ownership Platform

The cost to build a fractional music ownership platform depends on features, technology, and compliance requirements. Understanding these factors helps plan budgets effectively while ensuring a secure and scalable music investment solution.

| Development Phase | Description | Estimated Cost |

| Consultation & Discovery | Business consultation to define ownership model, revenue strategy, regulatory scope and platform feasibility. | $5,000 – $10,000 |

| Requirement Analysis & Platform Planning | Functional planning and workflow mapping to align user roles, asset lifecycle, and scalability goals. | $8,000 – $15,000 |

| Legal & Rights Framework Design | Music rights validation and compliance structuring for fractional ownership and royalty distribution. | $7,000 – $15,000 |

| Tokenization & Ownership Model Design | Fractional ownership logic including asset valuation, supply structure, and on-chain representation. | $10,000 – $20,000 |

| Smart Contract Architecture & Logic | Ownership and royalty smart contracts with secure execution and audit-ready logic. | $15,000 – $30,000 |

| Marketplace & Platform Development | Core platform development covering marketplace, ownership management, and dashboards. | $25,000 – $50,000 |

| Wallet, Payments & Royalty Automation | Wallet integration and automated payouts aligned with ownership records. | $12,000 – $25,000 |

| UI/UX Design & User Experience | User-centric interface design for artists, investors, and administrators. | $8,000 – $15,000 |

| Testing, Security & Quality Assurance | Security validation and performance testing to ensure platform reliability. | $10,000 – $20,000 |

| Deployment & Launch Support | Production deployment and launch readiness with monitoring setup. | $5,000 – $10,000 |

Total Estimated Cost: $62,000 – $120,000+

Note: Development costs depend on platform complexity, compliance, markets, automation, custom features, integrations, and scalability planning.

Consult with IdeaUsher for a tailored cost estimate and development roadmap for a compliant, scalable, high-performing fractional music ownership platform.

Cost-Affecting Factors to Consider During Development

Several technical, legal, and operational factors directly influence the development cost of a fractional music ownership platform, making early planning essential for accurate budgeting and scalable implementation.

1. Platform Scope and Feature Complexity

The number of user roles, asset workflows, marketplace features, and automation levels directly influences development effort, testing depth, and long-term maintenance requirements.

2. Compliance and Regulatory Requirements

Jurisdiction-specific regulations, identity verification needs, and financial reporting obligations can significantly affect development timelines, legal consultation efforts, and system design complexity.

3. Ownership and Royalty Logic Complexity

Defining fractional ownership rules, royalty calculation accuracy, and distribution frequency increases development effort, especially when handling multiple revenue streams and edge cases.

4. Blockchain Infrastructure and Integration Depth

The extent of blockchain usage for ownership records, transactions, and transparency impacts development cost, especially when balancing on-chain records with off-chain processing efficiency.

5. Security and Data Protection Measures

Implementing strong security controls, encryption, access management, and audit capabilities adds to development cost but is essential for protecting financial and ownership data.

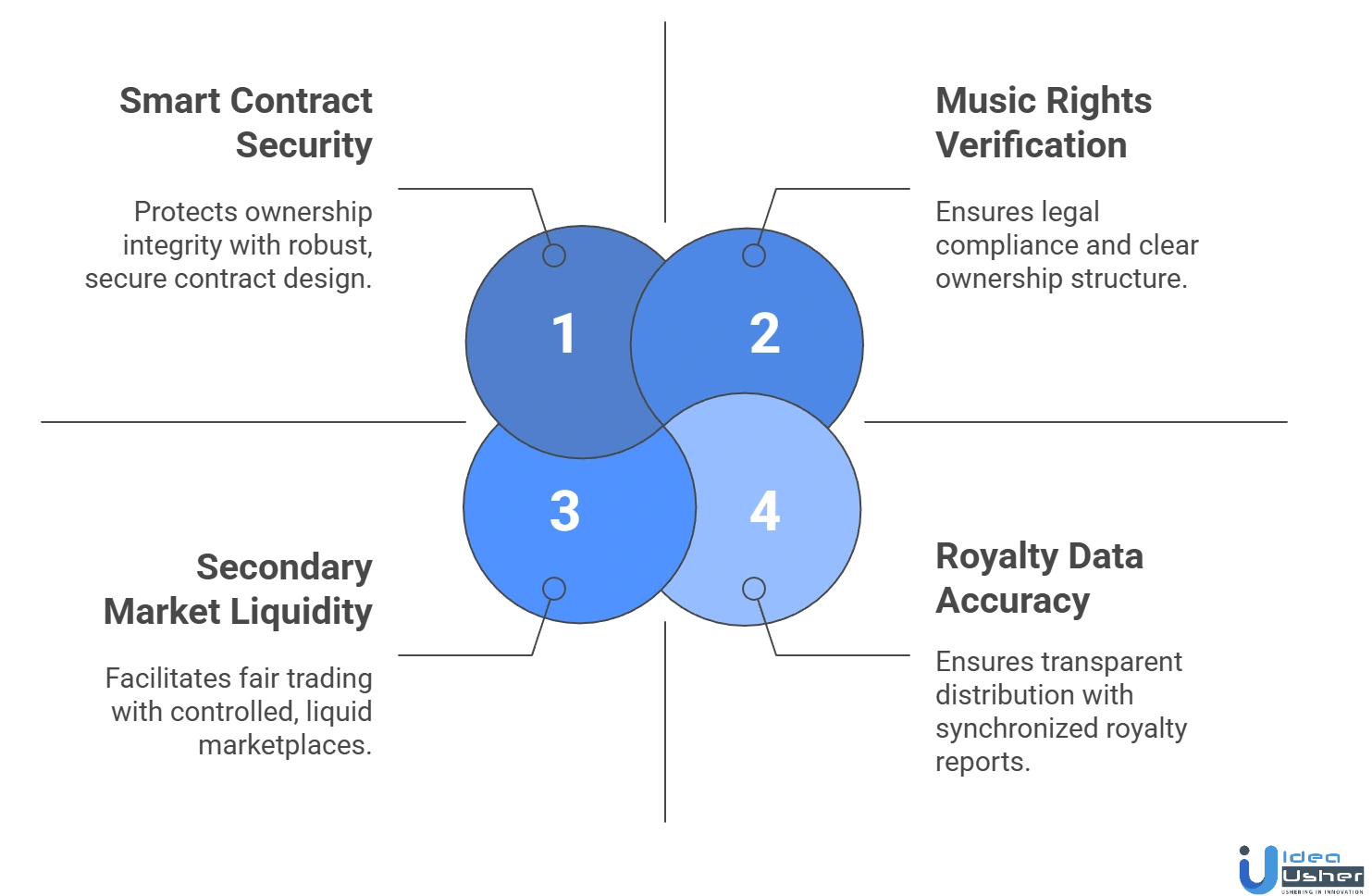

Challenges & How Our Developers Will Solve Those?

Building a fractional music ownership platform involves technical, legal, and operational challenges. Our developers follow a solution-driven approach to address these complexities while maintaining platform stability, compliance readiness, and long-term performance standards.

1. Music Rights Verification & Ownership Disputes

Challenge: Music rights are often fragmented across labels, publishers, and artists, making ownership verification complex and increasing the risk of disputes in fractional music ownership platforms.

Solution: Our developers build structured rights verification workflows that validate contracts, ownership splits, and metadata before tokenization, ensuring only legally cleared music assets are recorded on the blockchain.

2. Royalty Data Accuracy & Reconciliation

Challenge: Royalty earnings originate from multiple external sources, leading to inconsistencies between reported revenues and on-chain ownership data.

Solution: Our developers implement reconciliation mechanisms that synchronize off-chain royalty reports with blockchain ownership records, ensuring accurate calculations, transparent tracking, and fair distribution to fractional owners.

3. Smart Contract Security & Upgrade Management

Challenge: Errors or vulnerabilities in smart contracts can permanently impact ownership logic, revenue distribution, and investor trust.

Solution: Our developers follow secure contract design practices with modular logic and controlled upgrade paths, ensuring long-term contract reliability without compromising ownership integrity.

4. Secondary Market Liquidity

Challenge: Enabling fraction resale without price manipulation or ownership disputes is difficult in emerging digital asset marketplaces.

Solution: Our developers implement controlled secondary marketplaces with ownership validation, transaction visibility, and governance rules to support secure, fair, and liquid fraction trading.

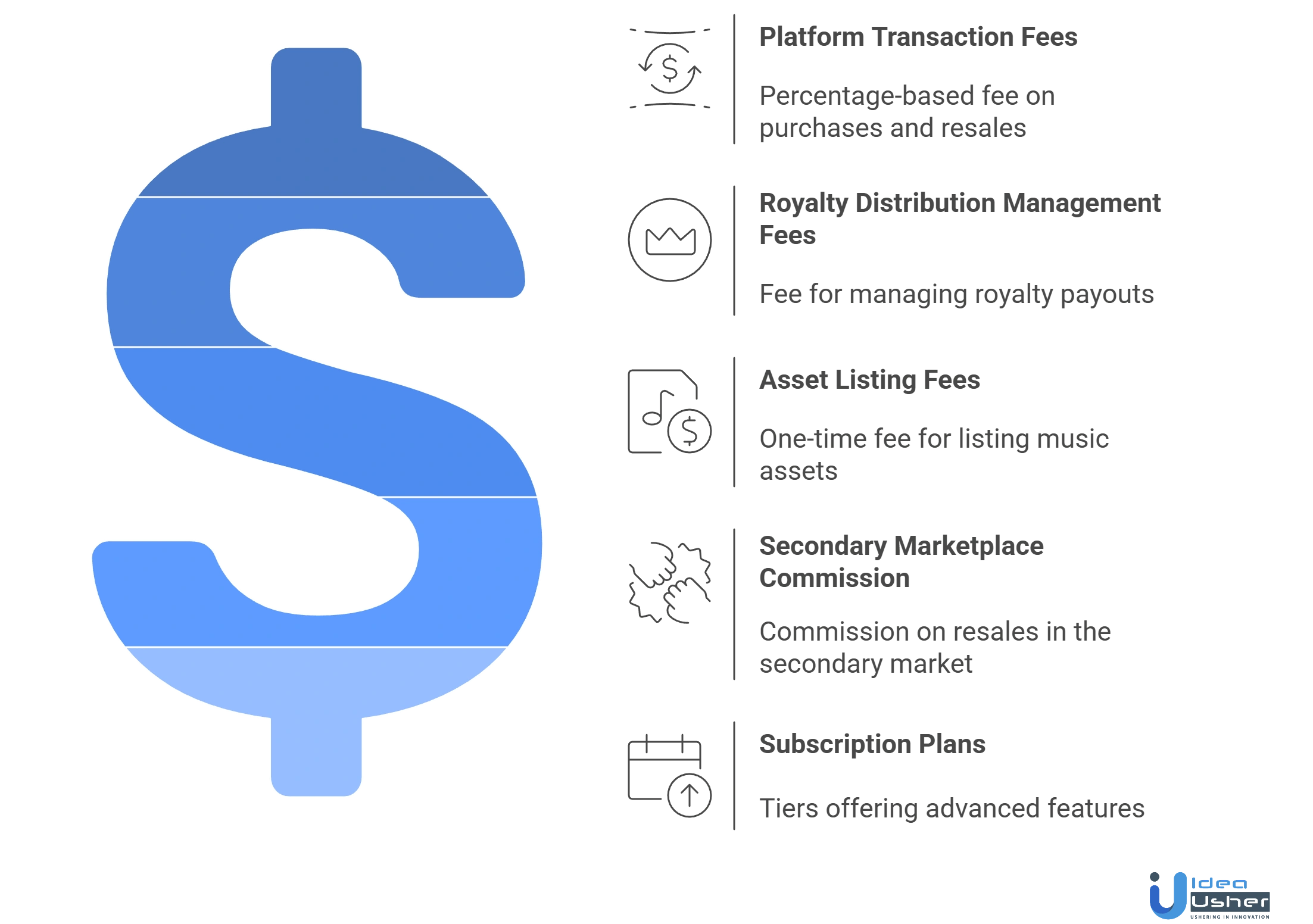

Revenue Models of a Fractional Music Ownership Platform

A fractional music ownership platform generates revenue through multiple streams that align with user activity, asset performance, and platform growth. These models are designed to scale as more music assets, investors, and transactions flow through the ecosystem.

1. Platform Transaction Fees

The platform earns a percentage-based fee on every fractional purchase and resale transaction. This model ensures recurring revenue as trading activity increases, directly tying platform earnings to overall marketplace liquidity and user engagement.

2. Royalty Distribution Management Fees

A small management fee can be applied during royalty payouts. Since the platform automates royalty tracking and distribution, this fee compensates for ongoing operational, reconciliation, and ownership management services.

3. Asset Listing Fees for Artists and Rights Holders

Artists or rights holders may pay a one-time listing fee to fractionalize and list their music assets. This covers asset review, rights validation, and onboarding, ensuring only verified and high-quality assets enter the platform.

4. Secondary Marketplace Commission

When investors resell music fractions on the secondary marketplace, the platform earns a commission on completed trades. This creates a long-term revenue stream driven by asset liquidity rather than one-time investments.

5. Subscription Plans for Advanced Access

The platform can offer subscription tiers for investors or rights holders, providing access to advanced analytics, detailed performance insights, early asset access, or portfolio management tools.

Real-World Fractional Music Ownership Apps in Market

These fractional music ownership apps enable shared investment in music royalties through regulated and blockchain-based models. This section highlights established platforms that demonstrate how music rights are being accessed and monetized in practice.

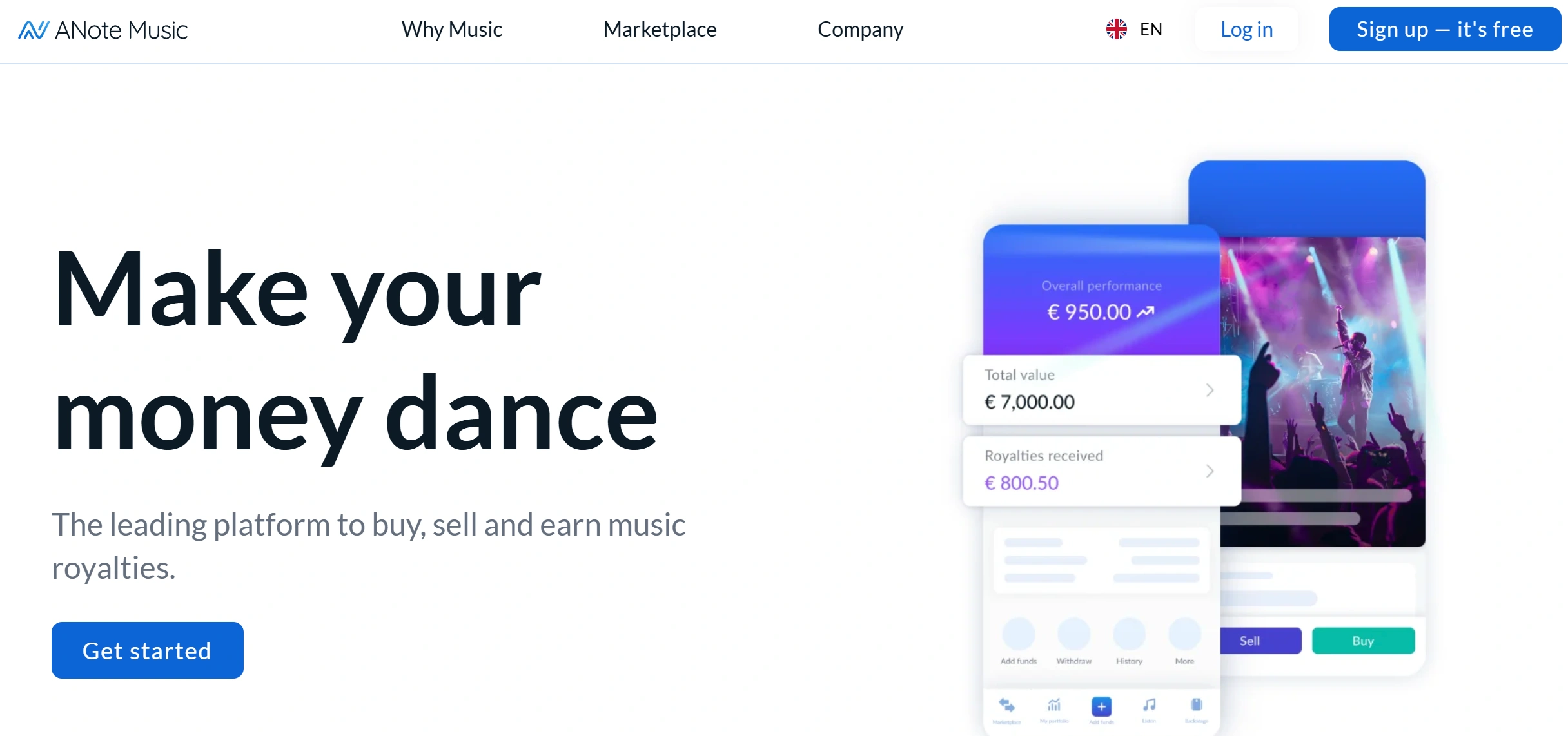

1. ANote Music

ANote Music is a blockchain-powered marketplace that allows investors to buy and trade fractional shares of music royalties. Built on Algorand, the platform ensures transparent ownership records, recurring royalty payouts, and liquidity through both primary auctions and secondary trading.

2. AnotherBlock

Anotherblock leverages blockchain and NFTs to tokenize music rights tied to real streaming revenues. Its platform enables fractional ownership, automated royalty distribution, and secondary trading, positioning music catalogs as investable on-chain financial assets.

3. Bolero Music

Bolero Music uses blockchain to issue tokenized Song Shares and Catalog Shares representing royalty income. Built with compliance in mind, it combines traditional music finance with on-chain transparency, portfolio diversification, and long-term royalty investing.

4. Audius

Audius uses blockchain to decentralize music storage, governance, and rewards. Through its native token, artists and fans earn value from engagement, reducing platform control and redistributing ownership and incentives across the ecosystem.

5. Catalog

Catalog uses blockchain to mint authentic, limited-edition music NFTs with immutable provenance. Its unique artist-first model emphasizes direct ownership, scarcity, and resale rights, helping establish music as a collectible and investable digital asset.

Conclusion

Building a fractional music ownership platform requires equal attention to technology, licensing, and trust. When these elements align, creators gain new funding paths and listeners gain meaningful participation. The process may feel complex, but each decision becomes clearer when guided by transparency and long-term value. By respecting artists, protecting rights, and designing with users in mind, you create a system that benefits everyone involved. That balance is what turns an idea into a sustainable fractional music ownership platform. It grows stronger as stakeholders learn, adapt, and collaborate responsibly together.

Why Partner With Us for Fractional Music Ownership Platform Development?

We work closely with founders who want to create legally sound, artist friendly music ownership platforms. Our approach combines technical execution with a clear understanding of music rights, investor expectations, and long term platform sustainability.

What You Gain by Working With Us

- Music Rights and Ownership Structuring: We help define how music rights are fractionalized, documented, and distributed to avoid conflicts and ensure transparency for artists and investors.

- End to End Platform Development: From architecture design to royalty tracking and payouts, we build platforms that handle real world ownership workflows reliably.

- Compliance Focused Execution: Our team considers securities and copyright regulations early in the build process to reduce legal risks before market launch.

- Built for Growth: We design platforms that support expanding catalogs, user bases, and international markets without reworking the core system.

Explore our portfolio to see how we have helped companies launch complex digital ownership platforms.

Connect with our experts to discuss how your fractional music ownership platform can be planned, built, and launched with confidence.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A.1. A fractional music ownership platform requires royalty tracking, secure ownership records, user wallets, licensing management, and transparent payout systems. These features ensure investors understand their shares while artists retain control over rights and revenue distribution.

A.2. Licensing involves legally splitting music rights into fractions and defining revenue entitlements. Clear contracts, rights verification, and compliance with copyright laws are essential to protect artists, investors, and platform operators from disputes or regulatory issues.

A.3. Most platforms rely on cloud infrastructure, smart contracts, secure databases, and payment gateways. Blockchain is often used for ownership transparency, while traditional systems handle compliance, reporting, and user management to ensure scalability and reliability.

A.4. Key considerations include securities regulations, copyright laws, investor disclosures, and regional compliance requirements. Working with legal experts helps structure ownership models correctly and prevents regulatory risks that could affect platform growth.