In finance, every millisecond and decision matters, and institutions must perform faster and more securely than ever before. Traditional automation can follow commands, yet it cannot truly interpret intent or adjust to changing market realities. That’s why many companies are now taking an interest in agentic AI platforms that can reason, plan, and act with measurable autonomy.

These systems can handle operations like credit approvals, compliance checks, fraud detection, and customer portfolio management with remarkable precision. They can analyze risk dynamically and respond to complex scenarios without waiting for human intervention.

Over the years, we’ve collaborated with leading banks and insurance firms to design and build bespoke agentic-AI solutions powered by autonomous decision-agent frameworks and real-time context-driven orchestration engines. Drawing on that experience, we’ve put together this blog to walk you through the key steps in building agentic AI platforms for financial institutions. Let’s dive in!

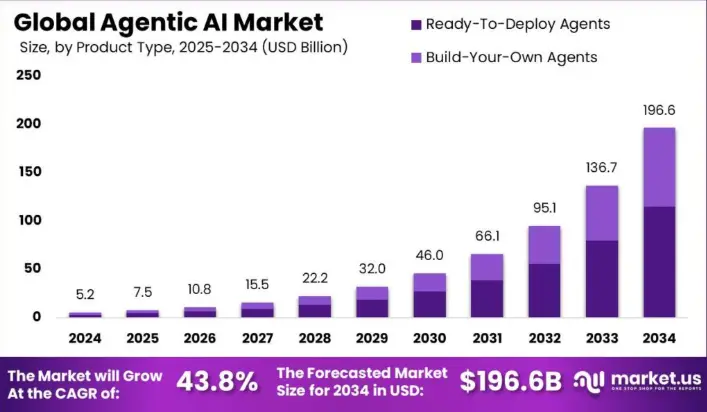

Key Market Takeaways for Agentic AI Platforms

According to MarketUS, the Agentic AI market in finance is accelerating at an extraordinary pace, expected to climb from USD 5.2 billion in 2024 to about USD 196.6 billion by 2034, growing at a 43.8% CAGR. This surge reflects how banks and financial firms are leaning into intelligent, autonomous systems to reduce inefficiencies, detect fraud more quickly, and stay ahead of compliance demands.

Source: MarketUS

Instead of relying solely on manual oversight or static automation, these institutions are turning to AI agents capable of learning, reasoning, and acting autonomously within complex financial environments.

Major players are already seeing the payoff. JPMorgan Chase has begun using agentic AI to refine trading strategies and improve real-time risk detection, allowing teams to respond to market shifts with speed and precision. Meanwhile, ING Group has deployed agent-based systems in its anti-money laundering efforts, giving analysts tools that can process and recognize suspicious patterns across millions of transactions, something traditional systems struggle to achieve at scale.

At its core, this movement signals a deeper transformation in finance. Agentic AI is not just automating tasks; it is redefining how financial institutions operate, blending human oversight with autonomous intelligence. The result is a more adaptive, efficient, and resilient financial ecosystem poised to handle the speed and complexity of modern markets.

Understanding Agentic AI Platforms for Financial Institutions

Agentic AI platforms are advanced systems that move beyond traditional automation or basic generative AI tools. They use autonomous agents capable of reasoning, planning, and completing multi-step tasks across various business functions with minimal human involvement.

In financial institutions, these platforms manage complex processes, including customer onboarding, credit underwriting, fraud detection, and compliance monitoring. By analyzing data and making decisions independently, they help banks improve efficiency, reduce risk, and deliver personalized services, while requiring strong governance and secure data management to maintain accountability and regulatory compliance.

Types of Agentic AI Platforms Used in Financial Institutions

Agentic AI platforms in finance are typically grouped into five categories: personal, process-oriented, hybrid, domain-specific, and infrastructure-based. Each serves a distinct purpose, ranging from improving customer service to automating internal workflows or managing enterprise-wide AI systems.

1. Personal (Customer-Facing) Agentic Platforms

These platforms use intelligent agents to interact directly with customers. They provide services such as payments, budgeting, account management, and financial advice via chat or voice interfaces. Infosys describes them as ecosystems designed to perform actions a person might take to manage their finances.

For example, Erica, from Bank of America, provides personalized financial insights, reminders, and spending analysis. It is evolving into a system that can autonomously manage transactions and recommend financial actions.

Value: Improves customer experience, offers 24/7 service, and reduces operational costs.

2. Enterprise or Process-Oriented Agentic Platforms

These platforms run complex internal workflows across departments such as compliance, lending, and risk management. They make decisions, route tasks, and execute processes with limited human supervision.

For instance, HSBC’s AML Investigation Platform uses agentic AI to detect suspicious activity, retrieve documents, and resolve compliance cases. This allows analysts to focus on more complex investigations.

Value: Delivers faster processing, better compliance, and fewer manual errors.

3. Hybrid or Augmentation Platforms

Hybrid systems support humans rather than replace them. Agents collect and organize information, suggest actions, and manage background tasks while people make the final decisions.

A clear example is Morgan Stanley’s AI Assistant, powered by OpenAI’s GPT models. It helps financial advisors summarize research, draft client updates, and prepare reports, leaving judgment and approval to the advisor.

Value: Enables a smoother path to automation, boosts productivity, and enhances decision quality.

4. Specialist Domain-Agent Platforms

These platforms are tailored for specific business functions such as fraud prevention, treasury operations, or investment analytics. Their agents are trained to recognize domain-specific patterns and act autonomously within strict controls.

Darktrace AI for Financial Services exemplifies this approach. It continuously monitors financial networks, detects anomalies, and automatically responds to potential cyber or fraud threats.

Value: Provides targeted accuracy, reduces risk, and strengthens system security.

5. Platform or Infrastructure Agentic Hubs

These foundational platforms allow financial institutions to build, deploy, and manage multiple agents within a single governance and data framework. They serve as an internal factory for creating and overseeing different AI agents.

J.P. Morgan’s COIN (Contract Intelligence) Platform is a strong example. Originally designed to review contracts, it now hosts multiple autonomous agents that handle compliance checks and process large volumes of documents across the organization.

Value: Offers scalability, consistent governance, and unified control over AI operations.

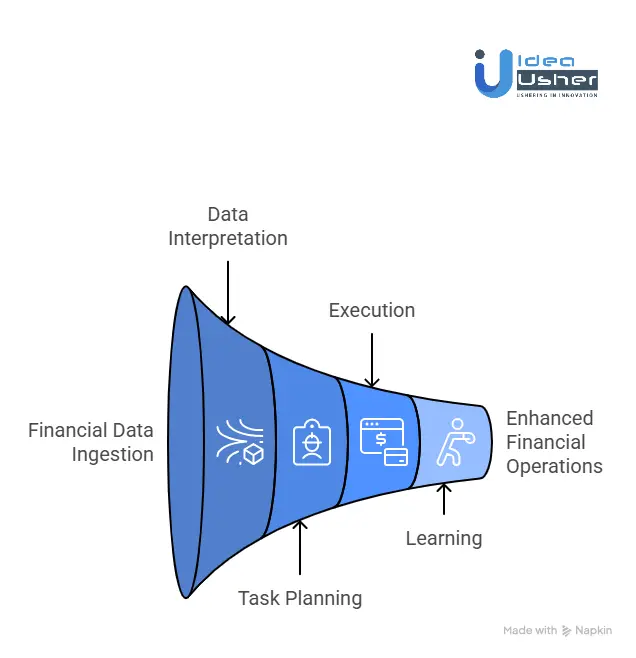

How Do Agentic AI Platforms Work in Financial Institutions?

Agentic AI platforms in finance work by using intelligent agents that can analyze data, plan actions, and execute complex tasks across systems with minimal human input. They can perceive real-time financial information, reason through rules and models, and act securely while following compliance boundaries.

Over time, these systems learn from every decision, allowing them to perform more accurately and efficiently in future operations.

1. Perception: Ingesting and Understanding Financial Data

The process begins with data intake. Agentic AI platforms connect to and interpret information from numerous internal and external sources, including:

- Core banking systems and payment networks such as SWIFT and ACH

- Market data feeds like Bloomberg and Reuters

- Internal CRMs and client portfolios

- Compliance databases and regulatory watchlists

- News outlets and real-time social sentiment streams

This integration gives the platform a unified, real-time view of market conditions, client activity, and institutional exposure.

2. Reasoning and Planning: Coordinated Analytical Intelligence

Once a goal is defined, such as executing a client trade or assessing portfolio risk, an Orchestrator Agent divides the task into smaller components and assigns them to the right agents.

For example, in executing a complex trade:

- A Compliance Agent checks the transaction against risk policies and regulatory constraints.

- A Market Analysis Agent reviews live prices, liquidity, and volatility.

- A Pricing Agent determines the best execution strategy to minimize cost and slippage.

These agents collaborate by combining analytical models, large language models for unstructured insights, and deterministic logic for enforcing financial rules.

3. Action: Executing with Accuracy and Oversight

After validation, the agents move from planning to execution, operating securely across institutional systems.

- The Execution Agent sends trade orders through the Order Management System (OMS).

- The Documentation Agent generates confirmations and updates portfolios automatically.

- The Settlement Agent ensures transactions close accurately and on time.

Built-in guardrails maintain safety and accountability. For instance, if a trade exceeds preset risk thresholds, it is automatically flagged and routed to a human trader for review before proceeding.

4. Learning and Memory: Continuous Optimization

Every transaction, market event, and outcome contributes to the platform’s knowledge base. A vector database stores these experiences, allowing agents to retrieve relevant insights from past activity.

Over time, this learning loop enables the system to answer analytical questions such as, “How did similar trades perform during the last period of high volatility?” It also helps the platform refine decision-making strategies and adapt to evolving market conditions.

How to Build Agentic AI Platforms for Financial Institutions?

Building agentic AI platforms for financial institutions starts with setting clear governance rules and creating a secure multi-agent system that can reason, decide, and act with full traceability. Each agent must operate within strict compliance boundaries while still being able to adapt intelligently to complex workflows.

We’ve built multiple custom agentic AI platforms that power digital operations across industries. Here’s how we approach it.

1. Governance and Policy Architecture

We start by implementing a Dynamic Policy Engine that enforces institutional rules and ensures agents act within regulatory boundaries. Tool-Call Gatekeepers validate every operation before it reaches sensitive APIs. For high-risk decisions, human-in-the-loop checkpoints maintain oversight and transparency.

2. Agentic Framework & Multi-Agent System

We develop a multi-agent framework tailored for financial use cases. Specialized agents like KYC, Risk Evaluation, Credit Decision, and Audit work together through an orchestration layer. Each agent has a clear role, context boundary, and authorization level.

3. Immutable Decision Ledger

We create an Immutable Decision Ledger to capture every decision step, from intent to outcome. This ledger uses secure, blockchain-like storage for tamper-proof traceability. Regulators and auditors can easily reconstruct decisions to ensure full accountability.

4. Build Compliance-Grounded RAG

Our compliance-grounded RAG setup restricts data access to certified internal sources. A Knowledge Gatekeeper ensures retrieval only from approved materials like AML guides, Basel III documentation, and credit policies. Each output includes citations for audit-ready transparency.

5. Legacy Core Banking Systems

We build secure API abstraction layers to connect the AI platform with legacy systems, including COBOL-based cores. Idempotent execution ensures each transaction runs exactly once. Token-based authentication and rate-limiting provide added security and control.

6. Risk Monitoring & Drift Control

We deploy Shadow Monitoring Agents that track fairness, bias, and model drift in real time. When irregularities arise, a failover system triggers human intervention. AI observability dashboards provide clients with continuous insight into system performance and compliance.

Common Challenges to Building Agentic AI Platforms

At our core, we are not just developers; we are problem-solvers for the financial sector. We have been in the trenches, and we know that the grand vision of Agentic AI often collides with the realities of legacy systems, strict regulations, and fragmented data.

The challenge is not just the AI itself; it is the complex environment it must operate in. After architecting platforms for numerous financial clients, we have identified the most pressing challenges and developed battle-tested strategies to address them.

1. The Legacy System Labyrinth

Your most valuable data and mission-critical processes often live inside decades-old mainframes and monolithic applications. These systems were never designed to communicate with modern, API-driven AI platforms. Direct integration is usually risky, time-consuming, and error-prone.

Our Solution: The Strategic Middleware Layer

We avoid costly rip-and-replace projects by building a specialized middleware layer, a set of intelligent microservices that act as translators between legacy systems and modern AI.

These services:

- Modernize Data Access: Expose clean RESTful or GraphQL APIs over outdated protocols.

- Handle Protocol Transformation: Seamlessly convert formats such as JSON to XML, manage screen-scraping for green-screen systems, and extract batch data for real-time processing.

- Ensure Safety: Prevent uncontrolled or unsafe AI calls to critical systems by acting as a secure buffer.

2. The Regulatory Maze

What is compliant in one region may be illegal in another. KYC requirements, data-handling laws, and trade rules vary by jurisdiction. Hard-coding these rules into AI workflows creates complexity, fragility, and the potential for compliance breaches.

Our Solution: The Dynamic Policy Engine

We treat compliance as code, not as an afterthought. By implementing a centralized policy engine (e.g., Open Policy Agent), we make regulations dynamic, testable, and enforceable.

Our approach includes:

- Region-Specific Rules: Automatically apply the right policies based on transaction type, location, and jurisdiction.

- Non-Bypassable Guardrails: Every AI-driven action is validated against the policy engine before execution.

- Agile Updates: Update a rule once in the central policy repository and instantly enforce it across all AI agents.

3. The Data Sovereignty Trap

Data privacy laws such as GDPR and region-specific banking regulations prohibit cross-border transfer of personal or financial data. Centralized AI models that require consolidated data cannot operate legally in such environments.

Our Solution: In-Situ Processing and Federated Learning

We bring computation to the data, not the other way around.

- In-Situ Data Processing: Lightweight AI models are deployed directly within each secure environment, whether in regional clouds or on-premise data centers. These models process data locally and share only anonymized outputs.

- Federated Learning: Global models are trained locally within each data silo, and only the learned parameters (not the raw data) are aggregated centrally to improve the model.

4. The Hallucination Problem

In finance, a hallucinated fact is not just an error; it is a potential compliance breach or financial liability. An AI that invents a figure or cites a non-existent regulation can cause reputational and regulatory damage.

Our Solution: Compliance-Grounded RAG

We treat LLMs as reasoning engines that must be grounded in certified information.

- Strict Retrieval-Augmented Generation: The AI can only generate responses based on verified internal documents such as compliance manuals, approved product data, and real-time market feeds.

- Approved Data Gatekeeping: A gatekeeper layer controls what information the AI can access, filtering out unvetted web content and ensuring every response is backed by trusted, up-to-date sources.

Monetary Benefits of Agentic AI Platforms for Financial Institutions

While the technological promise of agentic AI is compelling, its true value to financial institutions is measured by its financial impact. The move from simple task automation to autonomous, goal-driven systems represents a shift from cost reduction to measurable revenue generation and risk-capital preservation.

1. Direct Cost Reduction

The fastest and most measurable gain from agentic AI comes from reducing operational costs in labor-intensive processes.

Use Case: Automated KYC/AML and Loan Origination

Traditionally, a single KYC check consumes 2–4 analyst hours, while a complex commercial loan can require 20–40 person-hours across underwriting, data collection, and compliance.

Agentic AI agents can autonomously pull data from multiple sources, execute compliance checks, and draft underwriting memos or Suspicious Activity Reports. Human input is reduced to final validation, cutting total process time by roughly 70–80%.

| Process | Annual Volume | Manual Hours/Unit | Total Manual Hours | Annual Labor Cost | AI-Efficient Cost (75% Reduction) | Annual Savings |

| Loan Origination | 5,000 | 30 | 150,000 | $11.25M | $2.81M | $8.44M |

| KYC/AML Review | 10,000 | 3 | 30,000 | $2.25M | $0.56M | $1.69M |

| Total Annual Savings | $10.13M |

Justification:

Kasisto and Akira AI clients have reported 40–60% reductions in operational overhead within a year of deployment. A 75% efficiency gain for structured, high-volume workflows like KYC and loan origination is both conservative and realistic for a well-architected agentic platform.

2. Risk Mitigation

Financial institutions lose billions each year to fraud, compliance penalties, and credit losses. Agentic AI offers continuous, proactive monitoring that preserves both capital and reputation.

Use Case: Fraud Detection and Compliance

Conventional fraud systems react to historical data and static rules, often detecting issues after damage occurs. Agentic AI agents instead monitor transactions and communications in real time, using behavioral analysis and network intelligence to detect evolving fraud patterns.

They also track regulatory updates and internal activity to identify potential breaches before they trigger fines.

| Risk Category | Annual Loss | AI-Driven Reduction | Annual Savings |

| Fraud Losses | $50M | 25% | $12.5M |

| Regulatory Fines | $15M | 50% | $7.5M |

| Total Annual Savings | $20M |

Justification:

SymphonyAI’s Sensa Agents have demonstrated up to a 50% improvement in fraud detection rates. Platforms like Mozn’s agentic AML suite reduce false positives (cutting investigation costs) and increase true positives (reducing fines), directly tying their value to measurable financial outcomes.

3. Revenue Generation

Beyond cost and risk, agentic AI opens the door to new revenue streams through hyper-personalized client engagement and proactive portfolio management.

Use Case: Wealth Management and Client Servicing

Wealth managers typically handle only a limited number of high-value clients. Agentic AI changes this dynamic by deploying “Personal Financial Agents” that continuously monitor markets, life events, and idle assets to trigger personalized, pre-approved strategies.

These agents can reallocate idle cash, suggest tax-efficient trades, or identify cross-sell opportunities, without waiting for a manual prompt.

| Revenue Stream | Calculation | Annual Revenue Increase |

| AUM Growth | 2% of $50B AUM × 1% Fee | $10M |

| Fee-Based Income (Cross-Selling) | — | $50M |

| Total Annual Revenue Increase | $60M |

Justification:

Salesforce’s Agentforce for Financial Services and Interface.ai both highlight measurable uplifts in client retention and cross-sell ratios using autonomous client-service agents. These platforms demonstrate that proactive, always-on engagement directly translates into higher fee revenue and improved client lifetime value.

Summary ROI Outlook

| Benefit Category | Estimated Annual Impact |

| Direct Cost Reduction | $10.13M |

| Risk Mitigation | $20M |

| Revenue Generation | $60M |

| Total Annual Financial Impact | ≈ $90M |

A well-implemented agentic AI platform can deliver $80–$100 million in annual value for a mid-sized bank, combining operational savings, reduced risk exposure, and expanded revenue.

More importantly, these systems enable scalable growth without linear increases in headcount or capital allocation, a fundamental structural advantage in an increasingly margin-compressed industry.

Why 93% of Financial Institutions Aim to Adopt Agentic AI Soon?

A survey by Fenergo found that only 6% of financial institutions have implemented agentic AI, and 93% plan to within the next two years. This surge is not just hype because banks can already see how autonomous systems might streamline compliance, strengthen risk controls, and drive faster decisions.

If you work in finance, you can probably sense how this shift could soon redefine efficiency and competitiveness across the entire industry.

1. Competitive Obsolescence

The landscape has already changed. According to KPMG, 71% of organizations now use AI in their finance functions. Basic automation has become a minimum requirement. The 29% without it are already behind.

Agentic AI takes this further. It is not just a digital assistant for tasks but a system that can perform entire jobs independently, accurately, and quickly.

If a competitor’s AI can process a loan in minutes while your team takes days, you lose clients. If their AI provides 24/7 personalized wealth advice and yours cannot, you lose high-value relationships.

The institutions in this 93% group are not simply adopting new technology. They are building what experts call a Cognitive Moat, a protective edge made of intelligence, efficiency, and adaptability.

In two years, not having Agentic AI will be as limiting as not having online banking was a decade ago.

2. The Unignorable Economic Equation

The business case for Agentic AI is now proven. The financial benefits are too significant to ignore.

Cost Reduction

Financial firms report saving more than $4 million annually in compliance alone through Agentic AI (Fenergo). When extended to loan origination and KYC, total savings for a mid-sized institution can reach $10 to $15 million a year.

Capital Preservation

Proactive risk management powered by Agentic AI helps institutions avoid fraud and compliance fines. Many estimate $20 million or more in preserved capital each year from fewer losses and penalties.

Revenue Growth

Agentic AI drives hyper-personalization at scale. It improves client retention, boosts cross-sell ratios, and increases assets under management. The result can be $50 to $60 million in new annual revenue.

The return on investment is extraordinary. Many institutions project ROI above 800% within three years. For them, Agentic AI has become one of the most profitable investments in their technology portfolio.

3. The Regulatory and Operational Necessity

Finance is becoming more complex every year. Regulations multiply, fraud evolves, and data volumes surge. Legacy systems and manual workflows can no longer keep up.

The Compliance Challenge

Manual compliance is slow and costly. Agentic AI automates regulatory checks and embeds them into daily operations. Each decision becomes explainable, auditable, and aligned with current rules.

The Data Challenge

Financial institutions now handle more data than humans can process. Agentic AI does not just read this data; it interprets it, identifies risks and opportunities, and acts on insights in real time.

Agentic AI is not a futuristic luxury. It is the only scalable way for financial institutions to manage global complexity efficiently, securely, and in full compliance.

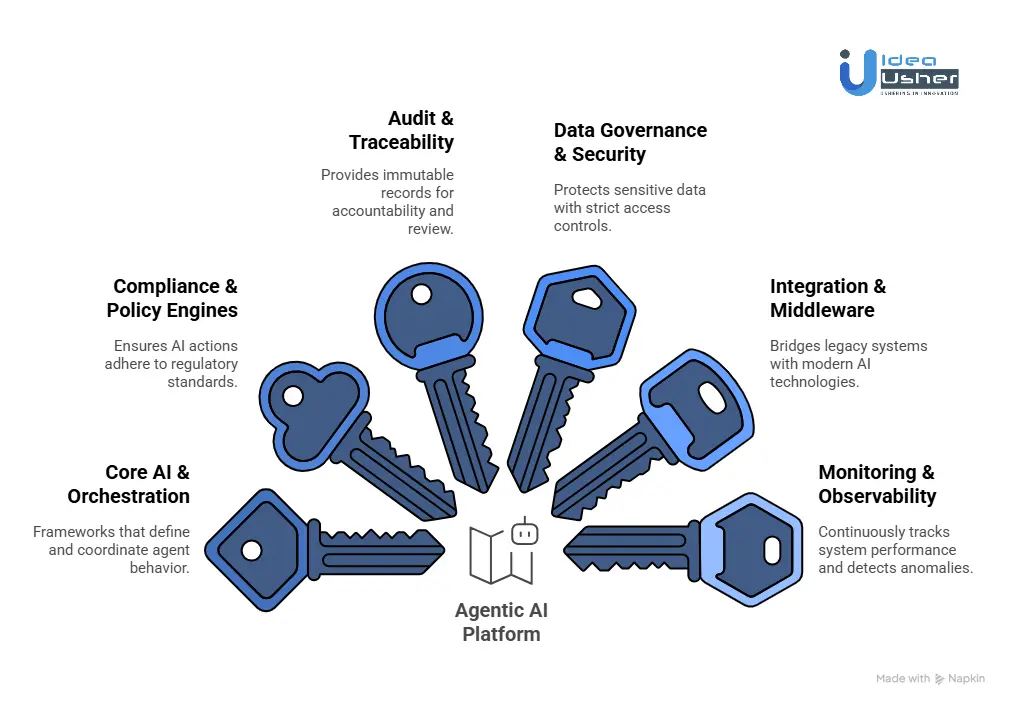

Key Tools to Build Agentic AI Platforms for Financial Institutions

Building an agentic AI platform for finance is not about chasing the latest model. It is about designing a secure, auditable, and compliant system where autonomous intelligence can operate safely. Every tool you choose must be enterprise-grade, interoperable, and governance-ready.

1. Core AI & Multi-Agent Orchestration

This is the brain of the platform, the framework that defines, coordinates, and governs agent behavior.

- CrewAI – Ideal for creating structured, role-based agents such as DataAnalystAgent or ComplianceOfficerAgent. It supports sequential workflows out of the box, making it intuitive for financial processes like loan origination or fraud detection.

- LangChain – The “Swiss army knife” for custom logic and complex integrations. Use it when you need deep control over data flow or unique orchestration patterns.

- Microsoft Semantic Kernel – Best suited for Microsoft-heavy environments. It integrates tightly with Azure AI and .NET, aligning with enterprise compliance and authentication stacks.

- AutoGen – Designed for collaborative, conversational agents. It is perfect for problem-solving scenarios where multiple models debate or cross-validate before reaching a consensus.

Reality check: Ease of use with CrewAI often trades off against flexibility with LangChain. In finance, frameworks that enforce clear role separation and deterministic logic usually work best.

2. Compliance & Policy Engines

This is the deterministic control plane, the part that ensures every AI action passes through a compliance gate.

Open Policy Agent

An open-source standard for policy-as-code. Define rules in Rego, such as: “Agents may only approve loans below $50,000.” OPA enforces these guardrails uniformly across services, ensuring consistent risk control.

Cloud-Native Policy Engines (Azure Policy, AWS Config)

These govern the underlying infrastructure. They verify that environments, data locations, and network configurations comply with regulations such as GDPR or SOX.

3. Audit & Traceability

In regulated finance, “Why was this decision made?” matters as much as “What was decided?”

- Apache Kafka – The event backbone. Every agent action, policy check, or tool call should be logged as an immutable event stream.

- Elastic Stack (ELK) – The user-facing audit interface. Ingest Kafka events into Elasticsearch, and visualize them in Kibana dashboards for compliance review and forensic analysis.

- Hyperledger Fabric – A heavier option, but invaluable for legally binding records or shared transaction logs where multiple parties need verifiable immutability.

4. Data Governance & Security

Agents must operate under strict data boundaries, seeing only what they are allowed to.

- API Gateways / PrivateLink (AWS, Azure) – Securely expose internal data sources via private connections, eliminating public endpoints.

- Data Loss Prevention (DLP) APIs – Services like GCP DLP or Microsoft Purview automatically scan and redact sensitive fields such as PII or account numbers before data reaches a model.

- Confidential Computing (Nitro Enclaves, Azure Confidential VMs) – Encrypts data even during processing. This is the gold standard for safeguarding sensitive workloads from insiders and co-tenants.

5. Integration & Middleware

Most financial institutions still rely on a mix of mainframes and modern cloud systems. Middleware can help your AI agents interact safely with both by managing the complexity behind the scenes. Tools like MuleSoft or Apigee handle authentication and traffic flow, while GraphQL lets agents pull only the exact data they need much more efficiently.

6. Monitoring & Observability

Autonomous systems demand continuous oversight.

- Prometheus & Grafana – Track API latency, task success rates, and system health. Trigger alerts on anomalies or degraded performance.

- Weights & Biases / MLflow – Core to MLOps. Track experiments, manage model versions, and monitor long-term performance.

- Evidently AI – Detects data and model drift in real time. This is crucial for spotting when live financial data begins to deviate from the model’s training distribution.

Top 5 Agentic AI Platforms for Financial Institutions

We have explored and evaluated some of the most capable agentic AI platforms built for financial institutions. You might find these solutions interesting because they can actually plan, reason, and execute with real precision across complex financial workflows.

1. Anthropic – Claude for Financial Services

Anthropic’s Claude for Financial Services and Agent SDK enable banks to build safe, auditable, and autonomous agents that integrate with internal and market data systems. Its agentic workflows support multi-step reasoning and planning, while financial institutions like Citi have already adopted Claude for its reliability, governance, and compliance-ready design.

Key capabilities:

- Connects internal + external data feeds (financial/market data).

- Agentic workflows: planning, reasoning, and enterprise integration.

- High emphasis on safety, governance, and auditability.

2. Unique AI – Purpose-built for Financial Services

Unique AI focuses exclusively on financial services automation, offering pre-built, audit-ready agents for investment research, due diligence, KYC, and onboarding. Its secure platform integrates seamlessly with leading data providers (like FactSet and LSEG), allowing wealth and asset managers to customise agents for compliance-sensitive workflows.

Key capabilities:

- Pre-configured agents for investment, KYC, and compliance tasks.

- Secure platform with customisation via SDK.

- Integrations with financial data sources and CRM systems.

3. Symphony AI – Financial Crime / Compliance

Symphony AI’s Sensa Agents deliver autonomous compliance and financial crime management for banks by automating multi-step workflows such as transaction monitoring and case management. The platform’s agentic automation enhances decision-making, ensuring faster detection, routing, and actioning of suspicious activity under strict regulatory oversight.

Key capabilities:

- Automates complex FinCrime and compliance workflows.

- Enables agents to make decisions, flag, and route actions.

- Strong focus on auditability and regulatory integration.

4. Gradient Labs – Regulated Industries

Gradient Labs is a specialised startup focused on bringing agentic AI to regulated sectors such as banking, offering autonomous customer operations agents for tasks such as onboarding, dispute resolution, and compliance. Its agility and domain-specific design make it attractive for institutions seeking adaptive automation in sensitive financial workflows.

Key capabilities:

- Agents for regulated customer operations and back-office workflows.

- Designed for automation in high-risk, high-volume environments.

- Tailorable architecture for financial institutions.

5. KPMG International – Workbench for Financial Services

KPMG’s AI Workbench is a multi-agent platform developed within its advisory framework, giving financial institutions access to agentic automation backed by KPMG’s governance, audit, and risk-management expertise. It provides an enterprise-ready foundation for AI transformation in compliance-heavy environments.

Key capabilities:

- Multi-agent architecture for audit, tax, and advisory tasks.

- Strong governance and compliance controls.

- Integrated advisory and implementation support.

Conclusion

Agentic AI is opening a new chapter for financial institutions where intelligence works hand in hand with accountability. When you build systems grounded in governance and transparency, you can transform complex compliance workflows without losing trust or control. At Idea Usher, we can help you design and deploy secure and scalable Agentic AI platforms that will let your business move confidently toward governed autonomy in the modern financial landscape.

Looking to Develop Custom Agentic AI Platforms for Financial Institutions?

At IdeaUsher, we can help you design and build custom agentic AI platforms that truly fit the needs of modern financial operations. Our team would develop secure, compliant, and context-aware systems that can automate analysis, detect risks, and optimize decision-making in real time.

You could rely on us to engineer scalable architectures that integrate smoothly with your existing financial systems and data pipelines.

Why partner with us?

- Deep Expertise: Leverage our 500,000+ hours of coding experience and ex-MAANG/FAANG talent.

- Financial-Grade Build: We specialize in the non-negotiable: audit trails, compliance guardrails, and legacy system integration.

- Proven Delivery: We turn complex challenges into robust, production-ready solutions.

See the proof. Explore our portfolio and let’s build your advantage.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A2: Agentic AI goes beyond prediction and recommendation by taking autonomous actions within defined governance rules. It can reason through complex financial logic and make policy-aligned decisions that traditional AI models would only suggest, making operations faster and more accountable

A2: Yes, they are designed with a compliance-first mindset where every action is traceable and reversible. You can maintain full auditability while keeping human oversight in the loop, ensuring systems meet strict regulatory standards without reducing efficiency.

A3: They can integrate seamlessly through secure APIs and idempotent middleware that ensures data consistency across systems. This approach allows legacy cores to interact safely with modern agentic frameworks while maintaining performance and operational stability.

A4: Industries like insurance, asset management, and compliance operations can use Agentic AI to automate governed workflows. These systems can adapt to domain-specific regulations and deliver precise, accountable automation that enhances both control and productivity.