“Everyday: The First 5000 Days”, the most expensive ever pure NFT-based virtual artwork, was recently auctioned at an astounding figure of $69.3 million. Mike Winkelmann, who is associated with Beeple, would never have imagined making the big headlines by delivering the third most expensive artwork ever. Such is the booming power of technology. One can never really underestimate a fresh domain. The NFTs domain is so full of dominating potential, and we are here to take you through a deep dive into this unique yet fascinating branch of blockchain.

- What is a Non-Fungible Token (NFT)?

- Key Market Takeaways for Non-Fungible Tokens (NFT)

- What is fungibility?

- Non-Fungible Tokens

- What makes Non-Fungible tokens so unique?

- What Are The Attributes and Benefits of NFT?

- A Journey Through NFT History

- How does NFT Work?

- How Are NFTs Used?

- Examples of the NFT World

- Benefits of NFTs

- How are people suddenly welcoming the NFT hype?

- Cryptogame and media

- How Can I Buy NFTs?

- Are NFTs Safe?

- What Does Non-Fungible Mean?

- How to use NFT in blockchain projects?

- Non Fungible token cryptocurrency uses

- NFT in the Gaming Ecosystem

- The top 5 Non Fungible tokens projects in the industry

- Choosing Idea Usher for blockchain development

- Takeaway

- Frequently Asked Questions

What is a Non-Fungible Token (NFT)?

NFTs, or non-fungible tokens, are unique digital certificates stored on a blockchain, a secure public record. Imagine them as titles of ownership for digital items like artwork, music, or even video game items. Unlike fungible things like money (where one dollar is the same as another), each NFT is one-of-a-kind, allowing you to buy, sell, or trade them, just like physical collectibles.

Here’s the technical twist:

- Non-fungible vs. Fungible: Unlike fungible things like money (where one dollar is the same as another), NFTs are unique (non-fungible). This uniqueness is thanks to a special code and data (metadata) attached to the NFT. The metadata can include details like the creator, ownership history, and even special abilities if it’s a digital item in a game.

- The Power of Blockchain: This secure, distributed ledger system ensures the authenticity and traceability of your NFT. Think of it like having a universally recognized certificate of ownership for your digital asset.

So, what can you do with your NFT? You can flaunt your ownership by trading or selling it on NFT marketplaces, just like collectors trade rare baseball cards. The value? That’s determined by the market and whoever desires your unique digital treasure!

Key Market Takeaways for Non-Fungible Tokens (NFT)

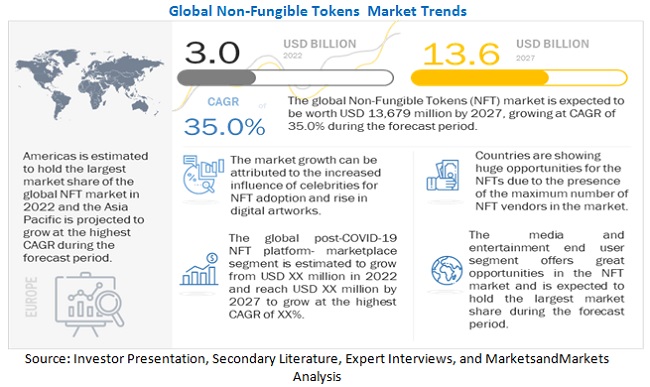

The Non-Fungible Token (NFT) market is experiencing explosive growth, with projections estimating a rise from $3.0 billion in 2022 to $13.6 billion by 2027. This translates to a Compound Annual Growth Rate (CAGR) of 35.0% over the forecast period. Several key drivers are fueling this market expansion.

Factors Propelling NFT Growth:

- Celebrity Influence: High-profile figures entering the NFT space are raising awareness and attracting new investors, accelerating mainstream adoption.

- Gaming Revolution: NFTs are transforming the gaming industry by enabling unique in-game items with verifiable ownership and potential resale value.

- Digital Art Surge: The demand for digital artwork continues to rise, and NFTs provide a secure and transparent way to own and trade these collectibles.

- Expanding Use Cases: The application of NFTs extends beyond art and gaming, finding potential in areas like supply chain management, retail, and fashion.

Furthermore, the push towards creating a real Metaverse (a persistent virtual world) by tech giants presents lucrative opportunities for NFT vendors. Additionally, the ability to personalize NFTs is expected to further enhance their appeal and value.

What is fungibility?

Fungibility reflects a resource’s ability to be replaced with a comparable resource without dropping its quality. It additionally portrays a resource’s trademarks, like detachability and plan.

Look at it this way; for instance, one $100 bill is equivalent to another $100 bill regarding esteem. All things considered, when you lend $100 to your friend, you don’t need him to return a similar note since another of its sort has the exact same worth.

In the cryptocurrency business, a BTC has a similar sum to that of some others. Every nonfungible token is unique in its own way.

Non-Fungible Tokens

NFTs are a moderately new pattern in the cryptocurrency world. However, they have been making progress quickly. The name represents non-fungible tokens, which is fundamentally a blockchain passage that addresses an interesting thing: Owners can’t trade with one another. NFTs don’t need to be pictures; however, they mostly are. Recordings, in-game things in computer games, and, surprisingly, a tweet have been auctioned as NFT, too.

In the easiest terms, NFTs change computerized masterpieces and different collectibles into exceptional, obvious resources that are not difficult to exchange on the blockchain.

Albeit that might be a long way from straightforward for first-timers to comprehend, the result has been enormous for some craftsmen, performers, influencers, and such, with financial backers spending as much as possible to claim NFT adaptations of advanced pictures. For instance, Jack Dorsey’s first tweet is currently auctioning for $2.5 million, a video clasp of a LeBron James sure thing sold for more than $200,000, and 10-year-old “Nyan Cat” GIF went for $600,000.

What makes Non-Fungible tokens so unique?

Some also describe NFT as a digital token encoded with the craftsman’s mark on the blockchain – a digital record that is the foundation of cryptographic forms of money like Bitcoin and Ethereum – permitting vendors and purchasers to confirm credibility and possession.

Virtual artistry faces unique difficulties that actual craftsmanship doesn’t, as it very well may be replicated and spread quite a few times on the web, lessening its worth. NFTs guarantee that a purchaser has genuine, unique straightforwardness from the craftsman. They likewise permit artists to sell works straightforwardly to purchasers all alone. Some have even stated, that it will democratize the artistry market.

Specialists have been utilizing equipment and programming to make fine art and appropriate it on the web for the last 20+ years, yet there was never a genuine method to really possess and gather it, with NFTs that have now changed.

What Are The Attributes and Benefits of NFT?

So what makes an NFT more unique than an average crypto coin? Indeed, the document stores additional data, which hoists it above unadulterated cash. Moreover, carries it into the domain of, all things considered, anything.

- Restricted: The estimation of NFTs comes from their shortage. Nonfungible designers can make a limitless volume of nonfungible tokens. They regularly adjust the tokens to expand interest.

- Indivisible: Most NFTs are unbreakable into more modest units. You perform the total purchase (with the total expense) of an advanced thing or purchase nothing.

- One-of-a-kind: NFTs have a solid database that clarifies their uniqueness. This data is completely secure and authentic.

A Journey Through NFT History

Non-fungible tokens (NFTs) have exploded in popularity in recent years, grabbing headlines with multi-million dollar sales of digital art and fueling a new kind of digital ownership. But the story of NFTs goes back further than you might think. Buckle up for a dive into the fascinating history of NFTs, from their conceptual roots to the present day!

Early Seeds: Colored Coins and the Dawn of Digital Scarcity (2012-2014)

The concept of NFTs can be traced back to the early days of Bitcoin, with the idea of “colored coins” emerging in 2012. Colored coins aimed to represent real-world assets like gold or loyalty points on the Bitcoin blockchain, planting the seed for unique digital tokens.

Enter “Quantum”: The First NFT (2014)

In 2014, artist Kevin McCoy took the next step by creating “Quantum,” considered the first true non-fungible token. “Quantum” was minted on the Namecoin blockchain, demonstrating the potential for blockchain technology to represent unique digital ownership.

Ethereum and the Rise of Standards (2015-2017)

The launch of Ethereum in 2015 provided a more fertile ground for NFTs. Ethereum’s programmability allowed for the creation of standards like ERC-721, specifically designed for non-fungible tokens. This paved the way for the explosion of NFTs in the years to come.

CryptoKitties and the Mainstream Moment (2017)

The year 2017 marked a turning point for NFTs with the launch of CryptoKitties, a game on the Ethereum blockchain featuring collectible digital cats. CryptoKitties’ popularity clogged the Ethereum network and captured the world’s attention, bringing NFTs into the mainstream consciousness.

The NFT Boom and Beyond (2021-Present)

The year 2021 witnessed a surge in NFT activity, with record-breaking sales of digital art like Beeple’s “$69 Million Dollar JPEG.” NFTs have expanded beyond art, encompassing music, collectibles, and even virtual real estate. The future of NFTs remains to be seen, but their impact on digital ownership and creative expression is undeniable.

How does NFT Work?

NFTs are essential for the Ethereum blockchain, so they are singular tokens with additional data put away in them. That additional data is the significant part, which permits them to appear as artistry, music, video, (etc.), JPGs, MP3s, recordings, GIFs, and then some more. Since they hold esteem, they can be purchased and sold actually like different kinds of art forms. And, as with actual artistry, the worth is generally set by the market and by request.

Did that sink in?

Also, don’t go reasoning you’ve hacked the situation by right-clicking and saving the picture of an NFT, all things considered. That will not make you a tycoon because your downloaded record will not hold the data that makes it part of the Ethereum blockchain. Did that sink in?

How Are NFTs Used?

NFTs use a cool process called minting to turn your digital stuff, like memes, music, or video game items, into unique collector’s items. Imagine putting your favorite meme in a giant, safe box that everyone can see but no one can touch. This super secure box is called a blockchain, and minting is like creating a special certificate that proves you own the meme inside the box.

Here’s a breakdown of how minting works:

- The Super Safe Box: The Blockchain: Think of the blockchain as a giant digital filing cabinet, but way more secure. When you mint an NFT, a special code gets attached to your meme, like a special mark that says “This belongs to [your name]!” This code is stored safely on the blockchain, so everyone can see it and no one can change it.

- Double Checking: Validators: Before your meme officially goes in the safe box, there are some digital guards called validators who make sure everything is okay. They check things like if your meme is new and not a copy of someone else’s.

- Special Rules: Smart Contracts: Sometimes, NFTs can come with special instructions called smart contracts. These are like little programs that can do things automatically, like sending a small fee to the person who created the meme every time it’s sold.

Minting basically takes your digital stuff and turns it into a special, one-of-a-kind collectible you can own and even trade! It’s like having a rare Pokemon card but for the digital world.

Fun Fact: Different Blockchains, Different Names!

While many blockchains can create NFTs, they might have different names. For example, on the Bitcoin blockchain, they’re called Ordinals. Like regular NFTs, Bitcoin Ordinals can be bought, sold, and traded. The key difference is that Ethereum creates special tokens for the asset, while Ordinals have special serial numbers (called identifiers) assigned to the smallest unit of Bitcoin, called a Satoshi.

Examples of the NFT World

NFTs, or non-fungible tokens, are like unique digital treasure chests holding a wide range of valuables. Here’s a glimpse into what you might find:

- Digital Collectibles: Remember those limited-edition trading cards? NFTs take it digital, offering one-of-a-kind ownership of things like:

- Crypto Critters: These were pioneers, adorable digital creatures with unique traits on the Ethereum blockchain, allowing them to “breed” and generate new NFTs with exciting combinations.

- Trading Cards 2.0: Imagine owning a rare digital trading card of your favorite athlete, complete with exclusive content or in-game benefits.

- Wearable Art: Accessorize your virtual avatar with one-of-a-kind clothing or items purchased as NFTs.

- Creative Corner: NFTs empower artists and creators:

- Photography Redefined: Photographers can tokenize their work, offering full or partial ownership to collectors, like stunning ocean photography collections on OpenSea.

- Musical Masterpieces: Musicians can release exclusive tracks or albums as NFTs, potentially granting ownership rights to the buyer.

- Artistic Expression: From pixel art to abstract masterpieces, NFTs provide a secure platform for artists to sell and showcase their work.

- The Metaverse Awaits: NFTs are unlocking new possibilities in virtual worlds:

- Virtual Land Baron: Ever dreamt of owning a digital plot of land? NFTs can represent ownership of virtual real estate in platforms like Decentraland.

- Membership Perks: Certain NFTs can act as digital keys, granting access to exclusive online communities or events.

- Beyond the Binary: The world of NFTs is constantly evolving, with applications extending to:

- Domain Names: Own the digital deed to your website’s name with NFTs.

Benefits of NFTs

Non-fungible tokens, or NFTs, have exploded onto the scene, revolutionizing the way we interact with and value digital assets. But beyond the hype and headlines, what are the tangible benefits of NFTs? Let’s dive into the exciting possibilities NFTs unlock for creators, collectors, and the future of digital ownership.

1. Unleashing the Power of Creators: NFTs empower creators to finally claim ownership and value for their digital works. Artists, musicians, and game developers can now monetize their creations directly, bypassing traditional gatekeepers and earning royalties on secondary sales. This fosters a more sustainable creative ecosystem, allowing artists to focus on their passion without financial constraints.

2. Verifiable Ownership and Scarcity: NFTs create a secure and transparent record of ownership for digital assets. Unlike easily copied digital files, each NFT is unique and verifiable on the blockchain, a tamper-proof digital ledger. This establishes scarcity, similar to limited edition prints or rare baseball cards, giving digital assets a new level of value and collectability.

3. Building Stronger Fan Communities: NFTs offer creators a powerful tool to foster deeper connections with their fans. Exclusive NFT drops, behind-the-scenes content, and even voting rights tied to NFTs can create a more engaged and loyal fan base. Imagine owning an NFT that grants you early access to a musician’s new album or exclusive artwork from your favorite artist.

4. Democratizing Art Collecting: Traditionally, art collecting has been an exclusive realm for the wealthy. NFTs break down these barriers by allowing anyone to participate in the art market with fractional ownership. Imagine co-owning a digital masterpiece with a group of collectors, making high-value art more accessible than ever before.

5. A New Era for In-Game Assets: NFTs are transforming the way we interact with video games. Imagine owning unique in-game items like weapons, skins, or even virtual land, all secured with NFTs. This opens doors for trading these assets with other players and potentially retaining value even as you move between games.

6. Revolutionizing the Digital Marketplace: NFTs pave the way for a more secure and efficient digital marketplace for all types of assets. From concert tickets to digital fashion items, NFTs can ensure authenticity, streamline transactions, and eliminate the risk of fraud.

How are people suddenly welcoming the NFT hype?

A portion of that interest is from individuals who embrace themselves by supporting independent creators’ work by buying their works; others are captivated by taking a computerized resource that anybody can duplicate and asserting responsibility for. The new feature value records for NFTs appear to have been generally determined by recently printed crypto moguls and very rich people hoping to differentiate their bitcoin property and more premium in the crypto biological system.

Cryptogame and media

As computerized artists install blockchain advances to sell NFTs, we can strongly hope to see a significant move in the video gaming industry as well.

Where does Blockchain fit in the gaming business?

It is well known that NFTs give the latest bread and butter of journalism and emotionalism. Still, computer games have a more significant history for blockchain use cases as microtransactions.

These days, the greatest games are allegedly free games with a detailed adaptation model. Fortnite is driving the accused in this field of a $2.4 billion income in 2018 and $1.8 billion in 2019.

Nonetheless, enormous games like Fortnite and Roblox have in-game monetary standards that fill in as a scaffold to fiat money transformation, V-Bucks, and Robux, individually.

They have a fixed cost corresponding to the U.S. dollar and other fiat cash. For instance, Fortnite’s 1,000 V-Bucks would cost you $7.99, while Roblox’s 800 Robux would take $9.99 from your ledger at the hour of composing.

Tradeable things in Fortnite

In any case, such standard super-mainstream games actually don’t have all-out commercial centers. Generally, they depend on thing shops and the selling of game records through Discord workers. Similarly, there are flourishing illicit businesses for Roblox (RBXPLACE, RBXFLIP, RBLXSHOPPING).

Referring to this, we can presume that:

- There is an incredible interest in a secluded commercial center arrangement that can connect to a game. Therefore, engineers don’t squander advancement assets on making something without any preparation, again and again with each new game.

- Engineers lose cash when players go to dim business sectors to exchange game resources. It ends up being their greatest advantage to utilize appropriate DeFi commercial centers.

- There is an extraordinary interest in decentralized commercial centers, which can run without depending on somebody purchasing and keeping a worker.

When designers are on enormous, brought-together, distributing stages, they also lose cash when selling DLC and other in-game things. For instance, Steam’s people group market expense exchange is right now 5%. Conversely, an NFT commercial center like Rarible takes 2.5% off deals.

Blockchain is obviously ready to supply such arrangements, but not exclusively. And, yet NFT commercial centers would already be able to be connected to a game’s lifecycle.

How Can I Buy NFTs?

Imagine walking into a digital marketplace filled with unique treasures. To snag an NFT, you’ll typically need two things: a digital wallet and some cryptocurrency. Think of your digital wallet as a secure online vault where you store your crypto, similar to how you might use a credit card at a regular store.

Now, the type of cryptocurrency you need depends on the marketplace you choose. Popular platforms like OpenSea accept various cryptocurrencies, while others might have specific requirements. It’s like using different currencies in different countries – do your research before diving in!

Are NFTs Safe?

Security is a top concern in the digital world. NFTs, built on blockchain technology like cryptocurrency, are generally very secure against hacking. However, the key to your NFT (think of it like a password) is crucial. If the software storing your key gets hacked, or if you lose the device where you keep it, your NFT could be at risk. This is similar to cryptocurrency – the saying “not your keys, not your coins” applies to NFTs as well. Remember, responsible security practices are essential when venturing into the NFT world.

What Does Non-Fungible Mean?

Imagine three identical baseball cards – they’re interchangeable, meaning you wouldn’t mind having any one of them. This is called fungibility. Now, take one of those cards and transform it into a one-of-a-kind NFT. Suddenly, it’s no longer interchangeable with the others – it’s become non-fungible. It possesses unique characteristics and value, just like a rare baseball card with a star player’s autograph.

How to use NFT in blockchain projects?

NFTs of works of art are like signatures. The exceptional character and responsibility for NFT are specific through the blockchain record. NFTs have metadata that they prepare through cryptographic hash work.

Ethereum makes it feasible for NFTs to work for various reasons:

- Exchange history and token metadata are openly certain – it’s easy to demonstrate possession history.

- When you affirm an exchange, it’s almost difficult to control that information to “take” possession of.

- Exchanging NFTs can happen distributed without requiring stages that can accept huge cuts as pay.

- All Ethereum items share the equivalent “backend.” Put another way, and all Ethereum items can see one another without much of a stretch. That makes NFTs compact across items. You can purchase an NFT on one item and sell it on another without any problem. As a maker, you can list your NFTs on numerous items simultaneously – each item will have the most state-of-the-art possession data.

- Ethereum never goes down, which means your tokens will consistently be accessible for sale.

Non Fungible token cryptocurrency uses

Fractional proprietorship

NFT makers can likewise make “shares” for their NFT. That offers financial backers and fans the chance to possess a piece of an NFT without purchasing the entire thing. That adds much more freedom for NFT minters and gatherers the same.

Fractionalized NFTs can be exchanged on DEXs like Uniswap, not simply NFT commercial centers. That implies more purchasers and dealers.

The cost of its portions can characterize an NFT’s general cost.

You have a greater chance to claim and benefit from things you care about. It’s harder when claiming NFTs evaluate you.

The copy/paste issue

Cynics regularly raise how NFTs “are idiotic” ordinarily close by an image of them screenshotting an NFT fine art. “See, presently I have that picture free of charge!” they say conceitedly.

Indeed, yes. In any case, does googling a picture of Picasso’s Guernica make you the glad new proprietor of a multi-million dollar piece of artistry history?

Eventually, claiming the genuine article is pretty much as important as the market makes it. The more a piece of substance is screen-gotten, shared, and for the most part, utilized, the more worth it gains.

Possessing an unquestionably genuine article will consistently have more worth than not.

Boosting gaming potential

NFTs have seen a ton of interest from game developers. NFTs can give proprietorship records to in-game things, fuel in-game economies, and carry a large group of advantages to the players.

In a ton of ordinary games, you can purchase things for you to use in your game. However, on the off chance that that thing was an NFT, you could recover your cash by selling it when you finish the game. You may even make a benefit if that thing turns out to be more alluring.

For game developers – as guarantors of the NFT – they could procure sovereignty each time an exchange of items happens in the open commercial center. That makes an all the more commonly advantageous plan of action where the two players and developers acquire from the optional NFT market.

This likewise implies that if a game is not, at this point, kept up by the developers, the things you’ve gathered remain yours.

NFT-supported loans

There are DeFi applications that let you acquire cash by utilizing a guarantee. For instance, you collateralize 10 ETH so you can earn 5000 DAI, which is a stablecoin. That ensures that the bank gets repaid – if the borrower doesn’t repay the DAI, the insurance ships off the loan specialist. Anyway, not every person has enough crypto to use as a guarantee.

Tasks are starting to investigate utilizing NFTs as insurance, all things considered. Imagine you purchased an uncommon CryptoPunk NFT some time ago – they can bring $1000s at the present costs. By putting this up as insurance, you can get credit with a similar guideline set. Suppose, in any case, if you don’t repay the DAI, your CryptoPunk will be shipped off the moneylender as security. This could, in the end, work with anything you tokenize as an NFT.

Furthermore, this isn’t challenging for Ethereum, in light of the fact that the two universes (NFT and DeFi) share a similar framework.

NFT in the Gaming Ecosystem

The worldwide gaming industry creates income across three market subsets: portable, PC, and reassure. These are esteemed in the many billions of dollars and developing. Be that as it may, while industry occupants benefit from this hearty development, players produce minimal enduring incentives for themselves. In the wake of putting resources into costly consoles, PCs, or cell phones, players enter gaming conditions that offer a layered admittance client experience. In these customary games, cash streams a single way. The way is, players should go through cash to access in-game substance and selective highlights.

Interestingly, blockchain-empowered games — a significant number of which are decentralized applications (dApps) — center all the more vigorously around producing an incentive for players. This dynamic presents a change in perspective that permits players to more readily catch the utility and estimation of resources. They are obtained through in-game buys, standard ongoing interaction, or limited-time occasions. For example, when a player buys a reinforcement update in a customary game, their solitary advantage is upgraded interactivity inside that one game setting. In any case, in a gaming biological system that uses cross-stage non-fungible tokens (NFTs), a similar defensive layer can be tokenized in a manner that changes in-game buys into adaptable resources. Adapting this practice, may present advantages across interconnected games or be traded for cash or other advanced resources.

The fundamental blockchain network empowers the age and organization of these NFTs inside numerous gaming conditions. Since NFTs are one of a kind and can be intended to hold esteem past the game they began, blockchain-constructed games can significantly extend gaming economies. They can set up new gaming classes, and fuel new game turn of events. To investigate how this cycle may unfurl, it’s significant first to comprehend NFTs.

The top 5 Non Fungible tokens projects in the industry

#1 Hashmasks: Unique, community-oriented fine art collectibles

Dispatched by Suum Clique Labs in Switzerland, the convention offers advanced artistry collectibles made by more than 70 craftsmen from around the globe. There is an aggregate of 16,384 interesting advanced representations (i.e., “Hashmasks”) on the organization, and each is novel regarding its character, cover, eye tone, skin tone, and things.

Each client possesses a Hashmask, and the convention empowers client investment by allowing the proprietor to dole out an interesting name for every craftsmanship. This is done by means of the stage’s local token — the, or NCT. Every holder can consistently guarantee around 10 NCTs created from their Hashmasks. And when they hold 1,830 NCT, they can consume them and rename the Hashmask on the Ethereum blockchain. The provenance record of each Hashmask can be through the Interplanetary File System.

Clients bought their first Hashmasks during the underlying circulation time frame that began in late January and has since closed. The buy costs of Hashmasks were determined on a sliding scale. Along these lines, the prior the buy, the less expensive the cost. Clients who partook in the underlying circulation time frame additionally got 3,660 NCTs each, empowering them to make two name changes for their Hashmasks.

#2 NBA Top Shot: Giving NFTs prime time

NBA Top Shot is a formally authorized blockchain application from the National Basketball Association, made in an organization with Dapper Labs and based on top of the Flow blockchain.

Every collectible in NBA Top Shot — accessible as an NFT — contains a short video of an in-game second (a dunk, a bell mixer, a match-dominating square, etc) that accompanies explicit data. It also includes the game the second came from, the collectible’s extraordinariness, details of the player it highlights, and occasional midpoints close by ongoing deals history.

They sell these minutes in a set number of packs every week, which are sorted into levels depending on their extraordinariness: Common, Rare, and Legendary. When the stage emerges from beta, a super uncommon fourth level, Ultimate, will be presented. That will incorporate one-of-one “Beginning” minutes and one of three “Platinum Ice” minutes. However, users will sell them through sale instead of through pack drops.

The Common, Rare, and Legendary minutes can likewise be bought from different clients straightforwardly from the platform marketplace. And their level controls their costs, including players and serial numbers.

Included packs are reliably sold out because of the solid client interest.

NBA Top Shot has detonated in fame and topped the absolute deals in the NFT circle. On Feb. 23, a Legendary LeBron James second in the Cosmic Series 1 Set was for $208,000. It was the top procurement of NBA Top Shot collectibles to date. NBA Top Shot has likewise earned more than $427 million in deals, and around 333,000 authorities possess collectibles as of the hour of composing. Going ahead, NBA Top Shot is required for extra highlights and games.

#3 CryptoKitties: The first NFT to go mainstream

Cryptokitties is essentially an Ethereum-based game that permits clients to gather and raise virtual cats. The game’s tokens are nonfungible, as everyone addresses a remarkable digital feline on the blockchain. These digital cats are separated regarding their appearance and qualities — their “attributes.” Given these tokens’ ideas, each digital kitty addressed by an NFT can’t be recreated, eradicated, or removed.

To begin reproducing digital cats, clients need to store Ether (ETH) in the game’s true wallet, Dapper. There are two different ways to breed new kitties — rearing two of your own kitties or reproducing with a public sire (i.e., the dad). Clients can get their first kitty by making a buy in the commercial center or offering a kitty in the game’s offer system.

Experienced CryptoKitties players intend to gather whatever number of important digital cats they can. Its age and extraordinariness dictate the estimation of every kitty. For ages, an overall dependable guideline is that kitties with fewer ages are more important than those with a bigger number. This is on the grounds that kitties with fewer ages have quicker cooldown speeds, so they can rise all the more frequently.

#4. Rarible: A marketplace for digital collectibles

Rarible is an NFT marketplace established by Alexander Salnikov and Alexei Falin in January 2020. The Moscow-based stage permits clients to mint, purchase, and sell their uncommon digital collectibles. Rarible backs an assortment of digital collectibles and items, including digital artistry, area names, DeFi protection approaches, images, and metaverses.

The printing of digital collectibles in Rarible is moderately clear. Clients can begin by transferring collectibles in any upheld digital structures (realistic, sound, and so forth), trailed by adding depictions and valuing subtleties. After this, clients need to interface with their Ethereum wallet to support printing exchanges.

The NFT printing highlight has been interesting to content makers and specialists. Specifically, the ones who can deliver mysteries for their substance and give full forms to clients solely after the acquisition of the applicable NFT.

Rarible acquired far-reaching prominence in the local crypto area because of its administration token, RARI. While the new promotion around administration tokens comes from the DeFi circle, Rarible was the principal NFT convention that launched its own administration token.

#5 Decentraland: A decentralized virtual world

Controlled by the Ethereum blockchain, Decentraland is a decentralized virtual world that permits clients to utilize altered symbols, exchange collectibles, and take an interest in the virtual world’s administration interaction.

To begin investigating Decentraland, clients need to initially associate an internet browser with their crypto wallet. Clients would then be able to choose and modify their avatars. Every avatar symbol is given a virtual identity addressing its personality in Decentraland. Whenever clients have finished their symbol’s underlying arrangement, they can begin fabricating their own area. And then, they can purchase uncommon digital resources.

Cooperation in Decentraland requires both fungible and nonfungible tokens. MANA is the digital cash utilized in the Decentraland marketplace. Each MANA token is exchangeable with another MANA token and is, thus, fungible.

Choosing Idea Usher for blockchain development

Blockchain development is getting more relevant by the second. We can utilize distributed ledger technology to make the transactions secure, reliable, and transparent. And you know you want professionals to manage this process. If you are looking to partner with a top blockchain development company in 2024, we’re here to help. Contact us for a one-on-one meeting to get a quote.

Takeaway

Non Fungible tokens will disrupt traditional business models transforming the Internet of Things. The NFT is a smart contract on the blockchain which allows users to purchase these tokens. Each token represents a specific asset, from a house to artwork to gold, and even other cryptocurrencies.

The NFT market is volatile and unpredictable. The next day you enter this market might be the one that will change your life forever, for good or bad. The bearish trends are common in the NFT market, and unfortunately, we have to accept them. However, one way of mitigating these risks is ensuring the safety of our assets.

Frequently Asked Questions

Q. How does an NFT make money?

NFTs don’t inherently make money. They represent ownership of a digital asset, and the value of that asset fluctuates based on market demand. Here are some ways someone might make money with NFTs:

- Selling an NFT: The most common way is to sell your NFT on a marketplace like OpenSea, potentially for a profit if its value has increased since you acquired it.

- Royalties: Some NFTs are created with royalty structures, meaning the original creator earns a percentage every time the NFT is resold.

- Utility: Owning certain NFTs can grant access to exclusive benefits or experiences, potentially increasing their value.

Q. How exactly does an NFT work?

NFTs rely on blockchain technology, a digital ledger that records transactions transparently and securely. Here’s a simplified breakdown:

- Digital Asset Creation: A digital file (image, video, etc.) is linked to an NFT.

- Minting: The NFT is created on a blockchain platform, assigning a unique identifier and recording ownership.

- Buying and Selling: NFTs can be bought and sold on marketplaces using cryptocurrency. Ownership is transferred on the blockchain.

Q. What is the concept behind NFT?

The core concept behind NFTs is digital scarcity. Unlike fungible digital assets like Bitcoin (every unit is identical), NFTs are one-of-a-kind tokens representing unique digital items. This allows for:

- Proof of Ownership: NFTs provide a verifiable record of ownership for digital assets.

- Collectible Value: NFTs create a market for limited-edition digital collectibles.

- New Revenue Streams for Creators: Artists and creators can leverage NFTs to sell their work directly and potentially earn royalties on resales.

Q. Will cryptocurrency be a lucrative business venture?

Yes. By 2050, over 9 million financial transactions will be digital. This number is growing by the day. The more people there are, the more money there needs to be circulated. Today, a growing field of business is popping up, and it is called cryptocurrencies. They are just like regular cash for goods and services on the internet. A way to better understand them is to think of them like Bitcoin, which doesn’t have any physical form. Cryptocurrencies exist online, and anyone can buy them from the entire world. It is regardless of their age or where they’re from. Now imagine how much money a business can possibly make by venturing into it.

Q. Can Idea Usher help my business with game development?

“Game development” is the next digital gold rush, and your business can get there first. However, cryptocurrency and blockchain technology have propelled game development further than we thought possible. Hiring with an agency like Idea Usher can help streamline your workflow, allowing you more time to develop brand strategy and market planning.

Q. Where can I buy NFT tokens?

NFT tokens are their own cryptocurrency, and they’re stored in an Ethereum wallet. You can buy them from exchanges that have listed them like OceanEx, IDEX, and ForkDelta. Just check on CoinMarketCap to find the trade that works for you.

Q. How secure is cryptocurrency?

Blockchain and other cryptocurrencies are becoming more popular. One of the advantages of cryptocurrency is security. In 2024, you can securely store and transfer value without a third party’s help seems quite revolutionary.

We hope you find our blog review on the Nonfungible tokens extremely helpful and informative!

If you are looking for more fascinating tech articles and guidance on Non-Fungible Token applications and Blockchain Development, we are more than happy to assist you. Feel free to reach out to us and get started today!

Vivek Badani