Digital payments work well for large transfers, but they can break down when value becomes small and frequent. Paying a few cents, tipping creators, or settling micro services often feels inefficient and costly. That’s why Bitcoin Lightning wallets have been gaining a lot of attention, as they can support creator tips, subscription billing, in-app purchases, and real-time service payments.

These wallets also offer instant finality, low transaction fees, QR-based invoicing, and near-real-time balance visibility. The shift did not come from hype but from everyday payment behavior failing at scale. Lightning introduced near-zero fee transfers with instant settlement.

Over the years, we’ve developed numerous types of Bitcoin Lightning wallets, powered by Lightning Network infrastructure and cryptographic payment channels. As we have this expertise, we’re writing this blog to discuss the steps to develop a Bitcoin Lightning wallet. Let’s start!

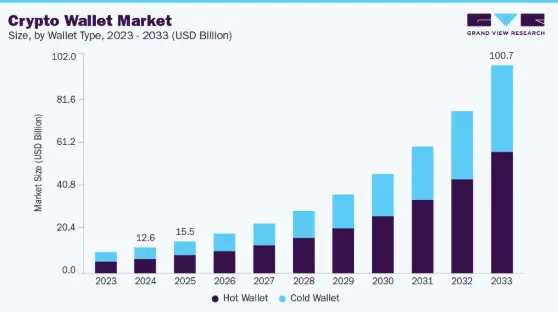

Key Market Takeaways for Bitcoin Lightning Wallets

According to Grand View Research, the crypto wallet market is entering a strong growth phase, driven by wider acceptance of digital assets beyond trading. Valued at USD 12.59 billion in 2024, the market is expected to cross USD 100 billion by 2033, growing at over 26 percent annually. This momentum reflects how wallets are evolving into everyday financial tools, with Lightning-enabled Bitcoin wallets emerging as a practical solution for fast and low-cost payments.

Source: Grand View Research

Bitcoin Lightning wallets are gaining traction as the network matures. By early 2026, public Lightning channel capacity reached around 5,600 BTC, showing real demand for instant micropayments and cross-border transfers.

These wallets solve Bitcoin’s base-layer speed and fee limitations, making them attractive for retail payments, remittances, and DeFi use cases where efficiency matters.

User and institutional adoption is being shaped by a new generation of products. Wallet of Satoshi focuses on simplicity, offering a smooth experience for both on-chain and Lightning payments.

Phoenix Wallet appeals to advanced users through self-custody and automated channel management while running a full Lightning node on mobile.

On the enterprise side, BitGo’s 2025 partnership with Voltage marked a key step by enabling Lightning payments directly from regulated custody, signaling growing confidence in Lightning for professional and large-scale use.

What is a Bitcoin Lightning Wallet?

A Bitcoin Lightning wallet is a wallet that connects to the Lightning Network, a Layer 2 protocol built on Bitcoin that enables instant, low-cost payments. Instead of recording every transaction on the Bitcoin blockchain, it moves payments off-chain through private payment channels while still using Bitcoin for final settlement and security.

This allows Bitcoin to be used for everyday transactions like small purchases, tipping, and real-time payments without long confirmation times or high fees.

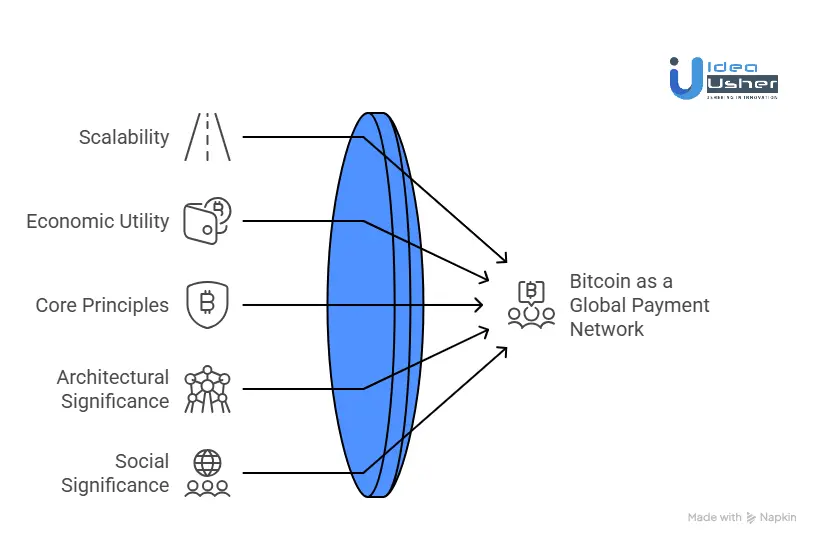

The Strategic Importance of the Lightning Network in Bitcoin

The Lightning Network strengthens Bitcoin by enabling real payments without weakening its base-layer security. It may scale transaction capacity through off-chain channels while keeping final settlement anchored to Bitcoin. This quietly turns Bitcoin from a passive store of value into an active global payment network.

1. Solving Bitcoin’s Scalability Trilemma

The classic blockchain trilemma posits a trade-off between decentralization, security, and scalability. Bitcoin’s base layer (Layer 1) prioritized decentralization and security, sacrificing transaction throughput (7-10 transactions per second). This made everyday payments slow and expensive during periods of congestion.

Lightning’s Resolution:

By moving the vast majority of transactions off-chain into payment channels, Lightning achieves massive scalability with theoretical support for millions of transactions per second across the network.

This is done without compromising Layer 1’s decentralization or security. The base chain remains the immutable, secure settlement layer, acting as the supreme court, while Lightning functions as a high-speed lower-court system for daily transaction settlement.

Significance: It proves that a decentralized monetary network can scale to serve billions, preserving Bitcoin’s core ethos while making it practically usable.

2. Transforming Bitcoin’s Economic Utility

Bitcoin’s primary narrative has been a store of value or digital gold. Lightning fundamentally expands this role to include a medium of exchange.

Enabling Micropayments and New Economic Models:

With fees measured in fractions of a cent, Lightning enables transactions that were previously uneconomical. This unlocks several new use cases.

- Streaming Money: Pay-per-second models for API calls, video streaming, or cloud computing.

- Content Monetization: Small creator tips, such as $0.10 without fees consuming most of the value.

- Machine-to-Machine Economy: IoT devices or AI agents autonomously transact small amounts of value.

Making Bitcoin Spendable Without Selling It:

Previously, spending Bitcoin required an on-chain transaction with unpredictable fees and confirmation delays, making it unsuitable for everyday purchases.

Lightning allows savings to remain in cold storage on Layer 1 while maintaining a separate spending balance on Lightning. This strengthens Bitcoin’s role as a long-term savings asset while enabling daily payments.

3. Reinforcing Bitcoin’s Core Principles

Contrary to some criticisms, Lightning does not weaken Bitcoin’s principles. It reinforces and evolves them.

| Bitcoin Principle | How Lightning Reinforces It |

| Peer to Peer | Enables users to route payments and earn fees, increasing network decentralization. |

| Permissionless | Channels can be opened without banks or identity verification. |

| Censorship Resistant | Onion routed-payments prevent transaction blocking in transit. |

| Sound Money and Finality | Payments settle instantly with cryptographic finality. |

4. The Architectural & Social Significance

A Blueprint for Blockchain Scaling:

Lightning pioneered the Layer 2 approach now adopted across the broader crypto ecosystem, including rollups on Ethereum. It demonstrates that complex state channels can operate securely on top of a simple and robust base layer.

Shifting Trust from Institutions to Code:

Traditional finance relies on trust in banks and intermediaries to maintain accurate records. Lightning replaces institutional trust with cryptography and incentive design. The revocable commitment model with penalties makes dishonest behavior economically irrational.

Democratizing Finance at the Infrastructure Level:

Anyone with a low-cost device and Bitcoin can operate a routing node, earn fees, and contribute to network resilience. This enables a bottom-up, user-owned financial system that contrasts sharply with the centralized and corporate-controlled structures of traditional finance.

Types of Bitcoin Lightning Wallets

Bitcoin Lightning wallets generally fall into a few clear categories based on who controls the keys, how channels are managed, and the level of technical effort required. Here is a clean breakdown that works well for technical and business readers.

1. Custodial Lightning Wallets

In custodial wallets, a third party manages the user’s private keys and Lightning channels. These wallets focus on ease of use and instant onboarding. Payments feel fast and simple because channel liquidity and routing are handled by the provider. The tradeoff is trust, since users do not fully control their funds.

A well-known example is the Wallet of Satoshi, which is widely used for quick Lightning payments.

2. Non-Custodial Lightning Wallets

Non-custodial wallets give users full control over their private keys. The wallet manages Lightning channels locally or through a personal node. This model aligns strongly with Bitcoin self-custody principles. It requires greater understanding but offers greater security and independence.

Phoenix Wallet is a common example, as it automatically manages channels while keeping keys in the user’s control.

3. Node-Based Lightning Wallets

These wallets connect directly to a self-hosted Lightning node. Users run their own Bitcoin and Lightning infrastructure, and the wallet acts as an interface. This setup provides strong control over routing, liquidity, and fees. It is commonly used by advanced users and operators.

Zeus Wallet is a popular choice for managing a personal Lightning node from a mobile device.

4. Hosted Node Lightning Wallets

Hosted node wallets sit between custodial and full self-hosting. The user controls the keys, but the Lightning node itself runs on managed infrastructure. Channel operations and uptime are handled externally while ownership remains with the user. This model reduces operational complexity.

Breez Wallet is a strong example, offering non-custodial access through hosted infrastructure.

5. Mobile First Lightning Wallets

Mobile Lightning wallets are optimized for daily payments. They abstract channel management and often use smart techniques to keep balances usable. Their main goal is speed, reliability, and a smooth user experience for small-value transactions.

Muun Wallet fits this category well, blending on-chain and Lightning payments into a single mobile flow.

6. Enterprise and Merchant Lightning Wallets

These wallets are designed for businesses accepting Lightning payments. They include features like invoice management, accounting exports, API access, and multi-user controls. Reliability and liquidity management are prioritized for scale.

BTCPay Server is a widely adopted example that gives merchants full control over Lightning payments.

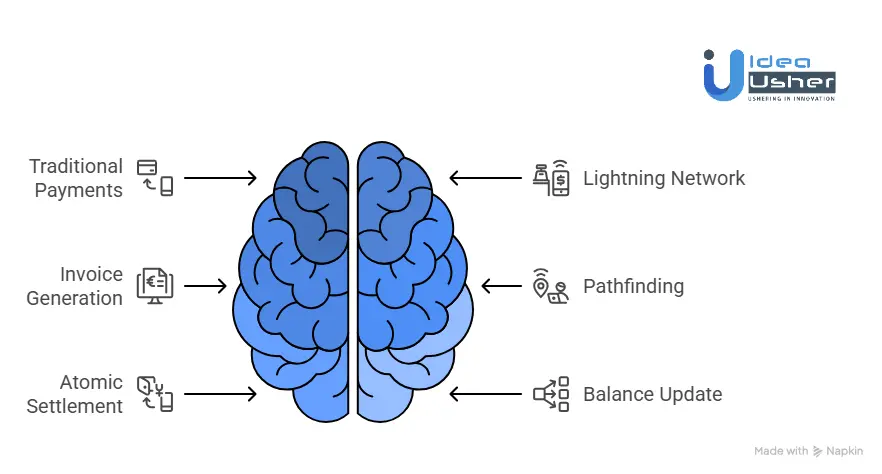

Cross-Border Payment Flow in Bitcoin Lightning Network Wallets

A Bitcoin Lightning network wallet can move value across borders almost instantly by treating payments as encrypted data instead of bank transfers. The wallet may find a live payment route, lock funds with cryptographic contracts, and settle the transaction in seconds with minimal fees.

Global payments can be processed efficiently while funds remain non-custodial and free of traditional settlement delays.

The Traditional Cross-Border Quagmire

To appreciate the breakthrough, consider the old way:

- Initiation: You visit a bank or service like Western Union, provide recipient details, and pay upfront fees (5–7% on average).

- The Black Box: Your money enters a multi-day labyrinth of intermediary banks, each taking a cut, performing compliance checks, and converting currencies at unfavorable rates.

Settlement: 3–5 business days later, a reduced amount is received. Total cost includes high fees, poor exchange rates, and significant opportunity cost of time.

Total Time: 2–5 Days.

Total Cost: Often 5–10% or more.

The Lightning Cross-Border Process

Let’s assume Alex in the US and Zinhle in South Africa are already using Lightning wallets with active channels and sufficient liquidity.

Step 1: Invoice Generation

Zinhle, the recipient, needs to request payment. She does not share sensitive bank details. Instead, she generates a Lightning Invoice in her wallet.

This invoice (lnbc…) contains the exact amount in satoshis (Bitcoin’s smallest unit), a payment hash (cryptographic puzzle), an expiry time (for example, 1 hour), and optional routing hints.

Key Difference: The amount is denominated in Bitcoin, instantly creating a neutral, global settlement asset. No USD-to-ZAR conversion is needed within the payment layer.

Step 2: Pathfinding & Routing

Alex scans Zinhle’s QR code. His wallet now performs a silent, real-time process.

Decode & Parse: It decodes the invoice, showing the amount (e.g., 50,000 sats ≈ $20) and the payment hash.

Map the Network: His wallet consults its view of the Lightning Network’s public channel graph shared via gossip protocols. It sees a decentralized mesh of nodes across the globe.

Find a Route: Using a pathfinding algorithm such as a privacy-enhanced Dijkstra’s, it searches for a path of connected, liquid channels from Alex’s node to Zinhle’s node. This path may hop through nodes in Germany, Nigeria, and Kenya in milliseconds. The algorithm optimizes for the lowest fees and the highest reliability.

Step 3: Atomic, Multi-Hop Settlement

This is the core innovation. The wallet does not send money along the path. It creates a conditional, self-enforcing contract chain.

HTLC Creation: Alex’s wallet constructs a Hashed Timelock Contract (HTLC). The contract states:

“Pay 50,200 sats (50k plus cumulative fees) to the next node if they can reveal the secret that generates Zinhle’s payment hash within 24 hours.”

Onion Routing: This HTLC is encrypted layer by layer at each hop. Node 1 (Germany) can only see:

“Forward this to Node 2 (Nigeria). You will get a 100 sats fee.”

It cannot see the final destination or the total amount.

Propagation & Secret Revelation: The onion propagates hop by hop across borders, each node committing its funds forward conditionally. When it reaches Zinhle’s wallet, she provides the preimage, the secret key to the hash. This proves payment completion.

Atomic Unlock: The pre-image travels back along the route. Each node uses it to claim the funds from the previous node. All hops settle simultaneously in under two seconds. If any hop fails, all fail, and funds are returned, eliminating settlement risk.

Step 4: Balance Update & Channel Rebalancing

The process concludes off-chain.

- For Alex: His channel balance with his first-hop node decreases by 50,200 sats.

- For Intermediate Nodes: Their channel balances adjust, earning tiny routing fees (for example, 50–200 sats total).

- For Zinhle: Her channel balance with her last-hop node increases by 50,000 sats.

Post-Process: Wallets may later run automated rebalancing via submarine swaps to refill depleted channels, ensuring readiness for the next payment.

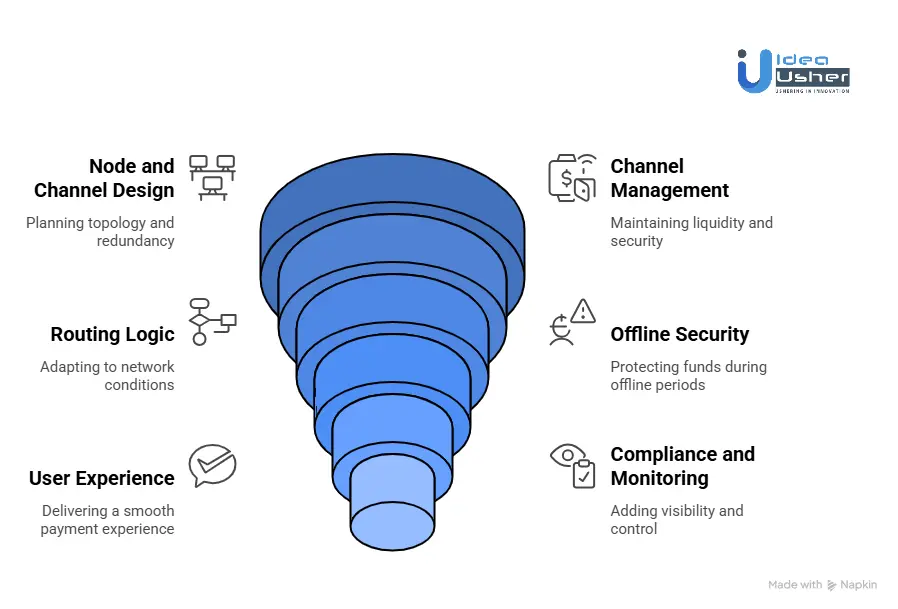

How to Develop a Bitcoin Lightning Wallet?

Developing a Bitcoin Lightning wallet usually starts with setting up reliable nodes and a channel strategy that can handle real payment flow. The system should actively manage liquidity, routing, and security even during offline periods.

We have built multiple Bitcoin Lightning wallets in production, and this is how we design and implement them.

1. Node and channel design

We start by choosing between self-hosted Lightning nodes and managed infrastructure based on the client’s scale and control requirements. Channel topology is planned to support expected payment flows and volume. Redundancy and failover paths are built in early to avoid payment interruptions.

2. Channel management

Our channel logic is designed to maintain liquidity balance and availability. We implement automated flows to open, rebalance, and close channels as usage changes. HTLC handling and timeout rules are carefully configured to protect funds. Continuous liquidity monitoring helps reduce failed payments.

3. Routing logic

We build routing systems that adapt to changing network conditions. Probabilistic pathfinding improves payment success rates across the Lightning Network. Fee-optimization models control routing costs without compromising reliability. Retry and fallback logic allow payments to recover from failed routes.

4. Offline security

We design security measures that protect users even when nodes are offline. Watchtowers are integrated or deployed in-house to monitor channel activity. Fraud detection logic enforces penalties for invalid state broadcasts. This layer ensures funds remain safe during offline periods.

5. User experience

We abstract Lightning complexity to deliver a smooth payment experience. Unified balances combine on-chain and Lightning funds in a single view. BIP 21 QR codes simplify payment flows. Submarine swaps enable seamless movement between on-chain Bitcoin and Lightning.

6. Compliance and monitoring

For enterprise clients, we add strong visibility and control layers. Audit logs capture transaction metadata for operational tracking. Reporting tools support regulatory and accounting needs. Role-based access controls help teams manage risk at scale.

What Happens if a Lightning Node Goes Offline During a Transaction?

If a Lightning node goes offline mid-payment, the transaction can safely pause because it is locked by cryptographic conditions. The funds may either be completed once both sides sync again or expire and return automatically after the timelock. You should see a clear success or failure when you reconnect, and your balance will update correctly without loss.

Scenario 1: The Recipient Goes Offline

Let’s take, for example, you are sending a payment to Bob. You scan his invoice and tap send, but Bob’s wallet loses its internet connection while the payment is routing through the network.

What Happens

- Your wallet attempts the payment using HTLCs, also known as Hashed Timelock Contracts.

- The conditional payment enters a pending state across the routing path.

- If Bob’s wallet does not come back online to claim the payment by revealing the secret, the HTLC expires after its timeout window, typically 24-40 hours.

- The funds automatically return to you along the original route. No funds are lost.

User Experience

Your wallet shows a payment failed message after retry attempts. Your balance remains unchanged. You can retry the payment once Bob is back online.

Scenario 2: The Sender Goes Offline During Routing

This case is slightly more complex. Your wallet initiates a payment, but your node goes offline before the process completes.

What Happens

If offline before the final recipient confirms,

The payment never completes. The HTLCs expire naturally, and funds return to the appropriate channel balances. When you reconnect, your wallet shows a failed transaction, and your balance is unchanged.

If offline after the payment completes but before confirmation reaches you,

This is the optimistic case. The recipient may already have received the funds, but your wallet missed the final success message. When you reconnect, your wallet synchronizes with channel peers and updates the channel state. You then see the payment as completed.

The Real Risk: Being Offline During a Channel Breach Attempt

The most serious offline risk is not related to mid-payment drops. It occurs when a node stays offline for a long period, and a malicious channel partner attempts to cheat.

The Attack Vector: Old State Fraud

- You have an open channel with Mallory. The current balance is You: 0.05 BTC, Mallory: 0.05 BTC.

- You pay Mallory 0.01 BTC. The new state is You: 0.04 BTC, Mallory: 0.06 BTC. You exchange revocation keys for the old state, rendering it invalid.

- You go offline for a week.

- Mallory broadcasts the old commitment transaction (You: 0.05, Mallory: 0.05) to the Bitcoin blockchain, trying to steal back 0.01 BTC.

Your Defense: Watchtowers

This is where Watchtowers become essential for a production-grade Lightning wallet. Watchtowers are third-party services or self-hosted servers that monitor the Bitcoin blockchain continuously on your behalf.

How They Work

You provide the watchtower with encrypted breach remedy data and a pre-signed justice transaction. If the watchtower detects an outdated channel state being broadcast, it immediately publishes the penalty transaction.

Result

All channel funds are awarded to you as a penalty against the attacker. Cheating becomes economically irrational. Your funds remain protected even while your wallet is offline.

A professional Lightning wallet should always integrate watchtower support or provide a managed watchtower service by default.

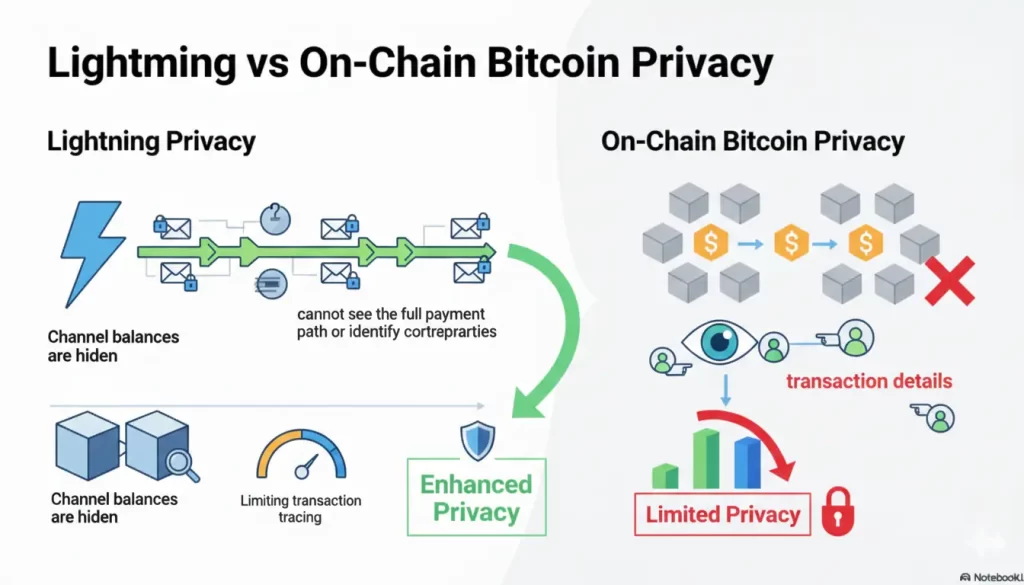

How Lightning Preserves Privacy Compared to On-Chain Bitcoin Transactions?

Lightning keeps most payments off the blockchain, so transaction details never become permanent public records. Payments move through encrypted routing hops, meaning intermediaries see only the previous and next nodes in the path. Wallets may also obscure balances and timing, making it difficult to reconstruct who paid whom or how much.

On-Chain Bitcoin: The Transparent Ledger

First, it is important to understand the baseline. On-chain Bitcoin offers pseudonymity, not anonymity.

Every transaction is public

Anyone can see the amount sent, sender address, receiver address, and the exact timestamp.

Address clustering is trivial

Sophisticated chain analysis firms such as Chainalysis and CipherTrace can algorithmically link addresses to real world identities by analyzing transaction patterns, exchange interactions, and IP metadata.

Permanent exposure

Once broadcast, transaction data is immutable and globally available forever.

Privacy Weak Points on the Chain

- Amount transparency: Alice paid Bob 1.2 BTC on Jan 15th at 14:30 UTC.

- Social graph mapping: If Alice’s identity is ever linked to a single address, her entire transaction history can be traced.

- Timing analysis: Transaction times can be correlated with real-world events.

Lightning’s Multi-Layered Privacy Architecture

Lightning addresses these weaknesses through three core mechanisms: off-chain settlement, onion routing, and balance obfuscation.

1. Off-Chain Settlement

This is the most significant privacy upgrade. The vast majority of Lightning transactions are never published to the blockchain.

Only net results are public: The Bitcoin blockchain records only the initial channel open and the final channel close. It has no visibility into the potentially thousands of payments that occur in between.

Take the Muun wallet, for example. When you pay a friend via Muun’s Lightning integration, neither the payment amount nor the recipient is recorded on the blockchain. Only if the underlying channel is later settled does a net balance appear on the chain, keeping the detailed payment history hidden.

2. Onion Routing

This is Lightning’s core privacy mechanism during routing. When you send a payment, it is wrapped in multiple layers of encryption and forwarded across several nodes.

Each node knows only its immediate neighbors: One node knows where the payment originated and where it must forward it next. No single node can see the full payment path from sender to receiver.

Consider a wallet like Breez. When it routes a payment, it relies on Lightning’s onion routing. Even if you pay a merchant in another country, intermediate routing nodes cannot determine that you are the original sender or identify the final merchant. They only process encrypted forwarding instructions.

3. Balance Obfuscation and Probabilistic Pathfinding

The Lightning Network’s gossip protocol announces channel capacity but never individual balances.

Pathfinding is probabilistic: Wallets attempt routes based on partial information. They can estimate whether sufficient liquidity exists, but they never see exact balances on either side of a channel.

On-chain contrast

On-chain, every UTXO balance is fully visible. A wallet like Phoenix by ACINQ demonstrates this well. Observers can see that the Phoenix node has channels with a certain total capacity, but they cannot see how much belongs to a specific user or how much any individual payment was.

Privacy Comparison at a Glance

| Privacy Aspect | On-Chain Bitcoin | Lightning Network |

| Transaction amounts | Public forever and visible on block explorers | Private and known only to sender and receiver |

| Counterparty identity | Pseudonymous but linkable | Hidden from intermediaries through onion routing |

| Transaction graph | Fully public and analyzable | Private between channel partners |

| Timing data | Exact public timestamp | Known only to the channel counterparty |

Top 5 Bitcoin Lightning Wallets in the USA

We have done some digging and found strong Bitcoin Lightning wallets that could work well in real-world use cases. Each option handles speed custody and routing a bit differently, which may matter depending on how Lightning is used.

1. Wallet of Satoshi

Wallet of Satoshi is a custodial Lightning wallet designed for simplicity and speed. It lets users send and receive Lightning payments instantly without setting up channels or managing keys. This makes it popular in the USA for everyday Bitcoin payments and quick onboarding.

2. Muun Wallet

Muun is a self-custodial Bitcoin wallet that seamlessly combines on-chain and Lightning transactions. It abstracts the complexity of Lightning while keeping users in full control of their private keys. The wallet is widely trusted in the USA for secure payments with a clean user experience.

3. BlueWallet

BlueWallet is a flexible Bitcoin wallet that supports Lightning through hosted services or by connecting to a personal node. It is non-custodial on the Bitcoin layer and offers advanced options for users who want more control. Many US users prefer it for its balance of usability and technical depth.

4. ZEUS Wallet

ZEUS is a non-custodial Lightning wallet built mainly for power users and node operators. It connects directly to a user’s own Lightning node and provides deep visibility into channels and routing. In the USA, it is commonly used by users who actively manage Lightning infrastructure.

5. Phoenix Wallet

Phoenix is a self-custodial Lightning wallet that automatically manages channels in the background. Users can make Lightning payments easily while still holding their own keys. It is popular in the USA for those who want Lightning convenience without giving up self-custody.

Conclusion

Bitcoin Lightning wallets are no longer experimental. In 2025, they represent a serious payment infrastructure choice for businesses seeking speed, cost efficiency, and global reach. Building one requires deep protocol knowledge, careful liquidity planning, and enterprise-grade security. With the right development partner, businesses can launch Lightning wallets that generate revenue and scale with demand.

Looking to Develop a Bitcoin Lightning Wallet?

IdeaUsher helps develop a Bitcoin Lightning wallet by first understanding the payment model and risk profile, ensuring the architecture scales safely from day one.

Our team can design non-custodial flows with automated channel management and Lightning-native security that typically perform reliably under high transaction loads.

Why Partner with Us?

- 500,000+ Hours of Expertise. Our ex-MAANG and FAANG veterans do not just write code. They solve the hard problems. Automated liquidity. Headless APIs for AI agents. Enterprise-grade security with MPC and watchtowers.

- Beyond Fast. We build wallets that manage themselves. JIT channels and submarine swaps enable a seamless user experience. PTLC-ready architecture prepares your platform for next-generation privacy.

- From Concept to Compliance. We ensure your non-custodial wallet is built for the real world. This includes strategies for regulatory clarity and robust audit trails.

Let us build a wallet that does not just move money. It transforms your business model.

Check out our latest projects to see the future built.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Bitcoin Lightning payments usually settle in milliseconds, which can feel almost instant in real usage. This speed comes from off-chain payment channels that avoid global block confirmation delays. Compared to card networks or bank rails, this can dramatically reduce waiting time and settlement uncertainty.

A2: A Bitcoin Lightning wallet can be safe for enterprise use when it is designed with strong operational controls. Proper channel management, watchtowers, and secure key storage should actively reduce fraud and downtime risk. With the right setup, enterprises can confidently handle production-level payment flows.

A3: Lightning wallets are built to handle high-frequency transaction patterns efficiently. By keeping most activity off-chain, the network can process thousands of small payments without congesting Bitcoin itself. This makes Lightning suitable for scalable micro payment and retail use cases.

A4: Businesses can monetize Lightning wallets through small routing fees that scale with volume. They may also offer premium features, APIs, or managed services for merchants and platforms. Over time, this can create predictable revenue without adding friction to payments.