Owning gold digitally often appears straightforward until accountability becomes a factor. Questions around custody and redemption may quietly change how trust is evaluated. Audits and jurisdictional clarity could become essential once real value is involved. This uncertainty gradually pushed serious participants toward structured gold tokenization platforms.

Compliance-driven models anchored each token to insured vault custody, real-time proof of reserves, and controlled minting logic. Blockchain systems could then automate reporting, enforce transfer rules, and pause supply when reserves fall short. As a result, digital gold became usable for institutions and long-term capital alike.

Over the past decade, we’ve built many compliant gold tokenization solutions that leverage technologies such as identity-bound token standards and regulated-custody integration APIs. With this expertise, we’re writing this blog to outline the steps to develop a compliant gold tokenization platform. Let’s start.

Key Market Takeaways for Gold Tokenization Platform

According to FortuneBusinessInsights, the asset tokenization market is entering a clear scale-up phase. Valued at USD 3.32 billion in 2024, it is expected to cross USD 12 billion by 2032, driven largely by enterprise blockchain adoption and rising demand for secure digital representations of real-world assets. Within this broader expansion, gold has emerged as one of the most trusted and actively adopted tokenized commodities.

Source: FortuneBusinessInsights

Gold tokenization platforms are gaining momentum because they remove long-standing friction from gold investing.

Fractional ownership lowers entry barriers, on-chain settlement enables continuous liquidity, and transparent reserve verification improves trust. As spot gold prices remain elevated, institutions are increasingly viewing tokenized gold as a balance sheet-efficient instrument.

Market leaders illustrate how this model is taking shape. Tether Gold represents each token with one troy ounce of gold held in Swiss vaults, offering exchange liquidity with physical redemption. PAX Gold, issued by Paxos, is backed by London Good Delivery bars stored in Brink’s facilities.

On the institutional side, a partnership between Ubuntu Tribe and Global Settlement Holdings has tokenized more than $5 billion in gold, in accordance with LBMA custody standards.

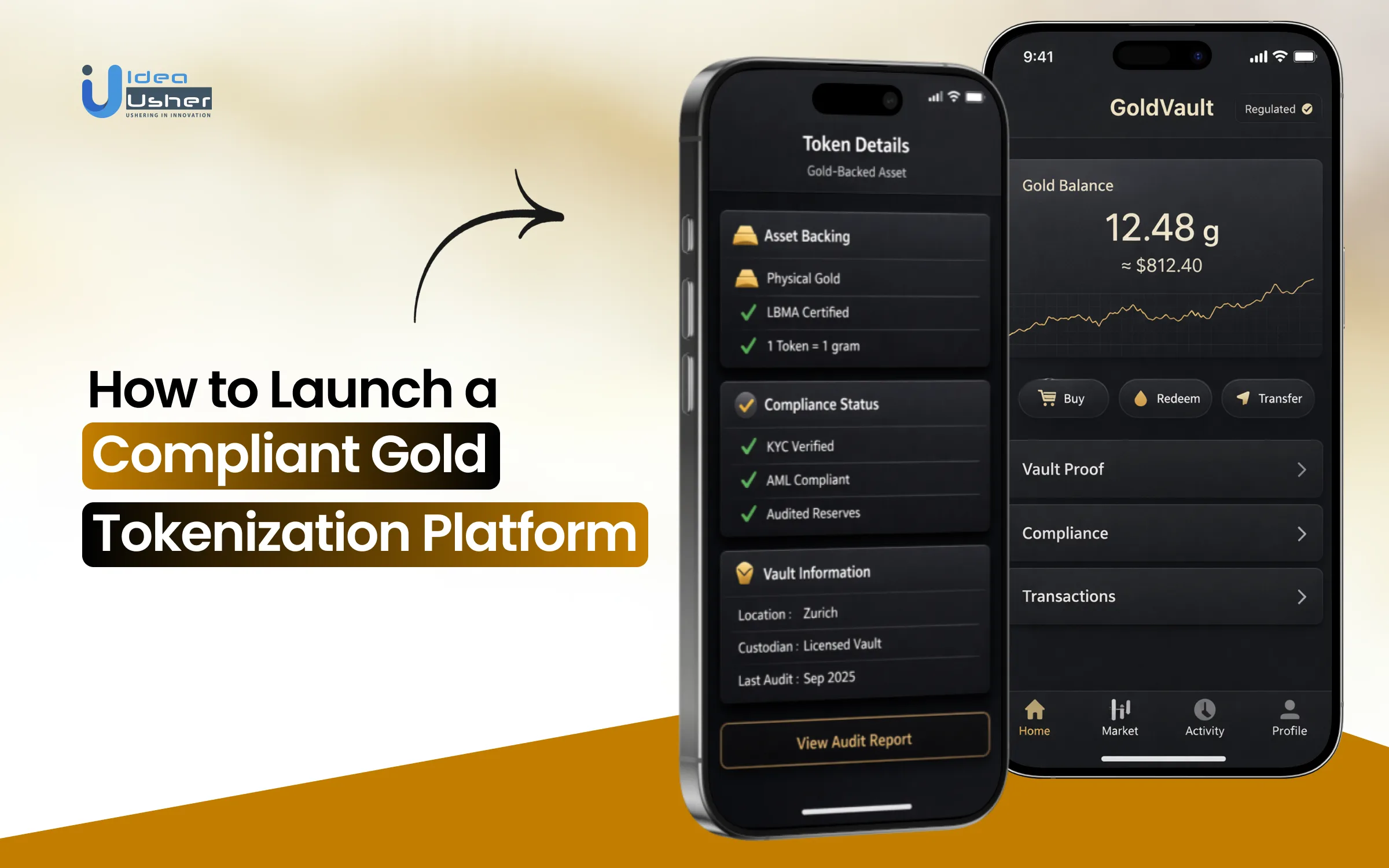

Overview of a Compliant Gold Tokenization Platform

A compliant gold tokenization platform is a regulated digital system where each issued token represents verified ownership of physical gold held in insured vaults. The platform follows strict legal, custody, and audit frameworks to ensure tokens are always fully backed and redeemable.

Compliance layers such as KYC, AML, proof-of-reserves, and controlled minting logic help maintain trust, prevent overissuance, and make tokenized gold acceptable for institutional and long-term use.

How Does a Compliant Gold Tokenization Platform Work?

A compliant gold tokenization platform works by legally locking physical gold inside regulated vaults and then issuing blockchain tokens that may directly represent that gold. Smart contracts typically govern minting and transfers, ensuring tokens can only move between verified wallets and remain fully backed.

1. Legal Structure and Asset Custody

Before any smart contract is deployed, the legal architecture is defined. This layer determines whether the platform is compliant or merely speculative.

Bankruptcy remote ownership

The physical gold is legally owned by a Special Purpose Vehicle or Trust, not the operating company. This structure ensures full asset segregation. If the platform operator becomes insolvent, the gold remains protected and legally owned by token holders.

LBMA-certified vaulting and allocation

Gold is stored in high-security, fully insured vaults accredited by the London Bullion Market Association or equivalent international standards. Each bar is serialized, assayed, and tracked, either under an allocated or pooled allocation model.

Jurisdiction-specific regulatory alignment

The platform is structured under defined regulatory regimes such as Switzerland’s DLT Act, UAE VARA, or the EU MiCA framework. This classification determines whether the token is treated as an asset-referenced token or a security token, directly shaping issuance rules, transfer restrictions, and market access.

2. Blockchain and Smart Contract Architecture

This layer converts legal ownership into programmable digital gold.

Compliance-aware token standards

Advanced platforms move beyond basic ERC-20 tokens. They adopt the ERC-3643 or ERC-1400 security token standards, which embed identity verification, transfer permissions, and regulatory controls directly into the token logic.

Minting a smart contract as the gatekeeper

New tokens can only be minted when all compliance conditions are satisfied. This includes verified gold deposits, successful KYC and AML checks, and approvals from multi-signature wallets involving custodians or auditors. Unauthorized minting is technically impossible.

On-chain identity and compliance module

Only whitelisted wallet addresses can hold or transfer tokens. This prevents anonymous peer-to-peer transfers and ensures adherence to securities law, AML standards, and jurisdictional restrictions.

3. Proof of Reserves and Oracle Integration

This layer ensures continuous trust and verifiability.

Real-time reserve verification

Platforms integrate decentralized oracle networks such as Chainlink. These oracles pull cryptographically signed inventory data directly from vault management systems.

Live on-chain attestation

Gold weight, purity, and serial numbers are continuously hashed on the chain. At any time, anyone can verify that the total token supply exactly matches physical gold reserves, eliminating reliance on quarterly reports and preventing fractional-reserve behavior.

4. Platform Interface and Operations

This is the layer through which end users interact via secure applications.

Digitally native onboarding and KYC

Users complete identity verification through regulated providers like Onfido or Jumio. Their verified identity is cryptographically linked to their wallet address within the permissioning system.

Controlled trading and transfers

Users can buy, sell, and transfer tokens only within the approved ecosystem. Platforms may offer internal trading mechanisms or integrate with regulated digital asset exchanges.

Redemption engine

When physical redemption is requested, tokens are locked and permanently burned. The smart contract then issues an immutable instruction to the vault and logistics provider. A specific serialized gold bar, or an equivalent allocation, is insured and shipped, preserving the 1:1 gold peg at all times.

5. Continuous Compliance and Governance

Compliance is embedded into daily operations rather than treated as a periodic task.

- Programmable regulatory enforcement: Smart contracts can automatically restrict transfers involving sanctioned jurisdictions or high-risk addresses as regulations evolve.

- Immutable audit trail: Every mint, burn, and transfer is permanently recorded on the chain. This creates a perfect audit trail for regulators, auditors, and internal compliance teams.

Multi-signature governance controls

Critical platform actions such as fee changes, contract upgrades, or vault additions require approvals from multiple independent parties, reducing operational risk and eliminating single points of failure.

How to Develop a Compliant Gold Tokenization Platform?

A compliant gold tokenization platform is developed by first establishing legal ownership and vault custody before any token is created. Smart contracts must then enforce identity and jurisdiction rules so that issuance and transfers occur only under verified conditions.

Having developed compliant gold tokenization platforms across several markets, we follow a structured approach grounded in long-term execution.

1. Legal & Custody Setup

We start by structuring the platform around an SPV or trust model that legally represents the underlying gold. This includes working with LBMA-certified vaults and drafting jurisdiction-aligned custody agreements that clearly define ownership, redemption rights, and asset segregation before any token is issued.

2. Compliant Smart Contracts

We design smart contracts that embed compliance directly into token behavior. Regulated token standards such as ERC-3643 or equivalent frameworks are implemented alongside identity registries and compliance claims. Jurisdictional transfer rules are encoded so tokens can only move between approved and eligible participants.

3. Proof of Reserves Integration

To maintain continuous trust, we connect vault inventory systems with blockchain oracle networks. Token minting is allowed only after verified gold reserves are confirmed, and automated freeze logic is triggered if reserve thresholds are breached. Live dashboards provide real-time visibility into reserves for stakeholders.

4. Redemption Engine

We develop a secure redemption workflow in which tokens are locked and burned upon request for physical gold. This system integrates logistics and insurance providers and applies AML and source-of-wealth checks, ensuring redemptions remain compliant and operationally controlled.

5. Regional Compliance Controls

For multi-market deployments, we implement modular compliance layers that adapt to regional regulations. Rules can be updated dynamically as laws evolve, and enforcement is automated across the platform without relying on manual intervention.

6. Enterprise & Monetization

Finally, we prepare the platform for scale by configuring fee structures, pricing logic, and revenue models. Enterprise APIs and white-label capabilities are added to support institutional clients, along with controlled integrations for DeFi and other enterprise systems, while maintaining compliance integrity.

Regulators Prefer Compliant Gold Tokenization Over Traditional ETFs

For decades, Gold Exchange-Traded Funds (ETFs) such as SPDR Gold Shares have been the default instrument for regulated gold exposure. They offered familiarity, scale, and alignment with legacy financial infrastructure.

However, as financial technology evolves, regulators in forward-looking jurisdictions increasingly view compliant gold tokenization platforms not as a risk but as a structural upgrade to the ETF model.

What is changing is not the asset. It is the quality of oversight, transparency, and control that regulators can exercise.

1. Unprecedented Transparency

Traditional gold ETFs operate on a trust-based audit cycle. Gold is deposited with custodians, and holdings reports are published once per business day. Detailed bar lists are usually updated monthly.

This creates a time lag between the physical state of reserves and what investors or regulators can verify. Oversight depends heavily on intermediaries, auditors, and post facto reporting.

The Tokenization Advantage

Compliant gold token platforms use on-chain Proof of Reserve mechanisms supported by cryptographic verification and oracle feeds.

Regulators can theoretically observe, in real time, the exact relationship between

- Total token supply

- Allocated physical gold in vaults

- Custody status and bar level data

This is not a report. It is a continuously verifiable system state.

Key regulatory gain: Audit effort is reduced, fraud risk is lowered, and supervision shifts to near-real-time rather than retrospective.

2. Settlement Efficiency & Lower Structural Risk

When an investor buys an ETF share, they own a claim on a fund that owns gold. The structure involves brokers, custodians, trustees, and sub-custodians. Settlement typically occurs on a T+2 basis.

This layered structure introduces legal abstraction and settlement risk, especially during periods of market stress.

The Tokenization Advantage

On compliant token platforms, settlement can be atomic. Payment and transfer of digital title can occur simultaneously.

More importantly, the legal design often uses bankruptcy-remote SPVs combined with smart contracts to represent a direct beneficial interest in allocated gold, not a claim on a pooled fund.

Key regulatory gains: Simpler ownership chains, reduced systemic exposure, and clearer investor rights that align with post-financial-crisis reform goals.

3. Enhanced AML/CFT and Investor Protection

ETF investors are verified at the broker level during onboarding. Once shares enter the secondary market, trading occurs between anonymous counterparties. Regulators oversee entry pointsbut do not have transaction-level identity control thereafter.

The Tokenization Advantage

Compliant gold tokens implement programmable compliance using identity-bound token standards.

Every transfer is checked against

- KYC status

- Sanctions lists

- Jurisdictional permissions

A token cannot move to a non-compliant wallet.

Key regulatory gain: AML and Travel Rule obligations are enforced by the protocol itself, creating an auditable and automated compliance layer that legacy securities infrastructure cannot easily replicate.

4. Operational Efficiency & Market Accessibility

ETF creation and redemption is optimized for institutions, not individuals. Retail investors typically cannot redeem physical gold for cash equivalents. Processes remain operationally heavy and limited to market hours.

The Tokenization Advantage

Tokenization enables

- Fractional ownership down to very small units

- Automated audit and reporting flows

- Continuous market availability

Smart contracts reduce manual intervention and operational error.

Key regulatory gain: Broader but controlled access, lower operational risk, and the foundation for regulated 24/7 markets.

Regulatory Priorities Compared Side by Side

| Regulatory Priority | Traditional Gold ETF | Compliant Gold Tokenization Platform |

| Transparency | Daily NAV and monthly bar list. Delayed and trust based. | Real time on chain Proof of Reserve. Cryptographically verified. |

| Investor Protection | Indirect claim on a fund structure. Multi-layer legal exposure. | Direct and bankruptcy remote claim to allocated gold. |

| AML and CFT Monitoring | KYC only at onboarding. No control over secondary trades. | Identity checks are enforced at every transfer. |

| Settlement Risk | T plus two settlement with intermediaries. | Instant or near instant settlement. |

| Market Integrity | Exchange and broker surveillance. | Compliance rules enforced by protocol logic. |

| Operational Oversight | Periodic audits and reports. | Continuous and automated audit trails. |

The Path Forward: Regulation as a Catalyst

Regulators in jurisdictions such as FINMA, ADGM, and MAS are not resisting tokenization. They are actively shaping frameworks to support it.

Their reasoning is pragmatic. A well-regulated gold tokenization platform provides more visibility, stronger controls, and better investor protection than legacy ETF structures.

For platforms, the message is clear. Those who engage regulators early and design with compliance at the core are not slowing innovation. They are building the next generation of regulated gold markets.

Most Profitable Customer Segments for Gold Tokenization Platforms

Compliant gold tokenization platforms do not earn evenly across all users. Profit is concentrated in specific customer segments, each contributing differently to revenue, stability, and long-term defensibility.is concentrated in specific customer segments, each contributing differently. Below is a clear, tier-by-tier view of where real profitability comes from.

Tier 1: Institutional and Enterprise

This is the primary profit engine for any mature platform. These customers do not just transact. They build on your infrastructure.

1. Banks and Neo Banks

Profit driver: B2B2C revenue and platform fees

Banks license gold tokenization as a Gold-as-a-Service layer and distribute branded gold products to theircustomers.

Revenue model

- Licensing fees charged as annual or monthly SaaS contracts

- Revenue sharing on transactions, custody, and portfolio services offered to the bank’s end users

This segment delivers high-margin recurring revenue with minimal churn.

2. Hedge Funds and Crypto Native Funds

Profit driver: High volume treasury activity and collateral usage

Funds treat tokenized gold as a liquid programmable reserve asset. They rotate large positions, deploy gold as DeFi collateral, and arbitrage between physical and digital markets.

Revenue model

- Bulk minting and redemption fees on large ticket flows

- Cross-chain bridge fees when moving gold tokens between networks for yield or cost efficiency

Revenue impact example:

Tether charges 0.25 percent for minting and 0.20 percent for redemption on its gold token, XAUT. A single fund cycling 50 million dollars quarterly can generate approximately 450,000 dollars in fees annually, excluding treasury yield on reserves. This segment produces outsized revenue per client.

3. Fintech and DeFi Protocols RWA Integrators

Profit driver: Ecosystem expansion and transactional rent

Fintechs and DeFi protocols embed gold tokens into savings apps, cards, lending pools, and settlement rails.

Revenue model

- API and integration fees for mint burn access and oracle data

- Transaction revenue sharing tied to on-chain usage and yield generation

This segment scales revenue indirectly through ecosystem growth.

Tier 2: Wealth Managers and Family Offices

Profit driver: Recurring assets under management fees

Wealth managers typically allocate 5 to 15 percent of portfolios to gold. Tokenization makes rebalancing and reporting far more efficient.

Revenue model: Annual basis point fees on assets under management, typically 0.5 to 1.0 percent

Example:

GoldRepublic charges partners 0.5 percent annually on gold AUM. A firm managing 200 million dollars with a 10 percent gold allocation generates 100,000 dollars per year in recurring revenue. This tier anchors revenue stability independent of trading volume.

Tier 3: High Net Worth Individuals

Profit driver: Large balances and premium services

These users value institutional-grade custody, compliance, and redemption options.

Revenue model

- Tiered transaction fees favoring larger trades

- Premium physical redemption services with insured and expedited delivery

- Advisory fees for lending, structuring, and estate planning

Example:

Kinesis concentrates revenue among top holders. The top 1 percent of users holding around 500 million dollars in gold generate roughly 2.25 million dollars annually at a 0.45 percent blended fee rate, with premium redemptions adding further upside.

Tier 4: Mass Retail

Profit driver: Liquidity, valuation uplift, and future monetization

Retail users create depth, velocity, and visibility, making the asset attractive to higher tiers.

Revenue model

- Micro fees and spreads on frequent small trades

- Subscription plans for automated gold savings and accumulation

Strategic value: A platform with one million retail users commands far higher strategic value for partnerships or acquisition than an institution-only model.

Top 5 Compliant Gold Tokenization Platforms

Compliant gold tokenization platforms typically operate on a strict full-reserve model, where the digital supply must always match the vaulted physical gold. These systems may rely on regulated custodians, audited proof-of-reserves, and controlled minting logic to quietly prevent overissuance.

1. Paxos – PAX Gold (PAXG)

PAX Gold is a compliance-first gold token, with each token representing one fine troy ounce of LBMA-approved gold held in London vaults. Issued under New York law, the platform maintains strict audit and reserve controls, with a circulating supply of roughly 380,000 PAXG that directly reflects physical gold held in custody.

2. Tether Gold (XAUT)

Tether Gold provides tokenized ownership of physical gold stored in Swiss vaults, with minting and redemption controlled by custody records. The token has a circulating supply of over 400,000 XAUT, making it one of the largest gold-backed tokens by physical ounces represented on-chain.

3. Kinesis Gold (KAU)

Kinesis Gold represents allocated physical gold held in insured vaults, with each token mapped directly to real inventory. Unlike ounce-based models, KAU is issued at 1 gram per token, enabling millions of tokens in circulation while maintaining full physical backing.

4. VeraOne (VRO)

VeraOne is a Europe-based gold token backed by physical gold stored in certified vaults and verified through independent audits. Each VRO corresponds to 1 gram of gold and is compliant with European regulatory and custody standards.

5. Aurus Gold (tGOLD)

Aurus Gold operates a standardized tokenization network where accredited vaults issue fully allocated gold tokens. Each tGOLD is backed 1:1 by physical gold, with minting strictly limited by verified inventory to prevent overissuance and maintain compliance.

Conclusion

Launching a compliant gold tokenization platform may feel like a strategic choice today, but it is steadily becoming the only path to safe, scalable growth. Markets are maturing, and capital typically flows to systems built on clear rules and verifiable reserves. A compliance-first architecture can quietly unlock institutional confidence and may reduce regulatory friction over time.

Looking to Develop a Gold Tokenization Platform?

IdeaUsher can help by designing a gold tokenization platform that links regulated vault custody with on-chain smart contracts.

With over 500,000 hours of coding experience and ex-MAANG/FAANG architects, our team will carefully build proof-of-reserve logic and compliance layers so the token supply always matches the physical gold.

Our platforms feature:

- Real-Time Proof of Reserve with on-chain oracles.

- Automated, compliant transfer logic (ERC-3643).

- Seamless ‘Burn-to-Ship’ physical redemption.

Check out our latest projects to see the kind of work we can do for you.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: Developing a gold tokenization platform starts with securing regulated gold custody through LBMA-approved vault partners and defining clear audit and insurance frameworks. From there, smart contracts are designed to enforce a strict one-to-one relationship between physical gold and on-chain tokens, backed by proof-of-reserve oracles.

A2: The cost of developing a gold tokenization platform depends on scope, compliance depth, and integrations rather than just code complexity. Expenses typically include smart contract development, proof-of-reserve infrastructure, KYC and AML systems, vault integrations, audits, and ongoing regulatory support.

A3: A gold tokenization platform works by linking physical gold held in secure vaults to digital tokens issued on a blockchain. When gold is deposited and verified, smart contracts mint tokens that represent ownership of that gold, while redemptions trigger token burning

A4: Core features include a digital wallet for holding and transferring gold tokens, fractional ownership support, proof-of-reserve dashboards, and redemption workflows tied to physical gold. Advanced platforms also include compliance controls, audit reporting, and integration with exchanges or DeFi systems.