Infrastructure costs used to feel predictable until scale accelerated faster than budgets could keep up. Running networks, storage, and compute slowly became a balancing act rather than a growth lever. What began as optimization often turned into survival mode for teams trying to stay online and efficient.

This pressure is why the popularity of DePIN platforms has been increasing among infrastructure-driven businesses. Companies adopted this model because it shifted cost from ownership to participation in a measurable way. Instead of building everything upfront, DePIN allowed the network to supply the infrastructure itself.

Over the years, we’ve developed numerous DePIN Platforms that leverage technologies such as protocol-level blockchain systems and cryptographic verification frameworks. Given our expertise, we’re sharing this blog to discuss the cost of building a DePIN platform. Let’s start!

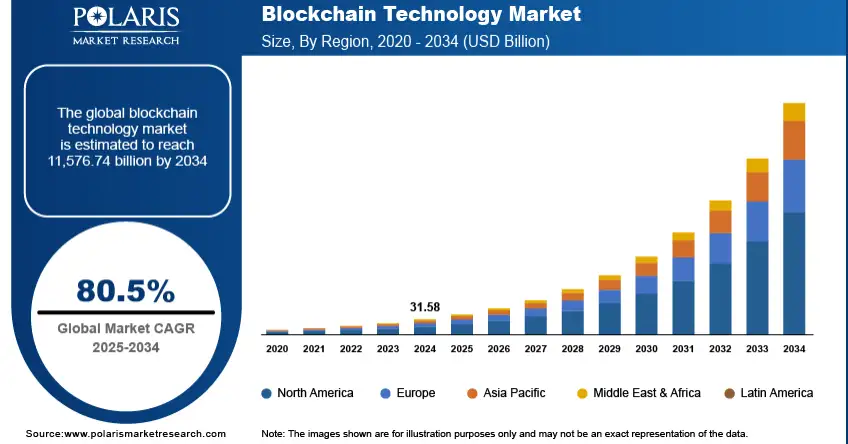

Key Market Takeaways for DePIN Platforms

According to Polaris Market Research, the global blockchain market has moved far beyond early experimentation and is entering a phase of real economic gravity. Valued at roughly USD 27–32 billion in 2024, it is projected to grow to USD 1.8–2.4 trillion by 2034, driven by adoption across finance, logistics, energy, and digital infrastructure. Within this expansion, Decentralized Physical Infrastructure Networks, or DePIN, are emerging as one of the most commercially credible subsectors, with current estimates placing the market between USD 30–50 billion.

Source: Polaris Market Research

What sets DePIN apart is its shift from narrative-driven growth to utility-driven adoption. These platforms decentralize physical assets such as mapping data, vehicle telemetry, and energy infrastructure, using blockchain incentives to coordinate global participation. By early 2026, DePIN networks collectively accounted for over USD 10 billion in market capitalization.

Two platforms illustrate this shift particularly well. Hivemapper has built a crowdsourced mapping network powered by dashcam-equipped vehicles, mapping over ten million kilometers of roads for enterprise-grade use cases.

In parallel, DIMO has connected more than 425,000 vehicles, enabling owners to control and monetize their data through APIs used by mobility and insurance platforms.

What Is a DePIN Platform?

A DePIN platform is a decentralized system where people contribute real-world infrastructure like compute, storage, or connectivity and get rewarded through blockchain-based incentives. Instead of a single company owning everything, the network coordinates participants using smart contracts and cryptographic verification to ensure that real physical work is delivered and paid for fairly.

Software-First DePIN Vs Hardware-First DePIN Platforms

Software-First DePIN usually builds faster because it converts idle digital resources into usable capacity with only software setup. Hardware DePIN must create and place physical devices, so progress may feel slower but more defensible over time.

The real difference is whether you want a flexible scale quickly or you want to carefully build new infrastructure that can last.

Software First DePIN Platforms

Software First DePINs do not create new physical infrastructure. They monetize existing and underutilized digital resources. These platforms connect owners of idle computing power, storage, or bandwidth with those who need it, creating a global marketplace for digital commodities.

Key Characteristics

| Aspect | How It Works | Examples |

| Resource Type | Fungible digital native assets | GPU cycles, RAM, disk space, internet bandwidth |

| Node Requirements | Standard consumer or enterprise hardware | Gaming PCs, data center servers, home routers |

| Geographic Logic | Location is largely irrelevant | Anywhere with internet connectivity |

| Verification Method | Cryptographic proofs | Hash validation, proof of space time, ZK proofs |

| Entry Barrier | Low and uses existing hardware | $0 to $5,000 for premium hardware |

| Time to Contribute | Minutes to hours | Install software, stake tokens, begin earning |

Real World Example:

Render Network is a software-first DePIN platform that connects idle GPUs from individuals and data centers into a shared rendering network. It lets creators access distributed compute on demand while GPU owners earn rewards without deploying new hardware.

Advantages of Software First DePINs

- Rapid Scaling. The network grows as fast as software can be installed

- Global From Day 1. No geographic constraints or shipping delays

- Lower Capital Risk. Participants use depreciated or idle assets

- Elastic Supply. Resources can be added or removed instantly

- Simpler Verification. Digital outputs are easily verified cryptographically

Limitations

- Commodity Economics. Competes with hyperscalers on price for generic resources

- Quality Variance. Mixed hardware leads to performance inconsistency

- No Physical Expansion. Does not create infrastructure where none exists

- Regulatory Simplicity. Misses opportunities in regulated physical sectors

Hardware DePIN Platforms

Hardware DePINs finance, deploys, and coordinates new physical infrastructure to address gaps left by market failures. They do not rely solely on existing resources. They create entirely new networks of specialized devices, often in underserved locations.

Key Characteristics

| Aspect | How It Works | Examples |

| Resource Type | Specialized location-bound physical assets | 5G radios, environmental sensors, EV chargers, solar panels |

| Node Requirements | Custom-designed hardware for specific purposes | Helium hotspots, DIMO vehicle adapters, Hivemapper dashcams |

| Geographic Logic | Strategic placement is critical | Coverage gaps, demand hotspots, and regulatory zones |

| Verification Method | Physical attestation plus cryptographic proofs | GPS proofs, trusted execution environments, and multi-sensor correlation |

| Entry Barrier | Medium to High | $200 to $5,000 for specialized hardware plus installation |

| Time to Contribute | Days to weeks | Order, ship, install, calibrate, onboard |

Real World Example:

Helium Network is a hardware-first DePIN platform that builds wireless coverage through user-deployed hotspots. It creates new physical connectivity infrastructure and rewards operators based on real coverage and data usage.

Advantages of Hardware DePINs

- Market Creation. Builds infrastructure where traditional providers will not

- High Margins. Specialized hardware creates strong competitive moats

- Regulatory Capture. Early entry into licensed or regulated environments

- Data Uniqueness. Location-specific data cannot be replicated elsewhere

- Physical Moats. Deployed hardware creates tangible barriers to entry

Limitations

- Slow Scaling. Growth is constrained by manufacturing and shipping

- Geographic Constraints. Last-mile deployment must be solved physically

- High CAPEX. Significant upfront investment in hardware development

- Maintenance Complexity. Physical failures require real-world repair

- Regulatory Hurdles. FCC certifications, spectrum licensing, and local permits

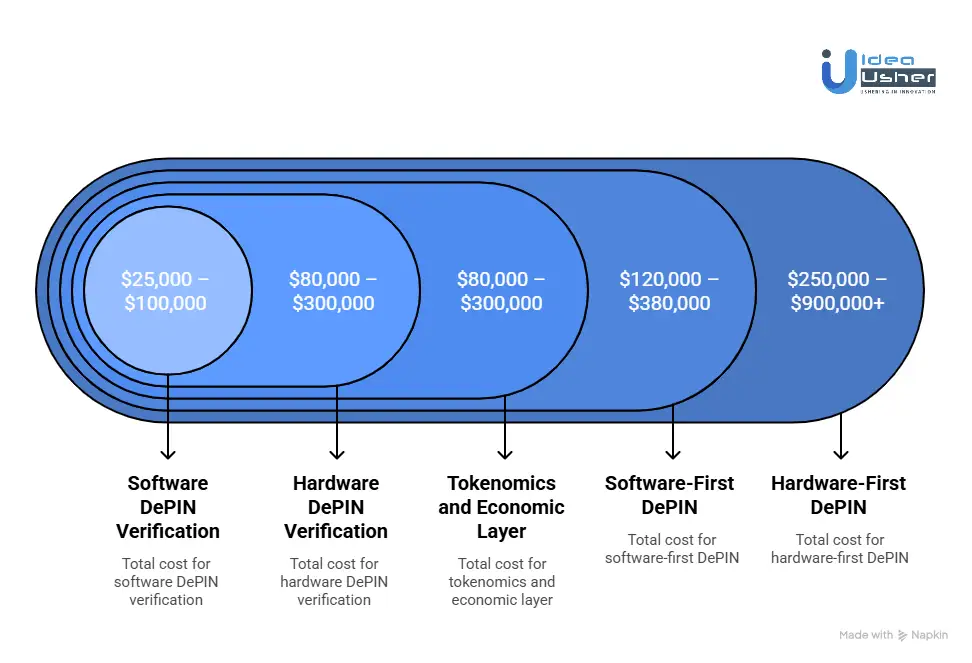

Cost to Build a DePIN Platform: Software vs Hardware

Building a DePIN platform is less about launching an app and more about engineering an ecosystem that can scale without burning capital.

When we develop DePIN solutions for our clients, we take a cost-effective approach that prioritizes early validation, modular builds, and spending only where the network truly needs growth to be sustainable.

1. MVP Development Phase

Software-First DePIN (Compute / Storage)

Total Cost: $120,000 – $380,000

| Component | Low Range | High Range | Details |

| Smart Contract Suite | $30,000 | $80,000 | Staking logic, reward distribution, and emission controls |

| Verification Layer | $25,000 | $70,000 | Proof-of-Work or Proof-of-Storage validation logic |

| Resource Marketplace | $35,000 | $100,000 | Provider matching, pricing, and allocation engine |

| User Dashboard | $20,000 | $80,000 | Admin panel and provider interfaces |

| API & SDK | $10,000 | $50,000 | Developer tools and external integrations |

Hardware-First DePIN (IoT / Wireless / Energy)

Total Cost: $250,000 – $900,000+

| Component | Low Range | High Range | Details |

| Firmware Development | $40,000 | $120,000 | Embedded systems programming |

| Hardware Prototyping | $25,000 | $150,000 | PCB design, 3D prints, assembly |

| Proof-of-Location System | $50,000 | $180,000 | GPS plus cryptographic attestation |

| Device Management Portal | $45,000 | $130,000 | Remote updates, diagnostics, and control |

| Hardware Security Module | $35,000 | $100,000 | TEE integration, secure boot |

| Supply Chain Setup | $55,000 | $220,000 | Manufacturing partners, QA and logistics |

2. Tokenomics and Economic Layer

Total Cost: $80,000 – $300,000

| Component | Software DePIN Range | Hardware DePIN Range | Details |

| Economic Modeling | $15,000 – $40,000 | $20,000 – $60,000 | Token flow simulations and incentive tuning |

| Smart Contract Audit | $20,000 – $50,000 | $25,000 – $70,000 | Third-party security reviews |

| Vesting and Distribution | $8,000 – $25,000 | $10,000 – $40,000 | Time locks and claim mechanisms |

| Governance System | $12,000 – $35,000 | $15,000 – $50,000 | Proposals, voting, delegation |

| Anti-Sybil Mechanisms | $10,000 – $30,000 | $20,000 – $80,000 | Hardware identity is significantly harder |

3. Verification and Consensus Layer

Software DePIN Verification

Total Cost: $25,000 – $100,000

| Component | Low Range | High Range | Details |

| Proof Validation | $8,000 | $30,000 | ZK-proof verification circuits |

| Oracle Integration | $7,000 | $25,000 | External data feeds and pricing |

| Dispute Resolution | $5,000 | $20,000 | Challenge and response systems |

| Slashing Logic | $5,000 | $25,000 | Penalty rules and execution |

Hardware DePIN Verification

Total Cost: $80,000 – $300,000

| Component | Low Range | High Range | Details |

| Physical Attestation | $25,000 | $90,000 | Hardware signatures and TEE proofs |

| Geospatial Validation | $20,000 | $80,000 | Coverage mapping and location proofs |

| Uptime Monitoring | $15,000 | $60,000 | Heartbeats and SLA tracking |

| Data Integrity Proofs | $20,000 | $70,000 | Sensor validation and tamper detection |

4. Scaling Infrastructure and Operations

| Component | Software DePIN Range | Hardware DePIN Range | Details |

| Node Onboarding | $15,000 – $45,000 | $50,000 – $200,000 | Hardware onboarding requires more UX and logistics |

| Network Monitoring | $10,000 – $35,000 | $30,000 – $120,000 | Health dashboards and alerts |

| Support Systems | $12,000 – $40,000 | $40,000 – $150,000 | Documentation, tickets, community ops |

| Compliance Setup | $8,000 – $25,000 | $20,000 – $80,000 | KYC, AML and regional compliance |

The numbers above are indicative estimates based on typical DePIN builds and real project experience, not fixed prices.

Depending on whether the platform is software-first or hardware-intensive, the total estimated cost can range from $300,000 to $1.8 million USD. For a more accurate quote aligned with your specific use case, feel free to connect with us for a free consultation.

Variable Factors Affecting the Cost of a DePIN Platform

The real cost difference in a DePIN platform often stems from how the system demonstrates work across software and hardware. Software networks can verify activity instantly, while hardware networks must contend with physical validation delays, which can quietly increase capital and security costs.

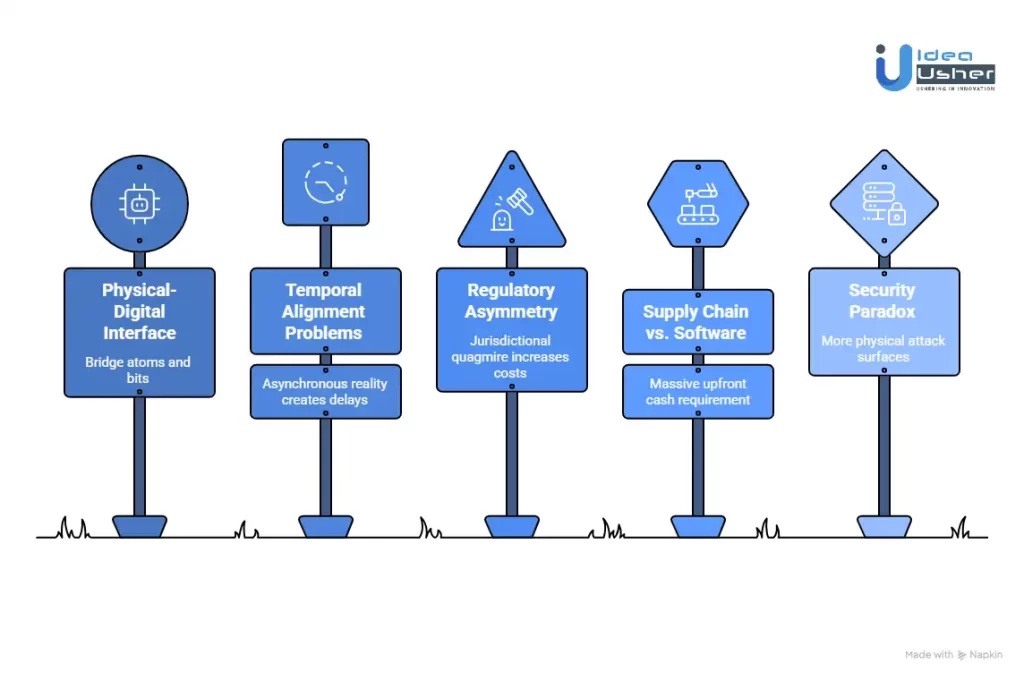

1. The Physical-Digital Interface

Cost Impact: $50,000 to $300,000

In software DePINs, verification is digital native. A hash matches or a computation completes. In hardware DePINs, you are building a bridge between atoms and bits, and that bridge carries a high cost.

| Verification Challenge | Software Solution Cost | Hardware Solution Cost | Why the Multiplier |

| Proving work done | Cryptographic proof $15K to $40K | Physical attestation plus TEE $60K to $180K | Requires hardware security modules |

| Preventing Sybil attacks | Staking requirements $5K to $20K | GPS spoof detection plus hardware signatures $40K to $150K | Physical location must be proven |

| Quality assurance | Automated testing $8K to $25K | Field testing plus environmental chambers $30K to $100K | Devices must survive real conditions |

| Data integrity | Hash verification included | Sensor calibration plus tamper evidence $25K to $90K | Analog to digital trust issues |

Unique Factor: Hardware DePINs must effectively build a forensic evidence system that proves physical events actually occurred. This goes beyond software and often involves custom silicon, multimodal sensing, and verification that can withstand legal scrutiny.

2. Temporal Alignment Problems

Software-First Platforms: Instant Coordination

Coordination Cost: $20,000 to $80,000

Digital resources can be allocated, verified, and paid in seconds. A smart contract can immediately confirm that a GPU completed a rendering task.

Hardware-First Platforms: Asynchronous Reality

Coordination Cost: $75,000 to $250,000

Physical devices introduce lead times, shipping delays, installation effort, and real-world failure modes. This creates three unique cost centers.

A. Time to Service Lag

Example: Weather Sensor Network

- Day 0: User orders device with $50 manufacturing cost

- Days 1 to 7: Device ships globally with $15 shipping

- Days 8 to 14: User installs and configures with a $25 support cost

- Day 21 plus: Device begins earning

This means the platform must absorb costs for manufacturing, shipping, and setup long before any rewards or revenue flow back into the system. Cash stays locked during this period, which can quietly strain liquidity and slow expansion plans.

B. Geographic Coordination Complexity

Challenge: Building a mesh network

In software networks, nodes can join freely regardless of location, but hardware networks must guide device placement to maintain efficient coverage. This often requires carefully tuned reward logic supported by manual controls when real-world behavior does not match the model.

Budget Impact: $30,000 to $120,000

C. Failure Response Time

Software nodes can be rebooted in minutes. Hardware nodes often require physical intervention. This adds insurance costs, dispatch systems, and regional repair operations.

3. Regulatory Asymmetry

Software-First Platforms: Global by Default

Compliance Range: $15,000 to $75,000

Primary concerns include data privacy regulations such as GDPR and CCPA, token-related financial regulations, and encryption export controls.

Hardware-First Platforms: Jurisdictional Quagmire

Compliance Range: $50,000 to $300,000 plus

| Regulation Type | Cost Range | Impact |

| Radio spectrum | $10K to $100K per country | FCC in the US, CE in the EU, MIC in Japan |

| Electrical safety | $5K to $50K per region | UL, CE, PSE certifications |

| Environmental | $3K to $30K | RoHS, WEEE, battery disposal rules |

| Import and export | $8K to $40K | Customs classifications and duties |

| Industry specific | $20K to $200K | Medical, automotive, and aviation standards |

4. Supply Chain vs Software Deployment

The Invisible Multiplier

| Factor | Software Cost Equivalent | Hardware Reality | Cost Impact |

| Minimum order quantity | Deploy one instance | Manufacture one thousand units | Massive upfront cash requirement |

| Lead times | Instant deployment | Eight to sixteen weeks of production | Capital locked |

| Quality variance | Identical copies | One to five percent defect rate | Warranty reserves required |

| Inventory risk | None | Obsolete stock possible | Write off exposure |

| Shipping and logistics | Zero | $5 to $50 per unit | Global logistics complexity |

The Bullwhip Effect in DePIN: A 10% increase in token price should not require a 10% increase in hardware production. In practice, it often does. This creates boom-and-bust cycles that software DePINs largely avoids.

5. The Security Paradox

Attack Vectors Unique to Hardware DePINs

Physical infrastructure often feels safer because it exists in the real world, but it can expose many more attack surfaces over time. Devices can be tampered with, relocated, or replicated, which forces stronger verification and monitoring layers.

You should expect security costs to rise steadily as the network expands and real-world threats become more unpredictable.

| Attack Type | Prevention Cost | Software Equivalent |

| Physical tampering | $40K to $150K secure enclosures | Not applicable |

| Location spoofing farms | $60K to $200K multi factor verification | Simple cryptographic challenge |

| Supply chain attacks | $30K to $120K factory audits | Code signing |

| Environmental manipulation | $25K to $90K sensor redundancy | Not applicable |

| Reverse engineering | $50K to $180K obfuscation | White box cryptography |

The Irony: Hardware feels more real and secure, yet it introduces more physical attack surfaces. Each surface increases both engineering complexity and long-term security cost.

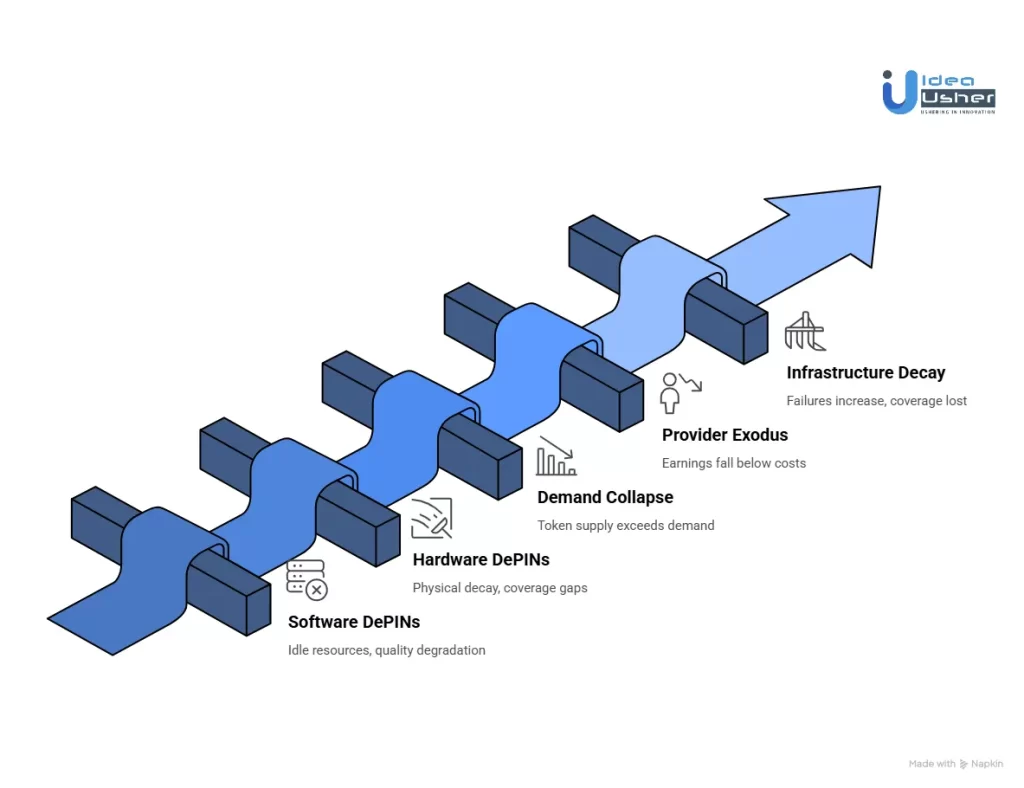

How Poor Token Demand Destroys DePIN Platforms?

In traditional startups, low demand means slow growth. In DePIN platforms, poor token demand triggers a catastrophic economic cascade that can collapse entire networks in months. This is not just a revenue problem. It is an existential threat to the physical infrastructure itself.

The Token Demand Equation

Healthy DePIN Economics:

Token Demand = (Enterprise Usage × Token Burn Rate) + (Speculative Demand × Velocity)

Failing DePIN Economics:

Token Demand < Token Supply = Death Spiral Initiated

The critical insight most founders miss is simple. Token price volatility is a symptom. Demand collapse is the disease. The treatment differs dramatically between software and hardware DePINs.

Software DePINs: The Idle Resource Crisis

When token demand weakens, enterprise usage drops, and token burns slow, pushing provider earnings below operating costs. As quality operators exit, idle resources pile up, network performance degrades, and the platform drifts into a low-activity zombie state where capacity exists, but demand does not.

Phase 1: Demand Softens

Enterprise customers begin scaling back usage as workloads shrink or shift elsewhere. Token burn activity is slowing by roughly 30 to 50 percent, and while the price decline may appear gradual, it signals that real demand is weakening across the network.

Phase 2: Provider Exodus Begins

As token earnings fall below electricity and maintenance costs, GPU owners and storage hosts start disconnecting. Within sixty days, twenty to forty percent of providers typically exit, reducing available capacity even though overall demand was already soft.

Phase 3: Quality Degradation Loop

Low Price → Best Providers Leave → Network Quality Drops → Remaining Customers Leave → Lower Price

Phase 4: Zombie Network

As higher-quality providers exit, only inefficient and unreliable resources remain on the network. Service consistency breaks down, enterprise SLAs cannot be upheld, and trust erodes rapidly. The software may still exist, but the token loses real economic value as the network becomes functionally irrelevant.

Take Filecoin as an example. During periods of weak demand, storage providers continued paying electricity and maintenance costs while earning fewer FIL tokens, pushing the ROI negative.

The hardware remained online, but incentives to maintain uptime and quality faded, creating a zombie network where capacity existed but service was unreliable.

Hardware DePINs: The Physical Unraveling

When token demand weakens, device operators shut down unprofitable locations, creating immediate coverage gaps. As hardware is unplugged and sold, physical decay sets in and the network loses infrastructure that cannot be easily or quickly rebuilt.

Phase 1: Geographic Erosion

As earnings decline, operators in low-ROI areas shut down first, especially in rural or high-electricity-cost regions. Coverage quickly becomes uneven, creating gaps that degrade service quality and disrupt enterprise use cases.

Phase 2: Hardware Salvage Cycle

ROI Turns Negative → Owners Unplug Devices → Hardware Sold on Secondary Market →New Buyers Expect Lower Prices → Network Value Declines Further

Phase 3: Infrastructure Decay

As devices are left unmaintained, failures from weather and wear increase steadily. With manufacturing paused and replacements unavailable, coverage gaps harden into permanent infrastructure losses.

Phase 4: Enterprise Flight

Enterprises that rely on the network for critical operations begin to experience repeated service failures and reliability crises. Contract penalties follow; legal exposure rises; and brand damage spreads beyond the project into the broader blockchain ecosystem.

Consider Helium during its expansion phase. When HNT prices fell, hotspot earnings in marginal regions fell below electricity costs, prompting operators to shut down devices.

Each offline hotspot created a physical coverage gap that could not be quickly remedied, demonstrating how demand collapse causes lasting damage to hardware DePINs.

The Demand Risk Comparison: Software vs Hardware

Software DePINs mainly lose economic coordination and can recover if demand returns. Hardware DePINs lose physical coverage, making recovery slower, costlier, and often irreversible.

| Risk Dimension | Software DePIN Impact | Hardware DePIN Impact |

| Recovery Time | 6 to 18 months | 24 to 48 months or more |

| Capital Loss | Opportunity cost only | Physical write-offs of 50 to 90 percent |

| Network Effect Loss | Digital coordination rebuild | Physical coverage re-establishment |

| Enterprise Trust Impact | High due to SLA failures | Extreme due to service outages |

| Regulatory Attention | Increased scrutiny | Potential investigations and liability |

| Secondary Market Effect | Minimal | Hardware fire sales depress sector |

Early Warning Signs Most Teams Miss

Software DePIN Red Flags:

- Declining provider quality scores despite stable node count

- Increasing task completion time across the network

- Rising support tickets for failed or delayed jobs

- Secondary market premium disappears and tokens trade below emission value

Hardware DePIN Red Flags:

- Geographic concentration increases as providers cluster in low-cost regions

- Hardware resale prices fall faster than depreciation curves

- Maintenance requests rise as operators cut corners

- New deployment rates slow even when hardware is available

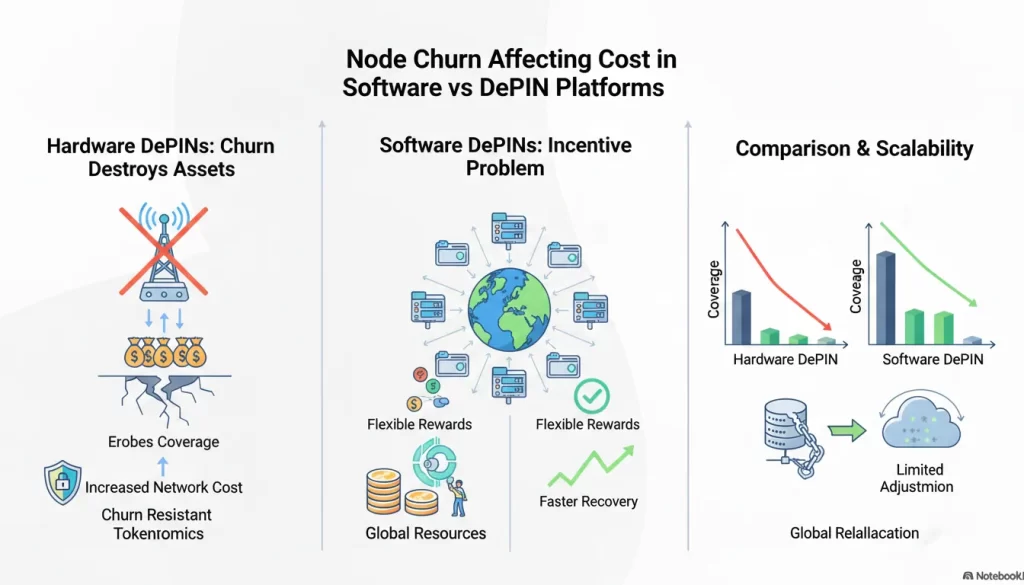

How Node Churn Affects Cost in Software vs Hardware DePIN Platforms?

When a node leaves a DePIN network, the economic impact is not just about lost capacity. It is about replacement economics. This is where hardware and software DePINs diverge dramatically.

Hardware DePINs (H-DePINs) are affected by the Abandoned Hardware problem.

When a Helium hotspot or Hivemapper dashcam owner stops participating, that $500 to $2,000 device does not automatically transfer to a new user. It becomes e-waste, and replacing that capacity requires convincing someone else to buy new hardware, ship it, install it, and maintain it.

Software DePINs (S-DePINs) face the Capacity Gap problem.

When a Filecoin storage provider or Render GPU node goes offline, the underlying hardware remains available. It simply stops serving your network. Replacement means convincing another data center operator to allocate resources to your protocol instead of alternatives.

Hardware DePIN Node Churn Costs

Irrecoverable Acquisition Cost

Every time a hardware node churns, the network absorbs costs that cannot be recovered. Teams must spend again on marketing to attract a new operator, often subsidize the device to reduce friction, and cover shipping and logistics. None of this creates new value. It only restores what was already lost.

Geographic Rebalancing Nightmare

Hardware coverage is location-bound, so churn creates physical gaps that software cannot smooth over. If a node drops in NYC, capacity in Dallas is useless. Until a replacement is installed in the same area, users experience degraded service and the network’s perceived reliability takes a hit.

Time to Value Lag

Replacing hardware nodes is slow by design. Manufacturing, shipping, and setup stretch across weeks, not days. During this entire window, the network operates below capacity, resulting in lower utility, weaker incentives, and an increased risk of further churn.

Total Replacement Cost: 280 to 1,100 dollars or more per node

Time Impact: 3 to 6 weeks of reduced service quality

Software DePIN Node Churn Costs

Capacity Reallocation Cost

When a software DePIN node churns, the cost is mainly economic rather than physical. The network adjusts incentives to attract new providers, typically by temporarily increasing token emissions. There are no shipping delays or hardware subsidies, so spending directly translates into restored capacity.

Location Agnostic Replacement

Software-based capacity is not tied to a specific geography. Storage or compute resources in Oregon can serve users in London without meaningful degradation. Because redundancy is built into the protocol, capacity can be rebalanced globally rather than rebuilt locally.

Near Instant Recovery

Recovery in software DePINs happens quickly and often quietly. New providers can come online within hours through automated APIs, and workloads are reassigned without user involvement. From the end user’s perspective, service continuity is usually maintained.

Total Replacement Cost: 50 to 300 dollars in incentive adjustments

Time Impact: Hours to days, often imperceptible to end users

The Network Effect Inversion

This creates a dangerous asymmetry in network growth.

Hardware DePINs experience negative network effects during churn

- Fewer nodes lead to worse coverage

- Worse coverage leads to lower utility

- Lower utility causes more users to leave

- Death spiral risk increases

- Each churning node creates a literal hole in the physical network

Software DePINs experience neutral to positive network effects

- Capacity redistributes among the remaining nodes

- Service continuity is typically maintained

- Geographic redundancy prevents service gaps

The Tokenomics Implications

For Hardware DePIN Founders

Your token economics must account for physical asset depreciation and geographic stickiness.

Required Mechanisms

| Mechanism | Description |

| Hardware Bound Staking | Tie a portion of token rewards directly to the physical device’s continued operation to reduce premature node shutdowns. |

| Location Locked Premiums | Offer higher rewards for nodes that maintain coverage in strategic or high-demand geographic areas. |

| Secondary Market Integration | Enable hardware resale or transfer so devices can remain active in the same region rather than become idle assets. |

| Gradual Decay Functions | Gradually reduce emissions from older devices while encouraging operators to upgrade their hardware promptly. |

Reality Check: If your token rewards do not cover the device’s monthly electricity, internet, and depreciation costs, you will experience catastrophic churn during bear markets.

For Software DePIN Founders

Your focus should be on provider stickiness and capacity consistency.

Required Mechanisms

- Commitment-Based Rewards: Tiered incentives for longer-term commitments

- Performance Bonding: Require staked tokens that are slashed for early exit

- Load Balancing Algorithms: Automatically redistribute work during churn events

- Spot vs Reserved Pricing: Encourage long-term reservations with discounts

Conclusion

Building a DePIN platform takes more than clean code and fast deployment. The real work happens when software coordination must align with physical infrastructure costs, and token economics must remain sustainable over time. Teams that understand the distinction between the DePIN platform’s software and hardware investments can gradually design networks that endure after incentives fade. With the right development partner, DePIN can become a scalable business model that delivers real-world value rather than a short-lived experiment.

Looking to Build a DePIN Platform?

IdeaUsher helps you build a DePIN platform by translating real-world hardware constraints into a scalable coordination and incentive layer that can actually sustain usage. We typically design verification first, architectures, and token models to align rewards with measurable physical or computational work.

What sets us apart?

- 500,000+ hours of coding expertise with ex-MAANG and FAANG developers who understand scalable and secure systems

- Hardware-ready tokenomics, whether you’re deploying wireless sensors or monetizing GPU clusters

- Verification first architecture from TEE attestation to ZK proofs for physical work validation

See our latest DePIN projects in action, and let’s build infrastructure that pays for itself.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: The cost usually depends on whether the network is software-led or hardware-heavy. A software-focused DePIN platform may start with a lower upfront budget because it relies on coordination layers and existing devices. Hardware-driven platforms can be more expensive because devices must be designed, manufactured, and deployed carefully.

A2: The right model often depends on how the enterprise plans to defend value. Hardware-based DePIN can feel more stable because physical assets create long-term lock-in. Software-based DePIN may suit enterprises that want flexibility and faster iteration in compute or storage networks.

A3: Launch timelines can vary based on operational complexity. Software DePIN platforms can go live relatively quickly once protocols and incentives are tested. Hardware DePIN platforms usually take longer because manufacturing validation and network verification must happen in sequence.

A4: Yes, they can when the model is designed correctly. Strong DePIN platforms link token value to real service usage and enterprise demand. Revenue can gradually come from data access network usage or infrastructure services rather than token emissions alone.