Decentralized finance lending didn’t explode overnight. It grew quietly through trial, failure, and iteration until it became one of the most reliable primitives in crypto. Protocols like Aave and Compound proved something important early on: lending without banks, custodians, or intermediaries actually works.But they also revealed the cracks.

As usage scaled, Ethereum mainnet became expensive, slow, and unfriendly for everyday lending activity. Borrowing small amounts stopped making sense. Managing collateral became costly.

Among them, Base has emerged as a particularly strong foundation for DeFi lending. It keeps Ethereum’s security and developer familiarity intact, while removing the friction that makes lending feel inaccessible to retail users and operationally inefficient for protocols.

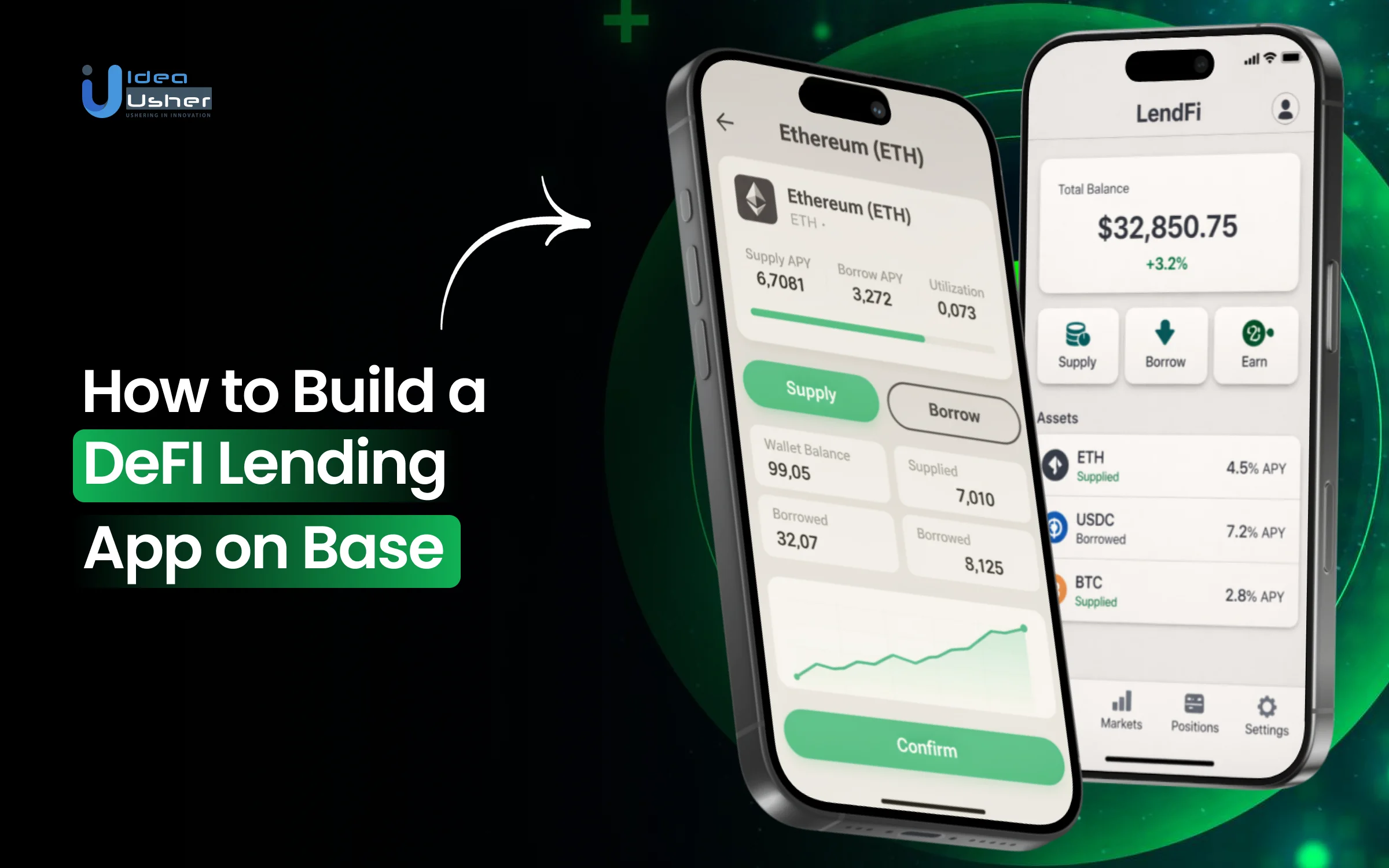

This guide focuses on the practical side of building a DeFi lending app on Base how the architecture comes together, why Base makes strategic sense compared to Ethereum mainnet and other L2s

What Is Base.org and Why It Matters for DeFi Lending

Base is an Ethereum Layer-2 blockchain developed using the OP Stack and backed by Coinbase. It is designed to offer low transaction fees, high throughput, and full Ethereum compatibility while maintaining Ethereum’s security guarantees.

For DeFi lending platforms, these characteristics are not optional—they are foundational.

Key Capabilities of Base for Lending Apps

- Ethereum-level security

- EVM compatibility (Solidity smart contracts)

- Extremely low gas fees

- Faster transaction finality

- Seamless wallet and DeFi tooling support

- Access to Coinbase’s broader ecosystem

This makes Base ideal for high-frequency financial operations such as interest calculations, liquidations, collateral rebalancing, and flash loans.

Why Base Is the Right Layer 2 for DeFi Lending Apps

Building a DeFi lending app requires more than smart contracts it demands an execution layer that can support frequent transactions, capital efficiency, and strong security without compromising user experience. This is where Base stands out as a purpose-built Layer 2 for scalable DeFi lending platforms.

Built for High-Frequency Lending Operations

DeFi lending protocols rely on continuous activity such as interest updates, collateral adjustments, repayments, and liquidations. Base’s Optimistic Rollup architecture processes these transactions off-chain and settles them on Ethereum, enabling high throughput without congestion. This allows lending apps to operate smoothly even under heavy usage.

Lower Costs Enable Capital-Efficient Lending

High gas fees often restrict DeFi lending to large loan sizes, excluding everyday users. Base dramatically reduces transaction costs, making smaller loans, frequent repayments, and dynamic interest models economically viable. This opens the door to more inclusive and capital-efficient lending markets.

Ethereum-Level Security for High-Value Protocols

Lending platforms manage large pools of user capital and are frequent targets for exploits. Base inherits the security guarantees of Ethereum, ensuring that lending contracts benefit from Ethereum’s decentralized security model while still enjoying faster and cheaper execution.

Full EVM Compatibility for Faster Development

Base is fully EVM-compatible, allowing developers to deploy Solidity smart contracts without major changes. Existing audited lending logic, ERC-20 tokens, oracles, and DeFi tooling can be reused, significantly reducing development time and technical risk.

Optimized for Real-World DeFi Adoption

Unlike experimental Layer 2s, Base is designed for production use. Faster settlement, predictable fees, and reliable infrastructure make it suitable for long-term lending products serving real users, DAOs, and institutions—not just short-term yield strategies.

Open, Interoperable, and Future-Ready

Built on the OP Stack, Base supports modular upgrades and future cross-L2 interoperability. This ensures DeFi lending apps can evolve alongside the Ethereum ecosystem, integrate new liquidity sources, and remain adaptable as Layer 2 networks mature.

Why Build a DeFi Lending App on Base Instead of Ethereum or Other L2s

While Ethereum mainnet remains the settlement layer of DeFi, building directly on it is no longer practical for lending platforms targeting mass adoption.

Strategic Advantages of Base

1. Low Gas Fees Enable Retail Lending

On Ethereum, a single borrow or liquidation transaction can cost tens of dollars. On Base, the same transaction costs cents—making micro-lending and small collateral positions viable.

2. Faster Loan Execution

Borrow, repay, and liquidation actions confirm quickly, improving user trust and reducing protocol risk.

3. Full Ethereum Compatibility

All existing DeFi standards—ERC-20, ERC-721, Chainlink oracles, OpenZeppelin contracts—work seamlessly on Base.

4. Early-Stage Ecosystem Advantage

Base is still growing. Early lending protocols can capture liquidity, users, and governance influence faster than on saturated chains.

5. Business-Friendly Infrastructure

Lower infrastructure and transaction costs significantly improve protocol profitability.

DeFi Lending App Architecture on Base

Base follows the same security and design principles as Ethereum-based protocols, but it’s structured to feel faster, cheaper, and more practical for everyday users. The architecture below reflects how real-world lending platforms are being built today not just in theory, but in production.

1. User & Application Layer

This is where users actually experience the product.

Most lending apps start with a clean web interface built using React or Next.js, with wallet connections through MetaMask or Coinbase Wallet. From the user’s perspective, everything happens here depositing assets, borrowing, repaying loans, and tracking risk.

What changes on Base is behavior. Because transactions cost cents instead of dollars, users:

- Adjust collateral more often

- Repay loans in smaller chunks

- Act faster during market volatility

This layer isn’t just about desig it directly influences how responsibly users manage their loans.

2. Core Smart Contract Layer

This is the backbone of the lending protocol and where all financial logic lives.

Lending Pool Contracts

These contracts hold user deposits and manage borrowing. When a user supplies liquidity, the protocol tracks it internally and allows others to borrow against approved collateral.

They handle:

- Deposits and withdrawals

- Borrowing and repayment

- Interest accrual over time

Interest Rate Logic

Interest rates are usually algorithmic. As borrowing demand increases, rates rise automatically to attract more liquidity and stabilize the pool. This keeps supply and demand balanced without manual intervention.

Risk Parameters

Each asset has its own set of rules, including loan-to-value ratios, liquidation thresholds, and penalties. These parameters are what protect the protocol during sharp price movements and prevent systemic losses.

3. Oracle Layer (Price Feeds)

A lending protocol is only as reliable as its pricing data.

Most Base-based lending apps integrate Chainlink to fetch real-time asset prices. These price feeds are continuously used to:

- Calculate borrowing limits

- Track user health factors

- Decide when liquidations should occur

Reliable oracles reduce manipulation risk and are critical for maintaining trust in the system.

4. Liquidation System

Liquidations are not a failure—they’re a safety mechanism.

When a borrower’s collateral value drops too low, the protocol allows liquidators to step in. They repay part of the debt and receive collateral at a discount. This keeps the protocol solvent.

Base’s faster confirmations matter here. During volatile markets, quick liquidations help:

- Reduce bad debt

- Protect liquidity providers

- Keep the system stable

5. Governance & Incentive Layer

Most lending protocols introduce a governance token to decentralize control over time.

This layer typically supports:

- Voting on risk parameters and asset listings

- Liquidity incentives for lenders

- Fee-sharing or protocol revenue models

On Base, low transaction fees mean governance isn’t limited to whales. More users can actually participate, which leads to healthier decentralization.

6. Security & Upgrade Framework

Security is not optional in DeFi lending.

Protocols commonly rely on OpenZeppelin libraries for audited components like access control, upgradeability, and reentrancy protection. Sensitive actions are usually gated behind:

- Multi-signature wallets

- Timelocks for contract upgrades

This setup balances flexibility with user protection.

7. Off-Chain Services & Monitoring

While lending logic stays on-chain, off-chain services improve usability and visibility.

These services handle:

- Indexing blockchain data for fast UI updates

- Risk monitoring and alerts

- Analytics dashboards for protocol performance

Because Base lowers on-chain costs, teams can invest more in monitoring, automation, and user experience instead of constantly optimizing for gas.

Core Features of a DeFi Lending App Built on Base

DeFi lending app built on Base is designed to feel simple for users while remaining robust under the hood. Below is a clear, high-intent breakdown of the core features, written for decision-makers, founders, and users who already understand DeFi and are evaluating how such a platform actually works.

User-Facing Features

These features define how borrowers and lenders interact with the protocol on a daily basis. On Base, low transaction fees encourage frequent, responsible usage rather than one-time interactions.

Wallet-Based Onboarding

Users connect directly using non-custodial wallets such as MetaMask or Coinbase Wallet. There is no sign-up, no KYC by default, and no custody risk. Wallet-based onboarding ensures:

- Full asset ownership

- Instant access to the protocol

- Seamless interaction with other DeFi apps on Base

Deposit & Withdraw Assets

Users can supply supported assets into lending pools and withdraw them at any time, subject to available liquidity. Deposits immediately start earning interest, visible in real time.

Because transactions are inexpensive on Base, users can:

- Add liquidity in smaller amounts

- Withdraw partially without worrying about gas costs

Borrow Against Collateral

Borrowers can lock approved assets as collateral and borrow supported tokens up to a defined loan-to-value limit. Borrowing power updates dynamically based on asset prices and risk parameters.

This feature enables:

- Capital efficiency without selling assets

- Short-term liquidity for trading, hedging, or yield strategies

Real-Time Interest Calculation

Interest accrues continuously and updates on every interaction. Users can clearly see:

- Current borrow APY

- Interest earned on supplied assets

- How utilization impacts rates

Transparent interest logic builds trust and improves decision-making.

Loan Health & Liquidation Alerts

The platform tracks each loan’s health factor and notifies users as they approach liquidation thresholds. Alerts can be delivered via:

- In-app notifications

- Wallet or off-chain alerts (optional)

This encourages proactive collateral management and reduces forced liquidations.

Transaction History Dashboard

Users have access to a complete on-chain activity log, including:

- Deposits and withdrawals

- Borrow and repay actions

- Interest accrued over time

A clean dashboard improves clarity, especially for users managing multiple positions.

Protocol-Level Features

These features define how the lending system operates behind the scenes and ensure long-term stability.

Overcollateralized Lending

All loans are secured with collateral worth more than the borrowed amount. This protects liquidity providers and ensures the protocol remains solvent during market volatility.

Dynamic Interest Rates

Interest rates automatically adjust based on supply and demand within each pool. As utilization increases, borrowing becomes more expensive, attracting additional liquidity and restoring balance.

Automated Liquidations

When a loan’s health factor drops below the allowed threshold, liquidation becomes permissionless. External liquidators can repay debt and receive collateral at a discount.

Base’s fast confirmations help liquidations execute efficiently, reducing bad debt risk.

Flash Loan Support (Optional)

Advanced protocols may support flash loans, allowing users to borrow assets without collateral as long as the loan is repaid within the same transaction.

This feature is commonly used for:

- Arbitrage

- Collateral swaps

- Advanced DeFi strategies

Multi-Asset Lending Pools

The protocol supports multiple assets across different risk profiles. Each asset has its own parameters, allowing teams to:

- Manage volatility exposure

- Introduce new assets gradually

- Optimize liquidity allocation

Why These Features Matter on Base

Base’s low fees and fast execution change how users behave. Instead of optimizing for rare interactions, lending apps on Base can support:

- Frequent repayments

- Active collateral management

- Higher overall engagement

This makes Base an ideal environment for building DeFi lending platforms that aim for real usage, not just TVL metrics.

DeFi Lending App Adoption Reaches 7.8 Million Users Worldwide

The global Decentralized Finance (DeFi) market is expected to reach USD 616.1 billion by 2033, up from USD 21.3 billion in 2023, growing at a CAGR of 40% from 2024 to 2033. This rapid expansion is being fueled by growing demand for permissionless financial services, yield-generating products, and on-chain credit markets.

Within this accelerating ecosystem, DeFi lending adoption has climbed to 7.8 million users in 2025, reflecting a 26% year-on-year increase, a clear signal that millions of users are actively choosing DeFi lending platforms to borrow, lend, and manage capital on-chain.

A. Why Rising User Adoption Signals Strong Market Readiness?

Growing user participation indicates that DeFi lending has moved beyond early experimentation into active, recurring usage.

- Increasing trust in on-chain lending models: Sustained user growth suggests rising confidence in smart contract–based lending, collateralization mechanisms, and transparent interest rate models.

- Demand for alternatives to traditional credit systems: Users are turning to DeFi lending to access liquidity without intermediaries, geographic restrictions, or lengthy approval processes.

- Expanding use cases beyond crypto-native users: As interfaces improve and education spreads, DeFi lending platforms are attracting a broader audience, including retail users and smaller institutions.

B. Why Now Is the Right Time to Build a DeFi Lending App on Base?

For founders planning to enter the DeFi lending space, timing and infrastructure choice are critical.

- Scalable infrastructure for growing user demand: Building on Base enables lower transaction costs and faster execution, which are essential as user volumes increase.

- Alignment with high-growth DeFi segments: Lending remains one of the most capital-efficient and revenue-generating DeFi verticals, making it attractive for new protocols seeking sustainable growth.

- Early positioning within a rapidly scaling ecosystem: As adoption continues to rise, launching now allows new platforms to establish liquidity, user trust, and market presence before competition intensifies.

The steady increase in DeFi lending users indicates that people are now using on-chain finance to address real financial needs, not just to experiment. This trend presents founders with an opportunity to develop DeFi lending apps on scalable networks like Base, where rising demand, reduced friction, and greater user trust can drive long-term growth.

If collateral value falls below required thresholds, liquidation logic is triggered automatically. This system repays outstanding debt using collateral and protects the protocol from insolvency without manual intervention.

How to Build a DeFi Lending App on Base?

Building a DeFi lending app on Base starts with smart architecture and secure protocols designed for real users. Our developers follow structured processes for reliable Base DeFi lending app development and long-term platform scalability.

1. Consultation

We begin by understanding the lending model, target users, supported assets, and regulatory considerations. This phase focuses on aligning the protocol’s financial mechanics with business goals, risk tolerance, and long-term scalability before any technical decisions are finalized.

2. Product and Lending Model Definition

Our team defines how lending, borrowing, collateralization, and interest mechanics will operate within the platform. We structure clear lending flows, repayment logic, and liquidation principles to ensure capital efficiency, transparency, and predictable user behavior across market conditions.

3. Protocol Architecture Planning

We design the overall protocol architecture, identifying which components operate on-chain and which remain off-chain. This step ensures secure value flows, modular design, and smooth interaction between lending logic, user interfaces, and supporting systems without overcomplicating the core protocol.

4. Risk Framework and Parameter Design

Our developers define risk parameters such as loan-to-value ratios, liquidation thresholds, and reserve factors. These controls are structured to balance user incentives with protocol safety, ensuring resilience during volatility while maintaining competitive borrowing and lending conditions.

5. Smart Contract Logic Design

We translate the lending model into deterministic on-chain logic that governs deposits, borrows, interest accrual, and liquidations. Contracts are structured around business rules, upgrade readiness, and predictable execution to support long-term protocol operations rather than short-term experimentation.

6. User Experience and Interaction Flows

We design user journeys that clearly communicate positions, risk exposure, and financial outcomes. The focus is on intuitive lending interactions, clear dashboards, and transparent actions so users can manage assets confidently without deep technical knowledge.

7. Testing, Validation, and Pre-Launch Review

Before launch, we validate protocol behavior under different scenarios including high utilization, price fluctuations, and liquidation events. This step ensures the platform behaves consistently, protects user funds, and is ready for real capital and real market activity.

8. Deployment and Market Launch

Once validated, the protocol is deployed on Base and prepared for public access. We support launch readiness by ensuring monitoring, upgrade paths, and operational processes are in place to sustain growth, liquidity inflows, and long-term protocol stability.

Cost to Build a DeFi Lending App on Base

The cost to build a DeFi lending app on Base depends on features, security needs, and technical scope. This overview outlines key factors influencing Base DeFi lending app development expenses.

| Development Phase | Description | Estimated Cost |

| Consultation & Discovery | Defines lending structure, target users, asset scope, and risk assumptions to align protocol goals with business objectives. | $3,000 – $6,000 |

| Product & Lending Model Design | Designs borrowing flows, collateral logic, interest behavior, and repayment mechanics to ensure capital efficiency and usability. | $6,000 – $10,000 |

| Protocol Architecture Planning | Plans onchain-offchain responsibilities, data flow, and system modularity for scalable and maintainable protocol design. | $7,000 – $12,000 |

| Risk Framework & Parameter Design | Defines loan-to-value ratios, liquidation thresholds, reserve factors, and safeguards to manage volatility and protect liquidity. | $14,000 – $18,000 |

| Smart Contract Development | Develops core lending, borrowing, liquidation, and interest accrual logic with upgrade readiness and long-term operability. | $20,000 – $34,000 |

| UI/UX & Frontend Development | Builds wallet interactions, position dashboards, and lending workflows for transparent and intuitive user engagement. | $10,000 – $18,000 |

| Testing & Pre-Launch Validation | Tests market stress scenarios, edge cases, liquidation behavior, and protocol consistency before handling real user capital. | $6,000 – $10,000 |

| Deployment & Launch Support | Manages mainnet deployment, monitoring setup, and launch stabilization for a secure and reliable market entry. | $4,000 – $7,000 |

Total Estimated Cost: $63,000 – $110,000

Note: Costs depend on protocol complexity, supported assets, and compliance needs. Advanced features like governance or integrations can further affect Base DeFi lending app development budgets.

Consult with IdeaUsher for a personalized cost estimate and detailed development plan to build and launch a secure, scalable DeFi lending app on Base, tailored to your vision and goals.

Cost-Affecting Factors to consider

The overall cost of building a DeFi lending app on Base is influenced by several strategic, technical, and operational factors. These variables determine development effort, testing depth, and long-term maintainability.

1. Scope of Supported Assets

The number and type of assets supported directly affect complexity. Supporting volatile tokens, stablecoins, or custom assets increases the effort required for risk modeling, parameter tuning, and testing across different market behaviors.

2. Lending and Interest Model Complexity

Simple fixed-rate models cost less to implement than utilization-based or algorithmic interest models. Advanced models require deeper design, simulation, and validation to ensure predictable behavior under varying liquidity conditions.

3. Risk and Liquidation Strategy Design

More sophisticated liquidation mechanisms, such as partial liquidations or dynamic penalties, increase development and testing time. The depth of risk controls directly impacts both security requirements and implementation cost.

4. Oracle Integration and Price Feed Reliability

Using multiple price sources, fallback mechanisms, or high-frequency updates adds complexity. Strong oracle design is critical for lending safety but requires additional development and validation effort.

5. Upgradeability and Governance Requirements

Protocols designed for long-term evolution often include upgrade paths and governance controls. These features add architectural complexity and require careful planning to avoid disrupting existing user positions.

6. Security Audits and Pre-Launch Validation

Thorough internal testing, third-party audits, and stress simulations significantly influence cost. Higher audit rigor reduces protocol risk but extends timelines and increases overall budget.

Smart Contracts for DeFi Lending on Base

Smart contracts are the backbone of any DeFi lending protocol. On Base, these contracts behave exactly like they do on Ethereum—same execution model, same tooling, same security assumptions—but run at a fraction of the cost. This allows teams to design more expressive lending logic without constantly optimizing for gas.

Below is a technical yet readable breakdown of the core smart contracts that power a DeFi lending app on Base.

Solidity Smart Contracts (Foundation Layer)

All core logic is written in Solidity, following Ethereum standards and best practices. Because Base is fully EVM-compatible, contracts developed for Ethereum can be deployed with minimal or no changes.

This gives developers access to:

- Mature development frameworks

- Battle-tested libraries

- Established auditing workflows

In practice, this reduces both development time and security risk.

Lending Pool Contracts

Lending pool contracts manage the flow of capital inside the protocol.

They are responsible for:

- Accepting user deposits

- Tracking supplied liquidity

- Issuing interest-bearing positions

- Enabling borrowing and repayment

Each pool typically corresponds to a specific asset or group of assets. The contract maintains internal accounting for total liquidity, total borrowed amounts, and available funds, ensuring accurate interest distribution.

Interest Rate Model

The interest rate model is usually implemented as a separate contract or module.

It dynamically adjusts borrow and supply rates based on pool utilization. When borrowing demand increases and available liquidity decreases, interest rates rise automatically. This incentivizes lenders to add liquidity and discourages excessive borrowing.

Separating the interest model from the lending pool allows:

- Safer upgrades

- Parameter tuning without redeploying core contracts

- Support for multiple rate strategies

Collateral Management Contracts

Collateral management ensures that every loan is properly secured.

These contracts:

- Define loan-to-value (LTV) ratios per asset

- Track user collateral balances

- Continuously calculate health factors

By isolating collateral logic, protocols can fine-tune risk parameters asset by asset. This is especially important when supporting volatile or newly listed tokens.

Liquidation Logic

Liquidation contracts protect the protocol from bad debt.

When a user’s health factor falls below the required threshold, liquidation becomes permissionless. External liquidators can:

- Repay a portion of the outstanding debt

- Receive collateral at a predefined discount

Base’s faster confirmation times improve liquidation efficiency, especially during high-volatility events, reducing the likelihood of undercollateralized positions persisting on-chain.

Upgradeable Smart Contracts

Most production lending protocols use upgradeable contracts to support long-term evolution.

Using OpenZeppelin proxy patterns, teams can:

- Fix bugs without migrating user funds

- Add new assets or features over time

- Adjust risk parameters safely

Upgrades are typically governed by multi-signature wallets and timelocks to maintain transparency and user trust.

Why Smart Contracts Work Better on Base

Since Base is EVM-compatible, smart contracts behave exactly like Ethereum—but at a fraction of the cost. This has meaningful implications for lending protocols:

- More frequent user interactions

- Safer liquidation execution

- Reduced pressure to over-optimize code for gas

- Faster iteration and experimentation

Developers get Ethereum’s security model with Layer 2 efficiency, making Base an ideal environment for building scalable DeFi lending infrastructure

For apps built on Base, strong risk management is not optional it is what protects user funds, preserves liquidity, and sustains long-term protocol credibility.

Security & Risk Management in Base-Based Lending Apps

While Base inherits Ethereum’s security model, its low fees and fast execution allow teams to enforce more active and responsive risk controls than what is typically practical on mainnet.

Smart Contract Audits

Every core contract in a lending protocol should undergo multiple independent security audits before mainnet deployment.

Audits focus on:

- Reentrancy and access control flaws

- Interest calculation and accounting errors

- Liquidation edge cases

- Upgradeability risks

Protocols commonly combine professional audits with public bug bounty programs. On Base, lower transaction costs make it easier to:

- Deploy test versions

- Run frequent simulations

- Patch and redeploy safely after fixes

This shortens the feedback loop between discovery and resolution.

Oracle Manipulation Prevention

Price oracles are one of the most common attack vectors in DeFi lending.

Most Base-based protocols rely on decentralized oracle networks like Chainlink, combined with additional safeguards such as:

- Time-weighted average prices (TWAPs)

- Multiple price sources per asset

- Circuit breakers for extreme price deviations

These measures reduce the risk of flash loan–based price manipulation and help ensure liquidations occur at fair market values.

Collateral Ratio Enforcement

Strict collateralization rules are essential for maintaining solvency.

Risk management contracts continuously enforce:

- Asset-specific loan-to-value limits

- Liquidation thresholds

- Minimum health factors

If a position approaches unsafe levels, the protocol automatically restricts further borrowing. On Base, users can rebalance collateral more frequently without worrying about gas costs, which:

- Reduces forced liquidations

- Improves overall protocol health

Emergency Pause Mechanisms

No system is immune to unexpected risk.

Most lending protocols include emergency pause (or “circuit breaker”) mechanisms that allow specific actions such as borrowing or liquidations to be temporarily halted in extreme scenarios.

These controls are designed to:

- Contain damage during active exploits

- Give teams time to assess and respond

- Protect liquidity providers and borrowers

Low fees on Base make it practical to test these mechanisms regularly, ensuring they work as intended when needed.

Multi-Signature Admin Controls

Administrative privileges are usually protected using multi-signature wallets rather than single private keys.

Multi-sig setups ensure that:

- No single actor can unilaterally change critical parameters

- Contract upgrades require multiple approvals

- Governance actions are transparent and traceable

Admin actions are often combined with timelocks, giving users advance notice before changes take effect and reinforcing trust.

Why Risk Management Is Stronger on Base

Base doesn’t change security fundamentals it improves execution.

Low transaction fees enable:

- Frequent security checks

- Regular collateral rebalancing by users

- More responsive liquidation systems

- Continuous monitoring without cost barriers

This leads to healthier lending markets and lower systemic risk over time.

Compliance & Regulatory Considerations

For enterprise teams and regulated businesses, compliance is not an afterthought it’s a core design requirement. DeFi lending apps built on Base can be structured to balance decentralization with regulatory readiness, depending on the target market and jurisdiction.

The key advantage is flexibility. Base’s Ethereum compatibility allows teams to adopt familiar compliance patterns without compromising performance or cost efficiency.

Non-Custodial Architecture (Compliance by Design)

At the foundation, most DeFi lending platforms on Base follow a non-custodial model.

This means:

- Users retain full control of their wallets and assets

- The protocol never holds private keys

- Smart contracts execute rules transparently on-chain

From a regulatory standpoint, non-custodial design helps reduce:

- Custody-related liabilities

- Counterparty risk

- Operational exposure for platform operators

For many jurisdictions, this architectural choice alone materially changes how the platform is classified.

KYC-Optional vs Compliance-Ready Versions

DeFi lending apps can be deployed in different compliance modes depending on business goals.

KYC-optional (permissionless) version

- Open access via wallet connection

- No identity checks at the protocol level

- Common for global, crypto-native user bases

Compliance-ready (permissioned) version

- Identity verification at the frontend or pool level

- Whitelisted wallets only

- Segmented pools for verified users

Because Base supports low-cost transactions, platforms can operate hybrid models, offering both permissionless and compliant pools without adding significant overhead.

Geo-Restrictions & Jurisdictional Controls

While smart contracts are global, access points do not have to be.

Many enterprise-grade DeFi lending apps enforce geo-restrictions at the application layer by:

- Blocking IP access from restricted regions

- Limiting frontend availability by jurisdiction

- Restricting asset access based on local regulations

This approach allows teams to remain compliant without altering the core smart contracts, preserving decentralization while managing legal exposure.

DAO Legal Wrappers

As protocols decentralize, legal clarity becomes critical.

DAO legal wrappers provide a bridge between on-chain governance and off-chain legal systems. These structures allow protocols to:

- Enter contracts

- Manage intellectual property

- Open bank accounts

- Limit liability for contributors

Common wrappers include foundations or DAO-specific entities in crypto-friendly jurisdictions. While governance remains on-chain, the wrapper provides a recognizable legal interface for regulators, partners, and enterprises.

Risk Disclosures & User Transparency

Clear risk disclosure is essential for both compliance and trust.

Well-designed DeFi lending platforms prominently disclose:

- Smart contract risk

- Liquidation risk

- Oracle dependency

- Market volatility exposure

These disclosures are often integrated directly into the user interface, ensuring users understand the risks before interacting with the protocol. On Base, low fees make it practical to add confirmation steps and disclosures without degrading user experience.

Why Base Helps with Compliance Execution

Base doesn’t remove regulatory obligations but it makes compliance easier to execute.

Low transaction costs allow:

- Frequent parameter updates

- Rapid deployment of compliant pool variants

- Ongoing risk adjustments without friction

This is especially valuable for enterprises operating in evolving regulatory environments where agility matters as much as correctness.

Monetization Models for DeFi Lending Apps on Base

DeFi lending apps built on Base can generate revenue through multiple protocol-level and platform-level mechanisms. Below are the most effective monetization models used by sustainable lending platforms.

1. Interest Rate Spread

The protocol earns revenue by retaining a small spread between borrower interest rates and lender yields. This model scales naturally with liquidity growth and borrowing demand while aligning protocol earnings with overall market activity.

2. Borrowing and Transaction Fees

Borrowers may pay fixed or variable fees on loan origination, repayments, or specific actions. These fees create predictable income streams and help cover operational, maintenance, and long-term protocol development costs.

3. Liquidation Penalties

When undercollateralized positions are liquidated, a portion of the penalty can be retained by the protocol. This model monetizes risk events while incentivizing healthy borrowing behavior and supporting overall system stability.

4. Reserve Factor Allocation

A percentage of interest generated across lending pools can be allocated to a protocol reserve. These reserves fund upgrades, audits, and risk buffers, enabling sustainable growth without relying solely on external funding.

5. Premium Features and Institutional Access

Advanced analytics, higher borrowing limits, or priority access can be offered through premium plans. This model targets institutional users or high-volume participants seeking enhanced control, insights, and operational flexibility.

Conclusion

Building a DeFi lending platform on Base requires a thoughtful balance of security, performance, and user experience. From smart contract design to liquidity management and frontend usability, every component plays a role in long-term success. Base lending app development offers the advantage of low transaction costs, scalability, and Ethereum compatibility, making it suitable for real-world financial applications. As you move forward, focus on compliance considerations, transparent risk models, and continuous testing. This approach supports trust, stability, and sustainable growth for your lending ecosystem.

Launch Your DeFi Lending App on Base

At IdeaUsher, our developers leverage proven enterprise DeFi lending experience to build high-performance apps using Base layer2 ecosystem. By combining established protocol design and security practices with Base’s fast, cost-efficient infrastructure, we deliver scalable DeFi lending solutions with robust smart contracts, liquidity architecture, and seamless wallet integration.

Why Partner with IdeaUsher?

- Proven DeFi Lending Expertise: Our developers bring hands-on experience building enterprise-grade lending platforms, applying proven protocol design and risk models to deliver reliable apps on Base.

- Real-World Base Implementation: We adapt established DeFi development practices to Base’s low-cost, high-speed infrastructure for optimal performance and efficiency.

- End-to-End Product Engineering: From smart contracts to frontend and wallet integrations, we deliver complete, market-ready DeFi lending solutions.

- Security and Scalability Focus: Our platforms are built to be secure, upgrade-friendly, and scalable, supporting long-term growth within the Base ecosystem.

Explore our portfolio to discover how we support companies in delivering reliable and high-performing Web3 solutions.

Book a free strategy call today and let’s build a DeFi lending app on Base that stands out in a competitive market.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A.1. A DeFi lending app should support borrowing, lending, collateral management, interest calculation, liquidation logic, and wallet integration. A clear dashboard and transparent risk indicators help users make informed financial decisions.

A.2. Base offers low transaction costs, high throughput, and Ethereum compatibility. These benefits improve user experience, reduce operational expenses, and allow developers to use existing tools and smart contract frameworks efficiently.

A.3. Security requires audited smart contracts, proper collateralization models, and continuous monitoring. Implementing fail-safe mechanisms and regular testing helps prevent exploits and protects user funds over time.

A.4. You should review regional regulations, user data policies, and financial compliance requirements. Consulting legal experts ensures your platform aligns with local laws while maintaining transparency and responsible risk management.