In this blog, we will understand in detail the difference between AI stock trading vs. human stock trading.

AI brings different strengths and weaknesses when it comes to trading stocks. Computers are constantly outperforming humans in stock trading.

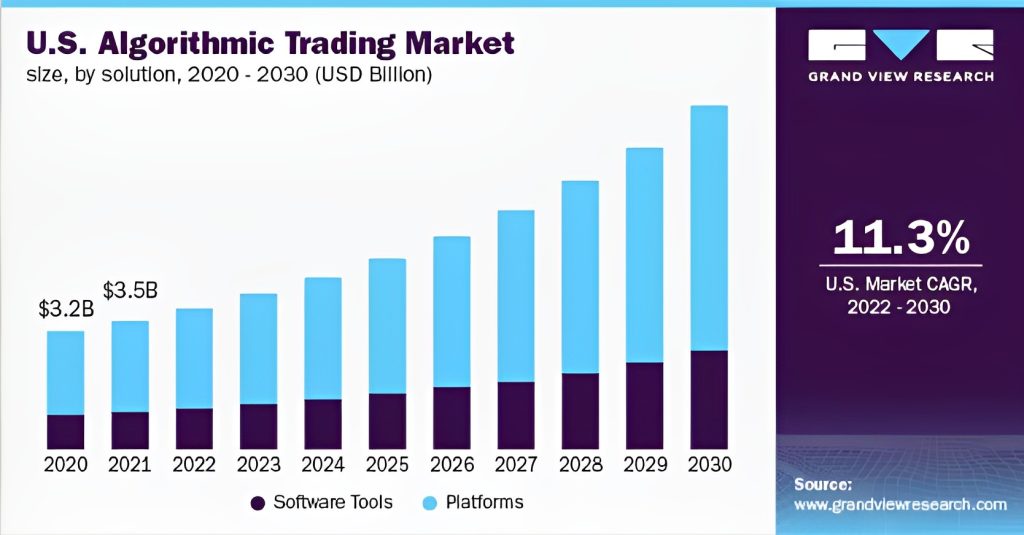

The algorithmic trading market is growing on a massive scale, indicating a better opportunity for investors and entrepreneurs to build their AI stock trading software.

Source: Grandviewresearch

The worldwide algorithmic trading industry was worth USD 3.5 billion in 2021 and is predicted to increase at a compound annual growth rate (CAGR) of 11.3% between 2022 and 2030.

Also, artificial intelligence brings strength to trade stocks because of the absence of human emotions and its ability to trade consistently.

In the following sections, we will highlight a key difference between AI and human stock trading.

How Does AI Trading Work?

The software works as an automated trading system allowing users to establish a set of trading rules that the software executes without human interference. The trading software automates and streamlines the entire trading process.

AI trading software makes decisions on behalf of information provided by traders, such as price movements, trade orders, etc.

The software interprets and merges traditional market signals and machine learning models to decide whether or not it’s a good trading opportunity and executes after meeting certain conditions.

Based on the trading platform, investors can use technical indicators to determine trading conditions and execute them. Technical indicators are trading tools that predict future price movements based on stock volume and price.

When creating custom trading software, traders and investors may need to work closely with programmers to develop a system and ensure its smooth functioning.

AI Stock Trading vs. Human Stock Trading- Key Differences

When comparing AI vs. human stock trading, the difference is clear. With artificial intelligence stock trading, users can trade multiple markets simultaneously with proper discipline.

Human stock trading comprises multiple challenges, such as maintaining trading psychology, breaking the rules, being unable to monitor the market continuously, etc. Understand how automation benefits traders and investors.

1. Involvement of human emotions

Automated trading removes the involvement of human emotion, giving them a better edge in executing trade even after certain losses.

On the other hand, humans may demotivated after certain losses that prevent them from taking the next trade (which may be their next winning trade).

Psychology plays a vital role in trading, where human emotions are a big hurdle for traders to succeed.

Poor psychology management in major trading challenges such as overtrading, fear of execution, breaking trading rules, revenge trading, etc.

2. Following trading rules

Artificial intelligence takes trades based on indicators, price changes, or any specific rules guided by traders and investors.

As we discussed, AI has no emotions. The software takes trade continuously without breaking the rules (giving better trading results in the longer term).

On the other hand, inexperienced traders are most likely to break the rules and take random trades when they can’t find trades based on their trading system, resulting in continuous losses.

3. Ability to take consistent trades

Trading software can monitor market movements all the time, which is not possible for humans to track and trade every market move continuously.

Trading consistently enables trading software to catch every market move, making them profitable.

4. Ability to monitor multiple markets

Markets such as stocks, forex, cryptocurrencies, etc, comprise multiple tradable assets that need to be monitored continuously to find any profitable trading opportunities.

There are many challenges to multiple markets for humans, and humans may be unable to monitor every move of multiple tradable assets.

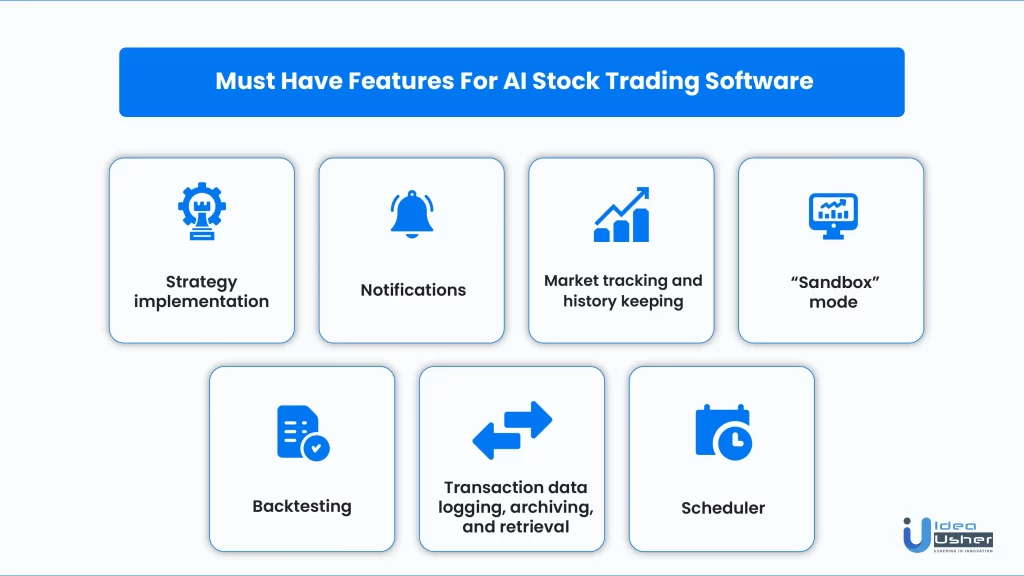

Must Have Features For AI Stock Trading

The features decide the functionality of trading software that helps traders to trade multiple assets in an automated way.

Explore essential features that are required for every artificial intelligence stock trading software.

1. Strategy implementation and dynamic changing

The feature will enable AI to perform a particular trading strategy. Artificial intelligence is flexible to change the strategy depending on its efficiency.

2. Market tracking and history keeping

These two features will enable artificial intelligence to collect market data for reference and trade analysis. The information will help machines to develop new algorithms and improve old ones.

Also, the feature will let trading software represent data reports as charts or graphs.

3. Transaction data logging, archiving, and retrieval

The feature keeps a historical record of all transactions carried out by trading software. Customers can track their past financial transactions to determine their profit/loss statements.

4. Notifications

Traders can receive notifications on their email addresses, SMS messages, or mobile app. The notification will inform traders regarding the price change or any specific trading event set by users.

5. Backtesting

Backtesting will let you try a new strategy by simulating the outcomes using past data from tracking markets. The feature involves market fees, latency, and other aspects that help track particular trading strategies.

6. “Sandbox” mode

The feature is helpful for traders to test their trading skills in real market conditions without risking their money. Sandbox mode creates a virtual trading environment that places a trade on price movement for real markets such as stocks, crypto, stocks, etc.

7. Scheduler

The scheduler allows the software to operate anonymously during specific user-defined periods. The software wakes up the device to start running and go back to sleep mode or turns off the power after the expiration of a certain time period.

Technical Requirements For AI Stock Trading

Implementing trading strategies using algorithms and programming is the final component of trading software. To create your trading software, there are certain technical requirements that you need to meet.

- Computer programming skills to program the necessary trading strategy

- Access to trade platforms and network connectivity to track the market price and execute trades

- Access to market data to help software identify trading opportunities

- Backtesting functionality to measure the efficiency of trading strategy before implementing them with live trading account

How To Get Started With AI Stock Trading?

You can start artificial intelligence trading by following the given steps.

1. Understand the fundamentals of stock trading

If you are new to trading, it would be best to know the basics of stock trading, such as technical analysis, risk management, trading psychology, and other essential topics.

If you are interested in trading penny stocks, you can explore the best apps.

2. Choose the appropriate stocks

Good quality stocks have high volume and greater liquidity. You can research different stocks and pick the best one for your trade.

Moreover, we suggest you include an index (a group of top-quality stocks) as tradable assets in your list as they offer high volume and greater liquidity.

3. Select your trading strategy

Multiple good strategies have a high win rate which can be profitable for your trading career. You can explore different trading strategies and can implement them in your trading software.

By backtesting with a demo account, decide whether to run single or multiple strategies with your trading software. You can consider trading strategies such as:

- Trend following strategies

- Arbitrage opportunities

- Index fund rebalancing

- Mathematical model-based strategies

- Trading Range (Mean Reversion)

- Percentage of volume (POV)

4. Build your AI trading software

We recommend you create custom trading software to take trades based on your predetermined rules and conditions.

Having your software will benefit you with multiple advantages, such as having full control over your trading system, no potential risk of scams, making new changes to your software (based on your trading needs), and much more.

5. Select tech stack

A proper selection of tech stack needs expertise in developing artificial intelligence software.

It would be best to consult development companies that build trading software for their clients. However, we recommend the following tech stack for building your trading software.

| Expertise | Tech Stack |

| DL Frameworks | PyTorch, MXNet, Nvidia Caffe, Caffe2, Chainer, Theano |

| Modules/Toolkit | Microsoft Cognitive Toolkit, Core ML, Kurento’s computer vision module |

| Libraries | OpenNN, Neuroph, Sonnet, Tensorlfow, Tensor2Tensor, tf-slim |

| Algorithms | Supervised/unsupervised learning, Clustering (density-based Hierarchical, partitioning), Metric learning, Few-shot learning |

| Neural Networks | CNN, RNN, Representation learning, Manifold learning, Variational autoencoders, Bayesian networks, Autoregressive networks |

6. Outsource your work to AI developers

To create your trading software, you will need expertise and experience in programming for artificial intelligence development that only full-time developers can have.

Therefore, we recommend you outsource your project to app development companies, as they can build custom trading software based on your trading needs. Know how to hire AI developers in detail.

7. Backtest your software on a demo account

After creating your trading software, you must backtest it on a demo account to test its efficiency for the real market.

Backtesting will let you know the win rate of a particular trading strategy you want to use with your software.

After getting positive results with your trading software, you can go for real trades.

8. Run your trading software with the live trading account

It’s time to fund your real trading account. Ensure that you are not putting too much capital for the first time.

Once you get confidence after experiencing multiple profits with your trading software, you can increase the capital of your trading account to make bigger profits.

Are You Interested in AI Stock Trading?

One way to identify a future trend in stock trading is to compare the efficiency of artificial intelligence algorithms to human traders.

To create your profitable AI stock trading algorithm, you must outperform the best human traders in the market.

You can build your trading app by leveraging the expertise of artificial intelligence development companies like Idea Usher.

The team comprises AI developers proficient in deep learning, natural language processing, and semantic analysis.

You can write your stock trading app development requirements or schedule a free consultation call with our team to learn more about how we can help create your trading software.

Contact Idea Usher

Build Better Solutions With Idea Usher

Professionals

Projects

Email:

Phone:

FAQ

Q. How do I get started with AI trading?

A. You can follow the given steps to get started:

- Know the basis of stock trading

- Pick up the right stocks

- Select your trading strategy

- Build your artificial intelligence trading software

- Outsource your work to developers

- Backtest your software on a demo account

- Use a real trading account to run your trading software

Q. Can AI trade better than humans?

A. AI can trade better than humans with proper risk management and better trading strategies.

Also, machine intelligence in trading offers additional advantages such as better trading psychologically, taking consistent trades, fast trading execution, trading multiple markets simultaneously, etc.

Q. What are the essential features of AI stock trading software?

A. The automated trading software includes features such as strategy implementation and dynamic changing, Market tracking and history keeping, Backtesting, Sandbox mode, Scheduler, Transaction data logging, archiving, retrieval, and Notifications.