Managing rentals felt manageable until growth quietly became overwhelming. Every new property added operational strain instead of revenue clarity. Teams were stretched, and systems rarely worked together. That is why property managers began using AI rent platforms like Mynd because they could centralize leasing, automate rent workflows, and track performance across entire portfolios.

Demand grew when manual scaling no longer worked. AI could handle tenant conversations, predict maintenance needs, and consistently support rent optimization. Technology became valuable because it reduced hidden operational overhead that teams could not address on their own.

Over the years, we’ve developed numerous rental automation solutions, powered by artificial intelligence and property data orchestration layers. Thanks to this expertise, we’re sharing this blog to discuss the steps to develop an AI rent platform like Mynd.

Key Market Takeaways for AI Rent Platforms

According to Grandview Research, the global lease management market was valued at USD 5.65 billion in 2024 and is expected to reach USD 8.13 billion by 2030, growing at a CAGR of 6.4%. This growth is being shaped by stricter accounting standards, such as IFRS 16 and ASC 842, as well as rapid urbanization and digital adoption in real estate.

Source: Grandview Research

In this landscape, AI rental platforms are emerging as practical tools to simplify lease administration and reduce operational friction.

AI rental platforms are gaining traction as they automate time-intensive workflows, including lease tracking, tenant screening, renewals, and maintenance coordination.

By using data-driven insights and predictive models, these systems help operators manage risk, anticipate maintenance needs, and maintain portfolio performance without relying on large on-site teams. This shift is especially valuable as property managers handle higher unit counts with tighter margins.

Platforms such as EliseAI and SmartRent reflect how AI is being embedded directly into rental operations. EliseAI automates resident and prospect communication across multiple channels through a centralized CRM, helping operators improve leasing speed and renewal outcomes.

SmartRent takes a complementary approach, combining AI with IoT data to deliver real-time property insights, energy optimization, and predictive maintenance, enabling owners to reduce costs while improving asset efficiency.

What is the Mynd Platform?

Mynd is a tech-enabled property management platform built specifically for single-family rental investors. It combines full-service operations with a centralized digital experience, allowing landlords to manage leasing, maintenance, and finances across more than 40 U.S. markets from one place. The platform is designed for growth-focused investors who want to scale without operational complexity.

Key Features of the Mynd Platform

The Mynd platform brings everything into one place, so portfolio performance, rent flow, and property health remain visible without jumping between tools. Leasing maintenance and financial workflows can be managed digitally, gradually reducing manual effort and operational delays.

1. Investor Dashboard

Provides a real-time snapshot of portfolio performance, including cash flow, occupancy rates, and property-level metrics. Investors can customize reports to track what matters most across their holdings. This centralized visibility helps owners quickly assess portfolio health without relying on multiple spreadsheets or tools.

2. Rent Guarantee Tracking

Offers clear visibility into guaranteed rent amounts, payment timelines, and future projections. This removes the need for manual follow-ups and ensures predictable income monitoring. Investors gain confidence in cash flow stability even during tenant turnover or vacancy periods.

3. Digital Leasing Marketplace

Enables access to pre-qualified tenant applications with built-in credit and background checks. Lease approvals can be completed fully online, significantly reducing leasing turnaround time. This streamlined process minimizes vacancies while maintaining high screening standards.

4. Maintenance Management Portal

Centralizes repair requests by allowing owners to review vendor bids, approve costs, and track progress through photos and status updates, all from a single interface. It improves response times while giving owners full transparency into maintenance spend and outcomes.

5. Financial Reporting Hub

Allows on-demand generation of income statements, expense reports, and tax documents such as 1099s, simplifying accounting and year-end financial preparation. Financial data stays organized and audit-ready without additional manual reconciliation.

6. Tenant Screening Interface

Automates verification of income, rental history, eviction records, and references, ensuring only qualified tenants move forward before lease execution. This reduces leasing risk and improves long-term tenant quality across the portfolio.

7. Performance Analytics & Insights

Uses interactive charts and alerts to highlight rent trends, occupancy patterns, and ROI forecasts, helping investors make data-driven decisions across markets and properties. These insights support proactive strategy adjustments rather than reactive management decisions.

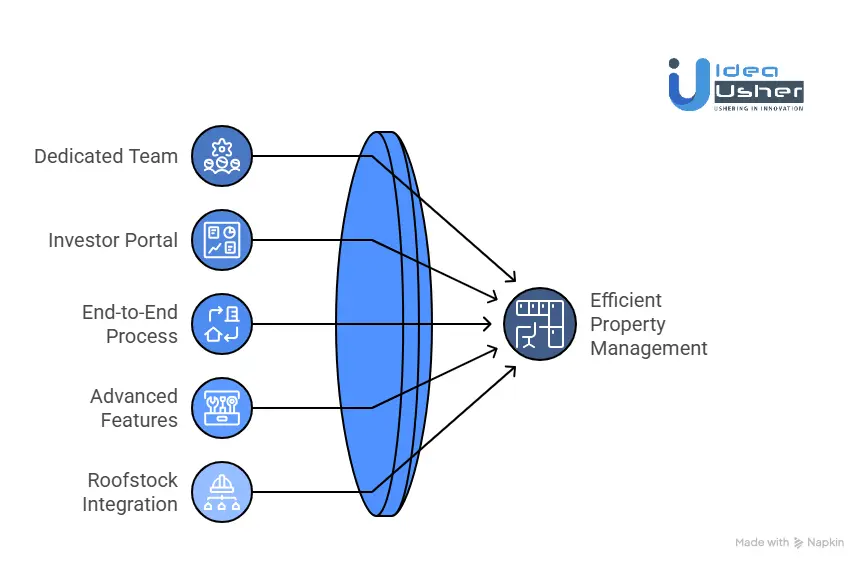

How Does the Mynd Platform Work?

The Mynd platform manages the full rental lifecycle through a centralized system. It can automate leasing, maintenance coordination, and rent tracking while local teams handle on-site execution. Performance can usually be reviewed in real time without involvement in daily operational tasks.

Dedicated Team and Local Experts

Each investor is assigned a dedicated property manager who acts as the primary point of contact. This manager is supported by a centralized operations team and a network of local experts. The operating model combines a central technology hub with on-the-ground professionals who handle inspections, vendor coordination, repairs, and market-specific tasks.

This structure allows Mynd to maintain consistent standards across markets while still responding effectively to local conditions.

The Investor Portal as the Command Center

Transparency is delivered through Mynd’s proprietary investor portal. The platform provides real-time visibility into daily operations, financial performance, leasing status, and portfolio-level metrics. Investors can monitor activity, review documents, and track outcomes from anywhere without being involved in day-to-day execution.

The portal is designed to keep investors informed without requiring operational involvement.

End-to-End Process Management

Mynd manages the complete rental lifecycle from tenant placement to ongoing operations.

Leasing

Homes are marketed using data-driven pricing and proven demand signals to reduce vacancy time while maintaining resident quality. The platform reports a delinquency rate below 2 percent by combining screening automation with local market expertise.

Maintenance and Support

Repairs are managed through a vetted vendor network, supported by in-house specialists and 24/7 emergency coverage. Scale enables service consistency and access to volume-based pricing, which helps control long-term maintenance costs.

Resident Relations

All tenant communication is handled by Mynd. Investors remain informed through updates and reports while being removed from direct day-to-day interactions.

Advanced Features for Growth Focused Investors

The platform is designed not only to manage properties but also to improve performance over time.

Performance Optimization

Between tenancies, Mynd applies its expert turn process to minimize vacancy days and prepare homes quickly for re-leasing. Market data and operational scale support competitive rent levels and strong renewal rates.

Risk Mitigation

An optional Eviction Protection Plan is available to help reduce the financial and administrative burden associated with eviction processes. This adds an extra layer of downside protection for investors.

Institutional Grade Services

For portfolios with more than 100 homes, Mynd provides expanded asset management services. These include advanced reporting, portfolio-level strategy, and performance analytics to improve Net Operating Income.

Integration and Ecosystem as a Roofstock Company

Understanding how Mynd works also means understanding its ecosystem. As a Roofstock company, Mynd benefits from integration with a broader single-family rental investment stack.

This relationship enables access to deeper market insights, transaction-level data, and integrated financial tools. Investors also benefit from Stessa’s connectivity, a widely used platform for tracking rental property financials and performance.

Who the Mynd Platform Is For

| Investor Profile | How Mynd Serves Them |

| Remote or Passive Investor | Provides a complete operational backbone that allows ownership across markets without local involvement |

| Growing Portfolio Owner | Offers scalable systems and centralized reporting to manage multiple properties efficiently |

| Institutional Investor | Delivers customized asset management, advanced analytics, and operational efficiency at portfolio scale |

What is the Business Model of the Mynd Platform?

Mynd.co operates as a tech-enabled property management platform focused on single-family rentals. It simplifies investor operations through digital tools for leasing, maintenance, and financial tracking.

The platform emphasizes guaranteed rent payments, rapid tenant placement (often within 30 days), and 24/7 support. Its model is designed for busy landlords, handling the full property lifecycle from tenant onboarding through ongoing operations.

- Monthly management fees: 8 to 12 percent of collected rent, providing steady recurring income. This is the core revenue stream, accounting for roughly 80 percent of total revenue.

- Leasing fees: 8 to 12 percent of the first month’s rent when securing tenants. This typically ranges from $1,500 to $2,500 per placement, depending on market rents.

- Lease renewal fees: Charged when tenants extend leases. With industry renewal rates of 60-70 percent, this creates predictable ancillary revenue.

- Other services: Renovation coordination (5-7% of project costs), utility management, insurance partnerships, and premium reporting subscriptions.

Financial Performance

Mynd’s model scales through proprietary software that automates leasing workflows and maintenance dispatching. While standalone 2024 to 2025 financials are private following the merger, the related entity Mynd.ai, which encompasses broader property technology operations, reported $267.4M in revenue for FY2024.

This was down from $411.8M the prior year due to broader market shifts. In the first half of 2024, gross margins reached 27.3 percent, up 100 basis points, and EBITDA losses improved by $0.6M.

Funding History

- Total raised: $210M across 8 funding rounds, with a peak valuation of $807M in September 2021.

- Key round: $30M Series C raised in July 2023, used to expand the platform and support the Roofstock merger for end-to-end investor services.

- Strategic moves: The merger strengthens monetization through integrated financing and property sales, with a target of at least 50 percent growth in managed properties, which currently number in the thousands.

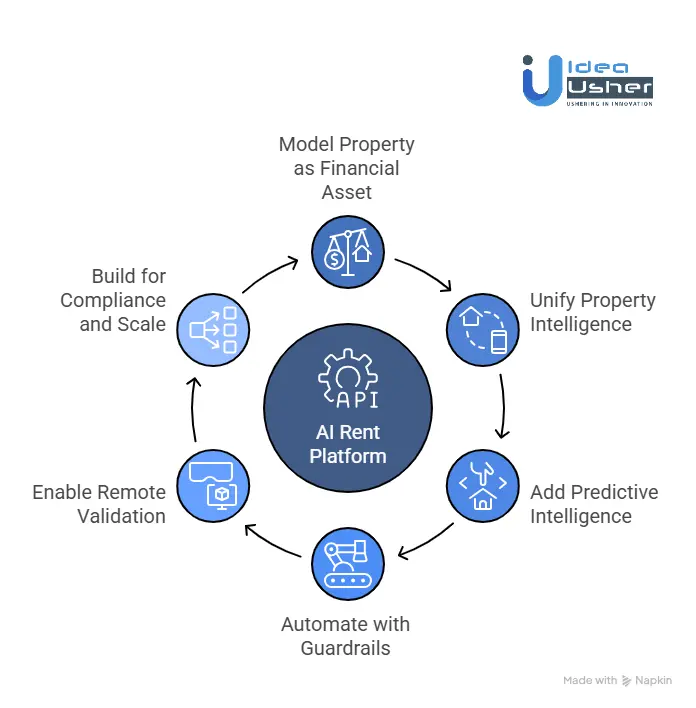

How to Develop an AI Rent Platform Like Mynd?

To develop an AI rent platform like Mynd, the process should begin by modeling each property as a financial asset so income, risk, and performance remain clearly defined. Leasing, accounting, and maintenance data can then be unified so the platform may operate with full context and respond reliably.

We have built multiple AI rent platforms similar to Mynd, and this is the process we typically follow.

1. Model the Asset Financially

We start by treating each property as a live financial asset rather than a simple listing. Our team designs data models where income, expenses, vacancy exposure, reserves, and capital events are core attributes. This approach allows the platform to support portfolio analysis and forecasting as it scales.

2. Unify Property Intelligence

Next, we connect the operational systems that generate day-to-day truth. Accounting, leasing, maintenance, and IoT data are integrated into a single intelligence layer. Real-time synchronization keeps rent rolls, ledgers, and work orders aligned across the platform.

3. Add Predictive Intelligence

With unified data in place, we move from reporting to prediction. We implement rent forecasting models that learn from seasonality, market demand, and renewal behavior. Maintenance risk engines surface cost and failure risks early for better planning.

4. Automate with Guardrails

Once intelligence is reliable, we translate it into action through agentic workflows. Vendor dispatch, approvals, and follow-ups are automated where possible. Owner-defined boundaries ensure sensitive actions still remain under human control.

5. Enable Remote Validation

To reduce physical friction, we build remote inspection and validation into the platform. Computer vision models analyze inspection photos and videos to identify issues. Turnover costs are estimated automatically using historical repairs and condition signals.

6. Build for Compliance and Scale

From the start, we embed compliance directly into system logic. Rule-based engines adapt workflows to state-specific leasing laws and regulations. This foundation allows clients to scale into new markets without reworking core systems.

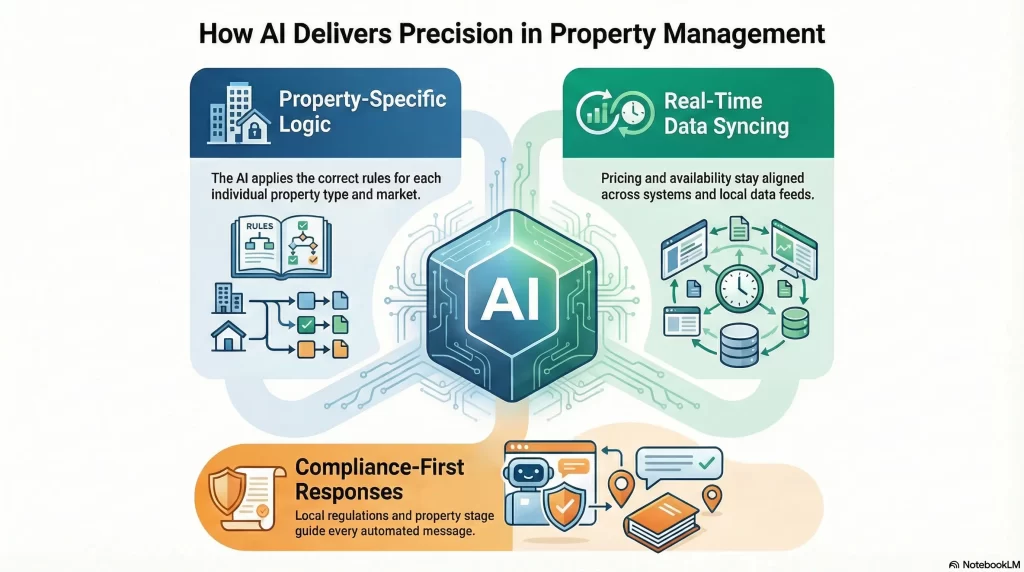

How AI Rent Platforms Maintain Accuracy Across Property Types & Markets?

In the fragmented real estate market, maintaining accuracy at scale is difficult. Suburban garden apartments, downtown luxury high rises, student housing, and senior living communities all operate under different pricing logic, lease structures, regulations, and demand cycles.

A single generalized AI model fails quickly in these conditions. Advanced AI rental platforms solve this by operating as multidimensional intelligence systems rather than one-size-fits-all solutions.

1. Property Type Specific Knowledge Bases

Instead of relying on one generic model, sophisticated platforms use modular intelligence layers designed for each property category.

| Property Type | Specialized AI Knowledge |

| Multifamily Conventional | Care level pricing, community fee structures, age verification, service package add-ons |

| Affordable and Section 8 Housing | Income certification workflows, voucher calculations, LIHTC compliance, waiting list logic |

| Student Housing | Standard lease terms, renters insurance requirements, utility billing logic, parking add-ons |

| Senior Living | Yard maintenance responsibility rules, utility transfer logic, and HOA communication |

| Single Family Rentals | Yard maintenance responsibility rules, utility transfer logic, HOA communication |

| Build to Rent | Community amenity packages, HOA equivalent rules, longer term lease incentives |

Implementation: The AI dynamically loads the correct rule set based on property classification. This ensures every conversation follows the correct terminology, pricing logic, and compliance expectations.

2. Hyperlocal Market Intelligence Integration

AI rent platforms maintain accuracy by continuously ingesting live market data rather than relying on static assumptions.

Connected Data Sources

- Rent comp and market analytics APIs

- Local regulatory databases covering rent control and eviction rules

- Neighborhood data feeds such as schools, transit, and walkability

- Seasonal demand models tied to academic cycles or tourism patterns

Example Application: In a rent-controlled market such as Los Angeles, the AI automatically applies allowable annual increase limits, just cause eviction requirements, and required disclosure logic. Lease offers, renewals, and responses adjust automatically without manual intervention.

3. Dynamic Pricing and Availability Synchronization

Accuracy is maintained through constant reconciliation across systems.

The Synchronization Engine

- Primary source of truth through direct property management system integration

- Secondary verification through listing service synchronization

- Tertiary cross-checking using internal pricing and revenue tools

- Real-time reconciliation that triggers alerts when discrepancies appear

Conflict Resolution Protocol

When pricing data conflicts across systems, the AI defaults to the highest verified amount to prevent under-quoting. The discrepancy is flagged for staff review within minutes. The prospect is informed transparently, with language that confirms current availability and the best pricing for the requested move-in date.

4. Regulatory Compliance Guardrails by Jurisdiction

Legal accuracy is built directly into platform logic.

How It Works

- Every property address is tagged with jurisdiction metadata

- The AI loads city, county, and state-specific regulatory rules

- Logic is applied for security deposit caps, late fee rules, disclosure requirements, and application fee restrictions

- Lease documents and notices are generated automatically to match local law

Safety Feature: The AI avoids answering subjective or legally risky questions and instead provides neutral data sources when appropriate.

5. Contextual Understanding of Property Lifecycle Stages

Accuracy also depends on understanding where a property sits in its operational lifecycle.

AI Adjustments by Property Phase

- Pre-leasing focuses on estimated availability, construction updates, and early incentives

- Lease up emphasizes immediate move-ins, opening promotions, and phased occupancy

- Stabilized assets highlight limited availability, renewals, and waitlist management

- Renovation phases adjust messaging around temporary closures, unit scatter, and pricing premiums

The AI automatically adapts communication tone, availability statements, and incentive logic based on the property’s current phase.

What Is the Minimum Scale Required for an AI Rent Platform to Be Profitable?

The rapid digitization of real estate has given rise to AI-powered rental platforms that promise to transform property management. These platforms combine machine learning, predictive analytics, and automated workflows to streamline operations, but profitability depends on overcoming significant upfront technology investments and customer-acquisition challenges.

Studying how successful platforms reached scale offers clear insight into the unit economics and growth strategies behind sustainable models in this space.

Core Components and Costs of AI Rent Platforms

Technology and Development

Building an AI rent platform requires substantial initial investment in the following areas:

- Predictive pricing engines that analyze local market data

- Automated tenant screening systems with risk assessment logic

- Maintenance prediction models that anticipate repair needs

- Communication automation for tenant interactions

- Integration frameworks connecting payments, listings, and compliance systems

Take Mynd as an example. The company developed proprietary algorithms across a portfolio of more than 20,000 properties. Their initial technology investment likely exceeded 500,000 dollars, but at the current scale, this equates to roughly 25 dollars per property, a cost structure that only becomes viable at meaningful volume.

Customer Acquisition Economics

AI rent platforms must clearly prove value to overcome adoption friction.

- Customer acquisition costs typically range from 800 to 1,200 dollars per property manager

- Onboarding and integration costs average 200 to 400 dollars per property

- Education is required to overcome owner skepticism toward automated management

Consider how Zumper approached this challenge. The platform began as a rental listings marketplace, then gradually introduced AI-driven tools for landlords. By cross-selling into an existing audience, Zumper reduced its effective acquisition cost compared to direct outreach models.

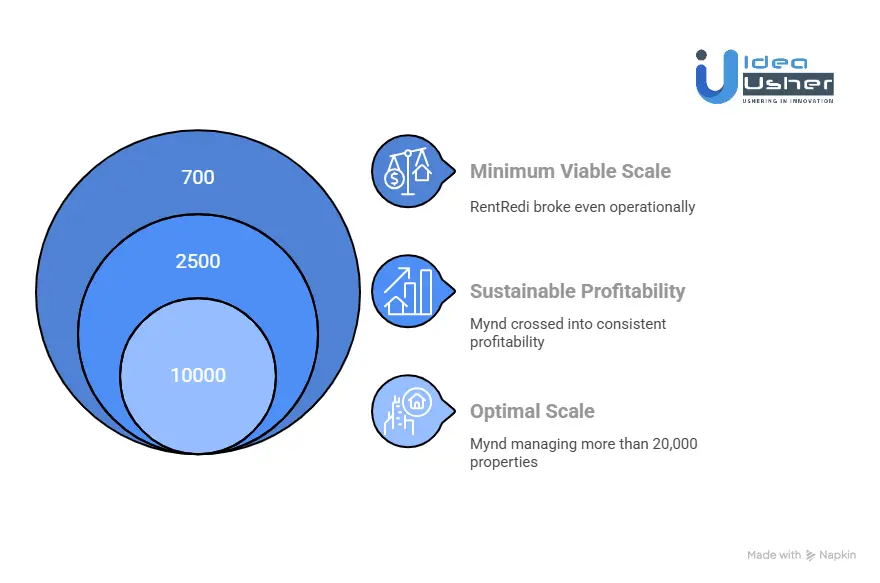

Critical Scale Benchmarks Based on Market Evidence

Minimum Viable Scale: 500 to 800 Properties

At this level, platforms typically achieve basic operational sustainability. When RentRedi reached approximately 700 properties under management, it reportedly broke even operationally.

Key characteristics at this stage include:

- Focus on niche landlord segments

- Limited geographic footprint across two to three states

- Feature prioritization around core automation

Estimated monthly revenue at this scale ranges from 35,000 to 56,000 dollars.

Sustainable Profitability: 2,000 to 3,000 Properties

This range often marks the point where unit economics become consistently favorable. Platforms operating at this level achieve:

- Monthly revenue between 150,000 and 300,000 dollars or more

- Staff efficiency of roughly one team member per 350 properties

- Sufficient data volume to train pricing and risk models effectively

- Initial leverage with vendors resulting in 10 to 15 percent cost reductions

Mynd crossed into consistent profitability near the 2,500 property mark, supported by improved automation and data density.

Optimal Scale: 10,000 or More Properties

At this level, platforms gain durable competitive advantages.

For Mynd, managing more than 20,000 properties across 40 markets has resulted in:

- Estimated monthly revenue exceeding 1 to 2 million dollars

- Customer acquisition costs reduced by roughly 35 percent through referrals

- Pricing model accuracy improved by more than 20 percent due to data scale

- Vendor negotiations are yielding 20 to 30 percent service discounts

Key Factors Influencing Scale Requirements

Technology Leverage and Automation

Platforms with deeper automation can reach profitability at a smaller scale because manual effort drops sharply. Automated screening, AI-driven maintenance routing, and self-service portals reduce staffing and support costs, allowing revenue to outpace expenses earlier.

Market Selection and Specialization

Focusing on a limited geography simplifies operations and speeds learning. Specializing in a single property type or owner segment also sharpens the value proposition and improves unit economics at a lower scale.

Zumper initially focused on high-density coastal markets such as San Francisco, New York, and Boston. This approach allowed them to:

- Build local density faster

- Train market-specific algorithms with less data

- Create network effects within concentrated regions

As a result, Zumper reached break-even with roughly 1,200 properties concentrated across five markets. In contrast, Mynd pursued a national strategy early on, requiring more total properties to achieve comparable efficiency, while diversifying against regional downturns.

Funding Strategy

Bootstrapped platforms typically need to reach profitability sooner, often around 1,000 properties. Venture-backed platforms can operate longer without profits and prioritize expansion, while hybrid models balance disciplined growth with selective scaling

The Network Effect and Scale Advantages

Data Network Effects in Practice

As AI rental platforms grow, their data advantage compounds.

For example, Mynd’s eviction prediction capability evolved as follows:

- At 500 properties, risk models relied mainly on credit and background data

- At 2,000 properties, rental payment behavior patterns were added

- At 10,000 or more properties, models incorporated maintenance history, neighborhood trends, and seasonality

At scale, this resulted in a reported 28 percent reduction in eviction rates compared with traditional screening.

Zumper’s pricing recommendations followed a similar progression, evolving from public listing data to real-time application behavior and landlord response signals unique to its platform.

Operational Efficiency at Scale

For example, Mynd’s maintenance coordination demonstrates how scale improves operations:

- At 500 properties, vendor matching was manual

- At 2,000 properties, basic routing algorithms were introduced

- At 20,000 or more properties, AI systems optimized vendor selection using performance history, capacity, geography, and timing

This progression reduced average repair completion times by 42 percent and lowered costs by 18 percent compared to early-stage operations.

Path to Profitability: Strategic Lessons

Phased Market Expansion

Zumper’s expansion followed a disciplined sequence:

- Years 1 to 2 focused on three coastal markets with roughly 800 properties

- Year 3 added seven similar markets, reaching 2,500 properties

- Years 4 to 5 expanded to more than 50 markets and over 15,000 properties

This approach enabled profitability before large-scale expansion and reduced execution risk.

Feature Development Prioritization

RentRedi’s roadmap illustrates a revenue-aligned development strategy.

| Stage | Properties | Features Introduced | Revenue |

| Launch | 0 to 200 | Listings, applications, payments | 10 to 20 dollars per property |

| Growth | 200 to 1,000 | Screening automation, maintenance portal | 15 to 25 dollars per property |

| Scale | 1,000 plus | AI pricing, predictive alerts | 20 to 30 dollars per property |

This enabled development to be funded through revenue rather than relying solely on external capital.

Challenges in Reaching Minimum Scale

The Data Conundrum

All platforms faced the challenge of needing data to improve algorithms while needing better algorithms to attract customers.

- Mynd partnered with Roofstock to access early property data

- Zumper leveraged its listing marketplace

- RentRedi relied on manual processes initially while collecting usage data

High Initial Customer Acquisition Costs

Customer acquisition is expensive because property owners need education before adoption. Trust takes time, as owners are cautious about entrusting valuable assets to technology, especially when incumbents already have long-standing relationships.

Regulatory Complexity

Scaling is further slowed by varying landlord-tenant laws across regions. Data privacy rules and licensing requirements add another layer of complexity, requiring careful compliance before expanding into new markets.

Conclusion

AI rent platforms like Mynd are steadily reshaping how real estate operations can run at scale. They bring intelligence, automation, and financial clarity into a single system that adapts as portfolios grow. When a business builds such a platform, it can gradually reduce friction across leasing and management workflows. Over time, this approach may deliver stronger margins, better control, and a more defensible position in a competitive market.

Looking to Create an AI Rent Platform like Mynd?

IdeaUsher can help you design and build an AI rent platform like Mynd by aligning AI models, data flows, and automation with real leasing operations. We can gradually architect systems that accurately handle renter interactions, pricing decisions, and financial updates.

Why Build With Us?

- Ex-MAANG/FAANG Led Architecture: Systems designed to scale across 50 states from day one

- Full-Stack Lifecycle Builds: From predictive AI models to compliant vendor ecosystems

- Real-Time Financial OS: Unified dashboards where maintenance events update investor ROI instantly

Your vision isn’t another rental website. It’s the autonomous future of real estate investment.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: You typically start by identifying where leasing teams lose time and money, as this shapes the system design. From there, you can define a clean data model that connects listings leads, tenants, and conversations in one place. With careful testing and gradual rollout, the platform can steadily replace manual steps while still keeping humans in control.

A2: An AI rent platform listens to every renter interaction and keeps context across messages, calls, and follow-ups. It can automatically answer availability questions, schedule tours, and update records in real time. This enables the system to respond quickly and consistently, even during surges in demand.

A3: The cost can vary widely based on scale, integrations, and level of automation. A focused MVP may cost less if it targets one workflow and limited channels. You should plan for ongoing costs, as model infrastructure and compliance must be maintained continuously.

A4: Core features usually include automated renter conversations, smart lead qualification, and tour scheduling. The platform can also handle maintenance requests, renewals, and payment-related queries. Over time, predictive insights can guide pricing, staffing, and leasing strategies with greater confidence.