Money lending has been a part of the economy for a very long time; being an informal lending method such as person to person without any formal paperwork or the formal loan lending process that is from banks to people, which requires a range of steps starting from application to credit score checks to tonnes of paperwork to collateral and then finally the loan approval process, it can take time and somewhere even loan rejection.

But as the internet trends are at a peak rise, we are surrounded by the world of startups new trend called peer-to-peer lending is on a recent surge, a paperless loan experience where the user has to login into the particular app, fill out the details and other information this app automatically detect the credit scores and gives a green signal on terms of lending and the user can apply for the loan.

This app follows a systematic process of obtaining a loan and has a fixed interest rate for every user. For example, the 12 percent club subsidiary of Bharat Pe has a revised 12 percent on lending and investment.

According to Acumen Research and Consultancy’s reports, the global P2P lending market size was valued at USD 82,300 million in 2021 and is expected to reach USD 804,200 million by 2030, growing at a 29.1% CAGR.

P2P lending, also known as “crowdfunding” or “social lending,” has been around since 2005, yet it grew and became a trend as we saw the internet grow.

The P2P app is a great investment opportunity; how can I build one myself? Here is a complete guide on how to do so.

So let’s get right into it without any delay.

P2P Apps: What are they? And the Key Takeaways.

- P2P apps follow a particular technology form where the borrower and the lender can borrow or invest the money as required.

- These apps and websites connect the investor and borrowers using dynamic software and set the rate of interest based on creditworthiness.

- These P2P apps help investors invest directly and get a better interest rate without ever investing in the banks or stocks market, which requires a lot of paperwork; moreover, investing here is easy since it does not require paperwork or tonnes of formalities.

- These apps charge relatively higher interest rates than banks since it is a form of crowdfunding.

- P2P apps have emerged as an alternative for borrowers to the bank, and they prefer borrowing from these apps.

How does the P2P app work?

First, an investor creates an account with the site and deposits funds to be distributed as loans. The loan applicant submits a personal profile, allocated a risk category, which affects the interest rate they will pay.

The loan applicant can analyze and accept offers. (Some applicants break up their requests into chunks and get multiple offers.) The software handles both money transfers and regular payments. The procedure can be automated entirely, or lenders and borrowers can bargain.

The working of these apps is simple yet effective, and since they are hassle-free, people have started moving to online borrowing for personal and small loans.

Creating a P2P App: A Step-by-step Guide

Here is a guide on how to build the perfect P2P lending app.

Step 1: Analyse the Market

The first step is to understand the market and what needs to be improved regarding P2P apps since several already existing apps exist.

You need to understand what features you want to add and what market and audience you want to cater to.

Analyzing the market also helps the investor understand the project’s shortcoming and even help the app/website grow rapidly.

Step 2: Manage the Legal and the Safety Aspects

When building any payment app, it is essential to encrypt these apps and follow the highest security form so that the customer’s personal information, funds, and assets are saved in an online format that no one can access.

These are the required security measures that are needed.

1. Authentication.

An identity verification method can improve the security of your peer-to-peer loan app. Passwords, 2-factor authentication, face recognition, and fingerprint scanning are just a few

to authenticate available to developers.

2. Encryption

Encryption is required for a peer-to-peer lending app. You must ensure your app uses secure server connections and has every necessary data-breaching structure.

3. Legal Law Compliance

In building apps like these, which are related to payments and are capable of holding necessary funds and private information, your application must comply with all the necessary laws of being a payment app.

As your app grows, you must grow your legal aspects and comply with every region’s laws.

Step 3: Select a Business Model for your App.

Because creating a P2P lending application demands plenty of workforces, you want to make it excellent. You can use standard revenue strategies such as advertising and subscription to keep your app profitable. You may opt for a commission-based business plan to secure revenue on every executed loan.

Step 4: Adding Features

Adding the most common to the most premium features is required in your app, so your app stands out from the rest; here are the required features.

1. Registration Form

When your customer downloads the app, this is the first step. An app must make the process for registering easy and quick as possible. Adding the ability to join up through social media profiles can be a game-changer move from your app.

2. Profile and Profile Edits

A profile where users can modify their details, add more personal information, and track their activity in the P2P lending app can improve their experience.

3. Loan Application

This is the most crucial step because this is why the user is here; the loan application process should be simple and self-explanatory to the user so they can access the app without any complications.

4. Loan Calculator

This is a fantastic feature to add to your apps; loan calculators can help users access payment possibilities while connecting with lenders. They can access the rate of interest and other required statical information.

5. Payment

The app should offer in-app payment options so the user can pay off the interest and principal amount using the app by connecting different payment methods like a credit cards, debit cards, and online banking.

6. Notifications

This is the most common yet crucial feature. Push notifications are the best way to remind customers about their payments, outstanding amounts, and other information like different offers and new notifications.

Step 5: API’s Integration in P2P App.

Financial APIs can be extremely useful when developing your P2P lending apps. APIs boost the production process, reduce expenses, shorten development time, and provide advanced functions in your program.

APIs also add to a safer and more secure account verification procedure.

Step 6: UX/UI

The user interface is the most that the consumer interacts with; thus, it is important that the UI you are using is very vibrant and easy to use, and the app should be user-friendly, making the user fall in love with the app.

- Make the UI/UX simple and effective to use

- Organize the information using graphs and pie charts so the user can interpret returns and investment opportunities.

- Add other content, such as newsletters, about different investment tools, etc.

Step 7: MVP Development of the P2P App.

Beginning app development with a Minimum Viable Product (MVP) is always preferable. This procedure can save you time, effort, and money while designing your P2P lending app, and it will highlight an issue in your app.

An MVP is simply a structure with the most important functionalities. However, it will assist you in preparing how people will accept your app so that you can focus on their wants, observe the advantages and negatives of your app, and keep the first consumers and make money.

Step 8: Collect Feedback

After the app is developed and exploited to the Play Store and App Store, you must collect all the information regarding the application and collect feedback on all flaws and positives so you can work on what is lacking in the application.

Collection of feedback is the most important and effective way to make your app grow and generate revenue streams.

Pros and Cons of Peer-to-Peer Lending Apps

You need to consider the advantages and disadvantages of P2P apps.

Pros

1. Cost and Time Effective

The most significant advantage of using a peer-to-peer lending system is saving time while drawing a loan. The user can expect a quick and paperless loan with actual in-person interactions; moreover, there are no extra hidden charges like a bank holds while executing a loan.

2. Impressive Rates

A lending system such as peer-to-peer lending is free from any middlemen. Thus, unlike banks, these apps do not levy extra convenience or hidden fees on any transaction levied on their platforms.

3. System of Multiple Borrowers and Lenders

Besides the advantages mentioned above, the significant advantage is always available funds because of the presence of so many lenders. Moreover, the lenders can lend funds to multiple borrowers simultaneously, which becomes an investment opportunity for all those looking to invest money and generate some profits.

4. Security

The security of these apps is beyond words. They use a high level of encryption on their platforms, free from mediators. The peer-to-peer lending apps use proper security and fall under all the regulations of being a financial and lending app; all these apps ask to submit essential documents like govt identification makes them more reliable.

Cons

1. Lack of Regulation

Like traditional banks, all the peer-to-peer lending apps are not always regulated; thus, they can carry a huge risk for the lenders and the borrowers.

2. Limited Borrowing Criteria

Since these apps cannot run huge background checks thus, they levy heavily on good credit score history, which some people do not have; this makes withdrawing a loan more complicated and can be rigid due to these regulations on their platforms and thus making it a restrictive platform.

3. Higher Rate of Interest

Since the banks are not mediating this transaction and some internet user or lender that charges a very high rate of interest on the lending due to the risk of losing the money, thus making it an expensive platform

4. Technological Risk

Since the whole app and the system are back on a server system, this carries a huge risk of significant risks like cyberattacks where the hacker can take control of personal information, including bank statements and other personal documents, and, at worst, withdraw funds from personal accounts.

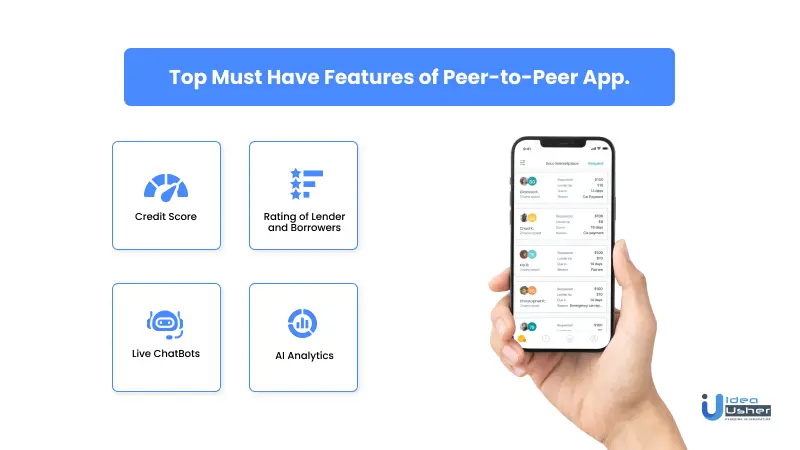

Top Must-Have Features of Peer-to-Peer App.

Here is a list of some premium features you can add to your app to make your app stand out.

1. Credit Score

Integrating the credit score in your app can benefit the lender because they can access the creditworthiness of the borrowers and can then decide to lend money.

2. Rating of Lender and Borrowers

It is one way to express acknowledgment to users. A good credit score will represent a user’s level as a loan partner because credit ratings reflect a user’s credit history.

3. Live ChatBots

Integrating your app with live chatbots is great so the user can interact with the bots if they find any hindrance in the app or the loan application process.

4. AI Analytics

This feature can help with in-app activity analysis in real-time. Admins can receive accurate information and user experience to upgrade their P2P lending in the future more efficiently.

Top Features of the Solo App.

If you are looking forward to building a Like SoLo app, you need to look at how an app like SoLo works to understand its features and work.

1. Signing Up

After downloading the app, the user must log in as either the borrower or the lender and then follow the steps as usual.

2. Analyze

Lenders can look into the risk factors for backing the borrower’s loans once the user has logged in as a borrower. The borrower’s credit rating will determine the rate of interest and terms.

3. Loan Request Submission

After the analysis is the loan request, the borrower needs to submit the loan request with the desired reason for why the loan is required, and with that, the application goes live on the loan market, where potential investors can tack these down.

4. Loan Acceptance

Now the loan request gets a green signal here; the borrowers can look at the potential loan offers and choose from the best after reading their terms and conditions.

5. Loan Repayment

The monthly payment dates will be sent to the borrower. If he fails to pay his monthly installments on time, his credit score might drop, and a late fee may be charged.

This is how the app SoLo works and helps the borrowers potentially connect with the investors; the app follows a simple and user-friendly user interface that keeps the user hooked, and all the steps are followed and self-explanatory.

SoLo Lending App in Numbers: Fascinating Statistics and Analysis

- Currently, the SoLo- lending app has more than 1,00,000 plus active users on its platform.

- The lender on the platform generates almost 3-10 percent in profit after lending the amount to the borrower.

- On the app, the user can request a loan of anywhere ranging from $50 to $500.

- The maximum time to repay the loan on this platform is 90 days.

- If the borrower cannot pay the loan in the said time, the user is levied with a 10% late fee.

- The net worth of SoLo Funds is more than 5 million dollars.

Peer-to-Peer (P2P) Funds: Understanding Their Safety and Risks

The next question might arise, are these apps even safe and worth investing in? So here is a statement to explain the above question.

The peer-to-peer lending apps do carry a higher risk than saving accounts or regular bank lending; this is because banks follow a proper formal system of lending where the banks complete all the formalities and paperwork and even keep security called collateral that the bank can sell to recover the loan money in any case of mishappenings.

Moreover, these apps levy a high-interest rate, meaning lenders charge a higher interest rate because they assume the risk of losing money.

So are these apps worth investing in and making yours?

Yes, because these apps are worth 82,000 million dollars in 2022 and are expected to grow to a whopping 804,000 plus million dollars by the end of 2030

So the market is ever-growing, and looking at the not explored sides of peer-to-peer lending, your app can grow by serving particular users and adding the features lacking in the market.

Top Key Considerations While Building a P2P App

Here is a list of essential items you should consider while building a peer-to-peer payment app.

1. Quality Lawyer

You must hire a quality lawyer who can overlook all the essential legal aspects of your app, suggest legal suggestions, and even settle legal issues.

2. Financial Experts

Having a financial expert on your team can suggest all the financial suggestions and help your app keep updated on all the economic laws and regulations so the app does not receive any reports.

3. Loan Agreement (PaperWork)

When launching a P2P lending company, it is necessary to consider establishing a loan agreement. Users must be notified of the agreement’s terms and conditions, and the deal must conform to national financial standards.

4. Banking Partners

You must select a bank partner on your own. The bank will offer to keep your money and the money of investors and borrowers. Because the bank already has a system, it will help you. You can also choose more banks as partners, but this will increase your costs.

5. Local, National, and International Laws

You must comply with all the laws and regulations where your app is going to release. If you plan to establish a P2P lending app that is not limited to your local region, you must be aware of both local and international rules and must comply with them.

6. Integration

It would help if you integrated with other applications like payment gateways, and integration of social media platforms, this can be a lengthy process, yet integrations can make your app stand out.

Conclusion

Building a P2P payment app requires careful planning, attention to detail, and a deep understanding of the target market. Understanding the competition and the users’ payment preferences and pain points is essential in developing an app that appeals to the target audience.

Unique features, such as social media integration or rewards programs, can be incorporated to make the app stand out from competitors. Monetizing the app through transaction fees, premium features, subscriptions, or partnerships can also be a crucial factor in its success.

Building a payment app like SoLo Payments requires a team of skilled developers experienced in payment app development. At Idea Usher, we have a team of experts equipped with cutting-edge technology and extensive knowledge of the P2P payment market. We work closely with our clients to develop a comprehensive plan that aligns with their business goals.

If you’re interested in building a payment app like SoLo payments, contact us today, and we will help you transform your vision into reality. Our team of experts is here to assist you every step of the way, from ideation to deployment, to ensure your app’s success.

Build Better Solutions With Idea Usher

Professionals

Projects

FAQ’s

Q. What kind of legal and regulatory requirements should I consider when building a P2P payment app?

A. Building a P2P payment app requires complying with various legal and regulatory requirements, including anti-money laundering (AML) and know-your-customer (KYC) regulations, data protection and privacy laws, and payment card industry (PCI) compliance. It is important to consult legal experts to ensure your app complies with all applicable laws and regulations.

Q. How can I ensure the security of my P2P payment app?

A. Security is a critical aspect of P2P payment app development. You should implement security measures such as data encryption, multi-factor authentication, and real-time fraud detection mechanisms to protect user data and transactions. Regular security audits and testing are also essential to identify and address vulnerabilities.

Q. How can I make my P2P payment app stand out from competitors?

A. To make your P2P payment app stand out from competitors, you should provide a seamless user experience with features such as instant notifications, easy-to-use payment methods, and an intuitive user interface. You should also consider incorporating unique features, such as social integration or rewards programs, that differentiate your app from others in the market.

Q. How can I monetize my P2P payment app?

A. There are several ways to monetize a P2P payment app, such as charging transaction fees, offering premium features or subscriptions, or partnering with merchants to offer discounts or cashback. It is important to carefully consider your monetization strategy and balance the needs of your users with your business goals.