The real estate world has always been guided by numbers, with prices shifting and markets changing unpredictably. But the real challenge for lenders, investors, and property platforms is staying ahead of data that evolves faster than they can analyze it. This can turn pricing into a guessing game instead of a precise process. However, technology is now making a huge difference. With AI-driven automated valuation models, property values can be calculated in seconds. These models remove the delays of manual appraisals and reduce errors. They are designed to adapt and evolve with the market, offering a more reliable and consistent approach. This makes property valuation faster and more accurate than ever before.

In this blog, we’ll walk you through how automated valuation models for housing are created. We’ll cover everything from the data pipelines and core components to the technical architecture and real-world applications.

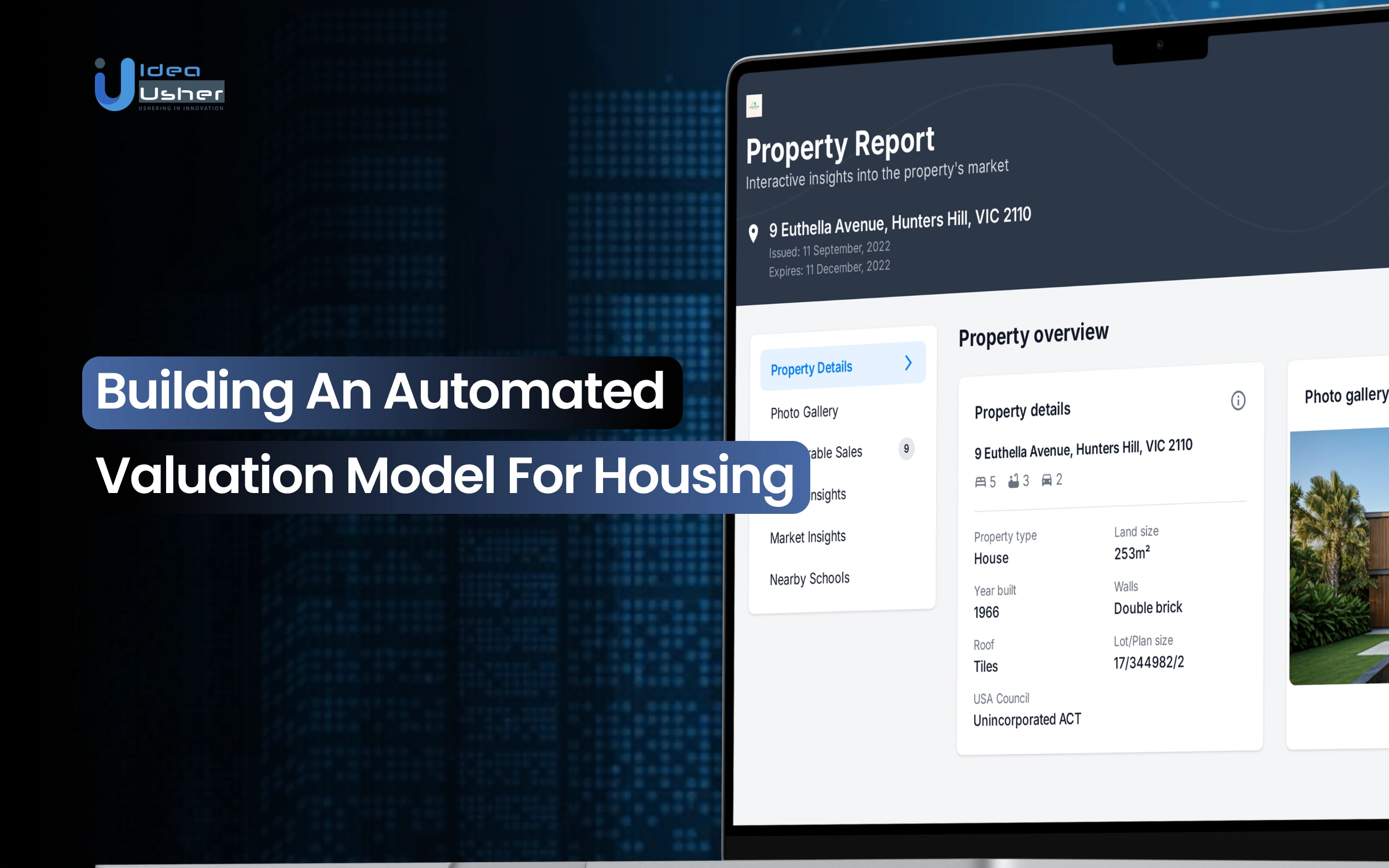

Over the years, we’ve worked with some of the leading real estate platforms, proptech startups, and developed numerous property valuation models that use AI, ML, and NLP technologies. Thanks to this knowledge, IdeaUsher can help proptech businesses to implement automated valuation models for housing in their platforms, that can analyze vast datasets and deliver accurate, real-time valuations for the buyers.

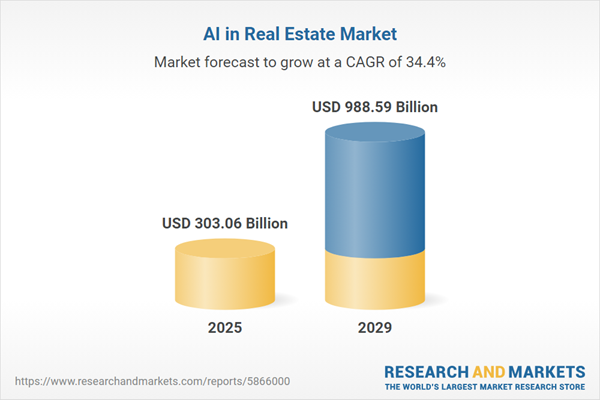

Key Market Takeaways for Property Valuation Models

According to ResearchandMarkets, in 2024, the real estate AI market was valued at $222.65 billion and is expected to grow to $303.06 billion by 2025. This rapid growth shows that the industry is starting to rely more on AI-powered tools, especially AVMs, to make property value estimates quicker and more accessible.

Source: ResearchandMarkets

AVMs are becoming increasingly popular because they are fast and reliable. They reduce the need for manual appraisals and offer instant pricing for buyers, sellers, and lenders. Big names like CoreLogic, Freddie Mac, and HouseCanary are leading the charge by using large data sets and advanced models to provide accurate valuations. New platforms like Plotzy also combine traditional methods with AI, making it easy to generate reports quickly and analyze multiple properties at once.

Partnerships between AVM providers and real estate companies are helping to improve this technology. AVM tools are now integrated into platforms like Rocket Mortgage, which makes it easier for consumers and professionals to get accurate property values. These partnerships are shaping the future of the real estate market by refining the technology and meeting growing demand.

What is an Automated Valuation Model?

An automated valuation model is a sophisticated technology tool that determines the value of a property using data analysis, mathematical modeling, and real estate market trends, without the need for a physical inspection. In essence, it predicts the likely selling price of a property by analyzing various data sources.

Key Components of an AVM

Data-Driven

The foundation of an AVM is its ability to process vast amounts of data, which include:

- Property-Specific Information: Key characteristics like square footage, number of rooms, lot size, and year of construction.

- Historical Transaction Data: Past sales data of the property in question and comparable properties (“comps”).

- Market Trends and Economic Indicators: Elements like interest rates, local demand, and the overall real estate market.

- Geospatial Data: Information on proximity to schools, amenities, and transit options.

AI-Powered

Modern AVMs leverage Artificial Intelligence (AI) and Machine Learning (ML) to go beyond basic rules. These technologies enable the AVM to understand complex, non-linear relationships in real estate data. For example, it can learn how factors like the number of bathrooms affect price differently in various neighborhoods.

Predictive Nature

The main output of an AVM is a forecast of the property’s current market value. This prediction is often accompanied by a confidence score or a range that reflects the likelihood of that valuation being accurate, which is crucial for risk assessment, portfolio management, and other financial decision-making.

AVMs vs. Traditional Appraisals

| Feature | Automated Valuation Model (AVM) | Traditional Human Appraisal |

| Speed | Quick results (seconds to minutes) | Takes days to weeks (includes inspection) |

| Objectivity | Data-driven, consistent results | Subjective, reliant on individual expertise |

| Scalability | Can value thousands of properties at once | Limited by appraiser’s time and capacity |

| Cost | Low marginal cost per property | High cost per appraisal due to manual work |

| Data Utilization | Uses large datasets across entire markets | Uses select comparables and inspections |

| Primary Use Case | Risk assessment, portfolio analysis, and market forecasting | Regulatory compliance for loans and unique valuations |

Different Types of AVMs

There are several types of AVMs based on the underlying technology, each suitable for different use cases.

1. Statistical Models

These models establish a linear relationship between property features (such as square footage) and their value.

Pros: Easy to understand, computationally efficient.

Cons: They can oversimplify the complex dynamics of real estate markets and often provide less accurate valuations.

Best For: Standard properties in homogeneous markets.

2. Machine Learning-Based AVMs

These models analyze vast datasets to find non-linear patterns that affect property value. They use techniques like Gradient Boosting or Neural Networks to provide a nuanced understanding of real estate trends.

Pros: More accurate than statistical models, capable of handling complex and diverse data types (e.g., images, descriptions).

Cons: Often considered a “black box,” making it harder to explain specific outcomes, and it requires significant data and computational resources.

Best For: High-accuracy requirements, particularly in complex markets.

3. Hybrid Models

These models combine the predictive power of ML with business rules. For example, after an ML model provides a valuation, a rule might adjust the value based on unique features, like an unrecorded renovation.

Pros: Combines the strengths of AI with human oversight and can handle edge cases (e.g., unique properties or sparse data).

Cons: More complex to build and maintain, requiring both technical and domain expertise.

Best For: Financial institutions and lenders that need both accuracy and compliance with regulations.

How Does an AVM for Housing Work?

An automated valuation model works by analyzing a wide range of data such as property details, market trends, and past sales. It uses algorithms to process this information and calculate an estimated value for the property. This process is quick and can provide real-time, accurate valuations that are constantly updated with new data.

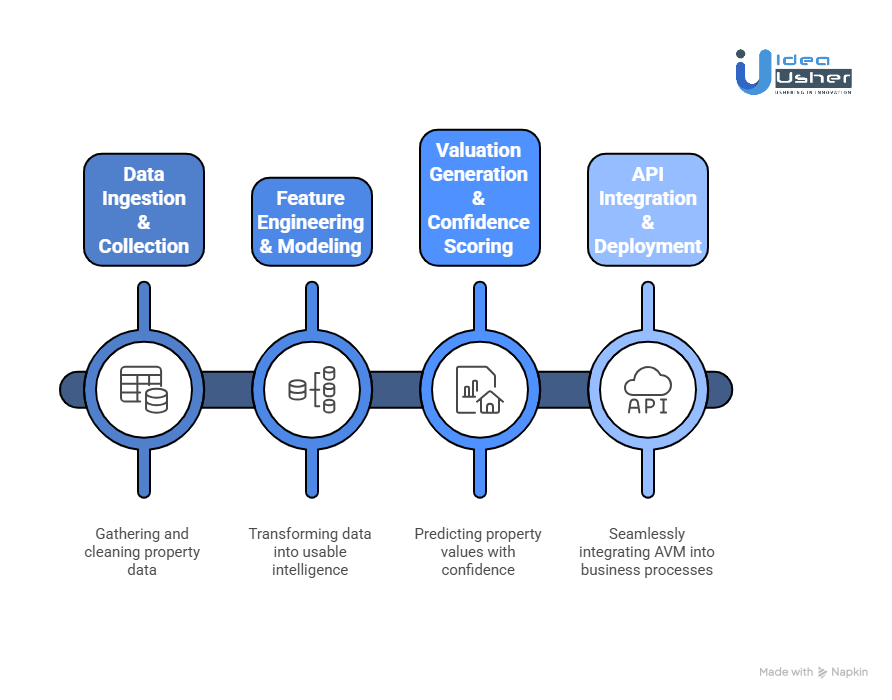

Stage 1: Data Ingestion & Collection

The first and most critical stage in any AVM is data collection. The accuracy of the valuation depends entirely on the quality and comprehensiveness of the data ingested. If the data is flawed or outdated, the final valuation will be unreliable.

Key data sources include:

| Data Category | Description |

| Property Data | Key details like size, bedrooms, bathrooms, lot size, age, and type. |

| Historical & Current Transaction Data | Sales data from MLS, deeds, and tax records, including comparable sales (comps). |

| Geospatial & Neighborhood Data | Location info such as proximity to schools, parks, transit, flood risks, noise, and satellite imagery. |

| Market & Economic Trends | Economic indicators like market inventory, interest rates, and days on market. |

Business Implication: Building a reliable data pipeline that sources, cleans, and normalizes this data from diverse places is one of the most technical and challenging parts of AVM development. The quality of the data directly impacts the reliability of the valuation.

Stage 2: Feature Engineering & Modeling

Once the data is collected, it needs to be transformed into usable intelligence. This is where the true power of the AVM is harnessed.

Feature Engineering

This involves creating meaningful features (or signals) from raw data. For instance, it’s not enough to know how many bedrooms a property has. More useful features might include the “price per square foot,” “bedroom-to-bathroom ratio,” or an “amenity score” that evaluates nearby points of interest.

Model Selection & Training

With engineered features in hand, the AVM moves to the core analysis stage, where machine learning algorithms are employed to identify patterns in the data. Common models include:

- Gradient Boosting Machines (e.g., XGBoost, LightGBM): These models are highly effective in capturing non-linear relationships and are known for their accuracy in property valuation tasks.

- Random Forests: This model is robust and less prone to overfitting, offering a reliable baseline.

- Neural Networks: Especially useful for integrating unstructured data, like images or text descriptions, into the model.

The model is trained on historical data, learning how property features influence sale prices, and then applies this knowledge to predict values for new properties.

Stage 3: Valuation Generation & Confidence Scoring

The AVM generates its property valuation, but it doesn’t just provide a single figure—it adds an important layer of insight: confidence scoring.

Valuation Estimate: This is the predicted market value of the property (e.g., “$547,500”).

Confidence Score: A crucial aspect of the model, the confidence score represents how certain the system is about its valuation. Factors that can affect confidence include:

- Insufficient comps: If there aren’t enough recent sales data in the area.

- Unique property features: Unusual properties that deviate from typical market trends may lower confidence.

- Market volatility: Rapid changes in market conditions can reduce the model’s certainty.

Business Implication: The confidence score is a risk-management tool. For instance, a low-confidence valuation can automatically flag the property for a human appraiser’s review, blending the speed of automation with the reliability of human expertise.

Stage 4: API Integration & Deployment

The final valuation and confidence score are made accessible via an API, which enables the AVM to become a powerful business tool.

Seamless Integration: The AVM’s output can be embedded into various business processes, including:

- A mortgage lender’s loan origination system for instant pre-approvals.

- A real estate platform’s website to offer on-demand property estimates.

- An investor’s dashboard for large-scale portfolio analysis.

This seamless integration transforms the AVM from a theoretical model into an actionable asset for businesses, enabling them to automate critical tasks and make data-driven decisions on the fly.

AVM-Powered Add-On Features for Your Real Estate Platform

By integrating a robust automated valuation model into your real estate platform, you can transform a simple home value estimator into a powerful revenue engine. Each feature below extends the AVM’s core intelligence into new, monetizable experiences that serve users across the full homeownership lifecycle.

1. The “Equity Unlocker” Dashboard

A dynamic homeowner dashboard that displays the estimated property value, remaining mortgage balance, and tappable equity—the portion available for a HELOC or cash-out refinance. Integrated lender offers allow users to explore financing options instantly.

Target Audience: Current homeowners.

Market Example: Zillow and Rocket Homes drive significant lead generation for their lending divisions through similar tools.

Revenue Model: Lead generation fees from mortgage and HELOC lenders.

Financial Projection:

- 1,000,000 monthly active homeowners

- 1% engagement → 10,000 dashboard visits

- 5% convert to qualified leads → 500 leads

- $75 average lead value

Estimated Monthly Revenue: 500 × $75 = $37,500

Estimated Annual Revenue: $450,000

This feature converts passive traffic into high-intent financial leads, creating a recurring, data-driven income stream.

2. “What-If” Renovation ROI Simulator

An interactive simulator that estimates the cost and potential value increase of home renovations based on local sales data. Users can visualize ROI before starting projects and connect with vetted contractors.

Target Audience: Homeowners planning upgrades or remodels.

Market Example: Realtor.com and Zillow offer simple valuation tools. This version adds true predictive ROI analysis for a competitive edge.

Revenue Model: Pay-per-lead or commission fees from contractors.

Financial Projection:

- 1,000,000 monthly users

- 0.5% (5,000) use simulator

- 10% convert to contractor leads → 500 leads

- $150 per lead

Estimated Monthly Revenue: 500 × $150 = $75,000

Estimated Annual Revenue: $900,000

This turns renovation curiosity into a direct revenue opportunity and positions your platform as a trusted home improvement advisor.

3. Portfolio Health Score for Investors

A centralized dashboard that aggregates property values, equity, and rental performance for real estate investors. It delivers a single “Portfolio Health Score” and flags underperforming or high-risk assets.

Target Audience: Individual and institutional real estate investors.

Market Example: Roofstock uses similar portfolio analytics as a foundation for its investor ecosystem.

Revenue Model: SaaS subscription.

Financial Projection:

- 1% of user base = 10,000 potential investors

- 5% conversion = 500 subscribers

- $29.99 monthly subscription

Estimated Monthly Recurring Revenue: 500 × $29.99 = $14,995

Estimated Annual Recurring Revenue: ~$180,000

This premium feature appeals to a high-value audience, building long-term retention and B2B potential.

4. Instant Offer (iBuyer) Partnership Portal

Users can request a cash offer directly through your platform. The AVM provides initial valuations that power instant bids from partner iBuyers like Opendoor or Offerpad.

Target Audience: Homeowners looking for a fast, convenient sale.

Market Example: Redfin and Realtor.com already support similar integrations.

Revenue Model: Referral fee or percentage of closed transactions.

Financial Projection:

- 1,000,000 monthly users

- 0.1% (1,000) request offers

- 5% close sales = 50 transactions

- Average home price: $400,000

- 1% referral fee

Estimated Monthly Revenue: 50 × $400,000 × 1% = $200,000

Estimated Annual Revenue: $2,400,000

This feature unlocks the highest revenue potential per transaction while strengthening partnerships with major market players.

5. Property Tax Dispute Assistant

Automatically compares AVM-estimated market value with county tax assessments. If a discrepancy is found, the homeowner is alerted and guided through a streamlined appeal process.

Target Audience: Homeowners, especially in appreciating or over-assessed markets.

Market Example: Niche startups like ValueAppeal offer this as a standalone service, integrating it natively provides a major consumer advantage.

Revenue Model: Contingency-based fee from successful appeals.

Financial Projection:

- 2% of homeowners (20,000) receive over-assessment alerts

- 2.5% sign up = 500 appeals

- $1,000 average savings per case

- 40% contingency fee

Estimated Monthly Revenue: 500 × $1,000 × 40% = $200,000

Estimated Annual Revenue: $2,400,000

This feature builds user trust while directly saving them money, a rare combination of social proof and profitability.

6. “Neighborhood Developer” Analytics Suite

A data-driven B2B toolkit for developers and municipalities. It models how zoning changes, construction projects, or new amenities will affect surrounding property values, visualized through predictive heat maps.

Target Audience: Developers, urban planners, and local governments.

Market Example: Zillow’s data is already used informally in development proposals, but a dedicated analytics suite formalizes and monetizes that role.

Revenue Model: Enterprise annual licensing.

Financial Projection:

- 500 target enterprise clients

- 10% conversion (50 licenses)

- $18,000 annual license fee

Estimated Annual Revenue: $900,000

This B2B feature positions your platform as an indispensable planning and valuation authority for the entire development ecosystem.

How to Develop an Automated Valuation Model for Housing?

Building an AVM for housing is complex but valuable. We’ve developed several AVMs for our clients, delivering accurate property valuations tailored to their needs. Whether you’re in real estate, lending, or development, our models provide reliable and up-to-date estimates.

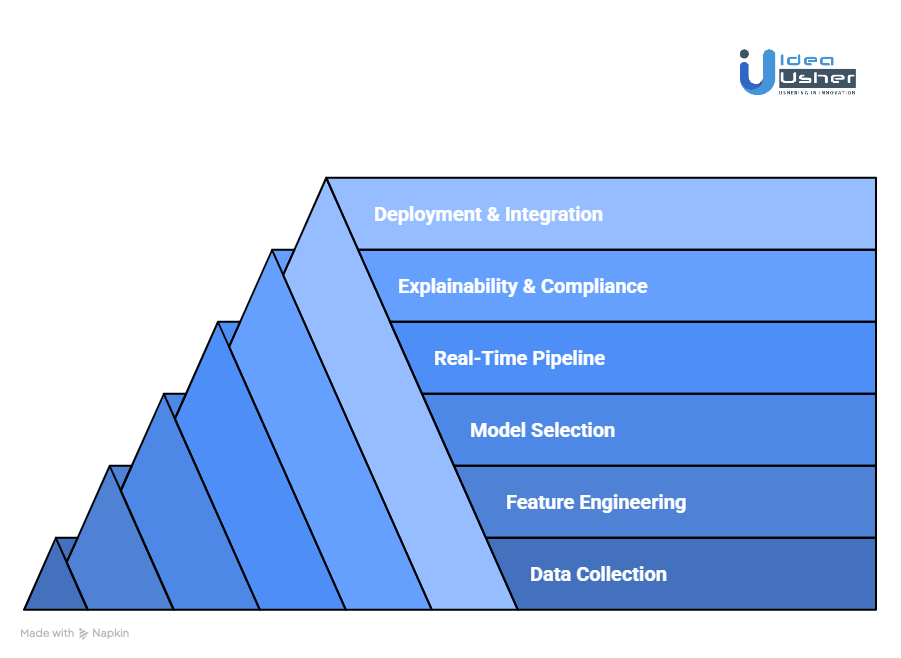

1. Data Collection and Integration

We start by gathering key data like property details, transaction history, and neighborhood metrics. We integrate sources such as public records, MLS feeds, and third-party APIs to build a comprehensive dataset. This allows us to create a model that reflects the true value of a property.

2. Feature Engineering and Preprocessing

Once the data is collected, we clean it by handling missing values and selecting important features. This includes factors like location, size, and nearby amenities. We also add economic data and geospatial features to give the model a deeper understanding of market trends.

3. Model Selection and Training

With clean data, we select the right machine learning models. We use methods like Random Forest, XGBoost, or Neural Networks, depending on the complexity. We fine-tune the model and evaluate its accuracy to ensure it provides reliable predictions.

4. Real-Time Pipeline Development

To keep your AVM up to date, we build a real-time pipeline that allows the model to update as new data comes in. This helps the model adapt to market changes, ensuring it always provides the latest property valuations.

5. Explainability and Compliance Layer

We integrate Explainable AI tools like SHAP and LIME to ensure transparency in how the model works. We also make sure the AVM complies with regulations such as the Fair Housing Act and GDPR, so you can trust that the results are fair and legal.

6. Deployment and Platform Integration

Finally, we integrate the AVM into your platform, whether it’s a dashboard, lending system, or custom app. We provide API endpoints and visualization tools so you can easily access and use the model’s predictions in your workflow.

Common Challenges of an AVM for Housing

Building an automated valuation model is challenging, and the real test lies in overcoming practical hurdles that affect its performance. At Idea Usher, we’ve faced these issues head-on for many clients, ensuring that our solutions are both effective and sustainable. We understand how to address these challenges so your AVM can work smoothly and fairly.

1. Data Scarcity in Emerging or Niche Markets

In emerging or niche markets, where historical sales data is often sparse, inconsistent, or even unavailable, training a data-hungry AI model becomes a significant hurdle. Without enough data, the model’s predictions can be inaccurate, resulting in low confidence scores.

Our Solution:

We take a two-pronged approach to overcome this issue:

- Advanced Data Augmentation: We utilize techniques like synthetic data generation to expand the dataset, providing the model with statistically valid data to learn from.

- Expert-Rule Hybrid Models: We combine machine learning with expert-driven rules to supplement the data and provide sensible valuations, even in the absence of comprehensive data.

2. Model Bias and Fairness

If an AVM is trained on biased historical housing data, it can inadvertently amplify those biases, leading to discriminatory valuations. This can create ethical concerns and legal risks, especially in an industry as regulated as housing.

Our Solution:

We integrate fairness into the core of our models with:

- Fairness-Aware ML: Using tools like AIF360 (Fairness 360), we test for disparate impacts across demographic groups during the training phase, ensuring fairness from the start.

- Bias Mitigation: We employ various techniques such as data cleaning, fair algorithms, and post-processing adjustments to minimize bias, ensuring that predictions comply with regulations like the Fair Housing Act.

3. Regulatory Hurdles and “Black Box” Distrust

Lenders and regulators are often wary of AI-driven “black boxes.” If the model doesn’t offer clear, understandable reasoning behind its predictions, it risks being rejected for loan approvals or regulatory compliance, regardless of its accuracy.

Our Solution:

We make our models transparent and understandable:

- Explainability Frameworks: We use frameworks like SHAP or LIME to provide clear breakdowns of how each factor, such as square footage or location, affects the property valuation.

- Continuous Audit Trails: Our system logs all predictions and their explanations, creating an auditable trail that simplifies regulatory reviews and builds trust with users.

4. Market Volatility and “Concept Drift”

Models trained on past data can quickly become obsolete in volatile markets. For instance, a model trained in a low-interest-rate environment will struggle to adapt to today’s fluctuating market conditions. This is known as “concept drift,” and it can lead to outdated predictions.

Our Solution:

We create AVMs that adapt to market changes:

- Scenario-Based Predictive Modeling: Our models simulate various market scenarios, such as rising interest rates or economic shifts, to predict a range of possible future values.

- Continuous Learning Pipelines: We implement MLOps pipelines that automatically retrain the model with fresh data, ensuring that predictions stay relevant as market conditions evolve.

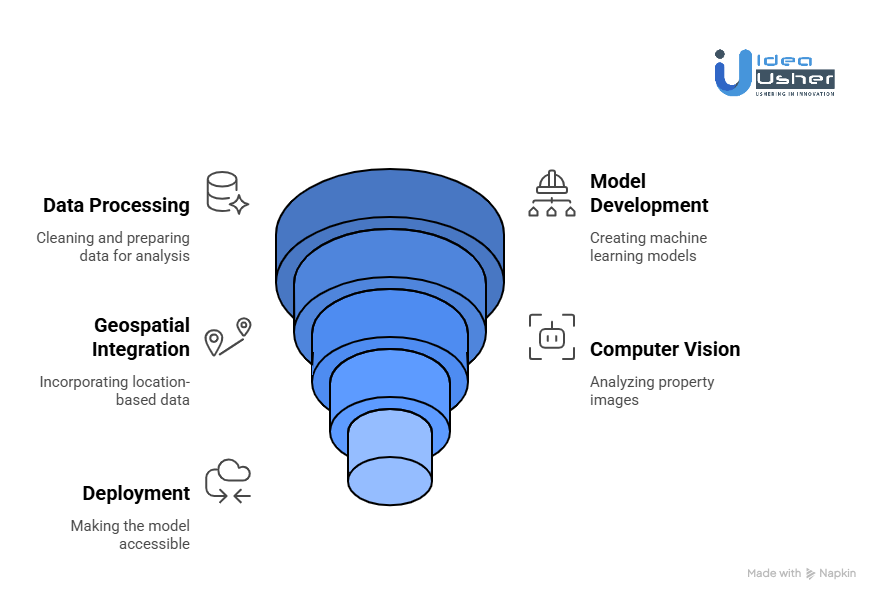

Tools & APIs for Building an Automated Valuation Model

Building an Automated Valuation Model requires the right tools and frameworks for data processing, machine learning, and deployment. You would need solid tools for handling data, running models, and visualizing results, ensuring that everything runs smoothly. It’s essential to choose systems that will scale well and deliver reliable predictions for real-world use.

1. Programming & Machine Learning Frameworks

Building an AVM requires the right tools to handle the complex logic and intelligence at its core. Here’s how we approach it:

- Python: The industry standard for data science and machine learning. Its diverse ecosystem of libraries makes it the perfect foundation for every stage of AVM development.

- Scikit-learn: This provides a robust toolkit for machine learning models like Random Forests and essential functions for data preprocessing. It’s indispensable for creating reliable baseline models and performing feature engineering.

- TensorFlow & PyTorch: These frameworks enable the development of deep learning models that can identify subtle patterns in data. They help integrate advanced capabilities such as computer vision for analyzing property images, enhancing model performance.

2. Data Processing & Management

Handling large datasets is a crucial part of building an AVM. We use a combination of the following tools to clean, process, and manage data efficiently:

Pandas & NumPy

The essential Python libraries for data manipulation and numerical computation. These tools are key for cleaning property data, engineering features, and preparing the dataset for model training.

Apache Spark

When handling large datasets like property records or transaction histories, distributed processing helps manage the data more efficiently. This ensures that models can be trained faster and scale as needed without any issues.

3. Geospatial Tools

An effective AVM needs to incorporate location-based data to enhance its accuracy. These tools quantify the often intangible factors related to location:

- GeoPandas & PostGIS: These extend the analytical capabilities of Python to geographic data, enabling spatial joins like identifying all properties within a certain radius of new infrastructure (e.g., a metro station).

- Mapbox GL JS / Deck.gl: These visualization tools allow us to create interactive, insightful maps and heatmaps of property values, providing an easy way for clients to explore geographic data and valuation trends.

4. Computer Vision

To stay competitive, an AVM should be able to process property photos effectively. We can automatically analyze these images to spot key features like renovations or overall condition. This helps refine the model and improve its accuracy in valuations.

5. Explainability

For a more advanced AVM, it’s crucial to process visual data like property photos. By using certain tools, we can automatically analyze these images and extract useful features like kitchen renovations or overall property condition. This adds a deeper layer of accuracy to property valuations.

6. Deployment & APIs

The real value of an AVM lies in its deployment. Here’s how we ensure the model is accessible and scalable:

FastAPI & Flask

We use these lightweight frameworks to create high-performance REST APIs that wrap the trained AVM model, enabling it to be called from any platform, whether it’s a website, mobile app, or loan management system.

Cloud Services (AWS/GCP/Azure)

To scale the AVM pipeline, we deploy it on cloud infrastructure, using services like AWS S3 for data lakes, Docker and Kubernetes for containerized deployment, and serverless functions for high availability and scalability.

7. Visualization

The final challenge is to make complex data understandable to users. We use the following tools to turn insights into intuitive visualizations:

- Plotly & D3.js: These libraries allow us to build dynamic, interactive charts and graphs for web applications, helping users explore data trends and model explanations visually.

- Tableau / Power BI: For enterprise clients, we integrate AVM outputs into business intelligence dashboards, providing executives with an easy way to analyze portfolios and generate insights from property data.

Top 5 Apps With Automated Valuation Models for Housing

We’ve done some thorough research and found some fantastic apps that use Automated Valuation Models for housing. These apps stand out with their unique features and offer a lot of value for anyone looking to get accurate property estimates.

1. HouseCanary

HouseCanary offers advanced AI-powered property valuations, delivering accurate real-time estimates and market forecasts. It caters to investors, lenders, and real estate professionals by providing detailed market analytics and predictions, ensuring data-driven decision-making.

2. Zillow (Zestimate)

Zillow’s Zestimate is a popular AVM that estimates home values using public data and user input. It offers homebuyers and sellers a quick, general estimate of property values, along with regular updates reflecting market trends, making it a go-to tool for everyday users.

3. Redfin

Redfin provides a reliable home value estimator, known for its accuracy with a median error rate of 6.47% for off-market properties. It continuously updates home values and offers a comprehensive look at market conditions, making it ideal for homeowners and prospective buyers.

4. Realtor.com

Realtor.com aggregates AVM estimates from multiple providers like CoreLogic and Quantarium, offering a diverse range of property valuations. With access to a broad database of listings and market data, it allows buyers and sellers to compare values and track real estate trends effectively.

5. SmartZip

SmartZip offers an innovative AVM that focuses on predictive analytics, helping real estate professionals assess property values and trends at the neighborhood level. The platform’s tools are tailored to help agents and brokers with lead generation and targeted marketing strategies, making it an excellent resource for professionals looking to optimize their business.

Conclusion

AVMs are truly transforming the housing market by providing quick, reliable property valuations based on a vast amount of data. They help businesses make faster, data-driven decisions and streamline processes. Platform owners can benefit from AVMs by improving efficiency, cutting costs, and driving more accurate insights for clients. Idea Usher can support your business by developing, integrating, and scaling AVMs, ultimately driving revenue growth and helping you stay ahead in the market.

Looking to Develop an Automated Valuation Model for Housing?

At Idea Usher, we create custom automated valuation models that use AI and machine learning to deliver fast, accurate, and scalable property valuations. These models can help you make better decisions in real estate by providing reliable insights quickly.

Why Partner with Idea Usher?

- Powerhouse Expertise: Our team has over 500,000 hours of coding experience. We have developers with top-level experience from some of the best tech companies who can bring the right skills to your project.

- Beyond the Algorithm: We build more than just an algorithm. We create solid data pipelines, use advanced machine learning models, and ensure that everything integrates smoothly into your existing workflow. This way, you don’t have to worry about technical complexities.

- Built for Your Business: We know every business has unique needs. Whether you’re a proptech startup or an established lender, we create AVMs tailored to your data, market, and goals. You can trust us to deliver a solution that fits your business perfectly.

When you work with us, you’re not just getting a model. You’re getting a valuable tool that can give you a competitive edge in the market.

Let’s partner up and bring your property valuation process to the next level.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: AVMs can value a wide range of properties, including residential, commercial, multi-unit housing, and special-use properties, as long as the necessary data is available. The more comprehensive the data, the more accurate the valuation. They can adapt to many property types based on the model’s design.

A2: AVMs, powered by advanced machine learning and extensive datasets, can often match or even outperform human appraisers, especially when valuing large portfolios. They rely on data consistency and model training for accuracy. For standard properties, they provide quick and reliable estimates.

A3: Yes, AVMs can quickly adapt to market changes by using dynamic data pipelines and ongoing retraining. This allows them to adjust valuations as market conditions shift. With timely updates, AVMs can remain highly relevant and reflect current trends.

A4: AVMs can be designed to comply with housing regulations, including Fair Housing laws, by incorporating bias detection and Explainable AI frameworks. When properly built, they ensure transparent and equitable valuations. Compliance is key to ensuring legal and ethical use of AVMs.