As decentralized autonomous organizations continue to grow across DeFi, governance, and Web3 ecosystems, ensuring financial transparency and operational integrity has become increasingly important. DAOs operate without a central authority, which makes robust auditing mechanisms essential to detect irregularities, prevent misuse of treasury funds, and maintain member trust. A dedicated audit platform can streamline this process by automating checks, analyzing on-chain transactions, and delivering real-time insights to the community.

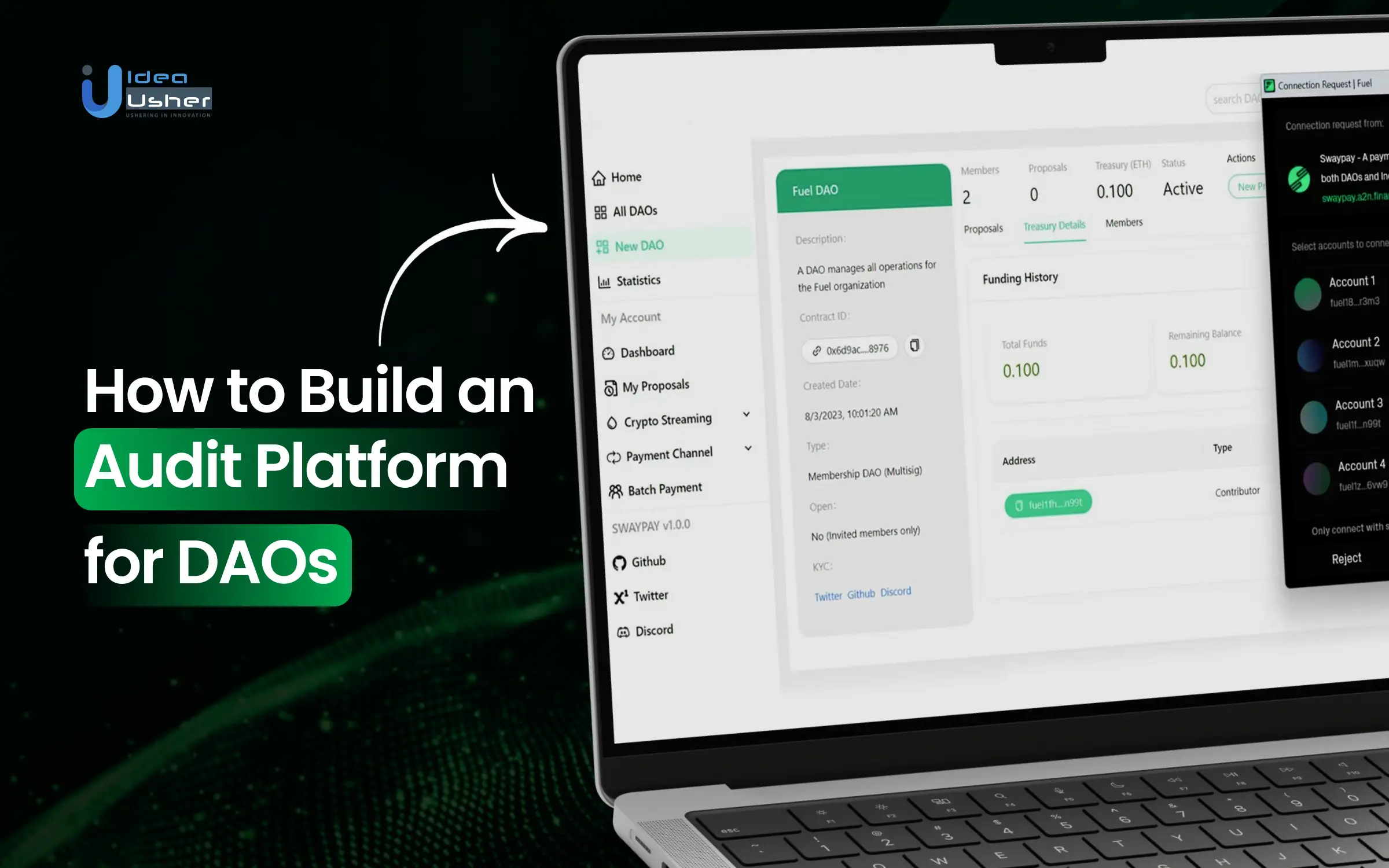

In this blog, we will talk about how to build an audit platform tailored for DAOs, exploring the essential components, core features, and development strategies that ensure both transparency and scalability within decentralized ecosystems. As we have hands-on experience building AI & blockchain products for numerous enterprises, IdeaUsher brings the technical depth and domain insight needed to craft solutions that truly align with decentralized governance models.

Why You Should Invest in Launching an Audit Platform for DAOs?

The global blockchain security solutions market size was approximately USD 3.1 billion in 2023 and is projected to reach around USD 273.4 billion by 2032, with a compound annual growth rate (CAGR) of approximately 64.5% between 2024 and 2032. Future innovations in technology and increasing cyber threats are expected to further stimulate market growth.

Spearbit’s Watchtower is a decentralized monitoring platform that secured $7 million in early funding, with backing from Paradigm and Framework Ventures. Its modular design allows white-hat security researchers to conduct monitoring across distributed networks.

Hexagate, an emerging leader in this sector, secured $8.5 million in a seed round to enhance real-time DAO audit dashboard monitoring. The platform integrates anomaly detection with governance risk analysis to help prevent protocol-level exploits.

Audits alone are insufficient in a constantly changing environment. DAO audit platforms offer real-time protection, detecting attacks before they happen and allowing for automated or human responses. Investing in a DAO audit platform now places your product at the center of Web3 security, providing scalable, proactive defense for live smart contracts in fast-growing markets.

What Is a DAO Audit Platform?

A DAO audit platform is a specialized system that reviews the on-chain governance logic, treasury controls, proposal execution flows, and voting mechanisms of Decentralized Autonomous Organizations. It goes beyond basic smart contract audits by validating how decentralized decision-making operates in practice. These platforms typically assess multi-sig wallets, quorum thresholds, role permissions, and contract upgradability to ensure a DAO’s code reflects its intended governance structure without introducing exploitable loopholes.

Core Components of an Audit Dashboard DAO

A DAO audit goes beyond standard contract reviews. It deeply inspects how decentralized governance functions in real-world conditions. The core components usually fall into five key categories, each critical for ensuring the DAO behaves as intended and resists manipulation.

1. Governance Token Contracts

These contracts define how voting power is distributed. The audit checks for flaws in token minting, distribution limits, quorum thresholds, and vote delegation logic to prevent vote rigging or power centralization.

2. Treasury Management and Multi-Sig Access

DAOs often manage large treasuries. The audit inspects multi-signature wallets, withdrawal logic, fund allocation controls, and on-chain treasury interactions to ensure funds can’t be drained or misrouted by rogue proposals or compromised keys.

3. Proposal and Voting Mechanisms

This component covers the process of creating, voting on, and executing proposals. Auditors look for vulnerabilities in time locks, vote counting logic, execution ordering, and the ability to prevent front-running or malicious stacking of proposals.

4. Role-Based Permissions and Access Control

Many DAOs utilize permission layers for tasks such as upgrading contracts or triggering critical functions. Audits confirm that these roles are assigned correctly and can’t be escalated through indirect functions or unchecked calls.

5. Upgradeability and Proxy Pattern Risks

DAO systems often use upgradable smart contracts through proxies. Audits check for risks in delegate calls, storage collisions, or backdoors in admin upgrade functions that could lead to irreversible control loss or silent takeovers.

How DAO Audit Platforms Work?

Before diving into development, it’s important to understand how DAO audit platforms function. These platforms don’t just track numbers; they bring transparency to on-chain decision-making, automate governance checks, and monitor treasury flows with real-time insights.

1. Contract Fetching and DAO Structure Mapping

DAO audit platforms begin by pulling smart contract code using connected wallets, GitHub repositories, or APIs like Etherscan. Tools like AST parsers and control-flow analyzers help map out roles, permissions, and proposal flows that feed directly into the DAO audit dashboard interface.

2. Static and Dynamic Vulnerability Analysis

The system utilizes static tools, such as Slither, and dynamic fuzzers, like Echidna, to uncover logic bugs and previously unknown vulnerabilities. This dual analysis is crucial in validating DAO treasuries and voting logic before surfacing results in the DAO audit dashboard.

3. Governance Logic Verification

Rule-based engines and formal verification tools like Certora simulate every possible voting condition to validate the integrity of proposal handling. These checks confirm quorum thresholds and rejection policies, which are then displayed inside the DAO audit dashboard for easy governance oversight.

4. Simulation of Governance Attacks

Governance-based attack simulations use transaction replayers and execution visualizers to mimic how bad actors could exploit DAO rules. These stress tests provide essential insight into voting manipulation or role hijacking, which is visualized inside the DAO audit dashboard for security teams.

5. On-Chain Activity Monitoring

By using node listeners and APIs like The Graph, audit platforms continuously watch DAO proposals, treasury transfers, and on-chain votes. The DAO audit dashboard displays these live insights to help stakeholders detect any unauthorized governance activity in real time.

6. Threat Scoring and Governance Impact Reports

After analysis, the system uses CVSS-style risk engines and machine learning classifiers to assign threat scores. These reports show tokenomics risk, proposal weaknesses, and audit severity, and are made downloadable within the DAO audit dashboard for stakeholders and contributors.

7. Dashboard and Audit Lifecycle Management

Built with technologies such as React and GraphQL, the DAO audit dashboard provides real-time log access, re-audit scheduling, and historical comparisons. It becomes the single source of truth for all governance security activity, empowering developers and community members with full transparency.

Key Features to Include in an Audit Platform for DAO

An effective DAO audit platform must go beyond traditional contract auditing. It needs to combine governance logic evaluation, treasury checks, and community insights into a single DAO audit dashboard interface to make decentralized oversight transparent, scalable, and secure.

1. Smart Contract Logic Assessment

The platform must audit DAO smart contracts powering voting, treasury flows, proposals, and staking logic. Automated static analysis with formal verification identifies critical flaws, helping DAOs update their governance workflows without introducing new risks or contract vulnerabilities.

2. Governance and Voting Audit Analytics

Using machine learning, the platform audits voting participation, token-based influence, and proposal outcomes to detect manipulation, low turnout, or Sybil attacks. Governance health scores and decentralization metrics are visualized clearly within the DAO audit dashboard for real-time monitoring.

3. Immutable Governance Logs and Transparency Trails

Every vote, proposal, and execution must be recorded on-chain with tamper-proof audit logs. These logs are displayed in readable formats for community verification and reporting, enhancing both regulatory compliance and DAO-internal transparency.

4. Smart Treasury Security and Multi-Signature Checks

Treasury safety is ensured by validating wallet rules, multi-sig thresholds, and time-locked withdrawals. Alerts help flag protocol drift or misconfigurations that can compromise DAO funds, all viewable in a real-time DAO audit dashboard environment.

5. Conflict of Interest and Delegate Risk Logic

Platforms must detect voting centralization or delegate dominance by analyzing token distribution and voting history. Conflict of interest detection algorithms provide recommendations like diversity thresholds to reduce risks of governance capture or insider control.

6. Dispute Resolution and Emergency Governance Fail-Safes

DAO platforms should validate the presence of dispute resolution systems such as Aragon Court, proposal cancellation rights, and emergency overrides. These ensure that DAOs have working safeguards if malicious or stalled proposals threaten governance flow.

7. AI Risk Scoring for Proposals

AI modules assign dynamic risk scores to new proposals based on factors like treasury access, role changes, or instant rewards. This helps prioritize reviews, flag suspicious activities, and adds a predictive layer to the DAO audit dashboard.

8. Insights Dashboard with Engagement Trends

Track contributor activity, proposal delays, and community participation using visual dashboards. These engagement insights help DAOs identify governance bottlenecks, improve member onboarding, and run educational campaigns to strengthen decision-making quality.

9. Wallet and GitHub Integration for Metadata Audit

The platform connects with GitHub repositories and wallets to match on-chain governance logic with source code. This ensures that the audit reflects live-deployed contracts, reducing gaps in code review and aiding compliance.

10. Developer Portal and Custom API Access

DAOs and developers can access custom dashboards, request audits, and integrate risk reports through APIs. This feature opens up flexible auditing workflows, enabling continuous checks and smart integration with DAO tooling ecosystems.

Development Steps of Audit Platform for DAO

Developing an audit platform tailored for DAOs involves careful planning, secure architecture, and governance-specific tooling. Below is a structured breakdown of the core steps our blockchain developers follow to deliver a reliable DAO audit dashboard platform.

1. Consultation

Our blockchain developers begin by holding detailed consultations to define your DAO’s governance architecture. We outline proposal workflows, treasury operations, delegate structures, and risk flags to shape how the DAO audit dashboard will function and what compliance, analytics, or intervention mechanisms must be built around it.

2. Smart Contract & Governance Logic Analysis

We perform in-depth code reviews of your DAO’s core smart contracts, including voting, staking, proposal handling, and treasury flows. Using static analysis and formal verification, we validate logic consistency and highlight any governance vulnerabilities that could compromise upgrade paths, automation, or quorum-based decisions.

3. AI-Powered Risk Detection & Proposal Profiling

Our team integrates AI models trained on DAO governance data to assess risk in real-time. We build classifiers that score each proposal based on treasury access, token movement, or manipulation patterns, enhancing your platform’s ability to detect threats early and maintain balanced decision-making.

4. Governance Analytics & Engagement Monitoring

We develop an DAO audit dashboard interface that visualizes participation trends, voting patterns, delegate dominance, and proposal status. Using ML, we flag issues like whale control or low engagement and provide insights that help DAOs fine-tune governance models for better community inclusivity.

5. Immutable Audit Logs & Transparency Trails

Our developers create on-chain audit trails that capture every governance action votes, proposals, funds with metadata. These logs are visualized in time-sequenced dashboards for transparency, enabling community members and regulators to verify decisions and track tamper-proof activity.

6. Treasury & Multisig Security Assessment

We assess DAO treasury setups by analyzing multi-signature wallets, time-locks, and emergency override flows. Any misconfigured access or security gaps are flagged immediately. Our goal is to make sure fund custody mechanisms are secure and resilient against unauthorized access or coordination failures.

7. Conflict-of-Interest & Delegate Risk Engine

Our audit logic includes algorithms to detect delegate concentration risks or conflicts of interest. We build dashboards that visualize voting clusters and recommend diversification tactics, such as delegate reassignments or weighted vote balancing, improving decentralization and fairness.

8. Proposal Threat Scoring & AI Risk Index

We implement an AI-powered threat scoring system that tags proposals based on risk factors like treasury impact, voting overrides, or governance mutations. This module enables DAO participants to prioritize scrutiny, while explainable AI helps simplify complex risk scenarios for more informed voting.

9. Hybrid Human Review & Remediation Workflow

To balance automation and oversight, we build a two-tier review system. Low-risk proposals are flagged and logged automatically. Medium to high-risk items are routed to our manual auditors for deeper inspection, ensuring sensitive decisions are reviewed with human accountability.

10. Continuous Monitoring

We enable real-time re-audits whenever proposals pass, contracts upgrade, or treasury changes occur. Insights from governance logs, community feedback, and AI models are fed back into the system, allowing your DAO audit dashboard to evolve and adapt with emerging risks or governance shifts.

Cost to Build a DAO Audit Platform

The total cost of developing a DAO audit platform depends on multiple factors like technical complexity, automation level, and AI integration. Below is a structured breakdown to help you understand where your budget will be allocated.

| Development Phase | Estimated Cost | Description |

| Consultation | $5,000 – $8,000 | Initial sessions to define governance rules, DAO structure, and key audit requirements. |

| Smart Contract & Logic Analysis | $12,000 – $18,000 | Codebase review, static analysis, and formal verification of DAO smart contracts. |

| AI-Powered Risk Detection Integration | $18,000 – $25,000 | Build and fine-tune LLM models to assess risk scores, Sybil patterns, and proposal bias. |

| Governance Analytics Dashboard | $10,000 – $15,000 | Develop real-time dashboards to monitor engagement, quorum, delegate activity. |

| Immutable Audit Trail Infrastructure | $6,000 – $9,000 | On-chain logging system for proposals, votes, and treasury actions. |

| Treasury & Multisig Security Module | $8,000 – $12,000 | Build logic for multi-signature wallet analysis, timelock verification, and alerts. |

| Conflict of Interest Detection Engine | $7,000 – $10,000 | Deploy algorithms to flag delegate concentration and power clustering. |

| Proposal Threat Scoring System | $9,000 – $13,000 | AI-based module to assign risk levels to DAO proposals and flag high-impact changes. |

| Developer Portal & API Interface | $10,000 – $14,000 | Build user-friendly portal for audit scheduling, insights access, and data APIs. |

| Human Review Workflow Integration | $5,000 – $8,000 | Add logic for escalation workflows and manual audit review processes. |

| Continuous Monitoring System | $7,000 – $11,000 | Enable re-audit triggers and adaptive learning based on governance activity. |

Total Estimated Cost: $65,000 – $143,000

Note: These are estimated ranges based on standard DAO audit platform requirements. Actual costs vary depending on scope, complexity, and AI integration depth. Custom features or third-party tools may increase the budget.

Consult with IdeaUsher to get a tailored quote and a complete roadmap for building a secure, scalable DAO audit platform that fits your unique governance structure and operational needs.

Tech Stack Required for Developing a DAO Audit Platform

A well-structured DAO audit platform depends on a mix of smart contract tools, on-chain data access, AI-based risk engines, and a scalable frontend framework. These technologies work together to ensure high security, transparency, and real-time monitoring for decentralized governance.

1. Backend & Smart Contract Layer

The foundation of any DAO audit platform lies in robust contract development, simulation environments, and AI-enhanced auditing tools.

- Solidity, Vyper: These are widely used smart contract languages for writing DAO logic such as proposal voting, treasury control, delegation models, and role management.

- Hardhat, Foundry: Development frameworks used for local testing, simulation of DAO governance flows, deployment, and contract debugging with built-in support for mainnets and testnets.

- AI Security Tools (e.g., MythX, ChainGPT APIs): Integrates automated vulnerability scanning and code intelligence, helping identify logic flaws, privilege escalation risks, and upgrade path vulnerabilities using AI models.

2. On-Chain Indexing and Data Layer

Indexing tools allow structured access to DAO-related data across chains, while decentralized storage ensures the longevity and immutability of audit records.

- The Graph, Covalent, Dune: These protocols enable efficient querying and indexing of blockchain data related to proposals, votes, delegate activity, and token transfers for dashboard display.

- IPFS/Arweave for Report Permanence: Decentralized storage protocols used to publish immutable audit reports, snapshots of governance decisions, and security logs for long-term public verification.

3. Frontend

An intuitive frontend interface helps users explore audits, track governance KPIs, and act on flagged risks with minimal friction.

- React, Next.js: React-based frameworks that help build dynamic, high-performance user interfaces for interacting with audit reports, dashboards, and proposal analysis

- Ethers.js or Wagmi for Wallet Connection: Web3 libraries that connect user wallets to the platform, enabling proposal submissions, voting, and role-based access to audit tools.

- Chart.js, Recharts for Visualization: Frontend charting libraries used to visually represent metrics like quorum levels, delegate voting weight, treasury trends, and governance participation over time.

4. AI & Analytics

AI layers provide deeper insights by learning from historical governance patterns and real-time activities to detect risks early.

- Custom LLMs: Language models fine-tuned on DAO proposal content, vote outcomes, and contributor behavior to detect bias, repetition, or manipulation attempts.

- AI-Based Anomaly Detection: ML algorithms that monitor treasury actions and flag irregular withdrawals, abnormal fund allocations, or repetitive delegate-controlled actions that may indicate risks.

Challenges to Mitigate in DAO Audit Platform Development

Building an audit dashboard for DAOs is not just a technical task. It requires solving for governance complexity, evolving risks, stakeholder adoption, and cross-chain data fragmentation. Below are the real challenges developers and teams face, along with actionable ways to address them using scalable and AI-driven solutions.

1. Scalability & High-Volume Governance Activity

Challenge: As DAOs grow, they produce thousands of governance events like proposals, votes, and treasury actions, surpassing manual review limits. This hampers real-time auditing and delays threat detection.

Solution: We’ll build a real-time analytics engine with streaming ledger ingestion, event-driven architecture, and incremental indexing to handle DAO activity. It will maintain low latency during peak voting using parallel processing and optimized pipelines.

2. Emerging Attack Vectors & Governance Exploits

Challenge: Sophisticated exploits like flash loan-based vote rigging, token rental attacks, and AI-generated Sybil accounts increasingly target DAO governance.

Solution: We will integrate AI-based threat detection trained on past exploit patterns to flag unusual voting behavior, wallet movements, and treasury actions. Our platform will continuously retrain its models and use rules-based systems to monitor proposals in real time, assigning them dynamic risk scores.

3. Lack of Standardization & Interoperability

Challenge: Many DAOs operate across Ethereum, Layer-2s, and alt-chains, each using different governance plugins and frameworks, creating integration challenges.

Solution: We will develop modular multi-chain adapters supporting major governance tools like Snapshot, Tally, Zodiac, ERC-20, and ERC-721 tokens. We’ll ensure cross-chain bridge compatibility and adopt emerging interoperability standards to enable the audit dashboard to aggregate data from ecosystems like Ethereum, Arbitrum, and Cosmos.

4. Stakeholder Resistance & Low Governance Adoption

Challenge: Even well-built DAO audit dashboards can be underutilized if members distrust the data, are overwhelmed by complexity, or feel audits expose flaws that hurt reputation. This leads to disengagement or pushback from key contributors.

Solution: We’ll design stakeholder-friendly dashboards with simple visuals, role-based access, and educational overlays to clearly explain audit results. We’ll also make reports public to build trust and provide delegate tools for participation.

Top Examples of DAO Audit Platforms

DAO audit workflows are not just about reviewing smart contracts. Top security firms use a mix of AI automation, blockchain tracing, and governance logic analysis to ensure decentralized systems are secure, transparent, and tamper-resistant. Here’s how major players handle it:

1. HashEx

HashEx conducts DAO audits by combining static smart contract analysis with real-time governance simulation. Their platform uses AI to flag permission-related risks, evaluates voting modules, and traces treasury paths to identify misconfigurations in DAO frameworks before they go live.

2. Hacken

Hacken audits DAO projects by using formal verification tools, threat modeling, and AI-driven behavior analysis. Their approach includes checking on-chain voting logic, token dynamics, and ensuring DAO proposals are not susceptible to manipulation through token rental or vote delegation exploits.

3. Hashlock

HashLock focuses on DAO audit reliability by simulating governance flows, performing code audits, and verifying smart contract states across multiple proposals. Their audits also test voting thresholds, quorum rules, and funding release logic using automated scenario modeling.

4. ChainSecurity

ChainSecurity applies formal methods alongside AI-enabled analytics to secure DAO contracts. Their process includes validating execution paths, analyzing on-chain governance rules, and checking if the DAO design aligns with decentralized principles while staying secure across multi-chain ecosystems.

Conclusion

Building an audit platform for DAOs is a critical step toward ensuring transparency, trust, and sustainable governance in decentralized ecosystems. With smart contract automation, real-time financial tracking, and community-accessible dashboards, such platforms help safeguard collective assets and operational integrity. As DAOs continue to scale, the need for tailored audit systems will only grow. Developing a reliable tool involves a clear understanding of blockchain infrastructure, DAO-specific workflows, and compliance frameworks. By integrating advanced analytics and security protocols, the platform can support both technical validation and community oversight, ensuring DAOs remain accountable and resilient in a rapidly evolving digital environment.

Why Choose IdeaUsher for Your DAO Audit Platform Development?

We help you build audit platforms designed specifically for decentralized governance. From treasury monitoring to governance anomaly detection, our solutions ensure that DAOs operate with integrity, transparency, and accountability at all times.

Why Work with Us?

- DAO-Centric Development: We understand the nuances of decentralized voting, multisig wallets, and on-chain governance models.

- Automated Risk Insights: Our platforms integrate real-time analytics and machine learning to flag suspicious behavior across treasury and proposals.

- Modular and Multi-DAO Support: Build one platform to serve multiple DAOs with isolated data, permissions, and configurations.

- Transparent Reporting Tools: Enable stakeholders to access visual reports, audit logs, and vote histories that reinforce trust within your community.

Explore our portfolio to see how we’ve delivered blockchain solutions that help communities scale securely.

Let’s work together to build a DAO auditing platform that supports secure and self-sustaining governance.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

They should offer on-chain treasury monitoring, transaction anomaly detection, governance event tracking, and automated reporting. These features enable communities to maintain financial oversight and transparency as operations evolve.

Audit systems track unusual transactions, voting irregularities, or treasury movements by using predefined thresholds, anomaly detection models, and pattern comparisons against historical data.

A strong architecture combines blockchain data ingestion, analytics engine, permissioned dashboards, and secure API access. Governance members can review audit logs, approve findings, and vote on proposed actions in real-time.

Yes. A multi‑tenant design allows separate governance groups to use the same platform, with isolated dashboards, configurable rule sets, and shared infrastructure that simplifies maintenance.