The world has witnessed a transformative shift in the financial sector after the emergence of cryptocurrencies and blockchain technology.

Cryptocurrencies like Bitcoin and Ethereum have emerged as new-age digital assets. As a result, the demand for secure, user-friendly, and efficient platforms to trade and manage these digital assets has grown exponentially.

Founded in 2011, Coinbase has emerged as a leading platform in Blockchain and the Crypto world. Coinbase, with its extensive set of services and easy-to-use UI and UX, has simplified how newcomers enter the crypto trading industry.

In 2022, Coinbase reported 98 million registered users, a 42 million increase from 56 million users in 2021.

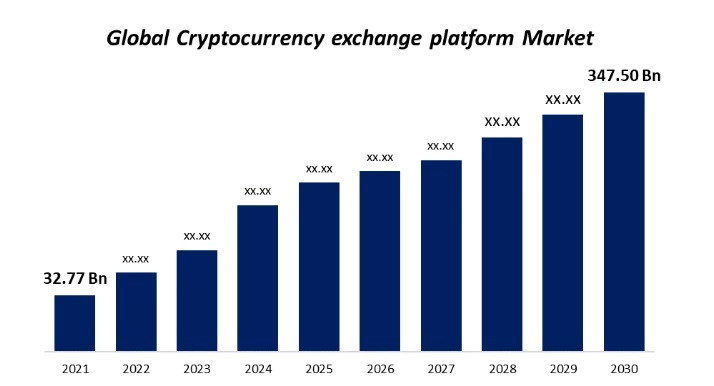

Also, the growing market size of global cryptocurrency exchange platforms indicates better opportunities for entrepreneurs to tap into the profitable market of blockchain with crypto exchange app development.

Source: Spherical Insights

In this guide, we explore the process of developing a cryptocurrency exchange app like Coinbase with key components, features, and tech stack through which you can offer a secure and seamless cryptocurrency trading experience to your users.

What Is A Coinbase App?

A cryptocurrency exchange provides a secure platform for buying, selling, transferring, and storing cryptocurrencies. Coinbase has developed an open financial system for the world and succeeded in becoming a leading brand for enabling people to convert crypto into their local currency.

There is no transaction fee for sending or receiving crypto between online crypto balances, friends, or merchants, which makes it easier to buy and sell cryptocurrency among crypto users on Coinbase.

| Launched in | 2011 |

| Founders | Brian Armstrong |

| Headquarter | San Francisco, US |

How Coinbase App Works?

A Coinbase exchange app facilitates the buying, selling, and trading of cryptocurrencies by operating as a digital marketplace where users can exchange various cryptocurrencies for fiat or other cryptocurrencies.

Here’s a simplified overview of the working of the Coinbase app:

1. User Registration

App users typically need to download the app, install it on their mobile device, and create an account to get started.

Also, to comply with regulatory requirements during registration, such as Know Your Customer & Anti-Money Laundering, users may be required to provide personal information and complete identity verification procedures.

2. Wallet Setup

Crypto wallets allow users to securely store, receive, and send many cryptocurrencies, where the app generates public and private keys for each wallet to facilitate transactions.

Therefore, After registration, users usually have to set up cryptocurrency wallets within the app.

3. Deposits

Users need to deposit cryptocurrencies into their wallets within the app to start trading. Some crypto exchange apps also allow users to deposit traditional fiat currencies, which can be used to purchase cryptocurrencies.

4. Marketplace Access

Users can select trading pairs like Bitcoin (BTC) to Ethereum (ETH) and see the current exchange rates by accessing the app’s cryptocurrency marketplace.

With marketplace access, users can view real-time market data, including cryptocurrency prices, trading volume, order book information, and historical price charts.

5. Placing Orders

Crypto exchanges allow users to place different types of orders, including market orders, where users can buy and sell at the market price; limit orders, a specific price at which to buy or sell); and stop orders, trigger a trade when the price reaches a certain level.

6. Execution

As cryptocurrency is purchased or sold at the agreed-upon price, the crypto exchange allows the trade execution where a user buys or sells an order that matches another user’s order.

7. Portfolio Management

Users can monitor the performance of their cryptocurrency holdings, view their balances, and review transaction history within the app through a portfolio tracking feature on crypto exchanges.

8. Withdrawals

Cryptocurrency exchange allows users to move their cryptocurrencies and funds from their exchange account to external wallets or bank accounts.

9. Security Measures

To protect users’ assets and data, crypto exchange apps employ multiple security measures, including two-factor authentication (2FA), encryption, and cold storage for funds.

Security is a crucial part of a cryptocurrency exchange app it protects users from the threat of hacking and builds trust for a successful platform.

10. Customer Support

A crucial part of any cryptocurrency exchange app for building trust with users, resolving issues, and ensuring a positive user experience.

Many crypto exchange apps provide customer support to assist users with issues or encounter questions while using the platform.

Must-Have Features For Crypto Exchange Apps like Coinbase

Developing a cryptocurrency exchange app similar to Coinbase for buying, selling, and managing cryptocurrencies involves incorporating various features to provide users with a secure, user-friendly, and efficient platform.

A successful cryptocurrency exchange app should provide users with a secure, user-friendly, and efficient platform that is a strong foundation for a cryptocurrency exchange app.

Here are some must-have features that should be included in a cryptocurrency exchange app:

1. Staking

Staking is similar to receiving interest over the capital kept in a bank. On crypto exchange platforms, users can deposit their crypto assets and earn interest by safely holding their cryptos to generate a passive income.

Many crypto exchanges offer staking features to their customers, where companies and asset holders earn good profits.

2. Cryptocurrency lending

The demand for crypto lending has been booming for a couple of years, and companies can benefit by integrating this feature into their platform.

Through cryptocurrency lending, users can become lenders, whereas other users can borrow crypto assets from lenders. Cryptocurrency lending also benefits exchange owners, who can charge a fixed or variable fee as a commission from lenders.

3. Trading bot

Crypto trading demands constant attention from the traders, which makes it time-consuming. Trading bots emerge as an effective solution for crypto traders seeking to automate their crypto trades.

Trading bots consist of advanced computer scripts that automatically place buy and sell orders on their behalf. Companies can benefit from crypto bots by earning recurring charges from users who utilize crypto bots on your platform.

4. Peer-to-peer trading

Many crypto asset holders prefer P2P because of their high profitability crypto rates and trades.

Integrating P2P trading features can bring growth opportunities as you can allow buyers to trade crypto with sellers and vice versa, where you can generate revenue by taking charge as a commission from your users involved in P2P trading.

5. Crypto Wallet

A digital address that allows users to store, receive, and send different cryptocurrencies. You can choose from hot and cold wallets to integrate them into your crypto exchange platform.

Users can access hot wallets, which can be accessed online, making them easier to use for quick operation.

Cold wallets are offline wallets, making them secure from online threats, but they are not always convenient. Hence, you can select between cold and hot wallets based on your platform capabilities and user requirements.

6. Security

User security is a crucial aspect of almost every crypto exchange platform. By offering security features such as 2FA authentication, multi-sig wallet integration, and protection against DDoS attacks, you can provide a secure environment for your users on your platform.

Moreover, complying with your app with Know Your Customer(KYC) and Anti-money laundering (AML) are other ways to enhance your app security and legally comply with the regions where you decided to launch your app.

Cost To Build A Cryptocurrency Exchange App like Coinbase

The development complexity, features, tech stack, and development aspects will significantly impact the development costs. Here are some key factors to consider:

1. Features and Functionality

The number of features and functionality you want to include in your app determines the cost of developing your app.

Coinbase offers numerous useful features like trading, price charts, a digital wallet, security features, real-time market data, and a user-friendly interface. Therefore, development and the complexity of such features impact the budget of crypto exchange development.

2. Platform

Making your exchange available on different platforms is another factor that affects the cost of developing crypto exchange platforms.

You can opt for native app development targeting a single platform such as Android, Web & iOS. On the other hand, you can go for hybrid platforms when you are considering developing your exchange for multiple platforms simultaneously.

3. Design and User Experience

Developing an intuitive and visually appealing user interface is crucial for a cryptocurrency app like Coinbase. It can be expensive to have a good app design, but is essential for attracting and retaining users on your crypto exchange platform.

4. Security

Investing in security features impacts the development costs as cryptocurrency apps like Coinbase require robust security measures to protect users’ funds and data.

Implementing security measures such as multi-factor authentication and continuous security audits will add to the development cost and can extend the app development budget requirement.

5. Regulatory Compliance

Depending on your target market and jurisdiction, you may need to invest in legal and compliance services to ensure your app complies with local and international regulations. This can include obtaining licenses and adhering to Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

To ensure your app complies with local and international regulations, you may need to invest in legal and compliance services depending on your target market and jurisdiction.

6. Technology Stack

The technology stack selection can affect the costs of developing a cryptocurrency app like Coinbase, such as fees of development tools, complexity, etc. Moreover, each blockchain platform has fees for different aspects, such as crypto transactions, gas fees, etc.

7. Third-Party Integrations

Integration to third-party APIs can overall enhance the functionality of your cryptocurrency exchange, such as you can allow users to create their accounts by sharing their social media details like name and email address.

If you want to integrate your platform with external services like KYC providers, payment gateways, or blockchain explorers, the cost of these third-party APIs will affect your overall development cost.

How To Develop A Crypto Exchange App Like Coinbase?

Developing a cryptocurrency exchange app like Coinbase requires a team of experienced developers, legal experts, and compliance professionals.

Moreover, it is essential to prioritize security, regulatory compliance, and user experience to succeed in this competitive market.

Here’s a high-level overview of the process for developing a cryptocurrency exchange app like coinbase:

1. Identify the problem

Understand the cryptocurrency market, target audience, and competition, and identify unique selling points and niches.

Moreover, you can create a detailed business plan outlining your goals, revenue model, and budget by researching the cryptocurrency market’s current trends and its users’ concerns.

By finding an existing problem, you can have the USP of your crypto app evaluate the available solutions that meet the user’s needs.

2. Decide app features and budget

The team working on the app development can plan for the budget and development time that has to be allocated for crypto exchange app development.

Also, it is essential to determine your budget for your crypto exchange app development, as failing to do so might result in losing your project by the development phase.

Moreover, planning an operating scope is critical to kickstart your crypto exchange app development, where you can list the functionalities and give the developers an idea of what they must work on.

3. Select tech stack and crypto exchange type

You can choose from three types of cryptocurrency exchange platforms: centralized, decentralized, and hybrid.

The functionality of your crypto exchange will be decided by the platform you choose for your crypto exchange app development. Moreover, choosing the right tech stack can prove your app’s success based on the crypto exchange type you have selected for development.

Therefore, if you are building a web application, consider selecting the HTML5 tech stack. Whereas for Android applications, Java & Kotlin are suitable tools, and Swift or Objective-C can be used to develop iOS apps.

4. Select jurisdictions

The choice of jurisdictions for your cryptocurrency exchange app should align with your business goals, risk tolerance, and compliance.

You can make informed decisions by conducting research and seeking legal counseling. Also, ensure you have secured all of the necessary licenses for the region where your app will be available.

Also, pay close attention to legislative changes before beginning your crypto exchange app development process to avoid any possible legal challenges.

5. Focus on compliance and regulations

Governments worldwide are cautious about cryptocurrency exchange usage due to the money involved. Therefore, establishing an accurate and powerful regulatory system is crucial to increasing the security measures of your crypto exchange app.

Ensure your app follows KYC standards, such as enabling documentation to verify your consumers’ credentials, thus eliminating the possibility of money laundering through cryptocurrency trading on your app.

Make your app comply with legal requirements such as GDPR, AML, and KYC, and build a backend database to track records by incorporating a customer verification API into your crypto exchange to comply with laws.

6. Integrate payment bank or processor

For fast transactions, clearing, and payment settlement, partner with a bank, as they can help you provide various online services to your app users.

You can also provide commercial banking services like corporate accounts and USD/fiat custodial accounts in addition to allowing customers to lend their crypto for interest.

7. Find a liquidity provider

Liquidity is another essential component of a cryptocurrency exchange, as users prefer highly liquid platforms. Moreover, consider integrating your cryptocurrency exchange with the exchange network to improve its liquidity position.

You can also provide commercial banking services like corporate accounts and USD/fiat custodial accounts in addition to allowing customers to lend their crypto for interest, where your partnered bank can receive a fee for the crypto earned.

8. Build and implement security features

Crypto exchanges can be an easier target for hackers and other harmful attacks due to the sudden increase in the usage of these platforms. Therefore, traceability should not be compromised.

You can ensure a solid security foundation with features like multi-signature wallets and two-factor authentication

for every transaction.

Moreover, keep your traders’ records and funds in a cold wallet to ensure that only authorized individuals can access their funds. The process should be quick, easy, and straightforward when money must be transferred between hot and cold wallets.

9. Create a customer support channel

Your crypto exchange software could reach its full potential by offering the best customer support.

You can support your users on your app regarding financial transactions and other crucial aspects by developing a customer service channel. A well-planned customer service channel guarantees quick responses to customer inquiries.

Consider developing various communication channels on your crypto exchange, such as live chat, email support, phone support, and a ticketing System.

10. Provide support to various cryptocurrencies

Decide on the number of supported cryptocurrencies, such as Bitcoin, Ethereum, Tether, Binance Coin, XRP, Terra, Cardano, Solana, etc.

The number of supported cryptocurrencies will determine the budget of your platform development as the more cryptocurrencies supported by your system, the more budget will needed on developing specialized APIs to access various functions of the supported crypto such as getting historical data, producing real-time charts, and making orders.

11. Test the crypto exchange app

Proper app testing can evaluate the crypto exchange’s crucial aspects. Performing a test launch before launching a crypto exchange into the broader market area will help you receive feedback and determine whether there are any areas for improvement.

By working on the following areas of improvement, such as performance, functionality, liquidity, transparency, ease, transaction speed, dependability, and security, you can ensure the seamless performance of your cryptocurrency app.

12. Ensure sustainability

After releasing your app, update it periodically with the latest versions and bug fixes to ensure its long-term viability.

For the sustainability of the crypto exchange app, you will need a dedicated team of engineers and developers who will handle your product to smoothen the app’s performance.

Challenges In Developing A Crypto Exchange App Like Coinbase

Due to the complex & highly regulated nature of the cryptocurrency industry, several significant challenges are involved in developing a cryptocurrency exchange app like Coinbase.

Moreover, there is a requirement of careful planning, a dedicated team, and ongoing commitment to security and regulatory compliance to facilitate the successful development and operation of a cryptocurrency exchange app like Coinbase

Some of the key challenges you may face during cryptocurrency exchange app development are as follows:

1. Regulatory Compliance

Staying up-to-date with changing regulations is crucial to avoid legal issues, as the regulatory environment for cryptocurrency exchanges is continuously evolving and varies by jurisdiction.

Moreover, it can be challenging to comply with financial regulations such as Know Your Customer (KYC), and Anti-Money Laundering (AML), but necessary to gain and maintain users’ trust.

2. Security

Developing a cryptocurrency exchange app like Coinbase while prioritizing security is complex and challenging.

Ongoing challenges include protecting user funds and data from hacking attempts, fraud, and other security threats by implementing robust security measures through regular security audits and staying ahead of emerging threats.

3. Liquidity

Liquidity is the platform’s ability to facilitate trading with minimal price fluctuations and handle a high volume of transactions.

There is typically a requirement for various features and resources, which can be challenging but required for high liquidity.

4. Market Volatility

Cryptocurrencies are known for their high volatility, where it is challenging to manage risk and ensure that the exchange can handle sudden spikes in trading activity.

You can mitigate the market volatility risks by developing and implementing risk management tools, like stop-loss orders for your users.

5. Scalability

There are several scalability challenges due to the requirement to handle a growing number of users, trades, and cryptocurrencies

With a combination of technical expertise, continuous monitoring, and the ability to adapt to ever-evolving market conditions, the scalability challenges can be addressed.

To ensure exchange can handle increasing demands from users and the market, it is crucial to conduct thorough load testing and performance optimization throughout the development and operational phases

How Does Coinbase Secure Their Platform?

How Coinbase makes its platform secure for the users dealing with millions of fiat and cryptocurrencies are crucial to know so you can implement the same and ensure that there will be no incidents of hackers stealing cryptocurrencies on your platform.

Coinbase distributes bitcoins (a form of their customer’s fund) worldwide in several safe deposit boxes and vaults. Also, the platform stores 98% of customer funds in an offline mode to prevent chances of loss and theft

Moreover, Coinbase includes HTTPS-encrypted SSL for running their website traffic and uses AES-256 encryption for storing all the wallet addresses and private keys.

Also, Coinbase asks to have a two-step verification process for all their users’ accounts where users get a code from their phone to log in with their password and username.

Top 5 Coinbase Alternatives In The Cryptocurrency Exchange Market

Based on features, functionality & ease of use, we have enlisted the top five crypto exchange apps that can be a perfect alternative to Coinbase as they help you research more for developing a crypto exchange platform.

1. Gemini

A suited platform for crypto traders of any skill level. The platform has many valuable features, such as allowing users to earn interest on crypto holdings and the Gemini Credit Card.

Having availability in all 50 states and commitment to meeting all U.S. regulatory compliance requirements is another plus point from Gemini.

However, Gemini doesn’t have some popular coins like Cardano (ADA) and has limited customer service options.

| Launched in | 2014 |

| Founded by | Cameron and Tyler Winklevoss |

| Headquarter | New York, US |

2. KuCoin

The best crypto exchange that supports a diverse range of cryptocurrencies. Headquartered in Seychelles, KuCoin experienced growing users in Asia, Europe, the Middle East, and Africa.

KuCoin offers competitive trading fees, such as volume discounts, and advanced features like margin and futures trading. Moreover, the platform accepts credit and debit cards to enable users to buy cryptocurrencies.

| Launched in | 2017 |

| Founded by | Johnny Lyu |

| Headquarter | Mahe, Seychelles |

3. Crypto.com

With more than 250 cryptocurrencies available, Crypto.com offers an excellent choice for crypto investors where users with a Crypto.com Visa Card can access unique perks and crypto rewards.

Moreover, users can take advantage of Crypto.com’s utility token Cronos (CRO) for paying fees with discounts and cashback of as much as 8% available for users with high balances in CRO.

| Launched in | 2016 |

| Founded by | Bobby Bao, Rafael Melo, Gary Or, Kris Marszalek |

| Headquarter | Singapore |

4. Kraken

Launched in 2011, Kraken is one of the oldest U.S. crypto exchanges. The platform offers a solid range of coins with very competitive trading fees.

Also, Kraken is one of the few U.S. exchanges that offers margin trading and a suite of other advanced trading tools like advanced order types and futures trading.

Moreover, the platform offers two trading platforms, Kraken and Kraken Pro, where the users can get volume discounts and lower their costs by trading on Kraken Pro.

| Launched in | 2011 |

| Founded by | Jesse Powell |

| Headquarters | San Francisco, US |

5. BYDFi

A Singapore-based crypto exchange founded in 2019 provides trading services in over 150 countries.

BYDFi provides spot trading with low fee requirements and is one of the few exchanges that comply with financial industry regulations.

The BYDFi holds licenses in Australia, Singapore, and the U.S., making it a reliable platform that accepts over 50 fiat currencies.

BYDfi Offers both an online wallet and cold storage; however, the platform lacks in terms of offering crypto staking and lending.

| Launched in | 2019 |

| Founded by | Michael Hung |

| Headquarters | Singapore |

Tech Stack For Coinbase-Like Crypto Exchange App Development

Creating a cryptocurrency exchange app is a complex process that requires a robust tech stack to ensure security, scalability, and performance. Here’s a general tech stack for developing a crypto exchange app:

1. Blockchain Platform

- Ethereum

- Solana

2. Smart Contract Development

- Solidity

- Vyper

3. Identity Verification

- Sovrin

- uPort

4. Decentralized Storage

- IPFS (InterPlanetary File System)

- Filecoin

5. Blockchain Development Frameworks

- Truffle

- Hardhat

6. Blockchain Explorer

- Etherscan

- Blockdaemon

- Anyblock

7. Consensus Mechanism

- Proof-of-work (PoW)

- Proof-of-stake (PoS)

8. Blockchain Wallets

- MetaMask

- Ledger

- Trezor

9. Blockchain Platforms

- Ethereum

- Hyperledger Fabric

- Binance Smart Chain

10. Smart Contract Development

- Solidity

- Chaincode (Go)

11. Development Tools and Frameworks

- Truffle

- Remix

- Hyperledger Composer

12. Web3 Libraries

- Web3.js

- Ethers.js

13. Identity Management

- uPort

- Cryptowatch

14. Consensus Mechanisms

- Proof of Work

- Proof of Stake

- Byzantine Fault Tolerance

15. Security Auditing Tools

- Mythril

- Truffle Security

16. DevOps and Deployment

- Docker

- Kubernetes

17. Testing Frameworks

- Mocha

- Chai

- Jest

18. Frontend Frameworks

- React,

- Angular

- Vue.js

19. Cloud Services

- AWS

- Azure

- Google Cloud

Conclusion

Starting a crypto exchange app development offers enormous opportunities for entrepreneurs to tap into the profitable market of the blockchain industry.

However, starting a crypto exchange app development is a complex and challenging process where having a careful plan, a robust tech stack, and a solid focus on security and compliance is essential.

Also, having an expert team of developers, security experts, compliance specialists, and legal advisors is another crucial factor in successfully starting crypto exchange app development.

Through your crypto exchange app, you can provide users with a reliable & secure platform for trading digital assets, with a well-executed plan and a commitment to security, which can be easy if you work with blockchain development experts.

Work with us, and we can assist you in developing a secure and highly responsible cryptocurrency exchange app.

Our blockchain experts build scalable and personalized crypto exchange apps configured with the relevant legal compliances for your targeted market region.

Consult with our experts about your cryptocurrency exchange app development right now to understand how we can help you with crypto exchange app development.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQ

Q. How do I create a crypto exchange app?

A. You can develop a crypto exchange app by following the given steps: identify the problem, set the operational scope and budget planning, choose the crypto exchange type and tech stack, select jurisdictions, focus on compliance and regulations, partner with a payment bank or processor, find a liquidity provider, build the best security features, introduce a Customer Support Channel, cryptocurrency support, testing crypto exchange app, ensure sustainability.

Q. Is starting a crypto exchange profitable?

A. Yes, there is a huge opportunity to make profits by developing a crypto exchange app, as the market of crypto exchanges is growing tremendously and is expected to reach $347.5 B by 2030.

Q. Which exchanges are best for buying Cryptocurrency?

A. Coinbase, Gemini, Crypto.com, KUCoin, and Kraken are some of the best crypto exchanges for buying cryptocurrencies.

Q. What are the features of crypto exchange?

A. Trading engine, user management and verification, admin panel, analytics, crypto wallet, withdrawal and deposits, mobile and desktop compatibility, user authentication, and authorization are some of the essential features of crypto exchange.