Early consumer crypto was dominated by charts and short-term reactions, and participation rarely lasted. What changed was user intent. People wanted to create value, access real products, and feel genuine ownership. This is why many businesses shifted to building crypto apps on Base, as it combines low transaction costs, fast confirmations, and Ethereum-level security in a way that suits consumer behavior.

Base supports high-frequency, instant actions, allowing crypto apps to behave like familiar mobile or web products. With strong ecosystem distribution and wallet abstraction, ownership and contributions happen quietly in the background, without users worrying about gas fees or networks.

We’ve built multiple consumer-focused crypto solutions on Base over the years that use account abstraction frameworks and Layer-2 smart contract architectures. As IdeaUsher has this expertise, we’re sharing this blog to discuss the steps to building consumer crypto apps on Base. Let’s start!

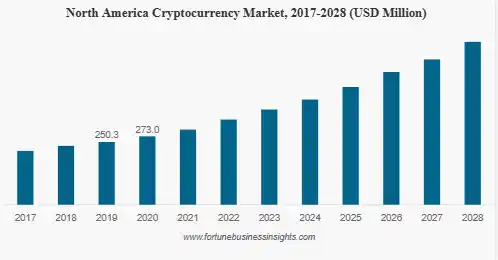

Key Market Takeaways for Crypto Apps

According to FortuneBusinessInsights, the global cryptocurrency ecosystem has reached meaningful scale, with total market capitalization touching USD 2.96 trillion in 2025 and projected to climb to USD 7.98 trillion by 2030 at a 30.1 percent CAGR. This expansion is no longer driven only by trading activity but by widespread mobile access, payments, staking, and real-world financial integrations. Crypto apps are now primary entry points, supporting millions of daily interactions across retail and institutional users.

Source: FortuneBusinessInsights

Among leading platforms, Binance continues to dominate usage metrics. Its Alpha platform reached 17 million users, while Binance Pay recorded 30% year-over-year user growth in 2025. Fiat on-ramps and peer-to-peer transaction volumes increased by 38 percent, signaling stronger everyday usage beyond speculative trading.

Coinbase follows closely with over 120 million monthly users across its ecosystem, 8.7 million monthly transacting users reported in Q2 2025, and 3.2 million active Coinbase Wallet users, driven by simplified mobile UX, staking access, and support for hundreds of digital assets.

Strategic financial partnerships are accelerating mainstream adoption. In 2025, JPMorgan Chase partnered with Coinbase to enable direct bank-to-wallet transfers, crypto purchases using Chase credit cards, and redemption of Ultimate Rewards points for digital assets.

What Are Consumer Crypto Apps?

Consumer crypto apps are applications in which blockchain serves as background infrastructure rather than a visible feature. They are designed to deliver everyday digital experiences such as payments, rewards, social interactions, or commerce while quietly using crypto rails for security, settlement, and ownership.

End users often do not realize they are interacting with blockchain, as these apps prioritize familiar interfaces, fast performance, and simple onboarding over crypto-native features such as wallets and gas fees.

Why Are Businesses Building Consumer Crypto Apps on Base?

Businesses are building consumer crypto apps on Base because it removes onboarding friction and quietly handles the complexity of blockchain in the background. Users can sign in with passkeys and interact instantly, while transactions are fast and economically sponsored. This approach can reliably support scale and feels familiar to mainstream users while still providing value on the chain.

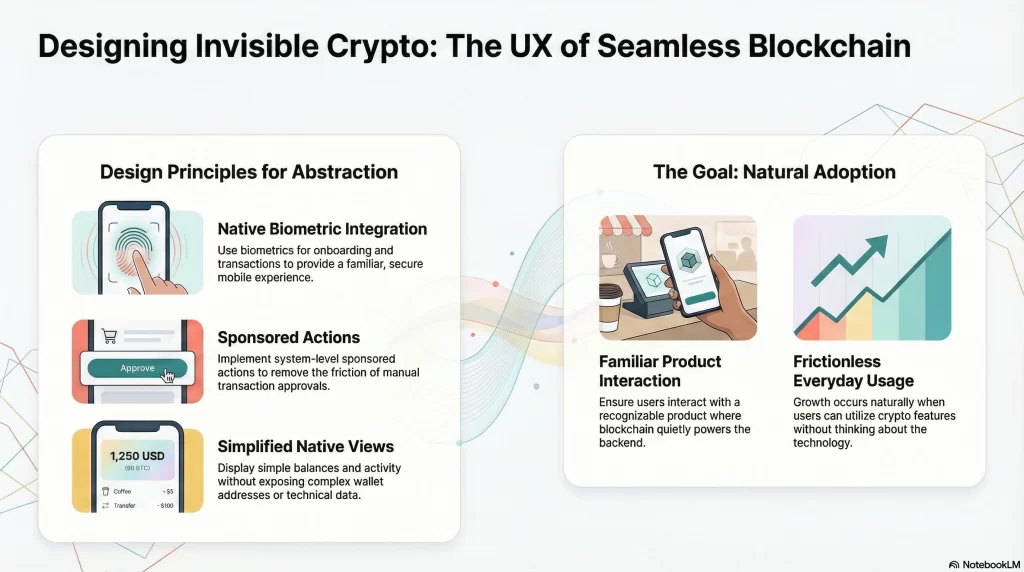

The “Invisible Blockchain” Standard

By 2026, successful consumer crypto apps will not feel like crypto at all. Users do not see gas fees, seed phrases, or complex bridging. They experience seamless interactions, instant rewards, and intuitive interfaces.

This is not a design trend. It is a fundamental shift in user expectations that Base was engineered to meet from day one.

Take, for example, Fren Pet, a virtual pet game on Base that exploded in popularity not because it was on blockchain, but because it removed every blockchain friction point. Players tap to feed and play with pets while earning tokens seamlessly.

- They never see a gas fee pop up because transactions are sponsored. They never write down a seed phrase because they sign in with Google.

- They never realize that millions of dollars in economic activity are happening on a chain. The result is over 100,000 daily active users who are not crypto gamers. They are simply people having fun.

Businesses are not choosing Base blockchain because it is the fastest or cheapest chain, although its sub-cent transactions help. They are choosing Base because it solves four core business challenges that have plagued crypto adoption since its inception.

Business Imperatives Driving Base Blockchain Adoption

1. User Acquisition

The Old Problem: Crypto onboarding converted less than ten percent of interested users. The twenty-four-word seed phrase consistently destroyed conversion rates.

The Base Solution: Native integration with smartphone passkeys such as FaceID and TouchID, along with social logins, enables Web2-style onboarding while preserving Web3 ownership.

Business Impact: The addressable market expands from crypto natives to anyone with a smartphone. Acquisition costs drop while funnel efficiency improves.

Real Example:

Blackbird, a restaurant loyalty app on Base, demonstrates this shift clearly. A diner walks into a participating restaurant and scans a QR code using their phone camera. A wallet is created instantly using Apple Passkeys.

There is no app download, no seed phrase, and no crypto education required. Within thirty seconds, the diner earns their first loyalty NFT and can claim rewards.

2. Retention Through Sponsored Economics

The Old Problem: Managing gas tokens introduced constant friction. Every action forced users to evaluate whether the interaction was worth the fee.

The Base Solution: Paymaster technology enables businesses to sponsor transaction fees as customer acquisition costs. With transactions costing less than one thousandth of a dollar on Base, companies can fund thousands of interactions for the price of a single traditional ad click.

Business Impact: This unlocks freemium models, microtransactions, and uninterrupted user journeys that were previously impractical in crypto.

Real Example:

Paragraph, a decentralized blogging platform, introduced sponsored gas for reader interactions. When a reader tips a writer, they pay exactly one dollar. The platform covers the transaction fee of roughly 3/10 of a cent.

This small but meaningful change removed the psychological friction of losing money to fees and increased tipping volume by 400% in the first month. Writers earned more, readers felt their contributions mattered, and engagement metrics climbed sharply.

3. Built-In Distribution

The Old Problem: Even well-built crypto apps struggled with discovery and liquidity. Many existed in isolation.

The Base Solution

Direct integration with Coinbase’s ecosystem provides access to over 110 million verified users.

Business Impact: This functions as a distribution-as-a-service, not just as infrastructure.

Real Example:

Frame, a social art collecting app, leveraged this integration at launch. Users could purchase artwork directly from their Coinbase balance with one click. No bridging or additional wallet setup was required if they already used Coinbase.

40% of their first 10,000 users came through this path alone, enabling the app to achieve immediate liquidity and adoption that would have taken months elsewhere.

4. Viral Growth

The Old Problem: Early crypto apps focused on transactions rather than social interaction, limiting organic growth.

The Base Solution: Base supports on-chain social ecosystems such as Farcaster, where user actions become shareable social objects.

Business Impact: This creates native viral loops that compound organically.

Real Example:

In Fren Pet, when users achieve milestones or breed pets, the action automatically generates a social post on Farcaster. Friends see the update, tap through, and begin playing within seconds using passkeys. This loop drove sixty percent of Fren Pet’s organic growth and created a self-sustaining acquisition engine without advertising spend.

Is Base Right for Your Business?

Base is especially effective for businesses where user experience drives adoption, microtransactions or frequent interactions create value, social sharing strengthens engagement, and mainstream users matter more than crypto native audiences.

If scale, engagement, and network effects define your growth model, Base is no longer just an option. It is increasingly the default.

The lesson from Fren Pet’s growth and Blackbird’s onboarding success is clear. Winning in 2026 means removing friction so thoroughly that users forget they are interacting with blockchain technology at all. They are simply enjoying products, earning rewards, and participating in communities.

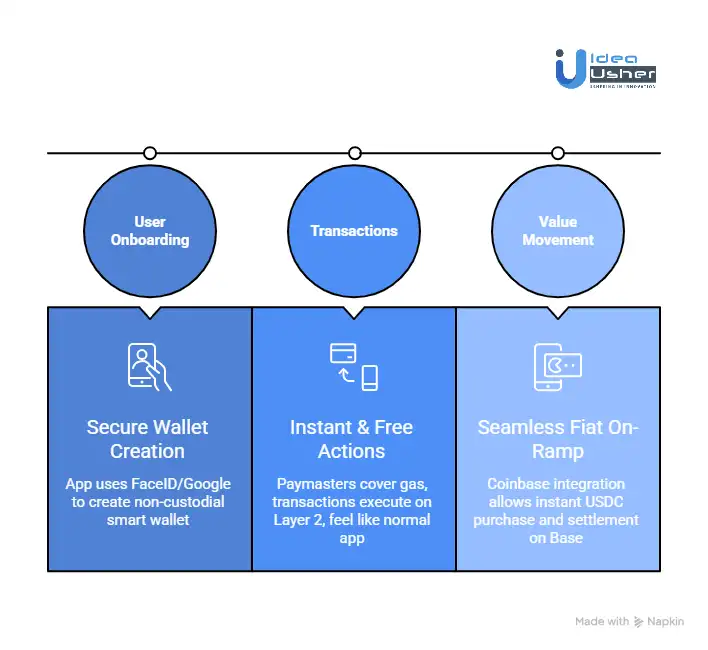

How Consumer Crypto Apps Built on Base Actually Work?

Consumer crypto apps on Base work by hiding blockchain logic behind smart wallets that can authenticate with FaceID and execute actions instantly. Transactions should feel free and fast because gas is sponsored, and settlement happens on a Layer 2 that anchors to Ethereum for security.

From the user’s perspective, it will feel like a normal app while ownership and value remain on the chain.

Layer 1: User Onboarding

What the user sees: A “Continue with Google” or “Sign in with FaceID” button.

What happens under the hood

- The app uses Base Smart Wallet infrastructure powered by account abstraction.

- When the user authenticates, a secure, non-custodial wallet is created programmatically.

- A cryptographic passkey tied to device biometrics becomes the login credential, with no passwords or recovery phrases.

- The wallet is ready to send, receive, and hold assets on Base instantly.

Why this matters: Traditional crypto onboarding sees nearly 90% user drop-off. Base Smart Wallets deliver Web2-level conversion rates with more than seventy percent completion.

Layer 2: Transactions

What the user sees: Like becomes liked. Buy becomes purchased. Send becomes sent. There are no confirmations and no fee popups.

What happens under the hood

- The app uses Paymasters, sponsored transaction contracts, to cover minimal gas fees that are often less than 1/1000 of a dollar.

- The company prepays for gas in ETH and treats it as a customer-acquisition cost.

- Transactions execute on Base Layer 2 and settle on Ethereum for security at a fraction of the cost and significantly higher speed.

- OnchainKit components manage signing and execution while exposing only simple button interactions to users.

Why this matters: Removing friction makes micro actions, such as tipping 10 cents or collecting a loyalty point, economically viable.

Layer 3: Value Movement

What the user sees: Add funds. Bank account or card. Funds available instantly.

What happens under the hood

- Base integrates directly with Coinbase to provide regulated fiat on-ramps.

- Users purchase USDC inside the app using Base Pay.

- Funds settle instantly on Base Layer 2 without external bridging.

- Existing Coinbase users can move assets into the app with a single click and without any bridge complexity.

Why this matters: Instant liquidity allows users to experience value immediately rather than waiting hours.

Real World Example: Coffee Loyalty App

Below is a complete user journey through a hypothetical but realistic Base-powered consumer app.

Monday, 8:15 AM

| Stage | User Experience | Backend Action |

| Download and Sign up | Sarah signs in with Apple using Face ID and earns 10 points instantly. | A Base Smart Wallet is created automatically. |

| First Purchase | She scans a QR code and pays five dollars for a latte. | The payment flow is prepared on the chain. |

| Payment Processing | The app shows a normal card payment screen. | Payment converts to USDC, and loyalty tokens are minted. |

| Social Reward | A friend taps her shared BrewChain Frame and earns points. | A sponsored transaction mints tokens to the friend. |

| Gas Handling | No fees or confirmations appear. | Gas is covered at roughly $0.0008. |

| Redeeming | Sarah unlocks a Free Pastry NFT after ten purchases. | The NFT is issued and ready for redemption. |

Backend: She presents the NFT at the cafe. The cashier scans it. The NFT is burned in a gasless transaction and the reward is triggered.

- Sarah never opened a crypto exchange.

- She never saw a wallet address.

- She never bought ETH.

- She never paid a gas fee.

- She never waited for a transaction.

This is why consumer crypto apps on Base feel like normal apps, even though they run on blockchain infrastructure.

How to Build Consumer Crypto Apps on Base?

Building consumer crypto apps on Base often begins by hiding the complexity of blockchain behind familiar app interactions. Smart wallets, gas sponsorship, and seamless funding should quietly work together so users can act without hesitation.

We have built multiple consumer crypto apps on Base for our clients, and this is the approach we follow.

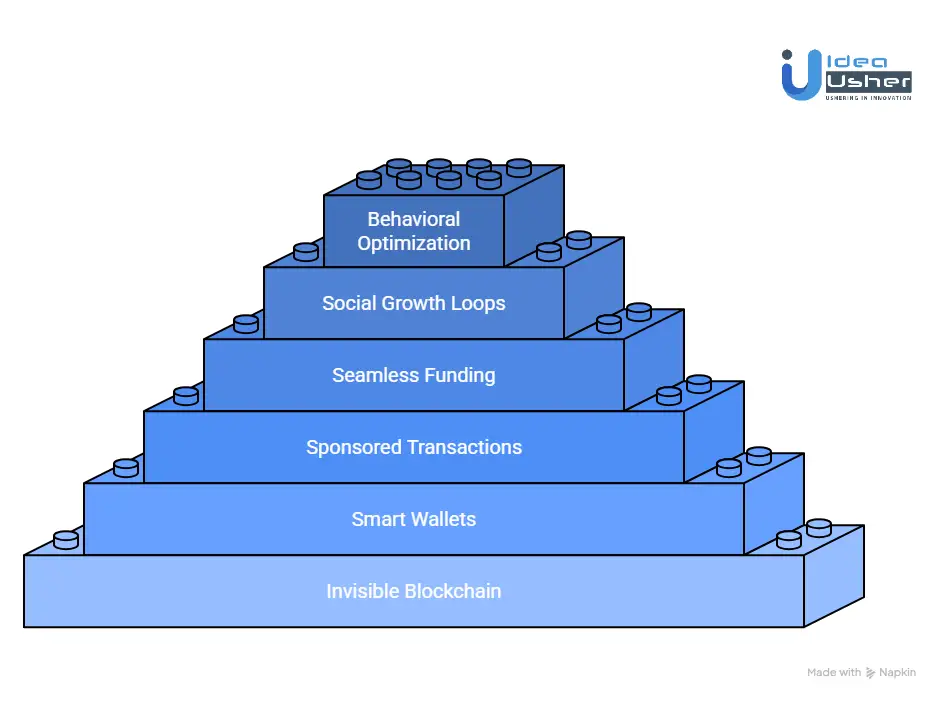

1. Invisible Blockchain Design

We design the product assuming users have no crypto knowledge. Wallets, gas, and networks are abstracted away so the experience feels like a familiar consumer app. Blockchain logic runs silently beneath simple and intuitive user flows.

2. Smart Wallet Access

We implement Base smart wallets with passkey and biometric authentication. Users log in using device-level security while retaining non-custodial ownership. Recovery is built into the wallet layer to avoid friction and support dependency.

3. Sponsored Transactions

We use paymasters to sponsor critical transactions during onboarding and early engagement. Gas costs are planned as part of the acquisition strategy rather than a hidden technical cost. This keeps the first user experience fast and interruption-free.

4. Seamless Funding

We integrate Coinbase onramps to enable direct funding into the app. Users can move from signup to action without leaving the product. This removes the most common activation barrier in consumer crypto apps.

5. Social Growth Loops

We build engagement loops that leverage on-chain social visibility. Integrations like Farcaster allow user actions to generate organic reach across the Base ecosystem. Usage naturally drives discovery and adoption.

6. Behavioral Optimization

We combine on-chain data with off-chain analytics to understand user behavior. High-intent users are identified early, and engagement signals trigger automated rewards and retention flows. This ensures the product continues to improve as it scales.

Popular Types of Consumer Crypto Apps Built on Base

On Base, consumer crypto apps often show up as loyalty systems, creator access tools, and embedded payment layers that feel familiar from the first tap. Blockchain usually handles ownership and settlement quietly in the background, while the interface stays fast and intuitive.

1. Digital Loyalty & Rewards Platforms

Brands are using Base to power loyalty systems where rewards live on-chain instead of in closed databases. Users earn and redeem rewards instantly without managing wallets or gas fees.

Example: Shopify-based loyalty experiments on Base allow merchants to issue on-chain rewards that users can redeem across campaigns without re-registration.

2. Creator & Membership Applications

Creator platforms use Base to represent memberships, subscriptions, or fan access on-chain. Eligibility checks happen automatically, payouts are instant, and creators maintain direct control over access.

Example: Friend.tech, built on Base, allows creators to tokenize access to private chats and communities while keeping onboarding simple for non-crypto users.

3. Gaming & In-App Economies

Games on Base use blockchain to manage in-game assets and rewards while keeping gameplay smooth. Ownership exists on-chain, but interactions feel instant and familiar to players.

Example: Parallel Colony, a game ecosystem connected to Base, uses on-chain assets while maintaining fast gameplay loops suitable for consumer audiences.

4. Fintech & Embedded Payments

Fintech apps leverage Base for micro-transactions, peer-to-peer transfers, and digital balances with near-instant settlement. Blockchain reduces backend reconciliation while remaining invisible to users

Example: Coinbase Smart Wallet–powered apps on Base enable seamless payments and balances without requiring users to manage seed phrases or gas fees.

5. On-Chain Identity & Access Control

Apps use Base to verify access rights or eligibility without exposing sensitive personal data. Users can log in or unlock features with minimal friction.

Example: Farcaster Frames on Base allow users to authenticate actions and access features directly inside social feeds without traditional Web3 onboarding.

6. Marketplace & Commerce Experiences

Marketplaces on Base handle ownership, settlement, and verification on-chain while preserving familiar checkout flows. Fees stay low and transactions settle quickly.

Example: Zora, deployed on Base, enables creators to mint and sell digital media while keeping the buying experience simple for mainstream users.

How Does Gas Sponsorship Impact Long-term Business Costs?

Gas sponsorship is often misunderstood as a nice-to-have feature for user convenience. In consumer crypto apps built on Base, it represents a foundational shift in how businesses think about costs, growth, and user economics.

This is not just a UX improvement. It directly reshapes long-term operating models.

Understanding Gas Sponsorship

Gas sponsorship using Paymasters means the app developer pays transaction fees on behalf of users.

On Base, these fees are often under $0.001 per transaction. While the cost per action looks small, the impact becomes transformative when applied across millions of user interactions.

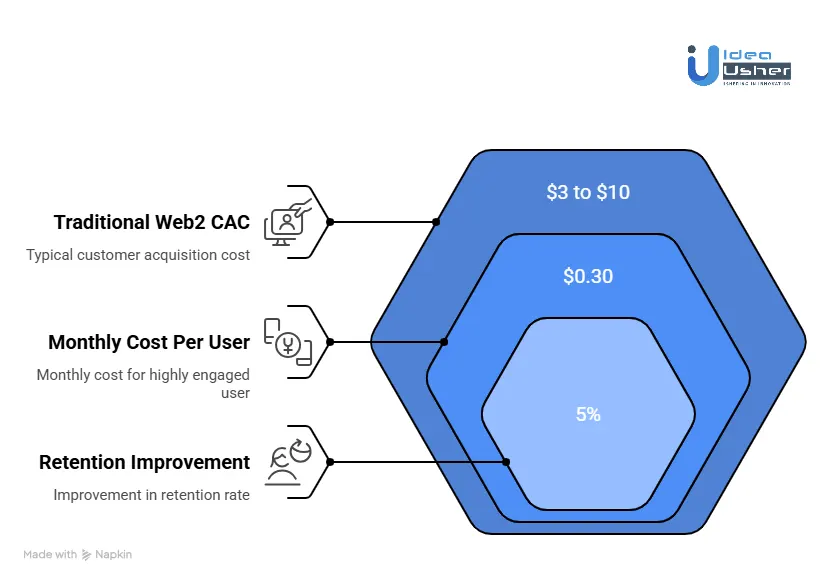

The Short-Term Math

Let’s break down sponsorship costs using a realistic consumer crypto example.

Scenario: A Farcaster Frames user might mint 3 NFTs, tip 5 creators, and vote on 2 polls in one session. That equals 10 on-chain actions.

Cost on Base: Approximately $0.01 per user per active session.

Monthly cost

Around $0.30 per highly engaged user.

Now compare this with traditional acquisition economics.

- Typical Web2 CAC ranges from $3 to $10 or more

- Without sponsorship, many users abandon the app at the first gas fee prompt

Paying for an entire month of real usage for less than one ad click shifts gas sponsorship from a cost center into a strategic growth investment.

The Long-Term Impact

1. From Friction to Flow

The biggest cost in consumer crypto is not gas fees. It is abandoned sign-ups and stalled user journeys. Each time a user is asked to approve a transaction with a visible gas fee, conversion rates drop sharply.

With sponsorship, this friction disappears. Actions complete instantly and user progression feels continuous.

Long-term cost impact: Effective CAC drops because more existing traffic converts into active users. The gas fee is not just a payment. It is an investment in higher conversion efficiency.

2. Enabling Previously Impossible Business Models

Gas sponsorship is not about hiding fees. It enables revenue models that were previously unviable on-chain.

- Microtransactions and micropayments: Users can tip $0.10, buy a $0.25 power-up, or pay $0.01 for content without fees overwhelming value.

- Freemium models: A free tier can include sponsored gas, while premium users unlock higher activity limits or advanced features. Gas becomes part of service delivery costs, similar to cloud infrastructure in SaaS.

- Predictable SaaS-style costing: Gas spend scales linearly with engagement. This creates a controllable operational expense rather than an unpredictable user-facing barrier.

3. The Retention Engine

Long-term costs are heavily influenced by churn. Complex user experience remains one of the strongest drivers of user drop-off.

With sponsorship, the app feels effortless. Users return because nothing breaks their flow.

Long-term cost impact

A 5 percent improvement in retention can increase profits by 25 to 95 percent according to Harvard Business Review. Sponsorship directly improves lifetime value while reducing the need for constant re-acquisition.

4. Volatility Shield

On networks without sponsorship, users carry the burden of gas volatility. When fees spike, activity collapses. With sponsorship on Base, the developer absorbs this cost. Base’s low and stable fees make forecasting realistic and controllable.

Long-term cost impact: Gas becomes a predictable budget line item. Daily active users remain stable even during network congestion elsewhere. Growth curves stay consistent instead of volatile.

How We Design Consumer Crypto Apps Where Blockchain Stays Invisible?

We design consumer crypto apps so blockchain works quietly in the background while the product feels familiar and fast. Users can sign in with biometrics, take actions instantly, and see balances in simple terms, without managing wallets or fees. This approach should reduce friction, improve trust, and allow adoption to grow naturally through everyday usage.

1. Onboarding

Traditional crypto onboarding kills conversions. We remove it entirely.

Our design solution

- Passkey-first authentication: Users sign up using FaceID, TouchID, or social login. Behind the scenes, we automatically generate and manage non-custodial smart wallets using Base account abstraction frameworks.

- Progressive crypto education: Users are never asked to store seed phrases during signup. Wallet backup is introduced weeks later as an optional security upgrade framed as enabling additional protection.

This works like iCloud Keychain for crypto. Strong encryption exists, but users never need to manage it directly.

2. Transactions

Gas fees and wallet pop-ups instantly break immersion. We design systems where they never appear.

Our design solution

- Sponsor-first architecture: Paymasters are implemented by default so businesses absorb sub-cent transaction fees. Users experience actions like liking, collecting, or unlocking content as free interactions.

- Batch and bundle logic: Smart contracts are architected to group multiple actions into a single on-chain transaction, reducing both friction and cost.

The abstraction effect: A user taps once to tip a creator. What happens quietly is fiat conversion to USDC, gas sponsorship, and settlement on Base within seconds.

3. Currency

Psychological resistance disappears when crypto terminology is removed.

Our design solution

- Native token wrapping: Users never see ETH or USDC. Instead, balances appear as Stars, Credits, Gems, or simply Balance.

- Automatic conversion layers: Prices are always shown in local currency. Stablecoin conversions and settlement occur transparently through Base infrastructure.

4. Performance

Slow confirmations destroy trust. We engineer around latency.

Our design solution

- Hybrid architecture: Non-critical data is handled off-chain using traditional databases. Ownership, value, and settlement remain secured on Base. Users get instant feedback with permanent finality.

- Predictive pre-loading: Behavioral analytics allow us to pre-fund wallets or pre-approve transactions before users take action.

- State channel patterns: For gaming and high-frequency interactions, off-chain state channels are used with periodic settlement to Base, creating real-time experiences.

5. Recovery

Lost keys and failed transactions are the silent killers of crypto adoption. We prevent them at the system level.

Our design solution

- Multi-device keyless recovery: Users regain access through biometrics or social authentication across devices without handling seed phrases.

- Transaction insurance layer: Real-time monitoring detects failed transactions and automatically retries with optimized parameters, often without user awareness.

- Human-centered error messaging: Technical errors are replaced with clear language such as We are retrying that for you or Please try again in a moment.

Top 5 Consumer Crypto Apps Built on Base Blockchain

We did some digging and found several consumer crypto apps built on Base that quietly push real usability forward. These products demonstrate how blockchain can operate in the background while maintaining fast performance and natural interactions.

1. Aerodrome Finance

Aerodrome Finance powers token swaps and liquidity on Base through an optimized decentralized exchange model. It supports fast trading and frequent interactions because Base keeps transaction costs low. Many consumer apps rely on Aerodrome for price discovery and access to liquidity.

2. FrenPet

FrenPet is a lightweight on-chain game where users own and interact with digital pets. Gameplay actions are frequent and inexpensive due to Base’s low fees. It demonstrates how casual gaming can work smoothly on a Layer-2 network.

3. BaseSwap

BaseSwap enables simple token swapping and liquidity access for Base users. The interface is designed for everyday transactions rather than advanced trading. It supports consumer-focused DeFi activity without overwhelming users with complexity.

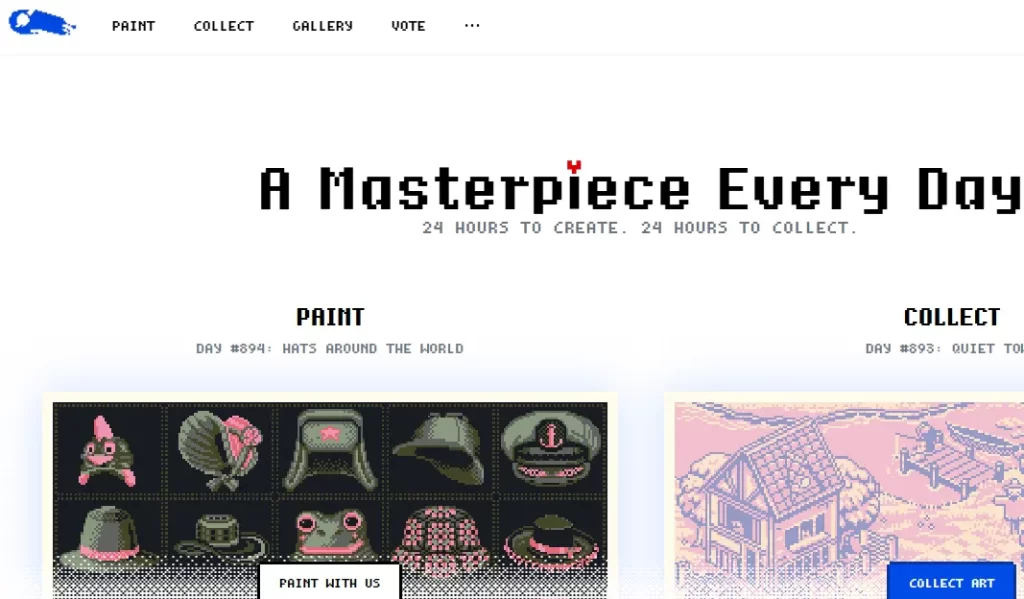

4. BasePaint

BasePaint allows users to create and mint digital artwork directly on-chain. Each interaction feels instant because Base handles high-frequency actions efficiently. The app highlights how creative tools can integrate blockchain without breaking user flow.

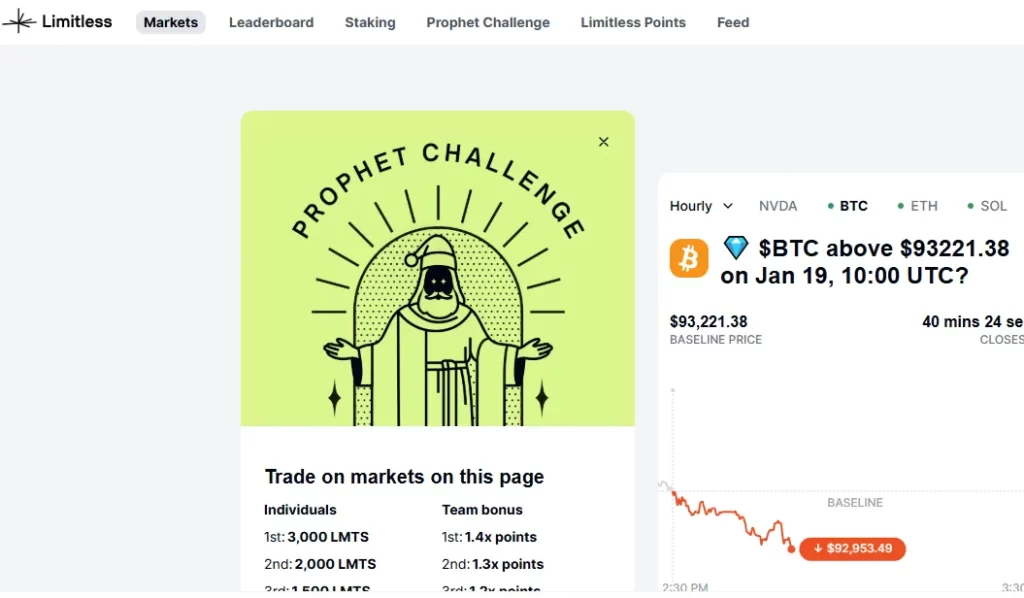

5. Limitless Exchange

Limitless Exchange offers on-chain prediction markets focused on real-world outcomes. Users can place positions and settle quickly due to Base’s fast confirmation times. The experience feels closer to a consumer betting app than traditional crypto platforms.

Conclusion

Consumer crypto apps are no longer experimental, and Base has clearly set the benchmark for mainstream adoption. Businesses that invest early gain a real structural advantage by building on infrastructure that already fits how users behave today. Base combines Ethereum-grade security with Coinbase-backed distribution, supporting scale without friction. With the right strategy and execution partner, Base-powered apps can unlock sustainable revenue. Our team at Idea Usher helps enterprises move from concept to production with confidence.

Looking to Develop a Consumer Crypto Apps on Base?

IdeaUsher can design a consumer crypto app on Base by starting with a secure smart contract layer and a gas-efficient transaction flow that feels simple to use. The team may integrate Base’s native tooling with scalable APIs so that wallets’ onboarding and on-chain actions run smoothly and reliably.

Why Partner With Us?

- 500,000+ Hours of Mastery: Our ex-MAANG/FAANG developers bring battle-tested expertise in building at scale, applied directly to the Base ecosystem.

- From Blueprint to Launch: We handle the full stack, from audited, secure smart contracts to sleek front-end apps built with Base’s OnchainKit for lightning-fast development.

- Focus on Your Business Logic: You focus on the product vision and growth. We build the robust, high-performance engine that makes it possible.

Check out our latest projects to see how we’ve transformed ideas into industry-leading apps.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Businesses that already engage large consumer audiences see the strongest results on Base. Retail platforms, social products, fintech services, and AI-driven apps can integrate crypto flows without changing the core user experience. This allows teams to extend value rather than rebuild behavior.

A2: Users do not need crypto knowledge to use Base-powered applications. Wallet creation transactions and key management can be fully abstracted at the system level. The product can behave like a familiar Web2 app while running on blockchain rails.

A3: Monetization happens through small, frequent transactions and value-added services. Teams can introduce premium access loyalty mechanics and embedded financial features that run natively on chain. This model supports predictable revenue without heavy speculation.

A4: Base is suitable for enterprise-scale use cases because it combines Ethereum security with reliable distribution. The infrastructure supports high throughput while maintaining clear contract boundaries. This makes it practical for long-term production systems.