DeFi platforms once treated scalability as a competitive advantage, and now it is simply expected. Users may tolerate new ideas, but they rarely tolerate slow confirmations or high gas. When a transaction fails, or costs rise, trust quietly erodes. Technical debt, therefore, shows up immediately in retention and volume. Builders have gradually shifted toward ecosystems designed for sustained throughput.

Base can reliably combine Ethereum security with low-latency execution. It can also offer predictable fees, strong EVM compatibility, deep access to Ethereum liquidity, and production-ready composability. That is why many companies are choosing Base blockchain specifically for developing DeFi platforms, as it supports scalable liquidity, fast settlements, and seamless integrations.

We have built a wide range of DeFi platforms on the Base blockchain that use technologies such as account abstraction infrastructure and liquidity routing engines. As we have this expertise, we’re writing this blog to discuss the steps to develop a Defi platform on Base.

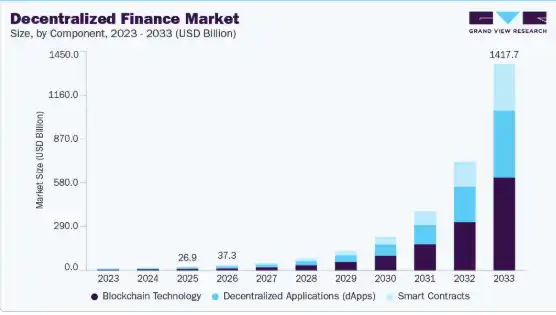

Key Market Takeaways for DeFi Platforms

According to GrandViewResearch, the DeFi market has moved from experimentation to acceleration. Valued at around USD 26.9 billion in 2025, it is on a trajectory that reshapes expectations for global finance, with projections stretching into the trillions by the early 2030s. What matters more than the numbers is the pace. Growth rates well above those of traditional fintechs signal that decentralized finance is no longer a niche layer but a rapidly scaling financial alternative.

Source: GrandViewResearch

This momentum is being driven by clear structural shifts. Cross-chain interoperability is reducing fragmentation, Layer-2 networks like Base and Arbitrum are lowering costs, and AI-assisted protocols are improving risk management and capital efficiency.

At the same time, real-world asset tokenization is pulling institutional capital on-chain. These forces have pushed total value locked past USD 120 billion in 2025, with daily trading volumes on major platforms regularly reaching multi-billion-dollar levels.

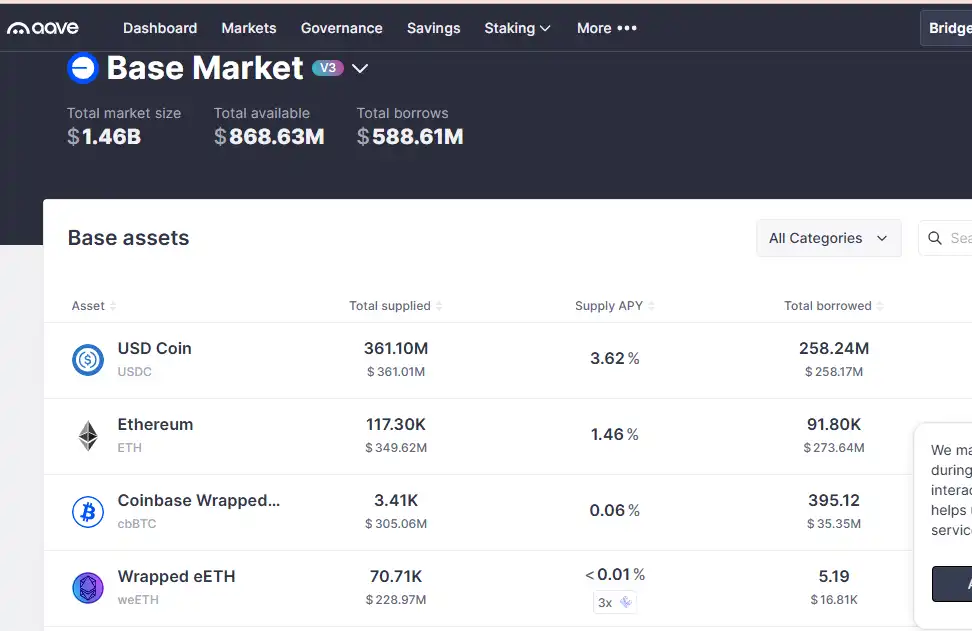

Within this ecosystem, a few platforms have become foundational. Uniswap continues to define decentralized trading through deep liquidity and automated market makers operating across multiple chains. Aave has positioned itself as a core lending infrastructure, combining multi-chain liquidity, advanced risk controls, and flash loans.

What Is a DeFi Platform?

A DeFi platform is a blockchain-based financial system that enables users to access services such as trading, lending, borrowing, and yield generation without relying on banks or intermediaries. It operates through smart contracts that execute transactions transparently and automatically on public blockchains. This approach gives users direct control over assets while enabling faster settlement and open financial access at a global scale.

Why Base Is the Right Blockchain for Building DeFi Platforms?

Base is right for DeFi because it provides Ethereum-level security while enabling fast, affordable transactions. Teams can ship quickly using familiar EVM tools and still reach real users through Coinbase-aligned onboarding. With stablecoin support and low fees, DeFi apps can finally scale without breaking their economics.

The Scalability Equation: Base vs Ethereum Mainnet

On the Ethereum mainnet, a simple DeFi transaction can cost 10 to 50 dollars during peak demand. For a user depositing 1,000 dollars, losing 2 to 5 percent upfront to gas makes most strategies unviable.

Take Aerodrome Finance, Base’s leading decentralized exchange and liquidity hub. Swapping 500 USDC for ETH on Aerodrome typically costs around 0.01 USDC. The same action on Uniswap mainnet can cost more than 15 dollars. This cost difference unlocks micro transactions, frequent rebalancing, and advanced strategies that simply do not work on mainnet.

Throughput: Handling the Next Million Users

Ethereum processes roughly 15 transactions per second. Base already supports more than 2,000 transactions per second with clear headroom to scale further.

This capacity is proven in production. Friend.tech, a social finance app built on Base, processed over 4 million transactions in its first week without network congestion. For DeFi platforms planning viral adoption, Base provides the runway Ethereum mainnet cannot.

Key metric: Base has settled over 300 billion dollars in on-chain value since launch, showing true production scale.

The Compliance and Trust Advantage

Base is incubated by Coinbase, a publicly traded company with:

- Over 100 million verified users

- More than 130 billion dollars in assets on the platform

- Regulatory licenses across 40-plus jurisdictions

For DeFi platforms, this translates into real advantages.

- Built-in distribution: Coinbase users can access Base apps with fewer steps, reducing wallet friction

- Regulatory clarity: Coinbase’s compliance frameworks provide a clearer path for RWAs, tokenized securities, and compliant DeFi products.

- Enterprise trust: Institutions gain confidence, building on infrastructure backed by a NASDAQ-listed company.

When BlackRock launched its tokenized BUIDL fund, it chose Ethereum and Base in partnership with Securitize. This choice reflected the need for institutional-grade security, predictable operations, and infrastructure aligned with compliance. Base delivers these requirements better than any other Layer 2 today.

EVM Compatibility and Faster Go To Market

The No Rewrite Advantage

The base is fully EVM-equivalent, with byte-for-byte identical execution. In practice, this means:

- Zero code changes when deploying Ethereum contracts

- Full compatibility with Hardhat, Foundry, Remix, and Ethers.js

- Immediate access to the global Ethereum developer talent pool

- Reuse of audited patterns and security models

Time-to-market impact: Teams can move from concept to production in weeks rather than months, without learning new languages or virtual machines.

The Superchain Effect

Base runs on the OP Stack and participates in the Optimism Superchain. This allows the same DeFi protocol to deploy across multiple aligned networks while sharing liquidity and security assumptions. It future-proofs protocol expansion without fragmenting development.

The Unit Economics of Mass Adoption

Consumer DeFi depends on sub-cent fees. Base enables business models that are impossible on the mainnet.

| Application Type | Ethereum Mainnet Viability | Base Viability |

| Daily DCA (Dollar Cost Averaging) | Not viable (30 dollar gas on 10 dollar purchase) | Highly viable (0.001 gas) |

| Payroll Streaming | Prohibitively expensive | Native use case |

| GameFi Micro Transactions | Impossible | Core competency |

| SocialFi and Tipping | Niche only | Mass market ready |

ParaSwap illustrates this shift well. On Base, users can swap even small amounts, like $ 5, without gas eroding value. This enables behaviors like daily micro DCA, real-time payroll streaming with Sablier, and social tipping that mainnet economics cannot support.

Architectural Superiority

Base’s Bedrock upgrade introduced tangible benefits for DeFi platforms:

- 1.5x lower L1 data posting fees

- 2x faster deposits from Ethereum

- A modular proof system prepared for future zero-knowledge upgrades

Each improvement directly lowers costs and improves capital efficiency.

Security Without Compromise

Base inherits Ethereum security directly by settling transaction batches on the Ethereum mainnet. This provides billions of dollars in economic security from Ethereum validators with no new trust assumptions and full fraud-proof guarantees.

For DeFi protocols managing user funds, this security model is essential. Base delivers application-level speed and cost efficiency while preserving Ethereum-grade trust.

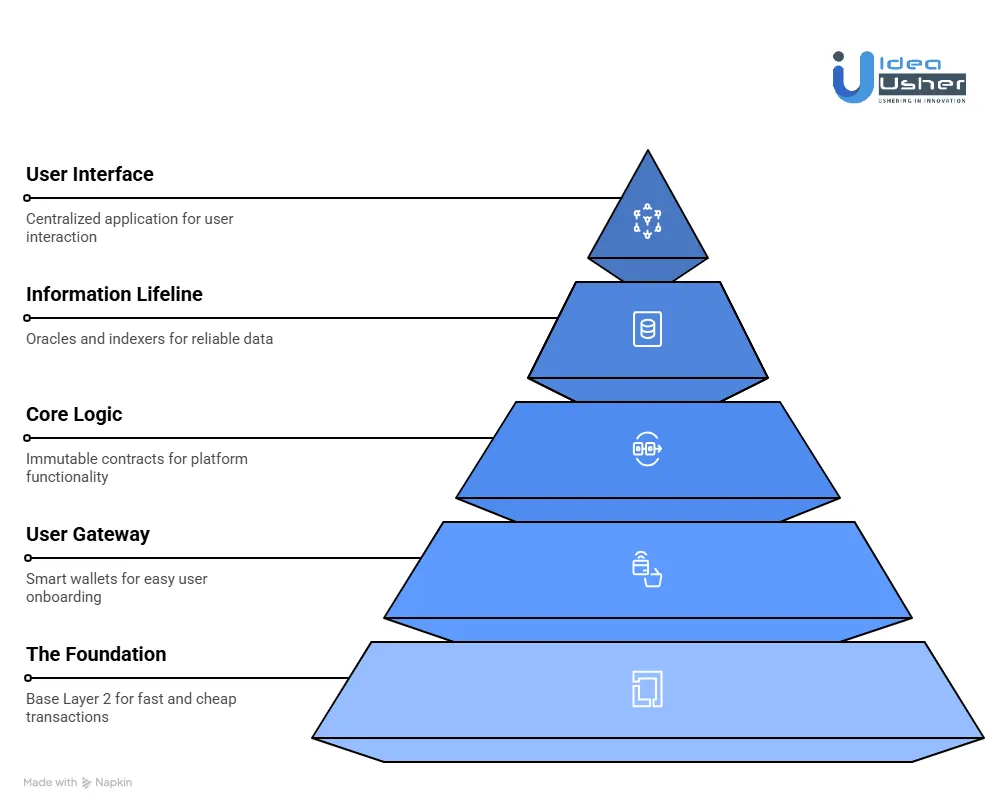

How Does a DeFi Platform Built on Base Work?

A DeFi platform on Base executes transactions quickly and cost-effectively on a Layer 2 while anchoring security to Ethereum. Users can easily onboard via smart wallets and interact without worrying about gas or complex keys. With oracles and indexed data feeding the system, the platform can reliably deliver fast and secure on-chain finance at scale.

1. The Foundation

Base is an Optimistic Rollup Layer 2. It processes transactions cheaply and quickly off-chain on Base, then posts compressed proofs of those transactions in batches to the Ethereum Mainnet for security and finality.

- Execution: A user’s swap, loan, or trade executes instantly on Base with gas fees often measured in fractions of a cent.

- Settlement: Transaction data is anchored to Ethereum, inheriting its security. To attack your DeFi platform, an adversary would need to attack Ethereum itself.

The Superchain advantage

Because Base shares the OP Stack and sequencing infrastructure with networks like OP Mainnet and Zora, liquidity and messages can move across chains smoothly. Your platform can access users and assets across the Superchain without custom bridges.

2. The User Gateway

Smart Wallets powered by ERC-4337 turn user accounts into programmable smart contracts instead of static key pairs. This is enabled through Coinbase Wallet as a Service and tools like OnchainKit.

- Onboarding: A user signs up using their email or Face ID. A non-custodial smart contract wallet is created in seconds.

- Transaction flow: When the user takes an action, they sign a UserOperation, which represents intent. Bundlers package this request and submit it to the wallet contract for execution.

The role of Paymasters: Your platform can deploy a Paymaster contract that covers gas fees for users. This enables gasless actions and allows you to sponsor onboarding or specific transactions as part of your growth strategy.

3. The Core Logic

This is the immutable rulebook of your platform deployed on the Base blockchain. It is an orchestrated system, not a single contract.

- Core protocol contracts: These define the primary functionality, such as AMMs for swaps or lending pools for borrowing. They custody funds and enforce protocol logic.

- Management and governance contracts: These control upgrades, risk parameters, interest rate models, and token-based voting. Low Base fees make governance more frequent and accessible.

- Security modules: Timelocks, multisignature treasuries, and emergency pause functions add institutional-grade safeguards.

4. The Information Lifeline

Blockchains operate in sealed environments. DeFi protocols require reliable external data to function.

Oracles

Lending and derivatives protocols depend on accurate prices. Networks like Chainlink and Pyth aggregate market data from multiple sources and deliver it to Base contracts with sub-second latency.

Data indexing

Raw blockchain data is difficult to query directly. Indexers like The Graph or Goldsky structure contract events and expose them via fast APIs. This powers dashboards showing balances, APYs, volumes, and historical activity.

5. The User Interface & Experience Layer

This is the only centralized layer. It is your web or mobile application that connects users to immutable contracts.

How it works:

The frontend uses libraries like viem or ethers.js to communicate with Base through RPC providers such as Alchemy or QuickNode. When a user clicks Swap, the UI:

- Connects to the smart wallet using WalletConnect or OnchainKit

- Constructs the transaction call data for the protocol contract

- Requests a signature via passkey or biometric authentication

- Submits the UserOperation and displays near instant confirmation through Base Flashblocks

This layered architecture is what allows DeFi platforms on Base to feel fast, usable, and production-ready while still inheriting Ethereum-grade security.

Types of DeFi Platforms That You Can Build on Base

On Base, you can build DeFi platforms such as exchanges, lending systems, payment protocols, and yield engines that rely on frequent, low-cost transactions.

More advanced use cases, such as derivatives, streaming finance, and tokenized assets, can also run efficiently. Because fees stay low and execution is fast, these platforms can scale to real user volume without breaking economics.

1. Decentralized Exchanges

DEXs on Base can support high-frequency swaps and deep liquidity without gas costs, helping users trade efficiently at any size. Aerodrome Finance is a strong example as it acts as the primary liquidity hub on Base while keeping swap costs extremely low.

2. Lending & Borrowing Platforms

Lending protocols on Base can offer deposits, borrowing, and automated liquidations with fast execution and minimal overhead. Moonwell stands out as a Base native money market that delivers simple lending mechanics with scalable performance.

3. Stablecoin & Payment Protocols

Payment-focused DeFi platforms benefit from predictable value flows and cheap transfers on Base. Superfluid is a good example as it enables real-time streaming payments for subscriptions, rewards, and payroll use cases.

4. Yield Aggregators & Vaults

Yield platforms on Base can rebalance frequently without gas penalties, improving overall returns. Morpho Vaults demonstrate how vault-based yield strategies can operate efficiently and integrate smoothly within the Base ecosystem.

5. Derivatives & Perpetual Trading Platforms

Derivatives protocols need low latency and frequent position updates, which Base supports well. Synthetix is a notable example with its perpetuals infrastructure deployed on Base to serve active traders.

6. Payroll & Streaming Finance Platforms

Streaming finance becomes practical on Base because continuous payments cost almost nothing. Sablier is a clear example, enabling on-chain payroll, vesting, and subscription-style token streams.

7. GameFi & SocialFi Platforms

GameFi and SocialFi apps can support tipping, rewards, and micro transactions at scale. DEGEN is widely used for tipping and creator rewards in the Base and Farcaster ecosystems, while Townies shows how on-chain games can thrive on low-fee infrastructure.

8. RWA & Tokenization Platforms

RWA platforms on Base can tokenize real-world assets with strong security guarantees. Backed is a key example, issuing tokenized treasury instruments on Base and proving that regulated financial assets can run on the network.

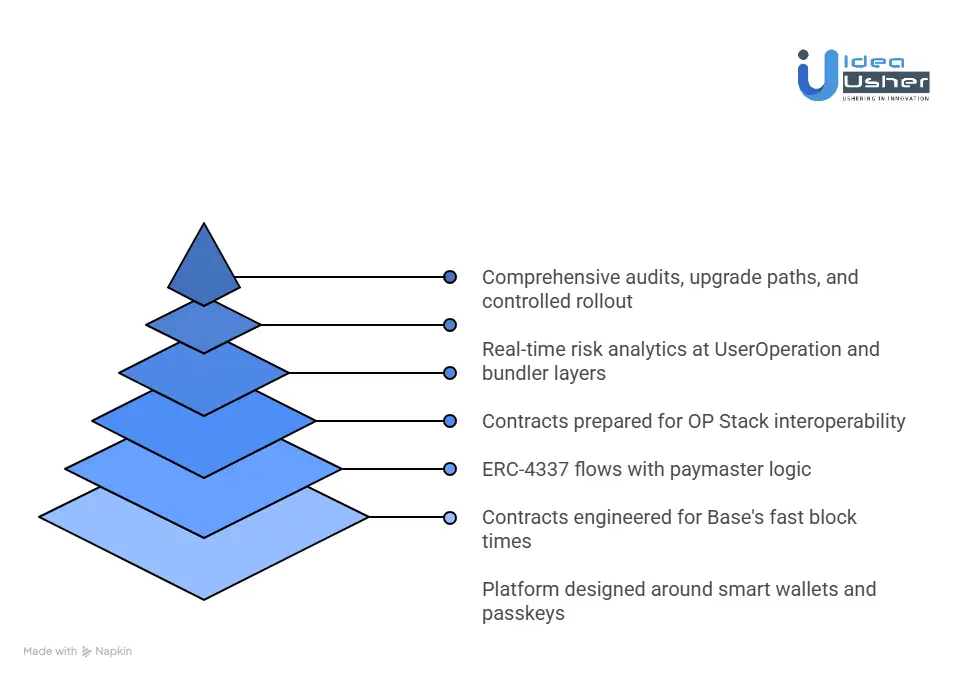

How to Build a DeFi Platform on Base?

A DeFi platform on Base is built by designing around smart wallets and account abstraction, so onboarding can happen quietly and securely. Smart contracts should be optimized for fast blocks and final settlement, while ERC 4337 paymaster logic can manage gas and risk carefully.

After developing several DeFi platforms on Base, this is the framework we consistently follow.

1. Smart Wallet–First Architecture

We design the platform around Base’s smart wallets and passkey onboarding rather than externally owned accounts. Wallet creation, recovery, and permissions are abstracted using account abstraction so users interact with DeFi features without friction. This keeps the experience intuitive while preserving non-custodial control.

2. Flashblock-Optimized Smart Contracts

Our contracts are engineered to take full advantage of Base’s fast block times. We minimize unnecessary storage writes, batch state transitions, and isolate execution-critical logic to ensure near-instant UX. Final settlement integrity and replay protection remain enforced at every step.

3. Account Abstraction and Paymasters

We implement ERC-4337 flows with paymaster logic aligned to business goals. Gas sponsorship rules are configured to support onboarding, control costs, and manage risk exposure. This allows users to transact seamlessly while maintaining predictable gas economics for the platform.

4. Superchain-Ready Liquidity

We prepare contracts and messaging layers for OP Stack interoperability from the beginning. Cross-chain communication is designed to handle asynchronous settlement and recovery safely. This ensures the platform can scale liquidity and functionality across the Superchain ecosystem.

5. Predictive Risk and Analytics

We integrate real-time risk analytics at the UserOperation and bundler layer. Transactions are evaluated using behavioral and state-based signals before execution. This enables dynamic risk control without slowing down the on-chain experience.

6. Security, Compliance, and Launch

We finalize the platform with comprehensive audits, clearly defined upgrade paths, and safety mechanisms. Compliance readiness includes documented execution flows and custody assumptions for enterprise users. The launch strategy focuses on controlled rollout, monitoring, and scalable onboarding.

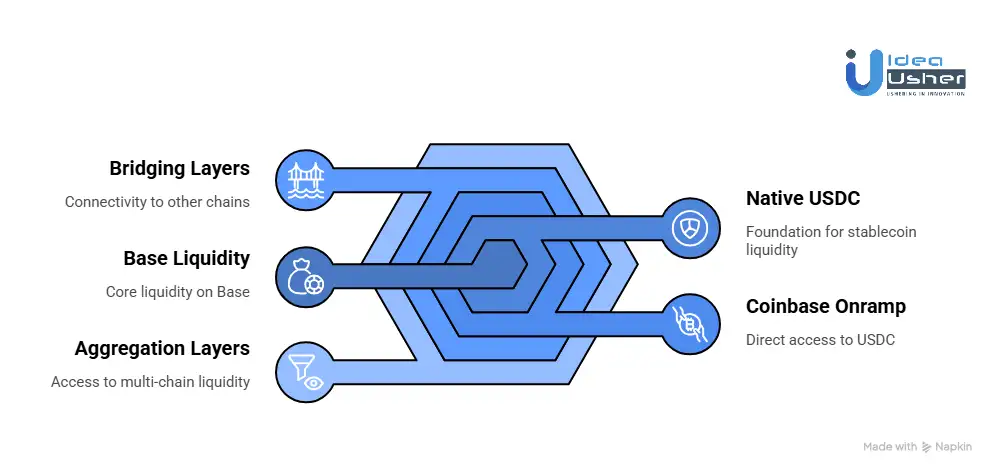

Is Liquidity on Base Isolated Compared to Other Layer 2 Networks?

Liquidity on Base is not isolated in practice. It can move efficiently through native USDC flows, Coinbase onramps, and fast bridging layers that connect Base to Ethereum and other L2s. For most DeFi platforms, liquidity will likely feel shared rather than siloed, as capital can enter and stay with minimal friction.

The Liquidity Silo Problem of Early L2s

First-generation Layer 2s genuinely suffered from isolation. Each chain had its own constraints.

- Native DEXs with separate liquidity pools

- Unique token bridges with long withdrawal delays on optimistic rollups

- Fragmented user bases and fragmented capital

This forced protocols to bootstrap liquidity from zero on each chain. The process was costly, inefficient, and slowed innovation across DeFi.

Base’s Fundamental Answer

Native USDC and the Coinbase Onramp

Base solves the bootstrapping problem at the foundation level through native, canonical USDC.

| Liquidity Type | Traditional L2 Challenge | Base’s Native Advantage |

| Stablecoin Liquidity | Must be bridged from Ethereum, creating wrapped versions | Native issuance by Circle. USDC on Base is canonical and identical to Ethereum USDC |

| Onramp Volume | Users bridge funds from CEXs through multiple hops | Direct deposits from Coinbase. Over 100M users can move USD to USDC on Base in under 2 minutes |

| Institutional Flow | Multi step and operationally complex | Circle and Coinbase enable direct institutional minting and redemption on Base |

Result: Base launched with billions in native, non-bridged USDC liquidity from day one. This is not fragile liquidity that exists during uncertainty. It is primary layer liquidity. For any DeFi platform, stablecoins are the core lifeblood, and Base provides them natively at scale.

Hyper Efficient Capital Movement

Isolation is not about the existence of bridges. It is about speed, cost, and security. Base leads across all three.

1. The Official Bridge

Security First and Cost Optimized

Base’s official bridge is a canonical and trust-minimized rollup bridge. While early optimistic rollups imposed a 7 day challenge period, the ecosystem has evolved.

- Liquidity networks like Hop, Across, and Stargate now provide instant withdrawals

- Base’s Bedrock architecture reduced L1 bridging costs by roughly 1.5x

Large capital movements are now faster and more cost-effective for both retail and institutional investors.

2. The Superchain

This is the real inflection point. Base is part of the Optimism Superchain, a network of OP Stack chains such as Base, OP Mainnet, Zora, and Mode that interoperate as a single system.

- Shared sequencer and messaging will allow near instant asset movement with unified security

- A unified developer stack allows liquidity deployed on Base to be accessed from OP Mainnet with minimal latency

The Aggregated Liquidity Layer

Modern DeFi platforms on Base do not rely solely on Base-native liquidity. They tap into Ethereum and the wider multi-chain ecosystem using aggregation layers.

The Technical Stack for Unified Liquidity

| Layer | Technology | Impact on Base DeFi Platforms |

| Intent-Based Systems | Socket, Li.Fi, Circle CCTP | Users can swap from any chain directly into Base assets |

| Cross Chain Yield | LayerZero, Axelar, CCIP | Lending protocols can source collateral from other chains |

| Liquidity Aggregation | 1inch, Matcha, CowSwap | Trades route across Base, Ethereum, and other L2s |

| Intent Based Systems | UniswapX, Anoma | Solvers fulfill user intent using global liquidity |

Practical Outcome: A user on Arbitrum holding ETH can provide liquidity to a Base native DEX in under 2 minutes using a single click aggregator. The complexity is abstracted away. Your platform’s effective liquidity becomes the sum of all connected chains.

Is Base’s Liquidity Actually Growing?

Moving from theory to on-chain reality using Q2 2024 metrics.

- TVL: Over 7.5B dollars, making Base the second largest L2 after Arbitrum

- DEX Volume: Consistently over 500M dollars daily, rivaling Ethereum on many days

- Bridge Activity: Billions bridged from Ethereum with consistent net inflows

- Unique Assets: Thousands of ERC 20 tokens, including LSTs and real-world assets

The trend is unambiguous. Capital is not merely passing through Base. It is staying, compounding, and forming complex financial positions. That behavior defines a mature and non-isolated DeFi ecosystem.

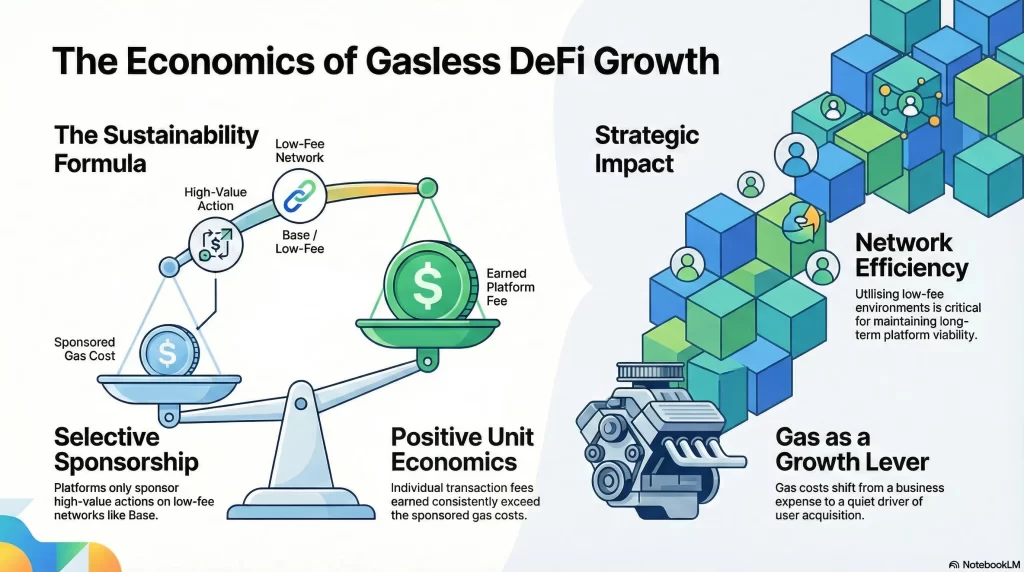

What Makes Gasless Transactions Sustainable for DeFi Platform Owners?

Gasless transactions remain sustainable because the platform decides when to sponsor gas rather than pay for everything. On low-fee networks like Base, this sponsorship may cost cents while the protocol still earns fees from meaningful user actions.

Over time, gas becomes a growth lever that quietly improves onboarding, retention, and volume without hurting unit economics.

The Paymaster

On Base, a Paymaster is a smart contract within the ERC 4337 account abstraction framework that determines when and how transaction gas fees are paid to users. Instead of every user holding ETH, the Paymaster can sponsor gas selectively based on rules such as transaction value, user status, or protocol activity.

This allows DeFi platforms on Base to control gas spending programmatically and turn gasless transactions into a scalable onboarding and growth mechanism rather than a fixed cost.

The Sustainable Sponsorship Framework

Successful platforms never sponsor all activity. They apply tiered and rules-based logic.

| Sponsorship Rule | Business Logic | Sustainability Impact |

| First Transaction Sponsorship | New users receive 1 to 5 gasless transactions | CAC drops to 0.02 to 0.10 dollars per user versus 10 to 50 dollars in traditional web3 marketing |

| Gas cost of 0.01 to 0.05 dollars is far below the fee revenue | Value-Based Sponsorship | Retention increases, and TVL becomes stickier |

| Gas is sponsored only for trades above 500 dollars or loans above 1,000 dollars | Active LPs or borrowers receive gasless privileges | Time-Based Sponsorship |

| Time Based Sponsorship | Gasless days or limited campaigns | Fixed marketing cost with clear conversion tracking |

A real example is Aerodrome Finance. veAERO holders receive priority gasless transactions across the protocol. This is not generosity. The gas cost is minimal compared to the value created by locked liquidity and long-term governance participation.

The Unit Economics

When 0.01 Dollar Gas Becomes a Superpower

Consider a simple onboarding scenario.

Scenario: A new user performs their first trade

- Gas cost sponsored: 0.03 dollars

- Platform fee earned: 0.05 percent on a 1,000 dollar trade equals 0.50 dollars

- Net gain: 0.47 dollars on the first transaction

Traditional web3 acquisition costs often range from $ 10 to $ 50 per user. On Base, gas sponsorship can be profit-positive on the first qualified action.

This model is impossible on the Ethereum mainnet, where sponsoring a single swap can cost over $ 15.

Sponsored Gas as a Service

Some platforms go further and monetize gas sponsorship directly.

- Token projects pay recurring fees to sponsor gas for their token pairs

- Institutional clients pay for guaranteed gasless execution

- Partner protocols subsidize gas for shared user flows

Gas shifts from an expense into a revenue-generating service while strengthening ecosystem ties.

How Gasless Drives Growth

Mature platforms on Base use gasless transactions to remove early friction and increase engagement. When users interact more easily, on-chain activity and volume naturally grow.

Higher volume generates more protocol fees, which are returned to the treasury. That treasury then funds further gas sponsorship, reinforcing adoption and strengthening the flywheel.

Real World Implementation: Aave on Base

Aave applies selective gas sponsorship for critical actions.

- Borrowers opening loans above 10,000 dollars receive gas sponsorship

- Liquidators get priority gasless execution during volatility

- First-time depositors receive three gasless transactions

The impact goes beyond UX. Sponsorship reduces liquidation risk during congestion when users might otherwise fail to rebalance due to gas costs. The small sponsorship expense improves capital efficiency and protocol stability.

Top 5 DeFi Platforms Built on Base

We spent some time digging into the Base ecosystem and came across several DeFi platforms that stand out through solid engineering and thoughtful protocol design. These platforms leverage Base’s low latency and cost efficiency to support reliable and scalable on-chain financial activity.

1. Aerodrome Finance

Aerodrome Finance is the primary liquidity hub on Base and the go-to decentralized exchange for deep liquidity and efficient token swaps. It uses a vote escrow model to direct emissions, which helps sustain long-term liquidity and protocol growth across the ecosystem.

2. Seamless Protocol

Seamless is a native lending and borrowing platform on Base that allows users to supply assets to earn yield or borrow against collateral. It is designed for capital efficiency and is tightly integrated with the Base ecosystem to support sustainable on-chain credit markets.

3. Uniswap on Base

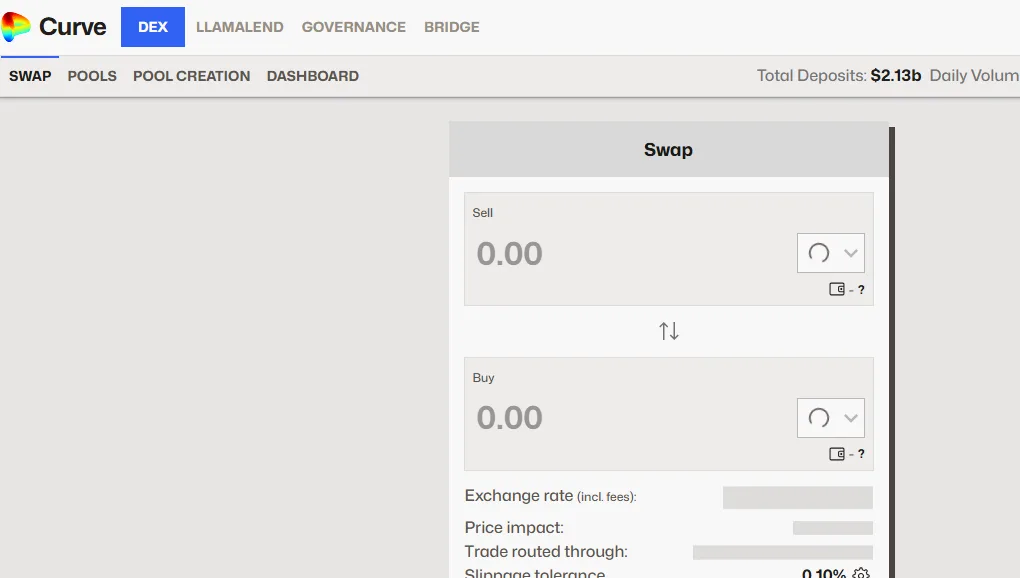

Uniswap operates on Base as a trusted decentralized exchange, enabling permissionless token swaps with minimal fees. By leveraging Base’s low-cost environment, Uniswap makes DeFi trading more accessible while maintaining Ethereum-grade security guarantees.

4. Aave on Base

Aave extends its battle-tested liquidity protocol to Base, enabling users to lend, borrow, and manage assets with advanced risk controls. Its presence on Base brings institutional-grade DeFi infrastructure to a faster and cheaper Layer 2 environment.

5. Curve Finance on Base

Curve Finance focuses on low-slippage swaps for stablecoins and correlated assets on Base. It supports efficient liquidity provisioning and is commonly used as core infrastructure for yield strategies and stable asset liquidity across DeFi.

Conclusion

Building a scalable DeFi platform on Base is a deliberate step for teams that want to approach decentralized finance with durability in mind. Base offers a practical mix of speed, security, and operational trust that can support real financial flows. With careful architecture and well-chosen integrations, DeFi systems may gradually evolve from controlled pilots into dependable infrastructure that supports revenue and scale.

Looking to Develop a DeFi Platform on Base?

IdeaUsher can help design and build a DeFi platform on Base with Ethereum-grade security and efficient execution. The team can architect smart contracts, smart wallets, and paymaster flows that may feel intuitive for real users.

With over 500,000 hours of coding experience and a team of ex-MAANG/FAANG developers, we transform your concept into production-ready, secure, and market-leading DeFi solutions.

Why Build with Us?

- Gasless UX Engineering: Implement Paymaster systems so users never touch ETH for gas

- Superchain Liquidity Integration: Unlock seamless cross-chain capital flows

- AI-Powered Vaults: Integrate predictive analytics for smarter risk management

- Institutional-Grade Security: Audit-ready architecture from day one

- Smart Wallet First: Biometric onboarding that converts mainstream users

Check out our latest projects to see how we’ve helped others scale, or book a technical consultation today to discuss your specific requirements.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Base is suitable for enterprise-grade DeFi platforms because it settles on Ethereum while offering a controlled execution layer. Enterprises can rely on familiar security assumptions and audit standards. The environment can support complex workflows without exposing users to mainnet friction.

A2: Users can interact with DeFi platforms on Base without holding ETH by using paymaster-based gas sponsorship. Transactions can be sponsored at the protocol level, so balances are not a blocker. This can make DeFi feel closer to a traditional financial application.

A3: Base improves user onboarding by enabling smart wallets that use passkeys and biometrics. New users can sign in with device-level security instead of seed phrases. This approach can reduce drop-off while keeping custody logic intact.

A4: DeFi platforms on Base can support institutional assets through permissioned pools and RWA frameworks. Compliance logic can be enforced at the smart contract layer. This makes Base increasingly practical for regulated capital.