Rare earth minerals are vital to modern manufacturing, but ownership and access are restricted by opaque supply chains and limited market participation. Although demand is rising in the energy, electronics, and defense sectors, asset infrastructure remains largely unchanged. This gap is fueling interest in a rare earth mineral tokenization platform, which would enable digital representation of verified mineral assets through transparent ownership models.

Tokenizing rare earth minerals introduces challenges that go beyond issuing digital tokens. Provenance verification, reserve validation, custody arrangements, regulatory compliance, and linkage to physical supply chains all need to be reflected accurately on chain. The platform must ensure that digital ownership aligns with real-world extraction, storage, and transfer processes, while maintaining trust across stakeholders.

In this blog, we explore rare earth mineral tokenization platform development by breaking down core system components, architectural considerations, and the practical steps involved in building a compliant and scalable platform for tokenized mineral assets.

What is a Rare Earth Mineral Tokenization Platform?

A Rare Earth Mineral Tokenization Platform is a blockchain-based system that represents ownership or economic rights in rare earth minerals as digital tokens. Instead of buying and holding physical minerals directly, investors can acquire and trade tokens on a blockchain, where each token corresponds to a portion of the underlying physical asset or its economic value. Tokenization makes traditionally illiquid and high-cost assets more accessible, transparent, liquid, and tradable across global markets.

How the Rare Earth Mineral Tokenization Platform Works?

A rare earth mineral platform tokenizes verified assets into blockchain tokens for transparent ownership and trading, linking physical resources with compliant digital investment.

1. Asset Onboarding & “Digital Twin” Creation

A physical asset (e.g., a stockpile of neodymium-praseodymium oxide) is legally placed into a secure legal structure, like a Special Purpose Vehicle (SPV). This establishes clear ownership.

A “digital twin” is created on the blockchain. This is not just a token; it’s a unique digital profile linked to the asset, containing immutable data like certified assay reports, volume, location, and ESG metrics.

2. Token Minting & Rights Encoding

The platform’s smart contract mints security or utility tokens representing a claim on the asset. The rules are coded into the token:

- What it represents: e.g., 1 kg of a specific oxide, a revenue share from a mine.

- How value flows: Automated royalty distributions or profit-sharing.

- Governance: Voting rights on major decisions.

3. Lifecycle Management via Oracles & Smart Contracts

Oracles (trusted data feeds) are critical. They push real-world data (new assay results, shipment GPS data, warehouse receipts) onto the blockchain, updating the digital twin’s status.

Smart contracts automatically execute actions based on this data: releasing payment upon verified delivery or distributing revenue to token holders.

4. Market Operations & Settlement

The platform typically hosts a B2B marketplace. Here, industrial buyers (e.g., magnet manufacturers) can purchase tokens representing physical material for delivery.

It enables trade and supply chain finance: A tokenized offtake agreement can be used as collateral for a loan, with the smart contract ensuring automatic repayment from sales proceeds.

Types of Rare Earth Minerals to Tokenize

Rare earth mineral tokenization focuses on elements with high industrial demand and strategic importance across global supply chains. This section outlines the key rare earth minerals commonly selected for secure, blockchain-based tokenization.

| Tokenization Stage | Primary Element(s) / Product | Key Driver for Tokenization |

| Refined Oxides & Metals (Most Likely) | Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy), Terbium (Tb) | Direct magnet industry demand. Need for verifiable, high-purity supply for EVs & defense. Enables financing of separation plants. |

| Europium (Eu), Terbium (Tb), Yttrium (Y) | Phosphors & display industry. High-value, low-volume markets where provenance and purity are premium factors. | |

| Intermediate Products (Emerging) | Mixed Rare Earth Concentrate (e.g., bastnäsite, monazite) | Project financing. Tokenizing a defined, assayed concentrate stockpile to secure funding for downstream processing. |

| Rare Earth Carbonate/Sulfate | Early-stage financing & trade. Represents a partially processed, bulk product that can be traded before costly separation. | |

| By-Products & Strategic Materials | Lanthanum (La), Cerium (Ce) | Market stability & utilization. High-abundance by-products of NdPr production; tokenization could help manage inventory and find new markets. |

| Heavy Rare Earth (HRE) “Baskets” | Risk diversification. Tokenizing a blended product of several hard-to-separate HREs to meet specific alloy or catalyst demand. |

Why Rare Earth Mineral Tokenization is Gaining Popularity?

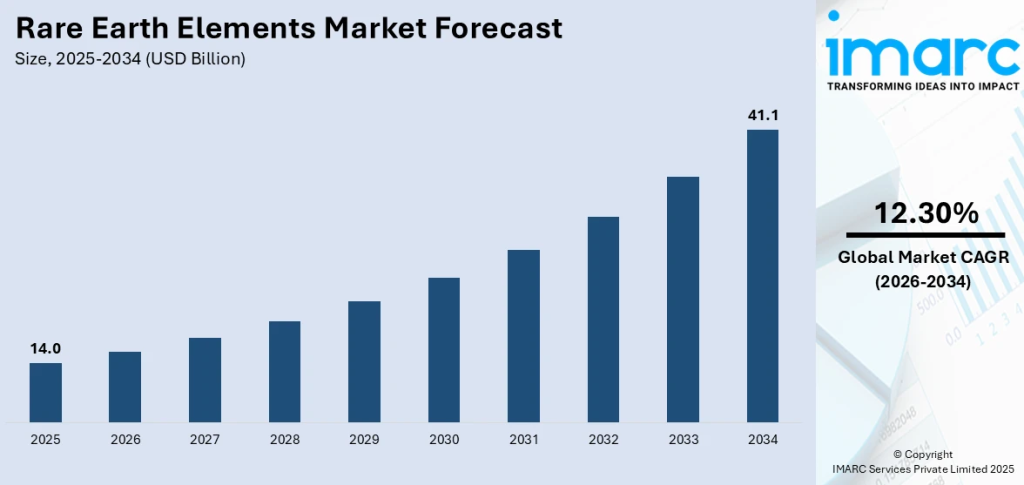

The global rare earth elements market was valued at USD 14.0 billion in 2025 and is expected to reach USD 41.1 billion by 2034, growing at a CAGR of 12.30%. This growth is increasing demand for transparent and secure ownership models, positioning tokenization as a practical solution for rare earth mineral investments.

This momentum aligns with a broader surge in institutional adoption of real-world assets. In 2025 alone, the RWA market expanded rapidly, growing from approximately USD 8.6 billion to over USD 25 billion within months, reinforcing confidence in tokenized models for scarce and high-value resources like rare earth minerals.

Businesses That Are Already in Rare Earth Mineral Tokenization

Several enterprises have already begun adopting rare earth mineral tokenization to improve traceability, financing access, and regulatory compliance across global supply chains.

1. ReElement Technologies & SAGINT Inc.: Developed a private blockchain solution using utility tokens to track refined Neodymium Oxide (Nd₂O₃), ensuring immutable chain-of-custody, traceability, and compliance with U.S. DoD and DFARS regulations.

2. CVMR Corporation & RAMINVEST: Launched an asset-backed token model for a gold-backed fund exceeding $7B, designed to finance and invest in global rare earth mining and refining projects through structured digital assets.

3. SMX (Security Matters): Built a molecular verification platform that embeds unique markers into rare earth materials, enabling physical fingerprinting to prove origin, purity, and ethical sourcing for trusted tokenization.

These market indicators and real-world implementations show why rare earth mineral tokenization is moving beyond concept into practical adoption. As demand grows for traceability, compliant ownership, and efficient capital access, tokenization offers a structured way to align mineral assets with modern digital and regulatory expectations.

How Tokenization Improves Liquidity for Rare Earth Minerals?

Tokenization does not create speculative liquidity for rare earth minerals. It introduces structured, compliant liquidity into a market historically constrained by high entry barriers, slow settlement cycles, and limited participant access.

1. Fractional Ownership of Mineral Assets

Tokenization breaks large, capital-intensive rare earth assets into fractional digital units, allowing participants to buy or sell smaller positions without transferring full physical inventories or renegotiating complex long-term contracts.

2. Creation of Controlled Secondary Markets

Tokenized rare earth assets can be traded on permissioned secondary markets, enabling periodic liquidity while maintaining buyer eligibility, regulatory compliance, and industrial-use restrictions that traditional commodity markets struggle to enforce.

3. Faster Transfer and Settlement Cycles

Blockchain-based settlement reduces transaction timelines from weeks or months to near real-time, allowing capital to move faster and increasing trade velocity for assets that are traditionally slow to transact.

4. Broader Access for Institutional Buyers

Tokenization enables verified institutional investors and industrial buyers to access rare earth exposure through standardized digital instruments, expanding the pool of potential counterparties beyond bilateral, relationship-driven transactions.

5. Standardized Pricing and Price Discovery

Tokenization represents rare earth minerals as standardized digital units and creates clearer price signals across transactions, reducing opacity from private negotiations and fragmented regional pricing structures.

6. Liquidity Without Physical Delivery

Tokenization allows ownership interests to change hands without immediate physical movement of minerals, enabling liquidity while preserving custody stability and avoiding logistical, regulatory, and export-related friction.

Key Features of Rare Earth Mineral Tokenization Platform

A rare earth mineral tokenization platform enables the secure digitization of critical minerals through blockchain. These features ensure transparency, regulatory compliance, traceability, and efficient access to rare earth mineral investments.

1. Mineral Asset Onboarding & Verification

A rare earth mineral tokenization platform includes a structured onboarding process to verify mineral assets using geological surveys, assay reports, licensing data, and third-party audits before any token issuance occurs.

2. Inventory & Assay Data Management

The platform manages reserve estimates, extracted inventory levels, and assay results to ensure token supply always aligns with verifiable mineral quantity, grade, and extraction status.

3. Geochemical Signature & Purity Certification

The platform records geochemical signatures, purity levels, and laboratory certification data (On-Chain Metadata) as immutable on-chain metadata, enabling buyers and regulators to verify mineral authenticity, grade, and origin without relying solely on off-chain documentation.

4. Token Issuance & Supply Control

Predefined rules govern token issuance and link it to verified reserves or inventory, preventing over-issuance while supporting minting, burning, or adjustment as minerals are extracted, depleted, or replenished.

5. Custody, Storage & Vault Integration

The platform integrates with certified vaults or warehouses for extracted minerals, linking custody records and storage proofs to tokenized assets to ensure physical backing and settlement readiness.

6. Chain-of-Custody & Provenance Tracking

The platform records each stage of mineral movement from extraction to storage or delivery, creating an immutable provenance trail that reduces fraud, prevents double-counting, and supports regulatory oversight.

7. Smart Contract–Based Ownership Enforcement

Smart contracts enforce ownership rights, transfer restrictions, and settlement logic to ensure tokens move, trade, or redeem only within predefined legal and compliance conditions.

8. Extraction, Depletion & Replenishment Tracking

The system tracks mineral extraction events and reserve depletion over time, automatically updating available token supply and ownership ratios to reflect the physical lifecycle of rare earth mineral assets.

9. Mineral-Backed Token Structuring

The platform applies distinct token structures, rights models, valuation logic, and risk disclosures to clearly differentiate between in-ground mineral reserves and extracted inventory based on their physical and operational status.

10. Tiered Liquidity Pools for Specific Elements

The platform supports separate liquidity pools for individual rare earth elements (e.g., Neodymium vs. Dysprosium), allowing differentiated pricing, controlled liquidity, and market access based on element-specific demand, strategic importance, and regulatory sensitivity.

Rare Earth Mineral Tokenization Platform Development

Rare earth mineral tokenization platform development concentrates on creating secure, compliant blockchain systems for digitizing key mineral assets. Our team adopts industry best practices to deliver scalable, transparent platforms that support digital mineral investments.

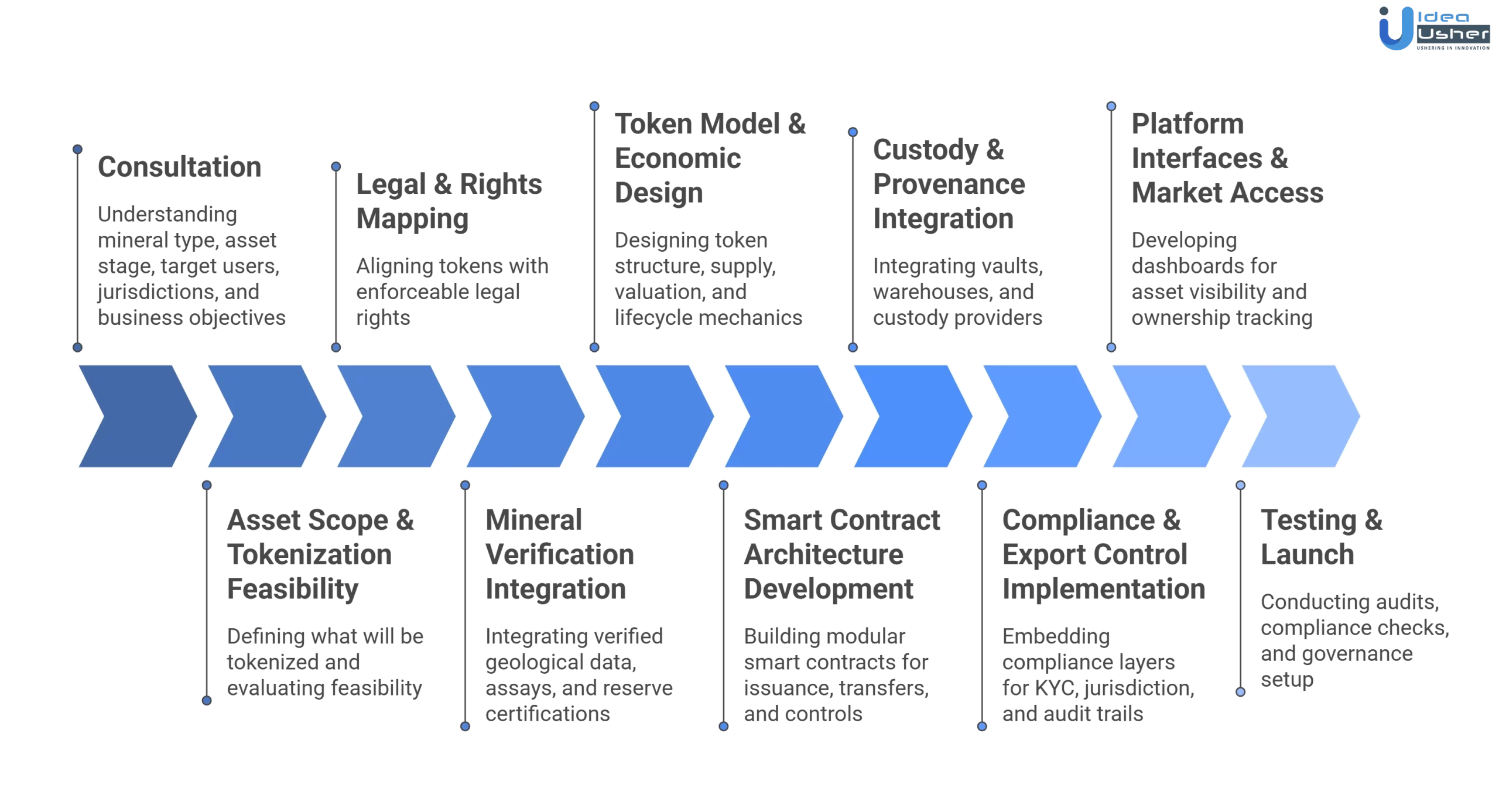

1. Consultation & Use-Case Alignment

We start with a structured consultation to understand the mineral type, asset stage, target users, jurisdictions, and business objectives. Our developers align the tokenization strategy with real operational, regulatory, and market constraints from day one.

2. Asset Scope Definition & Tokenization Feasibility

We define what will be tokenized such as in-ground reserves, extracted inventory, royalties, or offtake rights. Our team evaluates feasibility based on mining laws, export controls, custody requirements, and lifecycle complexity.

3. Legal Structuring & Rights Mapping

We work with legal inputs to map tokens to enforceable rights such as ownership, entitlement, or revenue claims. Our developers ensure that on-chain logic mirrors off-chain legal agreements without creating unenforceable digital representations.

4. Mineral Verification & Certification Integration

We integrate verified geological surveys, assay reports, purity certifications, and reserve classifications. Our platform design ensures token issuance is always anchored to certified, auditable mineral data.

5. Token Model & Economic Design

We design the token structure, supply logic, valuation rules, and lifecycle mechanics. Our developers differentiate between in-ground and extracted minerals to ensure accurate pricing, disclosures, and risk separation.

6. Smart Contract Development

Our developers build modular smart contracts to manage issuance, ownership enforcement, transfer restrictions, redemption, depletion, and emergency controls. Contracts are designed for upgradeability and long-term regulatory adaptability.

7. Custody, Storage & Provenance Integration

For extracted minerals, we integrate vaults, warehouses, and custody providers. Our platform links physical custody proofs and chain-of-custody records directly to token states to maintain asset backing integrity.

8. Compliance & Export Control Implementation

We embed compliance layers covering KYC, jurisdictional access, export restrictions, and audit trails. Our developers ensure only authorized participants can hold, trade, or redeem rare earth mineral tokens.

9. Platform Interfaces & Market Access

We develop investor, institutional, and industrial buyer dashboards for asset visibility, certification review, ownership tracking, and settlement workflows. Permissioned market access is configured based on compliance rules.

10. Testing, Launch & Post-Launch Governance

We conduct smart contract audits, custody reconciliation tests, and compliance validation before launch. After deployment, our governance framework supports upgrades, new asset onboarding, and regulatory changes without platform disruption.

Rare Earth Mineral Tokenization Platform Development Cost

Rare earth mineral tokenization platform development cost varies based on blockchain infrastructure, compliance requirements, asset complexity, and security needs, influencing overall investment, scalability, and long-term operational efficiency of the platform.

| Development Phase | What Our Developers Will Deliver | Estimated Cost |

| Consultation & Use-Case Alignment | Technical and business requirements, asset scope, regulatory assumptions, and platform architecture direction | $5,000 – $10,000 |

| Asset Scope & Tokenization Feasibility | Feasibility analysis covering mineral type, tokenizable rights, lifecycle complexity, and constraints | $8,000 – $15,000 |

| Legal Structuring & Rights Mapping | Token-right mapping aligned with legal agreements and enforceable ownership or entitlement logic | $12,000 – $25,000 |

| Mineral Verification Integration | Integration of assay reports, certification data, reserve documentation, and verification workflows | $10,000 – $20,000 |

| Token Model & Economic Design | Token structure, supply rules, valuation logic, risk disclosures, and lifecycle behavior definition | $12,000 – $22,000 |

| Smart Contract Architecture Development | Secure, upgradeable smart contracts for issuance, ownership enforcement, transfers, and redemption | $20,000 – $32,000 |

| Custody & Provenance Integration | Vault, warehouse, and chain-of-custody integration linked directly to token states | $14,000 – $25,000 |

| Compliance & Export Control Implementation | KYC, jurisdiction gating, export restrictions, audit trails, and compliance enforcement logic | $9,000 – $15,000 |

| Platform Interfaces & Market Access | Investor, institutional, and buyer dashboards with permissioned market access controls | $16,000 – $22,000 |

| Testing, Launch & Governance Setup | Security audits, compliance validation, deployment, governance configuration, and launch support | $14,000 – $22,000 |

Total Estimated Cost: $65,000 – $126,000+

Note: Rare earth mineral tokenization platform development depends on asset verification, regulatory compliance, blockchain architecture, smart contracts, and secure data integration.

Consult with IdeaUsher to evaluate your asset model, compliance requirements, and technical scope for building a reliable mineral tokenization platform.

Challenges and How Our Developers Will Solve Those?

Rare earth mineral tokenization platform development involves challenges around regulation, asset verification, and supply-chain complexity. Our developers address these issues with secure architecture, compliance-driven design, and industry-aligned blockchain solutions.

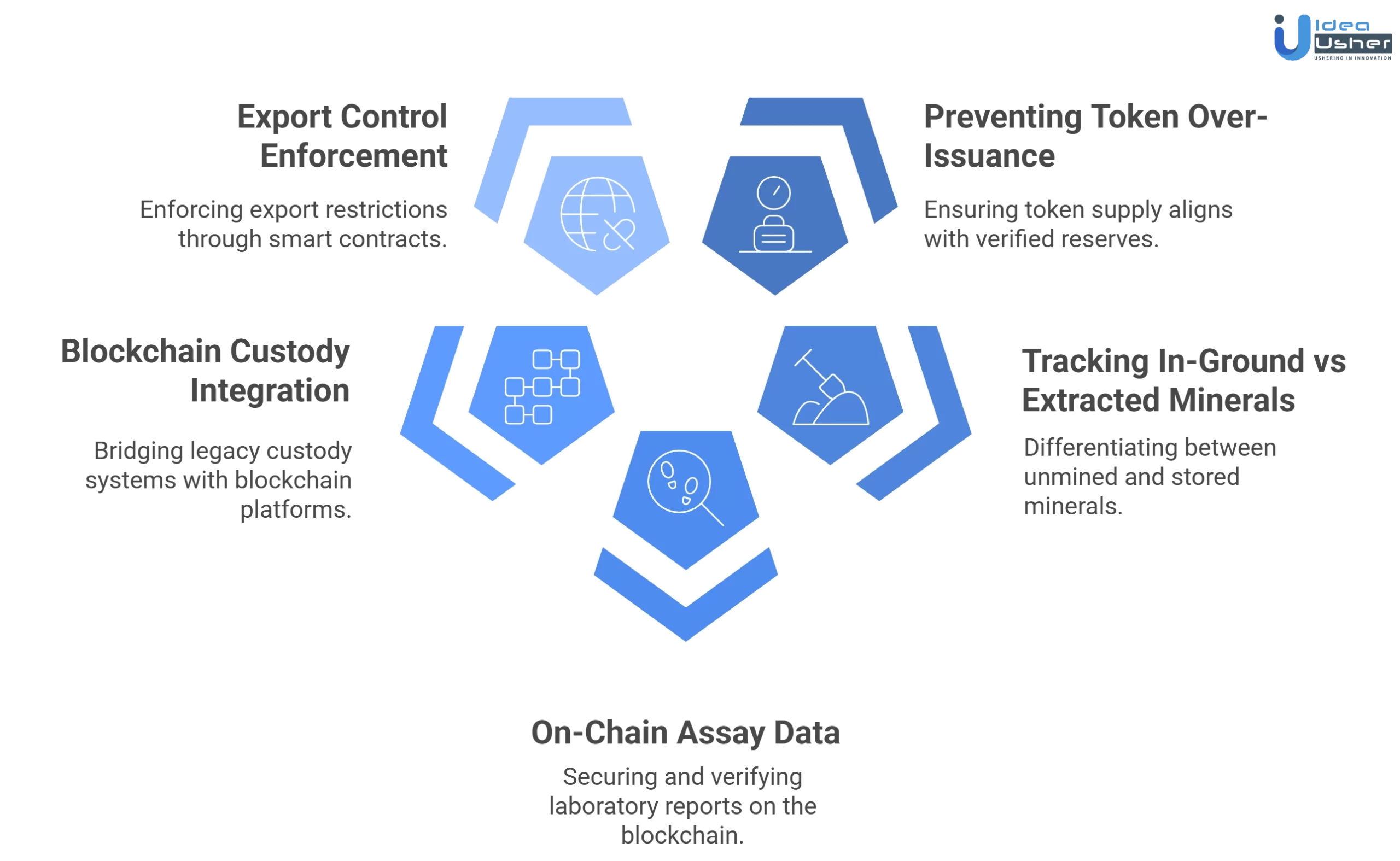

1. Preventing Token Over-Issuance

Challenge: Geological estimates change over time, and reserve classifications are probabilistic, not absolute. Over-issuing tokens against uncertain reserves creates legal and financial exposure.

Solution: We design issuance logic tied only to certified reserve classes and enforce conservative supply caps with controlled minting triggered by verified reclassification or extraction milestones.

2. In-Ground vs Extracted Mineral Tracking

Challenge: Treating unmined reserves and physically stored minerals as the same asset introduces valuation errors and misleading investor expectations.

Solution: We implement separate token models, disclosures, and lifecycle rules for in-ground versus extracted minerals, ensuring clear risk separation and accurate ownership representation.

3. On-Chain Assay and Purity Data

Challenge: Laboratory reports are off-chain, format-inconsistent, and vulnerable to tampering if not properly linked.

Solution: We hash assay reports, purity certificates, and geochemical signatures on-chain, creating immutable references that verify authenticity without exposing sensitive raw data publicly.

4. Blockchain Custody Integration

Challenge: Custodians operate legacy systems that do not natively communicate with blockchain platforms.

Solution: We build middleware layers that synchronize custody confirmations, inventory changes, and chain-of-custody events with smart contract states in near real time.

5. Export Control and Compliance Enforcement

Challenge: Rare earth minerals are often subject to export bans, quotas, or government oversight that generic token platforms cannot enforce.

Solution: We encode jurisdictional and buyer-type restrictions directly into access control, transfer logic, and redemption workflows, preventing unauthorized settlement or cross-border movement.

Business Models of Rare Earth Mineral Tokenization Platform

Rare earth mineral tokenization platforms adopt structured business models to balance regulatory compliance, asset security, and investor participation. These models define how mineral assets are digitized, monetized, and managed within blockchain-based investment ecosystems.

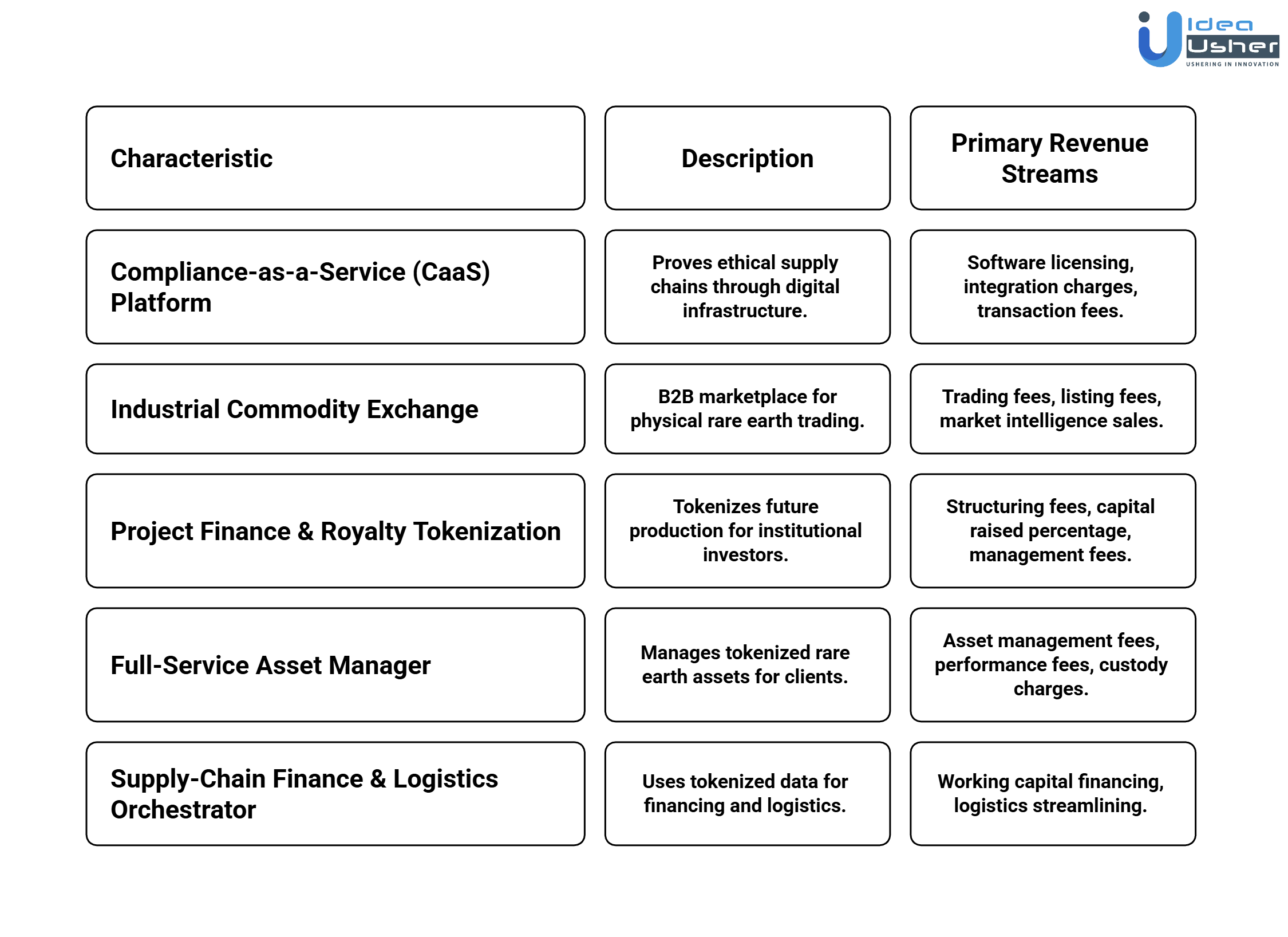

1. Compliance-as-a-Service (CaaS) Platform

A Compliance-as-a-Service platform enables miners and refiners to prove DFARS- and IRA-compliant, ethical rare earth supply chains to OEMs, governments, and regulators through auditable digital infrastructure.

Primary Revenue Streams: Revenue is generated through recurring software licensing or SaaS fees, onboarding and system integration charges, and transaction-based fees for provenance, certification, and compliance data usage.

2. Industrial Commodity Exchange

An industrial commodity exchange creates a liquid, B2B marketplace for physical rare earth oxides, alloys, and metals, enabling spot and futures trading under controlled, compliant market conditions.

Primary Revenue Streams: Revenue comes from trading fees, listing fees charged to producers and suppliers, and premium sales of market intelligence, pricing data, and supply-demand analytics.

3. Project Finance & Royalty Tokenization

This model unlocks capital for mining projects by tokenizing future production, royalties, or offtake agreements and offering them to institutional investors seeking long-term commodity exposure.

Primary Revenue Streams: Revenue is generated through structuring and advisory fees, a percentage of capital raised during token offerings, and ongoing management or servicing fees over the project lifecycle.

4. Full-Service Asset Manager

A full-service asset manager oversees the complete lifecycle of tokenized rare earth assets for institutional clients, such as operating tokenized physical commodity funds or managed portfolios.

Primary Revenue Streams: Revenue includes asset management fees based on assets under management, performance-based incentive fees, and custody, administration, and servicing charges.

5. Supply-Chain Finance & Logistics Orchestrator

This model uses tokenized inventory, contracts, and provenance data to enable working capital financing and streamline logistics across rare earth supply chains.

Primary Revenue Streams: Revenue is earned through interest rate spreads on financing, logistics coordination and verification fees, and transaction fees for platform usage.

How We Ensure Asset Verification in Rare Earth Tokenization Platforms?

Asset verification and due diligence are critical to rare earth tokenization platform integrity and investor trust. Our approach combines geological validation, compliance checks, and transparent data frameworks to ensure reliable, verifiable digital mineral assets.

1. Verification Is Enforced Before Token Issuance

A rare earth tokenization platform restricts token minting until all verification steps are completed. Geological reports, assay data, licensing records, and custody confirmations must be validated before issuance logic becomes accessible.

2. Asset Onboarding Workflows

The platform includes standardized onboarding modules where mineral data is submitted in defined formats. Reserve classifications, purity levels, geochemical signatures, and extraction status are recorded consistently to support reliable verification.

3. On-Chain Anchoring of Verification Evidence

Instead of storing sensitive documents on-chain, cryptographic hashes of assay reports and certifications are recorded. This provides immutable proof that specific verification data was reviewed at the time of token issuance.

4. Asset State Management and Enforcement

Each mineral asset moves through predefined states such as submitted, verified, active, or restricted. Token issuance, transfers, and redemption are automatically restricted when assets are unverified or flagged.

5. Certified Mineral Data-Based Token Issuance

Token supply is calculated using only approved reserve categories or confirmed inventory quantities. This prevents over-issuance and ensures token backing reflects certified mineral reality rather than estimated projections.

Conclusion

Rare earth minerals play a vital but essential role in modern industry, from clean energy to advanced electronics. Tokenization introduces a structured way to represent ownership, improve traceability, and reduce friction across complex supply chains. This shift is not about replacing existing systems, but about strengthening transparency and accountability where it matters most. Rare earth mineral tokenization platform development connects technology with responsible resource management, supporting investors, producers, and regulators alike. When implemented with care, it reinforces trust while recognizing the strategic value and long-term importance of these critical materials.

Develop Rare Earth Mineral Tokenization Platform with IdeaUsher!

We specialize in blockchain, tokenization, and dApp development for complex enterprise use cases. Using this expertise, our ex-FAANG/MAANG developers build rare earth mineral tokenization platforms that securely digitize critical mineral assets.

Why Work With Us?

- Critical Minerals Domain Knowledge: We design platforms aligned with reserve validation, production tracking, and mineral-specific compliance requirements.

- Asset-Backed Token Engineering: Our developers structure tokens around verified reserves, extracted minerals, or production-linked models.

- Regulatory & Traceability Focus: We integrate due diligence, auditability, and provenance tracking to support investor trust and global trade.

- Future-Ready Infrastructure: Our platforms are scalable, secure, and built to support institutional participation and long-term market growth.

Review our portfolio to see how we deliver blockchain solutions for complex, real-world asset ecosystems.

Get in touch for a free consultation and take the first step toward launching a secure rare earth mineral tokenization platform.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A.1. Rare earth mineral tokenization platform development focuses on building a blockchain solution that digitizes mineral assets into tradable tokens. These tokens represent verified mineral reserves or production rights, improving asset liquidity and ownership clarity.

A.2. Tokenization enhances traceability by linking tokens to verified mineral data, extraction records, and certifications. This creates transparency across supply chains, helping stakeholders track origin, ownership changes, and compliance throughout the mineral lifecycle.

A.3. Verification involves geological surveys, reserve reports, third-party audits, and regulatory approvals. Linking verified data to tokens ensures authenticity and prevents misrepresentation of mineral quantity or quality.

A.4. Challenges include data accuracy, integration with mining operations, regulatory alignment, and ongoing asset monitoring. A well-designed platform addresses these through automated reporting, compliance controls, and real-time asset tracking systems.