Real estate has always felt like an exclusive market that demanded high capital and patience, and most new investors could never break in. Even with modern investing tools available in finance and crypto, the property space stayed slow and traditional. Now, blockchain and smart contracts are finally changing how ownership can function. Investors can verify ownership on the chain and interact with assets without lengthy manual processes. At the same time, features such as automated dividend distribution, identity verification, and regulated token issuance make the system reliable.

Fractional real estate token platforms enable people to own small fractional shares of property in a structured, compliant way. Transfers can happen more quickly, and secondary-market trading can make previously locked assets liquid. What once required substantial capital and rigid time commitments is now evolving into a programmable, accessible investment model.

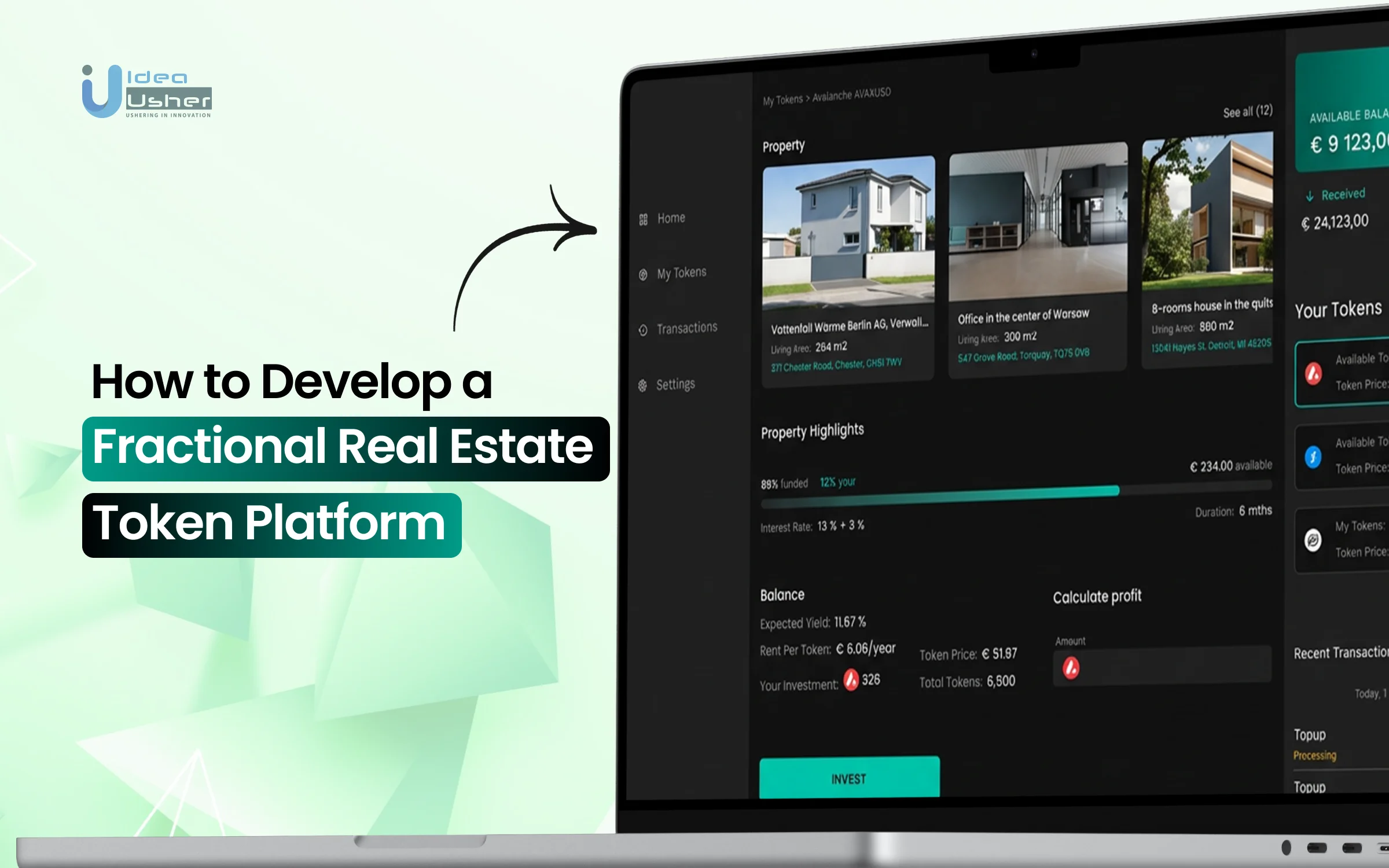

We’ve developed several fractional real-estate investment solutions over the years using distributed ledger technology and decentralized identity frameworks. Since IdeaUsher has this expertise, we’re putting together this blog to walk you through the steps to develop a fractional real estate token platform. Let’s begin.

Key Market Takeaways for Fractional Real Estate Token Platforms

According to CustomMarketInsights, the fractional real estate tokenization market is entering a strong growth phase, with demand accelerating from both retail and institutional investors. Current forecasts project a market valuation of roughly USD 3.5 billion in 2024, growing at an estimated 21% CAGR and potentially reaching USD 19.4 billion by 2033. This momentum reflects a broader shift toward decentralized investment structures and a growing willingness among investors to explore asset-backed digital securities.

Source: CustomMarketInsights

Platforms such as Securitize and RealT have already gained meaningful traction by proving that tokenized real estate is more than a concept. It is now an investable, income-producing opportunity.

While Securitize supports tokenization across multiple traditional asset classes with regulatory rigor, RealT focuses specifically on U.S. residential properties and offers global investors fractional ownership and blockchain-powered income distribution.

Strategic partnerships are increasingly shaping the competitive landscape. Solutions like DigiShares are collaborating closely with developers, property managers, and financial institutions to strengthen regulatory alignment, expand asset pipelines, and integrate with payment and identity systems.

What Is a Fractional Real Estate Token Platform?

A fractional real estate token platform is a digital marketplace that transforms physical properties such as commercial buildings, rental homes, or luxury developments into blockchain-backed ownership tokens.

These tokens allow multiple investors to buy fractional shares, earn rental income, and benefit from property appreciation without the large upfront capital or responsibilities of direct ownership. The platform brings liquidity, transparency, and global accessibility to real estate investing, making it as seamless as trading stocks or digital assets.

Types of Fractional Real Estate Token Platforms

Fractional real estate token platforms vary in how they structure ownership, distribute returns, and manage investor participation. While they all aim to make property investment more accessible and liquid, each model offers a different approach, ranging from direct equity ownership to tokenized portfolios, lending systems, or utility-based access.

1. Equity Tokens

Equity tokens represent partial ownership in a property or a legal structure holding the asset, such as an LLC, SPV, trust, or tokenized REIT. Investors benefit from value appreciation, rental income, and, in some cases, governance rights.

Example: RealT – Each token represents ownership in U.S. rental properties. Token holders receive rental distributions in stablecoins and can trade their tokens on approved marketplaces.

2. Asset-Backed Utility Tokens

These tokens provide usage or access rights rather than ownership, for example, access to vacation homes, co-working hubs, or member-only communities. They resemble digital memberships where the main value comes from utility rather than investment returns.

Example: StayDAO (using timeshare-style access passes) – Users can redeem or trade access to short-term stays in global properties. The token functions like a digital reservation right rather than ownership.

3. Debt Tokens (Real Estate Credit Tokens)

Debt tokens represent tokenized loans or mortgages where investors earn fixed interest until maturity, making them popular for development financing and crowdlending. They operate similarly to digitalized promissory notes, with principal returned at term completion.

Example: Centrifuge / Tinlake Real Estate Pools – Investors fund tokenized loans backed by real estate collateral. Returns are generated through stable interest streams tied to borrower repayment.

4. Revenue-Sharing Tokens

These tokens provide rights to rental income or cash flow without giving direct property ownership. They function similarly to digital royalties, appealing to income-focused investors with simpler regulatory structures compared to equity.

Example: Lofty AI Revenue Tokens – Token holders earn a share of monthly rental income from investment properties. The token structure separates income rights from legal ownership, simplifying compliance.

5. Governance or DAO-Based Tokens

Governance tokens allow holders to vote on decisions such as acquisitions, upgrades, or portfolio strategy. They are widely used in decentralized property investment communities where user participation is integral.

Example: Real Estate Investment DAO (REIDAO) – Token holders vote on which properties to include in the portfolio and management decisions. The governance token influences strategy rather than representing ownership.

6. Hybrid Tokens

Hybrid tokens combine features, for example, ownership plus revenue sharing or governance plus access rights. They are especially suited for mixed-use developments, tokenized resorts, and community housing with both user and investor value.

Example: Aspen Digital (Aspen Coin) – The token represents fractional ownership in the St. Regis Aspen Resort and grants income rights from hotel operations. It blends equity, revenue participation, and governance elements.

7. NFT-Based Property Tokens

NFT property tokens represent unique rights such as deeds, digital twins of physical assets, or time-based property segments. NFTs work well where ownership needs to be uniquely identifiable or non-interchangeable.

Example: Propy NFT Deed Sale – A U.S. home was sold using an NFT representing the ownership rights. The transaction demonstrated how NFTs can transfer legal property rights quickly and transparently.

How Fractional Real Estate Token Platforms Work?

Fractional real estate token platforms turn a property into a digital security so investors can own small regulated shares without needing the full purchase capital. Smart contracts automate governance and income payouts, and a blockchain ledger keeps every transaction verifiable and tamper-resistant.

Once compliance checks are passed, the tokens may trade on licensed secondary markets, so ownership becomes more flexible and liquid.

1. Property Acquisition

Everything begins long before a smart contract is deployed. The first task is identifying a property that works well in a fractionalized investment model.

Qualified assets typically share a few traits:

- Predictable cash flow, such as multifamily buildings, industrial storage, or triple-net leased retail

- Clean legal history with minimal encumbrances

- A professional or easily contracted property manager

- Market fundamentals that support long-term appreciation

Due diligence documents, including inspections, financial models, lease agreements, and environmental assessments, are digitized and secured in tamper-proof storage such as IPFS or Arweave.

Even if the acquisition uses traditional financing, the deal is structured with tokenized ownership in mind from day one.

2. Legal Structuring

Instead of giving every token holder direct ownership of the real property, which would be legally complex across multiple jurisdictions, ownership is centralized through a Special Purpose Vehicle, usually an LLC formed specifically for that asset.

The SPV operating agreement defines:

- How tokens represent proportional economic and governance rights

- The authority and responsibilities of the asset manager

- Voting procedures for decisions such as refinancing, capital improvements, or liquidation

- Securities compliance requirements for investor jurisdictions

Once structured, shares of the SPV are stored in secure digital asset custody solutions with multi-signature authorization, limiting unilateral control.

3. Tokenization

At this stage, the SPV’s economic and governance rights are encoded into a blockchain-based security token. Standards like ERC-1400 or ERC-3643 are used because they allow regulatory logic to be enforced on-chain.

A professionally engineered token includes:

- Transfer controls to ensure tokens only move between approved participants

- Built-in lock-up periods and restrictions required for securities law compliance

- Metadata that links to legal documents and property files

- Voting capabilities for governance decisions

- Automated income distribution logic tied to token ownership

Many platforms use upgradeable proxy patterns so the contract can be updated without requiring token migration if regulations evolve.

4. Investor Onboarding

Before investing, participants must complete a compliance-driven verification process. The best platforms make this feel simple even though the backend handles significant regulatory requirements.

The onboarding flow typically includes:

- Identity verification (KYC and AML checks through services like Onfido or Sumsub)

- Accreditation validation when required for offering types

- Jurisdiction screening to prevent restricted participation

- Wallet connection and smart contract whitelisting

Advanced platforms use progressive onboarding. New users share only basic information at first and unlock additional investment thresholds as more documentation is provided.

5. Automated Income Distribution

After the property manager collects rent and covers operating expenses such as mortgage payments, insurance, maintenance, and taxes, the remaining net income becomes distributable.

The typical workflow includes:

- Verification of net operating income

- Conversion of the distribution amount to a stablecoin such as USDC or EURC

- A verified trigger from an oracle or banking API

- Automated smart contract distribution based on ownership percentage

- Wallet-level receipt of payouts without manual processing

Tax forms, such as K-1 equivalents or region-specific equivalents, are generated automatically using the same accounting data.

6. Secondary Trading

Once regulatory lock-up periods expire, tokens can be traded. Liquidity levels depend on the platform’s regulatory model and its exchange relationships.

Trading mechanisms may include:

- A regulated order-book marketplace where verified participants post bids and offers

- Automated Market Maker liquidity pools for instant swaps

- Connections to digital securities exchanges such as tZERO or INX

Each trade is compliance-checked in real time, confirming that the buyer is approved, that lock-up restrictions have expired, that concentration limits are respected, and that insider rules are observed. Settlement typically occurs within seconds. No escrow, no title transfer delays, and significantly reduced transaction costs.

How to Develop a Fractional Real Estate Token Platform?

To build a fractional real estate token platform, you start by setting up a compliant legal structure and choosing a token model that fits the investment style. Then you create smart contracts that automate ownership rules, payouts, and asset lifecycle events with secure wallet and compliance integrations.

We have built several platforms this way, and the process consistently works well for regulated real estate tokenization.

1. Legal Setup

We begin by selecting the appropriate jurisdiction and determining whether the token will be treated as a security or another regulated asset class. Once that is defined, we incorporate the SPV, finalize the ownership structure, and outline the offering terms so the platform has a compliant legal foundation before any development begins.

2. Tokenomics and Compliance

Next, we model the token as either equity-based, debt-backed, or a hybrid, depending on the investment structure. We then configure ERC-3643 compliance rules and set the whitelist and eligibility logic so only verified and authorized investors can hold or transfer the asset.

3. Smart Contracts

At this stage, we build and test the contracts that mint asset-backed tokens, enforce transfer restrictions, and automate dividend distributions. Exit events, such as property sale or refinance, are also encoded through token burn and redemption logic.

4. Dashboards

We then create user interfaces for investors to view holdings, transactions, and payouts. Issuers receive property onboarding tools while administrators gain compliance and oversight dashboards to manage ownership, audits, and platform activity.

5. Integrations

Identity verification APIs are connected so investors must pass compliance checks before participating. We configure fiat on-ramp solutions, wallet infrastructure, and income automation flows so rental yields and distributions move seamlessly between traditional finance and blockchain.

6. Secondary Market and Governance

The final step introduces a regulated trading environment where verified users can buy or sell fractional shares. We also activate governance features such as proposals, token-holder voting, and automated execution so ownership feels participatory and transparent.

Fractional Real Estate Could Become a $1.4 Trillion Asset Class in Five Years

Fractional real estate could grow into a trillion-dollar asset class because the conditions are lining up faster than most people notice.

According to a study by Moore Global, if just 0.5 percent of the global property market is tokenized over the next five years, the market could reach $ 1.4 trillion. When technology improves liquidity and clarity around compliance increases, capital usually follows, and this shift might happen sooner than expected.

1. Demand Is Shifting Fast

We are entering the largest wealth transfer in history. More than $68 trillion is expected to move from Baby Boomers to Millennials and Gen Z. These generations grew up with digital banking, subscription models, and fractional investing, not traditional closings and deeds.

The global middle class is also expanding, with an estimated 160 million additional households by 2030. Many of them will not qualify for traditional property ownership but will seek exposure to real estate returns in smaller, flexible increments.

There is another factor creating urgency. Global retirement systems are under pressure, and there is an estimated $4 trillion retirement savings gap worldwide. Income-producing real estate, especially when fractional and liquid, fills a need that traditional portfolios cannot.

Put simply, there is massive investor demand waiting for accessible entry points.

When you run the math, even small allocations move markets:

If just 10% of the wealth transfer allocates 5% to tokenized real estate, that would represent approximately $340 billion in capital, even before institutional investors participate.

Institutional Investors Are Quietly Preparing

- Pension funds manage $56 trillion

- Family offices control about $6 trillion

- Hedge funds are exploring token-based arbitrage and digital valuation gaps

Institutions move slowly until structural clarity appears. Once regulation stabilizes, scale accelerates.

2. The Technology Is Finally Ready

Five years ago, tokenized real estate was mostly a concept. Today the underlying infrastructure is capable of handling institutional demand.

| Factor | Then | Now | Meaning |

| Transaction Speed | 15–30 TPS | 10,000+ TPS | Institutional volumes are possible |

| Transaction Cost | $50–100 | $0.01–$0.10 | Micro-investing becomes practical |

| Regulatory Standards | Undefined | ERC-3643 and ERC-1400 | Compliance is automatable |

| Interoperability | Isolated chains | Cross-chain networks | Global liquidity can form |

The supporting ecosystem has matured as well:

- Automated valuation models now reach 95%+ accuracy

- AI-powered smart contract audits reduce vulnerabilities by up to 80%

- Predictive analytics can forecast performance with about 85% accuracy

Technology is no longer the obstacle. Legacy processes are.

3. Regulators Are Catching Up Instead of Resisting

What used to be uncertain legal territory is now transitioning into formal policy.

- The European Union’s MiCA framework creates clear rules for security tokens

- Singapore, Hong Kong, and the UAE are positioning themselves as regulated tokenization hubs

- In the United States, the SEC, while slow, is signaling a clearer direction.

For the first time, tokenization platforms can operate with automated, jurisdiction-aware compliance, a necessity for scale.

Some tax systems have already adapted:

- Germany treats tokenized property the same as physical real estate for tax purposes

- Switzerland provides clear rules for digital asset taxation

- The United Kingdom has acknowledged digital securities under existing regulations

Regulation is shifting from restrictive to structured.

4. The Economics Are Too Advantageous to Ignore

Traditional real estate is notoriously illiquid. A typical cycle of ownership or exit ranges from 7 to 10 years. Tokenization compresses that process to seconds.

More liquidity does not only offer convenience. It influences valuation. The dynamic operates like a chain reaction:

Improved liquidity → Lower perceived risk → Higher valuations → More assets tokenized → Further liquidity improvements

Even a 10% liquidity improvement could free an estimated $1.2 trillion in dormant capital efficiency across the global property market.

With inflation affecting global purchasing power, investors are actively seeking inflation-resilient alternatives. Fractional access removes the affordability barrier.

5. Network Effects Are Already Visible

This is no longer a theory. Early platforms are showing compounding usage patterns:

- RealT now has more than 40,000 investors and over 2,500 tokenized properties

- Lofty.ai reports 20%+ monthly trading activity

- Blocksquare works with more than 100 real estate operators

Each new property tends to attract additional investors, and those investors tend to reinvest in further opportunities. This accelerates growth.

Meanwhile, infrastructure providers are reducing the time required to launch a compliant platform from multiple years to a matter of months.

6. The 0.5% Benchmark Is Likely Understated

There are historical precedents for adoption speed:

- REITs captured about 5% of the real estate market in 15 years

- ETFs reached 10% of equity markets in roughly 20 years

- Crowdfunding surpassed $1.3 trillion globally in about a decade

Tokenization combines elements of all three models, but with better technology and broader accessibility.

How Much Revenue Can a Fractional Real Estate Token Platform Generate?

A fractional real estate tokenization platform can become a strong revenue generator once product-market fit and liquidity are established. Based on market benchmarks, a well-built platform can earn between $5M and $50M per year within the first 3 to 5 years. At full maturity and scale, platform revenue can grow to $100M to $250M annually, especially when multiple revenue lines activate and network effects kick in.

The business model benefits from compounding growth. More properties attract more investors, and more investors make tokenized assets more liquid. Improved liquidity then attracts even more assets, creating a growth loop that strengthens over time.

Platforms in this sector generally pull revenue from five main sources.

1. Primary Issuance Fees

(Approximately 25 to 40 percent of revenue)

This fee applies when new properties are tokenized and offered on the platform. The charge is based on the capital raised.

Typical pricing ranges:

| Property Category | Typical Fee |

| Residential assets | 2 to 3 percent |

| Commercial real estate | 1 to 2 percent |

| Development projects | 2.5 to 4 percent |

Market Example: RealT has tokenized more than 2,500 properties. With an estimated average raise of $150,000 per property, that represents roughly $375 million in capital. At a 2.5 percent issuance fee, that would equal around $9.4 million earned purely from primary offerings.

Modeled Growth Scenario:

| Year | Properties | Average Raise | Total Capital | Avg Fee | Revenue |

| Year 1 | 50 | $200K | $10M | 2.5 percent | $250,000 |

| Year 3 | 500 | $250K | $125M | 2.5 percent | $3.125M |

2. Secondary Market Trading Fees

(Approximately 30 to 50 percent of revenue)

This is often the most scalable revenue pillar. Once assets become tradeable, token holders may trade multiple times per year rather than once every decade, as seen in traditional real estate.

Typical trading fee: 0.1 to 0.5 percent, sometimes applied to both sides of the trade.

Real Market Example: Lofty.ai reports a trading turnover near 20 percent per month.

If their tokenized inventory is around $50M, monthly trading volume would be about $10M and annual volume approximately $120M.

At a 0.25 percent fee charged to buyer and seller, revenue would equal $600,000 per year from trading alone.

Modeled Growth Example:

| Stage | Assets Tokenized (AUT) | Monthly Turnover | Annual Volume | Fee Model | Revenue |

| Year 1 | $10M | 15 percent | $18M | 0.5 percent | $90K |

| Year 3 | $125M | 20 percent | $300M | 0.5 percent | $1.5M |

| Year 5 | $500M | 25 percent | $1.5B | 0.5 percent | $7.5M |

When liquidity improves, this line can surpass all others.

3. Asset Management Fees

(Approximately 15 to 25 percent of revenue)

These fees cover long-term oversight such as property operations, compliance, reporting, or governance. The structure is usually tied to assets under management.

Typical range: 0.5 to 1.5 percent per year.

Benchmark: RealBlocks charges 0.75 to 1.25 percent for institutional-grade assets.

Revenue Forecast:

| Year | AUM | Avg Fee | Annual Revenue |

| Year 1 | $10M | 1 percent | $100K |

| Year 3 | $125M | 0.9 percent | $1.125M |

| Year 5 | $500M | 0.8 percent | $4M |

Fees often decrease slightly as AUM grows because operational costs scale more efficiently.

4. Infrastructure Licensing and White-Label Services

(Approximately 10 to 20 percent of revenue)

This model applies when the platform provides its technology to developers, brokers, real estate operators, or fintechs. Blocksquare and other B2B tokenization providers are strong current examples.

Common pricing elements:

- One-time onboarding fee: $50K to $200K

- Monthly subscription: $5K to $20K

- Additional transaction or volume fees: 0.1 to 0.3 percent

Reference Case: Blocksquare currently powers more than 100 real estate companies. If half of them are active paying clients at an average monthly subscription of $10K, that equals $6M in recurring subscription revenue, excluding transaction fees.

Modeled outcome:

| Year | Active Clients | Avg Monthly Fee | Annual Revenue | Plus Transaction Fees |

| Year 1 | 10 | $7.5K | $900K | Additional $250K to $500K |

| Year 3 | 50 | $12K | $7.2M | Additional $1M to $3M |

5. Add-On Revenue Streams

(Approximately 5 to 15 percent of revenue)

These enhance margins without requiring significant operational overhead.

Potential categories include:

- Identity and verification fees (KYC or compliance)

- Premium reporting or portfolio analysis tools

- API access for financial institutions

- Automated taxation and dividend reporting

- Institutional data subscriptions

Pricing varies from $10 per retail investor to $5K monthly for institutional analytics.

Key Success Factors That Drive Revenue

Four main success drivers influence how large and how quickly revenue grows.

- Liquidity Premium: Platforms with high trading velocity earn 3 to 5 times more in fees.

- Regulatory Positioning: Jurisdictions such as Dubai, Singapore, Switzerland, and the EU under MiCA currently offer smoother frameworks for asset tokenization.

- Network Effects: As the platform grows, the cost of acquiring investors and assets decreases dramatically.

- Technology Efficiency Over Time: Platforms that automate compliance, asset servicing, and fractional ownership workflows can reduce operational costs from roughly 30 percent of revenue in year one to 15 percent or lower by year five.

Common Challenges of a Fractional Real Estate Token Platform

After launching fractional real estate platforms across the United States, Europe, the UAE, and Asia, our team at Idea Usher has seen the same roadblocks surface repeatedly. These projects are exciting, but they require precision, regulatory awareness, and the right technical structure. Every challenge can be solved when the platform is designed with flexibility and compliance in mind.

1. Regulatory Uncertainty

Fractionalized real estate assets are categorized differently depending on location. In some regions, they are treated as securities, in others as digital assets, and in many jurisdictions, regulations are still evolving. A misunderstanding at the regulatory level can lead to frozen operations, legal disputes, or forced shutdowns.

Our Solution

We build platforms with regulation-aware architecture and policy modules that can adjust as markets evolve.

Key elements include:

- Jurisdiction-responsive smart contract logic that applies regulatory rules based on user location.

- Modular compliance components that activate or deactivate without rebuilding the system.

- Automated tax and reporting frameworks aligned with regional laws.

- A regulatory sandbox environment that allows simulation and testing before expansion.

This allows platforms to scale across borders without reworking their legal and smart contract frameworks from scratch.

2. Investor Confidence and Adoption

Many potential investors hesitate to trust token-based ownership models. Common concerns include legal standing, asset control, transparency, and exit opportunities. Without a clear trust framework, adoption becomes slow.

Our Solution

We strengthen trust through verifiable data, open reporting, and real-time insights.

This includes:

- A three-part verification process combining smart contract audits, title documentation, and on-chain financial records.

- Investor dashboards with real operational visibility such as live property imagery, rental yield data, expense history, and valuation updates.

- On-chain reputation scoring for property managers and operators based on payout frequency, tenant satisfaction, and financial performance.

Clear visibility replaces speculation with measurable evidence and increases user participation.

3. Data Manipulation and Oracle Reliability

Token values depend on property valuation data, rental income flows, and operational metrics. If this information is inaccurate or manipulated, pricing becomes unreliable and investor trust erodes.

Our Solution

We validate critical data using diversified sources and verification layers.

This includes:

- Multiple valuation and financial data sources, such as MLS feeds, satellite-backed assessments, and verified banking data.

- Physical verification layers using IoT devices where applicable.

- Consensus rules require multiple confirmations before updating token values.

- Dispute mechanisms and zero-knowledge verification models that allow transparency without exposing private financial details.

This creates a tamper-resistant environment where no single party controls price or reporting.

Tools & APIs Needed for a Fractional Real Estate Token Platform

Building a fractional real estate platform goes far beyond writing smart contracts. It requires a secure, compliant, and scalable technology stack that connects real property ownership with programmable digital assets. The tools selected determine whether the platform operates like a regulated investment marketplace or a speculative crypto product.

1. Blockchain Layer & Token Standards

Choosing the right blockchain foundation impacts security, speed, compliance, and future scalability.

Ethereum and Polygon

Ethereum is widely trusted for tokenized assets because of its security, regulatory familiarity, and robust developer ecosystem. Gas fees on Ethereum can, however, make small transactions expensive.

Polygon addresses that issue. As a Layer-2 network compatible with Ethereum, it supports low-cost and fast transactions while retaining interoperability. Many platforms benefit from a hybrid deployment model:

- Governance, compliance logic, and high-value actions on Ethereum

- User transactions and secondary market trading on Polygon

This approach preserves regulatory integrity without sacrificing usability.

ERC-3643 vs. ERC-1400

Token standard selection directly affects compliance automation.

- ERC-1400 uses partitions to manage investor classes and rule sets. This works but becomes complex across multiple jurisdictions.

- ERC-3643 centers compliance around identity using ONCHAINID. This allows compliance rules to be updated once and applied across every associated token.

For platforms expecting cross-border operations or regulatory changes, ERC-3643 is typically more flexible and maintainable.

2. Smart Contract Development Stack

This is where compliance rules, governance, ownership structure, and value distribution become automated logic.

- Solidity remains the standard language for EVM development thanks to its maturity and support ecosystem.

- Upgradeable contract patterns such as UUPS or Transparent proxies allow ongoing improvements without replacing deployed tokens.

- Hardhat is often preferred for development because of TypeScript support, mainnet forking, gas reporting, and powerful debugging features.

OpenZeppelin’s audited libraries provide foundational modules including governance, access control, and ERC token standards that reduce risk and development time.

3. Compliance and Identity Systems

Tokenized real estate falls under securities regulations. This means strong identity and compliance tooling is essential.

- Sumsub and Onfido support KYC, AML, residency verification, sanctions screening, and enhanced due diligence when investment thresholds increase. Wallet addresses that pass verification can be automatically added to smart contract allowlists.

- Chainalysis KYT adds ongoing monitoring for suspicious transactions and fund sources. This ensures compliance extends beyond onboarding.

This layered approach mirrors traditional financial compliance expectations while automating verification logic on-chain.

4. Oracles and Off-Chain Data Integrations

Real estate assets exist in the physical world, so the blockchain must be continuously anchored to real data.

Chainlink is widely used for secure decentralized data feeds, including:

- Rental income distributions

- Third-party valuation updates

- Regulatory or accreditation status

Custom API connections are also necessary to integrate with:

- Property management platforms such as AppFolio, Yardi, and RealPage

- Digital title and registry systems were available

- Banking and reconciliation systems

- Insurance verification providers

These integrations ensure token values reflect real-world conditions.

5. Wallets, Custody, and Payment Infrastructure

User experience and investor security depend heavily on wallet and payment architecture.

- MetaMask supports crypto-native users, but it is not sufficient for institutional custody requirements.

- Fireblocks provides MPC-based institutional custody, automated transaction approval policies, and insurance coverage suitable for funds and regulated entities.

- MoonPay and Stripe Crypto handle fiat-to-crypto conversions. MoonPay offers international onboarding logic while Stripe suits platforms already using conventional Stripe payments.

Top 5 Fractional Real Estate Token Platforms

We spent time digging into the space and found a few fractional real estate token platforms that genuinely stand out. Each one solves the same problem a little differently, and that makes the comparison actually useful.

1. RealT

RealT allows users to buy fractional ownership in rental properties using blockchain tokens, often with entry amounts under $100. Investors receive rental income automatically via smart contracts, and some tokens can be traded on secondary markets, offering more liquidity than traditional real estate.

2. RealBlocks

RealBlocks tokenizes real estate investment funds and commercial assets, letting investors purchase digital shares backed by physical properties. The platform aims to reduce friction, improve transparency, and provide better access to traditionally private and illiquid markets.

3. Red Swan

Red Swan offers fractional access to institutional-grade commercial real estate through tokenized digital securities. Investors can benefit from rental income and long-term appreciation, with blockchain infrastructure helping streamline processes and potentially improve liquidity.

4. REI Capital Growth

REI Capital Growth tokenizes income-producing real estate and enables investors to earn passive cash flow through digital securities. The platform focuses on long-term value and compliance, making it accessible to both U.S. and international investors.

5. The Investors Pool

The Investors Pool lets users invest in real estate through low-cost fractional tokens structured through regulated SPVs. Its goal is to make real estate ownership more accessible and flexible while enabling future liquidity through token marketplaces.

Conclusion

Fractional real estate token platforms are shaping the next wave of investment infrastructure because they introduce liquidity, compliance automation and global access, yet real success will depend on revenue models tied to real usage and a system built with regulation in mind from day one, which is why expert development partners matter since they understand security, scalability and compliance at a technical level and could help build something future-proof rather than experimental.

Looking to Develop a Fractional Real Estate Token Platform?

Idea Usher can help you build a secure and compliant fractional real estate token platform that aligns with property laws and security token regulations. The team supports everything from SPV structuring and smart contract development to KYC, custodial integration, and secondary trading modules. With this approach, you launch faster, operate reliably, and scale as investor demand grows.

Backed by 500,000+ coding hours and ex-MAANG/FAANG engineering leadership, we solve the critical triad:

- Legal-Tech Integration – SPV structures that survive regulatory scrutiny

- Smart Compliance – Programmable KYC/AML baked into token logic

- Real-World Oracles – Trusted bridges between physical performance and digital payouts

Don’t just tokenize, monetize, globalize, and future-proof your real estate portfolio.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Yes, it is legal when the platform is structured through an SPV model and follows security token regulations because this framework ties each token to a real asset and ensures compliance with investor protection laws and financial reporting rules.

A2: Retail investors can usually participate, although the rules vary by region and accreditation requirements, and in some jurisdictions, regulators may limit access or require added disclosures to protect first-time or non-professional investors.

A3: Investors may earn returns from rental income that is distributed as yield and from property appreciation, which can generate profit during resale, and in certain model,s dividends may also be issued based on operational and asset performance.

A4: Development normally takes four to eight months, and the timeline depends on platform features, compliance requirements, and integrations with custodians, KYC providers, and secondary trading infrastructure.