Inspecting auto damage has been a hassle with the old system. Slow, manual, and often filled with human error, leading to delays in insurance claims and unhappy customers. But thanks to the rapid advancement of digital technology, that’s all changing. AI-based auto damage assessment tool like Tractable uses cutting-edge computer vision and machine learning to assess vehicle damage accurately. This not only speeds up the entire process but also takes the guesswork out of it, leading to more reliable outcomes and a smoother experience for both insurers and customers alike.

The AI vehicle inspection market was valued at USD 1.2 billion in 2023. This surge is largely driven by the growing demand for faster, more accurate damage assessments in the insurance industry as companies look for ways to streamline processes and improve customer satisfaction. For entrepreneurs looking to tap into this booming market, this blog will be your roadmap to developing an AI-based auto damage assessment tool. We’ll walk you through the essential technology, market opportunities, and critical factors to consider, ensuring you know how to create a successful platform like Tractable that positions your business for long-term growth.

Key Market Takeaways of the AI Inspection Market

According to Global Market Insights, the AI vehicle inspection system market was valued at USD 1.2 billion in 2023 and is projected to grow at a CAGR of more than 18% from 2024 to 2032. This growth is fueled by the rapid progress in artificial intelligence and machine learning technologies, as well as the rising demand for more efficient and precise vehicle inspection solutions.

Source: GlobalMarketInsights

The AI vehicle inspection system market is segmented by application into damage detection, insurance claim assessment, quality control, safety inspection, and others. The damage detection segment is expected to grow at a CAGR of over 16% from 2024 to 2032. This growth is driven by the increasing emphasis on minimizing operational costs and enhancing vehicle lifecycle management, which is boosting the demand for AI-driven damage detection systems in the vehicle inspection market.

In 2023, North America led the global AI vehicle inspection system market, holding a dominant share of over 35%. In Europe, the growing adoption of EVs is driving the creation of AI inspection systems designed specifically for EV components, such as battery health, electric drivetrains, and charging systems. Meanwhile, in the Asia Pacific region, the rapid growth of smart city initiatives and urban mobility projects is having a significant impact on the AI vehicle inspection system market.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

Overview of AI-Based Auto Damage Assessment Tool Tractable

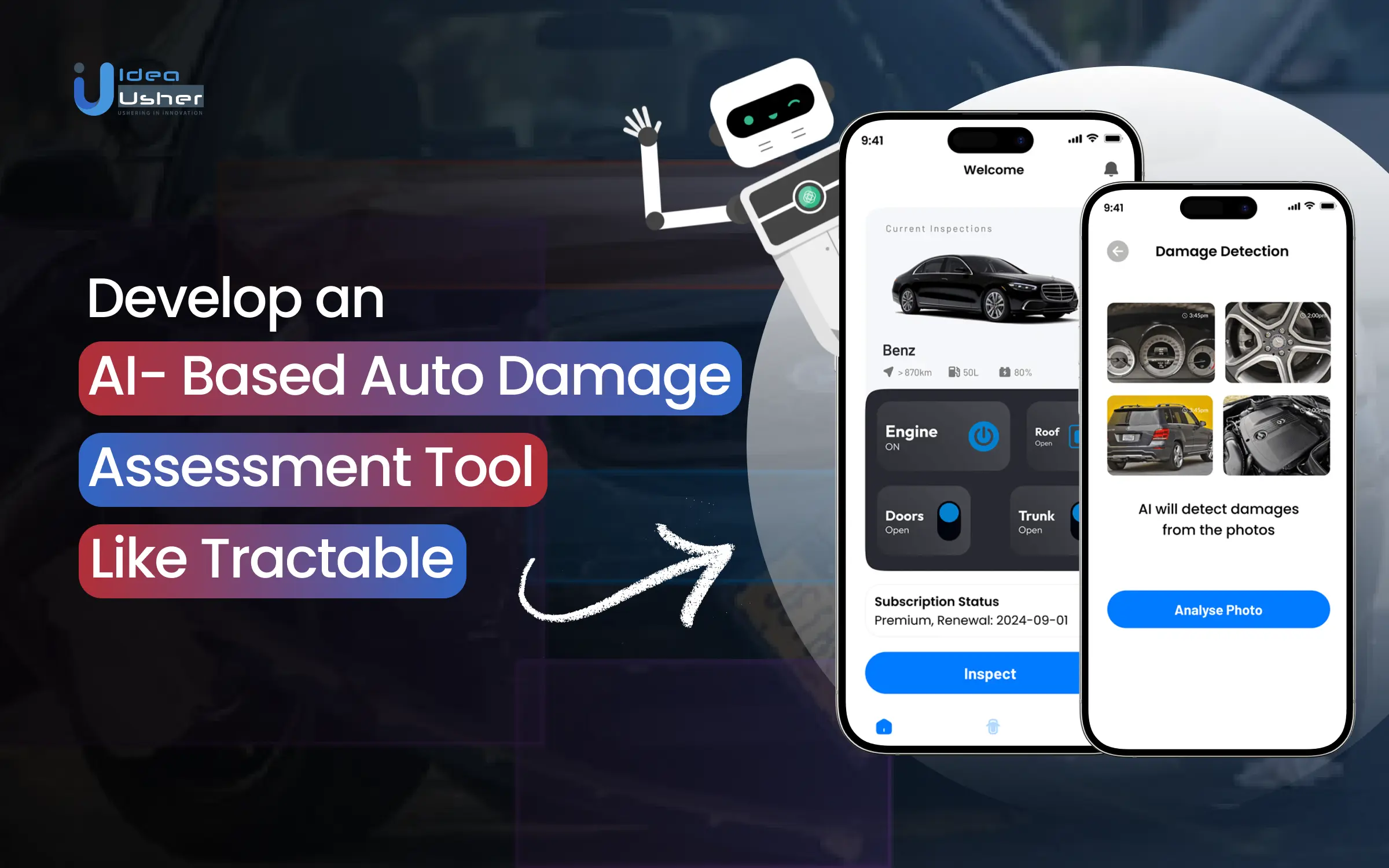

The Tractable is an advanced AI-driven platform designed for quick and precise assessment of vehicle damage. By utilizing deep learning and computer vision, this tool analyzes photos of damaged cars to produce accurate repair estimates rapidly. Its capabilities support insurance companies and auto repair shops in streamlining claim processes, making them faster and more reliable.

Key Features of the Tractable:

- Rapid and Precise Damage Assessments:

Unlike traditional assessments, which might require manual inspection and extensive review, Tractable uses deep learning models trained on vast datasets of vehicle damage cases. This AI-driven approach ensures that damage is identified swiftly and accurately, allowing insurance companies and auto repair shops to generate repair estimates almost instantly. - Reduction of Human Error:

Human assessments vary based on experience or situational biases, which may lead to inconsistencies in estimates. By relying on AI, the Tractable minimizes the risk of human error. This accuracy is especially valuable in high-volume claim situations, helping to ensure fair and reliable cost assessments. - Enhanced Customer Experience and Satisfaction:

Faster, more accurate estimates improve the claims experience for customers by reducing the time they spend waiting for claim resolutions. This tool empowers insurers and repair shops to process claims quickly and provides policyholders with a smooth, transparent claims journey. - Seamless Integration with Existing Systems:

The Tractable Auto Estimator is designed to integrate with existing insurance and repair shop management systems. This allows companies to adopt the tool without extensive changes to their workflows, making it easy to deploy and scalable for businesses of various sizes. - Data-Driven Insights for Better Decision-Making:

By analyzing and tracking patterns in vehicle damage assessments, the tool offers actionable insights that can help companies improve their operations. Insurance providers can use these insights to understand claim trends and refine their policies.

How Tractable Works?

Tractable’s Auto Damage Assessment Tool leverages advanced AI technologies, particularly deep learning and computer vision, to deliver fast and accurate vehicle damage assessments. By combining these AI capabilities, the tool enables a streamlined claims process, offering precise repair estimates and an improved customer experience. Here’s how the tool works, step-by-step:

- Image Capture

The process begins with the user capturing photos of the damaged vehicle using a smartphone or similar device. These images are then uploaded directly to the Tractable platform, providing the data needed for AI analysis. - Image Processing

Once the images are uploaded, Tractable’s AI-powered system processes them using deep learning and computer vision techniques. Tractable’s deep learning model is trained on millions of pictures of damaged vehicles, allowing it to recognize damage patterns with a high degree of accuracy. - Damage Estimation

After analyzing the images, the AI generates a detailed estimate of repair costs. This calculation takes into account several key factors, including the type and extent of the damage, as well as the costs associated with necessary parts and labor. The result is a highly accurate estimate that supports effective decision-making for repair needs. - Report Generation

The system then compiles a comprehensive report based on the assessment, which includes damaged parts, repair costs, and highlights indicating damaged areas. This detailed report serves as actionable information for insurance adjusters and repair shops, providing them with a clear roadmap for the necessary repairs. - Claims Processing

With a thorough report in hand, insurance companies can proceed with claims processing more efficiently. The fast and precise assessment provided by Tractable’s AI tool accelerates the claims process, improving transparency and satisfaction by offering customers quicker, more accurate claims resolutions.

Business and Revenue Model of Tractable

Tractable’s business model revolves around delivering AI-driven solutions to streamline and automate essential processes within the insurance sector. The AI-driven approach enables insurers to achieve faster, more accurate assessments of damaged assets like vehicles and property, significantly improving operational efficiency and customer satisfaction.

- AI-Powered Visual Assessment Platform

Tractable offers a cutting-edge platform utilizing AI and computer vision to evaluate images of damaged assets, such as cars, homes, or other types of property. It provides insurers with precise evaluations, enabling them to understand the scope of damage and associated repair costs almost instantly.

- Rapid Damage Analysis and Report Generation

With advanced algorithms, the platform can promptly determine damage severity, produce accurate repair estimates, and generate detailed, data-backed reports. Once the platform uploads an image of the damaged asset, the AI rapidly assesses the damage, generates an accurate cost estimate, and compiles a detailed report for direct integration into the insurer’s claims processing workflow.

- Streamlined Claims Processing

By automating the initial assessment phase, Tractable enables insurance companies to speed up claims processes, cut operational costs, and enhance overall customer experience. By reducing the complexity and delays typically associated with claims, insurers can offer faster, more responsive service to their customers, which is essential in today’s competitive insurance landscape.

Revenue Model

Tractable’s revenue model is based on a diversified approach, allowing it to capitalize on different income streams based on customer needs and usage patterns. This approach includes licensing, subscription, and service fees:

- Licensing Fees

Tractable generates a significant portion of its revenue through licensing fees for its AI technology. Insurance companies and businesses pay a licensing fee to integrate Tractable’s visual assessment platform into their systems. This arrangement allows insurers to control the platform’s application, making it flexible and scalable for various enterprises.

- Subscription Fees

In addition to one-time licensing fees, Tractable also offers its platform as a subscription service. This model is beneficial for clients looking for ongoing access to the platform’s features and updates. The subscription model not only provides recurring revenue for Tractable but also enables continuous engagement with clients, allowing them to benefit from regular AI model improvements, feature updates, and dedicated support.

- Service Fees for Custom AI Development and Data Analysis

Tractable also offers customized AI model development and data analysis services tailored to specific client requirements. These customizations may involve building unique AI models to handle specialized claims or refining algorithms based on a company’s historical data. Tractable charges service fees for these tailored offerings, enabling insurance companies to optimize their claims handling process further.

Why Is An AI-Based Auto Damage Assessment Tool Like Tractable A Strong Business Investment?

Tractable had an estimated annual revenue of $39.7 million and a significant valuation of $1 billion on Dec 31, 2023. The company generates revenue through diverse streams, including licensing fees from insurers integrating AI into their workflows. It also earns subscription fees for ongoing access and service fees for customized AI development. This multi-tiered revenue model ensures recurring income and steady financial growth. It appeals to investors seeking a sustainable business model.

Tractable’s backing from major investors, including SoftBank Vision Fund 2, has led to total funding of $119.9M that it used to expand research and development and form strategic partnerships with leading insurance and automotive companies. Such partnerships not only expand Tractable’s customer reach but also provide deep market insights that fuel continued innovation.

AI-based auto damage assessment tools can deliver strong returns by meeting the rising demand for automated solutions in claims processing. With proven revenue models, it attracts strong investor interest and delivers substantial returns in the rapidly evolving insurance tech market.

Applications of AI in Defect Inspection?

AI has significantly transformed the defect inspection process, bringing improved accuracy, speed, and efficiency. Here’s how AI can be applied in various stages of defect detection:

1. Visual Inspection

AI-driven image analysis allows systems to detect defects such as scratches, cracks, and missing parts. By utilizing computer vision, AI can be trained to identify patterns and anomalies even in complex production environments. Moreover, AI can perform real-time monitoring of production lines to catch defects immediately as they arise.

2. Predictive Maintenance

AI excels at analyzing sensor data from machinery, predicting potential failures before they happen, and enabling proactive maintenance schedules. With its ability to spot anomalies in operating patterns, AI can detect early signs of malfunctions, reducing the risk of unexpected breakdowns.

3. Quality Control

AI enhances statistical process control (SPC) by automating the analysis of large datasets. This helps identify trends and potential quality issues. Additionally, AI performs root cause analysis. It examines historical data to uncover the underlying causes of defects, enabling effective corrective actions.

4. Automated Testing

In the realm of software testing, AI can generate test cases based on historical data and requirements, ensuring better coverage. It can also automate test execution and analyze results to quickly identify defects, speeding up the testing phase.

5. Supply Chain Monitoring

AI can monitor products across the supply chain, helping to detect quality issues early in the process. Furthermore, AI’s ability to analyze data allows it to detect fraudulent activities, such as counterfeit goods or false claims, ensuring product integrity throughout the entire supply chain.

Steps to Develop An AI-Based Auto Damage Assessment Tool Like Tractable

A structured approach is essential to creating an AI-based auto damage assessment tool similar to Tractable. Here are the key steps to build a solution that leverages advanced AI to analyze vehicle damage and streamline assessment processes.

Step 1. Define Project Scope and Requirements

Start by analyzing the specific needs of insurance companies, body shops, and automotive repair centers to define the tool’s functions clearly. Conduct market research to identify core pain points, such as assessment accuracy, processing speed, and scalability, and outline the features necessary to meet these demands.

Step 2. Gather and Label Training Data

The backbone of an AI-driven visual assessment tool is high-quality, annotated data. Gather a large dataset of vehicle images showing various types and levels of damage. Partnering with insurers’ repair centers or using public datasets can be beneficial. Annotate images with specific details, including the type of damage, location, and severity, to train the model accurately.

Step 3. Choose the Right AI and Computer Vision Models

Select appropriate machine learning and computer vision algorithms, such as convolutional neural networks (CNNs), to identify and assess vehicle damage. Experiment with multiple model architectures to find the one that offers the best accuracy and speed for your tool’s requirements. Consider integrating deep learning frameworks like TensorFlow or PyTorch for flexibility and efficiency.

Step 4. Develop an AI Training Pipeline

Build a robust training pipeline for your AI models to process large image datasets efficiently. Implement data preprocessing steps, including image normalization and augmentation, to enhance the model’s ability to generalize. This ensures the model performs well across various damage types, vehicle models, and environmental conditions. Regularly test and evaluate the model to improve its accuracy and reliability.

Step 5. Create a User-Friendly Interface for Image Upload and Analysis

Design an intuitive front-end interface where users can upload images of damaged vehicles for analysis. Ensure the interface is compatible with mobile and web platforms for easier adoption. This interface should also display assessment results clearly, providing damage reports, repair cost estimates, and the predicted repair time.

Step 6. Integrate Real-Time Processing and Results Delivery

Set up real-time processing capabilities to enable instant damage assessments. This may involve cloud computing resources or edge computing options for faster processing. Implement APIs to facilitate smooth integration with insurers’ existing systems. It helps them access the assessment results directly through their platforms.

Step 7. Implement Continuous Learning and Model Updates

Integrate a continuous learning pipeline to improve the model’s accuracy over time as the system collects new data. Use feedback from users and additional datasets to fine-tune the model. It ensures that remains effective as new vehicle models, repair techniques, and damage types emerge.

Step 8. Ensure Compliance and Build Partnerships

To gain traction in the insurance industry, ensure your tool complies with relevant data privacy and security regulations. Partner with insurance companies, repair shops, and other stakeholders for real-world testing, feedback, and data sharing. Strategic partnerships can validate the tool, provide valuable insights, and support broader adoption.

Cost of Developing An AI-Based Auto Damage Assessment Tool Like Tractable

| Category | Description | Estimated Cost Range |

| Research and Development | Data collection, AI training, testing, and validation | $2,000 – $10,000 |

| Image processing, object detection, and damage analysis | $3,000 – $12,000 | |

| Front-End Development | UI design, mobile app, and web dashboard | $1,000 – $8,000 |

| Back-End Development | Cloud setup, API creation, and database design | $1,000 – $6,000 |

| App Features | Image upload, real-time detection, cost estimation | $1,000 – $10,000 |

| Report generation, insurance system integration | $1,000 – $8,000 | |

| Testing and Quality Assurance | Unit, integration, and user acceptance testing | $1,000 – $6,000 |

| Total Estimated Cost Range | $10,000 – $100,000 |

Factors Affecting Cost of Developing An AI-Based Auto Damage Assessment Tool

- Data Quality and Quantity: High-quality, labeled images of vehicle damage are essential, but gathering and processing this data can be costly. Large datasets with diverse damage scenarios increase accuracy but require more resources.

- Model Complexity: The level of sophistication in computer vision algorithms impacts cost. Advanced models that can detect complex damage types or variations require more development and training time.

- Real-Time Processing Requirements: Real-time analysis for instant damage assessments needs high computational power, which can increase both development and operational costs.

- Integration with Insurance Systems: Custom integration with insurance platforms for claim processing can increase costs, especially if extensive compatibility adjustments require implementation.

Conclusion

I believe that developing an AI-based auto damage assessment tool presents an exceptional business opportunity for companies in the insurance and automotive sectors. This innovative technology not only meets the growing demand for automation and accuracy in claims processing but also positions businesses at the forefront of digital transformation. With AI-driven tools, companies can reduce claim turnaround times, enhance customer satisfaction, and cut operational costs, creating a compelling ROI. As AI and machine learning continue to evolve, investing in such a platform now allows companies to harness a scalable, cutting-edge solution that aligns with future market trends and user expectations.

Want To Make A Platform Like Tractable?

At Idea Usher, we’re passionate about bringing your vision of an AI-powered auto damage assessment tool to life. With over 500,000 hours of app development expertise, we’re fully equipped to make it happen. We understand the value of your idea and the impact it can have in transforming the claims process for insurers and enhancing customer satisfaction. Our team is dedicated to building a high-performance, scalable solution that leverages real-time assessments and accurate damage detection to streamline operations.

By partnering with us, you’ll get a committed team ready to support you every step of the way in creating a truly innovative platform that positions your business at the forefront of industry advancements. To learn more about our services, check our services page!

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

How does the AI model detect vehicle damage?

The AI model detects vehicle damage by analyzing images uploaded by users through a mobile app or web interface. It uses advanced computer vision algorithms to identify areas of damage, assess severity, and even estimate repair costs by comparing visual features with a trained dataset of damaged vehicles.

How accurate is the AI in assessing damage?

The accuracy of the AI model depends on the quality and quantity of the data it is trained on. The more diverse and high-quality the training data, the better the model becomes at identifying different damage types and predicting accurate assessments. Continuous training and updates help improve the model’s accuracy over time.

What platforms will the tool be available on?

The tool can be developed for multiple platforms, including mobile apps on iOS and Android and web applications. The choice of platform depends on your target audience and business needs. We can help you choose the right platforms based on user requirements.

Is the tool scalable for future use?

Absolutely. The tool is designed to be scalable, allowing for future updates, enhancements, and the ability to handle increased data volume as your business grows. Regular updates to the AI model can ensure it stays accurate and efficient over time.