Vacant units are visible, but uncertainty is quieter and far more expensive. Leasing teams often do not know which prospects are serious, which prices will hold, or when demand may soften. Traditional tools record activity but fail to explain intent. This is why AI leasing intelligence software gained adoption, as it can score applicant seriousness, detect fraud risk, recommend optimal pricing, forecast lease conversion, and prioritize follow-ups automatically.

As markets became volatile and tenant behavior became less predictable, historical reports were no longer enough. AI systems learn from behavioral signals and real-time interactions, enabling teams to act earlier rather than react later.

Over the years, we’ve developed numerous AI property leasing intelligence solutions, powered by agentic AI systems and predictive leasing intelligence architectures. As we have this expertise, we’re writing this blog to discuss the steps to develop an AI leasing intelligence software.

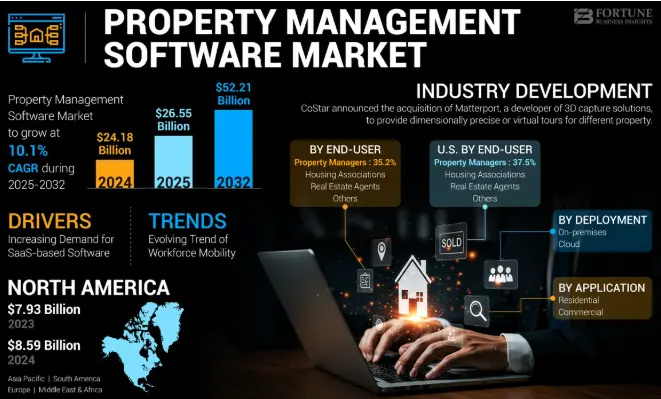

Key Market Takeaways for AI Leasing Intelligence Softwares

According to Fortune Business Insights, the property management software market is growing steadily and meaningfully. Valued at USD 24.18 billion in 2024, it is projected to cross USD 52 billion by 2032 with a CAGR of 10.1 percent. North America continues to lead adoption as operators increasingly replace legacy tools with AI-driven leasing intelligence that can act, not just report.

Source: FortuneBusinessInsights

What is driving this shift is the move toward autonomous property operations. Leasing teams no longer want dashboards that only organize leads. They want systems that can respond instantly, qualify prospects, and move renters through the funnel without manual follow-ups. AI leasing intelligence software is becoming a frontline operator rather than a back-office assistant.

Platforms like AppFolio and Entrata clearly reflect this change. AppFolio’s Realm X uses generative AI to respond to inquiries, schedule tours, and personalize outreach, helping reduce vacancy timelines by several days.

Entrata’s ELI Plus applies layered AI across voice, text, and email channels so leasing teams can focus on resident relationships while AI handles round-the-clock execution.

What Is AI Property Leasing Intelligence Software?

AI property leasing intelligence software is an AI-driven platform that analyzes leases, applicant data, and market signals to predict outcomes and guide leasing decisions. It can read unstructured documents, detect risk early, and recommend actions such as pricing or renewals before issues surface.

Unlike traditional systems that only store records, it actively learns from data and supports smarter portfolio-level decisions over time.

How It Differs from Traditional Leasing Softwares?

This is not about features. It is about capability. The gap is not incremental. It is foundational.

| Traditional Leasing Software | AI Leasing Intelligence Software |

| Acts as a System of RecordStores leases and triggers basic reminders for renewals or payments. | Acts as a System of IntelligenceInterprets the legal and financial context within those leases to flag risks and opportunities. |

| Reactive and Rules-BasedFollows the if-then-then logic programmed by humans. | Proactive and PredictiveUses ML models to forecast tenant churn, optimal pricing, and maintenance issues before they occur. |

| Manages Structured DataWorks with clean fields like dates, amounts, and names. | Processes Unstructured RealityReads PDF leases, analyzes scanned documents for fraud, interprets email tone, and understands voice messages. |

| Assists HumansProvides tools for humans to do the work. | Augments and Automates HumansDeploys autonomous agents to handle repetitive tasks such as screening and scheduling, and delivers strategic insights for high-value decisions. |

| Answers “What happened?”Lease expires June 30. | Answers “What will happen and what should we do?”Tenant has 73 percent churn risk. Recommend offering a 2-year renewal at a 3 percent increase with waived amenity fees to lock them in. |

Key Features of an AI Property Leasing Intelligence Software

AI property leasing intelligence software can quietly handle renter conversations while you focus on closing the right deals. It may automatically schedule tours for leads in real time and surface leasing insights that actually guide decisions.

1. AI Leasing Assistant

Users interact with a conversational AI that responds to renter inquiries in real time across chat, email, or SMS. For example, a system like EliseAI can answer availability questions at midnight and guide a prospect toward booking a tour without staff involvement.

2. Intelligent Lead Qualification

The software automatically evaluates leads based on intent signals and engagement behavior. For example, PERQ AI highlights prospects who repeatedly view listings and reply quickly, helping leasing teams focus on renters most likely to convert.

3. Automated Tour Scheduling

Leasing teams can allow prospects to book tours directly through the AI interface. For example, LeaseHawk ACE AI syncs with on-site calendars and automatically confirms tours, reducing back-and-forth coordination.

4. Application Pre Screening

Users can set eligibility rules, such as income ranges or move-in timelines, that the AI applies consistently. For example, TenantCloud helps filter applicants early by checking basic qualification criteria before formal screening begins.

5. Leasing Insights Dashboard

The platform provides interactive dashboards that show inquiry trends and conversion gaps. For example, AppFolio surfaces response time data and leasing performance metrics that managers can use to optimize follow-ups.

6. Multi-Channel Communication Management

Users manage leasing conversations from multiple channels in one interface. For example, LetHub consolidates website chats, site lead listings, and text messages into a single leasing inbox.

7. AI-Assisted Follow-Ups

The system automatically sends personalized follow-ups based on prospect actions. For example, Showdigs triggers reminders and re-engagement messages when a prospect misses a scheduled showing.

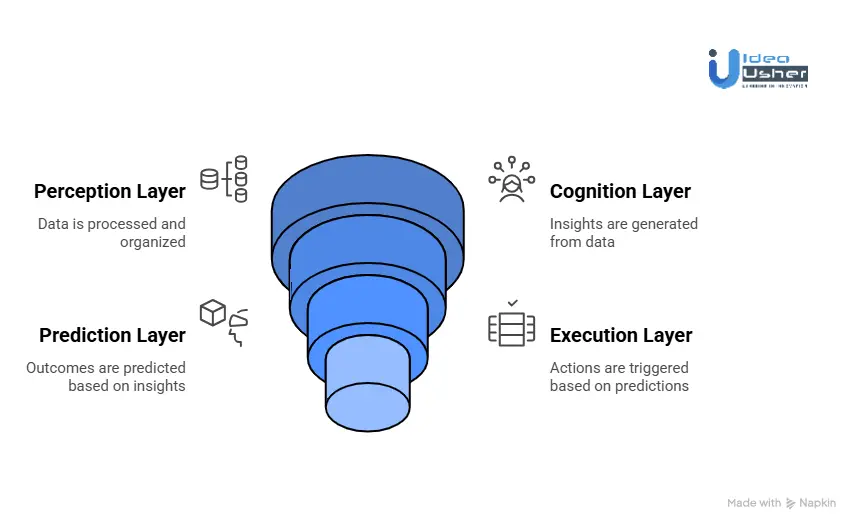

How Does an AI Property Leasing Intelligence Software Work?

AI property leasing intelligence software quietly watches how data moves across leases, conversations, and market signals, then learns what patterns usually lead to renewals or exits. It can read documents, interpret intent, and predict outcomes early, enabling decisions to be made before issues surface.

Layer 1: The Perception Layer

This is where raw, chaotic real-world data enters the system and becomes understandable.

Computer Vision Eyes

Scans uploaded documents such as IDs, pay stubs, and bank statements. It does not just read text using OCR. It analyzes the document’s digital fingerprint by checking inconsistent fonts, pixel-level edits, and metadata anomalies that flag potential fraud.

Natural Language Processing

Processes unstructured text from emails, chat messages, lease PDFs, and even voice call transcripts. It understands intent and sentiment, and extracts key entities like names, dates, financial figures, and obligations.

Data Integration Nervous System

Connects via APIs to pull real-time structured data from your existing Property Management System, CRM, accounting software, and external sources such as local market feeds or credit bureaus.

Output: Raw data is cleaned, categorized, and transformed into a unified, queryable knowledge graph.

Layer 2: The Cognition and Prediction Layer

This is where understanding turns into insight. Data is processed through specialized AI models.

Lease Abstraction Engine LLMs

A fine-tuned language model acts like a 24-by-7 paralegal. It reads entire leases, identifies critical clauses such as rent escalations, renewal options, and maintenance responsibilities, and summarizes risks in plain language.

Predictive Analytics Core

- Churn Risk Score: Analyzes hundreds of signals, including payment history, maintenance requests, engagement patterns, and market data, to assign a probability score for each tenant’s likelihood to renew.

- Dynamic Pricing Engine: Continuously evaluates hyper-local supply, demand, seasonality, and competitor pricing to recommend optimal rental rates for vacant or soon-to-be vacant units.

- Lead Scoring Model: Qualifies new inquiries in real time based on credit pre-checks, stated budget, and desired move-in date, prioritizing the highest intent leads for your team.

Output: Actionable intelligence. Not just “Lease expires June 1,” but “Tenant A has a 40 percent renewal probability. Recommend a 12-month renewal at a 2 percent increase to stabilize cash flow.”

Layer 3: The Execution and Agentic Layer

This is the breakthrough layer where intelligence triggers workflows and autonomous action.

Orchestrator and Workflow Engine

Acts as the system’s conductor. It uses Layer 2 insights to trigger complex, multi-step workflows. Example. If the churn risk score crosses a threshold above 70 percent, the orchestrator automatically

- Drafts a personalized renewal offer

- Schedules it for manager approval

- Sends it through the tenant’s preferred communication channel

Specialized AI Agents

| AI Agent | What It Does |

| Screening Agent | Conducts conversational interviews with applicants, verifies submitted information, and collects required documents for evaluation. |

| Scheduling Agent | Coordinates meeting times by syncing with both the prospect’s and the leasing agent’s calendars to finalize showings or calls. |

| Negotiation Agent (Rule-Based) | Presents pre-approved counter offers in defined scenarios, such as waiving an admin fee in exchange for a 24-month lease. |

Output: Completed tasks, executed workflows, and a dramatic reduction in manual and repetitive work for the human leasing team.

How to Build AI Property Leasing Intelligence Software?

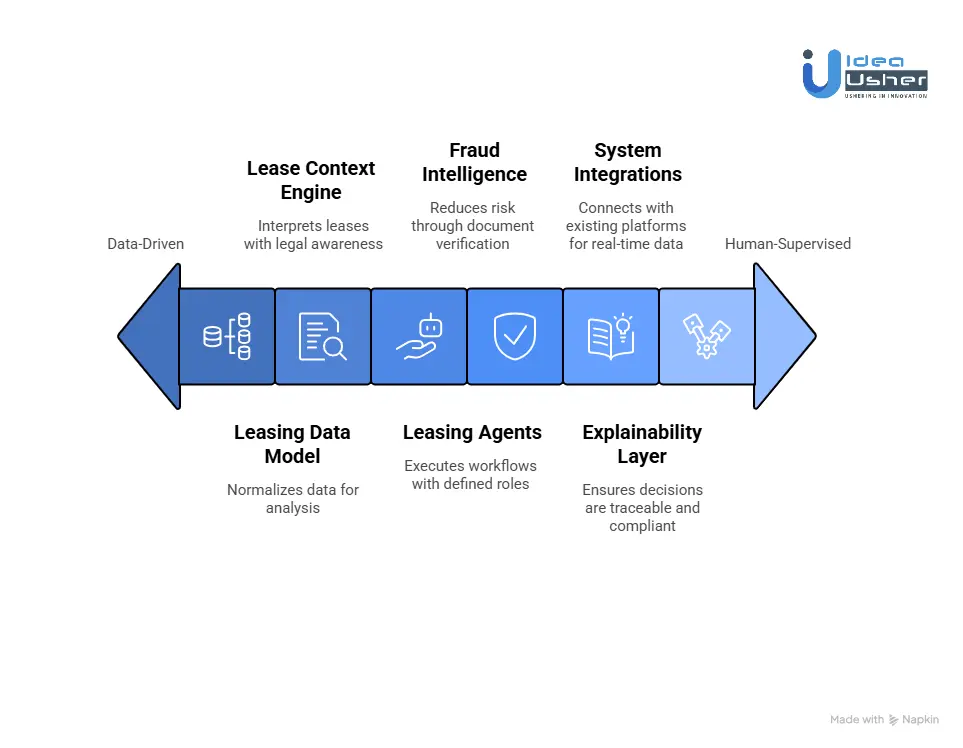

Building AI property leasing intelligence software starts with teaching the system how leasing really operates. Lease data and market signals are structured so intelligence can understand risk pricing and intent, then context engines may reason over clauses and history.

We have built several AI-driven property leasing intelligence systems, and this is how we design them for real-world leasing operations.

1. Leasing Data Model

We begin by designing a leasing-specific data model that reflects real operational workflows. Lease documents, tenant data, and market signals are normalized into a single structure that supports analysis. A leasing knowledge graph connects clauses, tenants, properties, and timelines, while intelligence signals, such as risk, churn, and pricing sensitivity, guide decision-making.

2. Lease Context Engine

We build context engines that allow the system to read and interpret leases with legal awareness. RAG pipelines ensure every response is grounded in verified lease data and internal policies. Semantic clause classification and legal intent indexing help the system understand obligations and exceptions, supported by a scalable vector database.

3. Leasing Agents

Our approach introduces agentic leasing workflows with strict control. Each agent is given a defined role and execution boundary, with decision thresholds that regulate autonomy. Human review paths are always available, ensuring sensitive leasing actions remain supervised.

4. Fraud Intelligence

We embed forensic intelligence to reduce leasing risk. Document integrity models verify authenticity, while behavioral identity graphs surface inconsistencies across tenant activity. Cross-dataset anomaly detection produces a risk confidence score that supports safer approvals.

5. Explainability Layer

Every decision made by the system is traceable. We implement policy-based scoring frameworks with clear reasoning logs and audit trails. Compliance controls are enforced at the workflow level, helping clients meet regulatory and internal governance requirements.

6. System Integrations

We connect the intelligence layer with existing platforms and live data sources. ERP integrations and event-driven pipelines keep systems in sync. Real-time pricing and demand feeds ensure leasing decisions remain aligned with current market conditions.

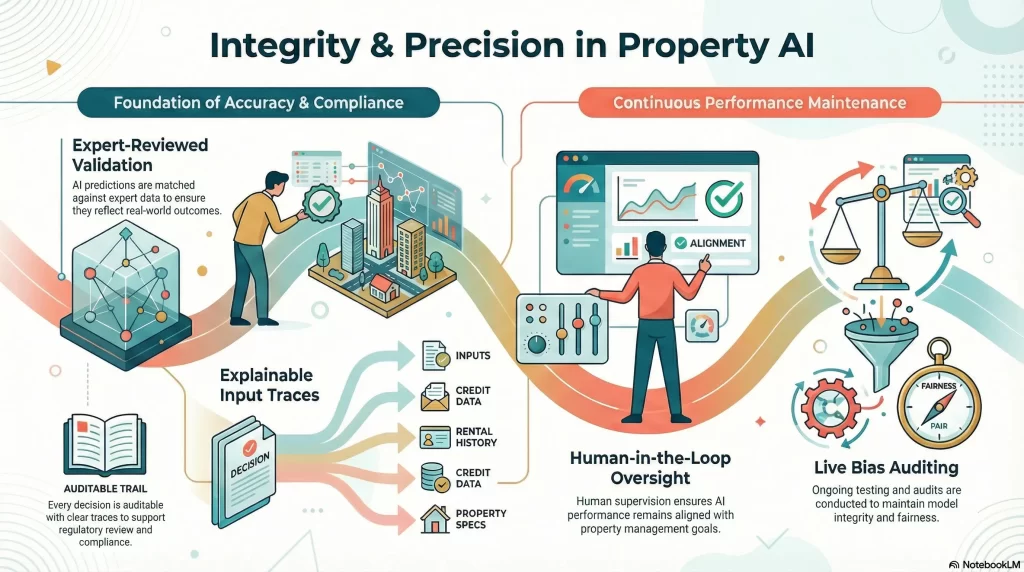

Validating the Accuracy of Property Leasing Intelligence Models

AI property leasing intelligence models are validated by testing them against expert-reviewed data so predictions align with real outcomes. Every decision can be traced back to clear inputs, which may be reviewed for accuracy and compliance.

1. Ground Truth Benchmarking

Before any model goes live, it is measured against a definitive standard.

Process

Expert human annotators, often legal associates or seasoned property managers, create a golden dataset. This includes hundreds of manually reviewed leases with clauses tagged, applicant files with verified fraud flags, and historical tenant data with documented churn outcomes.

Validation Metrics

AI outputs are compared directly against this human expert benchmark using standard evaluation metrics:

- Precision and Recall: For fraud detection, of all applicants the AI flagged as high risk, how many were actually fraudulent? And of all the actual fraudulent applications, how many did the AI catch?

- F1 Score: The harmonic mean of precision and recall, providing a single balanced accuracy metric.

- Mean Absolute Error MAE: For pricing models, this measures how far in dollars the AI-recommended rent deviates from the optimal market-clearing rent on average.

2. Explainability and Auditability

A correct answer is useless if its logic cannot be verified. This is critical for compliance with fair housing requirements and regulations such as the EU AI Act.

Process: Chain-of-thought logging and attention visualization techniques are implemented to surface decision-making reasoning.

Example:

If an AI denies an applicant, the system must log:

*”Denial Reason: Debt-to-Income ratio calculated at 43%.

Source: Bank Statement A (page 2), Pay Stub B.

Threshold per internal policy: ≤40%. Contributing Factor: Two recent late payments reported by the credit bureau.”*

Output: A clear and non-discriminatory audit trail for every significant decision, making AI reasoning transparent and legally defensible.

3. A/B Testing & Champion Challenger Models

The real world changes. A model that is accurate today may drift tomorrow.

Process: The live model, known as the Champion, runs in parallel with a new Challenger model on a small randomized portion of real traffic.

Validation Metrics

Evaluation focuses on business outcomes rather than accuracy alone.

- Does the Challenger pricing model reduce vacancy time?

- Does its churn prediction increase renewal rates?

The model that delivers stronger business KPIs gradually replaces the Champion.

4. Bias Detection and Fairness Audits

An accurate model that disadvantages a protected class is a legal and ethical failure.

Process: Fairness auditing toolkits such as Fairlearn or Aequitas are used to conduct statistical tests across demographic groups where data collection is legally permissible.

Validation Metrics: Disparate impact is evaluated.

For example, approval rates for applicants in Group A and Group B are compared when financial qualifications are equivalent. Regular audits ensure consistent enforcement of fairness standards.

5. Human in the Loop Validation

The strongest validation comes from expert human judgment in live environments.

Process: For high-stakes or low-confidence decisions, such as borderline fraud flags or unusual lease clauses, the system escalates the case to a human expert. The final human decision is fed back into the model as a new training signal.

Validation Metric: Human override rate. A low and stable override rate signals strong model accuracy and alignment with expert judgment. A sudden increase triggers immediate review and retraining.

Can Leasing Intelligence Software Start Without Years of Historical Data?

Property leasing intelligence software can get started without years of history, as it relies on pre-trained industry models and real-time market data from day one. The system may deliver baseline insights early and then learn quickly from human decisions and live outcomes. Within weeks, it can adapt to portfolio-specific behavior and continuously improve accuracy.

Stage 1: Pre-Trained Foundation Models

From day one, the system is not a blank slate. It is built on pre-trained models informed by large-scale, anonymized industry datasets.

Lease Abstraction

The platform uses a large language model trained on millions of public legal documents, regulatory filings, and commercial lease archives.

It understands legal phrasing, clause structures, and financial terminology before processing a single client lease.

Platforms such as EagleEye from MRI Software apply this approach, enabling immediate, accurate lease-term extraction for new customers.

Fraud Detection

Computer vision models are pre-trained on extensive datasets containing both authentic and manipulated financial documents. They detect inconsistencies in fonts, layout, and metadata based on global patterns rather than portfolio-specific history.

Stage 2: Leveraging External and Synthetic Data

When internal data is limited, the system incorporates external signals and simulated scenarios to inform early decisions.

External Data Fusion

Real-time third-party data feeds provide market context.

Pricing and demand signals are pulled from sources such as CoStar, AirDNA for short-term rental comparisons, and local MLS feeds to establish baseline rates, occupancy trends, and seasonality.

Economic and demographic indicators such as employment trends, migration patterns, and interest rate movements are sourced from public datasets to assess macro level risks and opportunities.

Synthetic Data and Simulation

Some platforms generate synthetic data to train models before sufficient real interactions exist.

For example, lead qualification models may be trained using simulated interactions with applicants across varying credit profiles and intent levels, enabling prioritization logic before live leads arrive.

Stage 3: Rapid Learning via Human in the Loop

This phase enables fast portfolio-specific intelligence. The system learns directly from human expertise during daily operations.

The Feedback Flywheel

- Each interaction becomes a training signal.

- The AI recommends an initial rent price based on external market data.

- A leasing manager adjusts that recommendation using contextual knowledge, such as recent renovations.

- The adjustment is captured and fed back into the model.

- Over time, the system learns to apply similar adjustments automatically in comparable scenarios.

Accelerated Specialization

Within weeks, the platform transitions from general industry intelligence to portfolio-specific insight. It learns internal policies, preferred tenant profiles, and competitive positioning without waiting years for historical data to accumulate.

A Practical Timeline: From Day 1 to Day 90

- Week 1: The platform delivers immediate value through accurate lease summaries, baseline fraud screening, and market-informed pricing, powered by pre-trained models and external data sources.

- Month 1: Through consistent human feedback, recommendations begin to align with actual leasing outcomes. Pricing reflects true closing rents, and communication tone adapts to brand standards.

- Month 3: The system operates with tailored intelligence. It identifies high-performing marketing channels for the asset class and detects early churn signals specific to the tenant base.

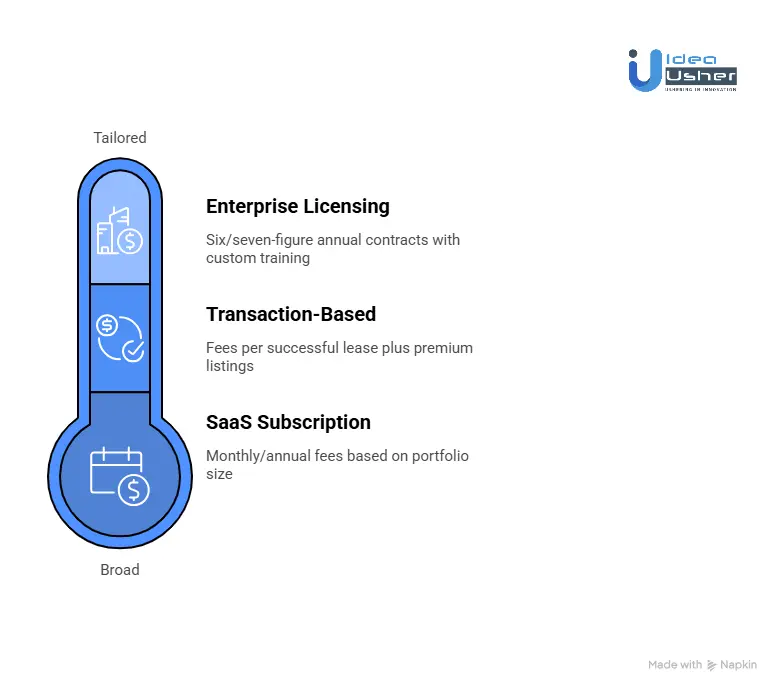

How AI Property Leasing Intelligence Software Generates Revenue?

AI property leasing intelligence software generates revenue by charging subscription or performance-based fees while helping owners lease units faster and price them more accurately. It can reduce losses from vacancies, fraud, and churn by predicting risk early and guiding better decisions.

1. SaaS Subscription Models

Most platforms operate on monthly or annual subscriptions priced by portfolio size, feature depth, and usage.

For example, AI leasing intelligence is bundled with AppFolio’s broader platform and typically priced between $1.25 and $3.00 per unit per month.

A 500-unit portfolio pays roughly $625 to $1,500 per unit, or $312,500 to $900,000 annually. AppFolio reported $621.4 million in revenue in 2023, with its property management segment growing 22 percent year over year.

2. Transaction-Based and Performance Pricing

Some platforms tie revenue directly to outcomes, aligning vendor incentives with client success.

For example, Zumper uses a hybrid model that charges $49 to $99 per successful lease through its Concierge service, in addition to premium listing fees. Industry estimates place annual revenue above $150 million in 2023, with AI-driven matching increasing successful lease conversions by roughly 34 percent.

3. Enterprise Licensing and White Label Deployments

Institutional owners and REITs represent the highest contract values.

MRI Software’s AI leasing solutions, including lease abstraction technology from its Leverton acquisition, are typically sold via six or seven-figure annual enterprise contracts.

These deployments include custom model training and deep integrations. MRI reported roughly $1.2 billion in annual revenue, with AI-powered modules commanding 30 to 50 percent premiums over legacy software.

Top 5 AI Property Leasing Intelligence Softwares

We spent some time digging into the market and came across a few AI property-leasing intelligence software products worth paying attention to. These systems can efficiently manage inquiries, qualify renters, and assist leasing teams with reliable decision logic.

1. EliseAI

EliseAI acts like a digital leasing agent, quietly handling prospect conversations from the first inquiry to tour scheduling. It responds instantly across channels, understands leasing intent, and keeps leads warm without constant human follow-ups. This helps leasing teams reduce response delays while maintaining consistent engagement.

2. Prophia

Prophia focuses on AI-powered lease abstraction and lease data intelligence, helping property owners and leasing teams quickly interpret and manage lease documents. By extracting and structuring key lease information, it speeds up decision-making, mitigates risks, and provides deeper visibility into tenant commitments and portfolio performance.

3. PERQ AI Leasing Assistant

PERQ focuses on leasing intelligence rather than simple automation. Its AI analyzes prospect behavior, engagement patterns, and funnel performance to help teams prioritize high-intent renters. Leasing managers can use these insights to improve conversion rates and reduce time spent on low-quality leads.

4. LeaseHawk ACE AI

LeaseHawk ACE AI supports leasing teams by combining conversational AI with call intelligence. It can answer leasing questions, assist with phone conversations, and guide agents during live interactions. This makes it useful for properties that rely heavily on inbound calls and phone-based leasing.

5. LetHub

LetHub provides AI-driven leasing and operations support for property managers handling multiple assets. It automates lead responses, scheduling, and routine tenant communication while integrating with common property management systems. The platform helps teams stay responsive without expanding headcount.

Conclusion

AI property leasing intelligence software marks a clear shift in how leasing operations may be run in practice. Instead of reacting to demand, teams can gradually rely on systems that predict intent, act autonomously, and quietly protect revenue. For many businesses, this should not be viewed as a simple tool upgrade but as a long-term intelligence layer that steadily learns from portfolio data and improves outcomes across markets and tenants.

Looking to Develop an AI Leasing Intelligence Software?

IdeaUsher can help you build an AI leasing intelligence system that understands lease data and tenant behavior at a deep level. We will design agent-driven workflows that could predict demand flag risk early and support pricing decisions with confidence.

With over 500,000 hours of coding experience and a team of ex-MAANG and FAANG developers, we architect systems that don’t just automate tasks. They think, predict, and act.

Why build with us?

- Specialized AI Agents – From lease abstraction bots to autonomous negotiators

- Forensic Fraud Detection – Catch edited bank statements & synthetic identities

- Predictive NOI Guardrails – Forecast vacancies & optimize pricing in real-time

- Zero-Trust Architecture – Built with compliance (GDPR/CCPA) and explainability at its core

Check out our latest projects to see how we’ve engineered intelligent systems for global clients.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Developing AI leasing intelligence software usually starts by mapping real leasing workflows and identifying where decisions stall or where revenue leaks. Data pipelines must then be built to ingest leads, conversations, tour activity, and lease outcomes in a structured way. Once this foundation is stable, predictive models and agentic workflows can be layered to handle responses, scheduling, and follow-ups while humans retain control over exceptions.

A2: The cost of building AI leasing intelligence software can vary widely depending on the level of automation and the complexity of the data. A focused MVP with core leasing intelligence may cost moderately, while a production system with multi-channel AI agents and compliance controls will require a higher investment. Over time, the value often compounds as the system reduces vacancy loss and manual workload across portfolios.

A3: AI leasing intelligence software typically includes lead qualification, automated responses, tour scheduling, and follow-up orchestration. Advanced systems may also add intent prediction, pricing sensitivity signals, and vacancy risk scoring. These features work together so leasing activity can run continuously with fewer delays and better conversion quality.

A4: The development timeline depends on the scope and readiness of data sources. A basic leasing intelligence system can be delivered in a few months if workflows are well defined. More advanced platforms that support autonomous execution and learning cycles may take longer as models are trained, tested, and safely integrated into live leasing operations.