Artificial Intelligence (AI) is the branch of computer science that involves developing intelligent machines that can perform tasks that usually require human intelligence, such as learning, decision-making, and problem-solving. In recent years, AI has emerged as a game-changer in various fields, including risk management.

AI has completely revolutionized the field of risk management by providing new tools and techniques that enable organizations to better manage and mitigate to-be happening risks. One of its advantages is its ability to analyze vast amounts of data quickly and accurately. This data can come from various sources, such as historical data, social media feeds, news articles, and other relevant sources.

Some exciting facts:

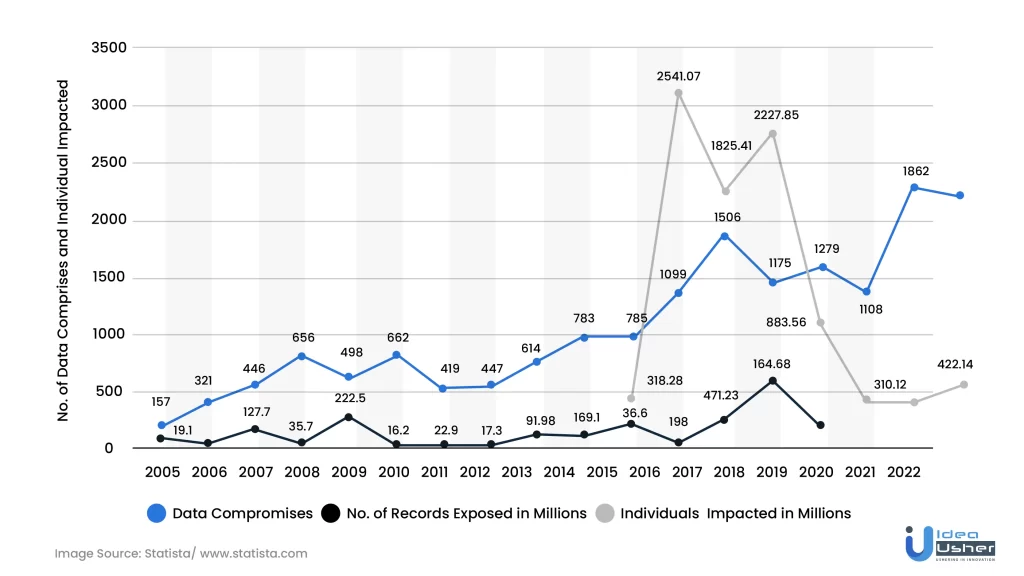

- In 2022, approximately 1802 data compromise incidents occurred in the US.

- Over 422 million individuals were affected by data compromises in the US in 2022.

- Healthcare, financial services, and manufacturing were the industries with the most data breaches in 2022.

- The largest data leakage was experienced by an adult streaming website, CAM4, with almost 11 billion records exposed.

- Yahoo’s data breach in 2013 is the second largest, with three billion records leaked.

- India’s national identification database Aadhaar had over 1.1 billion records exposed in March 2018.

Annual US Data Compromises & Individuals Impacted (2005-2022):

AI-powered risk management tools can also help organizations to identify patterns and trends that are not immediately apparent to human analysts. By analyzing these patterns and trends, organizations can gain insights into potential risks and take action to mitigate them before they become more significant.

AI can also help organizations automate, streamline and monitor their risk management processes. This can help reduce the time and effort required to identify and assess risks and improve the accuracy of risk assessments.

Understanding Risk Management

Risk management involves identifying, assessing, and controlling potential risks that an organization or individual may face in their business or personal activities.

It involves analyzing potential risks, implementing mitigation strategies, and monitoring their effectiveness. The objective of risk management is to reduce the likelihood of potential losses and increase the chances of achieving business goals.

Different Types of Risks

There are various types of risks that an organization or individual may face, including but not limited to operational, financial, reputational, legal, strategic, and compliance risks.

- Operational risks refer to the risks associated with an organization’s internal operations, such as system failures, human errors, fraud, and regulatory compliance.

- Financial risks relating to the potential loss of financial assets or income include market volatility, credit risk, liquidity risk, and counterparty risk.

- Reputational risks arise when an organization’s actions or inactions result in a negative perception among stakeholders, customers, and the general public. These risks can lead to losing trust, customers, and market share.

- Legal risks are associated with the potential legal consequences of an organization’s actions or inactions, such as lawsuits, fines, and regulatory penalties.

- Strategic risks relate to the potential impact of an organization’s strategic decisions on its long-term goals and objectives.

- Compliance risks arise from failing to comply with laws, regulations, and industry standards.

Importance of Risk Management

Risk management has become increasingly critical for organizations to survive and thrive in today’s rapidly changing business environment. Effective risk management enables organizations to identify potential risks, mitigate them, and seize opportunities that arise from them. It also helps organizations to minimize losses, protect their reputation, and maintain regulatory compliance.

Furthermore, effective risk management helps organizations make informed decisions and allocate resources effectively. It enables organizations to evaluate the potential impact of various risks on their operations and plan accordingly. Effective risk management also allows organizations to identify emerging risks and adapt their strategies accordingly.

Five cases of ineffective risk management

Managing risks involves identifying potential risks, assessing their likelihood and impact, and implementing measures to mitigate them.

However, as we all know, things don’t always go according to plan. In fact, there have been many infamous cases throughout history where risk management has failed, resulting in disastrous consequences.

Let’s look at five such infamous cases of ineffective risk management in history. These cases serve as cautionary tales, reminding us of the importance of effective risk management in all aspects of life.

Enron Corporation

Enron was an energy company that became infamous for its fraudulent accounting practices.

In 2001, the company filed for bankruptcy after it was revealed that it had hidden billions of dollars in debt and inflated earnings. This resulted from poor risk management practices, including inadequate internal controls, oversight by the board of directors, and a culture that encouraged unethical behavior.

Wells Fargo

In 2016, it was discovered that Wells Fargo employees had opened millions of fake accounts in customers’ names without their consent. This was done to meet unrealistic sales targets the company’s management set.

The scandal resulted in a $185 million fine and the resignation of the company’s CEO. The incident resulted from poor risk management practices, including insufficient oversight, a lack of accountability, and a failure to prioritize ethical behavior.

Volkswagen

In 2015, it was discovered that Volkswagen had installed software in its diesel engines to cheat emissions tests. This allowed the company to claim that its vehicles met environmental standards when they did not.

This scandal too resulted in a $4.3 billion fine and the resignation of the company’s CEO. This resulted from poor risk management practices, including a lack of oversight, insufficient internal controls, and a culture prioritizing profits over ethics.

Target

Target suffered a massive data breach in 2013 that exposed millions of customers’ personal and financial information.

The breach was a result of poor risk management practices, including inadequate security measures, insufficient oversight, and a failure to prioritize data privacy. The incident resulted in an $18.5 million settlement with 47 states and the District of Columbia.

Equifax

The Equifax data breach in 2017 was one of history’s largest and most significant. The breach exposed the personal information of over 147 million people, including their names, birth dates, social security numbers, and other sensitive data. The hackers could access millions of people’s personal information, and the breach was not discovered for several months.

The company faced multiple lawsuits and investigations, severely damaging its reputation. Equifax also had to pay millions of dollars in compensation to affected individuals, and the breach had a lasting impact on people’s credit scores and financial security.

How AI is Transforming Risk Management

The world witnessed firsthand the transformative power of AI and automatic techniques and tools — with machine learning, natural language processing, and predictive analytics revolutionizing the way organizations identify, assess, and mitigate risks.

- Machine learning algorithms can analyze vast amounts of data quickly and accurately, enabling organizations to identify patterns and trends that may not be immediately apparent to human analysts. These algorithms can also learn from historical data and predict future risks, allowing organizations to take proactive measures to mitigate those risks.

- Natural language processing (NLP) enables organizations to analyze unstructured data, such as news articles and social media feeds, to gain insights into potential risks. NLP algorithms can identify and extract relevant information from these sources and classify them according to their relevance and potential impact on the organization.

- Predictive analytics is another powerful tool used in risk management. It involves analyzing historical data and using statistical models to predict future events. Predictive analytics can help organizations to identify potential risks, assess their likelihood and impact, and develop strategies to mitigate them proactively.

Benefits of AI in risk management

The benefits of using AI in risk management are vast and diverse, with numerous applications for managing various types of risks. In this section, we will discuss some critical benefits of using AI in managing information security risks, reducing enterprise risks, fraud detection, improving data classification, and reducing false positives.

Managing Information Security Risks

Artificial Intelligence (AI) and Machine Learning (ML) offer effective solutions for mitigating data privacy and security risks businesses face in managing their information security.

Companies store a lot of sensitive data that cybercriminals target, and employees may also flout data ethics, putting confidential and sensitive data at risk. Traditional information security solutions have limitations in mitigating new risks, identifying potential risks, and analyzing various indicators for risk identification.

However, AI and ML systems can collect and analyze vast amounts of data from the operating environment to detect relevant patterns and gather insights about emerging cybersecurity threats.

This can help organizations to respond quickly and effectively to potential security threats, reducing the risk of data breaches and other security incidents.

Using Artificial Intelligence and Machine Learning to Manage and Reduce Enterprise Risks

AI-powered risk management solutions can help organizations to manage and reduce enterprise risks. For example, machine learning algorithms can be used to analyze historical data and identify patterns and trends that may indicate potential risks. This can help organizations to take proactive measures to mitigate those risks before they become more significant.

Using AI Risk Management Solutions for Fraud Detection

AI-based risk management solutions can effectively detect and prevent fraud by monitoring incoming data and learning from historical patterns to identify potential threats. AI algorithms can adjust their rules to detect and prevent new types of fraud, reducing the number of false positives and improving accuracy.

By using AI for fraud detection, businesses can block malicious bots and prevent common types of fraud, including card fraud, fake account creation, account takeover, and credential stuffing.

AI-based solutions are lightweight, fast, and unobtrusive, improving risk management without negatively impacting user experience or website performance.

Improving Risk Management in Enterprises by Improving the Classification of Data

AI-powered data classification not only helps organizations to organize their data into relevant subgroups but also identifies and categorizes sensitive information for optimized security efforts. This allows companies to focus their security resources on protecting their most sensitive data, reducing overall risk, and increasing visibility into all data collected, stored, and transmitted.

With AI, enterprises can also automate the data classification process, making it faster and more efficient. This enables companies to identify and respond to potential security threats quickly, preventing unauthorized access and data breaches.

In addition to risk reduction, AI-powered data classification helps organizations comply with various privacy regulations, such as HIPAA, PCI DSS, GDPR, and GLBA. By classifying data according to regulatory requirements, companies can ensure they are following all applicable rules and avoiding penalties for non-compliance.

Behavioral Analytics and Anomaly Detection

Anomalies in network access can create unwanted traffic flow in organizational networks. It can be caused by unauthorized access by users, such as using an IP address belonging to another company or accessing organizational IPs from outside the network.

Such activities can compromise data integrity and expose sensitive business information to third-party networks. In addition, remote access users may connect to office networks from personal networks while traveling or working from home.

Even after leaving an organization, some users may still access the company network if their access is not properly revoked.

To address this issue, organizations can use User Entity Behavior Analytics (UEBA) and Data Visualization tools to monitor user profiles, network usage data, IP addresses, location of access, and company affiliation over time. This approach can help classify user activities into normal usage patterns and anomalies, enabling organizations to identify potential security threats and take appropriate action.

Reduced False Positives

False positives are a significant issue in security, leading to teams becoming overwhelmed with irrelevant alerts, which can result in complacency.

To reduce false positives, teams can leverage better tools to create the context for more sophisticated rules and automated workflows. This includes using sensitivity and specificity to identify cases that need further investigation and mitigate the limitations of any specific test.

A more automated process for streamlining the security policy lifecycle can improve over time, and manual steps should be minimized to avoid alert fatigue and missing essential indicators. Teams can also use a layered approach to integrate data from multiple sources and create a standard data pipeline for correlating security data.

It’s crucial to keep in mind that there are always trade-offs between tools, and no security tool will catch every incident. However, teams can use AI-powered observability tools to train better rules automatically and reduce false positives.

Potential Challenges and Risks of AI in Risk Management

Ethical and Legal Challenges

While AI can potentially improve risk management practices significantly, it also presents particular ethical and legal concerns that must be addressed.

One potential challenge of using AI in risk management is the issue of “bias“.

AI models are only as unbiased as the data they are trained on, and if that data is biased, then the model will be biased as well. This is especially concerning in risk management, as biased models could lead to unfair treatment of certain individuals or groups. To mitigate this risk, it is important to thoroughly examine the data used to train AI models and ensure it is representative of the entire population.

“Privacy” is another ethical concern when it comes to AI in risk management.

Collecting large amounts of data about individuals could potentially violate their privacy rights. It is important to have strong data security measures in place to protect this sensitive information from unauthorized access or use. This is especially important in heavily regulated industries, such as healthcare and finance.

“Data security“ is also a major concern when it comes to AI in risk management.

Hackers and cybercriminals could potentially gain access to sensitive information, such as financial data or personal health information, and use it for malicious purposes. To mitigate this risk, it is important to have strong security protocols in place, such as encryption and multi-factor authentication.

Another challenge of using AI in risk management is the potential for the model to be manipulated. Hackers could potentially feed false data into the model, leading to inaccurate risk assessments. It is important to have measures in place to detect and prevent this type of manipulation.

Technical Challenges

In addition to ethical and legal concerns, many technical challenges are also associated with using AI in risk management. One challenge is the need for large amounts of high-quality data to train AI models effectively. This data must be clean, labeled, and representative of the entire population. Without this data, AI models may not accurately predict risks.

Another technical challenge is the need for computational power to train and run AI models. These models can be computationally intensive and require significant resources to run effectively. It is important to have the necessary infrastructure in place to support these models.

The future belongs to those who prepare for it today.

Malcolm X

Strategies for mitigating risks and addressing concerns

It is important to implement certain strategies to mitigate the above-identified risks and address ethical and legal concerns. One strategy is having a diverse team working on AI models. This team should include individuals from a variety of backgrounds and experiences to ensure that bias is minimized.

Another strategy is to be transparent about using AI for managing risks. This includes being transparent about the data used to train the models and the assumptions made by the model. This transparency can help build trust with customers and stakeholders.

To address technical challenges, investing in the necessary infrastructure to support AI models is important. This includes having high-quality data storage and processing capabilities and the necessary computational resources to run these models.

Conclusion

As digitalization, information technology, and finance evolve, so will AI’s role in risk management. With its ability to quickly analyze vast amounts of data and identify potential risks and opportunities, AI is becoming an increasingly important tool for financial institutions of all sizes.

But it’s not just about the technology itself – it’s about how we use it. By combining the power of AI with human expertise, we can create a more effective, efficient, and comprehensive approach to risk management. This means taking a collaborative approach, leveraging the strengths of both humans and machines to achieve the best possible outcomes.

By staying informed, embracing new technologies, and working together, we can help to build a safer, more secure future for us all.

Get in touch with us now!

Build Better Solutions With Idea Usher

Professionals

Projects

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQs

Q) How is AI used in risk management?

A) AI is used in risk management to identify potential risks, analyze data, and predict future risks. Machine learning algorithms can analyze vast amounts of data to detect patterns and anomalies humans may miss. AI can also automate certain risk management processes, allowing for faster and more accurate decision-making.

Q) How is AI used in risk management in banks?

A) In banks, AI analyzes customer behavior, detects fraud, and identifies potential risks. AI algorithms can analyze large amounts of transaction data to detect patterns that may indicate fraudulent activity. AI can also be used to automate compliance monitoring, allowing banks to identify and mitigate risks related to regulatory compliance more effectively.

Q) How do you build risk management in AI development?

A) To build effective risk management into AI development, it’s essential to start by identifying potential risks and assessing their likelihood and impact. From there, developers can build risk mitigation measures such as data validation, error handling, and automated testing. It’s also important to monitor and evaluate the effectiveness of risk management measures throughout the development process.

Q) Why AI is both a risk and a way to manage risk?

A) AI is both a risk and a way to manage risk because while AI can help identify and mitigate potential risks, it also introduces new risks, such as bias and data privacy concerns. It’s important to use AI responsibly and ethically and to implement appropriate risk management measures to mitigate these new risks.

Q) How do you mitigate risks with AI?

A) To mitigate risks with AI, it’s important to implement appropriate risk management measures throughout the development and implementation process. This includes validating data, building in error handling and testing, monitoring for bias and other ethical concerns, and implementing appropriate security measures to protect against data breaches and other cybersecurity risks. It’s also important to regularly review and evaluate the effectiveness of risk management measures to ensure they remain up-to-date and effective.