The incredible growth of FinTech has brought about a huge transformation in the financial industry. This shift may be attributed to a number of variables, such as the introduction of innovative services, ideal market strategies, and even the effects of social distance caused by pandemics. Among these shifts, connectivity emerges as a key component that supports the evolution of finance.

In the modern financial ecosystem, different organizations work together to provide improved customer services, including credit card firms, lenders, payment processors, conventional banks, and mobile applications. An effective Application Programming Interface or API powers these exchanges.

The fintech industry’s growth has encouraged investors and entrepreneurs to create applications that are intended for consumers to generate revenue and frequent usage.

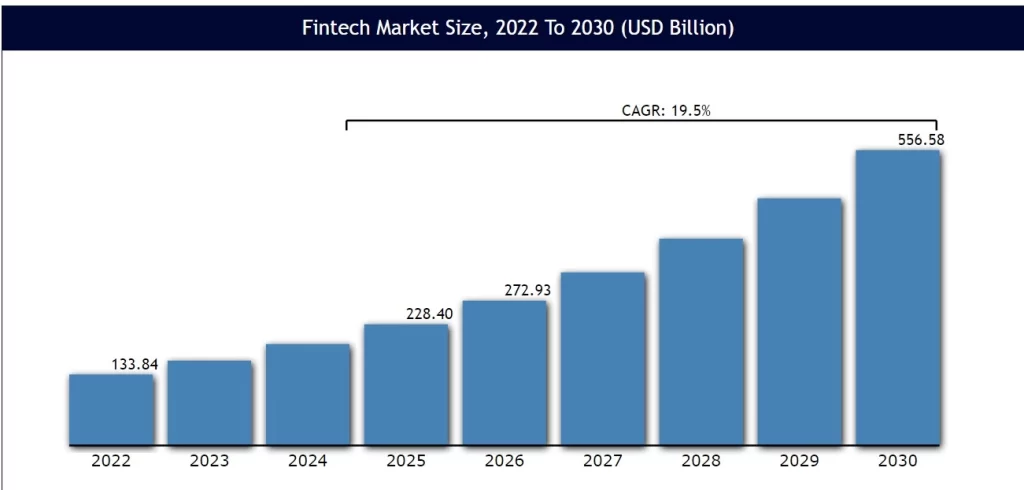

Source: Vantagemarketresearch.com

The FinTech business has increased the use of APIs, and this tendency will only continue. Financial executives now have a better awareness of the benefits of APIs, such as increased business automation, scalability, and acceleration, as they were first careful due to a lack of information about those benefits and perceived risks.

API integration has become a critical component of FinTech companies’ strategy as they innovate to improve customer experience and efficiency, opening the door for long-term growth in the digital ecosystem.

This blog aims to provide a comprehensive understanding of APIs in FinTech by examining their function and noteworthy advantages for the sector. Let’s delve into the details below.

What Are FinTech APIs?

Banking APIs are standardized protocols establishing secure communication channels between a bank’s server and mobile devices. These APIs are pivotal in enabling customers to seamlessly interact with banking services through dedicated mobile applications, requiring nothing more than a stable internet connection.

Consider your personal finance app as an example. It leverages Open Banking APIs to connect with your bank, providing real-time access to your account balance and financial information.

Have you ever wondered about the seamless integration between your wallet app and bank account? Or how do your credit card transactions receive swift approvals during online shopping ventures? These seemingly effortless experiences are made possible by the intricate workings of APIs, operating in the background to ensure the efficiency and security of your digital financial interactions.

The open banking has boosted the mainstream adoption of APIs within the FinTech sector. These APIs now play a crucial role in issuing commands to third-party service providers, expanding their utility beyond traditional banking functions.

Given the sensitivity of financial transactions and the data involved, banking APIs require strong authentication procedures and cutting-edge security encryption techniques. These measures are in place to secure sensitive information, preserving the confidentiality and integrity of financial data during digital transactions.

How Does Banking As A Service (BaaS) Work?

Banking as a Service (BaaS) is a model that allows non-banking entities to provide financial services by leveraging the infrastructure and capabilities of traditional banks. Here’s how BaaS works:

1. Request and Authentication

The BaaS process starts with a user-generated event, such as a financial transaction or interaction with a FinTech application. This results in the development of a request, which requires authentication for safe access. Common authentication techniques employ tokens, keys, or other credentials to validate the user’s identity and access. This authentication step creates a safe conduit for future data exchanges.

2. Data Retrieval and Processing

The created request is subsequently sent to the FinTech system or server using the API. During this step, the FinTech system processes the request, which may include database access, complex calculations, or contact with third-party services such as banks and payment processing. The speed of this processing phase is critical for providing consumers with real-time, accurate financial data.

3. Data Exchange

Following processing, the FinTech system sends a response back through the API, containing relevant data such as financial information or transaction confirmations. The API serves as the conduit for seamless data exchange between the FinTech system and external applications, ensuring effective communication and information flow.

4. Integration

The receiving end, often a mobile application or another external system, integrates

the acquired data into its user interface or uses it for additional actions. This integration facilitates a cohesive user experience, enabling end-users to seamlessly view, manage, or act upon financial information within the application.

5. Error Handling and Security

Robust error-handling mechanisms are embedded in Banking APIs to address various scenarios, including validation errors, server failures, and incorrect requests. Rigorous security measures, such as encryption, are implemented to safeguard sensitive financial data throughout the data exchange process, ensuring integrity and confidentiality.

6. Continued Monitoring

The operational lifecycle of FinTech APIs involves continuous monitoring to ensure optimal performance, adherence to security standards, and compliance with regulatory requirements. Ongoing assessment and surveillance identify and address emerging issues promptly, maintaining the reliability and effectiveness of API-based banking integration. This commitment to monitoring contributes to the overall stability and security of financial transactions facilitated through these APIs.

Business Benefits Of APIs In The FinTech Sector

In the era of the FinTech sector, Application Programming Interfaces (APIs) play a pivotal role, offering many advantages that drive innovation, efficiency, and enhanced user experiences.

1. Enhanced Cost-Effectiveness

API banking services offer a cost-effective solution for both banking institutions and users. Traditional banking services can be expensive to offer, but with the integration of open APIs, FinTech solutions can provide a range of services without extensive infrastructure investments. For instance, users can seamlessly integrate their banking information into third-party bookkeeping software, streamlining financial management. This collaborative approach optimizes resource allocation for banks and FinTech providers, leading to overall cost savings.

2. Facilitating Data Sharing for Improved Experiences

The growth of open APIs, especially propelled by regulations like PSD2 in the European Union, has transformed the way banks share user information. With APIs, users now have control over their data and can request banks to share it with third-party providers. This shift promotes greater transparency and facilitates a more personalized and enriched user experience through various integrated services.

3. Future-Proof Assets in FinTech Development

The continuous rise of FinTech startups underscores the enduring relevance of APIs in the banking industry. APIs play a pivotal role in enabling businesses to adapt to evolving customer demands and provide enhanced services. As the FinTech landscape evolves, the role of APIs in driving innovation and collaboration is unlikely to become obsolete.

4. Increased Competition Leading to Diverse Services

APIs have introduced heightened competition in the financial industry, benefitting customers with reduced prices and an array of services. Financial services aggregators powered by APIs enable users to compare offerings from different banks and institutions, providing them with choices and access to services previously confined to physical branches.

5. Swift and Efficient Operations

Adopting an API-driven approach allows banks to serve clients rapidly and efficiently, offering a seamless banking experience. APIs empower clients to conduct transactions through various channels, including mobile banking, online banking, and wallet services. This shift reduces the reliance on physical bank visits, saving clients time and contributing to significant resource and cost savings for banks.

6. Diversification of Product Portfolio

APIs play a crucial role in helping FinTech and banking organizations expand their product portfolios. By fostering connectivity with various frameworks and facilitating collaboration with partners and innovation firms, APIs enable the introduction of complementary products such as insurance. Additionally, banks can leverage APIs to offer non-financial products, enhancing their overall product offerings and meeting diverse customer needs. For example, banks like Emirates NBD provide cardholders access to hospitality, entertainment, and retail items through API-driven e-shops, showcasing the versatility of APIs in product diversification.

Business Opportunities For Innovation And Collaboration In Fintech

Technological improvements and the transformational function of APIs have opened up a variety of business options for innovation and cooperation in the financial space. Here are worth mentioning opportunities:

1. Developing new financial products and services

The integration of APIs in fintech has opened avenues for the development of innovative financial products and services. Financial institutions and fintech startups can collaborate to create solutions that cater to evolving consumer needs. For instance, leveraging APIs allows for the seamless combination of various financial functionalities, leading to the development of comprehensive products such as integrated budgeting tools, personalized investment platforms, or innovative payment solutions. This collaboration fosters a competitive environment where diverse financial offerings can emerge, providing consumers with a broader range of choices and driving continuous innovation in the industry.

2. Improving customer experience

APIs play a crucial role in enhancing the overall customer experience within the fintech landscape. Through collaboration, financial institutions and fintech companies can leverage APIs to create seamless and user-friendly interfaces. This enables customers to access a variety of financial services through a single platform, streamlining processes and reducing friction in transactions. For instance, API integration allows for real-time updates on account information, quick and secure fund transfers, and personalized financial insights. This improved user experience not only attracts new customers but also fosters loyalty among existing ones.

3. Enhancing security and fraud prevention

In the ever-evolving landscape of fintech, ensuring robust security measures is paramount. Collaboration through APIs enables the pooling of resources and expertise to develop advanced security solutions. Financial institutions can integrate cutting-edge security protocols from fintech startups directly into their systems using APIs. This collaboration helps in proactively identifying and addressing potential vulnerabilities, thereby enhancing overall cybersecurity. By sharing threat intelligence and implementing collaborative security measures, the financial industry can collectively stay ahead of emerging risks and protect both businesses and consumers.

4. Driving financial inclusion

APIs contribute significantly to expanding financial services to underserved populations, thereby promoting financial inclusion. Through collaboration, fintech entities can leverage APIs to create innovative solutions tailored for individuals and businesses with limited access to traditional banking services. For example, mobile-based financial apps that use APIs can provide users with easy access to basic banking services, facilitating transactions, and enabling financial management. This collaborative effort plays a pivotal role in bridging gaps and extending financial services to unbanked or underbanked communities, fostering economic growth and empowerment.

APIs In FinTech Use Cases

Navigating the dynamic landscape of FinTech APIs comes with its set of challenges. In this section, we’ll explore key challenges that FinTech companies encounter while harnessing the power of APIs to deliver innovative financial services.

1. Price Comparison Websites

Price comparison websites play a pivotal role in the FinTech landscape, leveraging APIs to become direct online distributors of financial products. A prime example is MoneySuperMarket, which has strategically embraced APIs to power its sites. By establishing robust API service layers, the platform facilitates commercial partnerships, providing users with a seamless experience. This integration allows MoneySuperMarket to maintain a comprehensive view of its customers, enhancing its ability to offer personalized services and improved customer experiences.

2. Peer-to-Peer Currency Exchange and Lending

The rise of P2P network innovation addresses the need for simplicity in financial transactions, leading to the development of thousands of P2P payment apps by financial institutions. This trend has extended to currency exchange, where FinTech companies like TransferWise have leveraged APIs to streamline processes. TransferWise’s API, known for its openness and modularity, eliminates intermediaries, enabling banks to integrate and offer efficient currency exchange services to users. Additionally, P2P lending platforms, exemplified by LendingClub, utilize APIs for searches, order execution, portfolio configuration, and loan monitoring.

3. Investment Management

The advent of open banking has transformed investment management, providing financial advisors with access to comprehensive portfolio information through APIs. These APIs enable seamless integration, eliminating the challenges associated with gathering client data from disparate sources. Investment management APIs empower financial advisors to offer optimized services by ensuring accurate and up-to-date insights into clients’ assets and net worth.

4. Open Banking Ventures

Financial institutions like ING are exploring the potential of launching independent ventures using APIs, focusing on creating new products that can be seamlessly integrated into existing frameworks. ING’s offerings, such as Yolt (a personal finance management aggregator) and Payconiq (a digital wallet), highlight the versatility of APIs in supporting diverse financial services. The API-based developer portal further enhances collaboration between traditional banking entities and external developers.

5. API Market Platforms

Recognizing the growing popularity of APIs, banks like BBVA have pioneered API market platforms, providing a diverse array of APIs, tools, and services. BBVA’s API Market serves as a collaborative space, allowing developers to build partnerships and explore commercial opportunities. TrueLayer, a FinTech startup, competes in the same space, aiming to establish itself as a leading provider of financial API development, fostering innovation in the FinTech ecosystem.

6. Payment Processing APIs

In the era of globalization, startups and businesses catering to an international standards require advanced payment processing solutions. Payment processing APIs diversify payment options for merchants, facilitating smoother transactions and streamlined online shopping checkouts. Major players like Adyen offer APIs that enhance the checkout experience, surpassing traditional methods and ensuring a seamless process for both businesses and consumers.

7. Regulation Services

The synergy between FinTech and Regulatory Technology (RegTech) is evident in the integration of third-party open APIs to confirm user identities and comply with regulatory standards. APIs, such as those provided by Trulioo, offer a range of solutions, including biometric identification and KYC programs, contributing to a secure and efficient user experience. These services are essential components of the open banking ecosystem, ensuring data security and user verification.

8. White Label Services

Branded APIs owned by major firms coexist with white-label APIs, providing banks and FinTech companies with options to access cloud-based Banking as a Service (BaaS) technology. Starling’s API, for example, allows users to integrate into payment schemes and access Faster Payments and SEPA. The expansion of FinTech API Marketplaces, as demonstrated by Starling Bank, empowers businesses and developers to build products within a collaborative ecosystem, reaching a broader client base.

9. Gaming

The gaming industry has benefited from FinTech APIs, particularly in facilitating prompt and efficient reward transfers for winners. RazorpayX, a notable example in this domain, has assisted gaming organizations like Mobile Premier League, RummyCulture, and Pokersaints. These APIs streamline the transfer of rewards, providing a seamless financial experience for users involved in online gaming platforms.

10. Smart Contracts

Decentralized applications leverage APIs to execute P2P transactions through smart contracts, ushering in a new era of secure and automated processes. For instance, a hotel room card reader connecting with an API can verify a customer’s credentials and initiate an API call to execute the agreed-upon payment. Smart contracts, powered by APIs, redefine how applications interact within a P2P network, enhancing efficiency and transparency in financial transactions.

Emerging Trends In APIs In Fintech

Explore the constantly shifting fintech innovation landscape as we examine the new API developments that are revolutionizing the financial sector.

1. Real-time Payments APIs

The financial landscape is witnessing a surge in the demand for instantaneous transactions, and APIs are at the forefront of fulfilling this need. Real-time Payments APIs are instrumental in enabling swift and secure money transfers. These APIs empower users to conduct transactions instantly, offering a seamless and efficient solution. Whether it’s peer-to-peer transfers, business payments, or retail transactions, Real-time Payments APIs contribute to the overall speed and responsiveness of financial processes. As the expectation for quick and convenient transactions grows, the role of Real-time Payments APIs becomes increasingly pivotal in shaping the future of fintech.

2. Embedded Finance APIs

Embedded finance is transforming the way financial services are integrated into non-financial applications, and APIs play a central role in this evolution. Embedded Finance APIs facilitate the seamless inclusion of financial functionalities within diverse platforms. Businesses can leverage these APIs to offer in-app payments, lending services, personalized financial insights, and more. This integration not only enhances user experience but also opens up new revenue streams for businesses incorporating financial services into their ecosystems. With Embedded Finance APIs, the boundaries between traditional financial institutions and other industries blur, creating a more interconnected and user-friendly financial landscape.

3. Open Banking Evolution

Open banking has emerged as a transformative trend in the fintech landscape, revolutionizing how financial data is shared and accessed. Through the use of APIs, financial institutions and third-party service providers collaborate to enable customers to share their financial data securely. This practice facilitates the development of innovative financial services and applications, such as budgeting tools and investment management platforms. Open banking not only enhances customer choice and convenience but also encourages a more interconnected and competitive financial ecosystem.

4. Blockchain-based APIs

The integration of blockchain technology into fintech APIs signifies a major advancement in ensuring secure and transparent financial transactions. Blockchain-based APIs leverage decentralized and tamper-resistant ledgers, providing an ideal solution for applications like secure payments, remittances, decentralized lending, and asset tokenization. The immutability and cryptographic security inherent in blockchain contribute to increased trust and efficiency in financial processes. As the financial industry continues to explore the potential of blockchain, these APIs play a pivotal role in shaping the future of secure and decentralized financial interactions.

5. AI and Machine Learning Integration

The incorporation of AI and machine learning into fintech APIs represents a significant leap in providing personalized financial services. These advanced APIs analyze vast datasets of financial information to offer tailored advice and services to customers. Applications range from credit scoring and fraud detection to sophisticated investment management. AI-powered APIs not only streamline decision-making processes but also contribute to a more nuanced understanding of customer behavior, enabling financial institutions to deliver highly customized and responsive financial solutions. As these technologies mature, AI and machine learning APIs are expected to play a central role in shaping the future of fintech innovation.

6. IoT-driven APIs

The intersection of the Internet of Things (IoT) and financial services is giving rise to innovative solutions, driven by APIs that connect IoT devices with fintech applications. These APIs enable functionalities like smart payment methods, automated expense tracking, and personalized financial recommendations based on data generated by IoT devices. The integration of IoT-driven APIs enhances user convenience by offering novel ways to manage finances and make data-informed decisions. This trend not only transforms how individuals interact with financial services but also opens up opportunities for businesses to create tailored offerings based on real-time insights derived from IoT data.

Challenges Of APIs In FinTech

Navigating the dynamic landscape of financial technology (FinTech) comes with its set of challenges, particularly in the domain of Application Programming Interfaces (APIs). In this section, we explore seven key challenges faced by FinTech APIs, ranging from security concerns to regulatory compliance,

1. Security Concerns

As FinTech APIs handle sensitive financial data, security is a paramount concern. Ensuring robust encryption, secure authentication mechanisms, and protection against potential cyber threats is challenging yet crucial. The risk of unauthorized access or data breaches requires constant vigilance and proactive measures to safeguard user information.

2. Regulatory Compliance

The financial industry is highly regulated, and adhering to various compliance standards poses a significant challenge for FinTech APIs. Meeting requirements such as GDPR, PSD2, and other regional regulations demands ongoing efforts to stay updated with evolving legal frameworks. Non-compliance can result in severe penalties and reputational damage.

3. Interoperability Issues

FinTech APIs often need to interact with diverse systems, platforms, and legacy infrastructure. Achieving seamless interoperability between different technologies, data formats, and protocols can be challenging. Standardizing communication protocols and data formats becomes essential to ensure smooth integration and data exchange across varied ecosystems.

4. Scalability Challenges

As FinTech services gain popularity, the demand on APIs increases. Scalability challenges arise when trying to handle a growing number of users, transactions, and data volumes. Ensuring that APIs can efficiently scale to meet increasing demands without compromising performance or latency requires careful planning and robust infrastructure.

5. Data Privacy and Consent Management

FinTech APIs often rely on accessing user data for various financial services. Managing user consent and ensuring compliance with privacy regulations are persistent challenges. Striking the right balance between providing personalized services and respecting user privacy preferences requires sophisticated consent management frameworks.

6. Reliability and Downtime

The reliability of FinTech APIs is crucial for maintaining uninterrupted financial services. Downtime, system failures, or disruptions in API availability can lead to financial losses and erode user trust. Implementing redundant systems, failover mechanisms, and thorough testing become essential to minimize the risk of service interruptions.

7. Complex Integration Processes

Integrating FinTech APIs into existing banking systems or third-party applications can be complex. The diversity of technologies, varying data formats, and different security protocols make integration challenging. Providing comprehensive documentation, developer support, and standardized integration practices can help alleviate some of these challenges.

How Businesses Can Unlock the Full Potential of Banking APIs?

Unlocking the full potential of banking APIs demands a holistic approach that encompasses strategic implementation, thoughtful monetization, and seamless collaboration between business and IT. Here are some of the ways businesses can unlock the full potential of financial services with APIs

1. API Implementation Strategy

Unlocking the full potential of banking APIs begins with a well-thought-out implementation strategy. Organizations need to carefully consider which APIs align with their business goals and the specific needs of their customers. Prioritizing API implementation is crucial, whether it involves enhancing customer experience, streamlining internal processes, or enabling new services. A phased approach, starting with essential APIs and gradually expanding, allows for efficient integration and testing, ensuring a robust foundation for future developments.

Moreover, organizations should be attentive to industry standards and compliance requirements during the implementation phase. Collaborating with key stakeholders, including IT teams, developers, and business leaders, can help create a comprehensive API implementation strategy that addresses both short-term objectives and long-term goals.

2. Monetization Strategy

Determining how to effectively monetize external APIs is a critical aspect of unlocking their full potential. Organizations can explore various monetization models, such as subscription-based plans, pay-per-use models, or freemium offerings. The chosen strategy should align with the value proposition of the APIs and cater to the diverse needs of developers and end-users.

Transparency in pricing, coupled with flexibility in payment options, fosters better relationships with API users. Additionally, organizations can consider offering tiered plans with varying levels of access and features to cater to different user segments. By carefully crafting a monetization strategy, businesses can not only generate revenue but also incentivize the adoption and utilization of their APIs.

3. Alignment between Business and IT

Maintaining alignment between business objectives and IT functions is crucial for effective API management. In API prioritization and governance, collaboration between business and IT teams ensures that the selected APIs contribute directly to achieving organizational goals. Clear communication channels and a shared understanding of priorities help streamline decision-making processes.

Regular assessments of API performance against business benchmarks are essential. This alignment ensures that API development remains agile and responsive to evolving market needs. Moreover, establishing a governance framework that involves both business and IT stakeholders helps address challenges promptly, ensuring that the overall API strategy stays on course.

How Idea Usher Can Assist Businesses In Fintech APIs?

Observing the current adoption and utilization of APIs in the FinTech sector, the outlook appears promising, reflecting upcoming API integrations among established businesses and larger communities—likely hosted on third-party infrastructure.

This trend arises as FinTech startups and enterprises seek solutions to safeguard businesses from failure. For example, future banking APIs could enable banks to connect with e-commerce websites, streamlining online payment processes. Additionally, they might integrate with brick-and-mortar banks and stores to facilitate financing and lending options at POS locations.

Choosing the right digital solutions provider is crucial for leveraging the potential of APIs in FinTech business.

Idea Usher has extensive experience working with diverse FinTech business models, offering streamlined and customized API banking solutions. As an innovative FinTech software development company, Idea Usher delivers quality app development services globally.

With years of expertise in simplifying and tailoring API integration platforms to align precisely with unique requirements, Idea Usher acknowledges the distinct attributes of each FinTech venture. Our customized solutions ensure seamless FinTech API integration, data security, and enhanced functionality.

Connect with our experts to empower your business and innovate in the dynamic world of finance.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQ

Q. What is Open Banking?

A. Open banking is a framework where financial institutions share their APIs (Application Programming Interfaces) with third parties, enabling access to users’ data for the creation of new financial services and applications in the realms of fintech and banking.

Q. What is an API in banking?

A. An API (Application Programming Interface) in banking acts as a set of protocols, facilitating data exchange and communication between software applications. It serves to integrate financial services and applications, leading to improved customer experiences and operational efficiency.

Q. How does API work in banking?

A. APIs in FinTech empower banks to offer customers access to accounts, facilitate payments, and share financial data through various channels. They also foster collaboration with FinTech partners, elevating the range of services offered. APIs in banking serve as standardized tools for secure communication and data exchange among diverse software systems, including banking applications and third-party services.