Private credit operates on negotiated terms, borrower-specific risk, and ongoing monitoring rather than open market trading. While the asset class has grown rapidly, the infrastructure supporting origination, ownership transfer, and reporting remains largely manual and fragmented. These limitations drive interest in Private Credit Tokenization, where loan positions and cash flows can be represented digitally while preserving required control and structure.

These platforms depend on how faithfully credit agreements are represented and enforced over time. Loan terms, repayment schedules, investor rights, compliance constraints, and servicing events must remain tightly aligned with off-chain legal documentation. Permissioned access, accurate reporting, and end-to-end lifecycle tracking become essential to maintaining credit governance without introducing operational or regulatory risk.

In this blog, we explain how to create a private credit tokenization platform by breaking down core system components, architectural considerations, and practical steps involved in building a compliant, scalable infrastructure for tokenized private credit markets.

What is a Private Credit Tokenization Platform?

A private credit tokenization platform is a blockchain-based system that converts private loans or debt instruments into digital tokens representing ownership rights. These tokens can then be issued, traded, and managed on a distributed ledger, increasing transparency, operational efficiency, and investor access to traditionally illiquid private credit markets by enabling fractional ownership, broader participation, and potentially enhanced liquidity and global capital flows.

What Makes Private Credit Tokenization Different From Other RWAs?

Private credit tokenization cannot be approached like real estate, commodities, or yield-bearing crypto RWAs. It represents contractual debt obligations, not ownership of a price-appreciating asset. This distinction fundamentally changes how platforms must be designed, governed, and scaled.

1. Cash-Flow Assets vs Price-Driven RWAs

Most RWAs rely on market price discovery. Private credit relies on predictable cash flows. Loan tokens derive value from scheduled interest payments and principal repayment, not trading demand. Liquidity, valuation, and returns are engineered around repayment performance.

2. Credit Risk as the Primary Risk Factor

Borrower default poses the primary risk, not price fluctuation in private credit. Platforms must track borrower health, repayment status, covenants, and recovery mechanisms. Tokenization exposes credit risk transparently, demanding stronger underwriting, monitoring, and servicing infrastructure.

3. Legal Enforceability Over Asset Custody

Private credit tokens represent legal claims on future cash flows, unlike physical RWAs. Platforms must couple on-chain tokens with off-chain legal agreements like loan assignments, SPVs, or trust structures. Without enforceability, tokenized loans remain symbolic.

4. Limits of Fractional Ownership in Credit Models

Simple fractional or NFT-based ownership works for divisible assets. Credit instruments require priority rules, seniority, and waterfall distributions. Token holders may have different rights to interest, principal, or recovery proceeds, demanding purpose-built credit logic.

5. Engineered Liquidity in Tokenized Assets

Private credit markets remain inherently illiquid. Tokenization does not create instant exits. Platforms design controlled liquidity mechanisms: transfer windows, NAV-based pricing, redemptions, or buyback programs. Treating tokens like freely traded assets leads to failure.

Types of Private Credit Assets to Tokenize

Private credit tokenization unlocks access to traditionally illiquid debt assets through fractional ownership. These instruments offer predictable cash flows and align well with blockchain-based transparency, compliance, and automated yield distribution.

| Private Credit Asset Type | Real-World Example | On-Chain Implications |

| SME & Mid-Market Loans | Hamilton Lane tokenized part of its $2.1B flagship fund on Polygon via Securitize, enabling accredited investors to access private credit exposure with lower minimums | Requires amortization logic, investor eligibility controls, automated capital calls, distribution workflows, and enforceable on-chain legal linkage |

| Invoice & Receivable Financing | Populous World allows SMEs to tokenize invoices on Ethereum, sell them to investors, and automate repayment distribution at invoice maturity | Requires rapid issuance, real-time payment oracles, automated principal recycling, and servicing integration |

| Trade Finance & Supply Chain Credit | we.trade, backed by banks like Deutsche Bank and HSBC, digitizes trade finance using Hyperledger Fabric with milestone-based smart contracts | Uses event-based smart contracts, shipment verification, multi-party access, bank guarantees, enforceable financing claims |

| Structured Credit & Private Debt Funds | Ondo Finance tokenizes pooled fixed-income products like OUSG and OMMF, demonstrating NAV-based fund tokenization with daily yield accrual | Requires periodic NAV updates, investor windows, automated fees, yield distribution |

| Asset-Backed Private Credit | Centrifuge enabled New Silver to tokenize real-estate-backed loans, allowing investors to earn yield from property-secured credit pools | On-chain systems track collateral, LTVs, repayments, liquidations, and recovery waterfalls |

How Liquidity Works in Tokenized Private Credit Markets?

Private credit tokens do not trade like equities or crypto assets. Liquidity must be intentionally engineered around cash flows, regulatory limits, and credit risk, balancing investor exits with borrower stability and legal enforceability.

1. The Liquidity Constraints of Private Credit Assets

Private credit assets are illiquid by nature. Tokenization does not create continuous buyers; it restructures access. Attempting instant liquidity misprices risk, destabilizes borrowers, and introduces regulatory exposure that undermines long-term platform credibility.

2. Controlled Secondary Markets & Transfer Windows

Most platforms enable liquidity through scheduled transfer windows. Tokens can trade only during predefined periods, aligning exits with cash-flow visibility, compliance checks, and operational readiness while preventing speculative churn and disorderly markets.

3. NAV-Based Pricing Instead of Order Books

Private credit tokens trade on net asset value, not bid-ask dynamics. NAV pricing reflects accrued interest, credit performance, and write-downs, ensuring transfers occur at economically fair values rather than volatile, sentiment-driven prices.

4. Redemptions & Platform-Managed Liquidity

Rather than open markets, platforms often offer redemption programs or issuer buybacks. These mechanisms provide predictable exits, protect remaining investors, and maintain alignment between on-chain liquidity and off-chain cash availability.

5. Liquidity Constraints as a Risk-Management

Liquidity limits are not a weakness. By restricting transfer frequency, volume, and participant eligibility, platforms preserve borrower stability, enforce compliance, and protect investors from forced exits during periods of credit stress.

Global Market Growth of Private Tokenization Platform

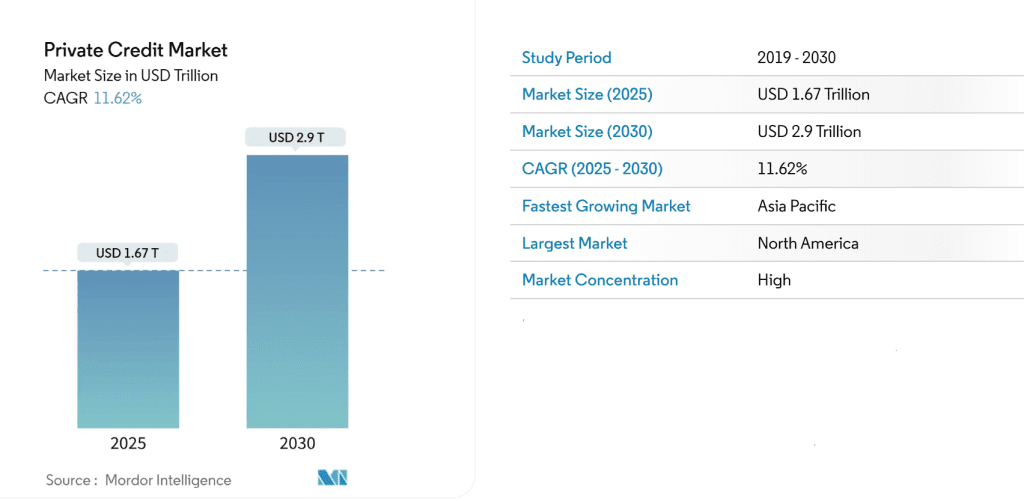

The Private Credit Market size is estimated at USD 1.67 trillion in 2025, and is expected to reach USD 2.9 trillion by 2030, at a CAGR of 11.62% during the forecast period (2025-2030). This growth is driving strong demand for secure, compliant private credit tokenization platforms that digitize origination, servicing, and liquidity.

Real-world assets (RWAs), excluding stablecoins, now represent 15% of total on-chain value locked (TVL), growing over 60% in 2024 to $13.7 billion. Private credit accounts for about 70% of the RWA market, exceeding categories like Treasury bills and commodities.

This sector’s rapid growth is fueled by demand for higher yields and improvements in tokenization infrastructure. Industry leaders such as Figure have supported this expansion, facilitating nearly $4 billion in tokenized private credit in 2024.

This growth is already visible across active on-chain private credit platforms:

- Goldfinch operates unsecured, trust-based private credit in emerging markets, with ~$446M active loans in 2024 and yields around 8–15% APY.

- Credix Finance focuses on invoice-backed lending in Latin America, managing ~$26–30M TVL with 11–14% APY through supply-chain collateral.

- Centrifuge enables cross-border SME and trade finance, supporting ~$443M TVL in invoice-backed and asset-backed private credit pools.

- Maple Finance serves institutional lenders globally, with ~$7.7B in cumulative loans issued, backed by US Treasuries and crypto collateral.

- RWA.xyz (active loans) tracks ~$14B in tokenized RWA private loans across regions, primarily structured as senior secured loans and term notes.

Benefits of a Private Credit Tokenization Platform

A private credit tokenization platform improves access, transparency, and efficiency in private debt markets. It enables fractional investment, real-time reporting, and automated compliance while expanding global participation across traditionally illiquid credit assets.

A. Capital Providers (Investors & Funds)

Capital providers benefit from programmable access to private credit, combining automated cash flows, transparency, and controlled liquidity without compromising credit discipline.

- Improved Capital Efficiency: Tokenization enables fractional participation and faster settlement, allowing investors to deploy capital efficiently across diversified private credit opportunities without long lock-in friction.

- Transparent, Automated Cash Flows: Smart contracts automate interest accrual, principal repayments, and fee distributions, ensuring predictable, rule-based payouts aligned with contractual credit terms.

- Controlled Liquidity Options: Investors gain access to engineered liquidity mechanisms such as transfer windows, redemptions, or buybacks—offering exits without exposing assets to speculative trading risk.

- Real-Time Transparency & Auditability: On-chain records provide continuous visibility into credit performance, repayment status, and asset state, improving trust and reducing dependence on delayed, manual reporting.

B. Credit Originators & Platform Operators

Originators and platform operators gain scalable infrastructure to raise capital faster, automate servicing, enforce compliance, and operate private credit efficiently.

- Lower Operational & Administrative Costs: Automated onboarding, servicing, and reporting replace manual workflows, reducing overhead and enabling scale without proportional cost increases.

- Faster Capital Formation & Deployment: Originators can refinance, syndicate, or distribute credit exposure faster by tokenizing assets, accelerating capital inflows and loan deployment cycles.

- Compliance-By-Design Infrastructure: Permissioned tokens, investor eligibility checks, and jurisdiction-aware transfers ensure regulatory requirements are enforced directly at the protocol level.

- Scalable, Programmable Credit Infrastructure: Once deployed, the platform supports multiple asset types, funds, and strategies, enabling long-term product expansion without reengineering core systems.

Key Features of a Private Credit Tokenization Platform

A private credit tokenization platform uses blockchain for secure asset structuring, transparency, and compliance. These features improve efficiency, investor confidence, and scalable access to private credit markets.

1. Fractionalized Private Credit Instruments

The platform divides large private credit assets into digital tokens, enabling fractional participation. Users invest with lower minimums, diversify across multiple loans, and gain exposure to institutional-grade credit instruments previously accessible only to large funds.

2. Smart Contract Loan Origination

The platform automates loan origination, servicing, and repayment using smart contracts. It enforces terms programmatically, distributes interest automatically, reduces manual intervention, and ensures consistent execution across the entire private credit lifecycle.

3. Transparent Asset Vetting and Risk Disclosure

The platform standardizes asset due diligence by publishing verified borrower data, risk metrics, and legal documentation on-chain. Users evaluate credit quality confidently with transparent disclosures, improving informed decision-making and trust in private credit offerings.

4. Tokenized Secondary Market Liquidity

The platform enables peer-to-peer trading of credit tokens via secondary market infrastructure. Users gain flexibility to rebalance portfolios, access earlier liquidity, and manage risk more dynamically than traditional buy-and-hold private credit structures.

5. Real-Time Global Private Credit Transparency

The platform delivers real-time visibility into ownership, cash flows, and loan performance while enabling global investor participation. Users track portfolios instantly, verify immutable on-chain records, and access international private credit opportunities without geographic, operational, or intermediary constraints.

6. Debt Service Coverage & Covenant Tracking

This feature continuously monitors borrower financial health by enforcing DSCR thresholds and covenant compliance in real time. It enables early risk detection, proactive intervention, and protects investors long before payment defaults occur, a critical institutional safeguard.

7. Seniority & Tranche Structuring

This feature structures credit deals into senior, mezzanine, and junior tranches, each with distinct risk-return profiles. It allows investors to choose priority in cash flows and recoveries, mirroring sophisticated private credit and securitization models.

8. Collateral Registry & Lien Management

This feature digitally records collateral, lien priority, and security interests with immutable, auditable records. It strengthens enforcement rights, simplifies legal verification, and improves recovery outcomes in distressed or default scenarios.

9. Secure Digital Custody and Settlement

The platform protects user assets through secure digital custody, combining institutional-grade key management and atomic settlement. Users settle transactions faster, reduce counterparty risk, and maintain cryptographic proof of ownership at all times.

10. TradFi System Integration for Tokenized Credit

The platform connects blockchain infrastructure with existing TradFi systems, supporting bank rails, custodians, reporting tools, and payment networks. Users transition smoothly between digital assets and traditional workflows without disrupting established financial operations.

Private Credit Tokenization Platform Development Process

Private credit tokenization platform development blends financial engineering, regulatory compliance, and blockchain infrastructure to digitize private debt assets securely. Our developers follow a structured, compliance-first approach to ensure scalability, transparency, and reliability.

1. Asset, and Regulatory Assessment

We begin by identifying target private credit assets, investor segments, and operating jurisdictions. Our developers and compliance teams analyze regulatory frameworks, securities classifications, and licensing requirements to ensure the platform aligns with legal obligations from day one.

2. Credit Product and Capital Structure Design

We design credit products and capital stacks, defining loan terms, tranches, seniority levels, interest models, and covenants. Our team structures tokenized assets to accurately reflect economic rights, cash flow priorities, and risk-return profiles.

3. Tokenization and Smart Contract Design

We architect the tokenization framework and develop smart contracts that govern ownership, cash flows, lifecycle events, and compliance rules. Our developers encode interest accrual, repayments, prepayments, and default conditions directly into on-chain logic.

4. Compliance, Identity, and Access Controls

We integrate KYC, AML, investor accreditation, and jurisdictional controls into the onboarding process. Our smart contracts enforce participation and transfer restrictions automatically, ensuring only eligible users interact with tokenized credit assets.

5. Loan Origination and Servicing Infrastructure

We build loan origination and servicing modules that manage borrower onboarding, documentation, covenant monitoring, and payment schedules. Our platform supports continuous loan oversight, borrower communication, and performance tracking throughout the credit lifecycle.

6. Custody, Settlement, and Payment Integration

We implement secure digital custody solutions, wallet management, and atomic settlement mechanisms. Our developers integrate fiat payment rails, stablecoins, and banking partners to ensure seamless interest distributions and principal repayments.

7. Secondary Market and Liquidity Enablement

We develop compliant token transfer and trading infrastructure to support secondary market activity. Our platform enforces regulatory transfer rules, settlement finality, and liquidity controls, enabling controlled and transparent asset liquidity.

8. Transparency, Data, and Analytics Layer

We deliver real-time dashboards and reporting tools that provide visibility into ownership, cash flows, performance metrics, and risk indicators. Our system publishes immutable on-chain records and standardized disclosures for informed decision-making.

9. Security Audits and Stress Testing

We conduct comprehensive smart contract audits, penetration testing, and financial stress scenarios. Our developers validate system resilience against security threats, operational failures, and adverse credit events before launch.

10. Launch and Continuous Optimization

We deploy the platform in phased releases, monitor system performance and risk metrics, and iterate continuously. Our team enhances features, expands asset coverage, and adapts to evolving regulatory and market conditions.

Cost to Build a Private Tokenization Platform

The private tokenization platform development cost depends on asset complexity, compliance scope, and technical architecture. Development investments vary based on security requirements, integrations, and scalability needs across regulated private credit markets.

| Development Phase | What We Deliver | Estimated Cost |

| Discovery & Regulatory Analysis | Asset scope definition, jurisdictional analysis, compliance mapping, legal-technical alignment | $8,000 – $10,000 |

| Credit Product & Structuring Design | Loan structures, tranches, seniority models, interest logic, covenant frameworks | $16,000 – $28,000 |

| Smart Contract & Token Architecture | Token standards, credit lifecycle contracts, payment logic, compliance rules | $20,000 – $32,000 |

| Identity & Compliance Integration | KYC/AML workflows, investor accreditation, access controls, transfer restrictions | $13,000 – $22,000 |

| Loan Origination & Servicing Modules | Borrower onboarding, documentation, covenant tracking, servicing dashboards | $15,000 – $28,000 |

| Custody, Settlement & Payments | Wallet infrastructure, custody setup, fiat/stablecoin payment integrations | $14,000 – $25,000 |

| Secondary Market Enablement | Compliant token transfers, liquidity controls, settlement mechanisms | $12,000 – $18,000 |

| Transparency & Analytics Layer | Real-time dashboards, portfolio analytics, on-chain reporting | $10,000 – $14,000 |

| Security Audits & Stress Testing | Smart contract audits, penetration testing, scenario simulations | $10,000 – $13,000 |

| Launch & Ongoing Optimization | Phased deployment, monitoring, feature enhancements, support | $10,000 – $14,000 |

Total Estimated Cost: $64,000 – $125,000+

Note: Costs vary based on asset complexity, regulatory scope, security requirements, and scalability needs across jurisdictions and investor participation levels.

Consult with IdeaUsher to receive a tailored cost estimate, architecture roadmap, and development strategy aligned with your private credit tokenization goals.

Challenges And How We Solve Them?

Building a private credit tokenization platform is not a standard blockchain project. The real complexity lies in credit behavior, legal enforceability, compliance constraints, and operational reliability. Below are the key technical challenges and how we solve them in production systems.

1. On-Chain Credit Logic Mapping

Challenge: Private credit involves amortization schedules, interest accrual, grace periods, defaults, recoveries, and waterfall distributions. Generic token standards cannot represent this lifecycle reliably.

Solution: We design credit-native smart contract state machines that explicitly encode loan states, cash-flow rules, and priority logic. Every transition is deterministic, auditable, and legally aligned.

2. Off-Chain Credit Data to On-Chain Execution

Challenge: Repayments, covenants, collateral updates, and legal events happen off-chain. Without reliable data, smart contracts enforce incorrect outcomes.

Solution: We implement multi-source oracle infrastructure with reconciliation logic, event validation, and fallback governance paths, ensuring on-chain execution reflects verified real-world credit events.

3. Protocol-Level Regulatory and Compliance

Challenge: Private credit tokens are often securities. Off-chain compliance checks alone cannot prevent unauthorized transfers or jurisdictional violations.

Solution: We embed compliance-by-design using permissioned token standards, on-chain investor eligibility checks, jurisdiction-aware transfer rules, and role-based access control enforced directly by smart contracts.

4. Liquidity Without Credit Risk Destabilization

Challenge: Always-on secondary markets introduce mispricing, regulatory exposure, and borrower instability for inherently illiquid credit assets.

Solution: We engineer controlled-liquidity models for transfer windows, NAV-based pricing, redemptions, and platform-managed buybacks, aligned with cash-flow visibility and regulatory constraints.

How Oracle & Data Infrastructure Maintain Credit Integrity?

Oracles and data infrastructure ensure that on-chain private credit systems reflect real-world credit reality. They bridge off-chain borrower activity, collateral status, and legal events with deterministic smart contract execution.

1. Repayment & Cash-Flow Oracles

Repayment oracles (The Source of Truth) ingest real borrower payment data from banks, escrow accounts, or servicers. This data drives interest accrual, yield distribution, delinquency detection, and investor payouts, making actual cash flow the foundation of tokenized credit value.

2. Credit Status & Covenant Monitoring Feeds

Beyond payments, credit feeds track covenant compliance, financial ratios, restructurings, and credit deterioration. Continuous on-chain updates expose early risk signals to investors, enabling proactive transparency instead of delayed default discovery.

3. Collateral & Valuation Data Oracles

For asset-backed private credit, valuation oracles supply LTV ratios, appraisal updates, insurance status, and collateral condition data. These inputs determine liquidation thresholds, margin safety, and recovery priorities within smart contract enforcement logic.

4. Event-Driven Triggers & State Transitions

Private credit operates on discrete events, not continuous pricing. Oracles validate missed payments, shipment confirmations, invoice approvals, or legal actions, triggering deterministic smart contract state transitions without manual interpretation or discretionary intervention.

5. Data Redundancy & Dispute Resolution

Single-source data creates systemic risk. Robust oracle systems use multiple data providers, reconciliation checks, and governed override mechanisms to prevent erroneous inputs from triggering false defaults, liquidations, or irreversible investor losses.

6. Auditability & Historical Data Integrity

All Oracle inputs must be timestamped, traceable, and historically preserved. This enables auditors, regulators, and investors to reconstruct cash flows, credit events, and enforcement actions, ensuring long-term trust and regulatory defensibility.

Examples of Some Private Credit Tokenization Platforms

Several platforms are applying tokenization to private credit and real-world assets. These examples show how blockchain enables fractional ownership, transparency, and scalable access to traditionally illiquid credit markets.

1. Centrifuge

Centrifuge enables private credit originators to tokenize real-world debt such as invoices and loans. It connects asset-backed credit pools to on-chain liquidity while preserving borrower underwriting, risk tranching, and institutional-grade reporting standards.

2. Maple Finance

Maple Finance focuses on tokenized private credit pools curated by professional credit managers. It enables on-chain issuance of credit instruments, automated interest distribution, and transparent performance tracking, making it a strong reference for institutionally focused private credit platforms.

3. Figure

Figure applies blockchain to originate, tokenize, and service private credit products such as consumer and real estate loans. Its vertically integrated model shows how compliant loan origination, servicing, and secondary liquidity can operate on a single tokenized credit platform.

4. Securitize

Securitize provides a regulated infrastructure for issuing and managing tokenized private credit securities. It supports investor onboarding, compliance workflows, and lifecycle management, making it suitable for platforms targeting regulated private debt and institutional investor participation.

5. Credix Finance

Credix Finance tokenizes private credit by connecting vetted borrowers with institutional liquidity through on-chain credit pools. Its model emphasizes borrower due diligence, predictable yield structures, and transparent cash flow distribution for tokenized private debt investors.

Conclusion

Building a secure and compliant private credit tokenization platform requires clarity of purpose, strong governance, and a practical understanding of both credit markets and blockchain infrastructure. The process brings together asset origination, data integrity, investor access, and regulatory alignment into a single operating model. When developers approach it thoughtfully, private credit tokenization platform development improves transparency, liquidity management, and operational efficiency without compromising risk controls. Making design decisions that serve real participants, respect jurisdictional rules, and support long-term scalability as the platform matures globally is most important.

Develop a Private Credit Tokenization Platform with IdeaUsher

We specialize in blockchain, tokenization, and dApp development for complex financial use cases. Leveraging this expertise, our ex-FAANG and MAANG developers build private credit tokenization platforms that digitize credit assets while maintaining compliance, transparency, and institutional standards.

Why Work With Us?

- Private Credit Domain Expertise: We design platforms aligned with lending structures, borrower risk assessment, and credit lifecycle management.

- Asset Backed Token Architecture: Our developers structure tokens around verified credit assets, repayment schedules, and yield models.

- Compliance Driven Design: We integrate KYC, AML, investor eligibility, and jurisdiction-specific regulatory frameworks.

- Institutional Ready Infrastructure: Our platforms are secure, scalable, and built to support long-term participation from professional investors.

Review our portfolio to see how we deliver blockchain solutions for real-world financial ecosystems.

Get in touch for a free consultation and take the first step toward launching a secure private credit tokenization platform.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A.1. Blockchain enables transparent ownership records, automated interest distributions, immutable transaction logs, and real-time settlement. It reduces manual processing while improving auditability and trust between borrowers, platform operators, and investors involved in private credit markets.

A.2. Liquidity is managed through structured redemption rules, secondary trading options, transfer restrictions, and investor eligibility controls. Clear liquidity policies help balance investor flexibility with borrower stability and prevent market disruptions within tokenized credit portfolios.

A.3. Key risks include borrower default, data accuracy, smart contract vulnerabilities, regulatory misalignment, and liquidity constraints. Addressing these early through audits, legal review, and conservative platform design helps reduce long-term operational and reputational exposure.

A.4. Institutional investors value clear asset documentation, strong compliance controls, predictable cash flows, robust reporting, and secure custody solutions. A platform that mirrors traditional credit discipline while improving efficiency is more likely to earn institutional trust.