Electric vehicle infrastructure combines physical assets, usage data, and operational planning. Charging stations, energy flow, maintenance, and utilization must work reliably in the real world, not just on dashboards. As networks expand across locations and operators, coordinating ownership, access, and incentives becomes increasingly complex. Tokenized EV infrastructure platforms enable physical infrastructure to be represented and managed through programmable, on-chain systems.

Once infrastructure is tokenized, the challenge shifts to aligning real-world activity with digital ownership and rewards. Charging usage, availability, performance metrics, and revenue sharing all need to be captured accurately and reflected on-chain. Token logic must remain tied to physical operations, ensuring contributors are rewarded fairly while the network remains transparent, auditable, and scalable.

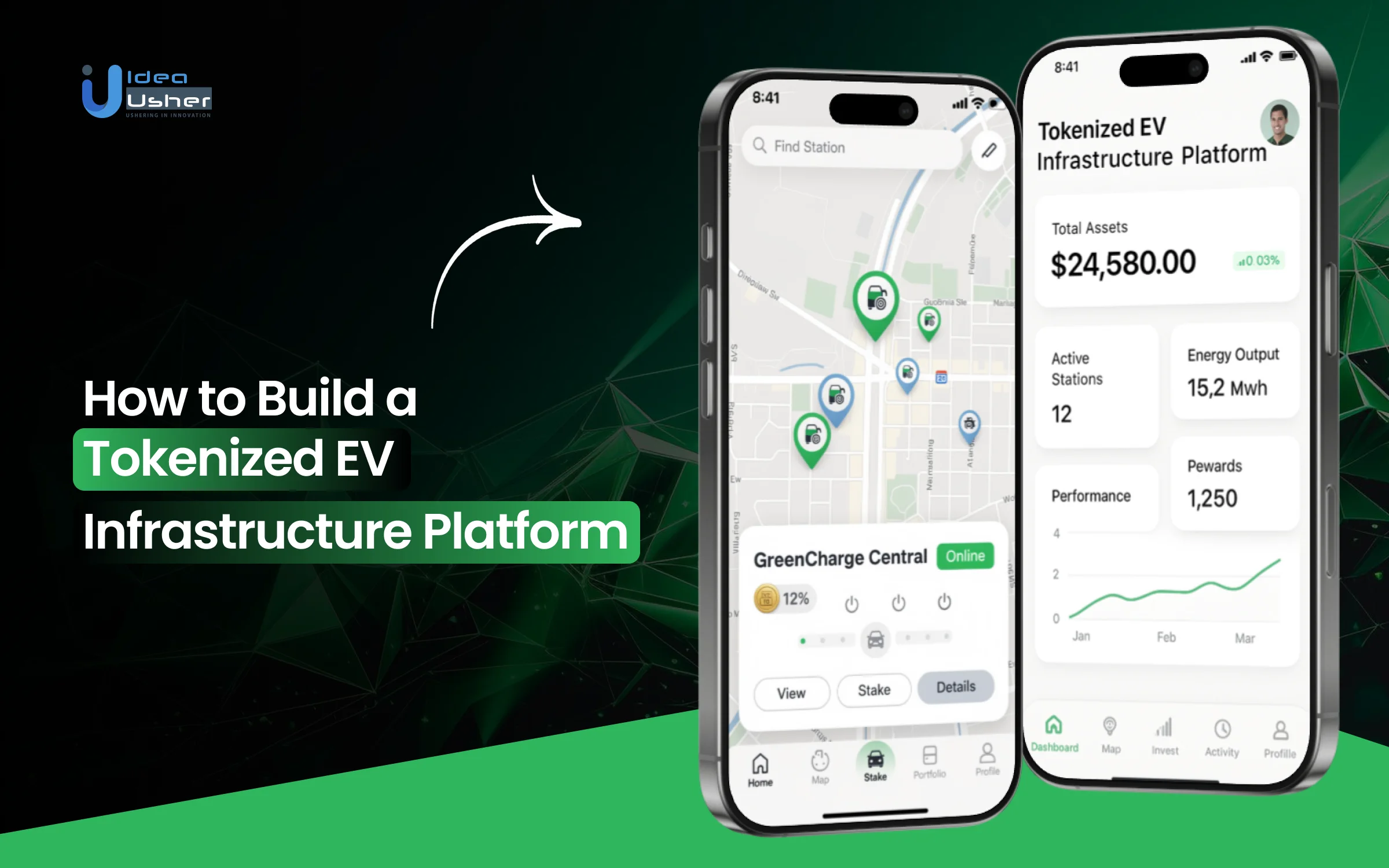

In this blog, we explain how to build a tokenized EV infrastructure platform by breaking down core components, system architecture, and practical considerations involved in coordinating physical EV networks through blockchain-based ownership and incentive models.

What is a Tokenized EV Infrastructure Platform?

A tokenized EV infrastructure platform is a blockchain-enabled system that converts physical components of the electric vehicle ecosystem such as charging stations, energy storage, batteries, or usage rights, into digital tokens representing ownership, revenue share, or usage rights.

These tokens are securely recorded on a distributed ledger, enabling fractional investment, transparent settlement, and broader investor participation in building and operating EV charging networks. Tokenization also supports automated smart contract-based payments and incentives between EV users, operators, and investors, creating more liquid and scalable infrastructure funding models

- Decentralized Infrastructure (DePIN): EV charging stations and grid assets can be operated and owned by network participants rather than a central provider, with token incentives for contributors.

- Tokenized Station Identity: Each EV charger can be represented as a unique on-chain token or NFT, enabling transparent tracking of ownership, performance, and usage history.

- Smart Contract Automation: Payments, revenue sharing, dynamic pricing, and fee settlement execute automatically via smart contracts without manual reconciliation.

- Grid Load Optimization Signals: Tokenization can integrate pricing incentives based on real-time grid conditions, rewarding off-peak charging to balance demand.

- Fractional Investment Models: Digital tokens allow fractional ownership of high-value charging assets, making infrastructure investment accessible to a broader pool of contributors.

- Peer-to-Peer Charging Settlement: EV drivers and station hosts can transact directly on-chain with transparent fee structures, reducing reliance on intermediaries.

- Immutable Usage Transparency: On-chain recording of charger availability, price, and historical usage data builds trust for drivers, investors, and operators.

- Token-Driven Incentive Layers: Rewards and governance tokens encourage infrastructure deployment, optimal energy use, and community participation at scale.

How a Tokenized EV Infrastructure Platform Works?

A tokenized EV infrastructure platform acts as a live financial and operational layer over physical EV charging assets, not a standalone blockchain. It mimics existing EV networks while removing bottlenecks like capital, transparency, and scalability.

1. Asset Onboarding and Verification

The platform is onboard each EV charger, hub, or energy asset after technical and legal checks. Teams verify hardware specs, location, grid approvals, ownership, and metrics. It then registers the asset on-chain as a unique, non-duplicable reference, preventing duplicates.

2. Real-World Asset Token Creation

The platform mints tokens only after asset registration and explicitly links them to defined economic rights like ownership stakes, revenue participation, or performance-based returns. These tokens map directly to charging activity, energy usage, or contracted cash flows generated by the infrastructure, not abstract value.

3. Controlled Capital Participation and Liquidity

Tokens are issued through a compliant primary offering or platform-managed issuance. Investors can acquire exposure based on eligibility rules, while transferability and liquidity are controlled to protect infrastructure stability and regulatory alignment.

4. Real-Time Operational Data Integration

Secure IoT systems stream charging sessions, energy consumption, uptime, and pricing data from EV chargers. A validation layer normalizes inputs and pushes trusted data on-chain via oracles. Token behavior then reflects actual charger usage, not projections or manual reporting.

5. Automated Revenue Accounting and Payouts

The platform calculates revenues at the asset level as drivers or fleets pay for charging. Smart contracts automatically allocate earnings to token holders based on predefined rules like factoring in operating costs, maintenance reserves, and platform fees. This removes manual reconciliation and reduces disputes.

6. Compliance-Aware Access and Governance

Embedded compliance logic controls investor access, transfers, and payouts. The platform enforces jurisdiction rules, investor eligibility, and token restrictions on-chain, while governance mechanisms allow operators to upgrade infrastructure, add new assets, or adjust operational parameters without breaking regulatory alignment.

7. On-Chain Asset Lifecycle Management

When chargers are upgraded, relocated, or retired, the platform updates asset state on-chain. Token rights, revenue models, and disclosures adjust automatically, ensuring investors remain aligned with real-world asset conditions.

What Gets Tokenized in an EV Infrastructure Platform?

An EV infrastructure tokenization platform digitizes economic rights linked to physical assets, revenues, and performance metrics. This structure enables transparent ownership, diversified monetization, and scalable financing while keeping core infrastructure securely off-chain.

| Assets | What Is Tokenized | Real-World Examples | Why It Is Tokenized |

| Physical Infrastructure Assets | Tangible EV charging and power hardware | DC fast chargers, AC chargers, transformers, on-site battery storage, land lease rights | Creates asset-backed trust, prevents double financing, and anchors tokens to verifiable infrastructure |

| Charging Revenue Rights | Income generated from EV charging usage | Per-kWh charging fees, per-session charges, fleet charging contracts | Enables predictable yield distribution without transferring legal ownership of assets |

| Energy & Grid Service Revenues | Grid-related income streams tied to energy behavior | Demand response incentives, peak shaving revenues, load balancing payments | Unlocks secondary revenue streams and improves infrastructure ROI |

| Environmental Assets | Sustainability-linked economic value | Carbon credits, renewable energy certificates (RECs) | Attracts ESG-focused investors and adds a tradable green revenue layer |

| Operational Performance Rights | Rights linked to asset efficiency and uptime | Uptime-based incentives, utilization bonuses, downtime penalties | Aligns incentives between operators, investors, and maintenance providers |

| Location & Usage Rights | Rights associated with strategic placement and access | Highway charging access, fleet-only charging zones, commercial parking integrations | Monetizes high-demand locations without selling physical infrastructure |

Why Tokenized EV Infrastructure Platform Gaining Popularity?

The global electric vehicle charging infrastructure market was valued at USD 40.22 billion in 2025 and is projected to reach USD 238.82 billion by 2033, with a CAGR of 25.0% from 2026 to 2033. This growth supports tokenized EV platforms, allowing fractional ownership, on-chain financing, and programmable revenue sharing.

The foundation for tokenized EV infrastructure is forming through real-time data from connected vehicles and charging networks. Platforms like DIMO already connect 17,000+ vehicles, while connected vehicle data markets grow from $17M to $11B by 2030, reinforced by the UK’s 80% ZEV mandate driving long-term infrastructure demand.

This data maturity is now translating into real-world tokenization initiatives across EV charging, energy assets, and sustainability-linked infrastructure:

- XCharge Energy Asset Vault is tokenizing EV charging networks, solar farms, and grid-scale batteries, launching with a $10 million treasury allocation to tokenize live energy infrastructure assets.

- U Power Limited is tokenizing battery-swapping station infrastructure, backed by a $50 million infrastructure commitment in Southern Europe tied to its tokenization strategy.

- Plugmate demonstrates a blockchain-powered crowdfunding model for community-funded EV charging station development, enabling shared ownership at the local level.

- Toucan Protocol has tokenized over 20 million carbon credits by 2025, creating composable sustainability assets that can integrate with EV charging and clean mobility ecosystems.

- Powerledger enables peer-to-peer renewable energy trading applicable to EV charging networks, tokenizing gigawatts of green energy and reducing energy costs by up to 30% across multiple regions.

How Tokenization Changes EV Infrastructure Ownership and Financing?

Tokenization fundamentally rewrites the rulebook for funding and owning EV infrastructure. Converting physical assets into digital tokens on a blockchain, it introduces new models of access, liquidity, and investment that were previously impossible with traditional finance.

1. Democratizing Capital Access

Tokenization democratizes capital by enabling fractional, affordable ownership while blockchain’s borderless design unlocks global investment pools, allowing retail and institutional investors worldwide to efficiently fund EV infrastructure where it is needed most for rapid deployment

2. Unlocking Asset Liquidity

Tokenization transforms traditionally illiquid physical assets, like charging stations, into easily tradable digital tokens on secondary markets. This provides investors with potential exit strategies and attracts capital by reducing long-term lock-up periods associated with infrastructure projects.

3. Automating Profit with Smart Contracts

Smart contracts automatically collect and distribute revenue from assets, such as charging fees, to token holders. This eliminates manual administration, ensures transparent and timely payments, and significantly reduces operational friction and intermediary costs.

4. Enhancing Value Through Network Effects

A tokenized network incentivizes both usage and investment. Token rewards for charging or providing grid services increase asset utilization, creating a flywheel effect where greater network participation drives higher asset value and investor returns.

5. Mitigating Risk via Fractionalization

By enabling investment across a diversified portfolio of tokenized assets like multiple chargers in different locations, investors can spread risk. This reduces exposure to the underperformance of any single asset, making infrastructure investment more resilient and appealing.

Key Features of a Tokenized EV Infrastructure Platform

A tokenized EV infrastructure platform integrates blockchain with physical energy and mobility assets for transparent ownership and automated revenues. These features expand capital access and enable scalable, compliant financing for EV infrastructure.

1. Physical Charger Tokenization

Each physical EV charging station is represented by a digital token that mirrors its real-world characteristics. This digital twin captures location, capacity, ownership structure, and operational status, forming the foundation for transparent infrastructure management and monetization.

2. On-Chain Charger and Location Registration

Charging stations are registered on-chain with verifiable metadata such as location, technical specifications, and operator details. This creates a tamper-resistant infrastructure registry that enables trust, traceability, and accurate attribution of revenues to specific physical assets.

3. Usage Linked Revenue Tokenization

Revenue generated from each charging session is programmatically linked to the corresponding infrastructure token. This allows charging usage, pricing, and energy consumption to directly influence token value and payouts, aligning digital assets with real-world performance.

4. Smart Meter and IoT Data Integration

Smart meters and IoT devices feed real time charging and energy data into the platform. These data streams ensure accurate measurement of electricity usage, session duration, and charger availability, which are essential for automated settlement and performance reporting.

5. Charger Performance and Uptime Monitoring

The platform continuously tracks charger uptime, fault events, and utilization rates. Performance data influences incentives, maintenance priorities, and revenue allocation, ensuring that reliable infrastructure is rewarded and underperforming assets are clearly identified.

6. Energy Source and Green Power Mapping

Charging sessions can be linked to specific energy sources such as renewable or grid supplied power. This enables transparent reporting of energy origin, supports sustainability claims, and allows platforms to introduce green charging incentives or energy backed token models.

7. Dynamic Pricing Based on Grid Demand

Charging prices can adjust automatically based on grid load, peak demand, or local energy availability. This encourages off-peak charging, supports grid stability, and aligns infrastructure economics with real-time energy market conditions.

8. Host and Operator Incentive Models

Charger hosts and operators receive token-based incentives for deploying, maintaining, and operating charging infrastructure. These incentives are tied to availability, reliability, and usage, helping scale networks without centralized infrastructure ownership.

9. Community Driven Charger Deployment (DePIN Model)

The platform enables individuals and businesses to deploy chargers as part of a decentralized physical infrastructure network. Token rewards encourage geographic expansion, improve coverage, and reduce reliance on centralized capital-intensive deployment strategies.

10. Automated Charging Revenue Settlement

Each charging session triggers automated settlement through smart contracts, calculating payments, fees, and revenue splits in real time. Revenues are distributed among asset owners, hosts, and operators based on predefined allocation models, supporting fractional ownership and transparent infrastructure monetization.

Tokenized EV Infrastructure Platform Development Process

Tokenized EV infrastructure platform development combines asset digitization, regulatory compliance, and blockchain engineering to support scalable EV financing models. Our developers follow a structured, security-first approach to ensure transparency, reliability, and long-term platform scalability.

1. EV Asset Definition

We begin by identifying and defining the EV infrastructure assets to be tokenized at launch, such as charging stations, locations, or charging revenues. This step ensures that every token is directly linked to measurable, real-world infrastructure activity.

2. Smart Contract and Token Structure

Our developers design the token structure to represent infrastructure ownership or revenue rights and build auditable, upgradeable smart contracts that register assets, mint tokens, manage supply, distribute revenue, and enforce governance for reliable on-chain EV infrastructure operations.

3. On-chain Charger Registry

We develop an on-chain registry to record each charging station with verified technical and location metadata. This registry connects physical chargers to their digital representations and ensures infrastructure data remains tamper-resistant.

4. Settlement and Revenue Distribution Model

We build smart contracts that automate charging session settlement, fee calculation, and revenue distribution. These contracts enforce predefined rules and remove the need for manual reconciliation or third-party settlement systems.

5. Charging Hardware and Data Sources

Our team integrates EV charging hardware, smart meters, and data feeds to capture real-time usage and energy consumption. Accurate data integration is critical for triggering settlements and reflecting true infrastructure performance.

6. Application Layer Development

We build intuitive dashboards for investors, operators, and administrators. Our applications translate complex blockchain logic into actionable insights covering asset performance, earnings distribution, compliance status, and operational controls.

7. Testing & Risk Mitigation

We conduct rigorous testing, including smart contract audits, oracle manipulation scenarios, data integrity validation, and load testing. Our approach minimizes financial, operational, and regulatory risks before platform launch.

8. Platform Launch with Live Infrastructure

We deploy the platform with active token contracts, registered charging assets, and operational settlement mechanisms. At launch, the system is fully functional and ready to support real-world EV charging activity on-chain.

Cost to Build a Tokenized EV Infrastructure Platform

The cost to build a tokenized EV infrastructure platform depends on asset scope, compliance requirements, and system architecture. These aspects help stakeholders budget accordingly by shaping platform complexity, security depth, and long-term scalability needs.

| Development Phase | What We Will Deliver | Estimated Cost |

| EV Asset & Token Scope | Asset classification, tokenization boundaries, revenue mapping, and jurisdiction-aware tokenization strategy documentation. | $8,000 – $10,000 |

| Token & Smart Contract Design | Custom smart contracts for token minting, supply control, compliance rules, and governance mechanisms. | $20,000 – $30,000 |

| On-chain Charger Registry | Secure on-chain registry linking EV chargers to verified metadata and token references. | $15,000 – $23,000 |

| Revenue Settlement & Payouts | Automated settlement logic for charging revenue calculation and programmable token holder payouts. | $17,000 – $28,000 |

| EV Data & Hardware Integration | EV charger integration, real-time data ingestion, oracle validation, and data normalization pipelines. | $15,000 – $25,000 |

| Platform Applications | Investor dashboards, operator panels, admin tools, APIs, and user experience workflows. | $10,000 – $17,000 |

| Security & Risk Validation | Smart contract audits, system testing, oracle risk analysis, and security hardening processes. | $8,000 – $14,000 |

| Launch & Live Deployment | Production deployment, asset onboarding, live data activation, monitoring, and stabilization support. | $10,000 – $15,000 |

Total Estimated Cost: $64,000 – $123,000+

Note: Actual development costs vary based on compliance depth, charger scale, data complexity, jurisdictions, integrations, and long-term platform scalability requirements.

Consult with IdeaUsher to get a tailored cost estimate aligned with your EV infrastructure, regulatory scope, and tokenization goals.

Challenges And How We Solve Them?

Building a tokenized EV infrastructure platform is not just a blockchain challenge; it is a systems engineering problem involving hardware, data, finance, and regulation. Below are the most critical technical challenges and how we design around them in real-world deployments.

1. Real-Time EV Charger Data Accuracy

Challenge: EV chargers operate in inconsistent environments. Network drops, faulty meters, delayed telemetry, and vendor-specific protocols can lead to inaccurate or incomplete charging data, directly impacting token revenue calculations.

Solution: We implement multi-layer data validation using IoT normalization, fallback data buffers, and oracle verification. Only verified, reconciled charging data is allowed to trigger on-chain settlement logic.

2. Preventing Double Tokenization of EV Assets

Challenge: Without a strong asset identity layer, bad actors can tokenize the same charger or charging location multiple times across platforms, creating investor risk and legal exposure.

Solution: We build a non-duplicable on-chain charger registry tied to immutable identifiers such as location, hardware IDs, and legal ownership references, ensuring one-to-one asset-token mapping.

3. Scalable Revenue Settlement and Payouts

Challenge: High-frequency charging transactions overwhelm smart contracts when developers handle settlement naively, creating high gas costs and performance bottlenecks.

Solution: We use off-chain aggregation with on-chain final settlement. Revenue is calculated at the asset level off-chain, while smart contracts handle batched, auditable payout execution.

4. Compliance-Aware Token Liquidity

Challenge: EV infrastructure tokens often sit close to securities regulations. Poor compliance design can freeze transfers, block investors, or restrict future expansion.

Solution: We embed compliance logic directly into token contracts like handling KYC, jurisdiction rules, and transfer permissions dynamically, so liquidity is controlled without sacrificing usability.

5. Multi-City and Vendor Network Scalability

Challenge: Each city, utility provider, and charger manufacturer introduces different data standards, pricing models, and regulatory constraints.

Solution: We build modular integration layers and configurable rule engines, allowing the platform to onboard new regions and vendors without rewriting core smart contracts.

How is Charging Revenue Calculated and Distributed On-Chain?

The on-chain calculation and distribution of charging revenue is the core financial mechanism of a tokenized EV platform. It replaces manual accounting with a transparent, automated process governed by smart contracts, ensuring that every kilowatt-hour dispensed leads to a verifiable and immutable transaction for token holders.

1. EV Charging Data Flow to Blockchain

Revenue calculation starts with IoT-integrated smart chargers. These devices record essential transaction data like energy dispensed (kWh), duration, time of use, and price per kWh, directly onto the blockchain. This creates a trusted, real-time data feed for financial calculations.

Example: A 50 kW fast chargerdispenses 32.5 kWhto a vehicle in 39 minutesduring peak hours. Instantly, an IoT device logs {Charger_ID: 15, kWh: 32.5, Timestamp: 18:30, Rate: $0.48/kWh} to the blockchain. This becomes the unchangeable source for all calculations.

2. Transparent Revenue Calculation and Aggregation

A smart contract, acting as a revenue aggregator, processes raw usage data continuously, calculates total revenue for specific periods using the agreed pricing model on metered energy, with all formulas and price parameters visible and auditable on-chain.

Example: Let’s assume the platform operates 10 tokenized chargers in a city:

- Daily Activity: Each charger averages 6 sessions/day at ~30 kWh/session.

- Gross Daily Revenue: 10 chargers * 6 sessions * 30 kWh * $0.48/kWh = $864.00

- Monthly Gross: This daily flow creates a predictable gross revenue pool of approximately $26,000 per month ($864 * 30 days).

3. Automated Profit Distribution

Once revenue is calculated, the distribution smart contract automatically executes, deducts operational costs, and splits remaining net profit proportionally, transferring it directly to token holders’ wallets, often in stablecoins like USDC.

Example: The smart contract executes the final split. Using the daily $864 example:

- Cost Deduction: 15% ($129.60) is automatically routed to an operations wallet for maintenance, software, and electricity costs.

- Net Profit Pool: The remaining 85% ($734.40) is the daily net profit for distribution.

- Per-Token Value: If 1,000,000 tokens represent ownership of this 10-charger network, each token earns ~$0.000734 per day ($734.40 / 1,000,000 tokens).

- Holder Payout: An investor holding 10,000 tokens receives $7.34 that day, sent directly to their wallet as USDC.

4. Real-Time Investor Dashboards

Token holders monitor this process in real-time through a platform dashboard. They verify total energy sold, gross revenue, fee deductions, and their distribution share. This transparency builds trust by allowing investors to audit cash flows independently.

Example: An investor can log in and see the exact figures that led to their payout:

- Your Holdings: 10,000 Tokens (1% of Network)

- Network Performance (24h): 60 Sessions | 1,800 kWh Sold

- Gross Revenue: $864.00 | Net Distributable: $734.40

- Your Share: $7.34 | Paid in: USDC

This dashboard updates with every completed session, providing live auditability.

5. Dynamic Pricing and Grid Incentives

Advanced platforms use complex models. Smart contracts dynamically adjust charging prices based on grid demand or renewable supply and automatically reward users charging off-peak, promoting grid stability.

Example: Numbers can change based on smart rules. For instance, to balance the grid:

- A smart contract could automatically lower the price to $0.32/kWh during solar-rich afternoon hours, incentivizing charging.

- If 500 kWh are sold at this discounted rate instead of the standard $0.48, the platform might forgo $80 in immediate revenue (500 kWh * $0.16 difference).

- However, this could secure $200 in grid incentive payments from a utility company, increasing the total net pool for token holders and proving how automated, data-driven decisions enhance profitability.

Top Examples of Tokenized EV Infrastructure Platform

Tokenization is increasingly being adopted across EV charging and energy infrastructure. Leading implementations demonstrate how blockchain enables asset-backed ownership, transparent revenue distribution, and scalable financing models within the electric mobility ecosystem.

1. DeCharge Network

DeCharge builds a decentralized EV charging network using DePIN principles, enabling individuals and businesses to host, own, and earn from chargers. The platform tokenizes chargers as on-chain assets, allowing fractional ownership. Smart contracts govern performance-linked rewards and charging fees, creating passive income for hosts.

2. GoChargeTech

GoChargeTech connects EV chargers to blockchain, allowing owners to list chargers, accept crypto payments, and earn passive income. The CHARGED token powers payments and incentives, reducing fees for token users. Owners set pricing and availability, earning revenue whenever drivers use chargers.

3. PowerLedger

PowerLedger enables transparent energy tracking, peer-to-peer trading, and EV charging infrastructure integration through blockchain. The platform matches charging events to renewable energy sources with certified traceability. POWR tokens power energy trading, settlement, and metering. PowerLedger balances grids and encourages charging during renewable abundance.

4. C4E(Chain4Energy)

C4E operates a DePIN-oriented blockchain platform for decentralized energy infrastructure, including EV charging tokenization and IoT integration. The platform tokenizes charging stations and energy nodes as blockchain assets, enabling secure verification. IoT, blockchain, and AI power decentralized energy management and scalable charging settlement.

5. EVX Protocol

EVX Protocol builds a community-oriented decentralized ecosystem linking idle EVs and charging points using blockchain incentives. The platform enables EV owners and charger hosts to contribute and earn from infrastructure usage. Protocol tokens reward users for sharing resources. EVX combines charging infrastructure with EV sharing features.

Conclusion

Building a tokenized EV infrastructure platform requires trust as much as technology. You align physical assets, energy data, investors, and regulators within a single digital framework. Clear governance, secure smart contracts, and reliable asset verification determine whether the platform scales responsibly. When developers approach tokenized EV infrastructure platform development with long-term planning, they enable capital efficiency, operational transparency, and sustainable growth. The strongest platforms reflect real-world constraints, anticipate regulatory change, and focus on delivering practical value to all participants globally.

Build a Tokenized EV Infrastructure Platform with IdeaUsher

We specialize in blockchain, tokenization, and dApp development for infrastructure-driven use cases. Using this expertise, our ex-FAANG and MAANG developers build tokenized EV infrastructure platforms that connect physical charging assets with transparent digital ownership models.

Why Work With Us?

- EV Infrastructure Understanding: We design platforms aligned with charging assets, energy usage data, and operational performance metrics.

- Infrastructure Linked Token Models: Our developers structure tokens around verified EV assets and revenue-generating infrastructure.

- Regulatory and Energy Compliance Focus: We incorporate securities considerations, data privacy, and energy sector compliance requirements.

- Scalable Platform Architecture: Our solutions are built for expansion across regions, asset types, and long-term infrastructure growth.

Review our portfolio to see how we deliver blockchain solutions for complex, real-world infrastructure ecosystems.

Get in touch for a free consultation and take the first step toward launching a compliant tokenized EV infrastructure platform.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A.1. Tokenized EV infrastructure platforms include charging stations, energy storage systems, grid connections, usage revenues, and maintenance contracts. Platforms verify each asset, link it to revenue, and support it with reliable operational and performance data.

A.2. Smart contracts automate revenue distribution, ownership transfers, performance-based payouts, and operational rules. They reduce administrative overhead while transparently executing agreements between asset operators, investors, and ecosystem partners.

A.3. Partnerships with charging operators, utilities, technology providers, and local authorities support asset sourcing, data accuracy, and regulatory alignment. Strong partnerships help platforms expand geographically while they maintain operational reliability and market credibility.

A.4. Compliance includes securities regulations, energy sector rules, data privacy laws, and local infrastructure licensing. Platforms align token structures with regional legal frameworks to avoid misclassification and ensure lawful investor participation.